robinhood 2025 Review: Everything You Need to Know

1. Abstract

This comprehensive robinhood review outlines Robinhood's current standing in 2025 as a mobile-first discount brokerage and crypto exchange with a clear focus on beginner and intermediate active traders. The platform is famous for its zero-commission trading policy and user-friendly interface. Robinhood offers a seamless trading experience for those just starting out in the markets. The platform's standout features include its commission-free trading and an intuitive, mobile-optimized design that caters to casual investors while still serving those with a moderate level of trading activity. However, it falls short for advanced traders. Although highly appealing to newcomers due to its low entry barriers, Robinhood lacks the depth of analytical tools and comprehensive research resources required for more sophisticated trading strategies. The broker's overall approach is streamlined for ease-of-use. This makes it ideal for investors who prioritize accessibility and simplicity over advanced functionalities. According to recent user reviews and industry observations, the educational resources and simplicity are significant draws, despite criticisms regarding the limited research capabilities and customer support details.

2. Important Considerations

It is important to note that Robinhood currently operates primarily within the United States, with its trading policies and service offerings tailored specifically for the domestic market. Cross-regional services and policies remain unaddressed in the available materials. Interested users from outside the U.S. should take this into account before proceeding. This review has been compiled using the most recent data and user feedback available in 2025. Additionally, while the absence of trading fees is a key selling point, prospective investors should remain aware that specific details regarding deposit/withdrawal processes, bonus promotions, and customer service channels have not been fully detailed in the public information. The U.S. Securities and Exchange Commission provides regulatory oversight. This ensures a level of operational transparency and compliance.

