deriv Review 143

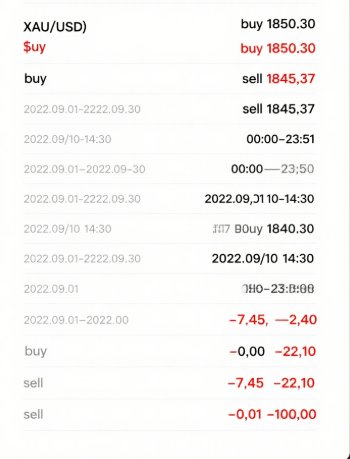

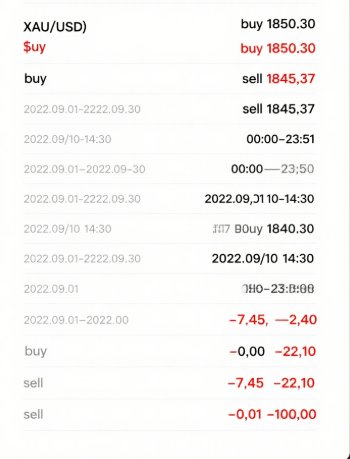

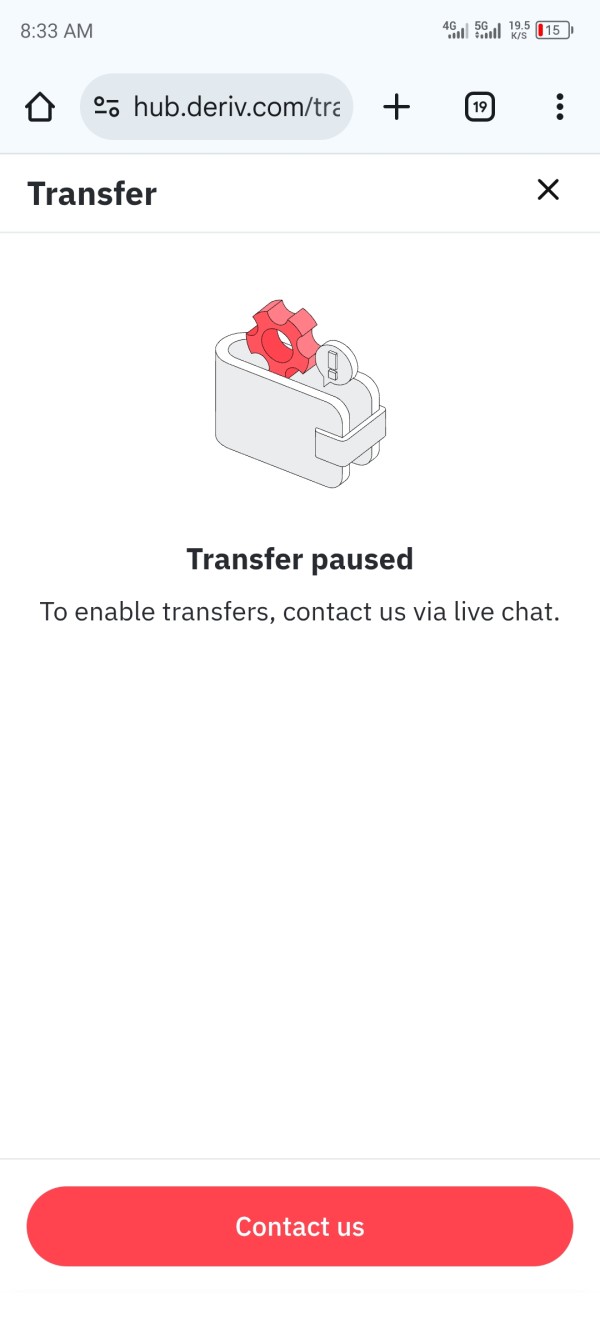

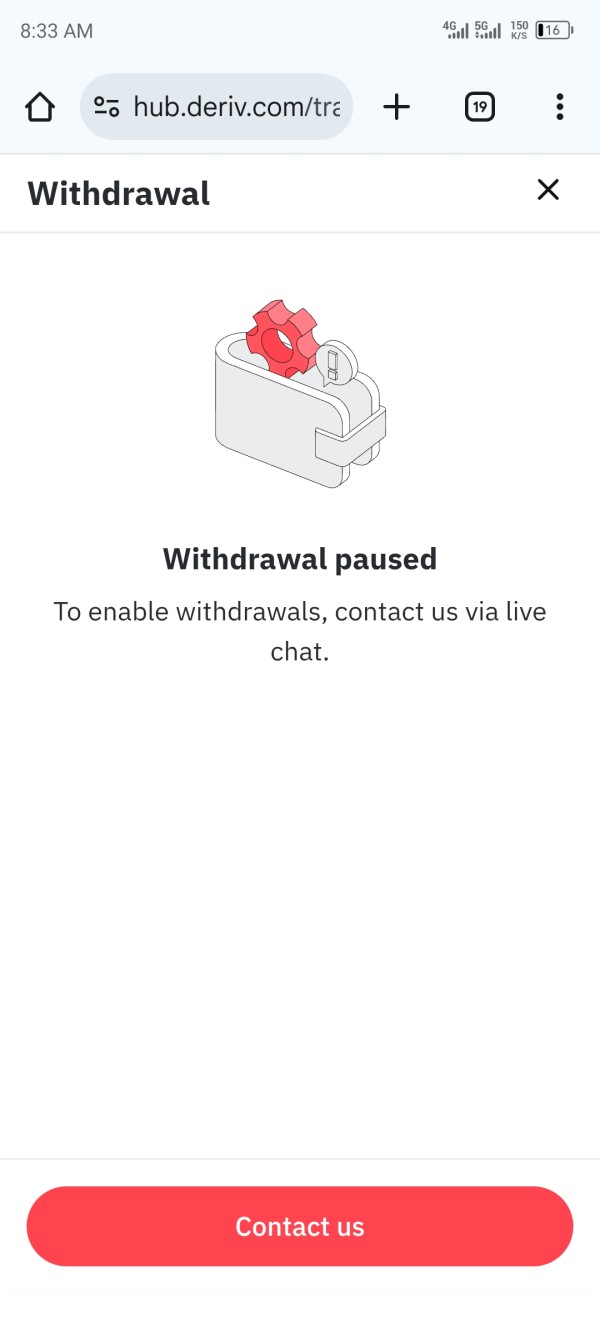

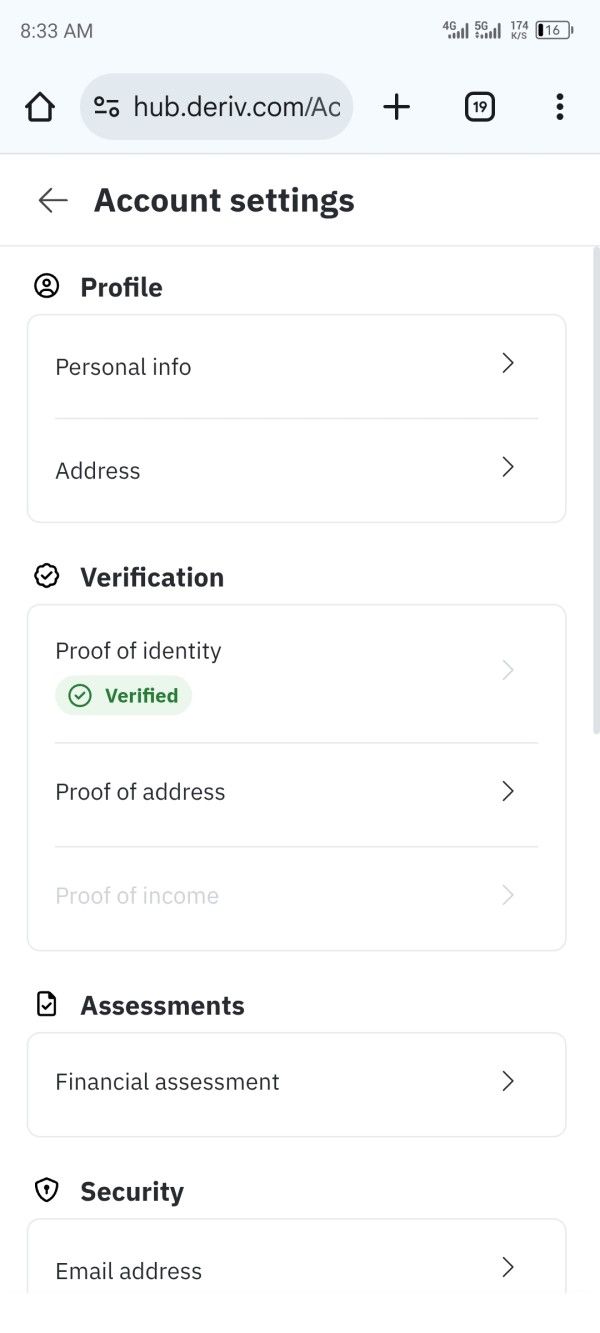

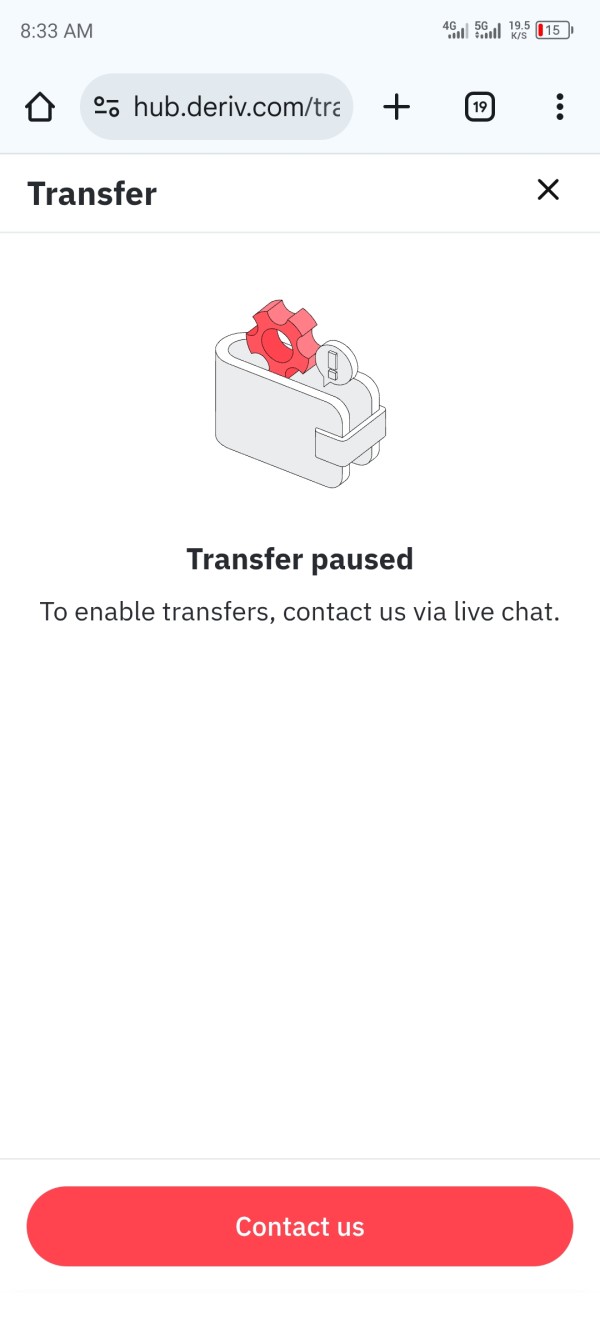

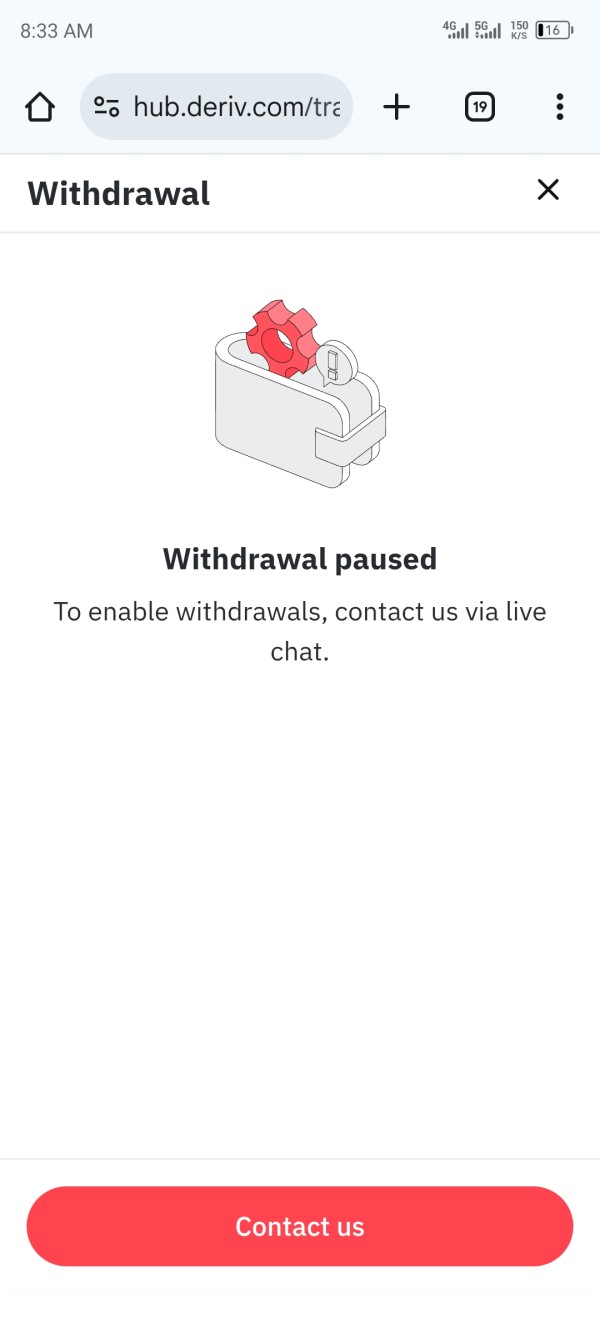

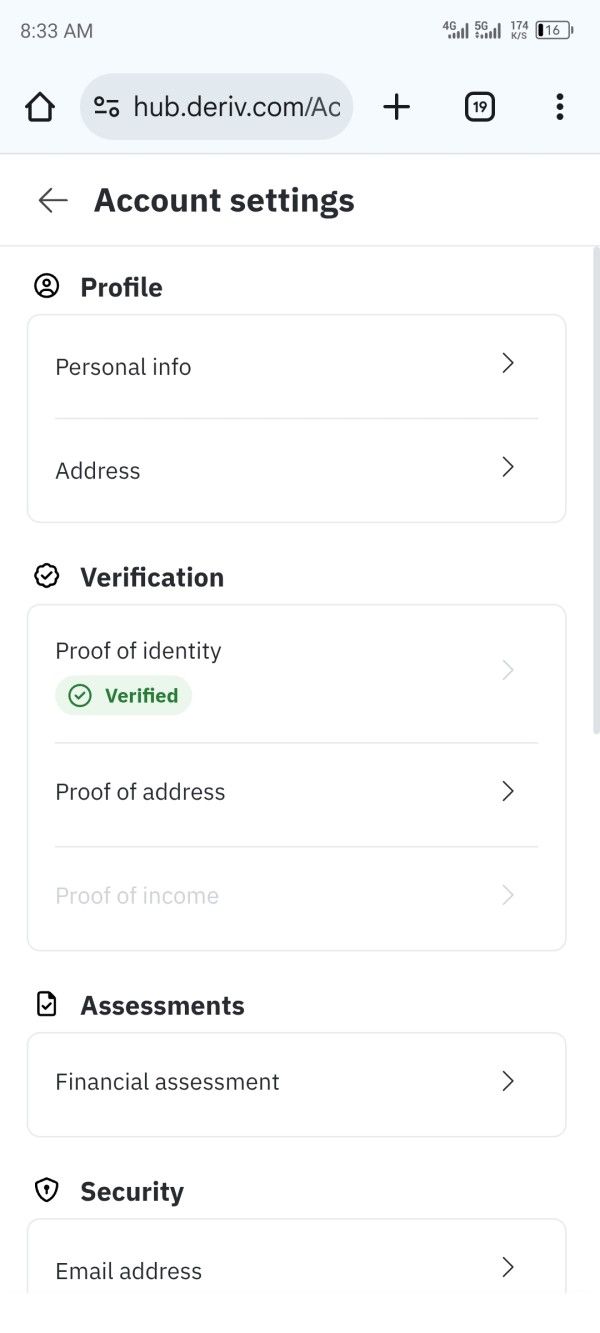

i need to help me please this Broker it's blocked my transfer and withdrawal 😭😭 I verified my ID last 3weeks ago

I advise all Indonesian traders to stay away from this broker. In March 2025, my Deriv account, holding 