Finq 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive finq review examines a controversial online forex and CFD broker that has generated significant attention in the trading community. Finq positions itself as a high-leverage trading platform offering access to over 2,100 financial instruments across multiple asset classes. However, our analysis reveals concerning user feedback. This feedback raises serious questions about the broker's credibility and operational practices.

The platform operates under the regulation of the Seychelles Financial Services Authority and provides MetaTrader 4 as its primary trading platform. While Finq markets itself to traders seeking high leverage opportunities and diversified investment options, user testimonials consistently describe experiences involving alleged fraudulent practices, poor account management, and questionable business conduct. Key features include high leverage trading options and an extensive range of tradeable assets spanning forex, stocks, commodities, indices, bonds, ETFs, and cryptocurrencies.

However, these offerings are overshadowed by numerous red flags identified through user feedback and operational transparency concerns. The broker targets traders with high risk tolerance who prioritize leverage and asset diversity. Though potential clients should carefully consider the significant warnings from existing users before proceeding.

Important Notice

This evaluation is based on available public information and user feedback collected from various sources. Finq operates under the regulatory oversight of the Seychelles Financial Services Authority, which may have different legal implications and protections compared to more established regulatory jurisdictions. The regulatory framework in Seychelles typically offers less stringent oversight than major financial centers.

Readers should note that regulatory environments and broker offerings can vary significantly across different geographical regions. The information presented in this review reflects the general operational structure of Finq but may not account for region-specific variations in services, legal compliance, or regulatory requirements. These factors could affect individual trading experiences.

Rating Framework

Broker Overview

Finq operates as an online forex and CFD broker in the competitive retail trading market. Specific founding details remain unclear from available sources. The company has established itself as a provider of leveraged trading services, focusing primarily on forex and contracts for difference across multiple asset classes.

According to available information, Finq attempts to differentiate itself through high leverage offerings and an extensive catalog of tradeable instruments. The broker's business model centers on providing retail traders with access to global financial markets through online trading platforms. However, the company's operational history and background details are not comprehensively documented in public sources. This raises questions about transparency and corporate disclosure practices that potential clients should consider when evaluating the platform.

Finq utilizes MetaTrader 4 as its primary trading platform, a widely recognized and industry-standard solution that provides traders with familiar tools and functionality. The broker offers access to over 2,100 financial instruments, including traditional forex pairs, individual stocks, commodities, market indices, bonds, exchange-traded funds, and cryptocurrency products. The platform operates under the regulatory supervision of the Seychelles Financial Services Authority. Though this finq review notes that Seychelles regulation typically provides less stringent oversight compared to major financial regulatory bodies in established markets.

Regulatory Jurisdiction: Finq operates under the regulatory oversight of the Seychelles Financial Services Authority. The Seychelles regulatory environment is known for providing a relatively permissive framework for financial services providers, which can offer both advantages and disadvantages for traders depending on their specific needs and risk tolerance levels.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in available sources. This lack of transparency regarding financial transaction processes represents a significant information gap. Potential clients should address this directly with the broker before opening accounts.

Minimum Deposit Requirements: Available sources do not specify minimum deposit requirements for opening trading accounts with Finq. This absence of clear financial requirements information contributes to overall transparency concerns regarding the broker's operational structure.

Promotional Offers and Bonuses: Current promotional activities, bonus structures, or special offers are not documented in available sources. Potential clients interested in promotional opportunities should contact the broker directly for current information regarding any available incentives or special programs.

Available Trading Assets: Finq provides access to over 2,100 financial instruments across multiple asset categories. The extensive catalog includes foreign exchange currency pairs, individual company stocks, commodity futures, market indices, government and corporate bonds, exchange-traded funds, and various cryptocurrency products. This offers significant diversification opportunities for traders.

Cost Structure and Fees: According to available information, Finq does not charge fees for deposit or withdrawal transactions. However, specific details regarding commission rates, spread structures, overnight financing charges, and other potential trading costs are not clearly documented in available sources.

Leverage Ratios: The broker offers high leverage trading options. Specific maximum leverage ratios are not detailed in available documentation. High leverage can amplify both potential profits and losses, requiring careful risk management from traders utilizing these features.

