FXCess 2025 Review: Everything You Need to Know

Executive Summary

FXCess is a new forex broker that started in 2020. It offers good trading conditions and many different financial products. As a new company in the forex market, this fxcess review gives traders complete information about what the broker offers and what it can do.

The broker stands out by giving access to over 300 assets you can trade across many markets. These include forex, metals, indices, commodities, futures, and stocks. FXCess supports different trading platforms, mainly MetaTrader 4 and their own FXCess App, which helps traders with different preferences and strategies.

Data from Trustpilot shows that FXCess has a 4.5 user rating based on 161 reviews. An impressive 94% of users recommend the broker. This shows users generally have a good experience, though traders should think about many factors before choosing any broker.

FXCess mainly targets traders who want access to different markets and good customer support. The broker offers 24/5 support in multiple languages, making it easy for traders from different regions to use. However, potential clients should know that specific account details like spreads, fees, and minimum deposits are not clearly shown in available materials, which may create uncertainty for new traders.

Important Notice

FXCess operates under different rules across various regions. The company is registered in Bermuda and regulated by authorities in Seychelles and the British Virgin Islands. Traders should carefully think about the specific legal requirements and protection measures that apply to their area before opening an account.

This review uses available user feedback, regulatory information, and market analysis to give an objective assessment of FXCess's services. The evaluation method considers multiple factors including trading conditions, platform functionality, customer service quality, and overall user experience to deliver a complete analysis for potential clients.

Rating Framework

Broker Overview

FXCess started in the forex trading world in 2020 as a financial services provider. It focuses on giving good trading conditions to retail and institutional clients. The company operates under the trade name of Notesco Limited and positions itself as a complete financial broker that provides trading platform access and financial market connectivity for forex traders worldwide.

As a new company in the highly competitive forex brokerage industry, FXCess has built its business around giving traders extensive market access and easy-to-use trading environments. The broker emphasizes its commitment to offering diverse trading opportunities while maintaining competitive service standards that appeal to both new and experienced traders.