150 million rupiah, was suddenly frozen due to "suspected unusual trading." I had previously been consistently profitable in long USD/IDR trades, and I suspected the platform was maliciously blocking my withdrawals. Customer service requested nearly six months of bank statements, proof of source of funds, and even utility bills, far exceeding Know Your Customer (KYC) standards. After submitting all the documents, I was asked to pay a 10% "fund verification fee" to release my funds. Inquiries with Mandiri Bank revealed that my funds had been transferred to an offshore account in Mauritius, not the Jakarta branch account claimed by the platform. Three months have passed since the account was frozen, and Deriv customer service has disappeared via WhatsApp. Yet, their Indonesian website still advertises "fund security and assurance." This blatant fraud is appalling.

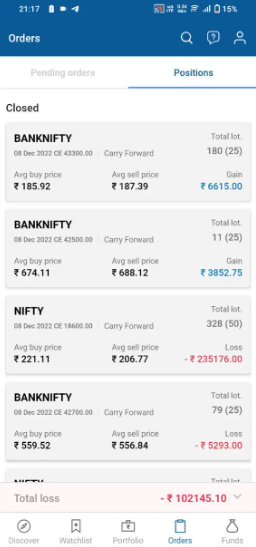

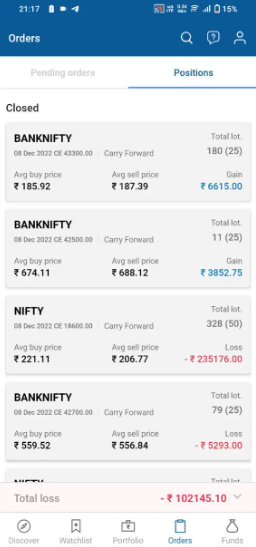

A platform that offers no guarantee of withdrawals. I have been trading in India for four years, and I have never seen a ridiculous platform like Deriv. I took a long position in GBP/USD on the night of the Non-Farm Payroll report. I had set the stop-loss at 1.2600, but the system closed it at 1.2450. That's a 150-pip drop, and I immediately lost 320,000 rupees. I applied to withdraw the remaining 500,000 rupees, but it took 18 days. No one responded to my requests. This platform lacks basic compliance and offers no withdrawal guarantees.

Deriv suddenly reduced my leverage, causing my initial investment of 720,000 rupees to be completely wiped out. They had advertised "maximum leverage 1:200," but I took a long position in USD/INR at 1:150 and held it until 3:00 AM when the "leverage was adjusted to 1:50." Before I could replenish my margin, the system forced liquidation. The USD/INR price had only dropped by 0.22 rupees, but the trade executed at a slippage of 0.48 rupees. This 42-point loss resulted in a 567,000-rupee loss—equivalent to the profit from three trucks of Spring Tea. I complained to SEBI, but they said Deriv is not registered in India and my money cannot be recovered. Deriv is a fraudulent platform that disregards regulations. Indian agricultural commodity traders should never trust their lies!