Trading Platform Options: Finq provides MetaTrader 4 as its trading platform solution. MT4 is a widely used and respected platform in the forex industry, offering comprehensive charting tools, technical analysis capabilities, and automated trading functionality through Expert Advisors.

Geographic Restrictions: Specific information regarding geographic restrictions or limitations on service availability is not detailed in available sources. Regulatory requirements may limit access in certain jurisdictions.

Customer Support Languages: Available sources do not specify which languages are supported by Finq's customer service team. This represents another transparency gap that potential clients should clarify before opening accounts.

Account Conditions Analysis

The evaluation of Finq's account conditions reveals significant transparency deficiencies that impact the overall assessment in this finq review. Available sources do not provide detailed information about different account types, their specific features, or the requirements for accessing various service levels. This lack of clarity makes it difficult for potential clients to understand what they can expect from different account offerings.

Minimum deposit requirements are not specified in available documentation. This represents a fundamental transparency issue for any financial services provider. Without clear information about minimum investment thresholds, potential clients cannot adequately plan their initial capital allocation or understand the financial commitment required to begin trading with the platform.

The account opening process details are similarly unclear from available sources. Information regarding required documentation, verification procedures, identity confirmation requirements, and the typical timeframe for account approval is not readily available. This lack of process transparency can create uncertainty for potential clients about what to expect during the onboarding experience.

Special account features, such as Islamic trading accounts that comply with Sharia law requirements, are not mentioned in available sources. Many brokers in the forex industry provide such specialized account options, and the absence of information about these features may indicate limited service customization options or simply inadequate disclosure of available services. User feedback regarding account management has been notably negative, with complaints about the quality of account management services and the appropriateness of trading recommendations provided by the broker's representatives.

These concerns suggest that even if account opening is straightforward, ongoing account management may present challenges for clients.

Finq's offering of over 2,100 financial instruments represents one of the broker's strongest features in terms of trading tools and market access. This extensive catalog provides traders with significant diversification opportunities across multiple asset classes, including traditional forex pairs, individual stocks from various global markets, commodities, indices, bonds, ETFs, and cryptocurrency products. The breadth of available instruments allows traders to implement sophisticated portfolio strategies and take advantage of opportunities across different market sectors.

The MetaTrader 4 platform serves as the primary trading interface, bringing industry-standard functionality that many traders find familiar and reliable. MT4 provides comprehensive charting capabilities, technical analysis tools, and support for automated trading through Expert Advisors. The platform's established track record in the forex industry means that traders can access extensive community resources, custom indicators, and trading robots developed by third-party providers.

However, available sources do not provide specific information about proprietary research and analysis resources that Finq may offer to complement the trading platform. Many competitive brokers provide daily market analysis, economic calendars, trading signals, or proprietary research reports to help traders make informed decisions. The absence of information about such resources suggests either limited offerings in this area or inadequate disclosure of available analytical support.

Educational resources and trader development programs are not detailed in available sources. This represents another potential gap in the broker's service offering. Comprehensive educational materials, webinars, trading courses, and market education can be valuable differentiators for brokers, particularly when serving newer traders who need guidance in developing their skills and understanding market dynamics.

The platform's support for automated trading through MT4's Expert Advisor functionality provides opportunities for traders interested in algorithmic strategies. Specific information about any proprietary automated trading tools or enhanced automation features is not available in current sources.

Customer Service and Support Analysis

Customer service quality emerges as a significant concern area in this analysis, with user feedback indicating substantial deficiencies in support quality and account management practices. Available user testimonials specifically criticize the broker's account management approach and the quality of trading recommendations provided by customer service representatives. This suggests systematic issues with client support operations.

The specific communication channels available for customer support are not detailed in available sources. This makes it difficult to assess the accessibility and convenience of reaching support staff when issues arise. Most competitive brokers provide multiple contact options including phone support, email communication, live chat functionality, and sometimes social media support channels.

Response time performance data is not available from current sources, though user feedback suggests that the quality of responses may be more problematic than response speed. Effective customer support requires not only timely responses but also knowledgeable, helpful, and appropriately trained staff who can address client concerns professionally and effectively. Service quality concerns are highlighted by user reports describing account management practices as potentially inappropriate or unauthorized.

These allegations suggest that customer service representatives may be providing unsuitable advice or engaging in practices that exceed their proper scope of authority. This could indicate inadequate staff training or problematic company policies.

