Regarding the legitimacy of Saxo forex brokers, it provides FCA, FSA, SFC, AMF, CONSOB, MAS, ASIC and WikiBit, (also has a graphic survey regarding security).

Is Saxo safe?

Pros

Cons

Is Saxo markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Saxo Capital Markets UK Ltd

Effective Date:

2011-10-05Email Address of Licensed Institution:

ukcompliance@saxomarkets.com, uklegal@saxobank.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.home.saxo/en-gb/Expiration Time:

--Address of Licensed Institution:

26th Floor 40 Bank Street London E14 5DA UNITED KINGDOMPhone Number of Licensed Institution:

+4402071512100Licensed Institution Certified Documents:

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

サクソバンク証券株式会社

Effective Date: Change Record

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都港区六本木1-6-1 泉ガーデンタワー3 6階Phone Number of Licensed Institution:

03-6701-4601Licensed Institution Certified Documents:

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

Saxo Capital Markets HK Limited

Effective Date: Change Record

2011-01-19Email Address of Licensed Institution:

hkcompliance@saxomarkets.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.saxomarkets.com.hkExpiration Time:

--Address of Licensed Institution:

香港中環皇后大道中12號上海商業銀行大廈19樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

AMF Market Making License (MM)

The Autorité des Marchés Financiers

The Autorité des Marchés Financiers

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

Saxo banque (France)

Effective Date:

2008-09-15Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

http://www.saxobanque.frExpiration Time:

--Address of Licensed Institution:

10 rue de la PaixPhone Number of Licensed Institution:

0178945640Licensed Institution Certified Documents:

CONSOB Derivatives Trading License (MM)

National Commission for Companies and the Stock Exchange

National Commission for Companies and the Stock Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

BG SAXO SIM S.P.A.

Effective Date:

2018-12-28Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

CORSO EUROPA 22 20122 MILANO (MI) ITALIAPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

MAS Market Making License (MM)

Monetary Authority of Singapore

Monetary Authority of Singapore

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

SAXO CAPITAL MARKETS PTE. LTD.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.home.saxo/en-sgExpiration Time:

--Address of Licensed Institution:

88 MARKET STREET CAPITASPRING #31-01 048948Phone Number of Licensed Institution:

+65 63037800Licensed Institution Certified Documents:

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

TOTALITY WEALTH LIMITED

Effective Date:

2004-12-07Email Address of Licensed Institution:

Compliance@totality.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SE 1 L 24 9-13 CASTLEREAGH ST SYDNEY NSW 2000 AUSTRALIAPhone Number of Licensed Institution:

0282679003Licensed Institution Certified Documents:

Is Saxo Safe or Scam?

Introduction

Saxo Bank, established in 1992 and headquartered in Copenhagen, Denmark, has positioned itself as a prominent player in the forex and multi-asset trading markets. With a reputation for providing a wide range of financial products and advanced trading platforms, Saxo has attracted a diverse clientele, including retail and institutional investors. However, as the financial landscape continues to evolve, traders must exercise caution when selecting a broker. The potential for scams and unethical practices in the forex industry necessitates a thorough evaluation of brokers like Saxo. This article aims to objectively analyze Saxo Bank's credibility by examining its regulatory status, company background, trading conditions, customer fund safety, client experiences, and overall risk profile.

Regulation and Legitimacy

Saxo Bank operates under a robust regulatory framework, which is crucial for ensuring the safety of client funds and maintaining market integrity. The bank is regulated by several tier-1 financial authorities, which are recognized for their stringent standards and oversight. Below is a summary of Saxo Bank's regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 551422 | United Kingdom | Verified |

| Australian Securities and Investments Commission (ASIC) | 126 373 859 | Australia | Verified |

| Swiss Financial Market Supervisory Authority (FINMA) | 136 813 | Switzerland | Verified |

| Monetary Authority of Singapore (MAS) | 200601141M | Singapore | Verified |

| Japanese Financial Services Agency (JFSA) | 239 | Japan | Verified |

| Securities and Futures Commission (SFC) | 1395901 | Hong Kong | Verified |

The presence of multiple tier-1 regulators underscores Saxo Bank's commitment to high compliance standards. The bank has maintained a strong regulatory track record, which enhances its legitimacy in the eyes of traders. Historically, Saxo has navigated regulatory scrutiny effectively, demonstrating adherence to best practices and transparency.

Company Background Investigation

Saxo Bank was founded by Kim Fournais and Lars Christensen, initially operating as Midas. The firm transitioned to Saxo Bank in 2001 and quickly became one of the first brokers in Denmark to gain EU regulatory approval. Over the years, Saxo has expanded its offerings and geographical presence, now serving clients in over 180 countries.

Saxo Bank is a privately owned entity, with significant investments from major stakeholders, including the Chinese automotive giant Geely. The management team comprises seasoned professionals with extensive experience in finance and technology, contributing to the bank's innovative approach to trading.

Transparency is a core principle at Saxo, evidenced by its comprehensive information disclosure regarding fees, regulatory compliance, and operational practices. The bank's commitment to providing detailed insights into its services fosters trust among its clients.

