ThinkMarkets 2025 Review: Everything You Need to Know

Executive Summary

This thinkmarkets review gives you a complete look at one of the industry's well-known multi-regulated brokers. ThinkMarkets started in 2010 and has its main office in England, making it a global provider of online trading services that reaches traders in 165 countries around the world. The broker shows a strong market presence with over 70% positive ratings on different review websites, but about 20% of user feedback on TrustPilot shows there are areas that need work.

ThinkMarkets stands out by offering a huge range of over 4,000 trading instruments across many different asset types. These include Forex, CFDs, Futures, Commodities, Indices, ETFs, Cryptocurrencies, and Stocks. The broker supports three major trading platforms - MetaTrader 4, MetaTrader 5, and TradingView - helping both retail and institutional traders with different experience levels and trading styles. While the broker looks promising with its complete tool selection and platform variety, some parts of its service need a closer look for potential traders thinking about their options in 2025.

Important Notice

Trading with ThinkMarkets involves big risks, and rules may be different depending on where you live. Different countries may have different legal rules, trading conditions, and ways to protect investors that could affect your trading experience. Future traders should carefully check the specific rules and trading terms that apply to their area before opening an account.

This review uses information that anyone can find and user feedback collected from different sources as of 2025. Individual trading experiences may be different based on personal trading strategies, market conditions, and specific account settings. We recommend doing your own research and talking with financial advisors when needed before making any trading decisions.

Rating Framework

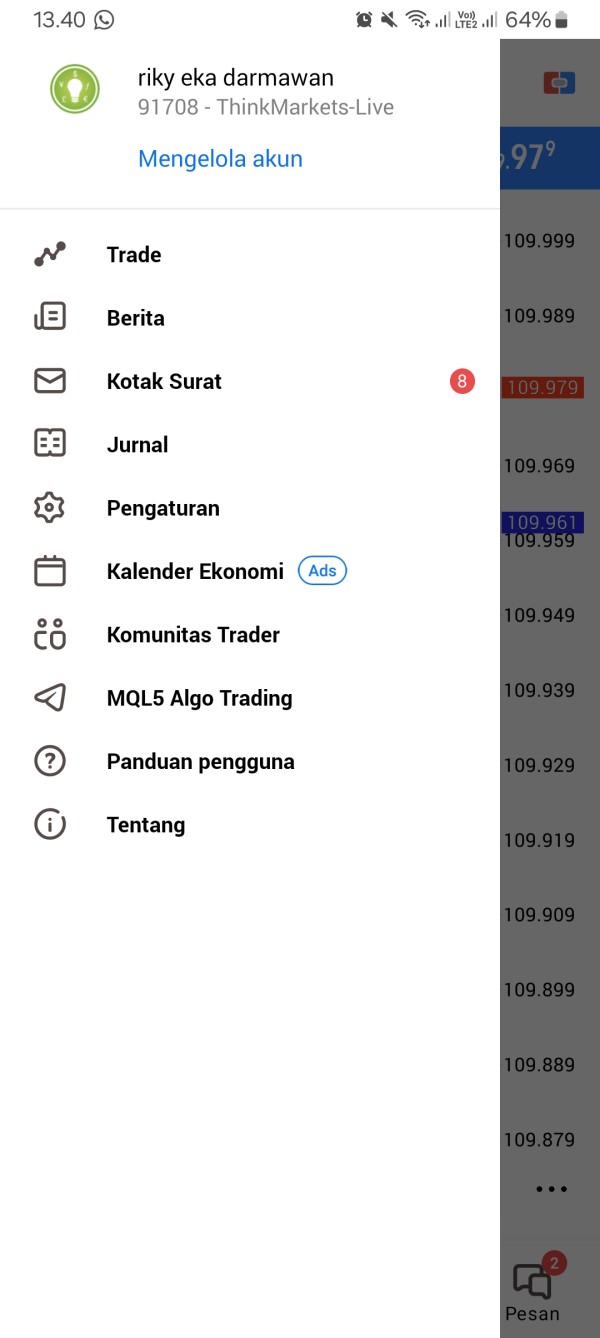

Broker Overview

ThinkMarkets started in the competitive forex and CFD trading world in 2010. The company set up its main office in England with a goal to provide complete online trading services to clients around the world. The company has successfully grown its reach to serve traders across 165 countries, making itself an important player in the international trading arena. According to BrokersWay, ThinkMarkets works as an England-based forex and CFD broker that has built its reputation on offering diverse trading opportunities and new technology.

