Is FXOpulence safe?

Pros

Cons

Is FXOpulence A Scam?

Introduction

FXOpulence is a forex broker that positions itself within the competitive landscape of online trading, claiming to offer a wide array of financial instruments, including forex, cryptocurrencies, commodities, and indices. As the financial markets become increasingly accessible, it's essential for traders to exercise caution when selecting a broker. The potential for scams in the forex industry is significant, and due diligence is paramount to safeguarding investments. This article aims to provide an objective analysis of FXOpulence, examining its regulatory status, company background, trading conditions, client experiences, and overall trustworthiness. The evaluation will be based on a comprehensive review of available information, including user feedback and expert analyses.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining a broker's legitimacy. FXOpulence claims to operate under the supervision of the Australian Securities and Investments Commission (ASIC). However, it is important to note that its license status has been flagged as "revoked," which raises serious concerns about its operational legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001302798 | Australia | Revoked |

The importance of regulation cannot be overstated. Regulatory bodies like ASIC impose strict guidelines that protect traders from fraud and ensure fair trading practices. The revocation of FXOpulence's license suggests potential non-compliance with these regulations, which could leave clients vulnerable to financial misconduct. Furthermore, the broker's registration in Saint Vincent and the Grenadines, a jurisdiction known for lax regulatory oversight, further complicates its legitimacy. This lack of robust regulation indicates that traders may not have adequate recourse in the event of disputes or issues with fund withdrawals.

Company Background Investigation

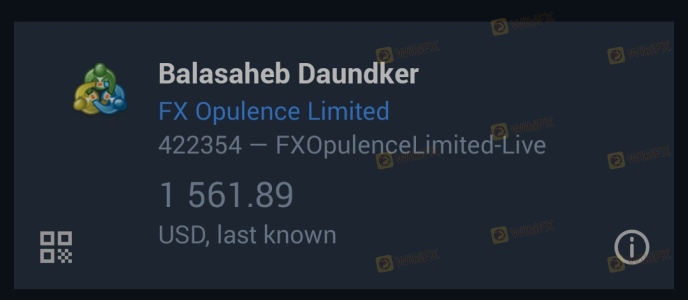

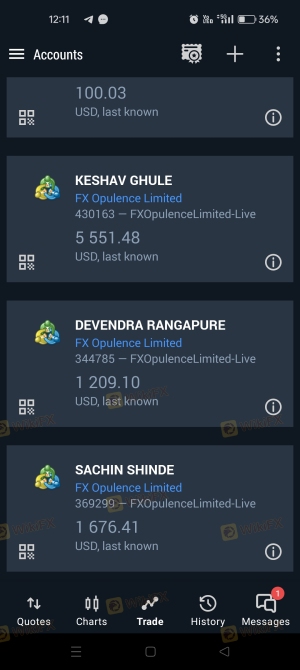

FXOpulence is operated by FX Opulence Pty Ltd, which was established in 2020. Despite its relatively recent inception, the broker claims to have a robust operational framework. However, the lack of transparency regarding its ownership structure and management team raises red flags. The absence of detailed information about the individuals behind the company makes it difficult for potential clients to assess the broker's credibility and reliability.

The company's history is also concerning, as it has faced numerous complaints from users regarding withdrawal issues and alleged fraudulent activities. A broker's transparency is crucial for building trust with clients, and FXOpulence's failure to provide comprehensive information about its operations and management team is a significant drawback. This lack of disclosure may suggest that the company is not fully committed to maintaining a trustworthy relationship with its clients.

Trading Conditions Analysis

FXOpulence offers a variety of trading conditions, including a minimum deposit requirement of $100 and leverage up to 1:500. While these figures may seem attractive, a closer examination of the overall cost structure reveals potential pitfalls.

| Fee Type | FXOpulence | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.6 pips | 1.0 pips |

| Commission Model | Varies | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

The spreads offered by FXOpulence are relatively high compared to industry standards, which could significantly impact trading profitability. Additionally, the commission structure is not clearly outlined, leading to uncertainty about the true cost of trading. Traders should be wary of brokers that do not provide transparent fee structures, as hidden fees can erode profits and lead to unexpected expenses.

