didimax 2025 Review: Everything You Need to Know

Executive Summary

didimax stands out as a noteworthy forex broker. The company has gained recognition mainly for its educational resources and regulatory compliance. According to available reports, this Indonesian-based brokerage company has made its mark in the competitive forex market through its commitment to trader education and comprehensive customer support services.

Key highlights include 24-hour customer support and prestigious recognition as "Indonesia's Best Forex Education Broker" in 2018. This shows the company's dedication to trader development. The broker operates under regulatory oversight from BAPPEBTI (Indonesian Commodity Futures Trading Regulatory Agency) and JFX (Indonesia Futures Exchange). This provides a foundation of regulatory compliance for its operations.

The platform mainly targets intermediate to advanced forex traders. It especially focuses on those seeking educational support and guidance to enhance their trading capabilities. With a minimum deposit requirement of $10,000, didimax positions itself in the higher-tier segment of the market. The broker caters to traders with substantial capital and serious trading intentions.

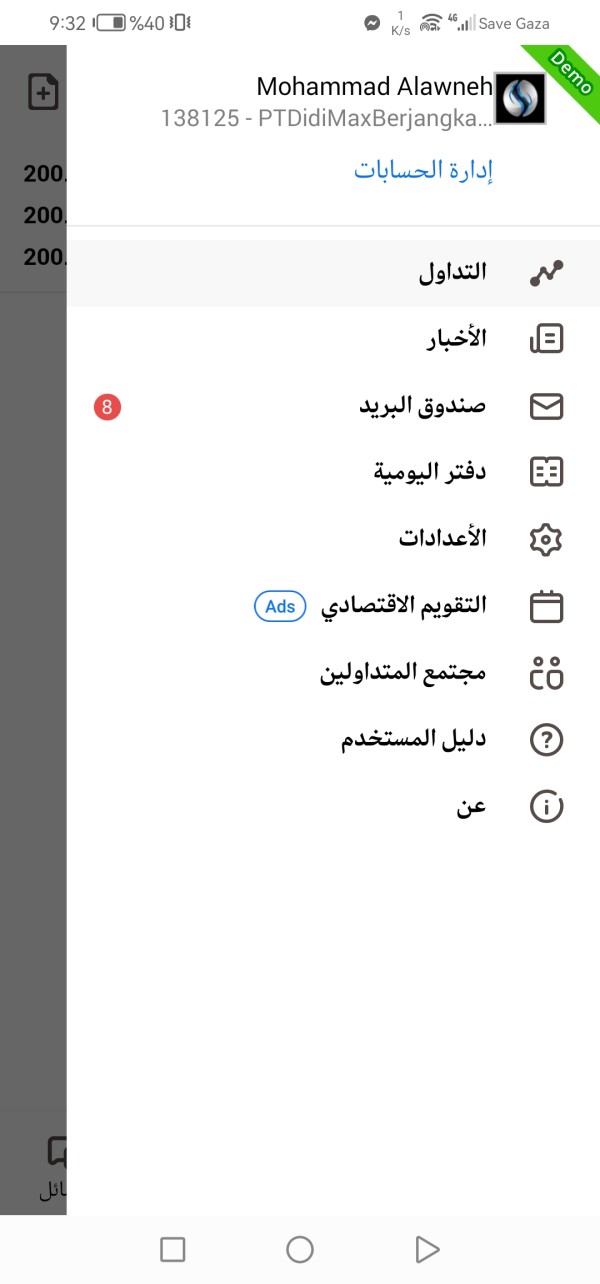

Founded in 1999, PT Didi Max Berjangka has established itself as a futures brokerage company specializing in forex and commodity trading. The company reportedly achieved the largest transaction volume in Indonesia. The broker offers access to MetaTrader 5 platform and provides trading opportunities across forex, commodities, and metals markets. This comprehensive didimax review aims to provide traders with detailed insights into the broker's offerings and performance.

