Ally 2025 Review: Everything You Need to Know

Ally Invest has emerged as a strong contender in the online brokerage space, particularly appealing to beginner and intermediate investors. With its commission-free trading on eligible U.S. securities and a low-cost structure for options trading, Ally Invest offers a user-friendly platform that integrates seamlessly with Ally Bank's services. However, its limitations in advanced trading tools and asset classes may deter more experienced traders.

Note: It's important to consider that Ally Invest operates under different entities in various regions, which can affect user experience and service availability. The review methodology prioritizes fairness and accuracy, drawing from multiple reputable sources to ensure a comprehensive overview.

Ratings Overview

We score brokers based on user feedback, expert analysis, and comprehensive data collection.

Broker Overview

Founded in 1919, Ally Invest is a subsidiary of Ally Financial, which has evolved from its origins as a financing arm of General Motors into a comprehensive digital financial services provider. The platform offers a web-based trading interface and mobile app, allowing users to trade a variety of assets, including stocks, ETFs, options, and bonds. Ally Invest is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), ensuring compliance with U.S. financial regulations.

Detailed Review

Regulated Geographic Areas

Ally Invest primarily operates in the United States, with regulatory oversight from the SEC and FINRA. It is important to note that the broker does not offer services to clients outside the U.S., which limits its international reach.

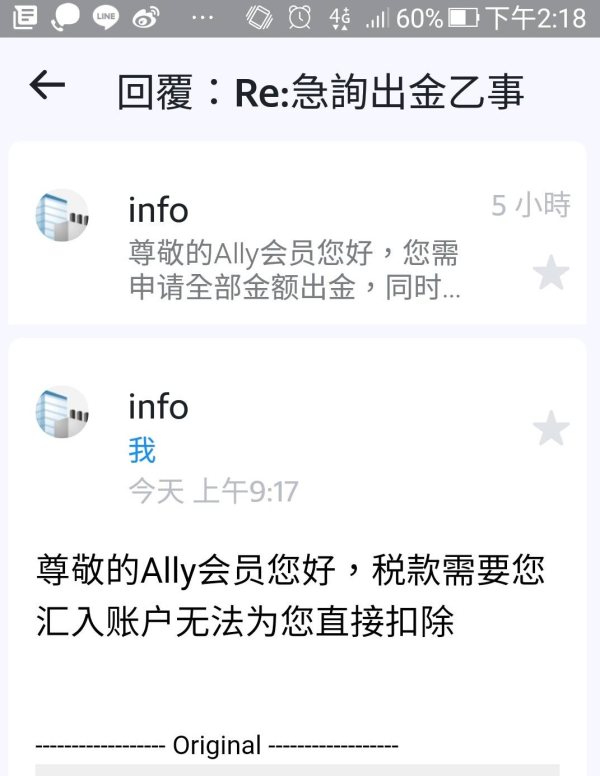

Deposit/Withdrawal Currencies

Ally Invest supports transactions in U.S. dollars (USD). It does not support cryptocurrency deposits or withdrawals, focusing instead on traditional investment vehicles.

