TorFX 2025 Review: Everything You Need to Know

TorFX has established a strong reputation in the international money transfer space, particularly for larger sums. The company is known for its excellent customer service, personalized account management, and competitive rates for significant transactions. However, it may not be the best option for smaller transfers due to higher exchange rate markups.

Note: It's important to recognize that TorFX operates under different regulatory frameworks depending on the region, which may affect service availability and terms. This review synthesizes insights from various sources to provide a balanced view of TorFXs offerings.

Ratings Overview

We rate brokers based on thorough research and user feedback to ensure an accurate representation of their services.

Broker Overview

Founded in 2004, TorFX is a UK-based currency broker that specializes in international money transfers and currency risk management solutions for both individuals and businesses. It operates a user-friendly online platform and mobile app, allowing clients to send money in over 60 currencies. The company is regulated by the Financial Conduct Authority (FCA) in the UK and has received multiple awards for its customer service excellence.

Detailed Section

Regulatory Geographies

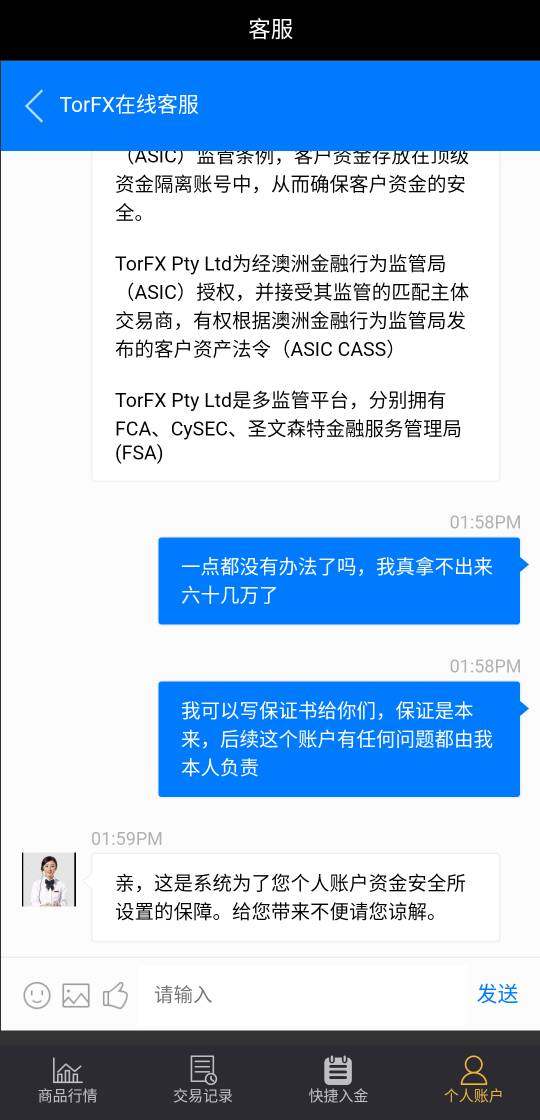