Important Notice

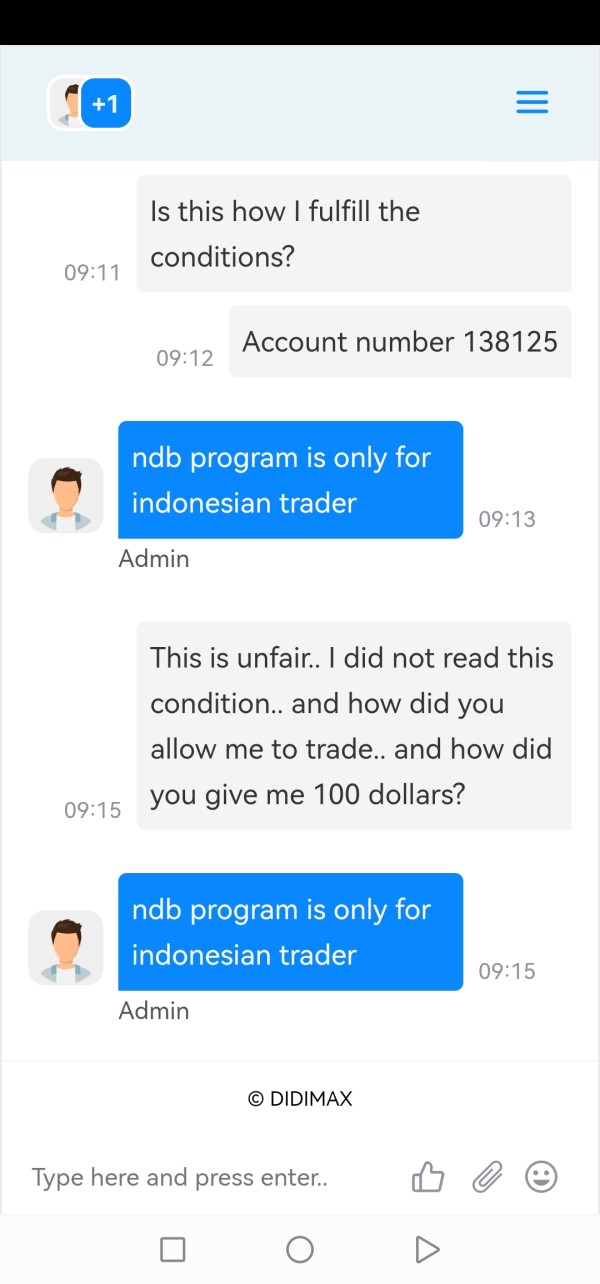

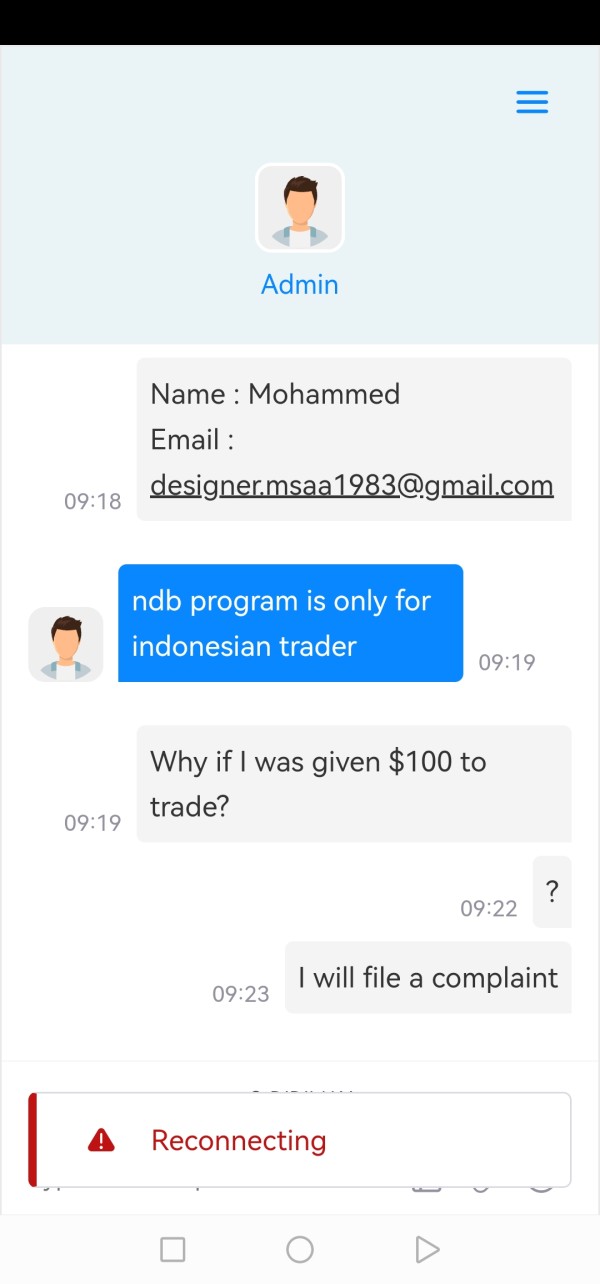

Regional Entity Differences: didimax primarily operates within Indonesia. Potential users should be aware that different regional regulations and market conditions may significantly impact the trading experience. The services, features, and regulatory protections available may vary depending on the trader's location and local financial regulations.

Review Methodology: This evaluation is based on available information from various sources and user feedback collected from multiple platforms. The assessment results may change due to market developments, regulatory updates, or modifications in the broker's service offerings. Traders are advised to verify current information directly with the broker before making investment decisions.

Rating Framework

Broker Overview

Company Background and History

Established in 1999, PT Didi Max Berjangka, commonly abbreviated as DIDIMAX, represents one of Indonesia's established futures brokerage companies. The company has built its reputation over more than two decades. It focuses specifically on facilitating forex and commodity trading for Indonesian investors. According to company information, didimax has achieved recognition for handling the largest transaction volume in Indonesia's futures trading sector. This indicates significant market presence and client trust within the domestic market.

The broker's business model centers on providing comprehensive trading platforms combined with extensive educational resources. This demonstrates a commitment to enhancing traders' knowledge and capabilities. This educational focus has become a distinguishing characteristic that sets didimax apart from many competitors in the regional market.

Trading Infrastructure and Asset Coverage

didimax operates primarily through the MetaTrader 5 platform. This offers traders access to professional-grade trading tools and analytical capabilities. The broker's asset coverage includes forex pairs, commodities, and precious metals. This provides diversification opportunities for traders seeking exposure across multiple market segments. Under the regulatory framework of BAPPEBTI and JFX, the company maintains compliance with Indonesian financial regulations. This ensures operational legitimacy within its primary market jurisdiction.