3. Score Framework

4. Broker Overview

Company Background and Business Model

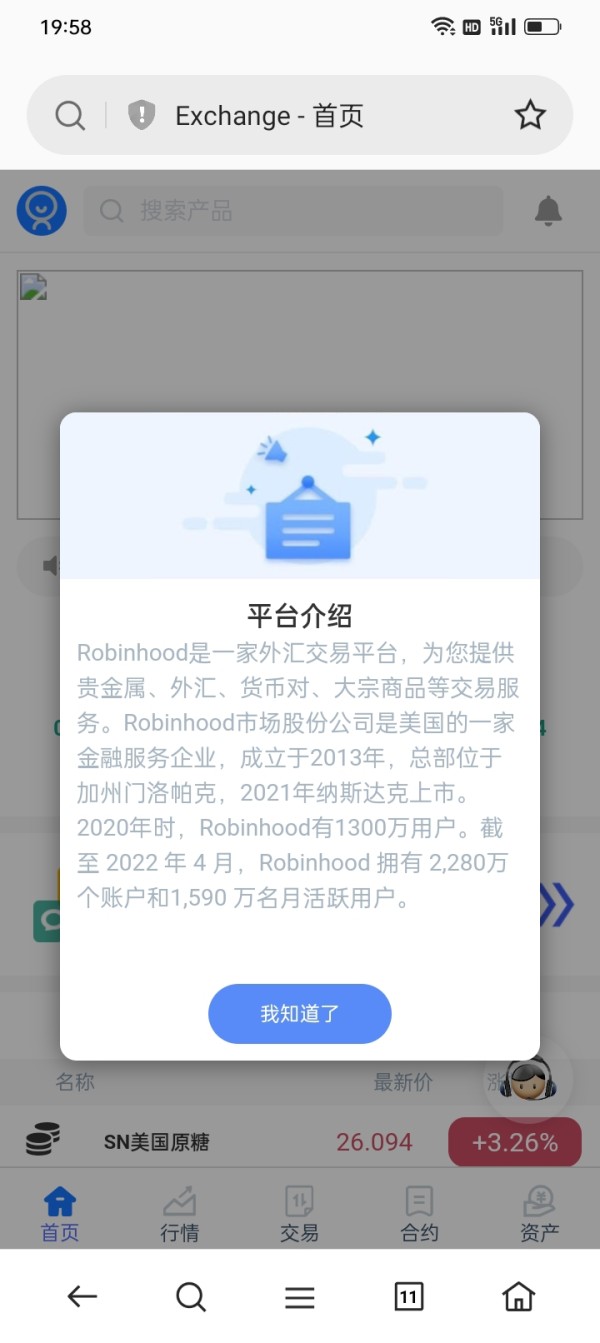

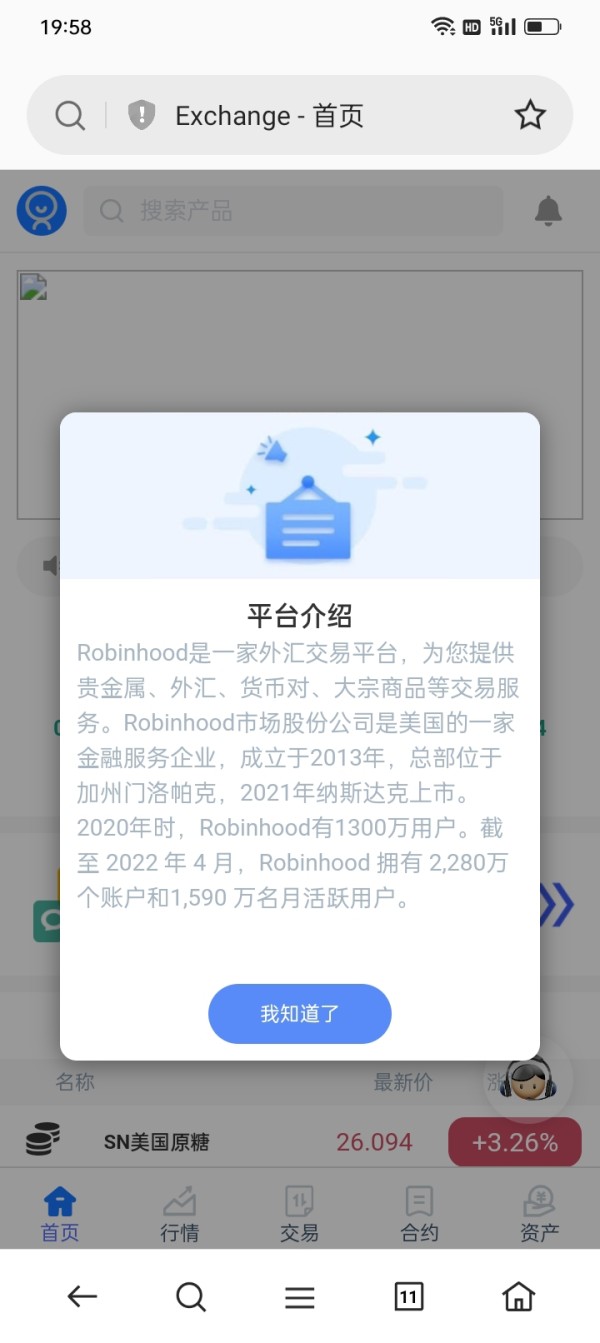

Robinhood has established itself as a leading mobile-first discount broker in 2025 by capitalizing on the trend toward zero-commission trading. The company was founded to address the needs of novice investors and casual traders. Robinhood's business model centers on providing commission-free access to a variety of asset classes, including stocks, options, ETFs, and cryptocurrencies. The platform earns revenue by leveraging payment-for-order-flow arrangements with its partners. Although the company's founding date is not explicitly mentioned in all sources, its rapid ascent to popularity is well documented. Users appreciate the straightforward account setup and low entry requirements. This allows individuals to begin trading with a $0 minimum deposit. This model has resonated well with first-time investors and those seeking a low-cost trading environment, though it remains less attractive to experienced traders who require more detailed market analysis and research tools.

Robinhood is built around a mobile-first trading platform that prioritizes simplicity and accessibility. The user interface emphasizes clarity and ease of navigation. This makes it an attractive option for beginners and intermediate investors alike. The platform supports trading in a diverse range of assets: stocks, ETFs, options, and cryptocurrencies, reflecting its commitment to accommodating a wide user base. In terms of regulation, the U.S. Securities and Exchange Commission primarily oversees Robinhood. This ensures that it adheres to strict regulatory standards to protect investors. Despite its strong regulatory backing and innovative mobile approach, Robinhood's focus on a younger, less experienced demographic means that it falls short in offering advanced research and analytical tools that professional traders expect. Overall, Robinhood's strategy is to provide a no-frills, commission-free trading experience that is both accessible and modern. However, potential investors should consider its limitations in research capabilities.

-

Regulated Regions :

Robinhood operates exclusively in the United States, where it is registered and regulated by the U.S. Securities and Exchange Commission . This regulatory oversight ensures that the platform adheres to stringent compliance and operational standards. It provides a fundamental level of investor protection.

