Saxo 2025 Review: Everything You Need to Know

Executive Summary

Saxo Bank is a well-known online investment platform around the world. It has built a strong reputation, especially in European markets, but faces some challenges in the UK. This detailed saxo review shows a broker that mainly serves mid-to-high-end investors who have significant trading capital and experience.

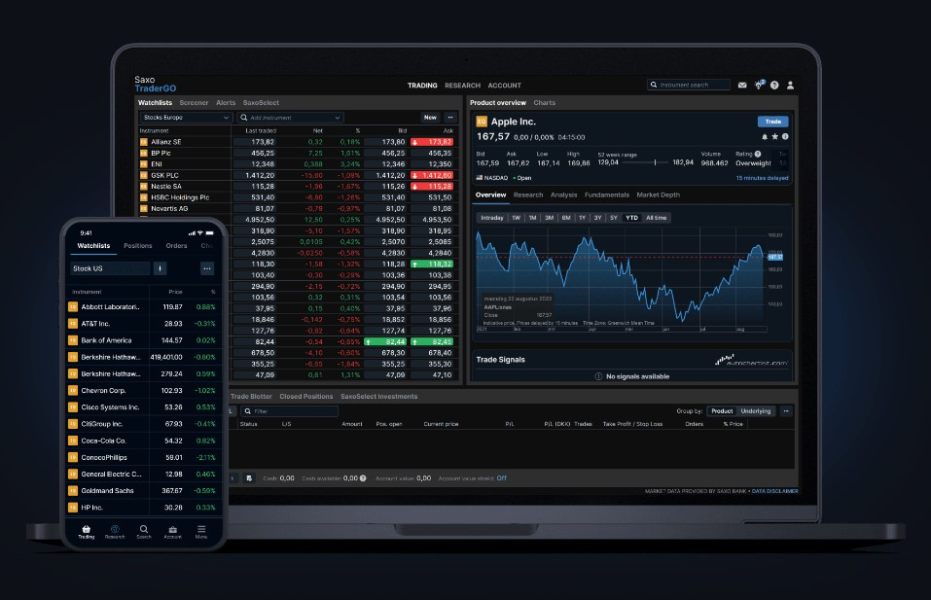

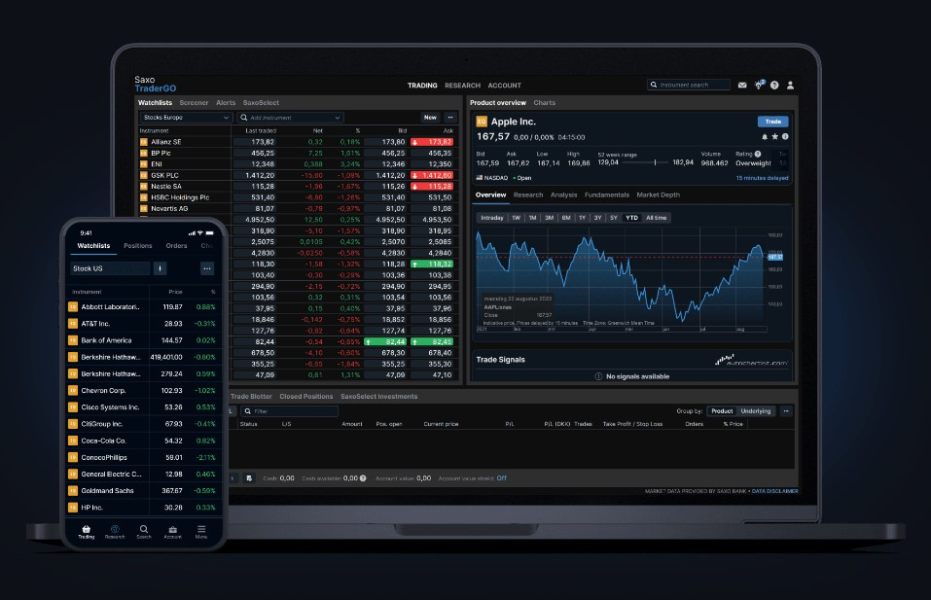

The company started in 1992 in Copenhagen, Denmark. Saxo Bank has grown into an advanced trading platform that gives access to over 71,000 financial instruments across many different asset types. The broker stands out through its high-tech trading platforms - SaxoTraderGO for easy web-based trading and SaxoTraderPRO for professional-level execution. This makes it good for traders at different skill levels.