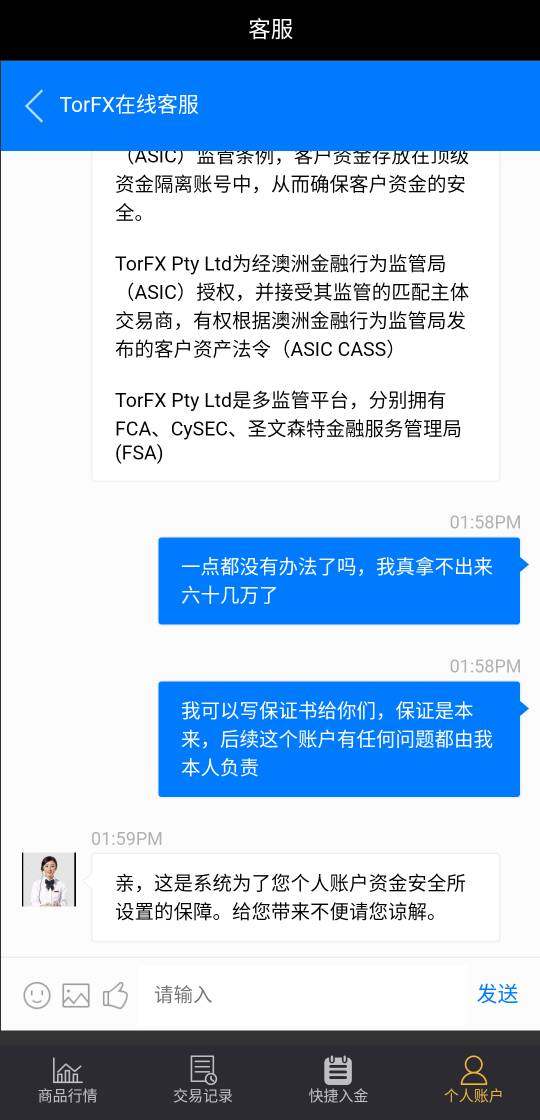

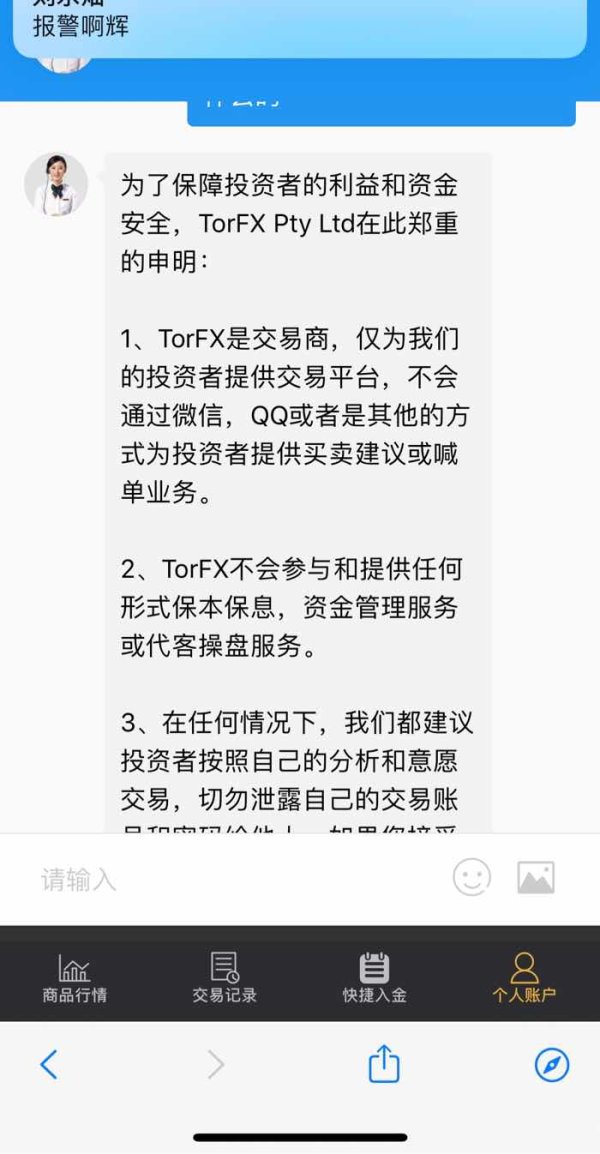

TorFX is primarily regulated by the FCA in the UK and holds an Australian Financial Services License (AFSL). It is also compliant with other international regulations, such as those set forth by the Bank of Spain and the Australian Transaction Reports and Analysis Centre (AUSTRAC). This regulatory framework ensures a high level of security and compliance for its operations.

Deposit/Withdrawal Currencies

TorFX supports various currencies, including GBP, AUD, EUR, and USD. However, it primarily operates through bank transfers, meaning clients must have a bank account to initiate transfers. The platform does not currently support cryptocurrency transactions.

Minimum Deposit

The minimum transfer amount for online transactions is £100, while for regular overseas payments, the minimum is £500. There is no maximum limit for transfers arranged via phone, making it suitable for high-value transactions.

TorFX does not typically offer bonuses or promotions. Instead, it focuses on providing competitive exchange rates and personalized service.

Tradable Asset Classes

The primary service offered by TorFX is currency exchange and international money transfers. Clients can execute spot contracts, forward contracts, and market orders to manage their currency risks effectively.

