FXPrimus 2025 Review: Everything You Need to Know

Executive Summary

This detailed fxprimus review looks at a broker that has caught attention in the forex trading world. However, this attention is not always positive. Based on user feedback and market research, FXPrimus shows a mixed picture for traders who might want to use their services.

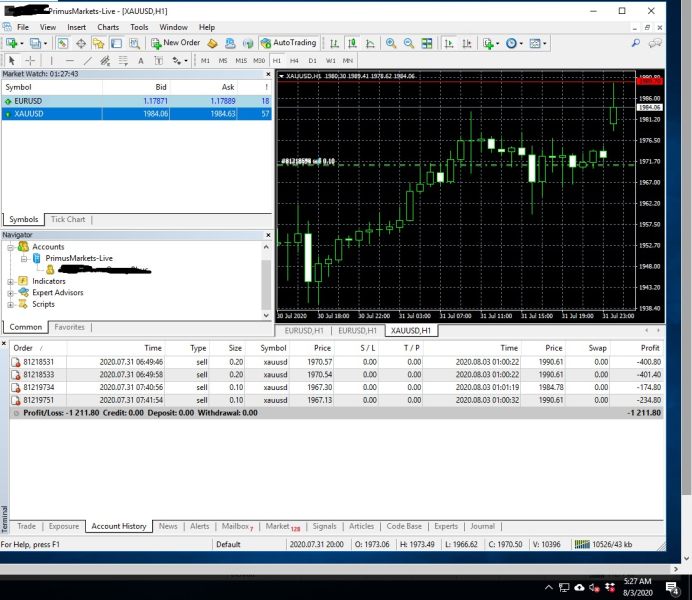

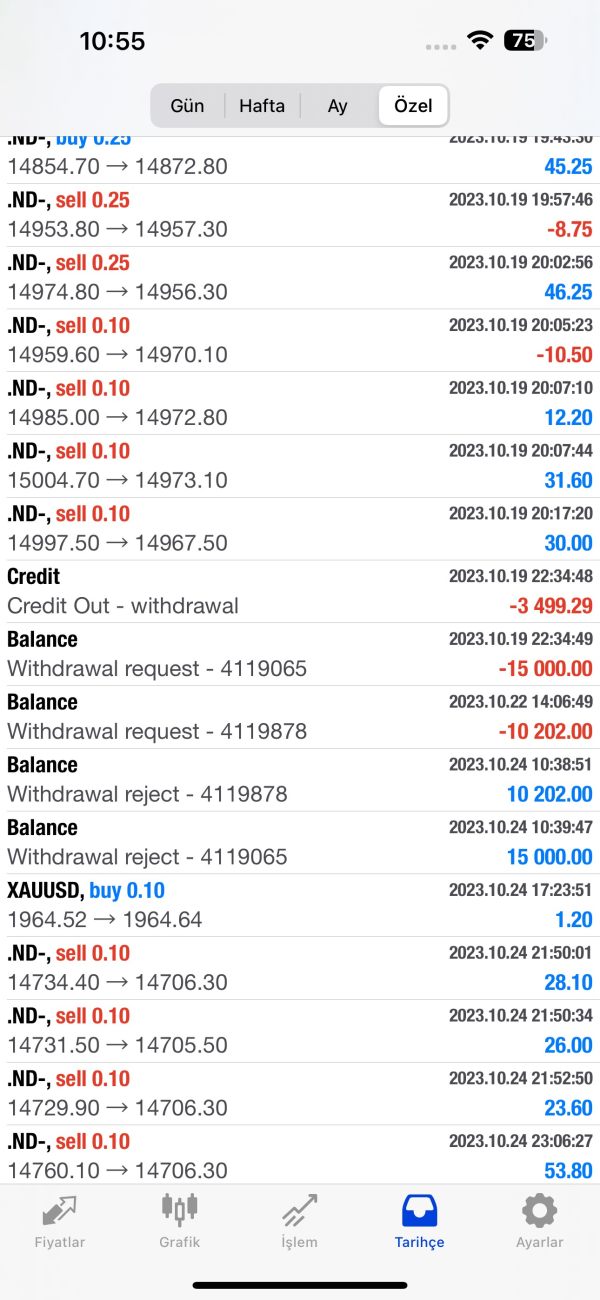

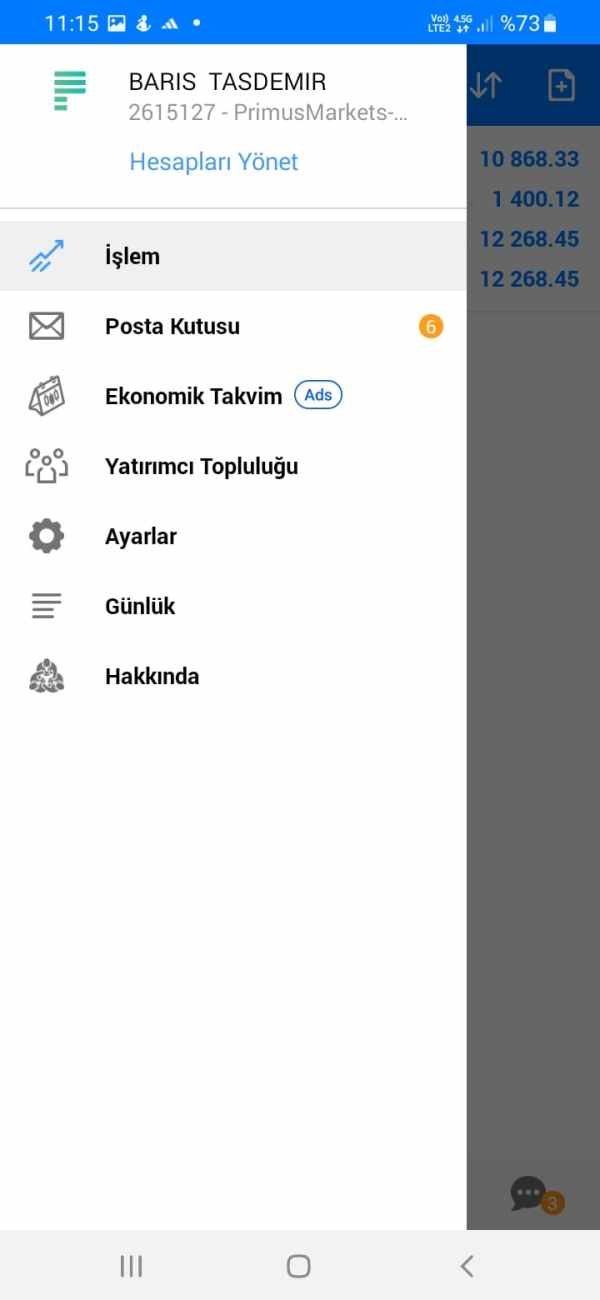

The platform gives traders access to multiple trading systems including MT4, MT5, and WebTrader. It also offers different account types for various trading styles and skill levels. FXPrimus says it provides complete trading solutions with access to forex markets, CFDs, and other financial tools.

The broker claims its range of accounts, support services, and trading resources help traders "invest smartly and safely." But industry reports and user feedback show the reality might be more complicated than their marketing suggests. The platform mainly serves traders who want different platform choices and multiple account options.

FXPrimus tries to attract both new and experienced traders through its varied services. However, potential users should carefully check all available information before making trading decisions. As with any financial service company, traders should do thorough research and think about multiple factors when picking a broker.

Important Notice

Regional Entity Variations: FXPrimus may work through different legal companies across various countries, which could mean different services, rules, and client protections depending on where you live. The specific rules governing your account may change based on your country of residence.

Review Methodology: This analysis uses publicly available information, industry reports, and user feedback from various sources. Due to limited detailed regulatory and operational information in available materials, some parts of this review may need additional checking through direct contact with the broker.

Rating Framework

Ratings based on available information and industry standards

Broker Overview

FXPrimus works as a multi-platform forex and CFD broker, offering trading services through well-known platforms including MetaTrader 4, MetaTrader 5, and WebTrader technologies. The company says it provides complete trading solutions, focusing on its range of account options and support systems designed to help traders across different experience levels.

