Is Ucapitals safe?

Business

License

Is Ucapitals A Scam?

Introduction

Ucapitals is an online forex trading platform that has garnered attention in the financial market since its inception in 2020. Operating under the domain name ucapitals.com, it positions itself as a broker offering a variety of trading instruments, including forex, cryptocurrencies, and commodities. However, the legitimacy of Ucapitals has come under scrutiny, prompting traders to exercise caution when evaluating this broker. The importance of carefully assessing forex brokers cannot be overstated, as the financial industry is rife with scams and unregulated entities that can lead to significant financial losses. This article aims to provide an objective analysis of Ucapitals by reviewing its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. Our findings are based on a comprehensive examination of various online reviews, regulatory databases, and user testimonials.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy and the safety of client funds. Ucapitals claims to operate under the auspices of Valep Ltd, allegedly registered in the Marshall Islands. However, it is essential to note that the lack of credible regulatory oversight raises red flags. The absence of licenses from recognized financial authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) suggests that Ucapitals operates in a high-risk environment.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The implications of operating without regulation are significant. Regulated brokers are required to adhere to strict guidelines designed to protect investors, including maintaining segregated accounts for client funds and ensuring transparency in their operations. Ucapitals, however, lacks such oversight, which exposes traders to potential fraud and financial mismanagement. Furthermore, claims of regulation through the International Financial Market Regulatory Center (IFMRC) have been debunked as this entity is widely recognized as a fake regulator that issues licenses to unscrupulous brokers. The overall lack of credible regulatory credentials paints a concerning picture of Ucapitals' legitimacy.

Company Background Investigation

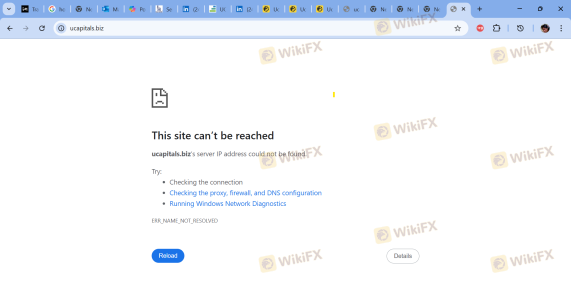

Ucapitals presents itself as a modern trading platform, but its background is shrouded in ambiguity. The company claims to be owned by Valep Ltd, which, according to various sources, is also registered in the Marshall Islands. However, a search in the GLOFSA company registry reveals no registered entities under either Ucapitals or Valep Ltd, raising questions about the authenticity of its claims. The lack of transparency regarding ownership and management is a significant concern, as legitimate brokers typically provide clear information about their leadership and operational structure.

The management team behind Ucapitals remains largely anonymous, with no verifiable information available regarding their qualifications or experience in the financial services industry. This lack of transparency is a common trait among scam brokers, who often operate without accountability. Furthermore, the absence of a physical address or contact information adds to the unease surrounding the company's legitimacy. In summary, Ucapitals' opaque ownership structure and the absence of credible management information contribute to the perception that it may not be a trustworthy trading platform.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is crucial. Ucapitals requires a minimum deposit of $250 to open an account, which is a standard practice in the industry. However, the trading costs associated with Ucapitals appear to be higher than average. Reports indicate that spreads for major currency pairs start from 1.2 pips, which is above the industry average.

| Fee Type | Ucapitals | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 0.6 - 1.0 pips |

| Commission Model | 0% | Varies |

| Overnight Interest Range | High | Varies |

Moreover, Ucapitals employs a withdrawal fee of 5% and an account maintenance fee of 5% after six months of inactivity. Such fees are concerning, as they can significantly erode traders' profits. Additionally, the companys practice of offering bonuses tied to trading volume requirements can be problematic, as it may trap clients into making further investments before being able to withdraw their funds. The overall fee structure raises concerns about the broker's commitment to fair trading practices and suggests that potential clients should be extremely cautious before engaging with Ucapitals.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. Ucapitals claims to implement various measures to protect client funds; however, the lack of regulation significantly undermines these claims. The absence of segregated accounts, which are essential for ensuring that client funds are kept separate from the broker's operational funds, poses a serious risk. Additionally, there are no investor protection schemes in place, leaving clients vulnerable in the event of the broker's insolvency.

Historically, Ucapitals has faced numerous complaints regarding withdrawal difficulties, with clients reporting that their requests for fund withdrawals have been ignored or delayed. Such incidents raise significant concerns about the security of client funds and the broker's overall operational integrity. The lack of a clear policy regarding negative balance protection further exacerbates the risks associated with trading through Ucapitals. In summary, the absence of robust fund security measures and the broker's unregulated status suggest that client funds may not be safe with Ucapitals.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. A review of various online platforms reveals a troubling pattern of complaints against Ucapitals. Many clients have reported difficulties in withdrawing their funds, citing unresponsive customer support and unexplained delays. Common issues include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Support | High | Poor |

| Account Closure | Medium | Poor |

One notable case involved a client who deposited funds but faced repeated obstacles when attempting to withdraw profits. After multiple attempts to contact customer support, the client was met with silence, leading to concerns about the broker's legitimacy. Another user reported being pressured into making additional deposits under the guise of "upgrading" their account, which is a common tactic employed by scam brokers. These testimonials highlight the potential risks of engaging with Ucapitals and underscore the importance of thorough due diligence before investing.

Platform and Trade Execution

The trading platform provided by Ucapitals is a web-based solution that does not require any installation. While it claims to offer a user-friendly interface, numerous user reviews indicate issues related to platform stability and execution quality. Many traders have reported experiencing slippage and delays in order execution, which can significantly impact trading outcomes. Additionally, there are allegations of data manipulation, where clients' trades were rendered unprofitable due to the broker's interference.

The lack of a reputable trading platform, such as MetaTrader 4 or 5, raises concerns about the reliability of Ucapitals' trading environment. The absence of robust trading tools and resources further diminishes the overall user experience, suggesting that the broker may not prioritize the needs of its clients. In conclusion, the platform's performance and trade execution quality appear to be subpar, raising additional red flags regarding Ucapitals' legitimacy.

Risk Assessment

Engaging with Ucapitals entails several risks that potential investors should carefully consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status exposes clients to fraud. |

| Fund Security Risk | High | Lack of segregation and protection measures. |

| Customer Service Risk | Medium | Poor response to complaints and support issues. |

| Execution Risk | High | Reports of slippage and data manipulation. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with any broker. It is also recommended to utilize regulated platforms that offer robust investor protection measures. Additionally, maintaining a cautious approach to deposits and withdrawals can help safeguard against potential losses.

Conclusion and Recommendations

In light of the evidence presented, it is clear that Ucapitals raises significant concerns regarding its legitimacy and reliability as a forex broker. The absence of regulation, coupled with a troubling history of customer complaints and questionable trading practices, suggests that Ucapitals may indeed be operating as a scam. Traders are strongly advised to exercise extreme caution and consider alternative, regulated options for their trading needs.

For those seeking a safer trading environment, reputable brokers such as IG, OANDA, or TD Ameritrade are recommended. These brokers are regulated by recognized authorities and offer robust protections for client funds. In summary, potential investors should prioritize their financial safety by choosing well-regulated brokers with transparent practices and positive customer feedback.

Is Ucapitals a scam, or is it legit?

The latest exposure and evaluation content of Ucapitals brokers.

Ucapitals Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ucapitals latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.