Hankotrade 2025 Review: Everything You Need to Know

Executive Summary

This hankotrade review looks at a new player in online forex trading. Hankotrade started in 2019 and offers high leverage up to 500:1 with attractive trading conditions including zero spreads in some cases. The broker gives traders access to forex, CFDs, cryptocurrencies, indices, and commodities through MT4 and MT5 platforms.

What makes this hankotrade review different is our close look at the broker's regulatory status. Hankotrade operates without regulation from major financial authorities like the FCA, ASIC, or CySEC. This creates big concerns for potential clients since there are no guarantees for fund safety or formal ways to resolve disputes.

The platform targets experienced traders who want high-risk, high-reward opportunities. Commissions start at just $2 and the broker promises zero spreads under specific conditions to attract cost-conscious traders. However, the lack of regulatory protection means users must be very careful when considering this broker, even though the trading conditions look good.

Important Notice

Regional Entity Differences: Hankotrade operates without regulation from any recognized financial authority. This means users in different countries may face varying degrees of legal risk and protection. The broker's unregulated status creates the same challenges globally, with no regional differences in regulatory oversight to provide extra security.

Review Methodology: This evaluation uses user feedback, market reports, and available platform information. We gathered data from multiple independent sources to give a balanced view of Hankotrade's services while noting the limits caused by the broker's unregulated status and limited transparency.

Rating Framework

Broker Overview

Hankotrade entered the forex market in 2019 as a technology-focused trading platform. The company operates as an online forex and CFD broker, offering trading across various financial instruments. Despite being new, Hankotrade tries to stand out by emphasizing competitive trading conditions and advanced platform technology.

The broker's business model focuses on providing direct market access through popular trading platforms while keeping fees low. Reports show that Hankotrade attracts traders through aggressive pricing, including low commissions and tight spreads. However, this hankotrade review must stress that the company operates without regulatory oversight from any major financial authority, which shapes its operations and risk profile.

Hankotrade's platform supports both MetaTrader 4 and MetaTrader 5, two of the industry's most recognized trading platforms. The broker offers access to foreign exchange pairs, contracts for difference (CFDs), cryptocurrency instruments, major global indices, and commodity markets. This wide range of options positions Hankotrade as a one-stop solution for traders who want exposure to multiple markets through a single platform.

Regulatory Jurisdiction: Hankotrade operates without regulation from any recognized financial authority. This means the broker does not fall under oversight from major regulators like the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), or Cyprus Securities and Exchange Commission (CySEC).

Deposit and Withdrawal Methods: Information about deposit and withdrawal methods is not available in our sources. This lack of transparency about banking options is a significant gap that potential clients should address directly with the broker.

Minimum Deposit Requirements: The exact minimum deposit requirements are not specified in available documentation. Prospective traders need to contact Hankotrade directly for this basic account opening information.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not detailed in available sources. This suggests either limited promotional activity or insufficient transparency in marketing communications.

Tradeable Assets: Hankotrade provides access to foreign exchange currency pairs, contracts for difference (CFDs) across various assets, cryptocurrency trading instruments, major global stock indices, and commodity markets including precious metals and energy products.

Cost Structure: Reports show that Hankotrade offers competitive pricing with spreads that can reach zero under certain conditions and commissions starting from $2 per transaction. These cost advantages represent one of the broker's key competitive strategies.

Leverage Ratios: The platform offers leverage up to 500:1. This represents very high leverage ratios that can amplify both potential profits and losses significantly.

Platform Options: Hankotrade supports both MetaTrader 4 and MetaTrader 5 platforms. These provide traders with access to advanced charting tools, technical indicators, and automated trading capabilities.

Geographic Restrictions: Specific geographic restrictions and availability limitations are not detailed in available information. Direct inquiry with the broker is required to determine service availability in specific countries.

Customer Service Languages: The specific languages supported by Hankotrade's customer service team are not specified in available sources.