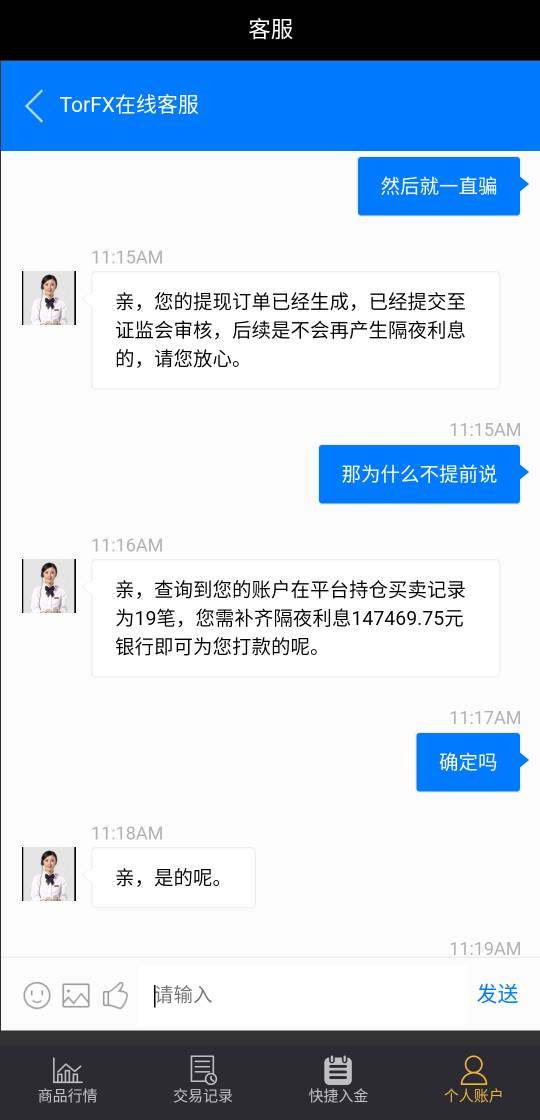

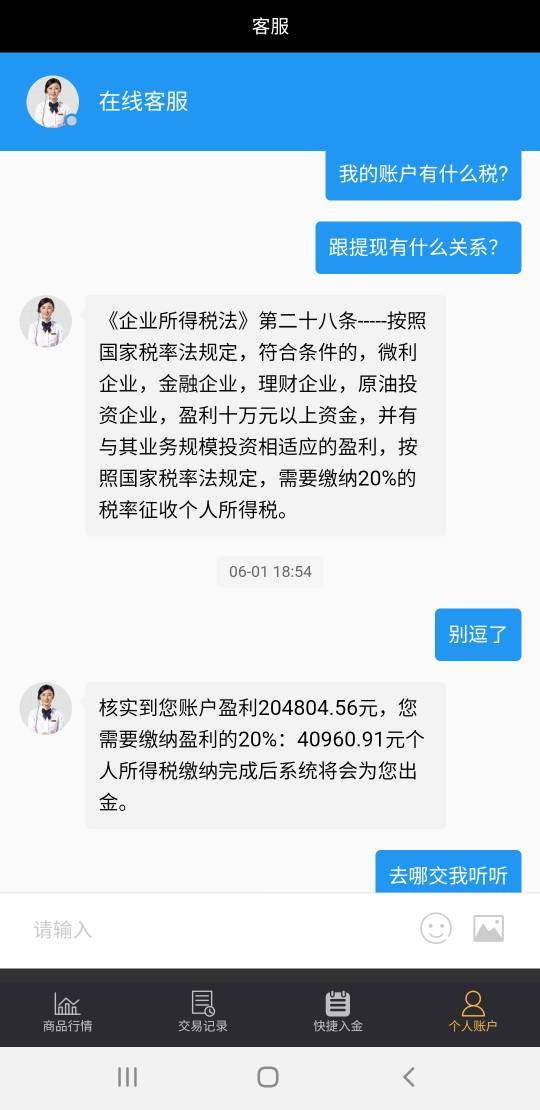

Costs (Spreads, Fees, Commissions)

TorFX does not charge upfront transfer fees; instead, it generates revenue through a markup on the exchange rate. While this markup can be less than traditional banks, it may be higher for smaller transfers, making it less competitive for low-value transactions. According to user feedback, clients often save between 2-4% compared to bank rates, particularly for larger amounts.

Leverage

TorFX does not offer leverage in the traditional sense, as it focuses on currency exchange rather than margin trading.

TorFX provides services through its website and mobile app, which is available on both iOS and Android. The platform is designed for ease of use, allowing clients to manage their transfers and view exchange rates conveniently.

Restricted Regions

While TorFX operates in multiple countries, it is essential to note that services may vary by region. For instance, customers in the US can only access TorFX services in specific states.