According to available information, FXPrimus gives access to various financial tools including foreign exchange pairs, contracts for difference, and other derivative products. The broker's website shows a focus on providing "smart and safe" investment opportunities, though specific details about when the company started, who founded it, and its corporate history are not easily found in current materials.

The platform's business approach seems centered on providing multi-platform access to global financial markets, with special focus on forex trading. FXPrimus offers promotional programs and partnership opportunities, suggesting a growth-focused approach to getting and keeping clients. However, this fxprimus review notes that complete regulatory and operational details need further investigation for full assessment.

Regulatory Status: Specific regulatory information and licensing details are not clearly shown in available materials, which may present concerns for potential traders regarding oversight and client protection systems.

Deposit and Withdrawal Methods: Detailed information about funding options, processing times, and related fees is not specified in current available resources.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not detailed in accessible materials.

Bonus and Promotions: While the broker mentions promotional offerings, specific bonus structures, terms, and conditions are not explained in available information.

Tradeable Assets: FXPrimus provides access to forex markets and CFD instruments, though the complete range of available assets and markets is not fully detailed in current materials.

Cost Structure: Specific information regarding spreads, commissions, overnight fees, and other trading costs is not clearly shown in available resources, requiring direct inquiry for accurate details.

Leverage Ratios: Maximum leverage offerings and their variations across different account types and asset classes are not specified in accessible materials.

Platform Options: The broker offers MT4, MT5, and WebTrader platforms, providing traders with multiple technology solutions for market access and trade execution.

Geographic Restrictions: Specific information about regional limitations and restricted territories is not detailed in current available materials.

Customer Support Languages: Available support languages and communication channels are not fully outlined in accessible resources.

This fxprimus review highlights the need for potential traders to seek additional detailed information directly from the broker regarding these operational aspects.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

FXPrimus offers multiple account setups designed to fit different trading styles and capital requirements, though specific details about account levels, their features, and qualification rules are not fully detailed in available materials. The broker's approach to account structure appears to follow industry standards with various options for different trader groups.

The lack of clearly published minimum deposit requirements, account-specific benefits, and detailed fee structures in readily available information creates challenges for potential traders seeking to evaluate account conditions effectively. While the broker mentions providing "a range of accounts," the specific differences between account types, their advantages, and eligibility requirements need direct inquiry.

Account opening procedures, verification requirements, and approval timeframes are not detailed in current materials, which may impact trader decision-making processes. The availability of specialized account features such as Islamic accounts, managed accounts, or institutional offerings is not clearly addressed in accessible information.

The scoring reflects the limited transparency regarding account conditions in publicly available materials, though the broker's multi-tier approach suggests standard industry practices. Potential traders should seek complete account information directly from FXPrimus to make informed decisions. This fxprimus review recommends thorough research regarding account terms and conditions.

FXPrimus shows strength in platform diversity by offering three established trading environments: MetaTrader 4, MetaTrader 5, and WebTrader. This multi-platform approach gives traders flexibility in choosing their preferred trading interface, from the widely-used MT4 to the more advanced MT5 platform, along with browser-based WebTrader access for convenience.

The availability of multiple platforms suggests that FXPrimus serves different trader preferences and technical requirements. MT4 remains popular for its stability and extensive third-party support, while MT5 offers enhanced features for advanced traders. WebTrader provides accessibility without software installation requirements, supporting traders who need flexibility across different devices and locations.

However, detailed information about additional analytical tools, market research resources, educational materials, and trading aids is not fully available in current materials. The absence of clearly outlined research services, market analysis, economic calendars, and educational content in accessible information limits the assessment of the broker's complete resource offering.

Automated trading support, expert advisor capabilities, and algorithmic trading features, while likely available through the MT4/MT5 platforms, are not specifically highlighted or detailed in available materials. The scoring reflects the positive aspect of platform diversity while acknowledging the limited information about complete trading resources and educational support.

Customer Service Analysis (Score: 4/10)

Customer service evaluation for FXPrimus is limited by the absence of detailed information about support channels, availability hours, response times, and service quality measures in readily available materials. The broker's website indicates support services, but specific details about communication methods, multilingual support, and service standards are not fully outlined.

