Regarding the legitimacy of De Riva forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is De Riva safe?

Pros

Cons

Is De Riva markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

De Riva Asia Limited

Effective Date:

2010-07-29Email Address of Licensed Institution:

admin@derivaasia.comSharing Status:

No SharingWebsite of Licensed Institution:

www.derivaasia.comExpiration Time:

--Address of Licensed Institution:

香港灣仔菲林明道8號大同大廈26樓2601-3室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is De Riva Safe or Scam?

Introduction

De Riva is a forex broker that has emerged in the competitive landscape of online trading, primarily offering services to clients looking to engage in currency trading and other financial instruments. As the forex market continues to grow, traders must exercise caution when selecting a broker, as the industry is rife with both legitimate firms and potential scams. Evaluating the credibility of a broker like De Riva is crucial for protecting ones investments and ensuring a safe trading experience. This article aims to provide an objective assessment of De Riva by examining its regulatory status, company background, trading conditions, customer safety measures, client experiences, and overall risks associated with trading through this platform.

Regulation and Legitimacy

One of the most critical factors in determining whether De Riva is safe is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards of conduct and financial practices. In the case of De Riva, there are mixed reports regarding its regulatory oversight. According to various sources, De Riva claims to be regulated under the Hong Kong Securities and Futures Commission (SFC). However, there are significant concerns about the quality and transparency of this regulation.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Hong Kong SFC | N/A | Hong Kong | Claims Regulation |

While the SFC is a recognized regulatory body, the lack of a specific license number raises questions about the legitimacy of De Riva's claims. Furthermore, some reviews indicate that the broker has faced scrutiny and negative feedback regarding its operational practices. Historically, companies that operate without stringent regulatory oversight are often associated with higher risks, including potential fraud. Thus, while De Riva may present itself as regulated, the absence of clear verification creates uncertainty regarding its safety.

Company Background Investigation

De Riva, operating under the name De Riva Asia Limited, has a relatively short history in the forex market, having been established in 2020. The company is based in Hong Kong, a region known for its financial services sector. However, the rapid growth of the company raises concerns about its long-term stability and commitment to ethical trading practices. The ownership structure of De Riva remains opaque, with limited information available about the key stakeholders and management team.

The management teams background is crucial for assessing the broker's credibility. A team with extensive experience in finance and trading can significantly enhance a broker's reputation. Unfortunately, the lack of publicly available information about De Riva's management team diminishes transparency and may contribute to a perception of risk among potential clients. Overall, the company's brief history and limited transparency regarding its operations and management raise questions about its reliability and whether De Riva is safe for traders.

Trading Conditions Analysis

Understanding the trading conditions offered by De Riva is essential for evaluating its overall attractiveness to traders. The broker provides various account types with different minimum deposit requirements, starting from $200. The leverage offered is up to 1:200, which is relatively standard in the industry. However, the details regarding spreads and commissions are less clear, with some sources indicating spreads as high as 2.2 pips.

| Fee Type | De Riva | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.2 pips | 1.5 pips |

| Commission Model | Unclear | Varies |

| Overnight Interest Range | Not Specified | Varies |

The higher spread compared to industry averages could indicate that trading costs at De Riva may be less favorable for traders, potentially impacting profitability. Moreover, the lack of clarity regarding commission structures and any hidden fees raises red flags about the broker's transparency. This uncertainty makes it difficult to ascertain whether De Riva is safe in terms of trading conditions, as traders may face unexpected costs that could erode their capital.

Customer Fund Safety

The safety of client funds is paramount when evaluating any forex broker. De Riva claims to implement measures to protect customer funds, but specific details are scarce. Key aspects to consider include whether client funds are kept in segregated accounts, the presence of investor protection schemes, and policies regarding negative balance protection.

Without clear information on these critical safety measures, it is challenging to determine the level of security that De Riva provides to its clients. Reports indicate that there have been instances of withdrawal issues and difficulties in accessing funds, which is a significant concern for any trader. Historical issues related to fund security can indicate a broker's overall reliability. Therefore, potential clients must carefully consider whether De Riva is safe in terms of fund safety before committing their capital.

Customer Experience and Complaints

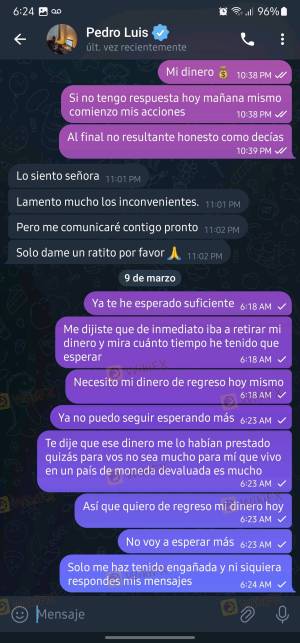

Customer feedback is a vital component of assessing a broker's reputation. Reviews of De Riva reveal a mix of experiences among traders, with some expressing satisfaction with the platform while others report significant issues, particularly regarding withdrawals and customer service. Common complaints include delays in processing withdrawals, lack of transparency in fees, and inadequate customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Inconsistent |

| Customer Service Issues | High | Poor |

For instance, several users have reported being unable to withdraw their funds after repeated requests, leading to frustration and distrust. Such complaints are serious and warrant cautious consideration when determining whether De Riva is safe. The overall sentiment among users suggests that while some traders may find value in the brokers offerings, significant issues could pose risks to potential clients.

Platform and Trade Execution

The performance of a trading platform can significantly impact a trader's experience. De Riva offers a proprietary trading platform, but user reviews indicate mixed experiences regarding its stability and execution quality. Traders have reported instances of slippage and execution delays, which can adversely affect trading outcomes.

Additionally, the absence of popular trading platforms like MetaTrader 4 or 5 may deter some traders who prefer these well-established interfaces. The lack of transparency regarding order execution practices and any potential manipulation raises further concerns about the reliability of De Rivas trading environment. Consequently, traders must question whether De Riva is safe for executing trades, given the potential for unfavorable trading conditions.

Risk Assessment

In summary, trading with De Riva presents a range of risks that potential clients must consider. These risks stem from regulatory uncertainties, unclear trading conditions, customer complaints, and the overall lack of transparency surrounding the brokers operations.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Uncertainty regarding regulatory status |

| Trading Costs | Medium | Higher spreads compared to industry average |

| Fund Security | High | Limited information on fund protection |

| Customer Support | High | Frequent complaints regarding responsiveness |

To mitigate these risks, traders should conduct thorough research, consider starting with a minimal deposit, and ensure they fully understand the terms and conditions before engaging with De Riva.

Conclusion and Recommendations

In conclusion, the evidence suggests that while De Riva presents itself as a legitimate forex broker, there are significant concerns regarding its safety and reliability. The absence of clear regulatory verification, coupled with reports of withdrawal issues and inadequate customer support, raises red flags for potential investors.

For traders seeking a secure and trustworthy trading environment, it may be prudent to explore alternative brokers with established reputations and robust regulatory oversight. Consider brokers that are well-regulated and have positive customer feedback to ensure a safer trading experience. Ultimately, while De Riva may appeal to some traders, the risks associated with its operations warrant careful consideration of whether De Riva is safe for your trading needs.

Is De Riva a scam, or is it legit?

The latest exposure and evaluation content of De Riva brokers.

De Riva Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

De Riva latest industry rating score is 6.94, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.94 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.