Available Customer Service Languages

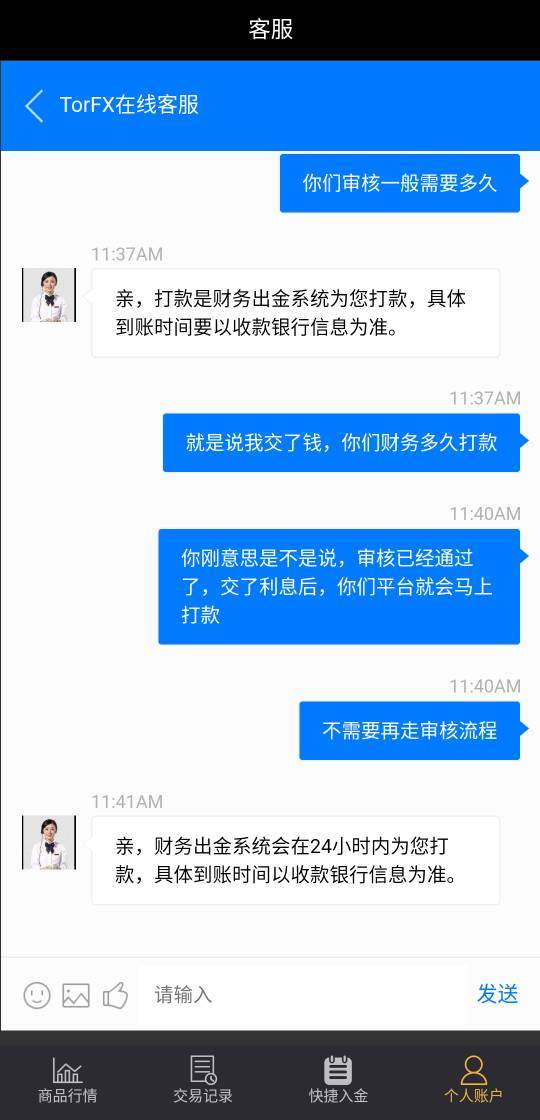

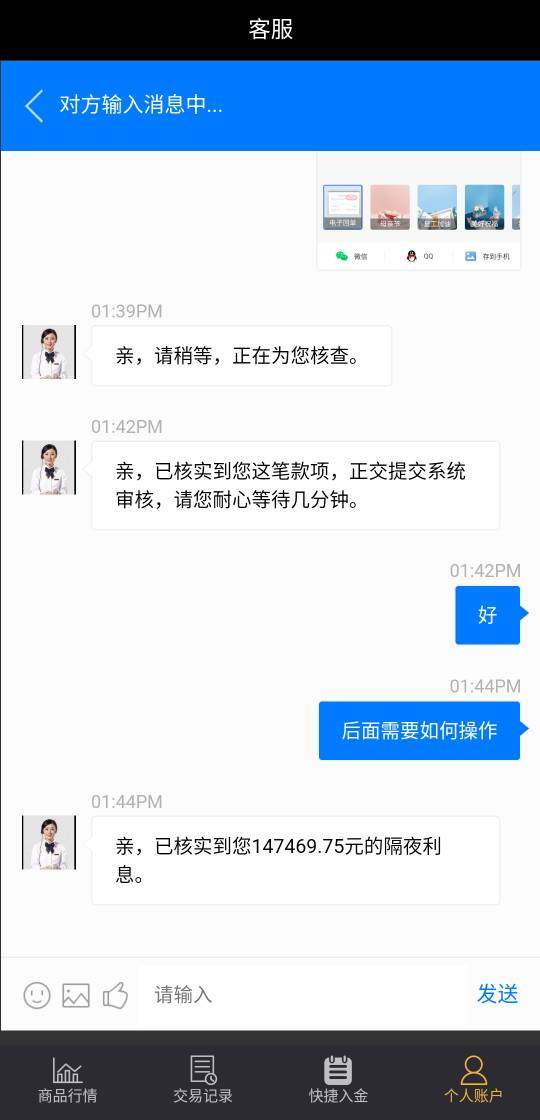

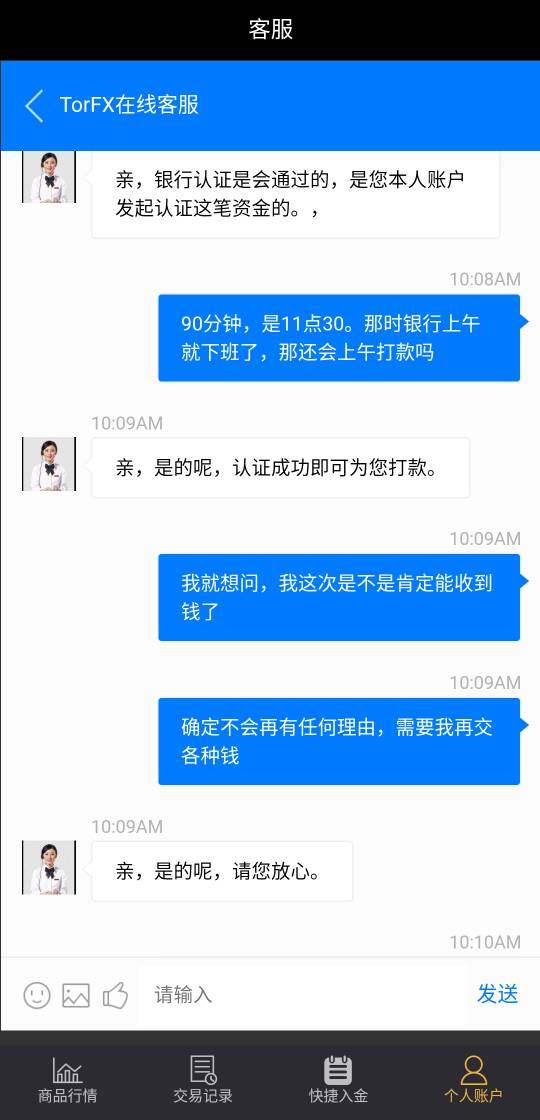

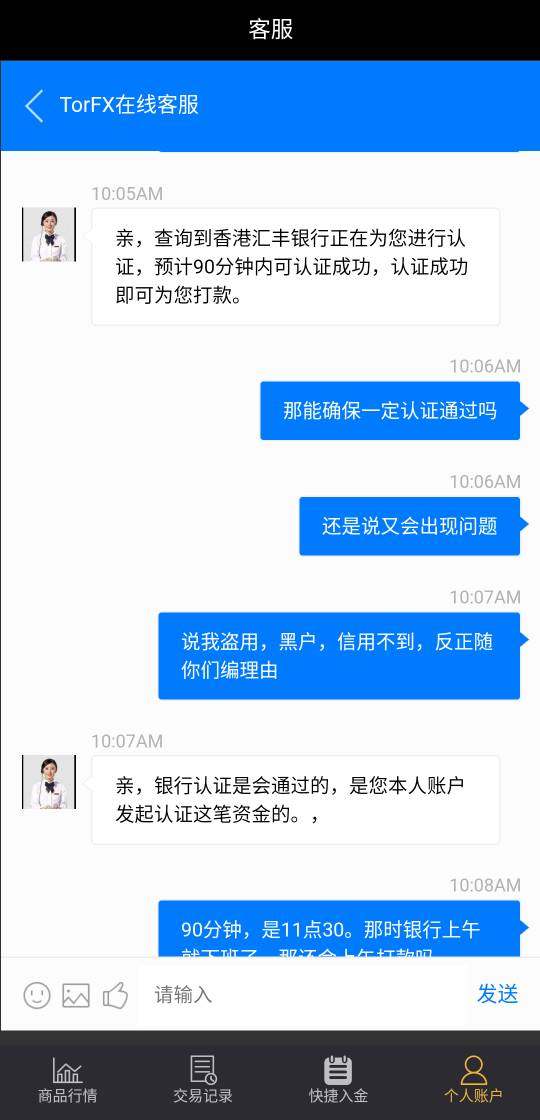