The platform focuses on experienced investors, especially those who trade forex and CFDs. With a minimum deposit of $2,000 (this varies by region) and commission rates starting from $1, Saxo places itself in the premium part of the brokerage market. However, potential traders should know that 65% of retail investors lose money when trading CFDs with this provider. This shows the risks that come with leveraged trading.

This saxo review will look at all parts of the platform to help you decide if it matches your trading goals and risk comfort level.

Important Notice

Saxo Bank works in many different countries, and services can vary a lot between regional offices. Trading conditions, available instruments, and legal protections differ based on where you live and which Saxo office serves your area. Potential clients should carefully read the terms and conditions for their location before opening an account.

This review comes from detailed analysis of user feedback, public market data, and official information from the broker. The review aims to give an objective evaluation while knowing that individual trading experiences may vary based on personal situations and trading strategies.

Rating Framework

Broker Overview

Saxo Bank started in 1992 as a new force in online investment banking. The company set up its main office in Copenhagen, Denmark, and built its foundation on using cutting-edge technology to improve trading experiences and make global financial markets more accessible. As an online investment bank, Saxo Bank has always evolved its services while staying committed to technology advancement and client satisfaction.

The broker uses a complete business model that includes trading, investment, and wealth management services. This varied approach lets Saxo serve many different types of clients, from individual retail traders to big investors and financial advisors. The company's focus on technology-driven solutions has made it a leader in the digital change of financial services.

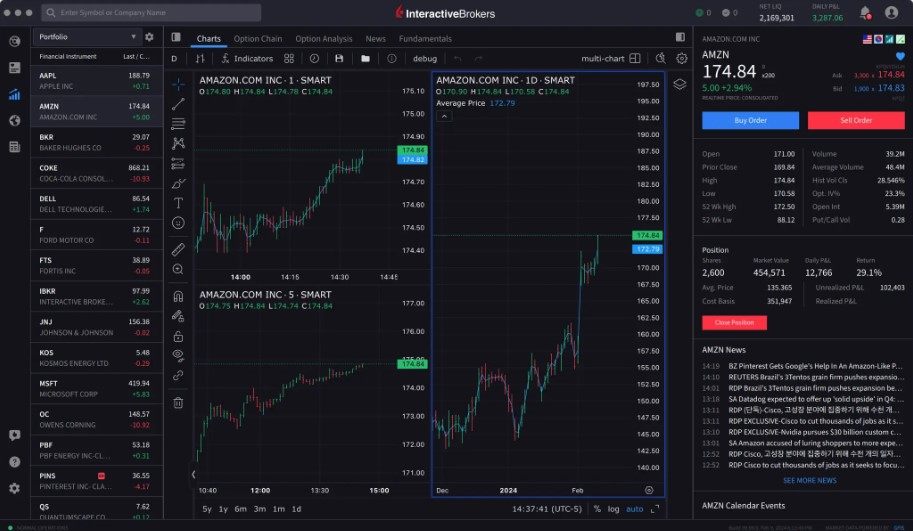

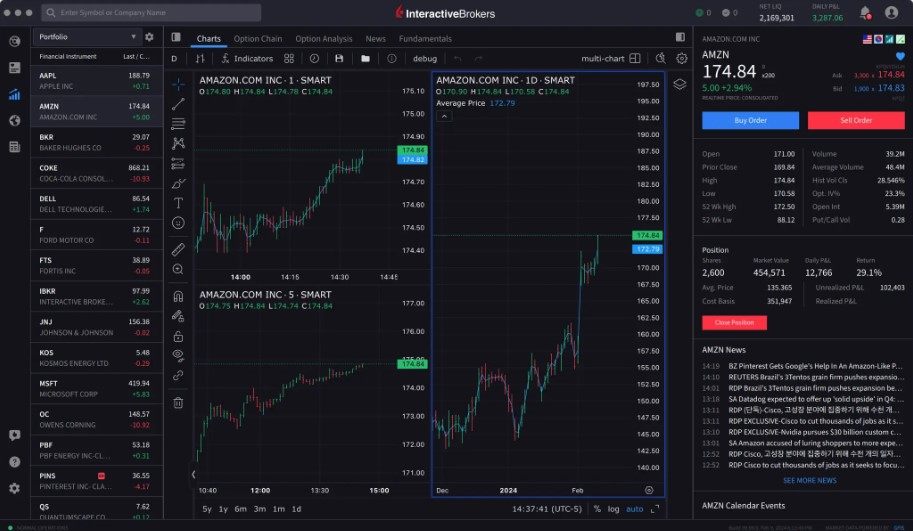

Saxo Bank's platform system centers around two main trading interfaces: SaxoTraderGO and SaxoTraderPRO. SaxoTraderGO gives users a friendly web-based platform designed for easy access and simple use. SaxoTraderPRO offers professional-level functionality for advanced traders who need sophisticated analytical tools and execution capabilities. The broker gives access to an impressive collection of over 71,000 financial instruments covering forex, stocks, commodities, and bonds across international markets.