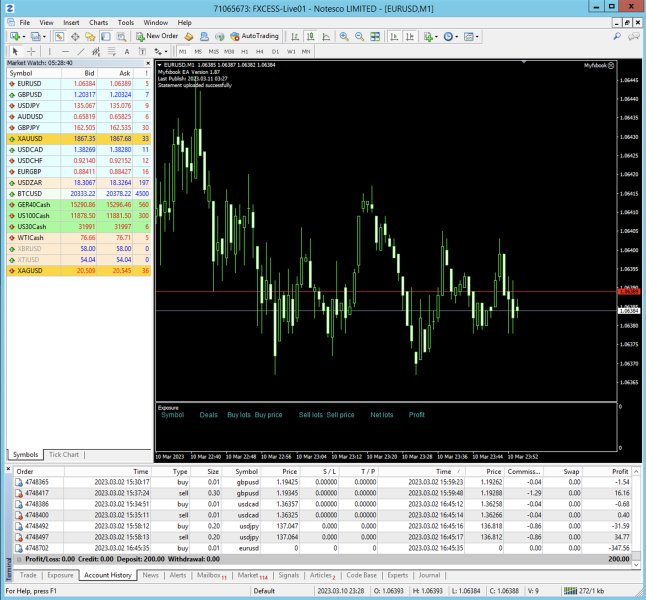

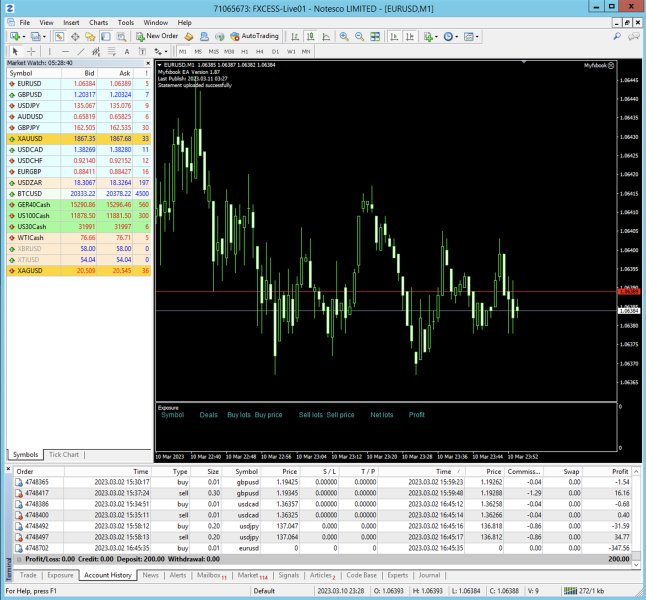

The broker's platform setup centers around two main trading solutions: the industry-standard MetaTrader 4 platform and their own FXCess App. This dual-platform approach allows the company to serve different trading preferences, from traditional desktop trading to modern mobile-first approaches. FXCess offers access to multiple asset classes including foreign exchange pairs, precious metals, stock indices, energy commodities, futures contracts, and individual stocks, totaling over 300 tradeable instruments.

Regulatory oversight for FXCess comes from authorities in Seychelles and the British Virgin Islands, with the company's main registration in Bermuda. This regulatory structure gives the broker operational flexibility while maintaining compliance with international financial standards, though traders should understand the specific protections available under these jurisdictions.

Regulatory Jurisdiction: FXCess operates under registration in Bermuda with regulatory oversight from Seychelles and British Virgin Islands authorities. The multi-jurisdictional regulatory approach provides operational flexibility while maintaining compliance standards, though specific regulatory license numbers are not clearly shown in available materials.

Deposit and Withdrawal Methods: Information about specific funding methods, processing times, and fees is not detailed in available sources. This lack of transparency may concern traders who want to clearly understand transaction processes before opening an account.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not shown in available materials. This makes it difficult for potential clients to plan their initial investment requirements.

Bonus Promotions: Available information does not detail any specific promotional offers, welcome bonuses, or ongoing incentive programs that might be available to new or existing clients.

Tradeable Assets: FXCess provides access to over 300 financial instruments across six major asset categories: foreign exchange currency pairs, precious metals (gold, silver), stock market indices, energy commodities, futures contracts, and individual company stocks. This complete selection allows for portfolio diversification and multiple trading strategies.

Cost Structure: Detailed information about spreads, commission structures, overnight financing charges, and other trading costs is not readily available in current materials. This transparency gap may make it challenging for traders to accurately assess total trading costs.

Leverage Ratios: Specific leverage offerings for different asset classes and account types are not detailed in available documentation. This is concerning given leverage's significant impact on trading risk and capital requirements.

Platform Options: The broker supports MetaTrader 4, the industry-standard trading platform known for its analytical tools and automated trading capabilities, alongside their own FXCess App designed for mobile trading convenience and modern user interface preferences.

Geographic Restrictions: Information about countries or regions where FXCess services may be restricted is not specified in available materials.

Customer Support Languages: The broker provides 24/5 multilingual customer support, though specific languages supported are not detailed in current documentation.

This fxcess review highlights several areas where additional transparency would benefit potential clients in making informed decisions about their broker selection.

