Regarding the legitimacy of ForexMart forex brokers, it provides CYSEC, FSC and WikiBit, (also has a graphic survey regarding security).

Is ForexMart safe?

Pros

Cons

Is ForexMart markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 21

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Instant Trading EU Ltd

Effective Date:

2015-01-13Email Address of Licensed Institution:

regulation@instaforex.euSharing Status:

No SharingWebsite of Licensed Institution:

www.instaforex.eu, www.forexmart.eu, www.instatradesolution.huExpiration Time:

--Address of Licensed Institution:

23A, Spetson, Leda Court, Block B, Office B203, Mesa Geitonia, CY- 4000 LimassolPhone Number of Licensed Institution:

+357 25 722 774Licensed Institution Certified Documents:

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

InstaFinance Ltd

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is ForexMart A Scam?

Introduction

ForexMart is an online forex and CFD broker that has been operating since 2015, aiming to provide traders with a wide range of financial instruments and competitive trading conditions. As the forex market continues to grow, the importance of selecting a reliable broker cannot be overstated. With numerous options available, traders must exercise caution and conduct thorough research to avoid potential pitfalls. This article aims to evaluate ForexMarts credibility by analyzing its regulatory status, company background, trading conditions, customer feedback, and risk factors. The assessment is based on a comprehensive review of the latest information available from various financial news and broker review sites.

Regulation and Legitimacy

ForexMart operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC). However, there are concerns regarding the legitimacy of its regulatory status, with some sources indicating that its CySEC license may be a clone. Regulatory oversight is crucial for any broker, as it ensures compliance with industry standards and provides a level of protection for traders' funds.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CySEC | 266/15 | Cyprus | Suspected Clone |

| FSC | N/A | Saint Vincent | Unregulated |

| FCA | 728735 | UK | Suspicious Clone |

The quality of regulation is essential, as it dictates the level of protection offered to traders. CySEC is considered a reputable regulatory body; however, the allegations of ForexMarts clone license raise red flags. Furthermore, the broker's history shows some compliance issues, including fines imposed for not adhering to specific regulatory requirements. This lack of transparency in its regulatory framework may lead potential clients to question the safety of their investments with ForexMart.

Company Background Investigation

ForexMart is operated by Instant Trading EU Ltd, a company registered in Cyprus. The broker claims to have a significant presence in the forex industry, but its history is relatively short compared to more established players. The management team behind ForexMart appears to have a mix of experience in finance and trading, but detailed information about their qualifications and backgrounds is limited. The company's ownership structure is not entirely transparent, which may pose concerns for potential investors seeking to understand who is managing their funds.

In terms of transparency, the broker provides some information on its website regarding its services and trading conditions. However, the lack of comprehensive details about its management team and ownership structure can be a cause for concern. Investors often prefer brokers with a clear and open approach to their operations, as this fosters trust and confidence.

Trading Conditions Analysis

ForexMart offers a variety of trading accounts, including classic, pro, cents, and zero spread accounts. The broker's overall fee structure is competitive, but there are some concerns regarding hidden fees and commissions. Understanding the costs associated with trading is vital for any trader, as it directly impacts profitability.

| Fee Type | ForexMart | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 1.2 pips | 1.0 pips |

| Commission Model | Varies | Varies |

| Overnight Interest Range | 1% - 3% | 1% - 2% |

ForexMart's spreads are generally in line with industry averages, but the potential for hidden fees—especially on withdrawals—may deter some traders. Furthermore, the broker's commission structure is not entirely clear, which can lead to unexpected costs during trading. Such policies can be problematic, particularly for new traders who may not be aware of the intricacies involved.

Customer Funds Safety

The safety of customer funds is a critical aspect of any brokerage. ForexMart claims to implement several measures to ensure the security of its clients' funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures can be called into question given the broker's regulatory concerns.

ForexMart is a member of the Investor Compensation Fund (ICF), which offers a level of protection for clients in case of broker insolvency. The maximum compensation limit is up to €20,000, which is a positive aspect for potential investors. However, the lack of a robust regulatory framework raises concerns about the overall safety of funds held with the broker.

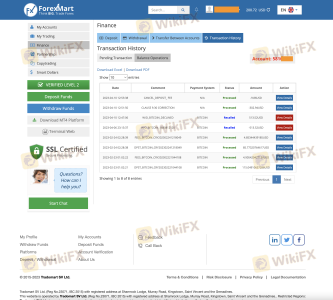

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability and service quality. ForexMart has received mixed reviews from its clients, with some praising its trading platform and customer service, while others express dissatisfaction with withdrawal processes and customer support responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Unresolved Issues |

| Account Verification Problems | Low | Delayed Processing |

Common complaints revolve around withdrawal delays, with some traders reporting that their requests were either ignored or met with excessive processing times. These issues highlight the need for ForexMart to improve its customer support and responsiveness to enhance overall client satisfaction.

Platform and Trade Execution

ForexMart utilizes the widely used MetaTrader 4 (MT4) platform, known for its reliability and user-friendly interface. The platform offers various features for technical analysis and automated trading, making it suitable for both novice and experienced traders. However, there have been reports of slippage and order rejections, which can negatively impact trading performance.

The execution quality is generally satisfactory, but traders should remain vigilant for signs of potential manipulation or unfair practices. The lack of transparency regarding order execution policies can be a concern for traders who rely on precise execution for their strategies.

Risk Assessment

Using ForexMart poses several risks that traders should be aware of. The combination of regulatory uncertainties, customer feedback, and the overall trading environment creates a moderate risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Suspected clone regulation |

| Customer Fund Safety | Medium | Segregated accounts but limited protection |

| Withdrawal Issues | High | Frequent complaints about delays |

To mitigate these risks, traders should consider using smaller amounts for initial deposits and conduct thorough research before engaging in trading activities.

Conclusion and Recommendations

In conclusion, while ForexMart offers a range of trading instruments and competitive conditions, there are significant concerns regarding its regulatory status and customer feedback. The alleged clone of its CySEC license raises serious questions about its legitimacy, and the mixed reviews from clients indicate that there are issues that need addressing.

For traders seeking a reliable broker, it may be prudent to consider alternatives with stronger regulatory oversight and a proven track record of customer satisfaction. Brokers such as FP Markets and eToro are often recommended for their robust regulatory frameworks and positive user experiences.

Ultimately, potential clients should exercise caution and conduct thorough research before committing funds to ForexMart or any broker with similar concerns.

Is ForexMart a scam, or is it legit?

The latest exposure and evaluation content of ForexMart brokers.

ForexMart Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ForexMart latest industry rating score is 7.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.