Multilingual support capabilities are not specified in available sources, which could limit accessibility for international clients who prefer to communicate in languages other than English. Given the global nature of forex trading, comprehensive language support is often an important service differentiator. Operating hours for customer support are not detailed in available documentation, making it unclear whether support is available during all major trading sessions or only during specific business hours.

The 24-hour nature of forex markets often requires extended support availability to serve clients effectively across different time zones.

Trading Experience Analysis

The trading experience evaluation reveals a mixed picture with both potential advantages and significant concerns that prospective clients should carefully consider. Finq's emphasis on high leverage trading provides opportunities for traders seeking to maximize their market exposure relative to their capital investment. This also substantially increases risk exposure and requires sophisticated risk management practices.

Platform stability and execution speed data are not available from current sources, making it difficult to assess the technical performance of the trading infrastructure. Reliable order execution, minimal slippage, and consistent platform availability are crucial factors for successful trading, particularly for strategies that depend on precise timing or rapid market movements. Order execution quality information is similarly limited in available sources, though this represents a critical factor for evaluating any trading platform.

Factors such as execution speed, price improvement opportunities, requote frequency, and slippage rates significantly impact trading profitability and overall user satisfaction with the platform experience. The MetaTrader 4 platform provides a solid foundation for trading functionality, offering comprehensive charting tools, technical analysis capabilities, and support for automated trading strategies. However, the overall trading experience depends not only on platform capabilities but also on the broker's implementation, server infrastructure, and operational practices that support the platform.

Mobile trading experience details are not specified in available sources, though mobile accessibility has become increasingly important for traders who need to monitor positions and react to market developments while away from their primary trading stations. Most competitive brokers now provide dedicated mobile applications or mobile-optimized web platforms. User feedback regarding the overall trading experience has been predominantly negative, with serious allegations about the broker's business practices that extend beyond normal trading platform concerns.

This finq review notes that such feedback suggests fundamental issues with the broker's operational approach that could significantly impact the trading experience regardless of platform technical capabilities.

