Regarding the legitimacy of GNFG forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is GNFG safe?

Risk Control

Software Index

Is GNFG markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Get Nice Futures Company Limited

Effective Date:

2005-12-16Email Address of Licensed Institution:

info@getnice.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.getnicefg.com.hkExpiration Time:

--Address of Licensed Institution:

香港皇后大道中183號新紀元廣場中遠大廈地下至3字樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Get Nice Safe or a Scam?

Introduction

Get Nice, officially known as Get Nice Financial Group Ltd., is a Hong Kong-based brokerage firm that has positioned itself in the forex and CFD trading markets. Established in 2015, the company offers various financial services, including securities, futures, and options brokerage. As the forex market continues to attract traders worldwide, it becomes increasingly crucial for investors to evaluate the legitimacy and reliability of brokers like Get Nice. In an industry where unscrupulous practices are not uncommon, assessing a broker‘s credibility is vital to safeguarding one’s investments. This article employs a comprehensive evaluation framework, focusing on regulatory compliance, company background, trading conditions, client funds security, and user experiences, to determine whether Get Nice is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a brokerage is a key indicator of its legitimacy. Get Nice claims to be regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is a reputable regulatory body. However, the verification of this regulation has been challenging. The following table summarizes the core regulatory information regarding Get Nice:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | Not disclosed | Hong Kong | Under investigation |

The quality of regulation is paramount in assessing a broker's trustworthiness. While the SFC is known for its stringent oversight, the lack of a disclosed license number raises concerns about the transparency of Get Nice's operations. Furthermore, the absence of a clear verification status may indicate potential compliance issues. Historically, brokers with weak regulatory frameworks have been associated with higher risks of fraud and mismanagement. Therefore, while Get Nice presents itself as a regulated entity, the ambiguity surrounding its regulatory status warrants caution. It is essential for traders to verify any claims made by brokers independently.

Company Background Investigation

Get Nice Financial Group Ltd. has a relatively short but notable history in the financial services sector. The company was spun off from Get Nice Holdings Limited and subsequently listed on the Hong Kong Stock Exchange in April 2016. Its ownership structure is transparent, with publicly available information regarding its parent company. The management team comprises professionals with backgrounds in finance and investment, lending credibility to the firm's operations. However, the companys transparency in disclosing its operational practices and financial health remains a point of concern. The level of information available to clients can significantly impact their confidence in the broker.

In terms of corporate governance, Get Nice has made efforts to maintain a professional image. However, the lack of comprehensive disclosures regarding its financial performance and internal controls may lead to questions about its operational integrity. As potential investors or traders consider opening accounts, they should demand a higher level of transparency and seek out detailed financial reports and governance policies.

Trading Conditions Analysis

Get Nice offers various trading conditions, including spreads, commissions, and overnight interest rates. The overall fee structure is a critical factor for traders when choosing a broker. Heres a comparison of core trading costs:

| Fee Type | Get Nice | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 1.5 pips | 1.0 pips |

| Commission Model | No commission | 0-10 USD |

| Overnight Interest Range | 0.5% to 1.5% | 0.5% to 2.0% |

While Get Nice does not charge commissions, the spreads on major currency pairs are slightly above the industry average. This may affect the overall trading costs for active traders. Additionally, the overnight interest rates are competitive but can vary significantly based on market conditions. Traders should be aware of these costs as they can impact profitability, especially for those engaging in high-frequency trading.

Client Funds Security

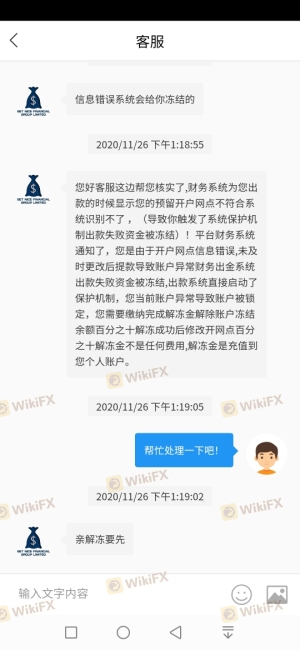

The safety of client funds is a paramount concern for any trader. Get Nice claims to implement several measures to secure client investments, including fund segregation and investor protection policies. However, the specifics of these measures are not adequately detailed on their website or in client communications.