The broker's business plan focuses on serving both retail and institutional clients through a multi-platform approach that emphasizes easy access and choice. ThinkMarkets has built its service offering around three main trading platforms: MetaTrader 4, MetaTrader 5, and TradingView, each helping different trader preferences and technical needs. This thinkmarkets review shows that the company's strategy centers on providing extensive market access through over 4,000 trading instruments, covering traditional forex pairs, commodities, indices, ETFs, cryptocurrencies, and individual stocks. The broker's commitment to technological advancement is clear in its recent initiatives, including the upcoming launch of the Traders' Gym backtesting tool on its own ThinkTrader mobile application, as reported in their 2025 announcements.

Regulatory Framework: While ThinkMarkets operates from England, specific regulatory details and licensing information were not fully detailed in available public sources. This may need further investigation by future traders.

Deposit and Withdrawal Methods: Specific information about available funding methods and withdrawal procedures was not extensively covered in the reviewed materials.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types were not clearly specified in the available documentation.

Promotional Offers: Current bonus structures and promotional campaigns were not detailed in the source materials reviewed for this thinkmarkets review.

Tradeable Assets: ThinkMarkets does well in this area, offering access to over 4,000 trading instruments across multiple asset categories. These include Forex, Futures, Commodities, Indices, ETFs, Cryptocurrencies, and Stocks, giving traders extensive market exposure opportunities.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not fully available in the reviewed sources.

Leverage Options: Specific leverage ratios for different instruments and account types were not clearly outlined in the available materials.

Platform Selection: The broker offers three primary trading platforms - MetaTrader 4, MetaTrader 5, and TradingView. This provides flexibility for traders with different technical preferences and requirements.

Geographic Restrictions: While the broker serves 165 countries globally, specific regional limitations were not detailed in the reviewed information.

Customer Support Languages: Multilingual support capabilities were not specifically outlined in the available documentation.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

ThinkMarkets' account conditions show a mixed picture based on available information. While the broker seems to offer services to a broad international clientele across 165 countries, specific details about account types, minimum deposit requirements, and account-specific features remain unclear from public sources. This lack of transparency in account condition details leads to a moderate rating in this category.

The absence of clearly outlined account tiers, Islamic account options, or specialized institutional account features in readily available information suggests that future traders may need to contact the broker directly for complete account details. This approach, while potentially allowing for customized solutions, may not meet the expectations of traders seeking immediate clarity about trading conditions. For this thinkmarkets review, the limited availability of account condition specifics represents a potential area for improvement.

Traders typically prefer brokers that provide clear, upfront information about account requirements, features, and limitations. The current information gap may discourage traders who prioritize transparency in their broker selection process.

ThinkMarkets shows exceptional strength in its tools and resources offering, earning a strong rating of 8/10. The broker's provision of over 4,000 trading instruments represents one of the most complete selections available in the retail trading market. According to BrokersWay, this extensive range covers Forex, Futures, Commodities, Indices, ETFs, Cryptocurrencies, and Stocks, giving traders diverse portfolio construction opportunities.

The broker's commitment to technological innovation is evident in its platform diversity and upcoming features. The integration of three major trading platforms - MT4, MT5, and TradingView - shows understanding of different trader preferences and technical requirements. Recent announcements about the Traders' Gym backtesting tool launch on the ThinkTrader mobile app indicate ongoing investment in trader education and analysis capabilities.

However, specific details about research resources, market analysis tools, and educational materials were not fully covered in available sources. While the platform variety and instrument selection are impressive, the lack of detailed information about additional analytical resources prevents a higher rating in this category.