Based on user feedback from various market analyses, Saxo Bank keeps a generally positive reputation. However, this saxo review notes significant regional differences in service quality and user satisfaction.

Regulatory Oversight: Specific regulatory information was not detailed in available materials. The broker operates across multiple jurisdictions with varying regulatory frameworks.

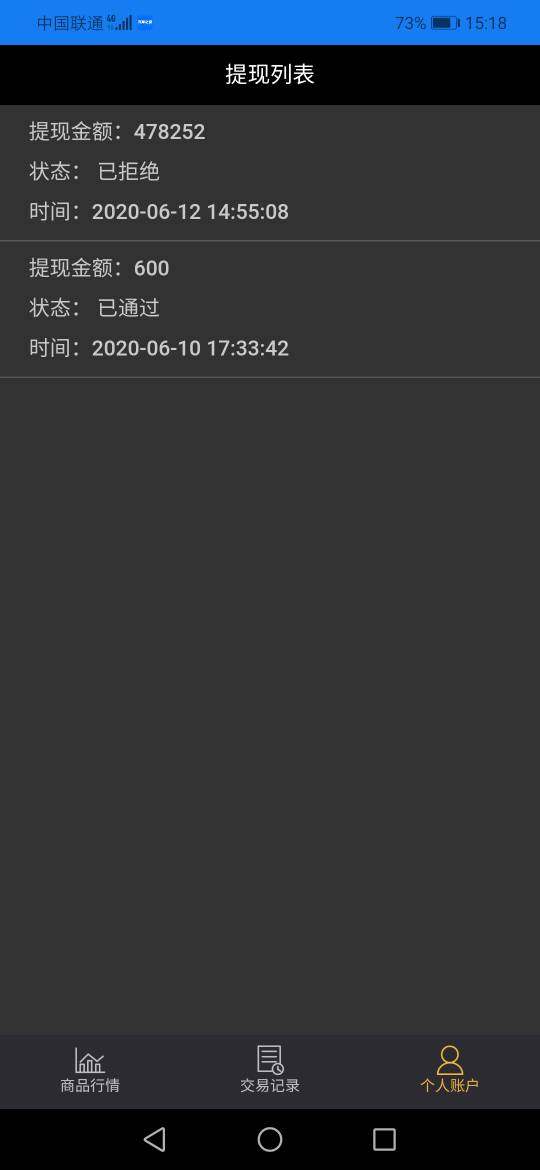

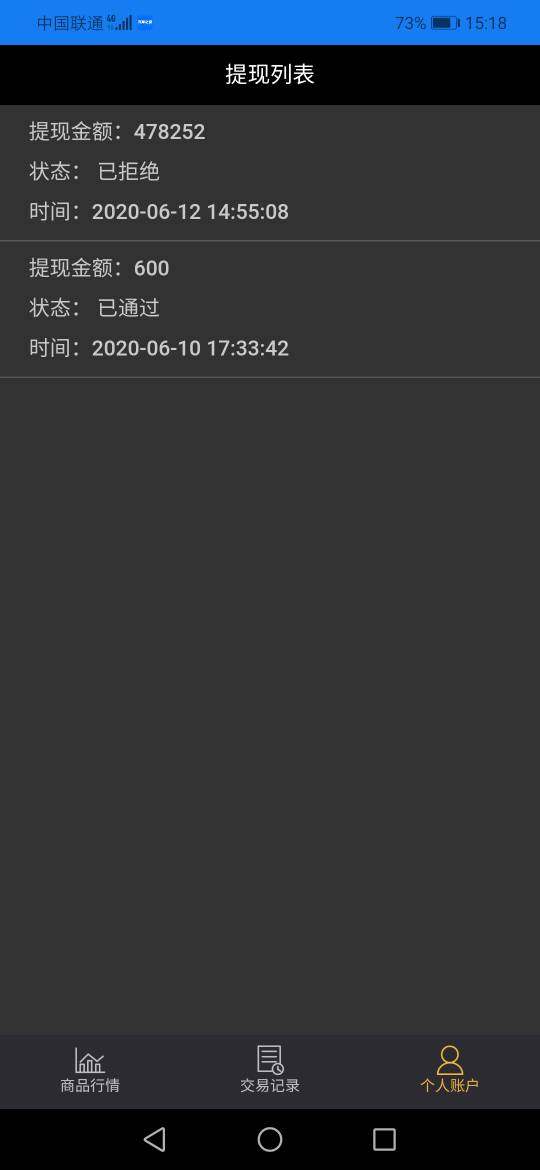

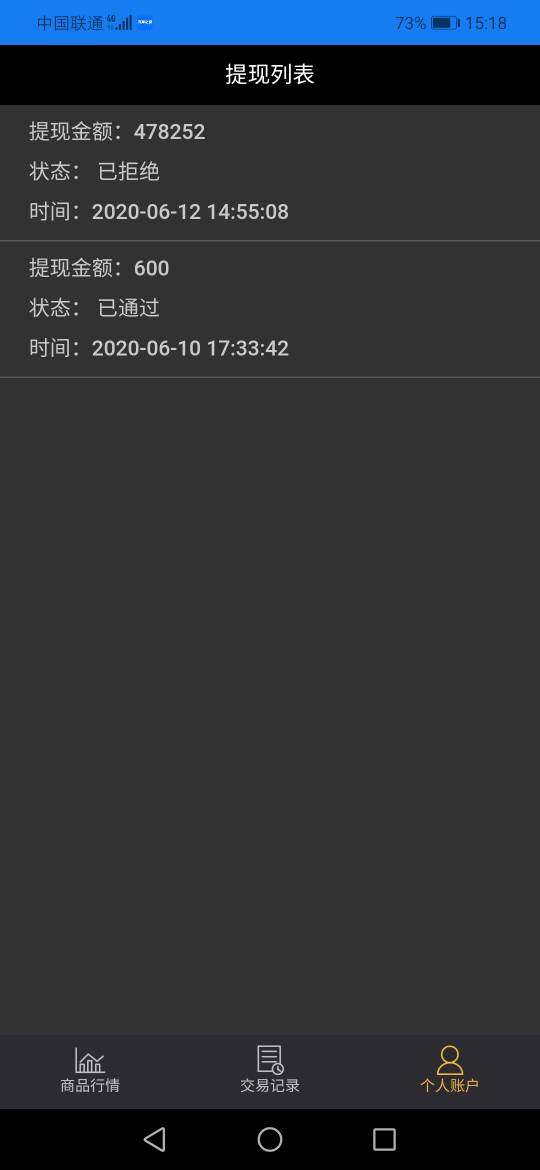

Funding Methods: Complete deposit and withdrawal options are available. Specific payment methods were not detailed in the source materials.

Minimum Deposit: The platform requires a minimum deposit of $2,000. This requirement may vary by region and account type, putting Saxo in the premium broker category.

Promotional Offers: Specific bonus and promotional information was not available in the reviewed materials.

Trading Instruments: Saxo provides access to over 71,000 financial instruments across major asset classes. These include forex pairs, individual stocks, commodities, bonds, and other derivatives, offering one of the most complete instrument selections in the industry.

Cost Structure: Commission structures begin at $1 per trade. Specific spreads and detailed fee information varies by region and account type. The cost structure appears competitive for active traders but may be higher than budget-focused brokers.

Leverage Options: Specific leverage ratios were not detailed in the available information.

Platform Options: The broker offers two primary trading platforms. SaxoTraderGO serves general users and SaxoTraderPRO serves professional traders, both designed to accommodate different skill levels and trading requirements.

Geographic Restrictions: While Saxo operates globally, specific regional restrictions were not detailed in the reviewed materials.

Customer Support Languages: Multilingual support capabilities were not specifically outlined in the available information.

This saxo review notes that while the broker offers extensive instrument variety and sophisticated platforms, some basic details about services and conditions require direct verification with the broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

Saxo Bank's account structure shows its position as a premium broker targeting serious investors rather than casual traders. The $2,000 minimum deposit requirement immediately shows the broker's focus on clients with substantial trading capital. This may exclude newer or smaller-scale traders but ensures a more committed client base.