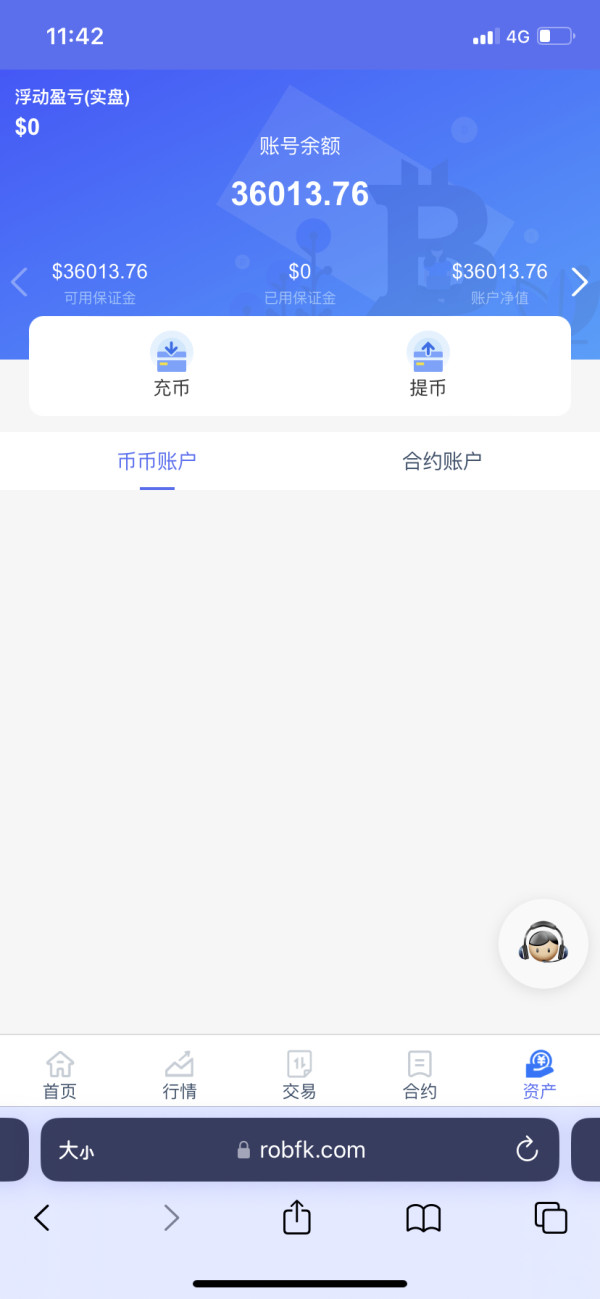

Deposit and Withdrawal Methods :

Specific details regarding deposit and withdrawal methods have not been fully disclosed. Users typically report a seamless experience. However, exact payment methods and processing times are not detailed in the available documentation.

Minimum Deposit Requirement :

Robinhood requires a minimum deposit of $0, making it an accessible platform for beginners eager to start trading without a significant initial investment.

Bonus and Promotional Offers :

There is no detailed information provided on bonus or promotional offers for new or existing customers. As such, the focus remains strictly on commission-free trading. Ancillary benefits are primarily tied to the mobile platform experience.

Tradable Assets :

The tradable assets on Robinhood include a wide array of stocks, options, ETFs, and cryptocurrencies. This selection reflects the broker's aim to cater to diverse investor needs. It ensures that the platform remains simple and user-friendly for beginners.

Cost Structure :

Robinhood's cost structure is very straightforward as it offers zero-commission trading for most transactions. However, users should be aware that certain regulatory fees and service charges may apply during specific transactions. These are particularly common in options trading and cryptocurrency purchases. Although the exact amounts of such fees are not explicitly detailed, they are minimal compared to traditional brokerage fees. This cost transparency has helped build its reputation among cost-conscious investors. However, experts urge novice traders to review the fine print regarding these small charges.

Leverage :

While Robinhood does offer margin accounts for qualified traders, specific details regarding leverage ratios or margin requirements are not comprehensively covered in available sources.

Platform Choices :

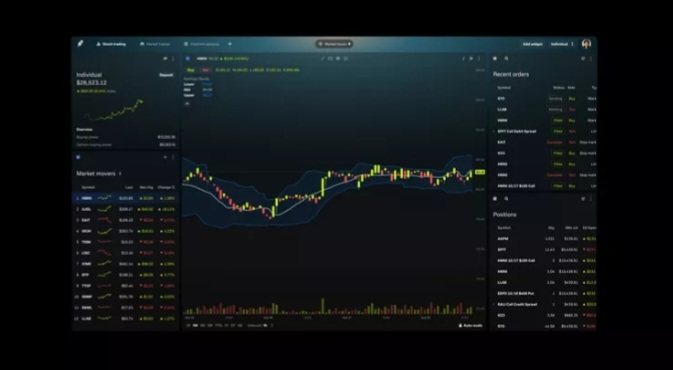

Robinhood is predominantly a mobile-based trading platform. It has focused heavily on developing a streamlined mobile app that reflects the current digital-first trend in trading. Unfortunately, details about a dedicated desktop platform are scarce. This suggests that the mobile experience is the primary focus.

Regional Restrictions :

As a U.S.-based broker, Robinhood primarily serves American clients. Information on operations or restrictions in other regions remains unspecified in the available reports.

Customer Service Languages :

The documentation does not provide explicit details regarding the range of languages in which customer support is available.

6. Detailed Scoring Analysis

6.1 Account Conditions Analysis

Robinhood offers a variety of account types tailored to meet the divergent needs of investors, making it particularly attractive for beginner traders. The zero minimum deposit requirement and commission-free trading structure provide an accessible entry point into the world of investing. This is evidenced by multiple user testimonials. The simplicity of account initiation has been applauded by novice investors who appreciate not having to commit a large initial sum. Despite clear benefits, details about the account opening process, such as identity verification and timeframes, remain moderately vague. Specific procedural information is not extensively detailed in the available sources. Additionally, specialized accounts—such as those designed to meet certain religious or other specific needs—are notably absent from the platform's publicly available documentation. In comparison to other brokers that offer a more extensive range of advanced account features, Robinhood's focus on simplicity and cost reduction is clearly a double-edged sword. While it is highly appealing to new investors, experienced traders may find the offerings somewhat limited. Nonetheless, the overall consensus is that Robinhood's straightforward account conditions play a major role in its popularity among beginners. This confirms its position as a cost-effective, easy-to-access platform.

