Regarding the legitimacy of AIMS forex brokers, it provides ASIC and WikiBit, .

Is AIMS safe?

Pros

Cons

Is AIMS markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

AURIC INTERNATIONAL MARKETS (AU) PTY LTD

Effective Date: Change Record

2022-09-06Email Address of Licensed Institution:

liauliau109@gmail.comSharing Status:

Website of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 13 300 ANN ST BRISBANE CITY QLD 4000Phone Number of Licensed Institution:

0421288859Licensed Institution Certified Documents:

Is AIMS A Scam?

Introduction

AIMS, also known as AIMSFX, is a forex and CFD broker that has positioned itself as a global player in the financial trading market since its inception in 2015. With its headquarters in Labuan, Malaysia, and regulatory licenses from multiple jurisdictions, AIMS claims to offer a variety of trading instruments, including forex, commodities, cryptocurrencies, and indices. However, the legitimacy and safety of trading with AIMS have come under scrutiny, prompting potential traders to carefully evaluate the broker before committing their funds. In the volatile world of forex trading, it is crucial for traders to assess brokers' credibility and regulatory compliance to mitigate risks associated with fraud and mismanagement. This article aims to provide a comprehensive analysis of AIMS, utilizing various sources and expert opinions to evaluate its safety, reliability, and overall trading conditions.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety for traders. AIMS claims to be regulated by several authorities, including the Australian Securities and Investments Commission (ASIC) and the Labuan Financial Services Authority (LFSA). Regulatory oversight typically assures traders that the broker adheres to specific standards and practices, which can protect client funds and ensure fair trading conditions.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| ASIC | 430091 | Australia | Verified |

| LFSA | MB/17/0017 | Labuan | Verified |

| SERC | SHR 1 # 29 | Cambodia | Verified |

The presence of a top-tier regulator like ASIC is generally seen as a positive sign, as it imposes strict regulations on brokers, including requirements for capital adequacy, transparency, and client fund protection. However, AIMS also operates under offshore licenses, which can sometimes indicate lower regulatory scrutiny. While the LFSA provides some level of oversight, it is often considered less rigorous than ASIC. This dual regulatory status raises questions about AIMS's overall compliance and the safety of client funds.

Company Background Investigation

AIMS was established in 2015 and has since expanded its operations to various countries, including Australia, Dubai, and several Southeast Asian nations. The company is owned by Auric International Markets Limited, which operates under the regulatory frameworks of the aforementioned authorities. The management team at AIMS claims to have significant experience in the financial markets, which can contribute to the broker's credibility. However, detailed information about the ownership structure and the specific backgrounds of key management personnel is not readily available, raising concerns about transparency.

In terms of information disclosure, AIMS provides some details about its services and trading conditions on its website, but lacks comprehensive insights into its operational practices and financial health. This lack of transparency may deter potential clients who prioritize clear and accessible information about their brokers.

Trading Conditions Analysis

The trading conditions offered by AIMS are a crucial aspect for prospective traders. AIMS features a low minimum deposit requirement of $50, which is attractive for new traders. However, the overall fee structure may not be as competitive as it appears at first glance. Traders should be aware of potential hidden fees or unfavorable trading conditions that could impact their profitability.

| Fee Type | AIMS | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.5 pips | 1.2 pips |

| Commission Structure | No commission | Varies widely |

| Overnight Interest Range | Not specified | Varies widely |

While AIMS advertises commission-free trading, the spreads offered are slightly higher than the industry average. This can lead to increased trading costs, particularly for high-frequency traders. Additionally, the absence of clear information regarding overnight interest charges may pose risks for traders who hold positions overnight.

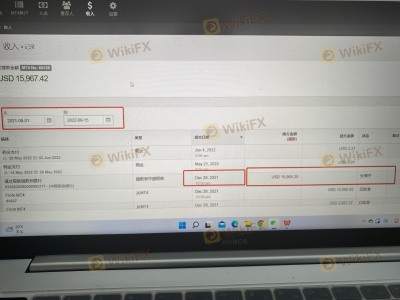

Client Fund Safety

The safety of client funds is paramount when considering a brokerage. AIMS claims to implement several measures to protect client deposits, including segregated accounts and investor protection schemes. The broker states that client funds are kept separate from company funds, which is a standard practice in the industry. Furthermore, AIMS offers insurance coverage for client accounts up to $2 million, which adds an additional layer of security.