While specific account types and their unique features were not detailed in available materials, the broker's positioning suggests multiple account levels designed to accommodate different trading volumes and client sophistication levels. The account opening process and specific verification requirements were not explained in the source materials. As a regulated financial institution, Saxo likely maintains standard KYC (Know Your Customer) procedures.

The commission structure starting at $1 per trade appears competitive for active traders, especially given the extensive instrument selection available. However, this saxo review notes that the overall cost-effectiveness depends heavily on trading frequency and volumes. The fixed commission model may be less favorable for smaller trades compared to percentage-based fee structures.

Special account features such as Islamic accounts or other religious compliance options were not mentioned in available materials. The platform's focus on CFD trading, where 65% of retail investors lose money, suggests that account conditions may include significant risk warnings and educational requirements. This ensures client understanding of leveraged product risks.

Saxo Bank's strength lies significantly in its complete tool offerings and extensive market access. With over 71,000 available instruments, the broker provides one of the most diverse trading environments in the industry. This spans traditional forex pairs, individual stocks from major global exchanges, commodities, bonds, and various derivative products.

The dual-platform approach with SaxoTraderGO and SaxoTraderPRO demonstrates thoughtful consideration for different user needs. SaxoTraderGO appears designed for accessibility and user-friendliness. SaxoTraderPRO likely offers advanced charting, analytical tools, and professional-grade execution capabilities, though specific feature details were not available in the reviewed materials.

Research and analysis resources, including market commentary, economic calendars, and technical analysis tools, were not specifically detailed in available information. Educational resources such as webinars, tutorials, or comprehensive trading guides also lacked specific mention in source materials. This may represent a gap for newer traders seeking educational support.

Automated trading support, including Expert Advisor (EA) compatibility or signal services, was not addressed in available materials. For a platform targeting professional traders, this represents an important area requiring direct verification with the broker.

Customer Service and Support Analysis (Score: 6/10)

Customer service represents an area where available information provides limited insight into Saxo Bank's capabilities and performance. Specific customer support channels, including phone, email, live chat availability, and their respective operating hours, were not detailed in the reviewed materials.

Response time expectations and service quality metrics were similarly absent from available information. This makes it difficult to assess the broker's commitment to client support. The variation in user satisfaction between different regions, particularly the noted concerns in the UK market, suggests potential inconsistencies in service delivery across different geographic areas.

Multilingual support capabilities, which would be crucial for a global broker serving diverse markets, were not specified in available materials. This represents a significant information gap for potential clients whose primary language may not be English.

The lack of specific customer service information in this saxo review highlights the importance of directly contacting the broker. Potential clients should understand support options and service levels before committing to account opening.

Trading Experience Analysis (Score: 7/10)

The trading experience at Saxo Bank appears centered around its two primary platforms - SaxoTraderGO and SaxoTraderPRO. While specific performance metrics such as execution speeds, platform stability, and uptime statistics were not available in reviewed materials, the broker's long-standing market presence since 1992 suggests established infrastructure and operational experience.

Order execution quality, including details about slippage rates, requote frequency, and fill rates, was not specifically addressed in available information. For a broker serving professional traders, these execution metrics would be crucial factors in platform selection and overall trading success.

Platform functionality completeness, including advanced order types, risk management tools, and analytical capabilities, requires direct platform evaluation. Specific features were not detailed in source materials. The mobile trading experience through smartphone applications also lacked specific mention, though most modern brokers provide mobile access.

Trading environment factors such as typical spreads, liquidity depth, and market access during volatile periods were not specified in available materials. The diversity of available instruments suggests robust market connectivity. However, specific performance characteristics require verification.

User feedback on trading experience was limited in available materials. The general positive reception in European markets contrasted with UK market concerns suggests regional variations in trading conditions or service quality. This saxo review emphasizes the importance of understanding region-specific trading conditions.

Trust and Reliability Analysis (Score: 6/10)

Trust and reliability assessment faces significant limitations due to absent regulatory information in available materials. Specific regulatory licenses, oversight bodies, and compliance frameworks were not detailed. This makes it challenging to evaluate the broker's regulatory standing and client protection measures.

Fund security measures, including segregated account policies, deposit insurance coverage, and bankruptcy protection protocols, were not specified in reviewed materials. These factors represent crucial considerations for client fund safety and should be verified directly with the broker.

