DeltaStock 2025 Review: Everything You Need to Know

DeltaStock, a Bulgarian-based brokerage established in 1998, continues to attract traders with its diverse offerings and competitive conditions. However, opinions about the broker are mixed, with some praising its trading platforms and customer support, while others raise concerns regarding regulatory oversight and withdrawal processes. This review will delve into the key features, pros and cons, and overall user experiences associated with DeltaStock.

Note: It's important to highlight that DeltaStock operates under different regulatory entities depending on the region, which may affect the level of investor protection and service quality. This review aims to provide a balanced view based on various sources to ensure accuracy.

Ratings Overview

How We Rate Brokers: Our ratings are derived from a comprehensive analysis of user experiences, expert opinions, and factual data regarding broker features and services.

Broker Overview

DeltaStock was founded in 1998 and is headquartered in Sofia, Bulgaria. It offers access to various trading platforms, including the popular MetaTrader 4 (MT4) and its proprietary Delta Trading platform. Traders can engage in a wide range of asset classes, including forex, CFDs on stocks, indices, commodities, and cryptocurrencies. DeltaStock is regulated by the Financial Supervision Commission (FSC) in Bulgaria, which is a significant factor for many traders when choosing a broker.

Detailed Breakdown

Regulatory Regions

DeltaStock is primarily regulated by the FSC in Bulgaria, operating under the European Union's MiFID II directive. This regulation provides a framework for investor protection, although it is often viewed as less stringent compared to Tier 1 regulators like the FCA or ASIC. Some reviews have noted concerns regarding the broker's regulatory status, particularly due to Bulgaria's reputation for having unregulated forex firms.