Investors should be aware that in the event of a broker's insolvency, segregated accounts can help protect client funds. Additionally, the presence of negative balance protection policies can further enhance security. Unfortunately, there have been no documented incidents of fund mismanagement or security breaches at Get Nice, which is a positive sign. However, the lack of detailed information regarding their security protocols may lead to apprehension among potential clients.

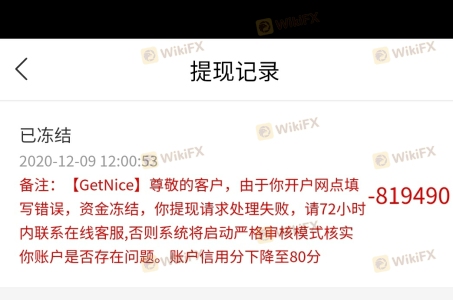

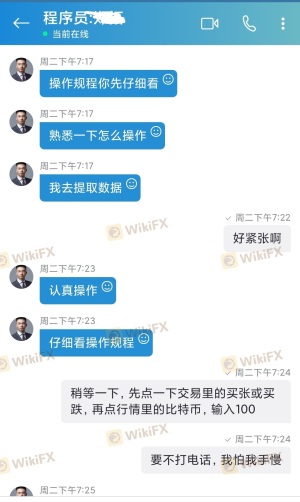

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reliability. Reviews of Get Nice reveal a mixed bag of experiences. While some users praise the firm for its responsive customer service and transparent pricing, others report issues related to account verification and withdrawal processes. Heres a summary of common complaints:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal delays | High | Delayed response |

| Account verification issues | Medium | Generally responsive |

| Customer service responsiveness | Low | Generally positive |

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and dissatisfaction. The companys response was reportedly slow, which exacerbated the situation. Such complaints highlight the importance of a broker's responsiveness and reliability in handling client issues.

Platform and Execution

The trading platform offered by Get Nice is essential for assessing user experience and execution quality. Reviews indicate that the platform is user-friendly, but there are concerns regarding order execution speed and slippage. Traders have reported instances of slippage during high volatility periods, which can negatively impact trading outcomes. Additionally, the rejection of orders has been noted, raising questions about the platform's reliability during critical trading times.

Traders should be vigilant regarding these factors, as they can significantly affect trading performance. A broker that demonstrates consistent execution quality and minimal slippage is generally viewed as more reliable.

Risk Assessment

When considering whether Get Nice is safe, it is crucial to evaluate the overall risk profile associated with trading through the broker. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unclear verification status |

| Customer Fund Security | Medium | Lack of detailed security protocols |

| Trading Costs | Medium | Higher spreads compared to industry average |

| Customer Service | Medium | Mixed feedback regarding responsiveness |

To mitigate risks, traders should conduct thorough research before engaging with the broker. It is advisable to start with a smaller investment to gauge the broker's reliability and responsiveness.

Conclusion and Recommendations

In conclusion, while Get Nice presents itself as a legitimate broker, several factors warrant caution. The unclear regulatory status and mixed customer feedback raise questions about its overall safety. Potential traders should be particularly cautious regarding the higher trading costs and the reported issues with withdrawals.

For traders seeking reliable alternatives, it may be beneficial to consider brokers with stronger regulatory oversight, transparent fee structures, and a proven track record of customer satisfaction. Brokers such as OANDA, IG, and Forex.com may provide more peace of mind for those looking to navigate the forex market safely. Ultimately, thorough research and due diligence are essential for ensuring a secure trading experience.

Is GNFG a scam, or is it legit?

The latest exposure and evaluation content of GNFG brokers.

GNFG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GNFG latest industry rating score is 6.94, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.94 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.