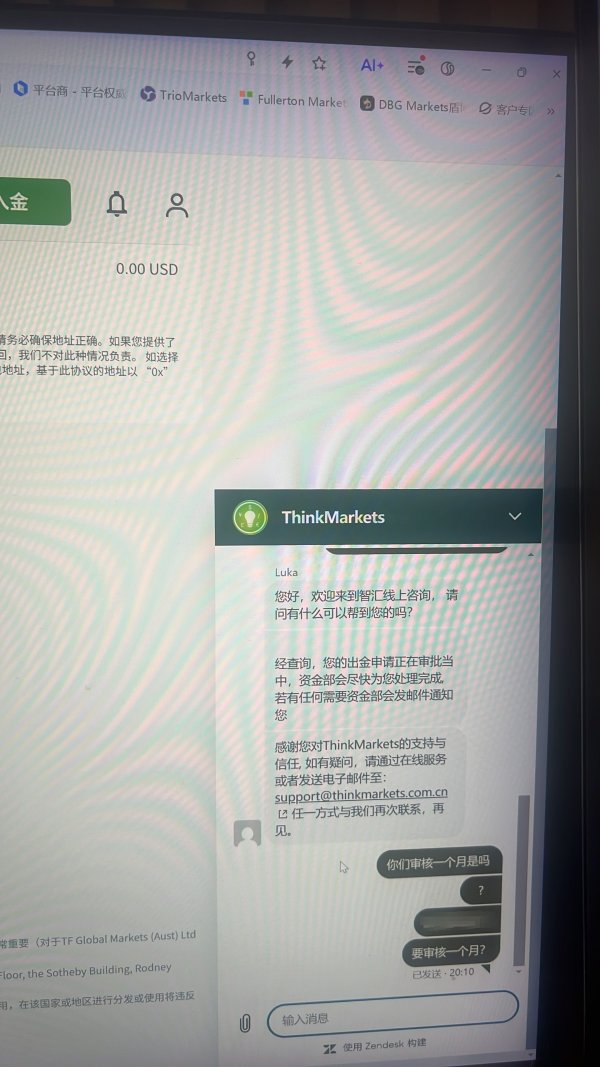

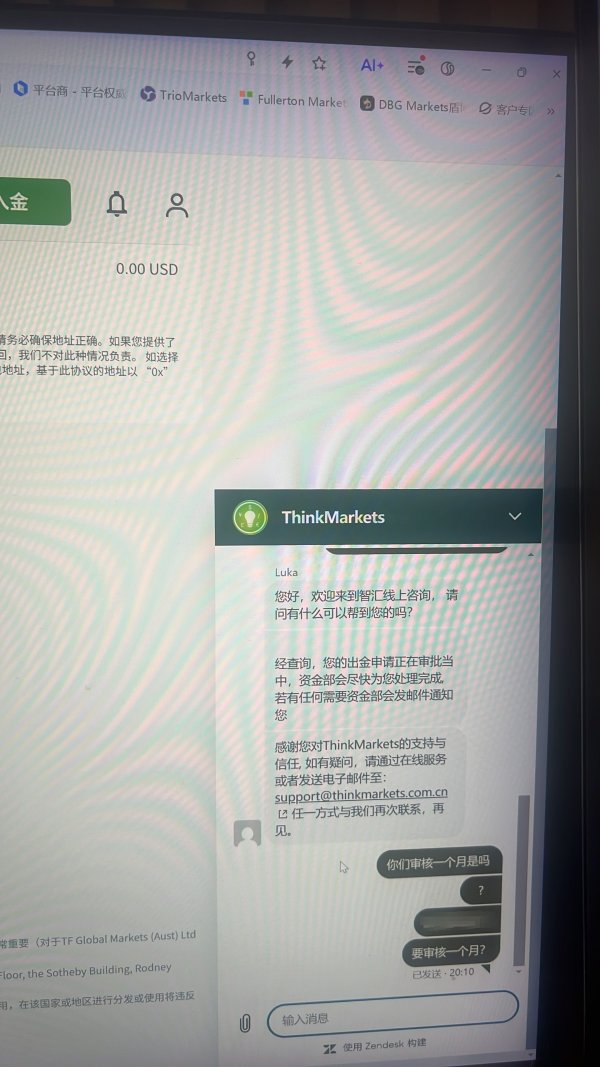

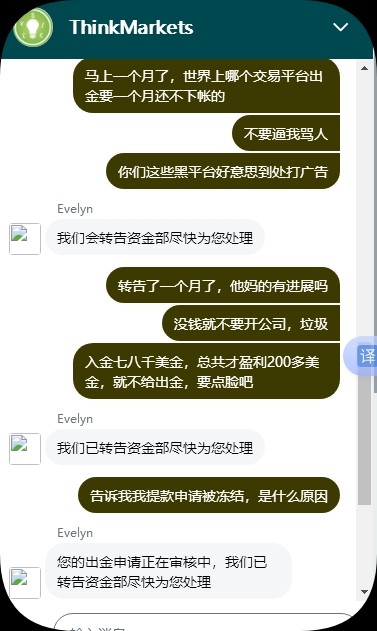

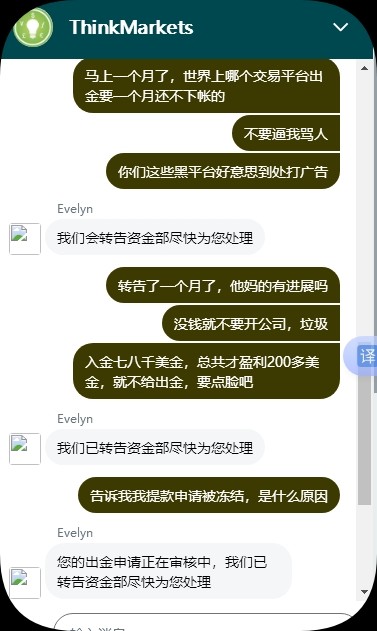

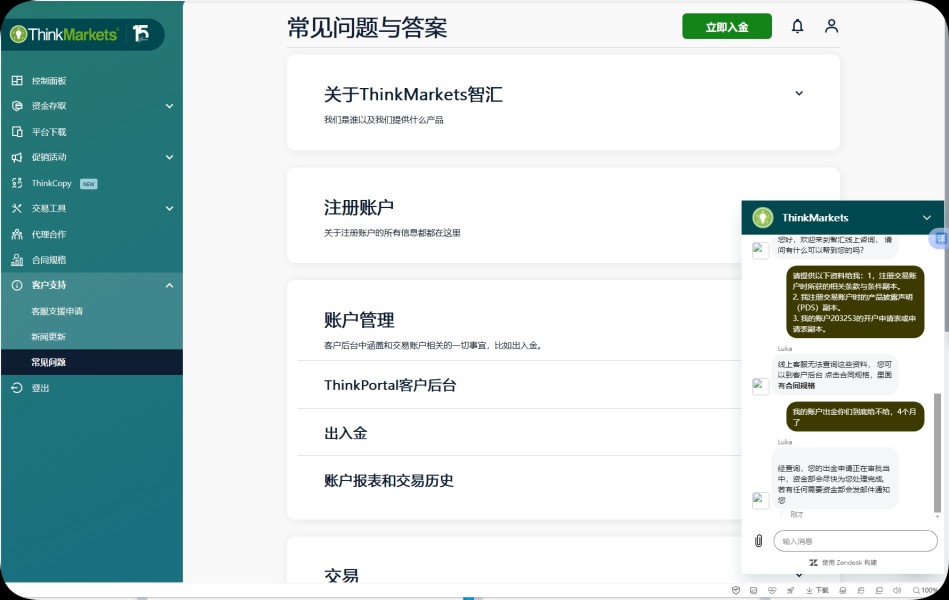