However, the effectiveness of these measures depends on the broker's adherence to regulatory standards and its operational integrity. There have been no significant reports of fund mismanagement or loss at AIMS, but traders should remain vigilant and conduct thorough due diligence before investing substantial amounts.

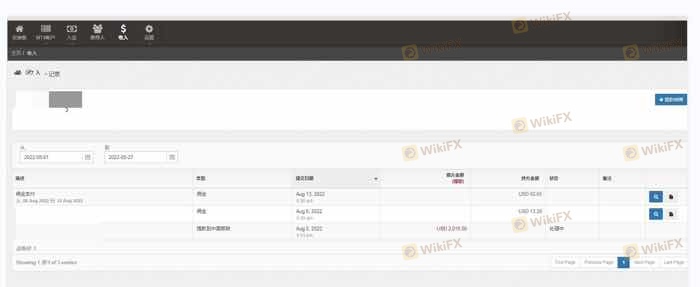

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. AIMS has received mixed reviews from its clients, with some praising its user-friendly trading platform and responsive customer support, while others have reported issues related to withdrawal delays and lack of educational resources.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Lack of Educational Resources | Medium | Limited support |

Common complaints include difficulties in withdrawing funds and inadequate educational materials for novice traders. AIMS has been criticized for not providing 24/7 customer support, which can hinder timely assistance for traders facing issues. A few notable cases involve users experiencing significant delays in fund withdrawals, leading to frustration and loss of trust in the broker's reliability.

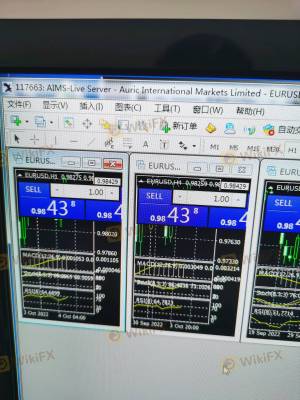

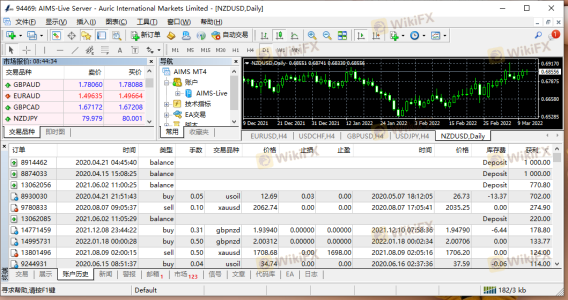

Platform and Trade Execution

AIMS utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. The platform supports various trading strategies and provides access to advanced charting tools and technical indicators. However, the quality of order execution and potential slippage can significantly affect trading outcomes.

Traders have reported mixed experiences regarding order execution speed, with some experiencing delays during volatile market conditions. While AIMS aims to provide a non-dealing desk (NDD) trading environment, any signs of manipulation or refusal to execute orders can severely damage its reputation.

Risk Assessment

Using AIMS as a trading platform involves several risks, primarily associated with its regulatory status and customer service quality. Traders should be aware of the following risk factors:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operating under dual offshore and top-tier regulations. |

| Customer Service Risk | Medium | Reports of slow responses and withdrawal issues. |

| Execution Risk | Medium | Potential delays during high volatility. |

To mitigate these risks, traders are advised to start with a small investment, utilize demo accounts for practice, and remain informed about market trends and broker updates.

Conclusion and Recommendations

In conclusion, AIMS presents a mixed picture regarding its safety and reliability as a forex broker. While it holds licenses from reputable regulatory bodies like ASIC, its offshore operations and mixed customer feedback raise concerns. There are no overt signs of fraudulent activity, but potential traders should approach with caution.

For novice traders or those seeking a reliable trading partner, it may be prudent to consider alternatives with stronger regulatory oversight and proven customer service records. Brokers like IG, OANDA, or Forex.com are recommended for their robust regulatory frameworks and positive user experiences. Ultimately, thorough research and risk assessment are essential before committing funds to any broker, including AIMS.

Is AIMS a scam, or is it legit?

The latest exposure and evaluation content of AIMS brokers.

AIMS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AIMS latest industry rating score is 8.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.