Detailed Rating Analysis

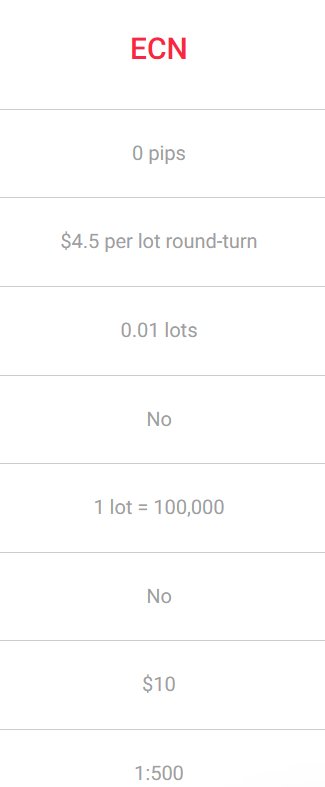

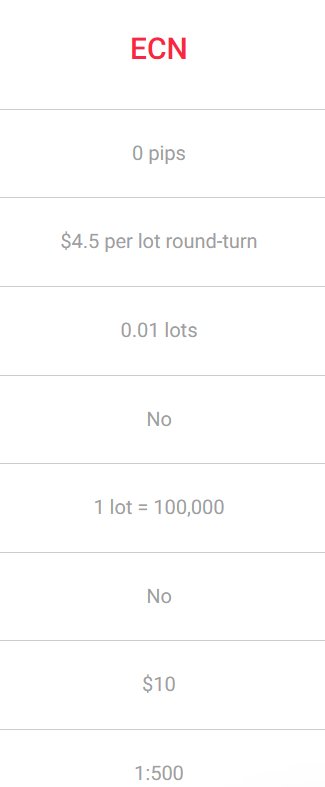

Account Conditions Analysis (5/10)

FXCess's account conditions present a significant transparency challenge that impacts the overall evaluation in this fxcess review. The broker does not provide clear information about basic account features that traders typically need for decision-making. Essential details such as minimum deposit requirements, account type variations, and specific features for different trader categories remain undisclosed in publicly available materials.

The absence of clear information about account opening procedures, verification requirements, and documentation needed creates uncertainty for potential clients. While the broker appears to serve both retail and institutional clients based on available information, the specific differences between account tiers, if any exist, are not clearly communicated.

Account management features, including any special account types such as Islamic accounts for traders requiring swap-free trading, are not mentioned in available sources. This lack of detailed account information makes it difficult for traders to understand what specific conditions and benefits they might expect when opening an account with FXCess.

The broker's approach to account conditions appears to follow a consultation-based model where specific terms may be discussed during the account opening process. However, this lack of upfront transparency may discourage traders who prefer clear, published terms before engaging with a broker.

FXCess shows strong performance in the tools and resources category by offering access to over 300 tradeable assets across multiple market categories. The broker provides exposure to foreign exchange markets, precious metals trading, global stock indices, energy commodities, futures contracts, and individual equity securities, creating complete opportunities for portfolio diversification.

The platform selection includes MetaTrader 4, which brings strong analytical capabilities, automated trading support through Expert Advisors, and extensive charting tools that professional traders rely on for market analysis. The inclusion of their own FXCess App suggests the broker is adapting to modern trading preferences with mobile-optimized solutions.

However, available information does not detail specific research resources, market analysis tools, economic calendars, or educational materials that might be provided to clients. The absence of information about analytical resources, trading signals, or market commentary services represents a gap in understanding the full scope of tools available to traders.

The broker's asset coverage spans major global markets, potentially providing opportunities for various trading strategies from scalping to long-term position trading. The diversity of available instruments suggests FXCess aims to serve traders with different market focuses and risk preferences.

Customer Service and Support Analysis (7/10)

FXCess offers 24/5 customer support with multilingual capabilities. This shows a commitment to serving an international client base. The availability of support during major trading sessions suggests the broker understands the global nature of forex markets and the need for accessible assistance during active trading periods.

The multilingual support feature is particularly valuable for traders who prefer communication in their native language, though specific languages supported are not detailed in available materials. This international approach aligns with the broker's global market focus and diverse asset offerings.

However, critical details about customer service quality remain unclear. Information about specific contact methods (phone, email, live chat), typical response times, and the technical expertise level of support staff is not available in current sources. The absence of user testimonials specifically addressing customer service experiences makes it difficult to assess the actual quality of support provided.

The 24/5 availability covers most trading days but excludes weekend periods when some markets may still be active or when traders might need account assistance. The overall customer service framework appears adequate for standard trading support needs, but the lack of detailed service level information prevents a higher rating.

