SimpleFX Review 2025: Everything You Need to Know

Executive Summary

SimpleFX stands out as a commission-free forex broker that has been serving traders since 2014. The company has built itself as a reliable platform for those seeking straightforward and efficient trading experiences. This SimpleFX review reveals a broker that puts simplicity first without giving up essential trading features. The platform offers floating spreads starting from 0 pips and provides leverage up to 500:1, making it attractive for both new and experienced traders looking to maximize their trading potential.

The broker serves over 100,000 clients across 160 countries. This shows its global reach and appeal. SimpleFX's primary strength lies in its user-friendly approach to CFD trading, covering multiple asset classes including forex, cryptocurrencies, indices, and commodities. The platform's commitment to zero commission trading, combined with competitive spreads and high leverage options, positions it as an appealing choice for traders who value cost-effective trading solutions.

According to available data, SimpleFX operates under the regulatory framework of St. Vincent and the Grenadines, with registration number 22361 IBC. The broker's seven-year track record in the market provides a foundation of experience that many newer platforms lack, though traders should always consider their individual risk tolerance and regulatory preferences when choosing a broker.

Important Disclaimers

Traders should be aware that SimpleFX's regulatory status may vary across different jurisdictions. It's essential to understand the applicable legal framework in your region before opening an account. The broker operates under St. Vincent and the Grenadines regulations, which may offer different investor protections compared to more strict regulatory environments such as those provided by FCA, ASIC, or CySEC.

This evaluation is based on publicly available information and user feedback collected from various sources. While we strive for fairness and accuracy, traders should conduct their own research and consider their individual circumstances before making any trading decisions. Market conditions, regulatory changes, and broker policies can evolve, potentially affecting the relevance of this assessment over time.

Rating Framework

Broker Overview

Company Foundation and Background

SimpleFX Ltd was established in 2014. The company has grown to become a notable player in the CFD trading space. Headquartered in St. Vincent and the Grenadines with registration number 22361 IBC, the company has built its reputation on providing accessible trading solutions for a diverse global clientele. Over its seven-year operational period, SimpleFX has successfully expanded its services to accommodate over 100,000 active traders spanning 160 countries worldwide.

The broker's business model centers on offering commission-free CFD trading across multiple asset categories. These include foreign exchange, cryptocurrencies, stock indices, and commodities. This approach has proven particularly attractive to cost-conscious traders who seek to minimize their trading expenses while maintaining access to diverse market opportunities.

Platform and Service Architecture

SimpleFX operates through two primary trading platforms: WebTrader and MetaTrader 4 (MT4). The WebTrader platform provides browser-based access for traders who prefer not to download software. MT4 serves those who require more advanced charting capabilities and automated trading features. The broker supports trading across various asset classes, with particular strength in forex and cryptocurrency markets.

According to available information, SimpleFX operates under the regulatory oversight of St. Vincent and the Grenadines authorities. This SimpleFX review notes that while this jurisdiction provides a legal framework for operations, it may offer different levels of investor protection compared to more established regulatory bodies in major financial centers.

Regulatory Jurisdiction: SimpleFX Ltd operates under St. Vincent and the Grenadines regulations. This provides a legal foundation for its global trading services while maintaining operational flexibility in serving international clients.

Deposit and Withdrawal Methods: The broker typically processes deposits and withdrawals without charging fees. However, minimal charges may apply depending on the selected payment method. Specific processing times and available payment options are not detailed in available sources.

Minimum Deposit Requirements: Current information sources do not specify minimum deposit requirements. This may indicate flexible entry conditions for new traders or variable requirements based on account type.

Bonus and Promotional Offers: Available documentation does not detail specific bonus structures or promotional campaigns. This suggests the broker may focus on competitive trading conditions rather than incentive programs.

Tradeable Assets: SimpleFX provides access to multiple asset categories including major and minor currency pairs, cryptocurrency CFDs, stock indices, and commodity markets. This offers traders diversified investment opportunities within a single platform.

Cost Structure: The broker operates on a commission-free model with floating spreads beginning at 0 pips. This SimpleFX review confirms that traders primarily face spread costs and swap charges, with no additional commission fees on standard transactions.

Leverage Ratios: Maximum leverage reaches 500:1. This provides significant capital amplification opportunities for qualified traders while requiring appropriate risk management strategies.

Platform Options: Traders can choose between WebTrader for browser-based access and MT4 for advanced functionality. This ensures compatibility with different trading styles and technical requirements.

Geographic Restrictions: Specific regional limitations are not detailed in available sources. However, traders should verify local regulatory compliance before account opening.

Customer Support Languages: Available documentation does not specify the range of supported languages for customer service communications.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

SimpleFX's account structure emphasizes accessibility through its commission-free trading model. This eliminates a significant cost component that many traders face with traditional brokers. The floating spread structure starting from 0 pips provides competitive entry conditions, particularly beneficial for scalping strategies and high-frequency trading approaches. However, the lack of clearly specified minimum deposit requirements creates uncertainty for potential clients who need to understand initial capital commitments.