Penurunan leverage yang tiba-tiba menyebabkan margin call, ditambah kerugian dari perdagangan produk pertanian di Medan. Penurunan leverage yang tiba-tiba dari Deriv menghabiskan 72 juta rupiah saya. Mereka mengiklankan "leverage hingga 1:500," tetapi saya sedang long USD/IDR di 1:200. Saya mempertahankan posisi saya hingga tengah malam, dan tiba-tiba menerima email yang mengatakan "leverage disesuaikan menjadi 1:50." Posisi saya terpaksa ditutup karena slippage 65 pip, mengakibatkan kerugian sebesar 4,55 juta rupiah. Selama 20 hari terakhir, saya telah kehilangan uang dalam lima perdagangan karena perubahan leverage yang tiba-tiba, dengan total 38 juta rupiah. Deriv adalah platform penipuan yang mengabaikan hak-hak pelanggan.

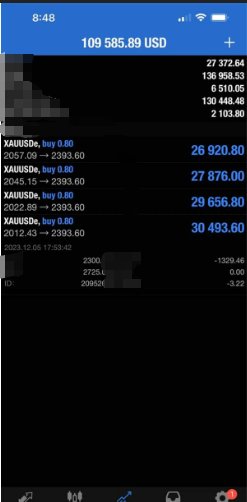

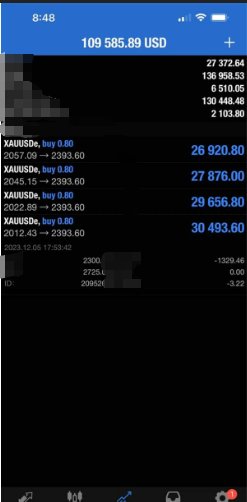

Deriv's customer service is an insult to my intelligence. My account was suddenly frozen in May, citing "identity update required." I submitted my passport and proof of address five times, only to be told each time by a different representative that the documents were "incomplete." I even had a video call with them once, but they still said they couldn't verify the information. Their leverage scheme, advertised as 1:1000 leverage, was secretly adjusted to 1:50 during trading. This resulted in my April crude oil trade being forced to close due to insufficient margin, resulting in a loss of 7,300 Australian dollars. When I pointed out their fraudulent practices, the representative simply hung up on me. This platform doesn't care about customer rights; they're only interested in swindling more money.

I angrily expose the egregious practices of the Deriv platform. The actual payout probabilities for "up/down" contracts on the platform systematically deviate from theoretical values. For example, for a contract with a 55% payout ratio, the theoretical win rate should be 54.5%, but the actual monitored win rate is only 48.7% (sample size ≥ 2,000). Even worse, when prices approach critical levels, the platform experiences significant "price jumps": within the final five seconds, quotes suddenly jump 0.2-0.5 pips in the opposite direction, turning previously profitable contracts into losses. These abnormal jumps occur 77% against the trader. Quotes from their proprietary platform (Deriv MT5) consistently deviate from other mainstream data sources, with an average latency of 800 milliseconds—enough for their algorithms to implement price adjustments that are unfavorable to their clients.

Deriv is a blood-sucking platform with no moral compunction! I made $2,800 in profit last month and applied for a withdrawal. It took 10 days for the funds to arrive, and only $1,900 remained! When I contacted customer service, they said "hidden service fees and exchange rate differences were deducted," but the deposit contract didn't mention anything about these at all! I asked for a detailed breakdown of the deductions, but customer service either sent vague documents or simply read them without replying. Later, I filed a complaint with the regulator, only to discover that their so-called "compliance qualifications" were forged! Why is my hard-earned money being arbitrarily deducted? This kind of fraudulent platform, which openly steals money, is unlucky for anyone who touches it!