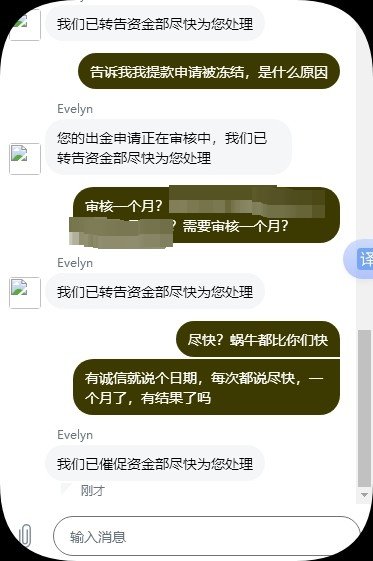

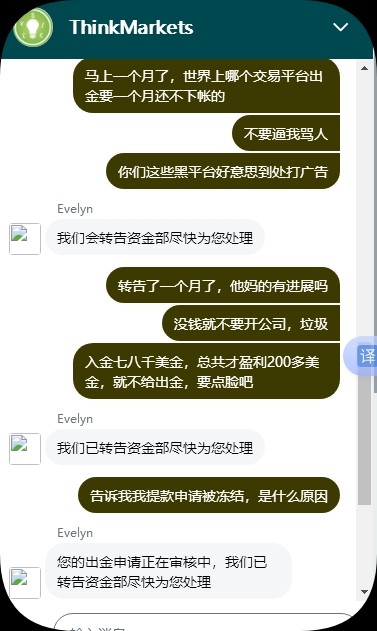

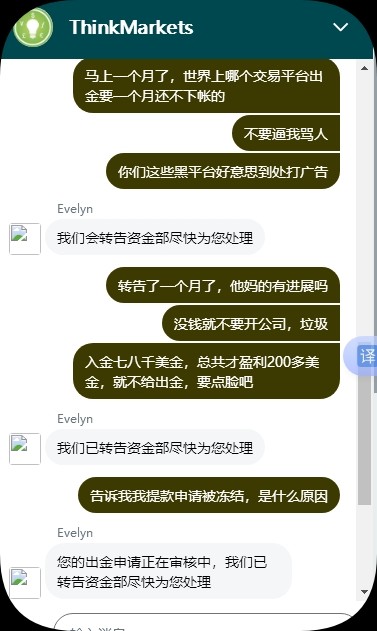

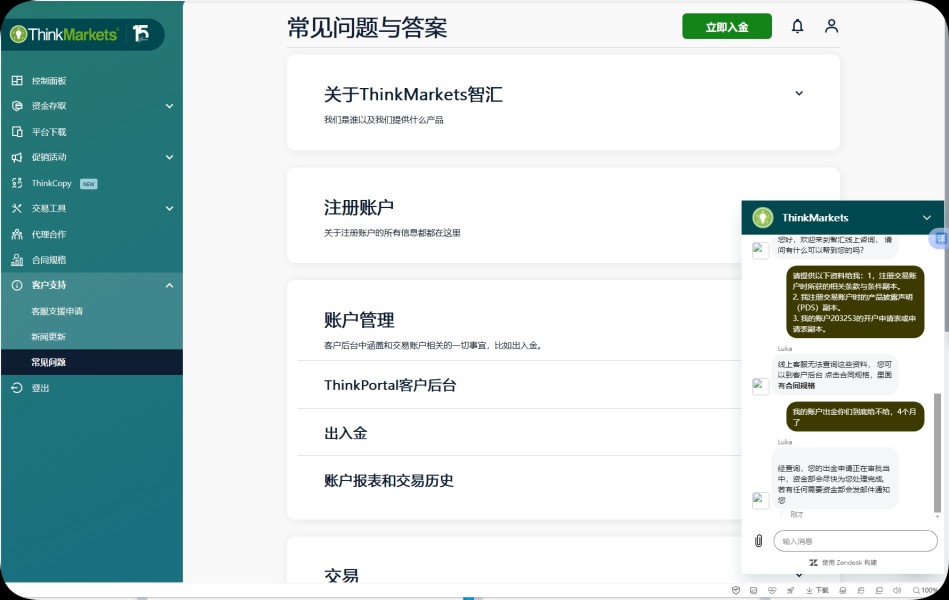

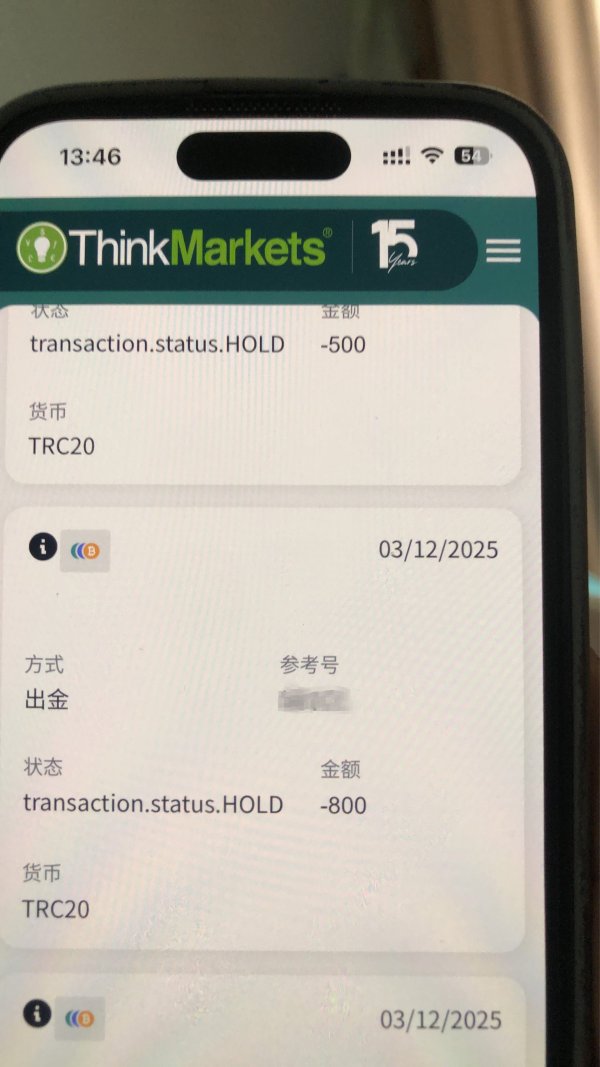

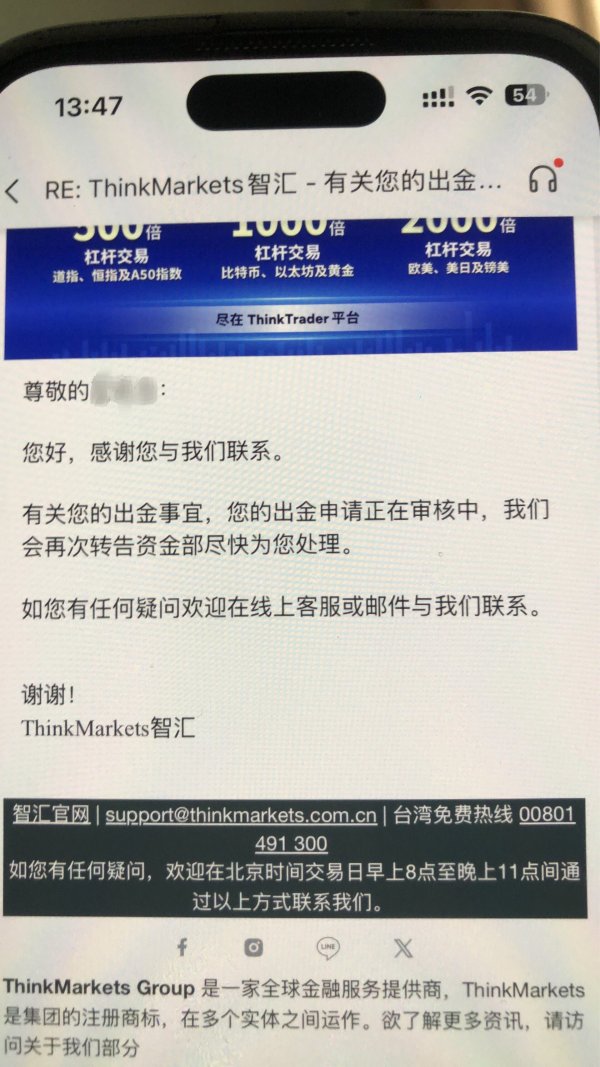

