Regarding the legitimacy of OEXN forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is OEXN safe?

Pros

Cons

Is OEXN markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 18

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

OEXN Limited

Effective Date:

2022-11-21Email Address of Licensed Institution:

info@oexn.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.oexn.comExpiration Time:

--Address of Licensed Institution:

1 Kalimnou Street, Office 602, 6037, Larnaca, CyprusPhone Number of Licensed Institution:

+357 24 242 499Licensed Institution Certified Documents:

Is OEXN A Scam?

Introduction

OEXN is a brokerage firm that has emerged in the forex market, positioning itself as a platform for both novice and experienced traders. Established in 2022, OEXN offers a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. Given the rapid growth of online trading, it is crucial for traders to carefully evaluate forex brokers before investing their funds. The forex market is rife with both legitimate opportunities and potential scams, making due diligence essential for safeguarding investments.

This article aims to provide a comprehensive assessment of OEXN by examining its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and overall risk profile. The evaluation is based on a thorough review of available online resources, user feedback, and regulatory documentation to ensure a balanced and objective analysis.

Regulation and Legitimacy

The regulatory environment in which a broker operates is one of the most critical factors influencing its legitimacy and trustworthiness. OEXN operates under the oversight of two regulatory bodies: the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Commission (FSC) of Mauritius. These regulatory agencies impose strict guidelines to ensure that brokers adhere to ethical trading practices and maintain financial integrity.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CySEC | 423/22 | Cyprus | Verified |

| FSC | GB21026677 | Mauritius | Verified |

The presence of dual regulation from CySEC and FSC adds a layer of credibility to OEXN, as it indicates compliance with both European and international financial standards. CySEC is known for its stringent requirements, which include maintaining adequate capital reserves and implementing robust client protection measures. However, it is essential to note that offshore regulation, such as that from the FSC, can sometimes raise concerns regarding the enforcement of regulatory standards.

OEXN has not reported any significant compliance issues or regulatory infractions since its inception, which is a positive indicator for potential traders. Nevertheless, it is advisable for traders to remain vigilant and conduct their own research to ensure that the broker continues to operate within the legal framework.

Company Background Investigation

OEXN was founded in 2022, with its headquarters located in Port Louis, Mauritius, and additional offices in Cyprus. The company is owned by a group of financial professionals with extensive experience in trading, fintech development, and risk management. This background suggests that the management team possesses the necessary expertise to navigate the complexities of the financial markets.

The company's transparency regarding its ownership and management structure is relatively commendable, as it provides potential clients with insights into the individuals responsible for its operations. However, the level of information available about the management team is limited, which could be a concern for those prioritizing transparency.

In terms of information disclosure, OEXN maintains a user-friendly website that outlines its services, trading conditions, and educational resources. Nevertheless, the lack of detailed biographies or professional histories of key management personnel may leave some traders questioning the firm's overall transparency.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its competitiveness and value proposition. OEXN employs a variable fee structure, which includes spreads, commissions, and overnight swap rates. The broker claims to offer competitive trading costs, which is an attractive feature for traders looking to optimize their profitability.

| Fee Type | OEXN | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.5 pips | 1.0 - 1.5 pips |

| Commission Model | $0 or variable | $5 - $10 per lot |

| Overnight Interest Range | Varies by position | Varies by broker |

While OEXN advertises spreads starting from 1.5 pips, this is at the higher end of the spectrum compared to industry averages. Additionally, the commission structure lacks clarity, with some accounts reportedly having no commissions, while others may incur fees based on trading volume. This ambiguity can be a red flag for traders seeking full transparency regarding costs.

Moreover, OEXN's overnight interest rates can vary significantly, which may affect traders holding positions overnight. Traders should carefully review the specific terms associated with their account type to avoid unexpected charges.

Customer Fund Security

The security of customer funds is paramount in the forex trading industry. OEXN implements several measures to protect client assets, including the use of segregated accounts. This practice ensures that client funds are kept separate from the company's operational funds, providing an additional layer of protection in the event of financial difficulties.