Trading Conditions Analysis

Saxo Bank offers a competitive trading environment, characterized by a diverse range of financial instruments and a complex fee structure. The bank provides access to over 70,000 tradeable instruments, including forex pairs, stocks, ETFs, and CFDs. However, the overall costs associated with trading can vary significantly based on account type and trading volume. Below is a comparison of Saxo's core trading costs:

| Fee Type | Saxo Bank | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.4 pips | 1.0 pips |

| Commission Model | Variable, based on account type | Fixed, depending on volume |

| Overnight Interest Range | Variable | Variable |

While Saxo's spreads on major currency pairs are competitive, the bank's commission structure can be complex, particularly for lower-tier accounts. Clients may encounter additional fees for small trades or inactivity, which could be a deterrent for novice traders. Overall, Saxo Bank's pricing is more favorable for high-volume traders who can benefit from reduced commissions and tighter spreads.

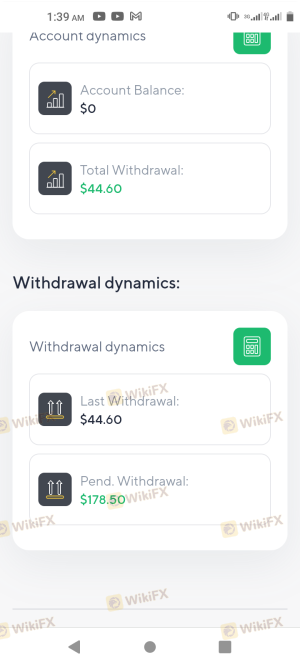

Customer Fund Safety

Saxo Bank prioritizes the safety of client funds through several protective measures. Client funds are held in segregated accounts, ensuring that they are not commingled with the bank's operational funds. This practice is essential for protecting client assets in the event of insolvency.

Additionally, Saxo Bank is a member of the Danish Guarantee Fund, which provides compensation of up to €100,000 for client deposits in the event of the bank's failure. This regulatory safety net further enhances the bank's credibility.

Saxo has not faced significant historical issues regarding fund safety, which is a positive indicator for potential clients. The bank's strong compliance culture and commitment to client protection contribute to a low-risk trading environment.

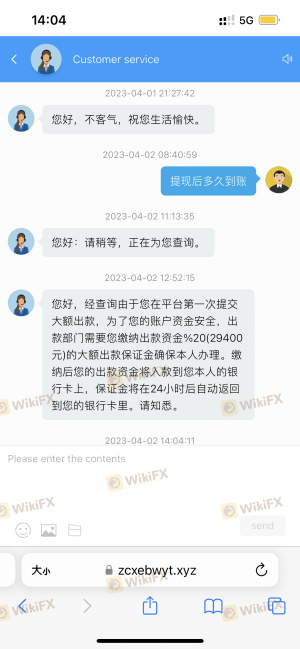

Customer Experience and Complaints

Customer feedback is a vital component of assessing a broker's reliability. Saxo Bank generally receives positive reviews for its extensive product offerings and advanced trading platforms. However, common complaints include issues related to customer service responsiveness and the complexity of the fee structure.

The following table summarizes the types of complaints reported by clients:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Customer Service Delays | Moderate | Generally responsive, but may take longer for complex inquiries |

| Fee Transparency Issues | High | Ongoing efforts to clarify fee structures |

| Platform Stability | Moderate | Mostly stable, with occasional reported outages |

One notable case involved a trader who experienced delays in fund withdrawals, leading to frustration. Saxo's customer service team addressed the issue, but the incident highlighted the need for improved communication regarding withdrawal processes.

Platform and Execution Quality

Saxo Bank's trading platforms, SaxotraderGO and Saxotrader Pro, are highly regarded for their performance and user experience. The platforms are designed to cater to both novice and experienced traders, offering a range of tools for analysis and execution.

In terms of order execution quality, Saxo Bank has established a reputation for providing reliable and efficient trade execution. However, some traders have reported instances of slippage during high volatility periods, emphasizing the importance of understanding market conditions when placing trades.

Risk Assessment

Using Saxo Bank as a trading platform entails several risks, which must be carefully considered by potential clients. Below is a summary of the key risk areas associated with trading with Saxo:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight across multiple jurisdictions. |

| Market Risk | High | Exposure to market volatility can lead to significant losses. |

| Operational Risk | Medium | Potential for platform outages or technical issues. |

| Customer Service Risk | Medium | Complaints regarding responsiveness and clarity of information. |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts to familiarize themselves with the platform, and consider setting risk management parameters, such as stop-loss orders.

Conclusion and Recommendations

In conclusion, Saxo Bank is a well-regulated and reputable broker that offers a comprehensive trading environment. The bank's strong regulatory framework, extensive product offerings, and commitment to client fund safety contribute to its credibility in the forex market. While there are some concerns regarding fee transparency and customer service responsiveness, Saxo Bank does not exhibit any significant signs of being a scam.

For traders considering Saxo Bank, it is advisable to evaluate their trading experience, capital requirements, and specific needs. Novice traders may find the platform's complexity overwhelming, while experienced traders could benefit from the advanced features and competitive pricing.

If Saxo Bank's minimum deposit requirements are a concern, alternative brokers such as IG or CMC Markets offer lower entry points and may be more suitable for beginner traders. Ultimately, conducting due diligence and understanding the trading environment is crucial for any trader looking to engage with Saxo Bank or any other broker.

Is Saxo a scam, or is it legit?

The latest exposure and evaluation content of Saxo brokers.

Saxo Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Saxo latest industry rating score is 7.76, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.76 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.