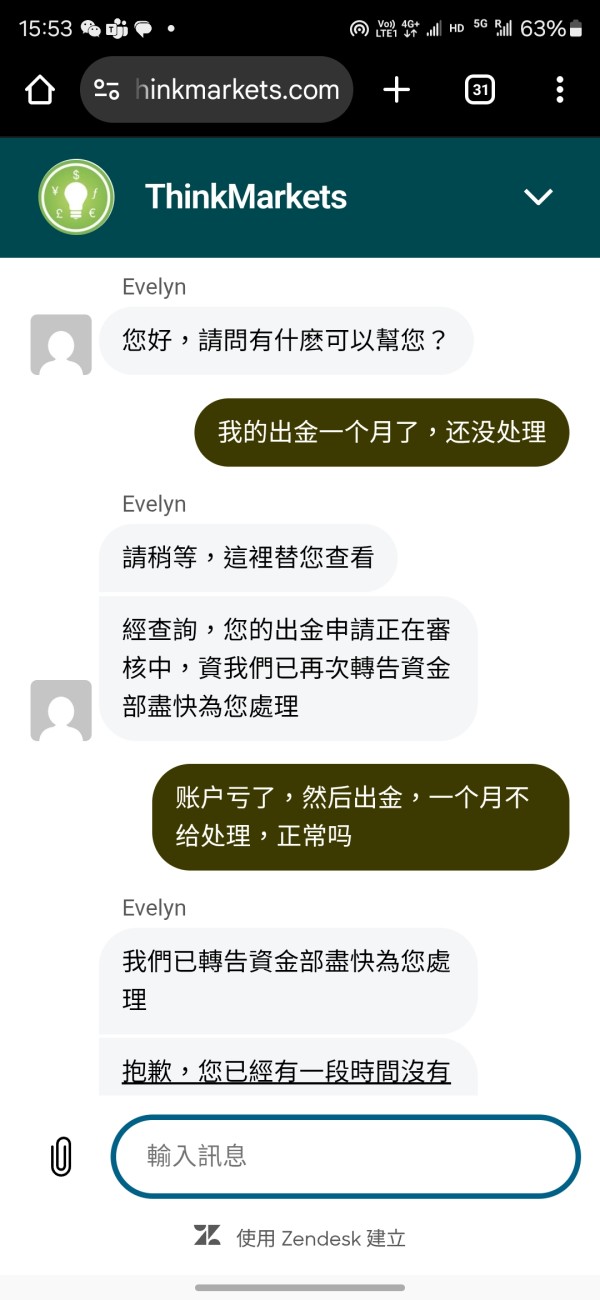

Customer Service and Support Analysis (6/10)

Customer service evaluation for ThinkMarkets presents challenges due to limited specific information about support structures, response times, and service quality metrics in available sources. The moderate rating reflects uncertainty rather than confirmed poor performance, as complete customer service details were not readily accessible for this review.