Robinhood provides a suite of trading tools that primarily cater to novice investors, with its advanced charting functionalities being one of its more recognizable features. While the platform offers clear and concise visual representations of market trends, it falls short when it comes to deep analytical tools and comprehensive research resources necessary for advanced market analysis. Several users have praised the broker's educational materials and interactive tutorials. They find them particularly useful for breaking into stock trading and understanding market mechanics. However, reviews indicate that the research tools fall below industry standards, limiting the ability to perform rigorous technical and fundamental analyses. The lack of automated trading support or sophisticated portfolio management tools further underscores the platform's focus on simplicity over complexity. Expert opinions frequently note that while Robinhood's tools are adequate for learning and basic trading, they do not satisfy the demands of high-frequency or professional traders. As such, while the educational resources remain a strong point – rated favorably by most users – the inherent limitations in research and analytical capabilities suggest a cautious approach for investors planning on scaling up their activity or requiring in-depth market insights.

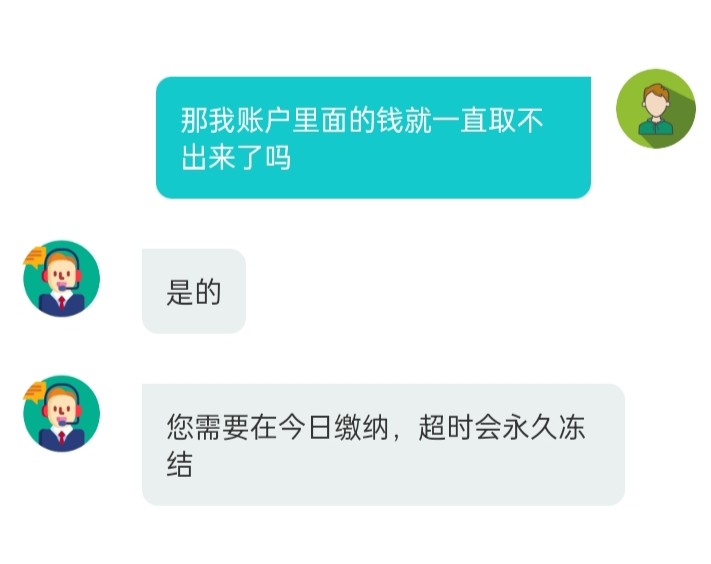

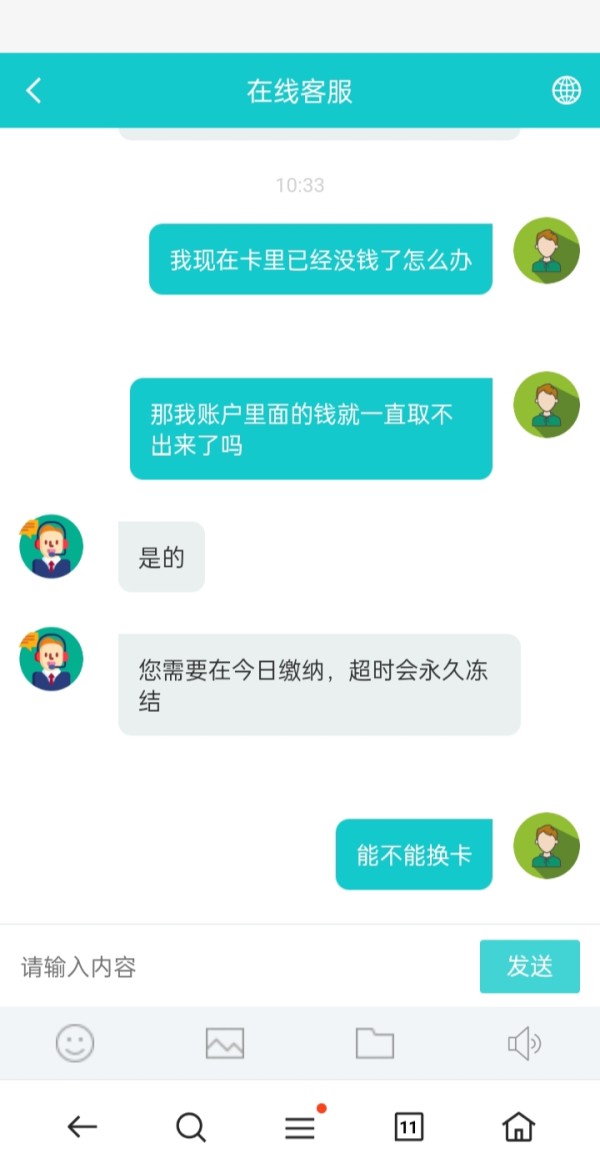

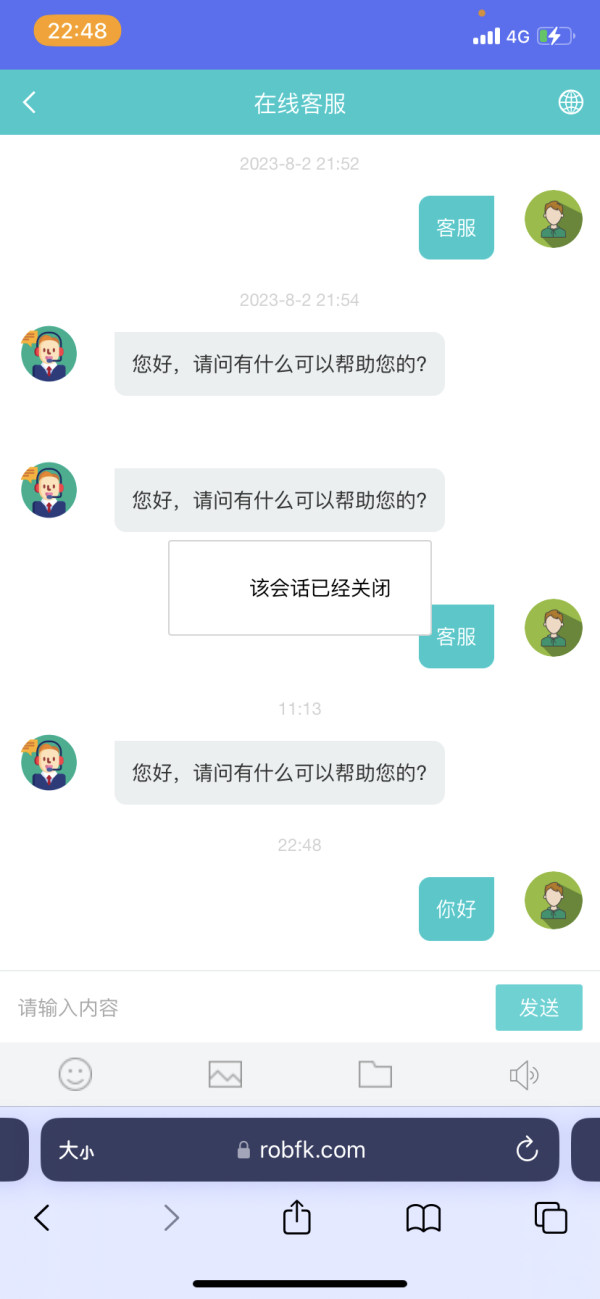

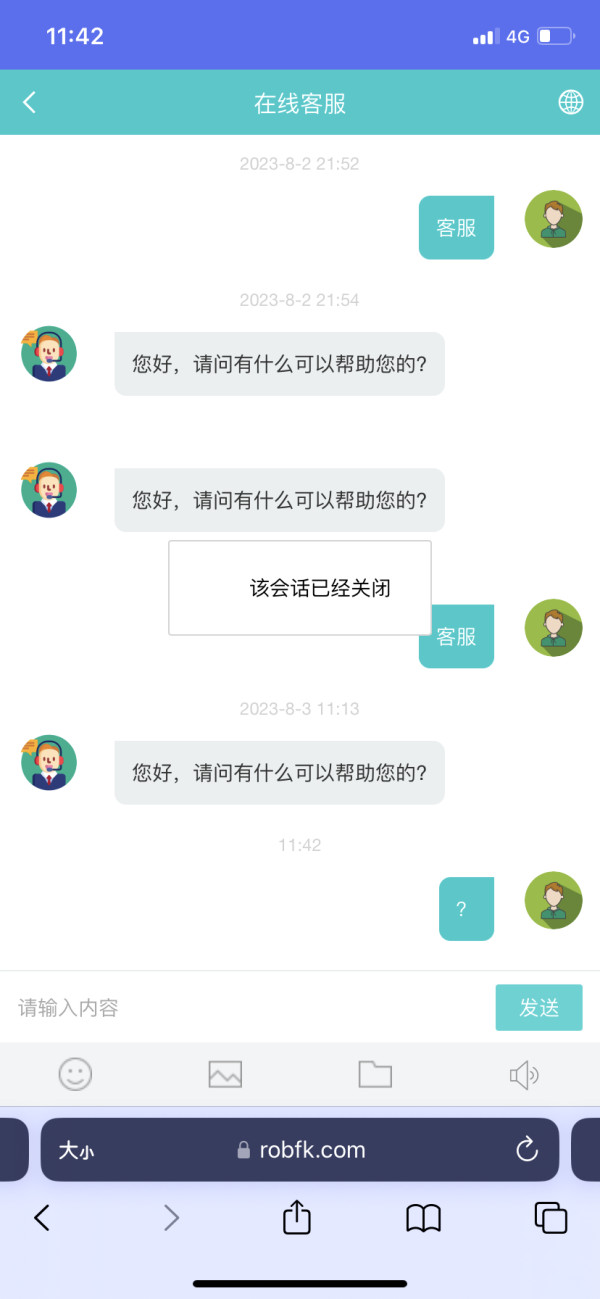

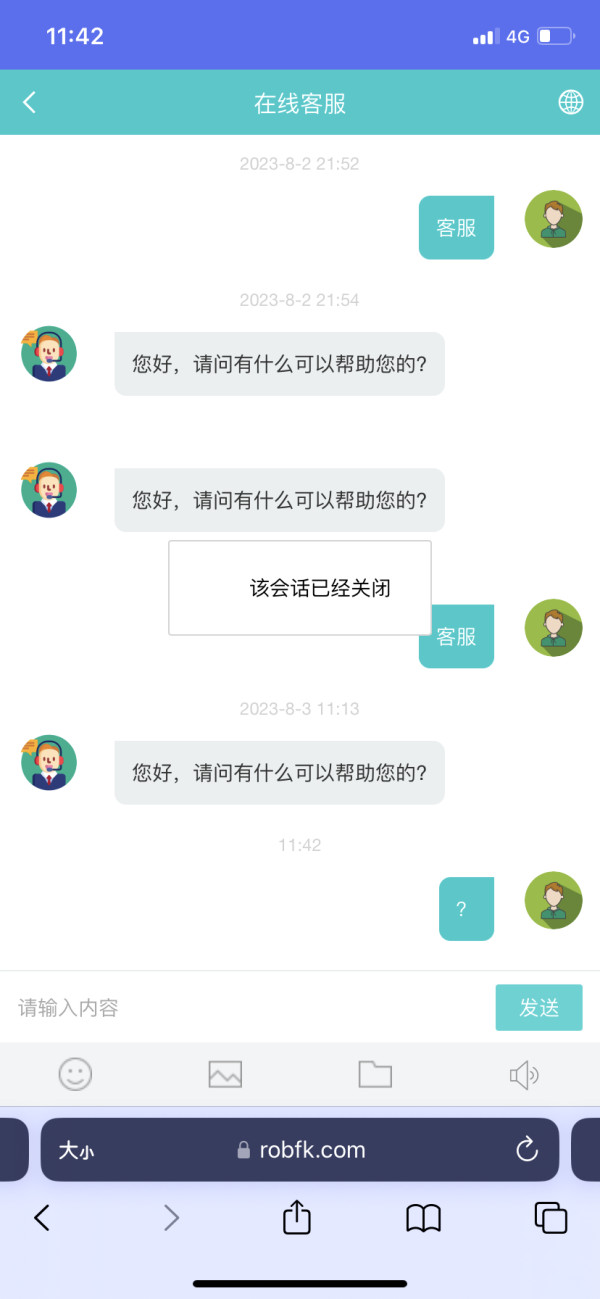

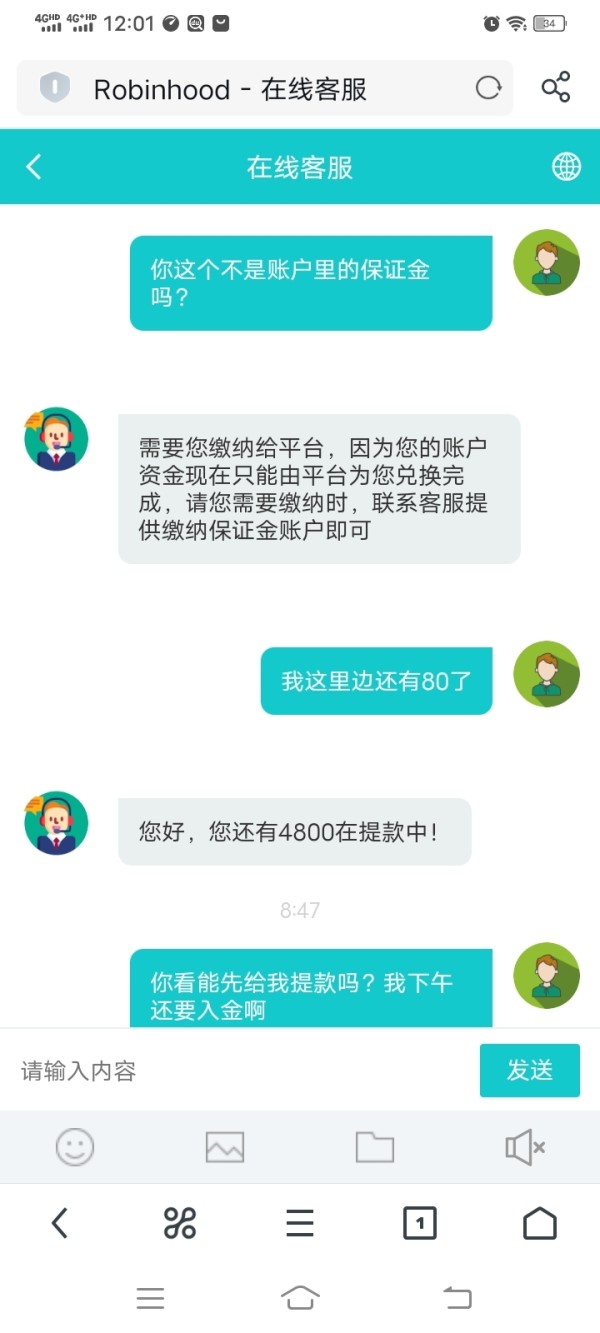

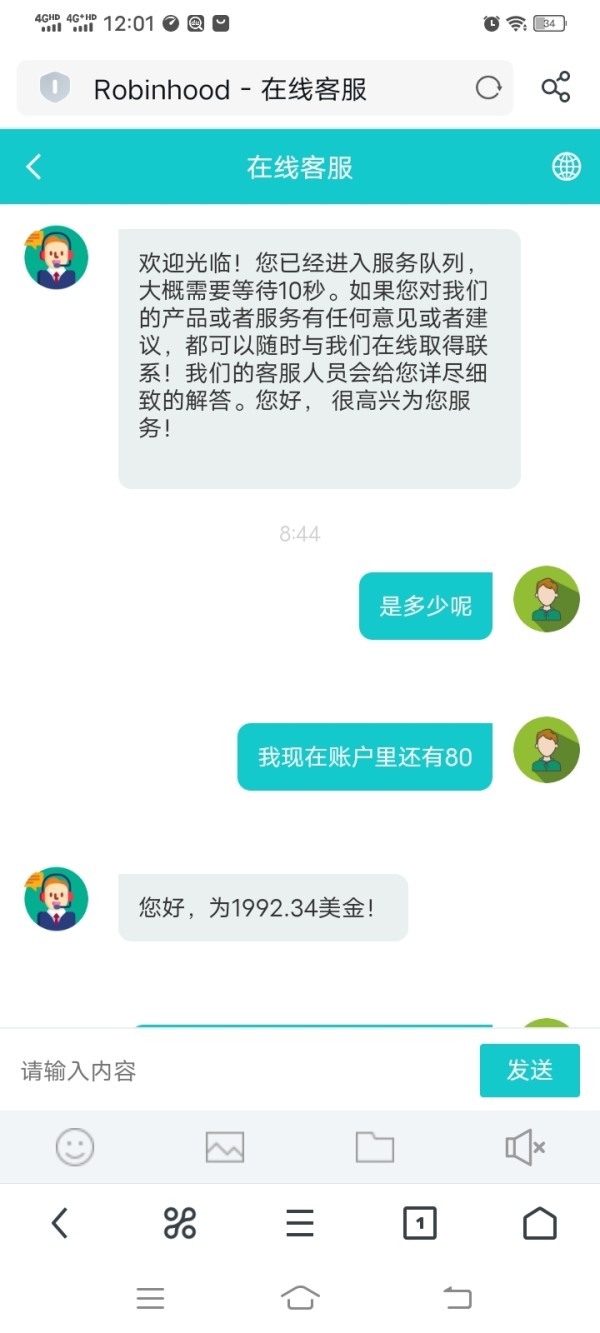