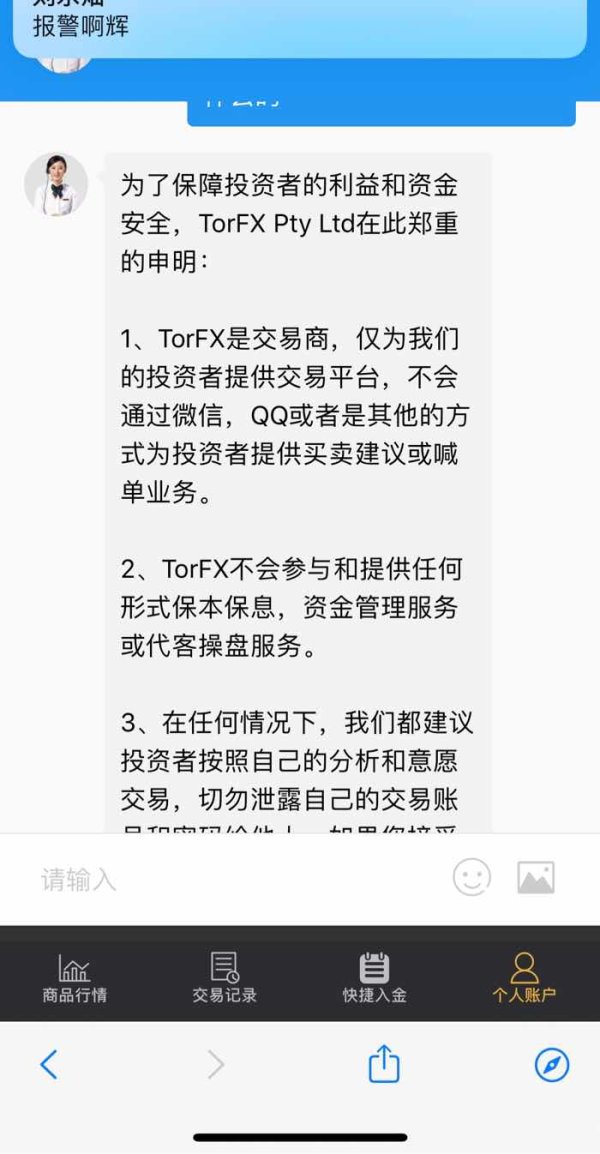

TorFX primarily offers customer support in English. Clients can reach out via phone, email, or through the online platform.

