Get Nice 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive get nice review examines a trading platform that has gained attention in the online brokerage space. The platform appears to operate in the competitive retail trading market based on available information from industry sources, though specific details about its regulatory status and operational framework remain limited in publicly available documentation.

Get Nice seems to target retail traders seeking accessible trading solutions. However, the exact scope of services and target demographics are not clearly defined in current market reports. According to various online broker comparison platforms, the retail trading industry has seen significant growth, with numerous platforms competing for market share through different service offerings and fee structures.

While comprehensive data on Get Nice's specific features, regulatory compliance, and user satisfaction metrics are not readily available in major financial industry publications, this review attempts to provide an objective assessment based on available information. The platform operates in an increasingly regulated environment where trader protection and transparency have become paramount concerns for both regulators and users.

Given the limited publicly available information about Get Nice's specific operations, potential users should exercise due diligence and verify all platform details directly with the provider before making any trading decisions.

Important Notice

This review is based on publicly available information and industry reports as of 2025. Trading platforms may operate under different regulatory frameworks across various jurisdictions, and services may vary significantly between regions.

Specific details about Get Nice's operations, including regulatory status, available instruments, and terms of service, should be verified directly with the platform. The evaluation methodology employed in this review considers standard industry metrics including regulatory compliance, trading conditions, platform functionality, and user experience factors.

However, due to limited specific information about Get Nice in major financial industry databases, some assessments may be incomplete. Prospective traders should conduct their own research and consider consulting with financial advisors before engaging with any trading platform.

Rating Framework

Broker Overview

Get Nice operates within the online trading industry. Specific details about its founding date, corporate structure, and operational history are not prominently featured in major financial industry publications.

The platform appears to be positioned in the retail trading segment, which has experienced significant growth according to industry reports from platforms like Forbes Advisor and The Motley Fool. The online brokerage industry has become increasingly competitive, with platforms differentiating themselves through various factors including fee structures, available instruments, technological capabilities, and regulatory compliance.

According to Forbes Advisor's 2025 analysis of online brokers, the industry continues to evolve with new entrants regularly joining the market. The current trading platform landscape, as reported by major financial publications, emphasizes the importance of regulatory compliance, transparent fee structures, and robust technological infrastructure.

Industry leaders typically offer comprehensive trading tools, educational resources, and multiple asset classes to serve diverse trader needs. This get nice review notes that while the platform operates in this competitive environment, specific differentiating factors and unique value propositions are not clearly documented in available industry analyses or comparison reports.

Regulatory Status

Specific regulatory information for Get Nice is not clearly documented in major financial industry databases or regulatory body websites that were reviewed.

Deposit and Withdrawal Methods

Available funding methods and withdrawal processes are not detailed in accessible platform documentation or industry reviews.

Minimum Deposit Requirements

Minimum deposit thresholds are not specified in available public information sources.

Current bonus structures or promotional campaigns are not documented in reviewed industry reports.

Available Trading Assets

The range of tradeable instruments and asset classes is not clearly specified in available platform information.

Cost Structure and Fees

Detailed fee schedules, including spreads, commissions, and additional charges, are not publicly documented in major industry comparison sites.

Leverage Options

Maximum leverage ratios and margin requirements are not specified in available documentation.

Trading platform options and technological infrastructure details are not described in accessible sources.

Geographic Restrictions

Regional availability and service limitations are not clearly outlined in public information.

Customer Support Languages

Available customer service languages and support options are not documented in reviewed sources.

This get nice review emphasizes that potential users should verify all operational details directly with the platform provider.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of account conditions for Get Nice proves challenging due to limited publicly available information about the platform's account structures and requirements. Industry standards typically include multiple account types designed for different trader experience levels and capital requirements.

These range from basic retail accounts to premium services for high-volume traders. According to major online broker reviews published by The Motley Fool and Forbes Advisor, competitive platforms generally offer tiered account structures with varying minimum deposits, fee schedules, and feature access.

