Is TCC safe?

Business

License

Is TCC Safe or Scam?

Introduction

TCC, also known as Top Capital Corporation, is a broker that has emerged in the forex market since its establishment in 2020. Positioned as a platform for trading various financial instruments, TCC claims to offer competitive trading conditions and a user-friendly experience. However, the increasing number of scams in the forex industry necessitates that traders conduct thorough evaluations of brokers before committing their funds. Understanding the safety and reliability of a broker like TCC is crucial for investors to protect their capital and ensure a productive trading environment. This article investigates TCC's legitimacy, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk profile, to provide a comprehensive answer to the question: Is TCC safe?

Regulation and Legitimacy

The regulatory framework within which a broker operates is a critical indicator of its legitimacy and safety. TCC claims to be regulated by the UKs Financial Conduct Authority (FCA). However, a closer examination reveals discrepancies in its regulatory status. The FCA registration number cited by TCC (796510) was canceled in December 2019, indicating that TCC is currently unregulated. This lack of oversight raises significant concerns regarding the safety of funds and the overall integrity of the trading platform.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 796510 | United Kingdom | Canceled |

The importance of regulatory compliance cannot be overstated; it ensures that brokers adhere to strict operational standards and provides a safety net for traders. Without proper regulation, traders are exposed to potential fraud and mismanagement of funds. TCC's claims of being regulated by the FCA, despite the cancellation, suggest a serious lack of transparency and raises alarms about its trustworthiness. Therefore, when assessing the question, Is TCC safe?, the answer leans towards caution due to its unregulated status.

Company Background Investigation

TCC was established in 2020, which places it in the category of relatively new brokers in the forex market. The company is registered in Hong Kong, but detailed information about its ownership structure and management team remains sparse. This lack of transparency makes it difficult for potential clients to gauge the reliability and experience of the individuals behind TCC. A well-established broker typically provides comprehensive information about its founders and key personnel, showcasing their expertise and experience in the financial industry.

Moreover, the absence of a physical office and the inaccessibility of its official website further complicate the situation. Traders often rely on a brokers history and operational stability to assess its credibility. The lack of verifiable information surrounding TCC's operational history raises significant red flags. Thus, the question of Is TCC safe? remains unanswered positively, as potential investors are left in the dark regarding the broker's legitimacy and operational integrity.

Trading Conditions Analysis

TCC offers a range of trading instruments, including forex pairs and commodities, with claims of competitive spreads and low fees. However, the overall cost structure and trading conditions presented by the broker require careful scrutiny. Reports indicate that TCC has a minimum deposit requirement of $200, which is relatively standard, but the absence of a demo account can be a deterrent for new traders.

| Fee Type | TCC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.03 pips | 1.0 pips |

| Commission Model | Not stated | Varies widely |

| Overnight Interest Range | Not disclosed | Varies widely |

While TCC advertises spreads as low as 0.03 pips, the lack of transparency regarding commissions and overnight interest rates raises concerns. Traders need to be aware of all potential costs associated with trading, as hidden fees can significantly impact profitability. The absence of clear information regarding these costs suggests that TCC may not be forthcoming about its pricing structure, further complicating the question of Is TCC safe?

Client Fund Security

The safety of client funds is paramount when evaluating any broker. TCC's measures for safeguarding client deposits are unclear. Regulatory bodies often require brokers to maintain client funds in segregated accounts, ensuring that traders' money is protected in the event of bankruptcy. However, TCC's lack of regulation raises doubts about its adherence to such practices.

Furthermore, there have been no indications of investor protection mechanisms, such as negative balance protection, which are standard in regulated environments. The absence of historical data on any previous fund security issues or disputes only adds to the uncertainty. Without robust safety measures in place, potential clients must weigh the risks associated with entrusting their funds to TCC. Consequently, the question Is TCC safe? is met with skepticism, as the broker does not appear to prioritize client fund security.

Customer Experience and Complaints

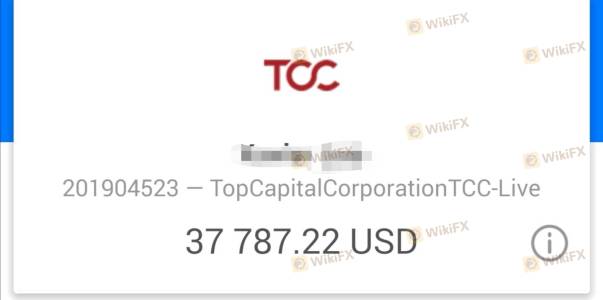

Customer feedback is a vital component in assessing the reliability of any broker. Reports from users of TCC indicate a troubling pattern of complaints, primarily focusing on withdrawal issues. Many clients have voiced their frustration over being unable to access their funds after making deposits. This common complaint is alarming and suggests that TCC may not be operating with the transparency and integrity expected from a legitimate broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Transparency Concerns | High | Non-responsive |

Typical cases highlight clients who, after depositing significant amounts, faced challenges when attempting to withdraw their funds. One user reported being unable to make withdrawals after several weeks of trading, leading to concerns about the broker's legitimacy. Such experiences contribute to an overall negative perception of TCC and further question Is TCC safe? Given the severity of these issues, potential traders should approach this broker with extreme caution.

Platform and Trade Execution

A broker's trading platform is crucial for a smooth trading experience. TCC offers the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading tools. However, user reviews suggest that there may be issues with order execution quality, including instances of slippage and rejected orders. These problems can severely impact trading performance and profitability.

Moreover, the platform's stability is a key consideration. Traders have reported intermittent outages, which can hinder trading opportunities and lead to losses. The absence of evidence indicating platform manipulation is a positive sign, but the overall execution quality remains questionable. Therefore, when considering Is TCC safe?, the potential for execution issues raises further concerns about the broker's reliability.

Risk Assessment

Using TCC as a trading platform carries several inherent risks. The lack of regulation is a significant red flag, suggesting that traders may have limited recourse in case of disputes or issues. Additionally, the unclear fee structure and withdrawal problems further compound the risks associated with trading with TCC.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Issues with fund withdrawals reported by users. |

| Execution Risk | Medium | Potential slippage and order rejections. |

To mitigate these risks, traders are advised to conduct thorough due diligence before engaging with TCC. Seeking alternative, well-regulated brokers with transparent practices can provide a safer trading environment.

Conclusion and Recommendations

In summary, the evidence gathered raises significant concerns regarding the safety and legitimacy of TCC. With its unregulated status, lack of transparency, and numerous customer complaints, it is prudent for potential traders to approach this broker with caution. The question Is TCC safe? leans heavily towards a negative answer, as the risks associated with trading on this platform may outweigh any potential benefits.

For traders seeking a reliable and secure trading experience, it is advisable to consider alternative brokers that are well-regulated and have a solid reputation in the industry. Brokers regulated by reputable authorities, such as the FCA or ASIC, can provide the necessary safeguards and transparency that TCC appears to lack. Always prioritize safety and due diligence when selecting a trading partner to protect your investments.

Is TCC a scam, or is it legit?

The latest exposure and evaluation content of TCC brokers.

TCC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TCC latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.