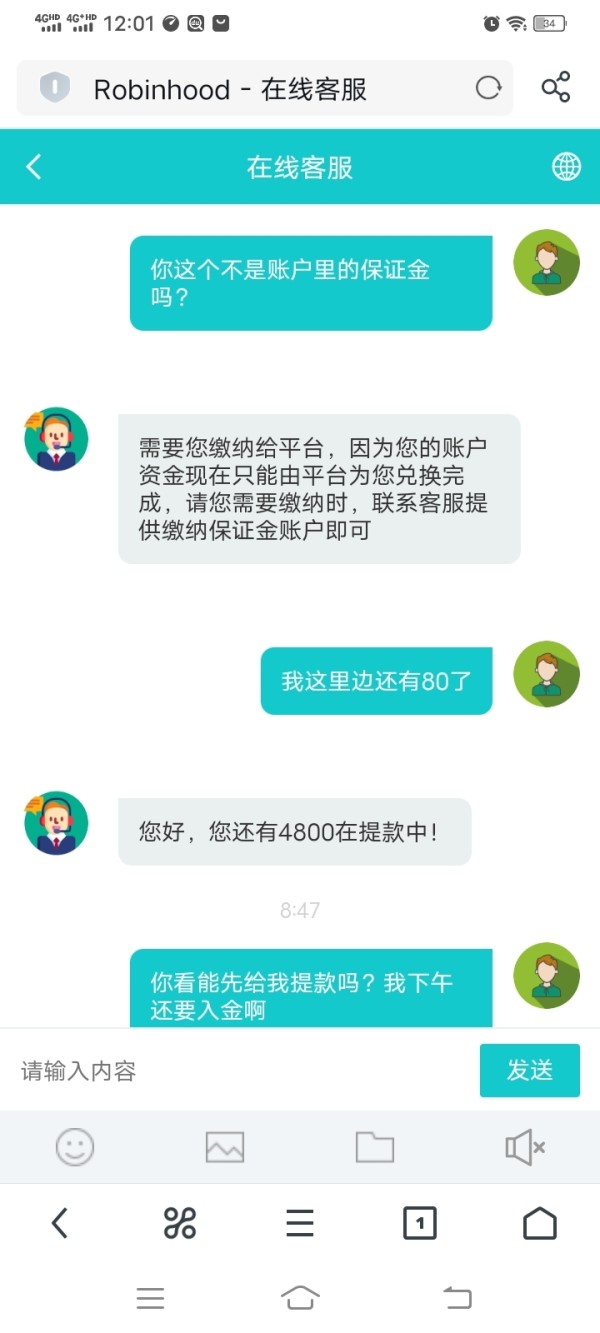

6.3 Customer Service and Support Analysis

Customer service and support are often pivotal for maintaining user satisfaction in an online trading environment. In the case of Robinhood, there is limited publicly available information regarding the breadth and effectiveness of its customer support channels. User reviews have frequently mentioned concerns about the absence of readily accessible support information, including response times and multiple language options. Anecdotal reports suggest that while the platform may eventually resolve issues, the lack of clearly defined service channels can leave new users feeling uncertain when they encounter technical or transactional difficulties. Detailed insights into whether the support team operates 24/7 or handles inquiries via live chat, email, or phone remain noticeably sparse. Furthermore, the documentation does not indicate the existence of robust self-help resources or a comprehensive FAQ section that could mitigate potential problems. This is particularly concerning for newcomers unfamiliar with trading platforms. Despite the SEC-regulated nature of the firm adding a layer of credibility, the overall customer service experience is marred by a notable gap in transparent support infrastructure. As such, potential users are advised to consider these shortcomings. They might impact overall trading satisfaction, especially in situations where prompt technical assistance is crucial.

6.4 Trading Experience Analysis