The broker's global reach across 165 countries suggests some level of international support capability. However, without specific information about support channels, operating hours, or multilingual capabilities, it's difficult to provide a definitive assessment. User feedback from TrustPilot indicates mixed experiences, with about 20% negative reviews potentially reflecting service-related concerns.

For traders prioritizing strong customer support, the limited transparency about service standards and support infrastructure may be concerning. Professional traders and institutions typically require reliable, accessible support channels with knowledgeable representatives, and the current information gap makes it difficult to assess ThinkMarkets' capabilities in this crucial area.

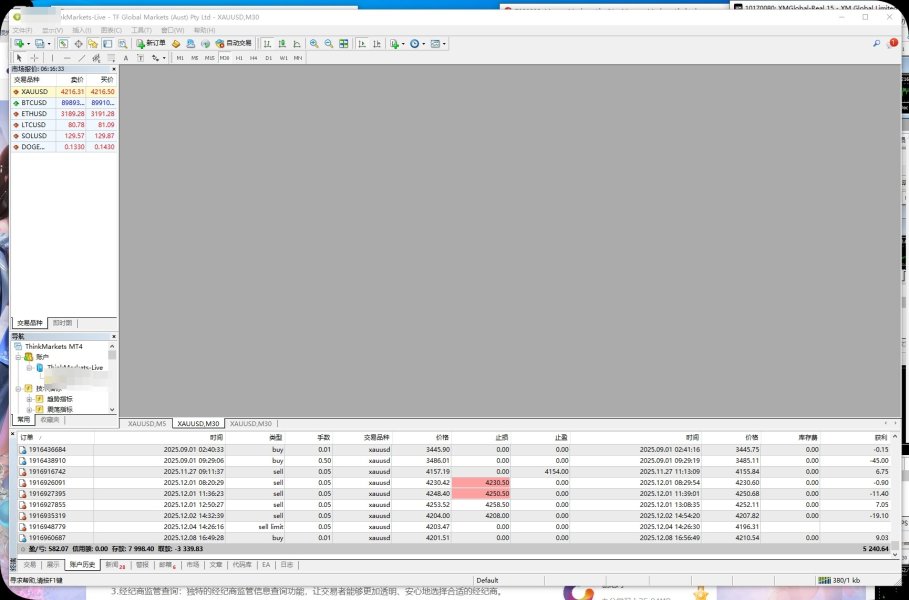

Trading Experience Analysis (7/10)

ThinkMarkets earns a solid 7/10 rating for trading experience, mainly driven by its diverse platform offering and extensive instrument selection. The availability of MT4, MT5, and TradingView platforms provides flexibility for traders with different technical preferences and experience levels. Each platform brings distinct advantages - MT4 for traditional forex trading, MT5 for advanced features and additional asset classes, and TradingView for sophisticated charting and analysis capabilities.

The broker's offering of over 4,000 trading instruments significantly enhances the trading experience by providing extensive market access within a single account. This complete selection allows traders to diversify across multiple asset classes and implement complex trading strategies without requiring multiple broker relationships. However, this thinkmarkets review notes that specific information about execution speeds, order types, trading conditions, and platform stability was not detailed in available sources.

While the platform variety and instrument selection are strong positives, the absence of technical performance data and detailed trading condition information limits the ability to provide a higher rating.