Trust and Reliability Analysis

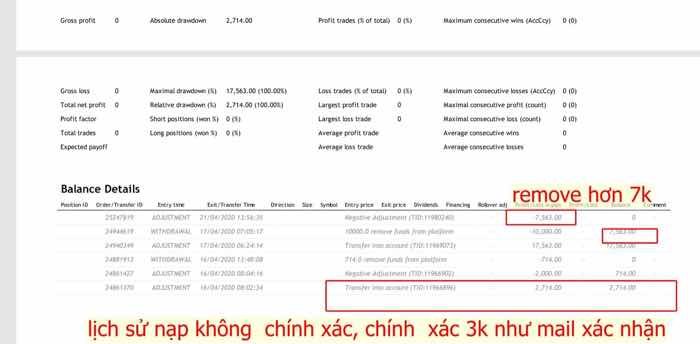

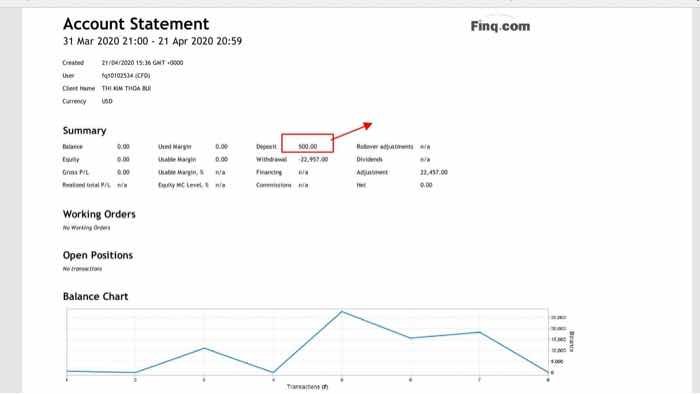

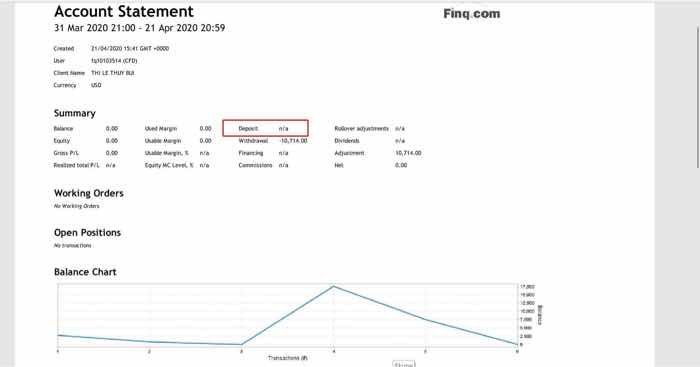

Trust and reliability represent the most concerning aspects of Finq's operations based on available user feedback and operational transparency issues. The broker operates under Seychelles Financial Services Authority regulation, which provides some regulatory oversight but is generally considered less stringent than regulation in major financial centers such as the United Kingdom, United States, or European Union. User testimonials include serious allegations describing the broker as fraudulent, with specific claims about inappropriate account management practices and unauthorized trading recommendations.

Such allegations, if accurate, would represent fundamental violations of proper broker conduct and raise severe questions about the company's operational integrity and client protection practices. Fund security measures and client money protection protocols are not detailed in available sources, representing a significant transparency gap for a financial services provider. Reputable brokers typically provide clear information about segregated client accounts, deposit insurance coverage, and other measures designed to protect client funds from operational risks or potential company financial difficulties.

Corporate transparency regarding company ownership, management structure, financial statements, and operational history appears limited based on available sources. Comprehensive disclosure of corporate information helps clients assess the stability and credibility of their chosen broker, and limited transparency in these areas can be a warning sign for potential clients. Industry reputation has been significantly impacted by negative user feedback and allegations of improper business practices.

The forex industry has established standards for ethical conduct and client protection, and brokers that fail to meet these standards often face regulatory action and industry censure. Negative event handling and dispute resolution processes are not documented in available sources, making it unclear how the broker addresses client complaints or resolves conflicts that may arise. Effective dispute resolution mechanisms are important indicators of a broker's commitment to fair dealing and client protection.

User Experience Analysis

Overall user satisfaction appears significantly compromised based on available feedback, with predominantly negative testimonials raising serious concerns about the broker's service delivery and operational practices. The limited availability of positive user reviews suggests either a small satisfied client base or systematic issues that affect a large proportion of clients. Interface design and platform usability benefit from the MetaTrader 4 foundation, which provides a familiar and functional trading environment for most forex traders.

However, the overall user experience encompasses much more than platform interface design, including account management, customer service quality, and operational reliability. Registration and account verification processes are not detailed in available sources, making it difficult to assess the convenience and efficiency of getting started with the broker. Streamlined onboarding processes that balance security requirements with user convenience are important factors in overall user experience evaluation.