Trading Experience Analysis (6/10)

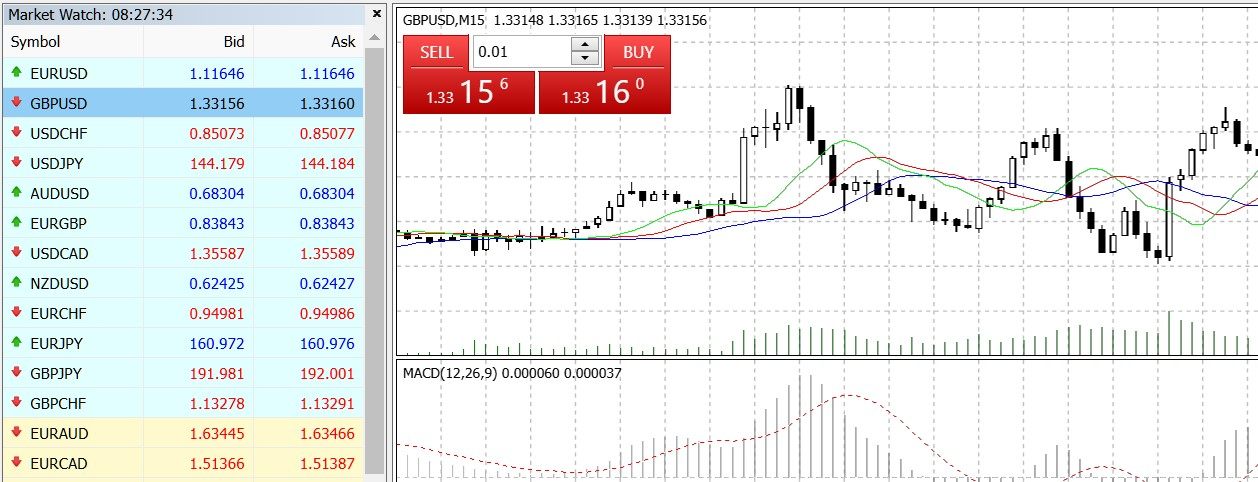

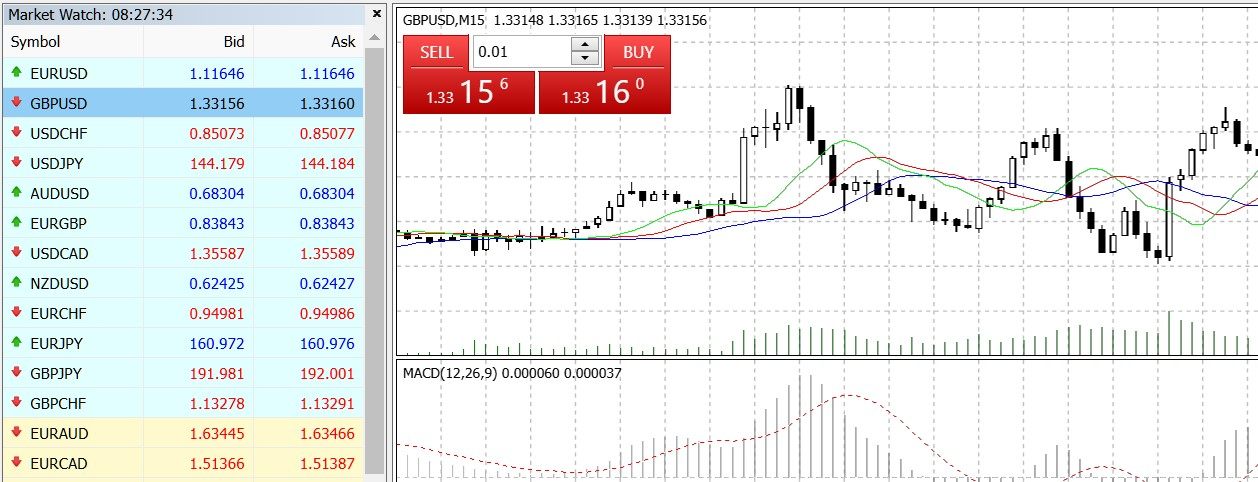

The trading experience evaluation for FXCess centers around the broker's platform offerings and execution environment. Supporting MetaTrader 4 provides traders with a familiar, industry-standard platform known for reliable performance and complete functionality. MT4's proven track record in the forex industry suggests traders can expect standard professional trading tools and analytical capabilities.