The trading experience on Robinhood is largely defined by its mobile-first design, which has been optimized for ease-of-use and accessibility on smartphones. Many users appreciate the straightforward navigation and clear, uncluttered interface that allows traders to execute orders with minimal hassle. The platform's stability on mobile devices ensures that users can track market movements and manage their portfolios on the go. This complies with the modern demand for flexibility. However, despite these advantages, the review indicates that there are areas of uncertainty concerning the quality of order execution and the consistency of platform performance during periods of high volatility. While the simplicity of the trading environment facilitates quick decisions, there is limited publicly available data regarding specific execution speeds, spreads, or liquidity metrics that are critical for professional-level trading. Overall, the user experience is characterized by a balance of intuitive design and moderate performance under fast market conditions. This makes it an excellent option for beginners. Nonetheless, high-frequency traders or those seeking more granular control might find the trading environment less than optimal. Enhancements such as more detailed market data and a desktop trading option could greatly benefit those requiring advanced order management capabilities.

6.5 Trustworthiness Analysis

Trust is a paramount factor in selecting a brokerage service, and Robinhood has built a reputation that is partially anchored on its regulatory compliance. As a platform regulated by the U.S. Securities and Exchange Commission , Robinhood upholds certain mandatory standards that contribute to its overall trustworthiness. Nevertheless, various sources have raised concerns about the