Regarding the legitimacy of EFSG forex brokers, it provides HKGX, HKGX, SFC, FCA and WikiBit, (also has a graphic survey regarding security).

Is EFSG safe?

Rating Index

Pros

Cons

Is EFSG markets regulated?

The regulatory license is the strongest proof.

HKGX Type AA License

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Type AA License

Licensed Entity:

英皇金號有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.empfs.com/about-us/licensesExpiration Time:

--Address of Licensed Institution:

香港灣仔軒尼詩道288號英皇集團中心28樓Phone Number of Licensed Institution:

28356688Licensed Institution Certified Documents:

HKGX Type B License

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Type B License

Licensed Entity:

英皇國際金業有限公司

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

香港灣仔軒尼詩道288號英皇集團中心28樓Phone Number of Licensed Institution:

28356670Licensed Institution Certified Documents:

SFC Leveraged foreign exchange trading

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Leveraged foreign exchange trading

Licensed Entity:

Emperor International Exchange (Hong Kong) Company Limited

Effective Date:

2005-01-20Email Address of Licensed Institution:

support@empfs.comSharing Status:

No SharingWebsite of Licensed Institution:

www.empfs.comExpiration Time:

--Address of Licensed Institution:

香港灣仔軒尼詩道288號英皇集團中心26-29樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FCA Appointed Representative(AR)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RevokedLicense Type:

Appointed Representative(AR)

Licensed Entity:

Emperor Financial Services (UK) Limited

Effective Date:

2017-02-21Email Address of Licensed Institution:

enquiry@empfs.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2019-12-20Address of Licensed Institution:

3 Kings Meadow Oxford OX2 0DP UNITED KINGDOMPhone Number of Licensed Institution:

+44333350018Licensed Institution Certified Documents:

Is EFSI a Scam?

Introduction

EFSI, or Emperor Financial Services International, is a forex broker that has positioned itself within the competitive landscape of foreign exchange trading. Established in 2017 and registered in the British Virgin Islands, EFSI claims to offer a range of trading services including forex, precious metals, and commodities. However, in the world of forex trading, where scams can be rampant, it is crucial for traders to thoroughly evaluate the legitimacy and safety of brokers like EFSI. This article aims to provide a comprehensive assessment of EFSI by analyzing its regulatory standing, company background, trading conditions, customer experiences, and overall risk profile. The investigation is based on a review of various online sources, user feedback, and market data to ascertain whether EFSI is safe or potentially a scam.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is paramount to its credibility and the safety of its clients' funds. EFSI claims to be regulated by several authorities, including the Securities and Futures Commission (SFC) of Hong Kong and the Financial Conduct Authority (FCA) of the United Kingdom. However, there are significant concerns regarding the validity of these claims, particularly the designation of EFSI as a "suspicious clone" by multiple regulatory watchdogs.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | N/A | Hong Kong | Suspicious Clone |

| Financial Conduct Authority (FCA) | N/A | UK | Suspicious Clone |

| Hong Kong Gold Exchange (HK GX) | 240 | Hong Kong | Suspicious Clone |

The term "suspicious clone" suggests that while EFSI may claim to be regulated, it operates under a license that is either misrepresented or invalid. This raises serious questions about the broker's legitimacy and regulatory compliance. Furthermore, the lack of a concrete license number from the SFC or FCA further complicates the situation, as traders cannot verify the broker's claims independently. The overall regulatory environment for EFSI is concerning, and potential clients should approach with caution, as the absence of robust regulatory oversight can expose traders to significant risks.

Company Background Investigation

EFSI, operating under Emperor Financial Services (International) Limited, has a relatively short history in the forex market. The company was founded in July 2017 and is registered in the British Virgin Islands. The ownership structure and management team of EFSI remain somewhat opaque, with limited information available about key personnel and their qualifications. This lack of transparency can be a red flag for potential investors.

The company's website provides minimal details about its operational history or the experience of its management team, which is essential for establishing trust. A reputable broker typically discloses information regarding its executives and their professional backgrounds, allowing potential clients to assess their expertise and credibility. In EFSI's case, the absence of such information raises concerns about its commitment to transparency and ethical practices.

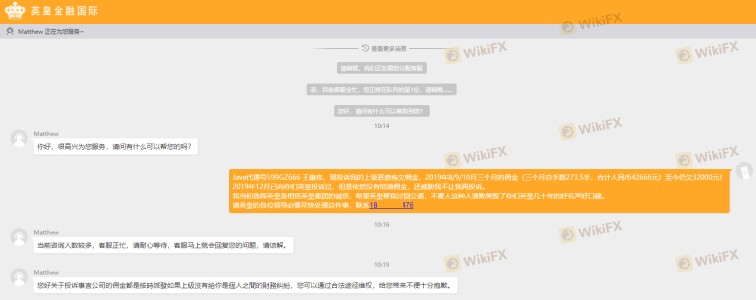

Moreover, the company's operational history is marred by numerous complaints from users regarding fraudulent activities and poor customer service. Reports of clients being scammed out of significant sums of money by employees of EFSI have surfaced, further tarnishing the company's reputation. The lack of accountability and responsiveness to customer grievances is indicative of a company that may not prioritize client welfare.

Trading Conditions Analysis

When assessing whether EFSI is safe, it is crucial to analyze its trading conditions, including fees, spreads, and overall cost structure. EFSI offers a minimum deposit requirement of approximately $1, which is attractive for new traders. However, the trading costs associated with this broker may not be as favorable as they appear on the surface.

| Fee Type | EFSI | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 1.0 - 1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

EFSI's spread of 1.3 pips for major currency pairs is on the higher end of the industry average, which typically ranges from 1.0 to 1.5 pips. Additionally, the commission structure is not clearly defined, leading to potential confusion among traders regarding the actual costs of trading. High overnight interest rates have also been reported, which can significantly erode profits for traders holding positions overnight.

