Is Dana safe?

Pros

Cons

Is Dana A Scam?

Introduction

Dana is a brokerage firm based in Iran, established in 2005, that positions itself as a comprehensive platform for trading various financial instruments, including forex, stocks, and options. In an era where online trading has gained immense popularity, the need for traders to carefully assess the legitimacy and reliability of their chosen brokers has never been more critical. The forex market, in particular, is rife with both reputable and fraudulent entities, making it essential for traders to conduct thorough due diligence before committing their capital.

This article aims to evaluate the safety and reliability of Dana by examining its regulatory status, company background, trading conditions, customer fund security, and user experiences. The analysis is based on a review of various credible sources, including regulatory filings, customer feedback, and expert assessments, to provide a balanced view of whether Dana is safe or potentially a scam.

Regulatory and Legitimacy

One of the most significant factors in determining a broker's credibility is its regulatory status. Regulatory oversight helps ensure that brokers adhere to industry standards and protect clients' interests. Dana claims to hold various licenses, including those for online trading and operation on the Tehran Stock Exchange. However, the lack of confirmation from reputable regulatory organizations raises questions about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Tehran Stock Exchange | N/A | Iran | Unverified |

| Online Trading License | N/A | Iran | Unverified |

The absence of a well-known regulatory authority overseeing Dana's operations is a red flag. While the firm asserts compliance with local laws, the lack of transparency regarding its regulatory framework makes it difficult for potential investors to ascertain its legitimacy. The quality of regulation is crucial; brokers under the supervision of respected entities are generally held to higher standards of accountability and client protection. Dana's unclear regulatory status and the ongoing investigations into its operations by various authorities suggest a potential risk for traders.

Company Background Investigation

Dana Brokerage Co. has been operational since 2005, primarily serving the Iranian market. Despite its claims of being a well-established brokerage, there is limited information available regarding its ownership structure and management team. The company's history indicates growth in the Iranian financial sector, but details about its founders and key executives remain scarce.

The management team‘s background is critical for assessing the broker’s reliability. A team with extensive experience in finance and trading can inspire confidence among traders. However, the lack of publicly available information about the management raises concerns about transparency. Furthermore, Dana's website does not provide comprehensive details about its operational practices or business model, which is essential for potential clients to make informed decisions.

Trading Conditions Analysis

When evaluating a brokerage, understanding the trading conditions it offers is vital. Dana claims to provide competitive trading fees, but a closer examination reveals some inconsistencies. The overall fee structure should align with industry standards to ensure fairness and transparency.

| Fee Type | Dana | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies (typically $5 - $10 per lot) |

| Overnight Interest Range | N/A | Varies (typically 2% - 5%) |

The absence of clear data regarding Dana's fees is concerning. Traders typically expect brokers to provide transparent information about spreads, commissions, and any additional fees. The lack of clarity could indicate hidden charges that may arise later, impacting overall trading profitability. Traders should be cautious and seek brokers with clearly defined and competitive fee structures.