Company transparency regarding financial reporting, management structure, and operational policies was not addressed in available information. For a financial services provider, transparency in operations and financial health represents a fundamental trust factor.

Industry reputation and recognition through awards or third-party certifications were not mentioned in source materials. The notable statistic that 65% of retail investors lose money when trading CFDs with this provider, while standard for CFD brokers, underscores the high-risk nature of the products offered. This emphasizes the importance of appropriate risk management.

The absence of detailed regulatory and safety information in this review highlights critical areas requiring direct verification before account opening.

User Experience Analysis (Score: 7/10)

Overall user satisfaction appears positive based on available feedback, particularly in European markets where Saxo Bank maintains a good reputation. However, the contrast with UK market reception, where the broker is not recommended according to some sources, suggests significant regional variations in user experience quality.

Interface design and usability were not specifically detailed in available materials. The provision of both SaxoTraderGO and SaxoTraderPRO suggests attention to different user preferences and skill levels. The web-based nature of SaxoTraderGO likely emphasizes accessibility and ease of use.

Registration and account verification processes were not outlined in available information. The $2,000 minimum deposit suggests a streamlined process for qualified applicants. The verification timeline and documentation requirements would be important factors for potential clients.

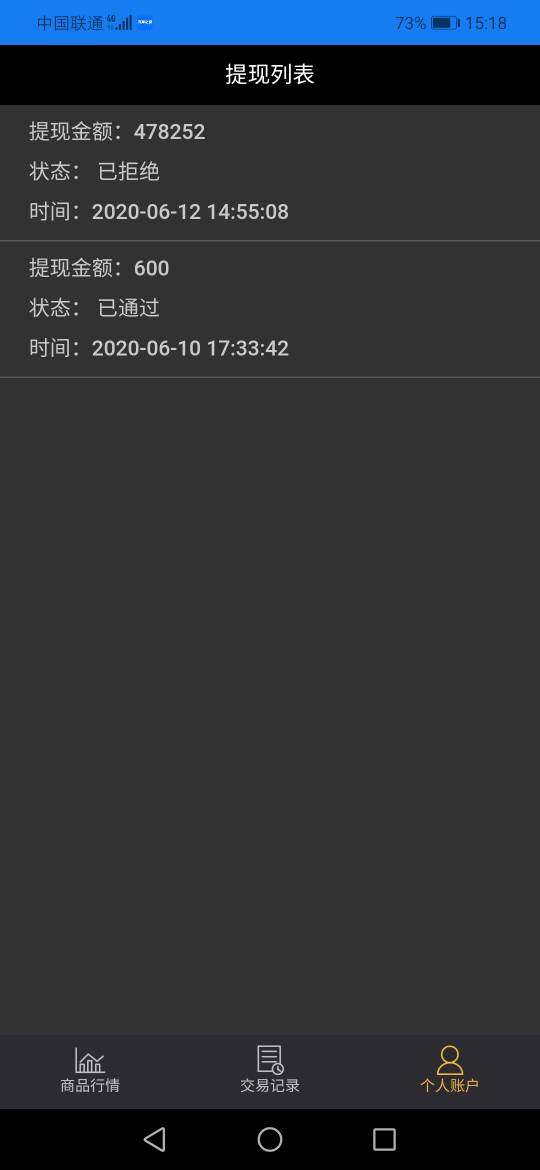

Fund operation experience, including deposit and withdrawal processing times, available payment methods, and associated fees, was not detailed in reviewed materials. These operational aspects significantly impact overall user satisfaction and require direct verification.

The target user profile of mid-to-high-end investors with CFD and forex trading experience suggests that the platform may be less suitable for beginners or those seeking educational support. The 65% loss rate among retail CFD traders indicates that successful platform use requires significant trading knowledge and risk management skills.

Conclusion

This comprehensive saxo review reveals a broker with significant strengths in instrument diversity and platform sophistication. These are balanced against concerns about transparency and regional service variations. Saxo Bank appears well-suited for experienced traders and investors who value extensive market access and professional-grade trading tools, particularly those operating in European markets.

The platform's primary advantages include access to over 71,000 financial instruments and dual-platform architecture accommodating different trader profiles. However, limitations include insufficient transparency regarding regulatory oversight, customer service capabilities, and the high risk associated with CFD trading where most retail clients lose money.

Potential users should carefully consider their experience level, risk tolerance, and geographic location when evaluating Saxo Bank. They should pay particular attention to region-specific service quality and regulatory protections.