Is FXGlory safe?

Pros

Cons

Is FxGlory A Scam?

Introduction

FxGlory is an online forex broker that has been operating since 2011, offering traders access to a variety of financial instruments, including forex pairs, commodities, and cryptocurrencies. The broker markets itself as a platform that provides high leverage options and low minimum deposits, attracting both novice and experienced traders. However, the lack of regulation and numerous complaints from users raise concerns about its legitimacy and safety. In the highly volatile and competitive forex market, traders need to exercise caution and conduct thorough evaluations of any broker before committing their funds. This article aims to assess the credibility of FxGlory through an analysis of its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

One of the most critical factors in evaluating a forex broker is its regulatory status. A regulated broker is subject to oversight by a financial authority, which helps ensure compliance with industry standards and provides a level of protection for traders. FxGlory is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. Unfortunately, it does not hold a license from any reputable financial authority, which significantly raises the risk for traders.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that traders have limited recourse in the event of disputes or issues such as withdrawal delays. Furthermore, the lack of strict oversight can lead to questionable practices, making it essential for potential clients to be aware of the risks involved. Historical compliance issues, such as warnings issued by regulatory bodies in other countries, further underscore the importance of exercising caution when considering FxGlory as a trading partner.

Company Background Investigation

FxGlory was established in 2011 and has since expanded its operations to various countries, including branches in the UAE, Malaysia, Cyprus, and the UK. However, it is important to note that none of these branches are regulated by any significant financial authority. The company is owned by FxGlory Ltd., which operates as an offshore entity.

The management team consists of professionals with backgrounds in trading and finance, but the lack of transparency regarding their specific qualifications and experience raises concerns. The company's website provides limited information about its operational practices and corporate structure, which can hinder potential clients' ability to make informed decisions.

Moreover, the company's commitment to transparency is questionable, given the absence of detailed disclosures about its financial health or operational practices. This lack of information can be a red flag for potential investors, as it may indicate a reluctance to provide insight into its operations.

Trading Conditions Analysis

FxGlory offers competitive trading conditions, including a low minimum deposit requirement of just $1 and leverage up to 1:3000. However, the overall fee structure and trading conditions warrant a closer examination.

| Fee Type | FxGlory | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2 pips | 1.5 pips |

| Commission Model | No | Varies |

| Overnight Interest Range | N/A | Varies |

While FxGlory advertises no commission fees, the spreads are higher than the industry average, which can significantly impact trading costs, especially for high-frequency traders. Additionally, the broker has been reported to impose withdrawal fees that vary depending on the payment method, which can add an unexpected layer of costs for traders.

Such practices can be concerning, especially for traders who expect a transparent and straightforward fee structure. The lack of clarity regarding potential hidden fees may lead to dissatisfaction among clients and could serve as a warning sign for those considering opening an account with FxGlory.

Customer Funds Security

The safety of customer funds is paramount when selecting a forex broker. FxGlory claims to implement various security measures, including segregated accounts for client funds and SSL encryption to protect personal information. However, the effectiveness of these measures is questionable given the broker's unregulated status.

FxGlory does not participate in any investor protection schemes, which means that in the event of insolvency, clients may have no recourse to recover their funds. While the broker claims to have negative balance protection, the lack of oversight from a reputable regulatory authority raises concerns about the actual enforcement of these policies.

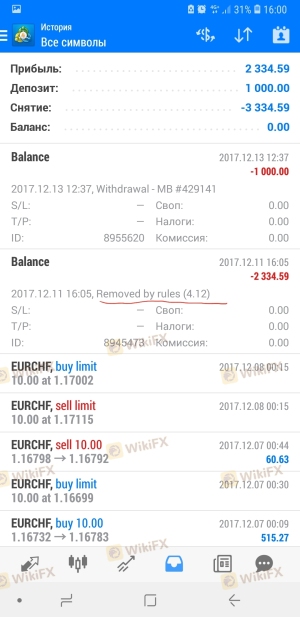

Historically, there have been reports of withdrawal issues and delays, which could indicate potential problems with the management of client funds. Traders should be cautious and consider the risks associated with entrusting their capital to an unregulated broker like FxGlory.

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reliability. Reviews of FxGlory reveal a mixed bag of experiences, with many users reporting issues related to withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

| Lack of Transparency | High | Minimal Disclosure |

Common complaints include delayed withdrawals, lack of effective customer support, and insufficient transparency regarding fees and trading conditions. For instance, some users have reported waiting weeks for their withdrawal requests to be processed, which can be particularly concerning for traders who require timely access to their funds.

In one case, a trader expressed frustration over the difficulty in contacting customer support, noting that responses were often slow and unhelpful. Such experiences can significantly impact a trader's overall satisfaction and trust in the broker.

Platform and Trade Execution

FxGlory offers the widely-used MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading features. While the platform performs well in terms of stability and functionality, the quality of trade execution has been a point of contention among users.

Traders have reported instances of slippage and re-quotes, particularly during volatile market conditions. These issues can lead to unexpected losses and negatively affect trading strategies. Additionally, there are concerns about the potential for platform manipulation, given the lack of regulatory oversight.

Risk Assessment

Using FxGlory comes with several inherent risks that traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk of fraud or loss. |

| Fund Security | High | Lack of investor protection schemes poses risks. |

| Withdrawal Issues | Medium | Reports of delays and complications with withdrawals. |

Given these risks, traders should carefully consider their risk tolerance and investment objectives before engaging with FxGlory. It is advisable to use caution and to only trade with funds that one can afford to lose.

Conclusion and Recommendations

In conclusion, while FxGlory offers some attractive features, such as low minimum deposits and high leverage, the lack of regulation and numerous negative reviews raise significant concerns about its safety and reliability. The broker's unregulated status, coupled with reported issues related to withdrawals and customer service, suggest that traders should proceed with caution.

For those considering trading with FxGlory, it is essential to be aware of the potential risks involved. Additionally, it may be prudent to explore alternative brokers that are regulated by reputable authorities, such as FCA or ASIC, which can provide a higher level of safety and investor protection.

Overall, while FxGlory is not categorically a scam, the numerous warning signs and lack of regulatory oversight make it a risky choice for traders.

Is FXGlory a scam, or is it legit?

The latest exposure and evaluation content of FXGlory brokers.

FXGlory Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXGlory latest industry rating score is 2.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.