Ratings Revisited

Detailed Breakdown

Account Conditions

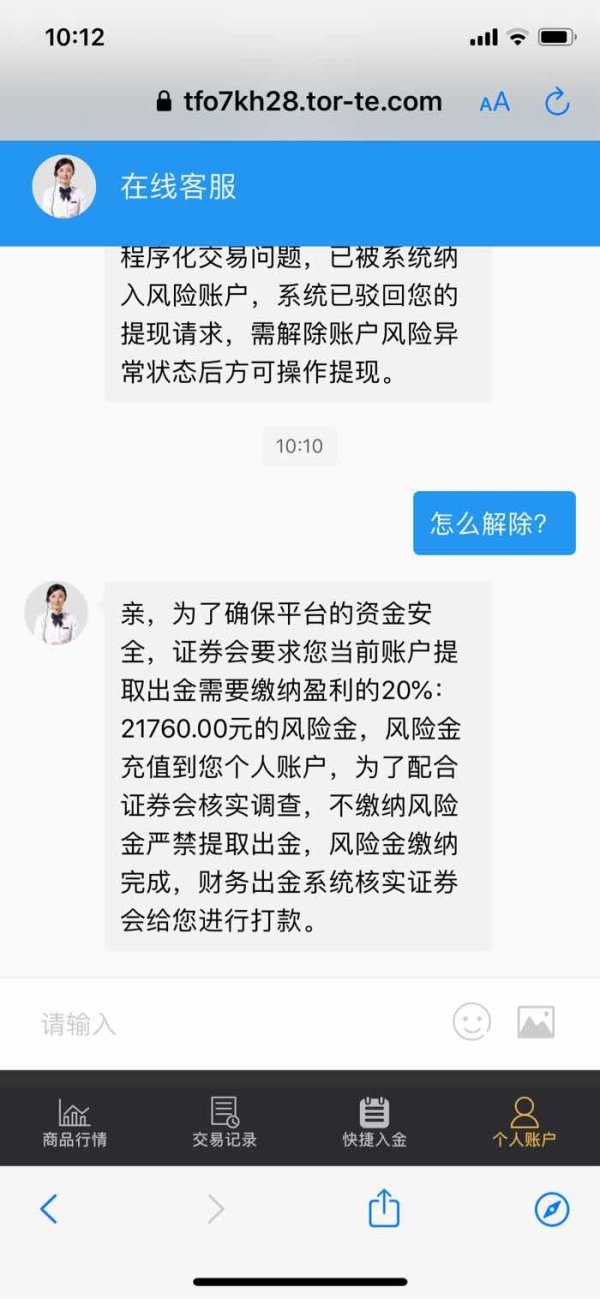

TorFX offers a straightforward account setup with no hidden fees. The minimum deposit is accessible, making it suitable for a wide range of users. However, clients looking for immediate quotes will need to register first, which can be a drawback for some.

While TorFX provides essential tools like forward contracts and market orders, the resources available for smaller trades are somewhat limited compared to competitors like Wise, which offers more transparent pricing.

