EFSI 2025 Review: Everything You Need to Know

Summary

This comprehensive efsi review examines Essential Fund Services International. EFSI is a regulated broker-dealer that specializes in providing administrative and brokerage services to institutional clients. EFSI is registered with the Securities and Exchange Commission and maintains membership with the Financial Industry Regulatory Authority and the Securities Investor Protection Corporation. The firm manages over $5 billion in assets under administration. It offers a comprehensive suite of services including accounting, reporting, administrative services, and capital introduction solutions.

EFSI primarily targets private investment funds and managed account investment managers. The company provides them with essential back-office and middle-office operations support. The company's business model focuses on enabling investment managers to concentrate on their core investment strategies. EFSI handles critical administrative functions through experienced professionals. With its robust regulatory framework and substantial asset base, EFSI positions itself as a reliable partner for institutional investors. These investors seek comprehensive fund administration and brokerage services.

Important Notice

This review is based on publicly available information from regulatory filings and company disclosures. EFSI operates under U.S. regulatory jurisdiction, and services may vary based on client type and regulatory requirements. Different regional entities may have varying service offerings and regulatory obligations. The evaluation presented here reflects information available as of 2024. It may not capture all recent developments or service modifications. Potential clients should verify current service offerings and regulatory status directly with EFSI before making any investment decisions.

Rating Framework

Broker Overview

Essential Fund Services International operates as a specialized financial services provider. The company focuses on institutional clients within the alternative investment space. The company has established itself as a significant player in fund administration. It manages over $5 billion in assets under administration across various investment strategies. EFSI's business model centers on providing comprehensive back-office solutions that allow investment managers to focus on their core competencies. The firm ensures critical administrative functions are handled by experienced professionals.

The firm's service portfolio extends beyond traditional brokerage activities. It includes accounting, reporting, and administrative services for private investment funds and managed accounts. Additionally, EFSI offers capital introduction services and advisory solutions. These include outsourced Chief Operating Officer and Chief Financial Officer services. This efsi review highlights the company's strategic positioning to serve both established and emerging trading advisors in the alternative investment universe. The firm facilitates connections and introductions within the industry.

EFSI operates under robust regulatory oversight. The company is registered with the SEC as a broker-dealer and maintains active membership with FINRA and SIPC. This regulatory framework provides clients with important protections. It ensures the firm operates within established industry standards. The company serves as the official books and records keeper for funds. It records all trading activities and validates pricing according to fund policies and third-party pricing sources such as Bloomberg and Refinitiv.

Regulatory Jurisdiction: EFSI operates under United States regulatory authority. The company is specifically registered with the Securities and Exchange Commission and maintains membership with the Financial Industry Regulatory Authority and Securities Investor Protection Corporation. This regulatory framework ensures compliance with U.S. securities laws. It provides investor protections.

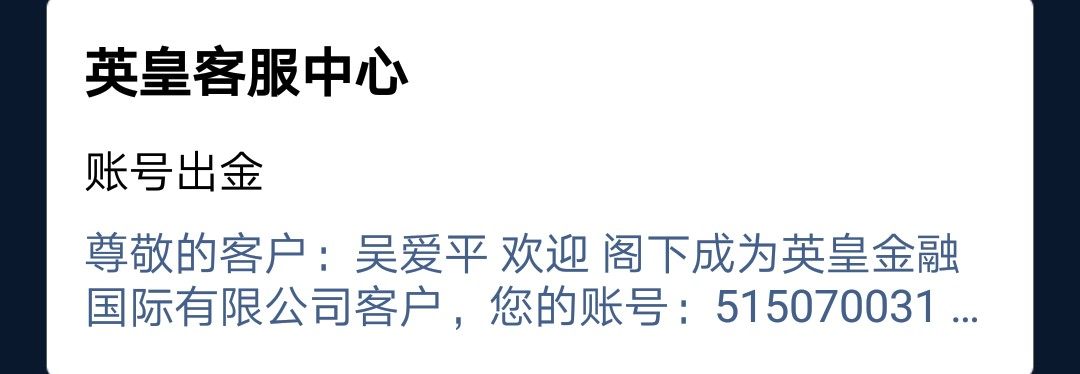

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available public materials. Clients should contact EFSI directly for current funding options and procedures.

Minimum Deposit Requirements: Minimum deposit requirements are not specified in accessible documentation. These requirements likely vary based on account type and client classification.

Bonuses and Promotions: No promotional offerings or bonus structures are mentioned in available materials. This is consistent with the institutional focus of the firm's services.

Tradable Assets: EFSI provides brokerage services across various asset classes. Specific tradable instruments are not detailed in public documentation. The firm's focus on alternative investment funds suggests exposure to diverse investment strategies and asset types.

Cost Structure: Detailed fee structures and cost information are not provided in accessible materials. This efsi review notes that institutional clients typically receive customized pricing based on service requirements and asset levels.

Leverage Ratios: Leverage information is not specified in available documentation. These ratios likely vary based on client needs and regulatory requirements.

Platform Options: Specific trading platform details are not provided in current materials. The firm mentions offering several IRA and retail brokerage account platforms directly to investors.

Regional Restrictions: Geographic limitations are not detailed in accessible documentation.

Customer Service Languages: Language support information is not specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis

The specific account conditions offered by EFSI are not detailed in publicly available materials. This makes a comprehensive evaluation challenging. Based on the firm's institutional focus and regulatory status, it appears that EFSI primarily serves sophisticated investors through customized account structures. The company does not rely on standardized retail offerings. The company's emphasis on serving private investment funds and managed accounts suggests that account conditions are likely tailored to meet the specific needs of institutional clients.