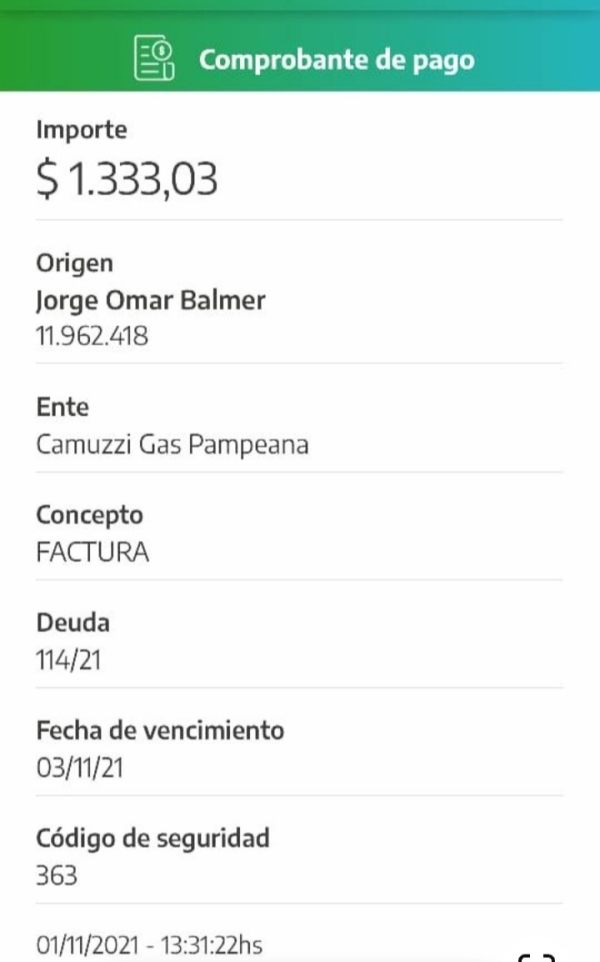

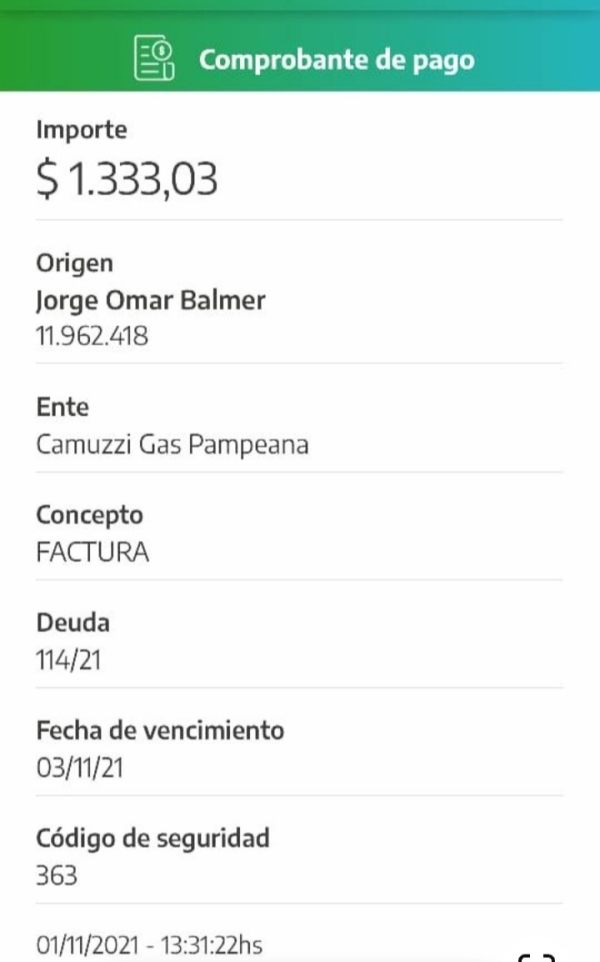

Deposit/Withdrawal Currencies/Cryptocurrencies

The broker accepts multiple currencies for deposits, including USD, EUR, BGN, and others. However, deposits made through credit/debit cards and ePay incur a 2% fee, while bank wire transfers are free within the European Economic Area (EEA). Withdrawal processes may vary, with some users reporting delays, particularly with bank transfers.

Minimum Deposit

The minimum deposit required to open an account with DeltaStock is $100. This relatively low barrier to entry makes it accessible for new traders.

DeltaStock offers various bonuses, including a 10% welcome bonus for new clients, although details on other promotional offers are less clear. The broker does not currently provide a referral program or trading contests.

Tradable Asset Classes

DeltaStock provides a wide range of tradable instruments, including over 80 forex pairs, 1000+ CFDs on stocks, commodities like gold and oil, and cryptocurrencies such as Bitcoin and Ethereum. This diverse offering allows traders to build a well-rounded portfolio.

Costs (Spreads, Fees, Commissions)

Spreads at DeltaStock can vary, with competitive rates starting as low as 0.4 pips for major currency pairs. However, commissions apply to shares and ETFs, which can be a drawback for some traders. The broker does not charge for most other trades, but overnight swap fees may apply.

Leverage

For retail traders, DeltaStock offers leverage of up to 1:30, while professional traders can access leverage up to 1:200. This flexibility allows more experienced traders to amplify their positions but also comes with increased risk.

Traders can choose between the proprietary Delta Trading platform and MetaTrader 4. Both platforms offer various features, including advanced charting tools and automated trading options. However, some reviews suggest that the proprietary platform may be more susceptible to market manipulation.

Restricted Regions

While DeltaStock serves clients globally, it does not accept traders from the United States and several other jurisdictions due to regulatory restrictions.

Available Customer Support Languages

DeltaStock offers customer support in multiple languages, including English and Bulgarian. Support is available via email, phone, and social media, although some users have noted that response times can vary.

Ratings Overview (Revised)

Detailed Breakdown of Ratings

Account Conditions

DeltaStock offers a straightforward account structure with a minimum deposit of $100, making it accessible for beginners. However, the lack of an Islamic account option may deter some traders.

The broker provides a range of educational resources, including webinars and video tutorials, which can help traders improve their skills. The presence of multiple trading platforms also adds to the versatility.

Customer Service and Support

DeltaStock has received positive feedback for its customer service, with many users praising the responsiveness and knowledge of support staff. However, some reviews noted inconsistencies in service quality.

Trading Experience

While DeltaStock provides a user-friendly trading experience, some users have reported issues with withdrawal processes and market manipulation concerns, which can affect overall satisfaction.

Trustworthiness

The brokers regulatory status under the FSC in Bulgaria is a point of contention. While it does adhere to EU regulations, the tier-2 nature of its regulation raises concerns for some traders.

User Experience

Overall, user experiences with DeltaStock vary. While many appreciate the competitive spreads and diverse asset offerings, concerns about regulatory oversight and withdrawal issues persist.

In conclusion, DeltaStock presents a mixed bag for traders. Its competitive offerings and accessible platforms make it a viable option for many, but potential clients should weigh the regulatory concerns and user experiences before committing significant funds. As always, conducting thorough research and considering personal trading needs is essential when selecting a broker.