The combination of high spreads and unclear commission structures raises concerns about the overall cost-effectiveness of trading with EFSI. Traders should be wary of unexpected fees that could diminish their returns. In light of these factors, it is essential to consider whether EFSI's trading conditions align with industry standards and whether they prioritize the interests of their clients.

Customer Funds Security

The safety of customer funds is a critical aspect of evaluating any forex broker, and EFSI presents a mixed picture in this regard. While the broker claims to implement various security measures, including segregating client funds, the lack of regulatory oversight raises doubts about the effectiveness of these measures.

EFSI has not provided clear information regarding its policies on investor protection, negative balance protection, or compensation schemes in the event of insolvency. In regulated environments, brokers are typically required to maintain client funds in separate accounts to ensure that they are not misused for operational expenses. However, the "suspicious clone" status of EFSI suggests that there may be inadequate safeguards in place.

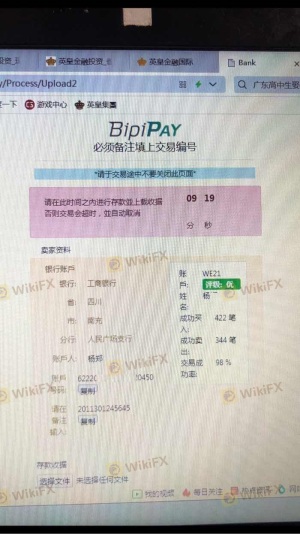

Historically, there have been several complaints from clients regarding the misappropriation of funds and lack of recourse when issues arise. Reports indicate that some clients have experienced difficulties withdrawing their funds, leading to further concerns about the broker's reliability and commitment to safeguarding client assets. Given these factors, potential clients must carefully consider the risks associated with entrusting their funds to EFSI.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability, and EFSI has garnered a significant amount of negative reviews from users. Many clients have reported being scammed or experiencing poor customer service, leading to a general sense of mistrust surrounding the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Fund Withdrawal Issues | High | Poor |

| Misleading Marketing | Medium | Poor |

| Unresponsive Customer Support | High | Poor |

Common complaints against EFSI include difficulties with fund withdrawals, misleading marketing practices, and unresponsive customer support. Clients have reported being unable to access their funds after making requests, which is a significant red flag for any broker. Additionally, the lack of transparency in marketing materials has led to accusations of deception among potential clients.

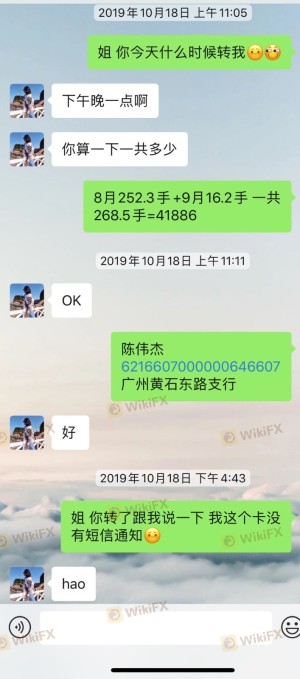

One notable case involved a client who claimed to have been scammed out of 50,000 RMB by an employee who provided no formal documentation or contract. This incident was reported to the Hong Kong police, highlighting the severe risks associated with trading with EFSI. Such cases underscore the importance of conducting thorough due diligence before engaging with any broker, particularly one with a questionable reputation.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a satisfactory trading experience. EFSI offers a trading platform that is compatible with MetaTrader 4 (MT4), which is known for its functionality and user-friendly interface. However, user experiences indicate that the platform may have issues with stability and execution quality.

Traders have reported instances of slippage, where executed prices differ from expected prices, particularly during volatile market conditions. Additionally, there have been claims of order rejections, which can severely impact trading strategies and overall profitability. Such issues raise concerns about the integrity of EFSI's trading infrastructure and whether it can provide a fair trading environment.

The potential for platform manipulation is another concern, as clients have expressed doubts about the broker's practices in executing trades. Given the lack of regulatory oversight and the negative feedback from users, traders should be cautious when considering EFSI as their trading platform.

Risk Assessment

In evaluating whether EFSI is safe, it is essential to assess the overall risk associated with trading through this broker. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation and oversight. |

| Financial Risk | High | Reports of fund misappropriation and withdrawal issues. |

| Operational Risk | Medium | Platform stability and execution quality concerns. |

| Customer Service Risk | High | Poor response to customer complaints and issues. |

Given the high-risk levels associated with regulatory compliance, financial security, and customer service, potential clients should approach EFSI with extreme caution. To mitigate these risks, it is advisable to seek out brokers with established reputations, robust regulatory frameworks, and positive customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that EFSI may not be a safe choice for forex trading. The broker's dubious regulatory status, coupled with numerous customer complaints and a lack of transparency, raises significant concerns about its legitimacy and reliability. While EFSI may offer attractive trading conditions on the surface, the underlying risks associated with this broker are substantial.

For traders considering EFSI, it is crucial to weigh these risks carefully. It is advisable to explore alternative brokers with solid regulatory backing, transparent practices, and positive customer experiences. Some reputable alternatives include brokers regulated by the SFC or FCA, which offer a higher degree of safety and investor protection.

Ultimately, the question of "Is EFSI safe?" leans towards a cautious "no." Traders should prioritize their financial security and choose brokers that demonstrate a commitment to ethical practices and client welfare.

EFSG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EFSG latest industry rating score is 7.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.