Standard industry practice includes providing demo accounts for new traders, multiple live account options with different minimum funding requirements, and specialized accounts such as Islamic accounts for traders requiring Sharia-compliant services. The account opening process across the industry has become increasingly streamlined, with most reputable platforms offering online applications with document verification systems.

However, specific details about Get Nice's account types, minimum deposit requirements, verification procedures, and special account features are not documented in available industry analyses. This get nice review cannot provide a definitive assessment of account conditions without access to detailed platform specifications and user experience data from verified sources.

Trading tools and educational resources represent critical differentiators in the modern online brokerage industry. Leading platforms typically provide comprehensive charting packages, technical analysis tools, economic calendars, and market research resources.

According to industry reports, successful brokers often integrate third-party analysis tools and provide proprietary research content. Educational resources have become increasingly important, with top-rated platforms offering webinars, trading guides, video tutorials, and market analysis content.

Many brokers also provide automated trading support through expert advisors, copy trading systems, or algorithmic trading capabilities. Risk management tools, including stop-loss orders, take-profit levels, and position sizing calculators, are considered essential features by industry analysts.

Advanced platforms often include sentiment analysis, heat maps, and correlation tools to support trading decisions. However, specific information about Get Nice's trading tools, research capabilities, educational offerings, and automated trading support is not available in reviewed industry publications.

The platform's technological capabilities and resource offerings cannot be accurately assessed based on currently available public information.

Customer Service and Support Analysis

Customer service quality represents a crucial factor in trader satisfaction and platform reliability. Industry leaders typically offer multiple contact channels including live chat, email support, and telephone assistance with extended operating hours to serve global markets.

Response time benchmarks vary across the industry, with top-rated platforms often providing immediate live chat responses and email replies within 24 hours. Professional customer support teams are expected to handle account-related inquiries, technical issues, trading questions, and platform guidance.

Multi-language support has become standard for platforms serving international markets, with major brokers offering assistance in dozens of languages. Quality customer service includes knowledgeable representatives capable of addressing both basic account questions and complex trading scenarios.

Leading platforms often provide dedicated account managers for premium clients and comprehensive FAQ sections for common inquiries. Unfortunately, specific information about Get Nice's customer service channels, operating hours, response times, language support, and service quality metrics is not documented in available industry reviews or user feedback platforms.

This limits the ability to provide an accurate assessment of the platform's support capabilities.

Trading Experience Analysis

The trading experience encompasses platform stability, execution speed, order management capabilities, and overall user interface design. Industry benchmarks emphasize the importance of reliable platform uptime, fast order execution, and comprehensive order types to support various trading strategies.

Modern trading platforms are expected to provide real-time price feeds, advanced charting capabilities, one-click trading options, and mobile accessibility. Platform performance during high-volatility periods and market opening hours represents a critical evaluation criterion for serious traders.

User interface design significantly impacts trading efficiency, with successful platforms balancing comprehensive functionality with intuitive navigation. Mobile trading capabilities have become essential, with traders expecting full platform functionality across desktop, tablet, and smartphone applications.

Order execution quality, including fill rates, slippage management, and price improvement opportunities, directly affects trading profitability. Leading brokers typically provide execution statistics and transparency reports to demonstrate their commitment to best execution practices.

This get nice review cannot provide specific assessment of trading experience quality due to the absence of detailed platform performance data, user experience reports, or technical specifications in available industry sources.

Trust and Safety Analysis

Trust and regulatory compliance form the foundation of any reputable trading platform. Industry standards require proper licensing from recognized financial authorities, segregated client fund protection, and transparent operational practices.

Leading brokers typically hold multiple regulatory licenses and submit to regular audits. Client fund security measures include segregated accounts with top-tier banks, investor compensation schemes, and transparent fund handling procedures.

Reputable platforms provide clear information about their regulatory status, including license numbers and regulatory body contacts for verification. Corporate transparency involves providing detailed company information, management team details, and financial stability indicators.

Established brokers often publish annual reports, regulatory filings, and corporate governance information to demonstrate their commitment to transparency. Risk disclosure and client education about trading risks represent additional trust factors, with responsible brokers providing comprehensive risk warnings and educational materials about potential losses in leveraged trading.