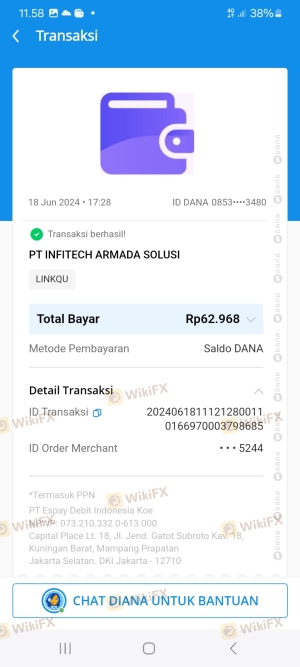

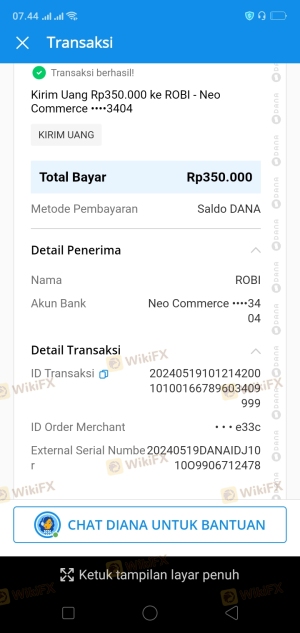

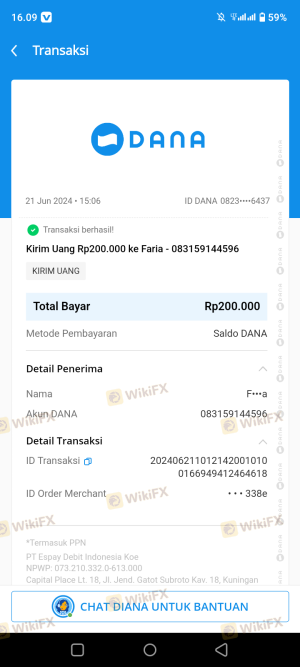

Customer Fund Security

The safety of customer funds is paramount when choosing a broker. Danas policies regarding fund security, such as segregation of client funds and investor protection measures, are essential indicators of its reliability. Unfortunately, the available information on these aspects is limited.

Dana claims to implement measures for fund security, but without concrete details or third-party verification, it is challenging to assess the effectiveness of these measures. Additionally, the absence of a clear policy on negative balance protection raises further concerns. Traders should always prioritize brokers that provide robust security measures to safeguard their investments.

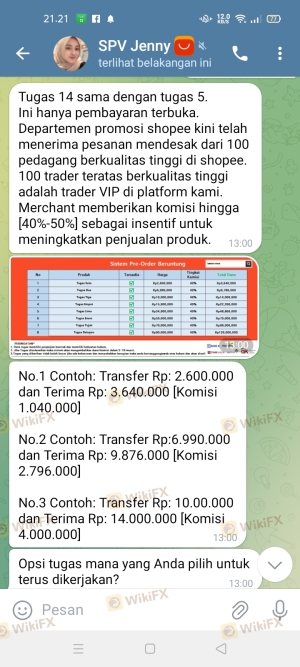

Customer Experience and Complaints

Customer feedback is an invaluable source of information when assessing a broker's reputation. Reviews of Dana indicate a mixed bag of experiences, with several users reporting issues related to customer service and withdrawal processes.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Inconsistent |

| Manipulative Practices | High | No Resolution |

Common complaints include difficulties in withdrawing funds, unresponsive customer service, and allegations of manipulative trading practices. Such issues can significantly impact a trader's experience and trust in the broker. For instance, one user reported being unable to withdraw funds for months, while another highlighted poor communication from the support team. These patterns of complaints suggest a concerning trend that potential clients should consider before engaging with Dana.

Platform and Trade Execution

The trading platform offered by Dana is another critical aspect to evaluate. A reliable platform should provide a stable, user-friendly experience with efficient order execution. However, reviews indicate that Dana's platform may not meet these expectations.

Traders have reported instances of slippage and rejected orders, which can hinder trading performance. These issues raise concerns about the platform's reliability and whether it operates in the best interest of its clients. Moreover, any signs of platform manipulation could further compromise the integrity of the trading experience.

Risk Assessment

Using Dana as a trading platform presents several risks that potential investors should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of clear regulation and oversight. |

| Withdrawal Risk | High | Reports of delayed or denied withdrawals. |

| Transparency Risk | Medium | Limited information about fees and management. |

Given the findings, the overall risk associated with trading through Dana appears high. Traders should exercise caution and consider alternative brokers that offer clearer regulatory oversight and better customer support.

Conclusion and Recommendations

In conclusion, while Dana presents itself as a legitimate brokerage option, the evidence suggests that it poses significant risks for traders. The lack of regulatory clarity, coupled with numerous customer complaints about withdrawal issues and poor service, raises serious concerns about its reliability.

For those considering trading with Dana, it is advisable to proceed with caution. Traders should explore alternative, well-regulated brokers that provide transparency, robust customer service, and a solid reputation in the industry. Some recommended alternatives include brokers with established regulatory frameworks and positive user feedback, ensuring a safer trading environment.

Ultimately, the question of whether Dana is safe remains contentious, and potential investors should weigh the risks carefully before making any commitments.

Is Dana a scam, or is it legit?

The latest exposure and evaluation content of Dana brokers.

Dana Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Dana latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.