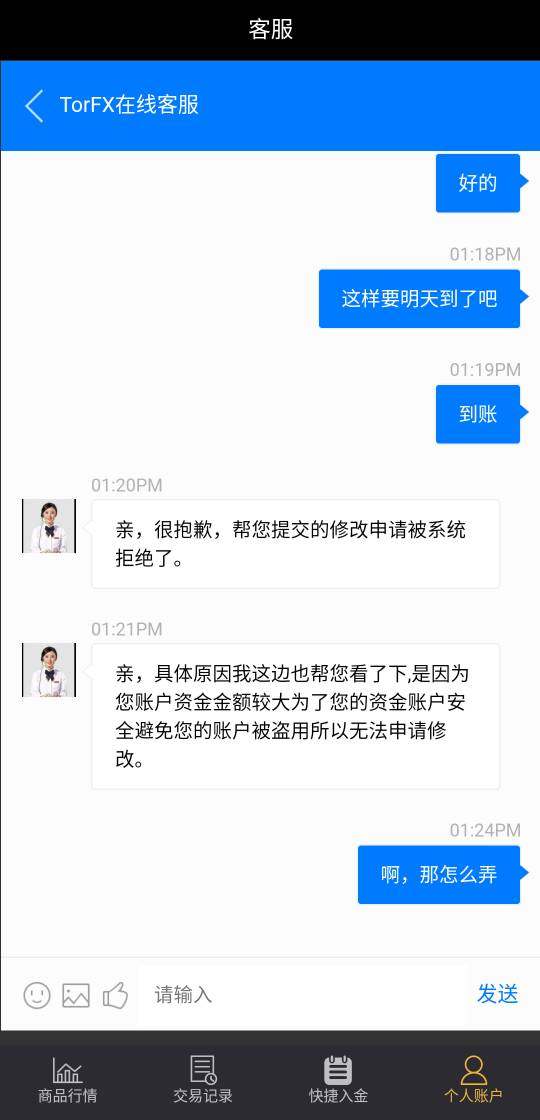

Customer Service and Support

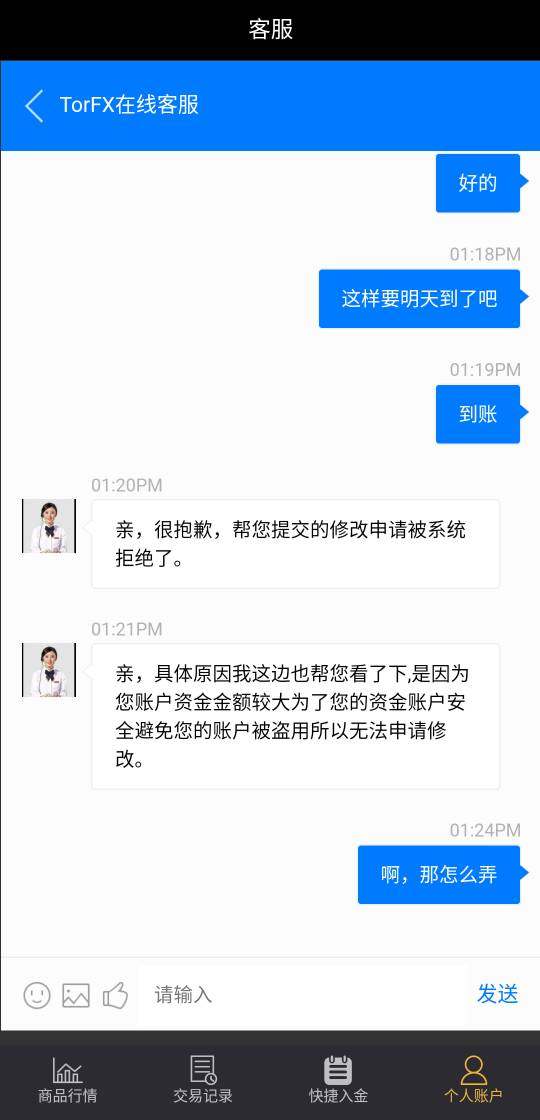

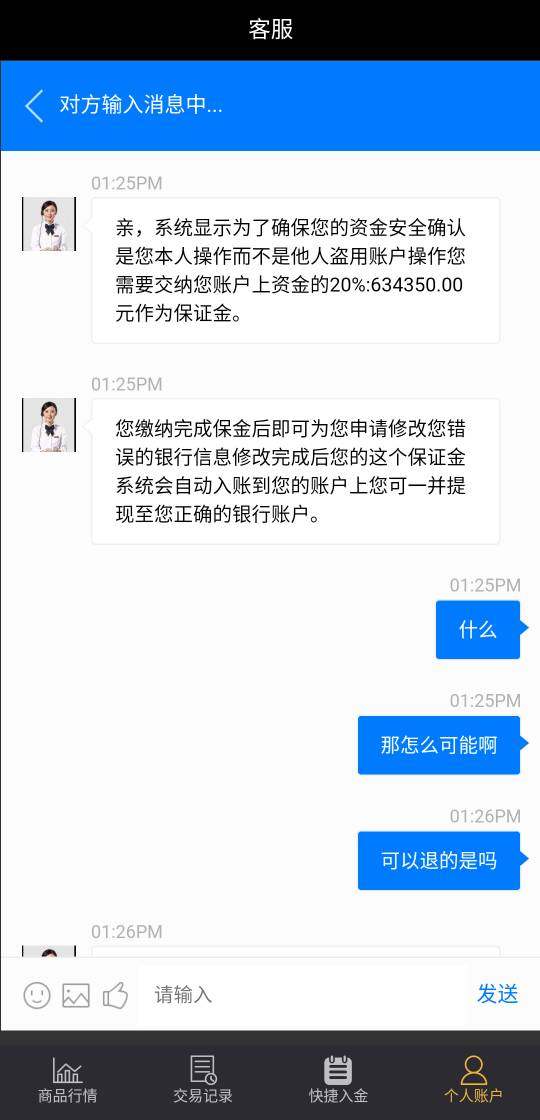

Customer service is one of TorFX's standout features. Users frequently praise their dedicated account managers, who provide personalized assistance. Support is available via phone and email, and clients appreciate the quick response times.

Trading Setup (Experience)

The trading experience is generally smooth, with many clients reporting fast transfer times for major currencies. However, larger transactions require phone interactions, which some users may find cumbersome.