transparency of the company's background and its internal safety measures. While the SEC oversight does provide investors some assurance regarding regulatory compliance and operational integrity, the lack of detailed public reporting on internal risk management and cybersecurity protocols leaves some investors seeking further clarity. In addition, comparisons with other brokers reveal that although Robinhood's cost structure and ease-of-use are significant attractions, its overall corporate transparency falls short of what more advanced or institutional investors demand. While there have been no major publicized incidents compromising user funds, the absence of exhaustive details regarding funds protection and customer complaint resolution processes continues to haunt critical assessments. Hence, while Robinhood is generally trusted by its community of novice traders – and benefits from the regulatory shield provided by the SEC – potential users might prefer additional transparency. This is particularly true if they plan to engage in more complex trading activities.

6.6 User Experience Analysis

User experience remains one of Robinhood's strongest selling points, particularly among investors new to the trading arena. The platform's clean design and straightforward layout contribute to a highly accessible and intuitive user interface that resonates strongly with beginners. Navigation through various sections – from order placement to portfolio tracking – is seamless, which minimizes any potential learning curve that can typically deter new users from engaging. A majority of user reviews highlight the simplicity of the mobile app and the robust educational resources that aid in market understanding. However, there is a recurring sentiment regarding the limited availability of advanced analytical tools. This can frustrate more experienced investors accustomed to in-depth charting and research functionalities. Additionally, while the registration and account setup process is generally regarded as efficient, detailed information about the efficiency of funds transfer and the troubleshooting process remains lacking. Thus, while overall user satisfaction is high given the platform's emphasis on ease-of-use and design clarity, there remains noticeable room for improvement. This is particularly true in areas that appeal to advanced trading functionalities and comprehensive market analytics. Expanding the breadth of features could further enhance the user experience and broaden the platform's appeal beyond its current target demographic.

7. Conclusion

In summary, Robinhood offers a compelling, commission-free trading environment that is particularly well-suited for beginners and moderately active traders. This review confirms that while the broker's mobile-first design and zero-commission policy are significant advantages, the limitations in advanced research tools and customer support infrastructure may prove restrictive for more experienced investors. Overall, those new to investing will find Robinhood's ease-of-use and accessible features highly attractive. However, potential users should weigh these benefits against the noted deficiencies. For a cost-effective and user-friendly entry into the markets, Robinhood remains a strong contender in the evolving brokerage landscape.