This hankotrade review reveals significant information gaps that potential clients should address through direct communication with the broker before making trading decisions.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

Hankotrade's account conditions show competitive advantages mixed with transparency concerns. The broker's commission structure starts from $2 per transaction, which positions it well against many competitors in retail forex. The promise of zero spreads under certain market conditions could provide significant cost savings for high-frequency traders and scalping strategies.

However, this hankotrade review must note that specific account types, minimum deposits, and detailed fee schedules are not clearly documented. This lack of comprehensive account information creates uncertainty for potential clients trying to evaluate the true cost of trading with Hankotrade. The absence of information about Islamic accounts, swap-free arrangements, or premium account tiers further limits our assessment.

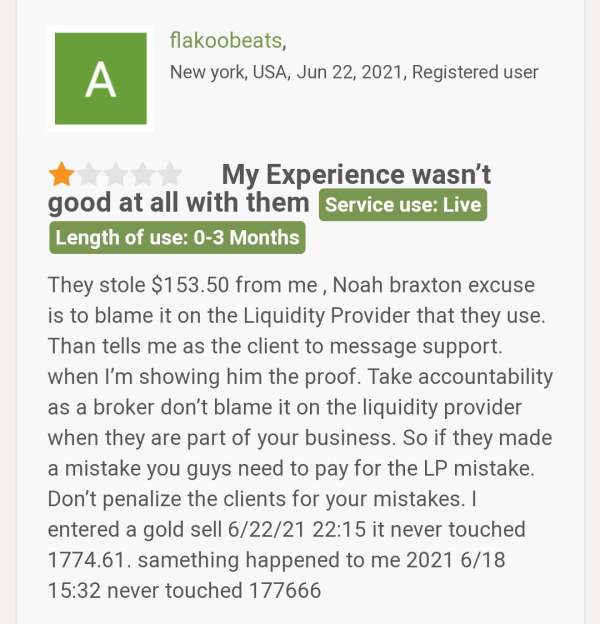

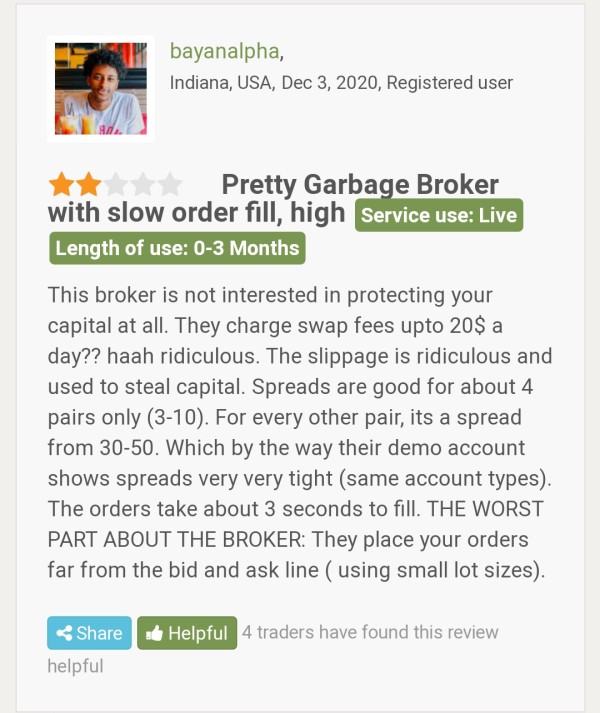

User feedback suggests that while trading costs can be competitive, the overall account experience varies significantly among traders. Some users report positive experiences with basic account setup, while others express concerns about the clarity of terms and conditions. The unregulated status also means that account protection measures like segregated client funds or compensation schemes are not guaranteed by external regulatory frameworks.

The account conditions score of 7/10 reflects the competitive pricing and basic functionality while acknowledging significant transparency and regulatory protection limitations that affect overall account security and clarity.

