Regarding the legitimacy of TorFX forex brokers, it provides ASIC and WikiBit, .

Is TorFX safe?

Pros

Cons

Is TorFX markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

TOR FX PTY LIMITED

Effective Date:

2004-02-26Email Address of Licensed Institution:

thomas.pearman@torfx.com.auSharing Status:

No SharingWebsite of Licensed Institution:

www.currenciesdirect.com.auExpiration Time:

--Address of Licensed Institution:

Suite 202, 25 Elkhorn Avenue, SURFERS PARADISE QLD 4217Phone Number of Licensed Institution:

07 5560 4431Licensed Institution Certified Documents:

Is TorFX A Scam?

Introduction

TorFX, established in 2004, positions itself as a leading currency broker specializing in international money transfers and foreign exchange services. With a focus on providing personal account management and competitive exchange rates, TorFX aims to cater to individuals and businesses engaging in foreign currency transactions. Given the complexities and potential risks of the foreign exchange market, it is crucial for traders to carefully evaluate the credibility and reliability of their chosen brokers. This article investigates TorFX's legitimacy by examining its regulatory status, company background, trading conditions, client fund safety measures, customer experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

Regulation is a critical factor in determining the legitimacy of any financial service provider. TorFX operates under the oversight of the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) in Australia. These regulatory bodies enforce strict compliance standards to ensure that clients' funds are protected and that the broker operates with transparency and integrity.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 900706 | UK | Verified |

| ASIC | 246838 | Australia | Verified |

The FCA and ASIC require brokers to maintain segregated accounts for client funds, ensuring that clients' money is protected in the event of the broker's insolvency. TorFX has maintained a strong compliance record since its inception, with no significant regulatory infractions reported. This regulatory framework enhances the credibility of TorFX as a legitimate broker.

Company Background Investigation

TorFX was founded in Cornwall, UK, and has since expanded its operations to include offices in Australia, the US, and other regions. The company has grown significantly, processing billions in international payments annually. It is now part of a larger group that includes Currencies Direct, which further solidifies its market position.

The management team at TorFX comprises experienced professionals with extensive backgrounds in finance and foreign exchange. This expertise contributes to the company's reputation for providing personalized customer service and effective currency solutions. Transparency is a cornerstone of TorFX's operations, with clear communication regarding its services, fees, and policies.

Analysis of Trading Conditions

TorFX offers a competitive fee structure, emphasizing that it does not charge upfront transfer fees for international payments. Instead, the company generates revenue through a markup on the exchange rates it provides. This model can be advantageous for clients making large transfers, as they may benefit from better rates compared to traditional banks.

| Fee Type | TorFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (Competitive) | Higher for banks |

| Commission Model | None | Varies by provider |

| Overnight Interest Range | Varies | Varies |

While the absence of transfer fees is appealing, clients should be aware of the potential for higher costs associated with smaller transactions due to the exchange rate markup. It is advisable for clients to compare TorFX's rates with other providers to ensure they are receiving a competitive deal.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. TorFX employs several measures to protect clients' money, including segregated accounts and adherence to anti-money laundering (AML) regulations. Client funds are held separately from the company's operational funds, ensuring that they are safeguarded in the event of financial difficulties.

TorFX also provides negative balance protection, which prevents clients from losing more than their account balance in trading activities. However, it is essential for clients to remain vigilant and aware of any potential risks associated with foreign exchange trading, including market volatility and liquidity concerns.

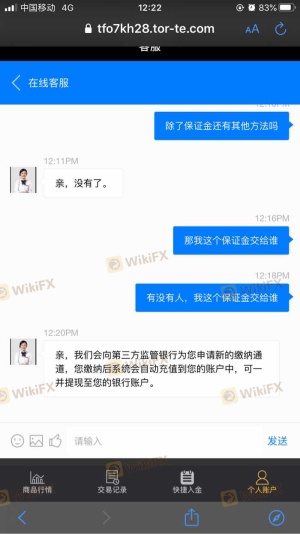

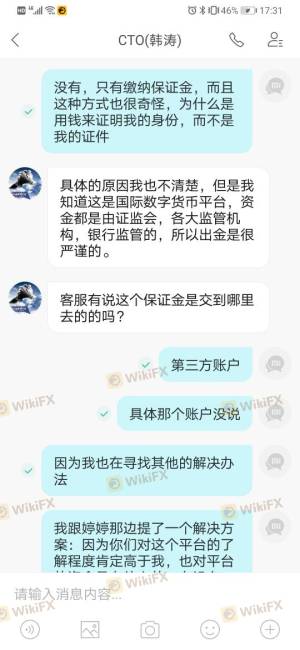

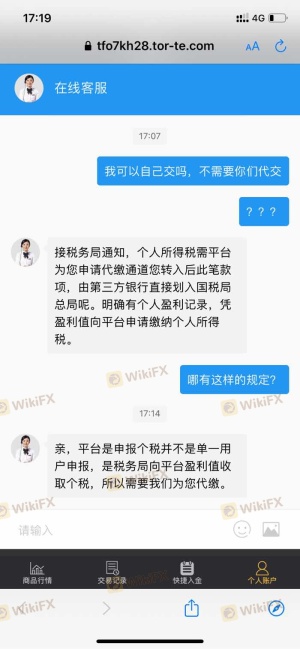

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. TorFX enjoys a strong reputation on platforms like Trustpilot, where it has received a rating of 4.9 out of 5 based on thousands of reviews. Clients frequently commend the company's personalized service and the responsiveness of account managers.

However, common complaints include delays in payment processing and challenges during the account verification process. These issues can arise from the stringent compliance checks that TorFX implements to safeguard against fraud.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Payment Delays | Moderate | Generally responsive |

| Verification Issues | High | Proactive communication |

One notable case involved a client who experienced a delay due to additional documentation requests. While the process was frustrating, the client ultimately received their funds after completing the necessary verification steps.

Platform and Trade Execution

The performance of TorFX's trading platform is generally rated positively. Users report that the platform is user-friendly and efficient, allowing for seamless transactions and real-time tracking of transfers. However, it is important to note that execution quality can vary, particularly for high-volume trades.

Clients should be aware of potential slippage during periods of high volatility, which may impact the final exchange rate received. TorFX does not exhibit any signs of platform manipulation, and the company is committed to providing a fair trading environment.

Risk Assessment

Using TorFX for international money transfers carries certain risks, as with any financial service provider. It is crucial for clients to assess their risk tolerance and consider factors such as market volatility and the potential for regulatory changes.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by FCA and ASIC |

| Market Risk | Medium | Currency fluctuations can impact transfers |

| Operational Risk | Low | Established company with a solid track record |

To mitigate these risks, clients should stay informed about market trends and utilize risk management tools offered by TorFX, such as forward contracts and limit orders.

Conclusion and Recommendations

In conclusion, TorFX is a legitimate and regulated broker that provides a range of services for international money transfers. The company has a solid reputation, backed by regulatory oversight and positive customer feedback. While there are some areas of concern, such as potential delays and the need for thorough verification, these are common in the industry and do not indicate fraudulent activity.

For traders seeking a reliable broker, TorFX is a strong option, particularly for those making larger transfers. However, clients should remain vigilant about the costs associated with smaller transactions and consider comparing rates with other providers.

If you are looking for alternatives, consider reputable providers like Wise or Currencies Direct, which may offer competitive rates and services tailored to different needs. Ultimately, the choice of broker should align with your specific requirements and risk tolerance.

Is TorFX a scam, or is it legit?

The latest exposure and evaluation content of TorFX brokers.

TorFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TorFX latest industry rating score is 7.00, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.00 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.