Trust and Safety Analysis (6/10)

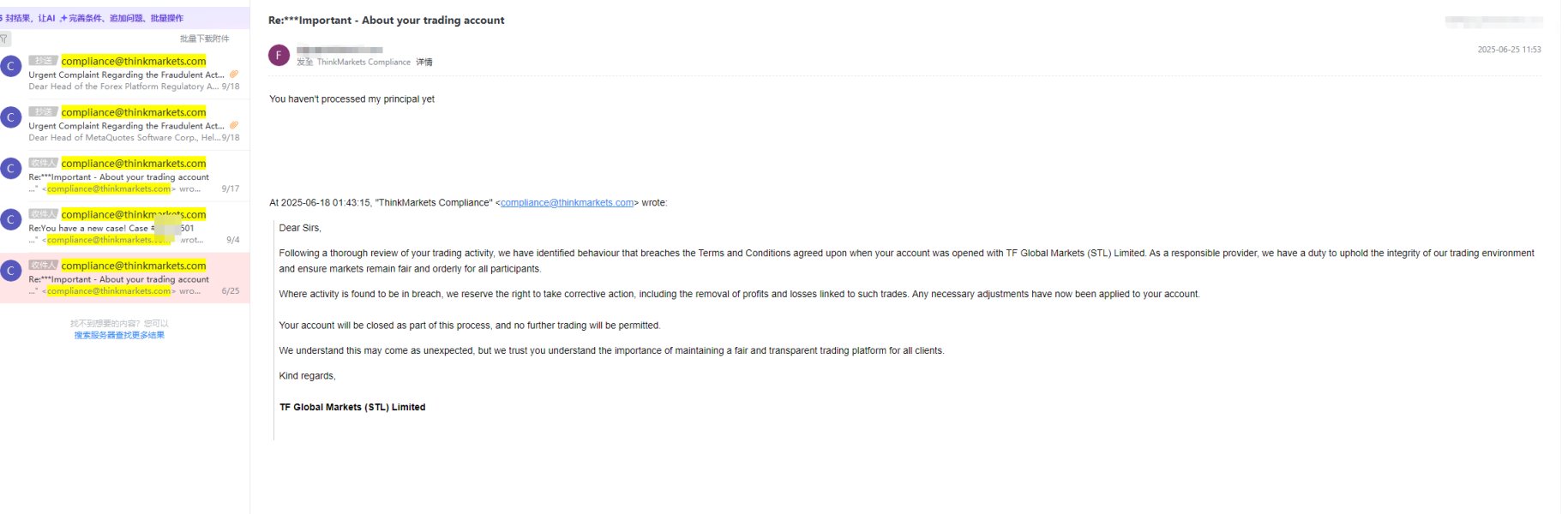

Trust and safety considerations for ThinkMarkets yield a moderate 6/10 rating based on available information and user feedback patterns. While the broker operates from England and serves a global clientele, specific regulatory details and safety measure information were not fully available in reviewed sources.

User feedback on TrustPilot presents a mixed picture, with over 70% positive ratings indicating general satisfaction. However, about 20% negative reviews suggest areas of concern that require attention. This feedback pattern indicates that while many users have positive experiences, there are recurring issues that affect a significant minority of clients.

The lack of detailed information about regulatory compliance, fund segregation practices, investor protection measures, and dispute resolution procedures contributes to the moderate rating. For traders prioritizing safety and regulatory oversight, the limited transparency about protective measures may be a consideration in broker selection decisions.

User Experience Analysis (7/10)

User experience assessment for ThinkMarkets shows generally positive trends with room for improvement. The broker achieves over 70% positive ratings across review platforms, indicating that the majority of users have satisfactory experiences with the service. This positive feedback trend suggests that ThinkMarkets successfully meets basic user expectations for many clients.

The platform diversity offering MT4, MT5, and TradingView demonstrates user-centric thinking by accommodating different trader preferences and technical requirements. The upcoming launch of the Traders' Gym backtesting tool on the mobile platform indicates ongoing efforts to enhance user experience through technological innovation. However, the 20% negative feedback rate on TrustPilot indicates recurring user experience issues that warrant attention.

Without specific details about common user complaints or areas of friction in the trading process, it's challenging to identify specific improvement areas. The mixed feedback pattern suggests that while many users are satisfied, there are consistent issues affecting a notable portion of the client base.

Conclusion

This complete thinkmarkets review reveals a broker with notable strengths in instrument diversity and platform selection, balanced against areas requiring greater transparency and improvement. ThinkMarkets demonstrates clear value in its extensive offering of over 4,000 trading instruments and flexible platform options, making it potentially suitable for traders seeking comprehensive market access and platform choice.

The broker appears most appropriate for traders who prioritize instrument variety and platform flexibility over detailed transparency about trading conditions and regulatory specifics. However, the limited availability of detailed information about account conditions, costs, and regulatory frameworks may concern traders who prioritize complete disclosure in their broker selection process. Overall, ThinkMarkets shows promise as a trading partner but would benefit from enhanced transparency about its service terms, regulatory standing, and customer support capabilities to better serve the evolving needs of today's informed traders.