Moreover, the broker's high leverage can be a double-edged sword. While it allows traders to amplify their potential profits, it also increases the risk of substantial losses. New traders, in particular, should approach high-leverage offerings with caution and ensure they have a solid risk management strategy in place.

Client Funds Security

The safety of client funds is a paramount concern when choosing a forex broker. FXOpulence claims to implement various security measures, including the use of segregated accounts. However, the lack of independent verification raises questions about the effectiveness of these measures.

FXOpulence does not provide adequate information regarding investor protection policies or negative balance protection, which are essential for safeguarding clients' funds. The absence of these protective measures can leave traders vulnerable to significant financial losses, particularly in the event of market volatility or broker insolvency.

Historically, there have been numerous complaints from clients regarding difficulties in withdrawing funds. These issues highlight potential weaknesses in the broker's operational integrity and raise concerns about the overall safety of client funds. Traders should prioritize brokers that offer transparent information about their security measures and have a proven track record of protecting client investments.

Customer Experience and Complaints

Analyzing customer feedback is crucial for assessing a broker's reliability. Numerous reviews and testimonials regarding FXOpulence reveal a pattern of dissatisfaction among clients. Common complaints include withdrawal delays, unresponsive customer support, and issues with account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Account Management Issues | High | Poor |

Two notable cases exemplify the challenges faced by FXOpulence clients. In one instance, a trader reported being unable to withdraw funds for several months, leading to frustration and financial loss. Another client experienced similar issues, claiming that their withdrawal requests were repeatedly ignored or delayed without explanation. These accounts suggest systemic problems within the broker's operations and highlight the need for potential clients to proceed with caution.

Platform and Execution

The trading platform provided by FXOpulence is based on MetaTrader 5 (MT5), which is widely regarded for its advanced features and user-friendly interface. However, user experiences indicate that the platform may suffer from performance issues, including lag and execution delays.

Traders have reported instances of slippage and rejected orders during critical trading moments, raising concerns about the broker's execution quality. Such issues can significantly impact trading outcomes and contribute to a negative trading experience. Additionally, the lack of transparency regarding order execution practices raises questions about the broker's commitment to fair trading conditions.

Risk Assessment

Engaging with FXOpulence comes with inherent risks that potential clients should consider carefully. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Revoked ASIC license raises concerns about legitimacy. |

| Financial Risk | High | High leverage and unclear fee structure can lead to significant losses. |

| Operational Risk | Medium | Complaints about withdrawal issues and unresponsive support indicate operational weaknesses. |

To mitigate these risks, traders should conduct thorough research before engaging with FXOpulence. It may also be advisable to start with a demo account to familiarize themselves with the platform and trading conditions without risking real capital.

Conclusion and Recommendations

In conclusion, the evidence suggests that FXOpulence exhibits several characteristics commonly associated with untrustworthy brokers. The revocation of its ASIC license, coupled with numerous complaints regarding withdrawal issues and poor customer support, raises significant red flags. While the broker offers a variety of trading instruments and competitive leverage, the overall lack of transparency, regulatory oversight, and client protection measures warrant caution.

For traders seeking reliable forex trading options, it is advisable to consider well-regulated brokers with a proven track record of client satisfaction and transparent operations. Alternatives such as brokers regulated by the FCA, CySEC, or ASIC with positive user feedback and robust security measures may provide a safer trading environment. Always prioritize due diligence when selecting a broker to protect your investments and ensure a positive trading experience.

Is FXOpulence a scam, or is it legit?

The latest exposure and evaluation content of FXOpulence brokers.

FXOpulence Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXOpulence latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.