Given EFSI's role as a fund administrator managing over $5 billion in assets, account opening procedures likely involve extensive due diligence and documentation requirements. These requirements are consistent with institutional standards. The firm's regulatory compliance with SEC, FINRA, and SIPC requirements suggests robust account protection measures. It also indicates adherence to industry best practices. However, without specific details about minimum deposits, account types, or special features, this efsi review cannot provide a definitive rating for account conditions.

The absence of publicly available information about account conditions may reflect the firm's focus on institutional clients. These clients typically negotiate terms directly rather than choosing from standardized offerings. Potential clients should engage directly with EFSI to understand available account structures and requirements.

Information regarding specific trading tools and resources provided by EFSI is not detailed in accessible public materials. This limits the ability to conduct a thorough evaluation. The firm's role as a fund administrator and broker-dealer suggests access to institutional-grade systems and resources. However, specific platforms and tools are not described in available documentation.

EFSI's mention of price verification services using third-party sources like Bloomberg and Refinitiv indicates access to professional market data and pricing tools. The company's comprehensive administrative services suggest sophisticated back-office systems capable of handling complex fund operations, trade capture, and reconciliation processes. However, without specific information about client-facing tools, research resources, or analytical capabilities, a complete assessment remains challenging.

The firm's focus on serving investment managers and funds implies that tools and resources are likely designed for institutional use. They are not designed for retail trading. Educational resources and research materials specific to individual traders are not mentioned in available materials. This is consistent with the company's institutional market focus.

Customer Service and Support Analysis

Specific details about EFSI's customer service channels, response times, and support quality are not provided in accessible public documentation. The firm's institutional focus suggests that client service is likely delivered through dedicated relationship management. This differs from traditional retail customer support channels.

Given EFSI's role in managing over $5 billion in assets and providing critical administrative services to investment funds, client support is presumably structured to meet the demanding requirements of institutional clients. The company's emphasis on enabling investment managers to focus on their strategies while handling administrative functions suggests a high-touch service model. This model uses experienced professionals.

Without specific information about service availability, response times, or communication channels, this evaluation cannot provide detailed insights into customer service quality. The firm's regulatory compliance and substantial asset base suggest professional service standards. However, specific metrics and client feedback are not available in public materials.

Trading Experience Analysis

Details about the trading experience provided by EFSI are not specified in available public materials. This makes a comprehensive evaluation difficult. The firm's registration as a broker-dealer with SEC and FINRA membership indicates compliance with regulatory standards for trade execution and client protection. However, specific platform performance metrics are not disclosed.

EFSI's role in trade capture and reconciliation for managed funds suggests sophisticated back-office capabilities. The company has experience with complex trading operations. The company's validation of pricing using established sources like Bloomberg and Refinitiv indicates attention to accuracy and market standards in trade processing.

The firm's focus on institutional clients rather than retail trading suggests that the trading experience is designed for professional money managers. It is not designed for individual traders. This efsi review notes that specific information about execution speeds, platform stability, and trading tools would require direct inquiry with the firm.

Trust and Regulation Analysis

EFSI demonstrates strong regulatory credentials through its registration with the Securities and Exchange Commission as a broker-dealer. The company maintains active membership in both the Financial Industry Regulatory Authority and the Securities Investor Protection Corporation. This regulatory framework provides significant investor protections. It ensures compliance with established industry standards for financial services firms.

The firm's management of over $5 billion in assets under administration demonstrates substantial operational scale. It shows client trust within the institutional investment community. EFSI's role as official books and records keeper for funds requires adherence to strict regulatory standards for record-keeping, trade processing, and client asset protection.

The company's compliance with regulatory requirements for pricing validation, trade reconciliation, and administrative services indicates robust operational controls. It shows transparency measures. SIPC membership provides additional protection for client securities and cash. FINRA oversight ensures adherence to industry conduct standards. These regulatory safeguards contribute to a high trust rating for EFSI's operations and client protections.

User Experience Analysis

Specific information about user experience, interface design, and client satisfaction is not detailed in publicly available materials. This limits the ability to provide a comprehensive evaluation. The firm's institutional focus suggests that user experience is tailored to professional investment managers rather than retail clients. The experience likely emphasizes functionality and efficiency over consumer-oriented design elements.

EFSI's emphasis on enabling investment managers to focus on their core strategies while handling administrative functions suggests a service model designed to simplify complex operational requirements. The company's comprehensive administrative services indicate systems designed to streamline fund operations. They reduce administrative burden for clients.

Without specific feedback from users or detailed descriptions of client interfaces and processes, this evaluation cannot provide definitive insights into user experience quality. The firm's substantial asset base and institutional client focus suggest professional-grade systems and processes. However, specific user satisfaction metrics are not available in accessible documentation.

Conclusion

This efsi review reveals Essential Fund Services International as a well-regulated institutional financial services provider. The company has strong regulatory credentials and substantial operational scale. The firm's registration with SEC, membership in FINRA and SIPC, and management of over $5 billion in assets under administration demonstrate significant credibility within the institutional investment space.

EFSI appears best suited for private investment funds, managed account operators, and investment managers seeking comprehensive administrative and back-office support. It is not designed for individual retail traders. The company's strength lies in its regulatory compliance, substantial asset base, and specialized focus on institutional clients. However, the limited availability of specific information about services, costs, and client experience represents a notable limitation for potential clients. These clients seek detailed comparisons.

Prospective clients should engage directly with EFSI to obtain current information about services, costs, and capabilities. This information should align with their specific institutional requirements.