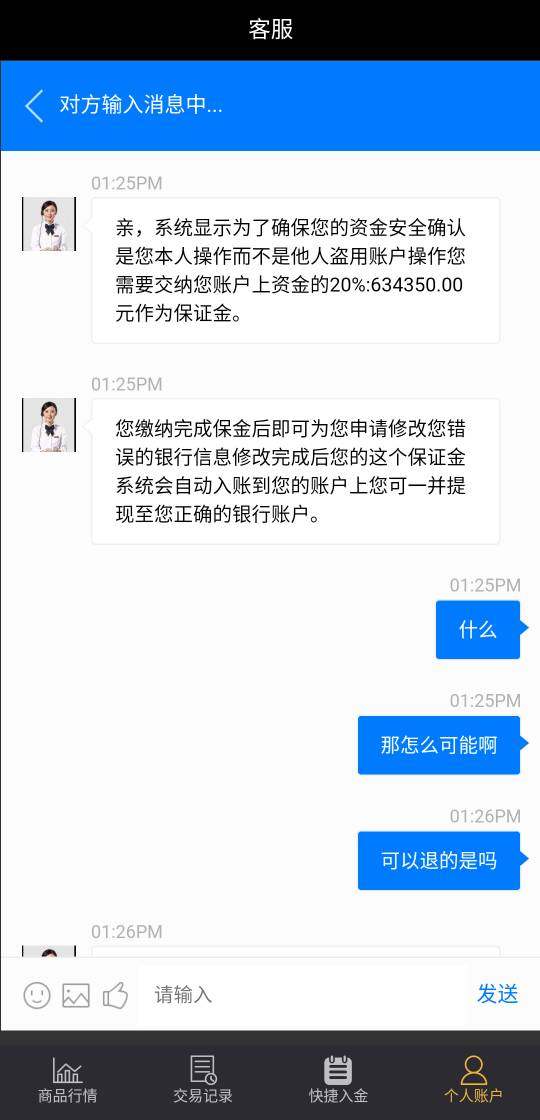

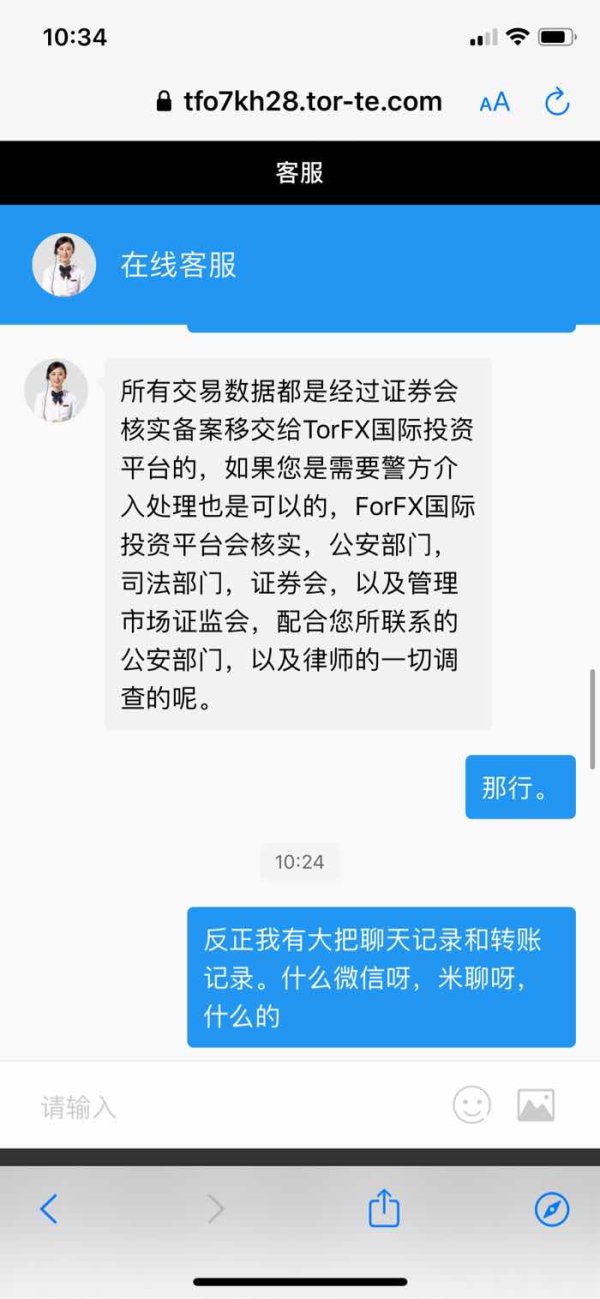

Trustworthiness

TorFX enjoys a high trust rating, bolstered by its FCA regulation and positive user reviews. The company has a strong credit rating from Dun & Bradstreet, indicating low risk.

User Experience

The user experience is generally positive, with an intuitive online platform and mobile app. However, some users have reported issues with the app's performance, particularly on iOS devices.

Additional Features

TorFX offers unique features like market insights and a referral program, which can enhance the overall user experience, although these are not as extensive as those provided by some competitors.

In conclusion, TorFX is a reputable choice for individuals and businesses looking to make significant international money transfers, particularly due to its excellent customer service and tailored support. However, for smaller transfers, users may find better value with alternative providers that offer lower fees and more transparent pricing structures.