Industry standards typically include multiple contact channels such as live chat, email support, telephone assistance, and potentially social media engagement. However, FXPrimus's specific support infrastructure, including available languages, regional support teams, and specialized assistance for different account types, is not clearly detailed in current accessible information.

Response time expectations, escalation procedures, and service level agreements are not specified in available materials, making it difficult to assess the broker's commitment to customer service excellence. The absence of published customer service policies, complaint resolution procedures, and satisfaction measures in accessible resources presents challenges for evaluation.

Without specific user feedback data or detailed service information in available materials, this assessment relies on the limited information accessible through standard research channels. The scoring reflects the uncertainty surrounding service quality and the need for potential clients to directly evaluate customer support responsiveness and effectiveness before committing to the platform.

Trading Experience Analysis (Score: 5/10)

The trading experience assessment for FXPrimus centers primarily on the platform offerings, which include the established MT4, MT5, and WebTrader environments. These platforms provide basic trading functionality, order management capabilities, and market access, forming the foundation of the trading experience for users across different skill levels.

Platform stability, execution speed, and order processing quality are critical factors that are not specifically detailed in available materials. While the use of established platforms like MT4 and MT5 suggests standard functionality, specific performance measures, uptime statistics, and execution quality data are not readily available for assessment.

Mobile trading capabilities, which are increasingly important for modern traders, are not explicitly detailed in current materials, though MT4 and MT5 typically include mobile applications. The absence of specific information about mobile app features, cross-platform synchronization, and mobile-specific functionality limits the complete evaluation of the trading experience.

Advanced trading features such as one-click trading, advanced order types, risk management tools, and customization options are not specifically highlighted in available information. The trading environment's sophistication, user interface quality, and overall user experience require direct evaluation by potential traders.

This fxprimus review scores the trading experience based on platform availability while acknowledging the need for hands-on evaluation to fully assess execution quality, platform performance, and overall trading satisfaction.