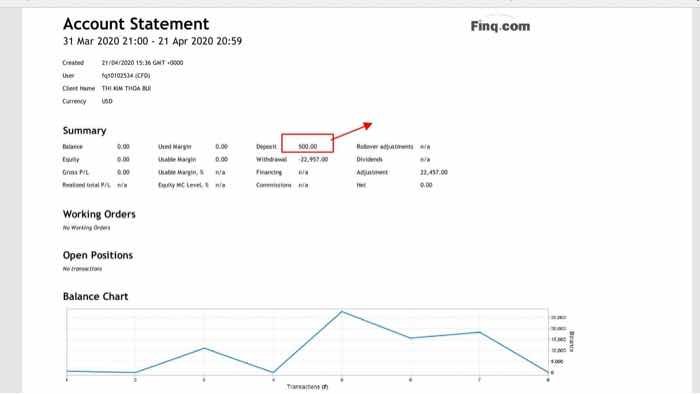

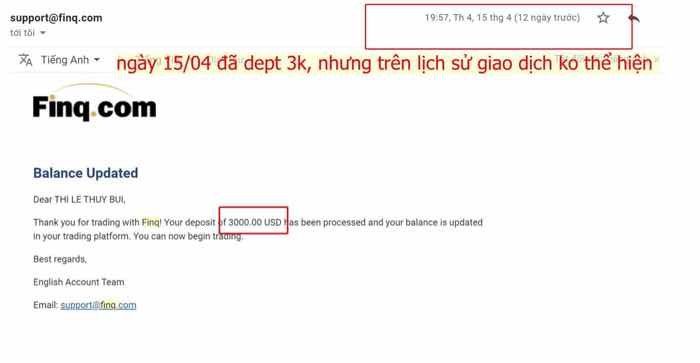

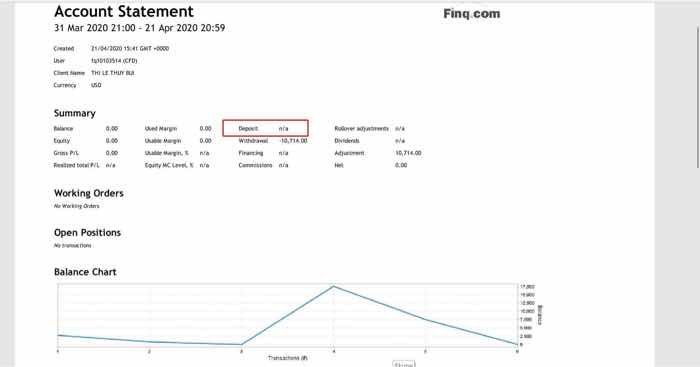

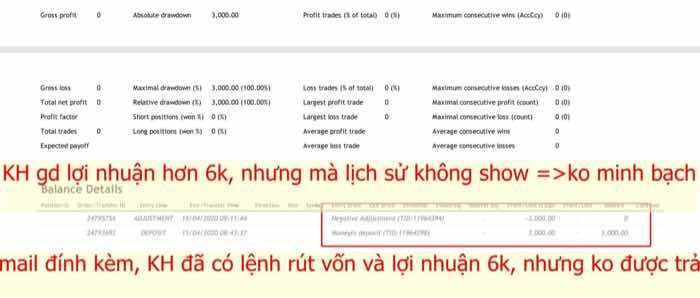

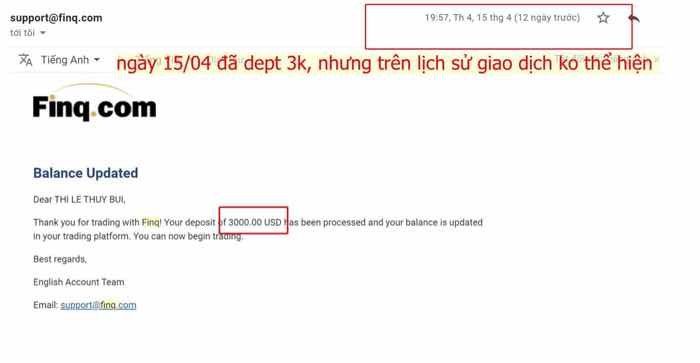

Fund operation experiences, including deposit and withdrawal processes, are not comprehensively documented in available sources. However, user feedback suggests significant concerns about the broker's overall handling of client relationships, which could extend to financial transaction processes and account funding operations. Common user complaints center around allegations of fraudulent practices, inappropriate account management, and unauthorized trading advice.

These concerns go beyond typical service quality issues and suggest fundamental problems with the broker's approach to client relationships and business conduct. The target user profile appears to focus on traders seeking high leverage opportunities and access to diverse asset classes. However, the serious concerns raised by existing users suggest that even traders who fit this profile may encounter significant difficulties with the broker's service delivery and operational practices.

Potential improvements based on user feedback would need to address fundamental operational and ethical concerns rather than minor service enhancements. This suggests that the broker faces substantial challenges in rebuilding user confidence and satisfaction levels.

Conclusion

This comprehensive finq review reveals a broker that presents significant red flags despite offering some potentially attractive features such as high leverage trading and access to over 2,100 financial instruments. While the MetaTrader 4 platform provides a solid technical foundation and the extensive asset catalog offers diversification opportunities, these advantages are overshadowed by serious concerns about operational integrity and client protection. The broker may appeal to traders with high risk tolerance who prioritize leverage and asset diversity over regulatory protection and operational transparency.

However, the predominant negative user feedback, allegations of fraudulent practices, and limited operational transparency suggest that most traders would be better served by choosing more established and transparently operated alternatives in the competitive forex broker market. The main advantages include high leverage options and comprehensive asset access, while significant disadvantages encompass trust and reliability concerns, poor customer service feedback, and limited operational transparency. This makes it difficult for potential clients to make fully informed decisions about the broker's suitability for their trading needs.