OEXN also claims to have robust security protocols in place to safeguard personal and financial information. However, there is limited public information regarding the specifics of these security measures, which may leave potential clients with unanswered questions.

Historically, OEXN has not reported any significant security breaches or issues related to fund safety. Nevertheless, traders should remain cautious and conduct their own due diligence to ensure that their investments are adequately protected.

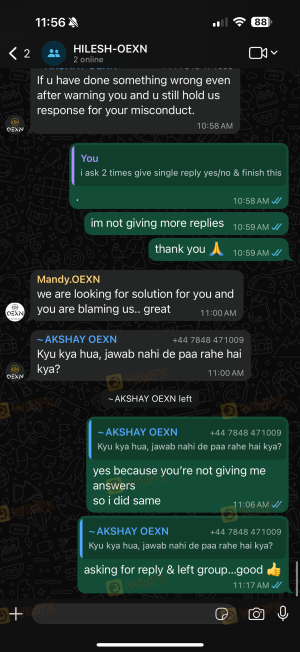

Customer Experience and Complaints

Client feedback is a crucial aspect of evaluating a broker's reliability and service quality. Reviews of OEXN reveal a mixed bag of experiences. While some users praise the platform's ease of use and customer support, others report difficulties with withdrawals and a lack of responsiveness from the company.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Account Access Issues | Medium | Inconsistent support |

| High-pressure Sales Tactics | High | No effective resolution |

One common complaint involves delays in processing withdrawals, with some traders expressing frustration over extended waiting times and inadequate communication from customer support. Additionally, instances of high-pressure sales tactics have raised concerns among users, suggesting that the broker may prioritize acquiring deposits over providing quality service.

For example, one user reported that after successfully trading on a demo account, their experience changed drastically upon transitioning to a live account, citing significant slippage and withdrawal difficulties. This type of feedback underscores the importance of considering customer experiences when evaluating a broker.

Platform and Trade Execution

The trading platform's performance is critical for a successful trading experience. OEXN offers popular platforms such as MetaTrader 4 and MetaTrader 5, alongside its proprietary platform. These platforms are generally well-regarded for their user-friendly interfaces and advanced trading features.

However, users have reported mixed experiences regarding order execution quality. While some traders praise the platform's reliability, others have highlighted issues with slippage and order rejections during volatile market conditions. Such problems can significantly impact trading outcomes and raise concerns about the broker's execution practices.

Risk Assessment

Engaging with OEXN involves several risks that potential traders should consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Dual regulation but offshore presence can raise concerns. |

| Customer Fund Security | Medium | Segregated accounts in place, but limited information on security measures. |

| Customer Support | High | Mixed reviews regarding responsiveness and support quality. |

| Trading Costs | Medium | Higher spreads and unclear commission structure. |

To mitigate these risks, potential traders should ensure they fully understand the broker's terms and conditions, conduct thorough research on user experiences, and consider starting with a smaller investment to test the waters.

Conclusion and Recommendations

In conclusion, while OEXN operates under the regulation of CySEC and FSC, which lends a degree of credibility, there are several red flags that potential traders should consider. The broker's higher-than-average spreads, mixed customer feedback, and reports of withdrawal difficulties warrant caution.

For traders seeking a reliable forex broker, it may be prudent to explore other options that offer clearer fee structures, more transparent customer service, and a proven track record of client satisfaction. Reputable alternatives include brokers like IG, OANDA, or Forex.com, which have established themselves in the market with strong regulatory oversight and positive user experiences.

Ultimately, the decision to trade with OEXN should be made with careful consideration of the risks involved and a thorough understanding of the broker's offerings.

Is OEXN a scam, or is it legit?

The latest exposure and evaluation content of OEXN brokers.

OEXN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OEXN latest industry rating score is 7.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.