Minimum Deposit

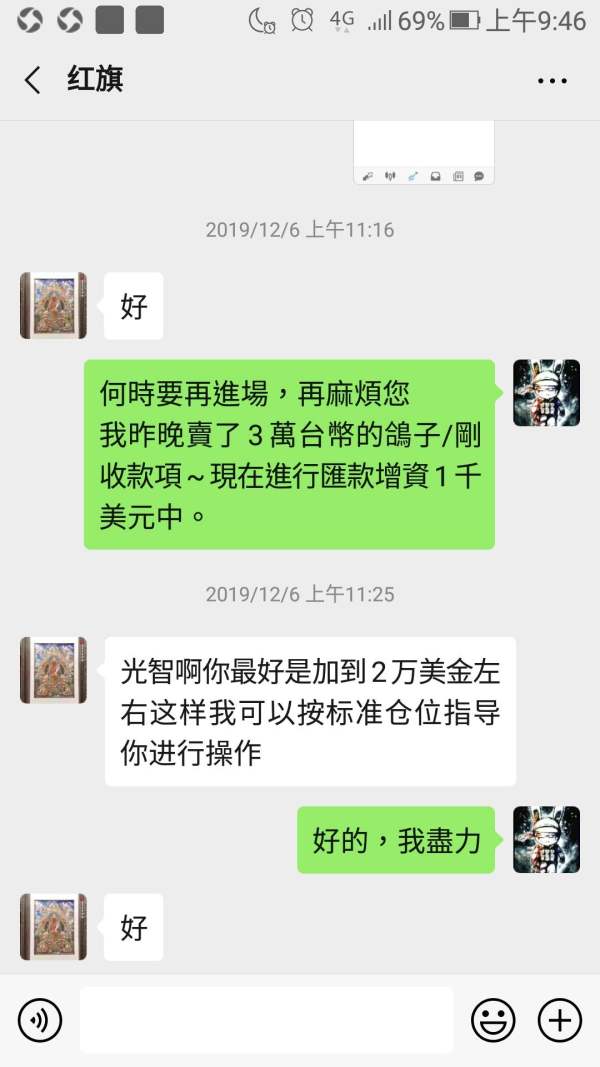

Ally Invest has no minimum deposit requirement for self-directed accounts, making it accessible for new investors. However, a $100 minimum is required for robo portfolios, and a $2,000 minimum is needed for margin accounts.

Ally Invest offers promotional incentives for new accounts, including bonuses for transferring funds from other brokerage accounts. However, the specifics of these promotions can vary, and potential investors should check the website for current offers.

Tradable Asset Classes

The platform allows trading in various asset classes, including:

- Stocks: Commission-free for U.S.-listed securities priced above $2.

- ETFs: Commission-free trading available.

- Options: $0.50 per contract, which is competitive compared to industry standards.

- Bonds: $1 per bond with a $10 minimum transaction fee.

- Mutual Funds: Offers over 17,000 no-load mutual funds.

Costs (Spreads, Fees, Commissions)

Ally Invest provides a transparent fee structure, with no commissions for stock and ETF trades. However, stocks priced under $2 incur a commission of $4.95 plus $0.01 per share. Options trading is priced at $0.50 per contract, which is lower than many competitors. The platform does not charge annual fees, inactivity fees, or transfer fees for standard accounts, although there is a $50 fee for outgoing transfers.

Leverage

Ally Invest offers margin trading with tiered interest rates. The rates start at 13% for balances under $25,000 and decrease to 8.5% for balances over $1 million.

Ally Invest provides a web-based trading platform and a mobile app that allows for seamless trading on the go. However, it does not support advanced trading platforms like MetaTrader 4 or 5, which may limit options for more sophisticated traders.

Restricted Regions

The services of Ally Invest are primarily available to U.S. residents. International clients looking for a global brokerage experience may need to consider alternatives.

Available Customer Support Languages

Ally Invest offers customer support primarily in English, with 24/7 availability via phone, email, and live chat. The platform's customer service has been rated positively, with quick response times and knowledgeable representatives.

Ratings Overview (Detailed)

Detailed Breakdown

- Account Conditions: Ally Invest's lack of minimum deposit requirements allows for easy entry for new investors. The integration with Ally Bank enhances cash management capabilities.

- Tools and Resources: While Ally Invest provides basic tools for trading and research, its offerings fall short compared to competitors that provide more comprehensive educational resources and advanced trading tools.

- Customer Service and Support: The platform's customer service is robust, with multiple avenues for assistance and generally favorable user experiences reported.

- Trading Experience: The platform is designed for ease of use, but serious traders may find it lacking in advanced functionalities such as complex order types and real-time data analytics.

- Trustworthiness: Ally Invest is a reputable broker backed by significant regulatory oversight, ensuring a safe trading environment for investors.

- User Experience: The user interface is generally intuitive, making it easy for users to navigate and execute trades, although some advanced features are not available.

- Additional Features: The inclusion of robo-advisory services and integration with Ally Bank for cash management adds value to the overall offering.

In conclusion, Ally Invest presents a compelling option for those seeking a straightforward, low-cost brokerage experience, particularly for beginners and casual investors. However, those looking for advanced trading features or a wider array of asset classes may need to explore other options.