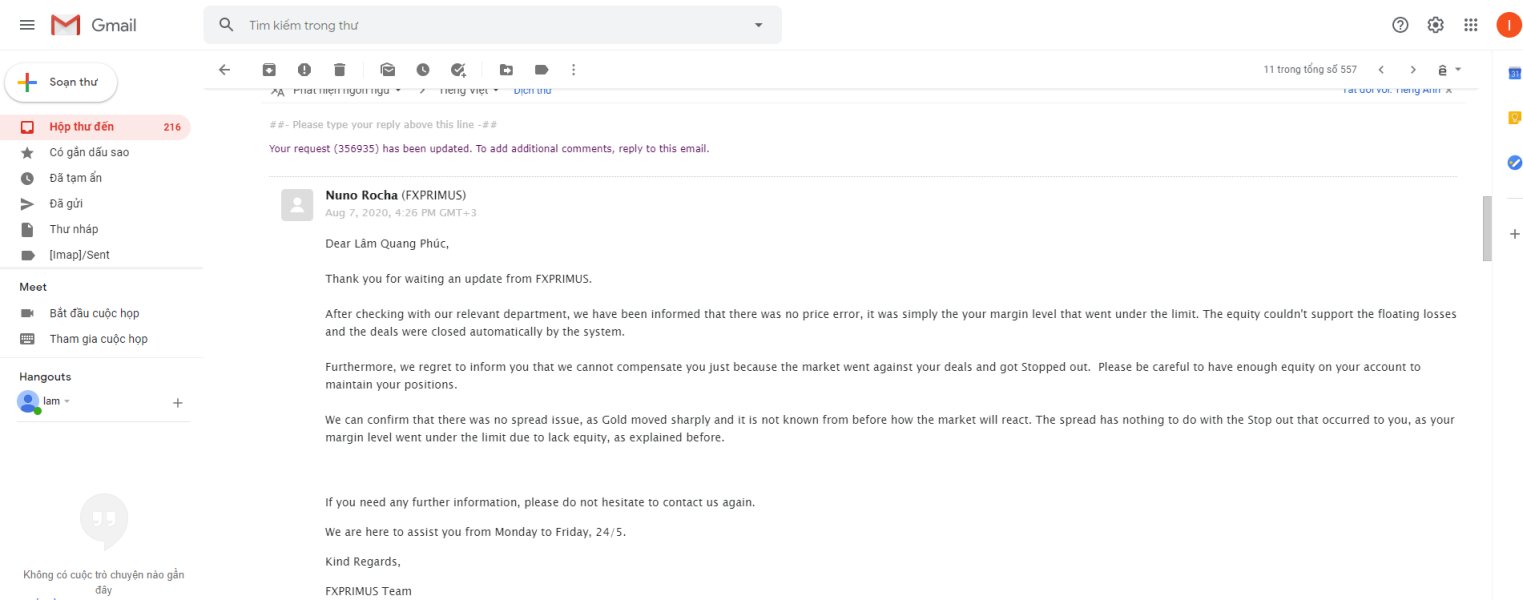

Trust and Security Analysis (Score: 4/10)

Trust and security assessment for FXPrimus faces significant limitations due to the absence of clearly detailed regulatory information, licensing specifics, and client protection measures in readily available materials. Regulatory oversight represents a fundamental aspect of broker trustworthiness, and the lack of complete regulatory details in accessible information presents concerns for potential traders.

Client fund protection mechanisms, such as segregated accounts, deposit insurance, or compensation schemes, are not specifically outlined in current materials. These protections typically vary by jurisdiction and regulatory framework, making the absence of clear regulatory information particularly significant for trust evaluation.

Company transparency regarding ownership, management, financial stability, and operational history is not fully available in accessible resources. Corporate governance information, audited financial statements, and regulatory compliance records, which contribute to trustworthiness assessment, are not readily available for review.

Third-party certifications, industry memberships, and external validations that might support credibility are not prominently featured in available materials. The absence of clear information about dispute resolution mechanisms, regulatory complaints procedures, and client protection frameworks further impacts the trust assessment.

The scoring reflects the significant information gaps regarding regulatory status, client protections, and transparency measures that are typically expected from established financial service providers in the forex industry.

User Experience Analysis (Score: 5/10)

User experience evaluation for FXPrimus is primarily based on the platform accessibility and account variety mentioned in available materials, though complete user feedback and detailed usability information are not readily available for thorough assessment. The multi-platform approach suggests consideration for different user preferences and technical requirements.

Website navigation, account registration processes, verification procedures, and overall digital experience quality are not specifically detailed in current materials. The user journey from initial interest through account opening, funding, and active trading requires direct evaluation to assess effectiveness and user-friendliness.

Interface design quality, information accessibility, educational resource presentation, and overall digital experience are not fully outlined in available information. Modern traders expect intuitive navigation, clear information presentation, and streamlined processes throughout their interaction with broker services.

Account management features, reporting capabilities, transaction history access, and administrative functionality are not specifically detailed in current materials. The quality of back-office systems, statement generation, tax reporting assistance, and account maintenance tools impacts overall user satisfaction.

Mobile responsiveness, cross-device compatibility, and modern web standards compliance are not specifically addressed in available information, though these factors increasingly influence user experience quality. The scoring reflects the limited available information about complete user experience while acknowledging the need for direct user evaluation.

Conclusion

This fxprimus review reveals a broker with mixed characteristics that potential traders should carefully evaluate. FXPrimus offers multiple trading platforms including MT4, MT5, and WebTrader, providing technology diversity that can accommodate different trader preferences and requirements. The broker's emphasis on multiple account types suggests an attempt to serve various trader segments.

However, significant information gaps regarding regulatory status, detailed operational procedures, cost structures, and client protections present concerns that require additional investigation. The absence of complete regulatory details, specific fee information, and detailed service descriptions in readily available materials makes thorough evaluation challenging.

FXPrimus may be suitable for traders who prioritize platform variety and are comfortable conducting extensive research to fill information gaps. However, traders seeking transparent, well-documented broker relationships with clear regulatory oversight might find the available information insufficient for confident decision-making.

Potential users should directly contact FXPrimus to obtain detailed information about regulatory status, account conditions, fee structures, and service terms before making trading decisions. The broker's actual performance, service quality, and trustworthiness require hands-on evaluation beyond what publicly available materials currently provide.