User feedback consistently highlights the simplified account opening process. Traders appreciate the straightforward registration requirements of email address and password setup. This streamlined approach reduces barriers to entry while maintaining necessary verification standards. The absence of detailed information about specialized account types, such as Islamic accounts for Sharia-compliant trading, represents a notable information gap in this SimpleFX review.

The broker's seven-year operational history suggests established account management processes. However, specific details about account maintenance fees, inactivity charges, or premium account features remain unclear from available sources. This transparency limitation prevents a more comprehensive evaluation of the complete account cost structure.

SimpleFX provides a solid foundation of trading tools through its dual-platform approach. The platform combines the accessibility of WebTrader with the advanced capabilities of MetaTrader 4. The MT4 integration ensures access to comprehensive charting tools, technical indicators, and automated trading capabilities through Expert Advisors, meeting the needs of both manual and algorithmic traders.

The platform's support for multiple asset classes demonstrates versatility in tool application. This allows traders to apply consistent analytical approaches across forex, cryptocurrency, and other CFD markets. User feedback suggests satisfactory tool performance, though specific details about proprietary research resources, market analysis content, or educational materials are not extensively documented in available sources.

The availability of both web-based and downloadable platform options provides flexibility for different trading environments and technical preferences. However, this evaluation notes the absence of detailed information about mobile trading applications, which increasingly represent essential tools for modern traders requiring market access across multiple devices.

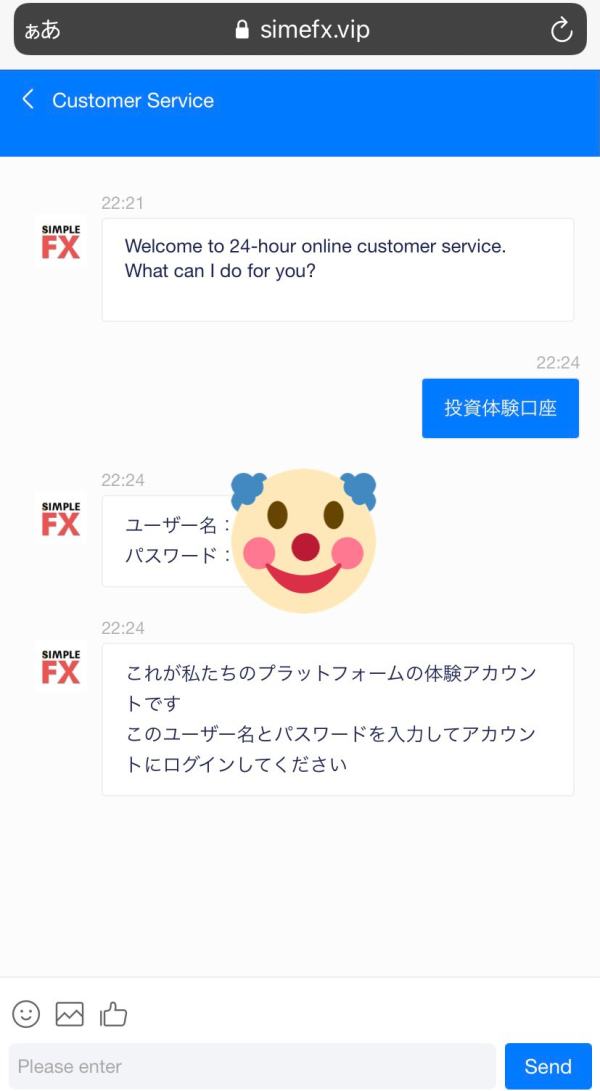

Customer Service and Support Analysis (7/10)

Available user feedback indicates generally positive experiences with SimpleFX's customer support services. Traders note responsive assistance and helpful problem resolution. The broker's seven-year operational experience suggests developed support processes, though specific metrics regarding response times, availability hours, or support channel options are not detailed in accessible documentation.

The global nature of SimpleFX's client base, spanning 160 countries, implies multilingual support capabilities. However, the specific languages offered and regional support variations are not clearly documented. This SimpleFX review identifies this as an area where additional transparency would benefit potential clients from diverse linguistic backgrounds.

User testimonials suggest adequate support quality for common trading inquiries and technical issues. However, the absence of detailed case studies or problem resolution examples limits the depth of this assessment. The broker's focus on simplicity may extend to its support structure, potentially offering streamlined assistance processes that prioritize efficiency over extensive service options.

Trading Experience Analysis (8/10)

User feedback consistently emphasizes SimpleFX's delivery of fast and simple trading experiences. Platform stability receives positive mentions from the trading community. The commission-free structure enhances the trading experience by eliminating additional cost calculations, allowing traders to focus on market analysis and position management rather than fee optimization.

The combination of competitive spreads starting from 0 pips and high leverage up to 500:1 creates favorable conditions for various trading strategies. These range from scalping to position trading. Platform execution quality appears satisfactory based on available user reports, though specific data regarding slippage rates, requote frequency, or order execution speeds are not detailed in accessible sources.