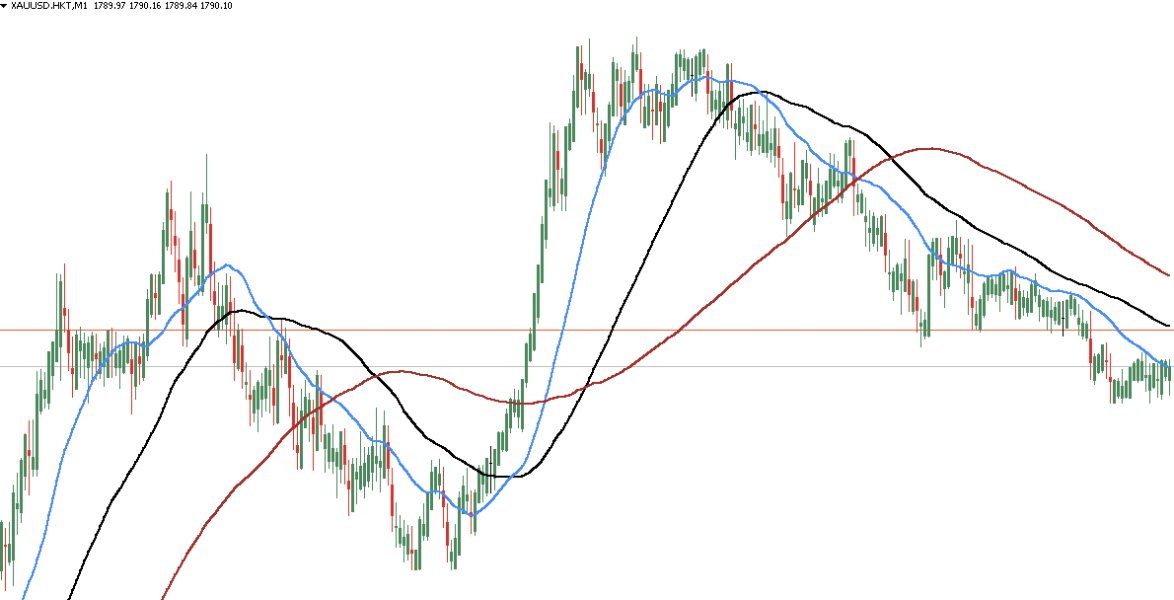

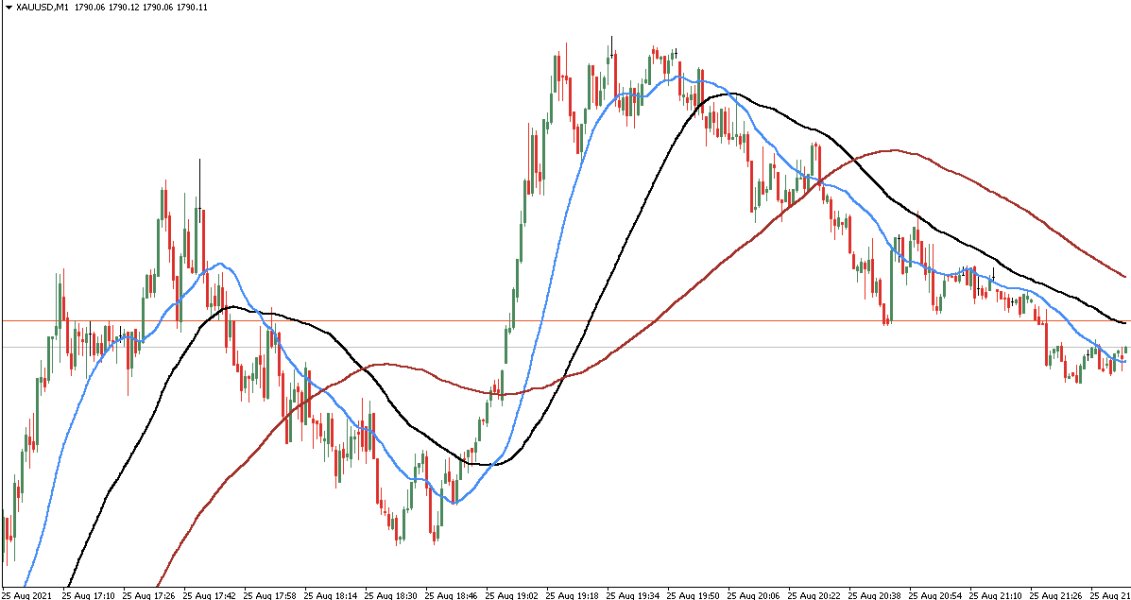

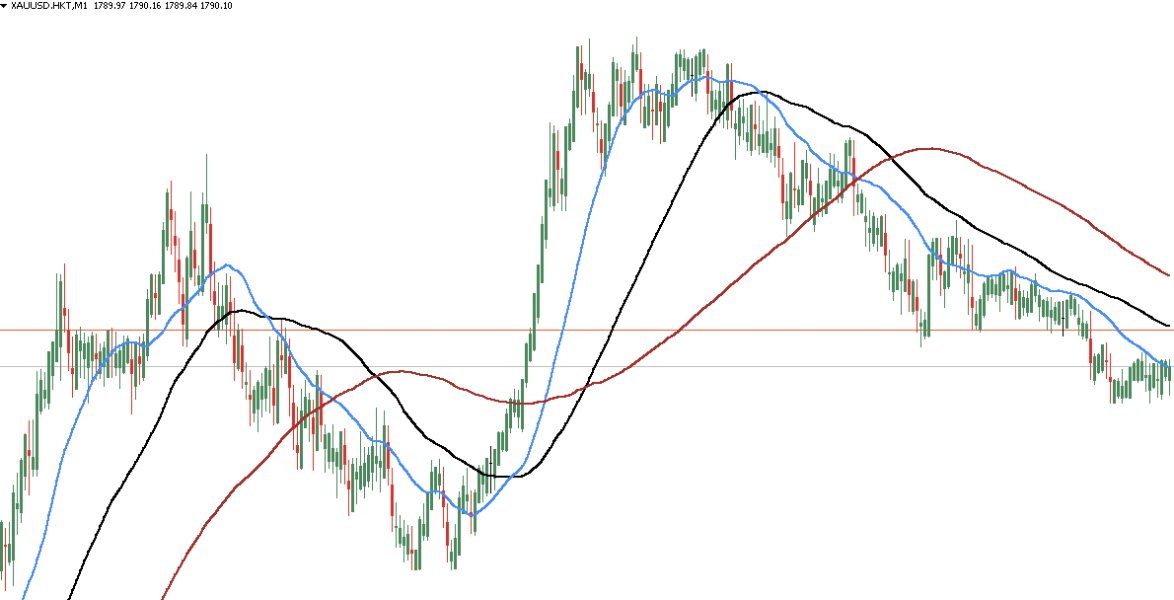

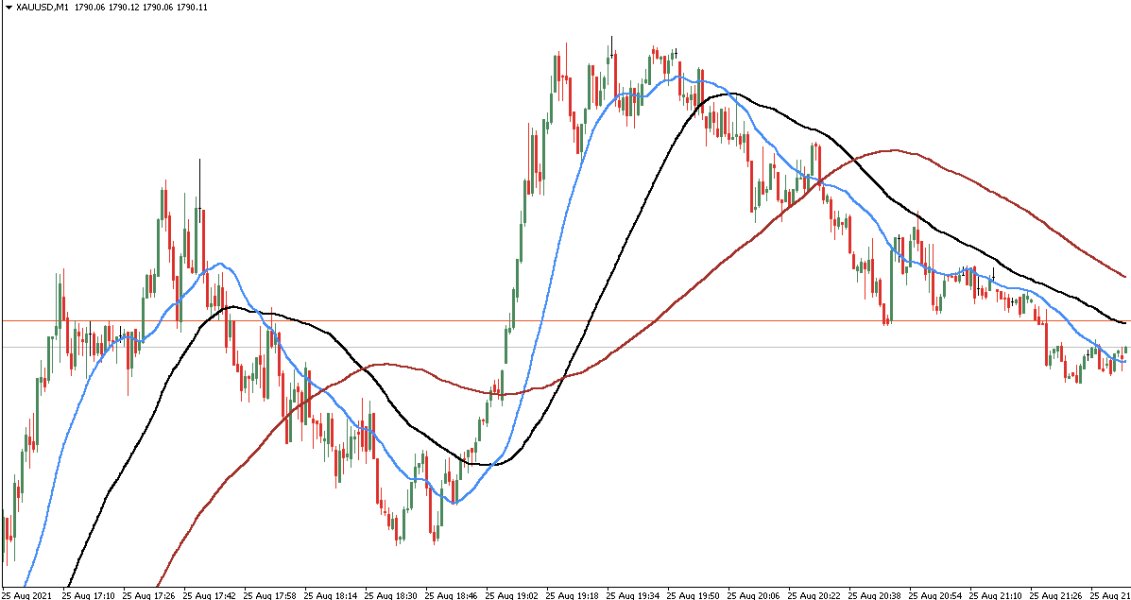

Hankotrade's trading tools and resources represent one of the platform's strongest aspects through its support of MetaTrader 4 and MetaTrader 5. These industry-standard platforms provide traders with comprehensive charting capabilities, extensive technical indicator libraries, and robust automated trading support through Expert Advisors (EAs) and signal services. The dual-platform approach allows traders to choose their preferred interface while maintaining access to advanced analytical tools.

User feedback shows the platform provides access to a wide range of technical analysis tools, multiple timeframe charts, and customizable interface options for different trading styles and experience levels. The MT4 and MT5 integration ensures compatibility with third-party tools, custom indicators, and automated trading systems that many experienced traders rely on for their strategies.

However, this hankotrade review notes that specific information about proprietary research resources, market analysis content, or educational materials is not detailed in available sources. Many established brokers provide daily market commentary, economic calendars, and educational webinars, but Hankotrade's offerings in these areas remain unclear. The absence of detailed information about research quality and educational support represents a potential limitation for traders seeking comprehensive analytical resources.