However, specific information about Get Nice's regulatory licenses, client fund protection measures, corporate transparency, and risk management practices is not available in reviewed regulatory databases or industry publications, preventing a comprehensive trust assessment.

User Experience Analysis

Overall user experience encompasses the complete client journey from initial platform discovery through ongoing trading activities. Successful platforms typically provide streamlined registration processes, efficient account verification procedures, and intuitive platform navigation that accommodates both novice and experienced traders.

Interface design quality affects daily trading efficiency, with leading platforms investing heavily in user experience research and interface optimization. Modern traders expect customizable dashboards, saved workspace configurations, and personalized alert systems.

Account management features including deposit and withdrawal processes, account statement access, and portfolio tracking tools contribute significantly to overall user satisfaction. Efficient fund transfer procedures and transparent fee disclosure enhance the user experience.

Platform reliability and technical support quality directly impact user satisfaction, with successful brokers maintaining high uptime percentages and providing responsive technical assistance when issues arise. Unfortunately, specific user experience data, interface design information, account management features, and user satisfaction metrics for Get Nice are not available in major review platforms or industry analyses.

This limits the ability to provide a comprehensive user experience assessment.

Conclusion

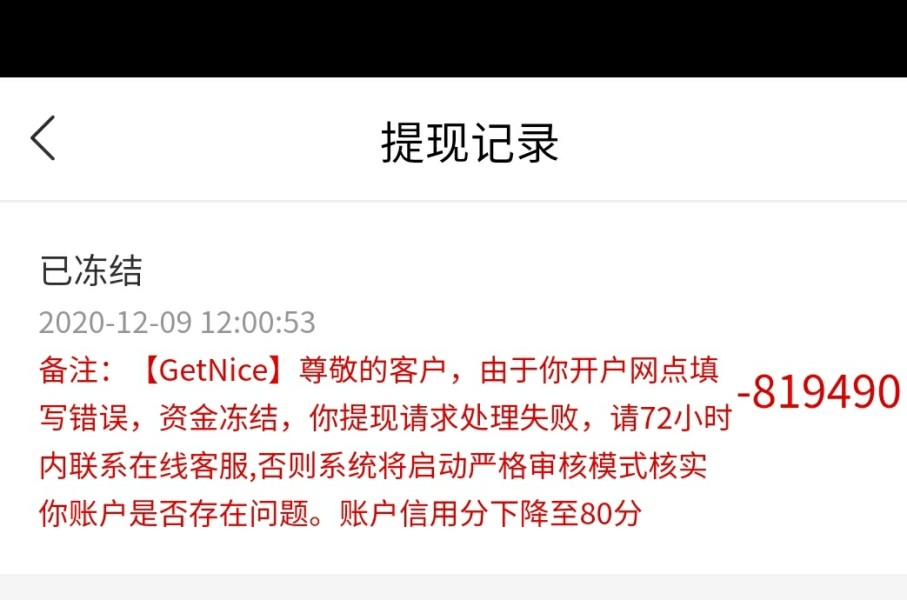

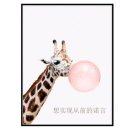

This comprehensive get nice review reveals significant limitations in available public information about the platform's operations, regulatory status, and service offerings. While Get Nice appears to operate in the competitive online trading industry, the absence of detailed information in major financial industry publications, regulatory databases, and user review platforms raises questions about the platform's market presence and transparency.

Potential users should exercise particular caution and conduct thorough due diligence before engaging with any trading platform that lacks comprehensive public documentation of its regulatory status, operational practices, and user feedback. The online trading industry offers numerous well-established alternatives with transparent operations, clear regulatory compliance, and extensive user reviews.

Given the limited available information, this review cannot recommend Get Nice for any specific trader category without additional verification of the platform's legitimacy, regulatory compliance, and operational capabilities. Traders seeking reliable trading services should prioritize platforms with clear regulatory status, transparent fee structures, and established market reputations.