The availability of both WebTrader and MT4 platforms ensures traders can select interfaces that match their experience levels and functional requirements. Advanced users benefit from MT4's comprehensive features, while newcomers can utilize WebTrader's simplified approach. This SimpleFX review notes that mobile trading experience details are not extensively documented, representing a potential area for enhanced information transparency.

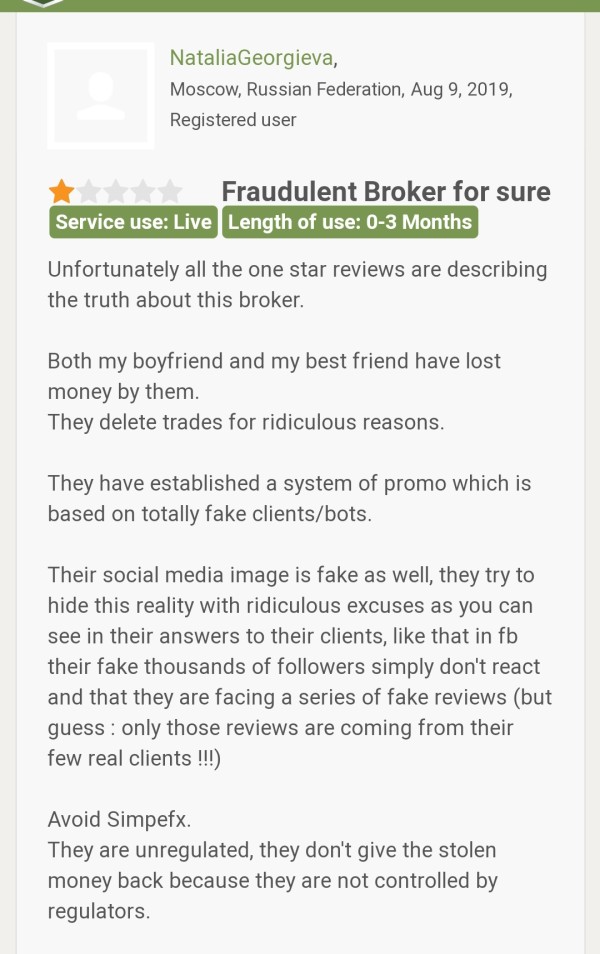

Trust and Security Analysis (6/10)

SimpleFX operates under St. Vincent and the Grenadines regulatory framework. This provides legal structure for its operations while offering different investor protection levels compared to major regulatory jurisdictions such as the UK's FCA or Cyprus's CySEC. The broker's registration number 22361 IBC provides official identification, though specific regulatory compliance measures and investor protection schemes are not detailed in available documentation.

The company's seven-year operational history demonstrates market persistence and suggests established business practices. However, specific information about fund segregation, insurance coverage, or third-party auditing is not readily available. This regulatory environment offers operational flexibility but may provide less comprehensive investor protection compared to more stringent jurisdictions.

Independent verification of the broker's regulatory status confirms its legitimate operation under applicable laws. However, traders seeking maximum regulatory protection may prefer brokers operating under more established financial oversight frameworks. The absence of detailed security measure documentation limits the comprehensiveness of this trust assessment.

User Experience Analysis (8/10)

SimpleFX receives consistently positive user feedback regarding overall satisfaction and ease of use. The broker's emphasis on simplicity translates into user-friendly interfaces that accommodate traders with varying experience levels. The straightforward registration process requiring only email and password setup reduces initial complexity while maintaining security standards.

User testimonials highlight appreciation for the platform's intuitive design and efficient navigation. This contributes to positive trading experiences across different skill levels. The seven-year operational period has allowed SimpleFX to refine its user experience based on client feedback and market evolution, resulting in what users describe as streamlined and effective trading environments.

The global reach serving 160 countries demonstrates successful adaptation to diverse user preferences and requirements. However, specific details about regional customization or localized features are not extensively documented. Users particularly value the combination of competitive trading conditions with simplified platform access, creating an overall positive user experience profile.

Conclusion

SimpleFX emerges from this comprehensive evaluation as a user-focused broker that successfully balances simplicity with essential trading functionality. The platform's commission-free structure, competitive spreads starting from 0 pips, and high leverage options up to 500:1 create attractive trading conditions for cost-conscious traders. The seven-year operational history and service to over 100,000 clients across 160 countries demonstrate proven market presence and scalability.

This broker particularly suits traders who prioritize straightforward trading experiences without sacrificing access to multiple asset classes or essential platform features. The combination of WebTrader and MT4 platforms ensures compatibility with different trading styles and technical requirements. However, potential clients should carefully consider the regulatory framework of St. Vincent and the Grenadines in relation to their individual protection preferences and local legal requirements.

While SimpleFX offers compelling trading conditions and positive user experiences, areas such as minimum deposit transparency, detailed security measures documentation, and comprehensive customer service information represent opportunities for enhanced disclosure. These improvements would benefit prospective traders in making informed decisions.