The addition of the own FXCess App shows the broker's effort to modernize the trading experience and cater to mobile-first traders. However, specific details about the app's functionality, unique features, or user interface advantages compared to standard MT4 mobile applications are not available in current materials.

Critical trading environment factors such as execution speed, slippage rates, requote frequency, and server uptime statistics are not disclosed. These technical performance metrics significantly impact actual trading results, and their absence makes it difficult to assess the real-world trading experience traders might expect.

The broker's approach to order execution, whether using dealing desk or no dealing desk models, is not clearly specified. This information gap affects traders' understanding of potential conflicts of interest and execution quality expectations. Without detailed user feedback about actual trading experiences, platform stability, and execution quality, the overall trading experience assessment remains limited.

This fxcess review notes that while the platform foundation appears solid with MT4 support, the lack of detailed performance data and user experience feedback limits the evaluation.

Trust and Security Analysis (6/10)

FXCess operates under a regulatory framework that includes oversight from Seychelles and British Virgin Islands authorities, with main registration in Bermuda. While these jurisdictions provide legitimate regulatory oversight, they are generally considered to offer less complete investor protection compared to top-tier regulatory bodies like the FCA, ASIC, or CySEC.

The broker's regulatory status provides basic operational legitimacy, but specific license numbers, regulatory compliance details, and investor protection measures are not clearly shown. This transparency gap makes it difficult for potential clients to verify regulatory standing and understand available protections.

Information about client fund segregation, deposit insurance coverage, or compensation schemes is not available in current materials. These security measures are crucial considerations for traders when evaluating broker trustworthiness, and their absence from readily available information raises questions about the broker's commitment to transparency.

The company's recent establishment in 2020 means it has a limited operational history for assessing long-term stability and regulatory compliance. While newer brokers can offer innovative services, they lack the proven track record that some traders prefer when selecting financial service providers.

Third-party trust indicators beyond user reviews are not extensively documented, and the absence of industry awards, certifications, or recognition from established financial publications limits the available trust validation sources.

User Experience Analysis (8/10)

FXCess shows strong user satisfaction metrics with a 4.5-star rating based on 161 Trustpilot reviews and a remarkable 94% user recommendation rate. These statistics suggest that clients who have used the broker's services generally report positive experiences, indicating effective service delivery in practice.

The high recommendation percentage particularly stands out as a strong indicator of user satisfaction, as it reflects clients' willingness to endorse the broker to other traders. This metric often correlates with reliable service quality, fair trading conditions, and adequate customer support responsiveness.

However, the relatively small sample size of 161 reviews for a broker operating since 2020 suggests either limited client base growth or low review participation rates. While the quality of feedback appears positive, the quantity of reviews is modest compared to more established brokers with thousands of user evaluations.

Specific details about user interface design, account management convenience, platform usability, and overall client experience journey are not extensively documented in available materials. The absence of detailed user journey analysis makes it difficult to understand specific strengths and weaknesses in the service delivery process.

The strong satisfaction metrics provide confidence in the broker's ability to meet client expectations, though potential users should consider the limited scope of available feedback when making their evaluation decisions.

Conclusion

FXCess presents itself as a competent emerging forex broker with notable strengths in asset diversity and user satisfaction. However, significant transparency gaps limit a more complete evaluation. The broker's offering of over 300 tradeable instruments across multiple asset classes provides valuable diversification opportunities for traders seeking broad market exposure.

The strong user satisfaction metrics, with 94% of clients recommending the service, suggest that FXCess delivers on its promises to existing clients. However, the lack of detailed information about trading conditions, costs, and regulatory specifics creates uncertainty for potential clients who prefer transparent, upfront disclosure of terms.

FXCess appears most suitable for traders who prioritize diverse asset access and are comfortable engaging directly with the broker to understand specific account conditions. The broker may appeal to clients who value responsive customer service and modern platform options, though traders requiring extensive educational resources or detailed cost transparency might find the offering incomplete.

The main advantages include complete asset selection, positive user feedback, and multilingual support, while the primary disadvantages center on limited transparency regarding trading costs, account conditions, and regulatory details. Potential clients should conduct thorough due diligence and direct consultation with the broker before making account opening decisions.