The tools and resources score of 8/10 reflects the strong foundation provided by MT4 and MT5 platform access while acknowledging uncertainty about additional analytical and educational offerings that could enhance the overall trading experience.

Customer Service and Support Analysis (Score: 6/10)

Customer service and support show mixed performance based on available user feedback. Some traders report positive interactions with support staff, but the overall picture suggests inconsistent service quality and limited transparency about support availability and response times. The broker's unregulated status also means that formal complaint procedures and escalation processes may not follow established industry standards.

Available feedback shows that response times and service quality can vary significantly depending on the nature of inquiries and communication channels used. However, specific information about supported contact methods, business hours, multilingual support capabilities, and average response times is not clearly documented. This lack of transparency about service standards makes it difficult for potential clients to set appropriate expectations.

User experiences range from satisfactory problem resolution to concerns about communication effectiveness and follow-up procedures. Some traders express frustration with the clarity of information provided during support interactions, while others report adequate assistance with basic platform and account questions. The absence of detailed service level agreements or published support standards contributes to uncertainty about service reliability.

The customer service score of 6/10 reflects mixed user feedback and acknowledges that while basic support appears available, the quality and consistency of service delivery remain uncertain due to limited transparency and the broker's unregulated operational framework.

Trading Experience Analysis (Score: 7/10)

The trading experience with Hankotrade centers around the robust functionality of MetaTrader 4 and MetaTrader 5 platforms. User feedback generally shows acceptable platform stability and reasonable execution speeds, though comprehensive performance data is not readily available in public sources. The high leverage options up to 500:1 and competitive spread conditions can create favorable trading environments for experienced traders who understand the associated risks.

Platform functionality appears comprehensive, with users having access to multiple order types, advanced charting capabilities, and automated trading options through Expert Advisors. The multi-asset approach allows traders to diversify their strategies across forex, CFDs, cryptocurrencies, indices, and commodities from a single platform interface. This hankotrade review notes that the breadth of available instruments can support various trading strategies and portfolio approaches.

However, specific information about order execution quality, slippage rates, requote frequency, and platform uptime statistics is not detailed in available sources. These technical performance metrics are crucial for evaluating the true quality of the trading experience, particularly for strategies that depend on precise execution timing. Mobile trading capabilities and cross-device synchronization features are also not comprehensively documented.

The trading experience score of 7/10 reflects the solid platform foundation and positive user feedback about basic functionality while acknowledging the lack of detailed performance metrics and transparency that would enable a more comprehensive evaluation of execution quality and reliability.

Trust and Reliability Analysis (Score: 4/10)

Trust and reliability represent the most significant concerns in this hankotrade review, primarily due to the broker's unregulated status. Operating without oversight from recognized financial authorities means that Hankotrade lacks the institutional safeguards that regulated brokers must maintain. This absence of regulatory supervision eliminates formal requirements for segregated client funds, capital adequacy standards, and dispute resolution mechanisms.

The unregulated nature of Hankotrade's operations means that clients have no recourse to financial ombudsman services or compensation schemes that typically protect retail traders when dealing with regulated entities. Fund safety measures, if any exist, are not guaranteed by external regulatory frameworks, creating inherent risks for client deposits and trading capital. The lack of published financial statements, audit reports, or regulatory filings further limits transparency about the company's financial stability and operational practices.

User feedback reflects these trust concerns, with some traders expressing specific worries about the legitimacy and safety aspects of dealing with an unregulated broker. While some users report satisfactory experiences, the overall sentiment includes significant caution about the risks associated with the broker's regulatory status. The absence of industry awards, third-party certifications, or independent security audits compounds these reliability concerns.

The trust and reliability score of 4/10 reflects the fundamental challenges posed by the unregulated status and limited transparency, which create inherent risks that potential clients must carefully consider against any potential benefits offered by the platform.

User Experience Analysis (Score: 7/10)

User experience with Hankotrade presents a complex picture of generally positive platform functionality combined with underlying concerns about regulatory protection and transparency. Feedback from actual users shows that the basic trading interface through MT4 and MT5 provides familiar and functional access to markets, with most traders able to navigate the platform effectively and execute their intended strategies.

The registration and account verification processes appear straightforward based on available user reports, though specific details about documentation requirements and approval timeframes are not comprehensively documented. Users generally report that the platform interface design meets basic usability standards, though advanced customization options and user interface innovations beyond the standard MetaTrader offerings are not clearly detailed.

However, this hankotrade review must emphasize that user satisfaction is significantly tempered by ongoing concerns about the broker's unregulated status and associated risks. Many users express appreciation for the competitive trading conditions while simultaneously acknowledging discomfort with the lack of regulatory protection. Common user complaints center around transparency issues and uncertainty about fund safety rather than platform functionality problems.

The user experience score of 7/10 reflects the generally positive feedback about platform usability and basic functionality while acknowledging that overall user satisfaction is constrained by legitimate concerns about regulatory protection and transparency that affect the complete trading experience beyond pure platform performance.

Conclusion

This comprehensive hankotrade review reveals a broker that presents both attractive trading conditions and significant regulatory concerns that potential clients must carefully weigh. Hankotrade offers competitive elements including low commissions from $2, potential zero spreads, high leverage up to 500:1, and access to popular MT4 and MT5 platforms across multiple asset classes. These features may appeal to experienced traders seeking cost-effective market access and advanced trading capabilities.

However, the broker's unregulated status represents a fundamental limitation that overshadows its competitive advantages. The absence of oversight from recognized financial authorities eliminates crucial protections including segregated client funds, formal dispute resolution procedures, and compensation scheme access. This regulatory gap creates inherent risks that experienced traders must acknowledge and accept.

Hankotrade appears most suitable for sophisticated traders who fully understand the implications of dealing with unregulated entities and are comfortable assuming the associated risks in exchange for potentially favorable trading conditions. New or risk-averse traders would likely benefit from considering regulated alternatives that provide institutional protections, even if trading costs might be slightly higher. The key strengths include competitive pricing and robust platform access, while the primary weaknesses center on regulatory protection and transparency limitations that affect overall trustworthiness and fund security.