The regulatory oversight by these Indonesian authorities provides a foundation of trust and compliance. However, traders from other jurisdictions should verify the applicability of these protections to their specific circumstances. This didimax review emphasizes the importance of understanding the regulatory environment when evaluating broker selection criteria.

Regulatory Status and Jurisdictions

didimax operates under the supervision of BAPPEBTI (Indonesian Commodity Futures Trading Regulatory Agency) and JFX (Indonesia Futures Exchange). This ensures compliance with Indonesian financial regulations and trading standards.

Deposit and Withdrawal Methods

Specific information regarding deposit and withdrawal methods was not detailed in available sources. Prospective clients are advised to contact customer service directly to obtain comprehensive information about available funding options and associated processing times.

Minimum Deposit Requirements

The broker maintains a minimum deposit requirement of $10,000. This positions itself in the premium segment of the market and targets intermediate to advanced traders with substantial trading capital.

Bonus and Promotional Offers

Current promotional offers and bonus programs were not specified in available information. Interested traders should monitor the official website or contact customer support for updates on any available promotional campaigns.

Available Trading Assets

The trading portfolio includes forex currency pairs, commodities, and precious metals. This provides traders with diversification opportunities across multiple asset classes and market sectors.

Cost Structure and Fees

The broker implements a transparent fee structure with spreads starting from 1 pip and commission charges of $5 per 0.1 lot. This allows traders to calculate trading costs with clarity and precision.

Leverage Ratios

Maximum leverage is available up to 1:100. This accommodates various risk preferences and trading strategies while maintaining reasonable risk management parameters.

Trading Platform Options

didimax provides access to the MetaTrader 5 platform. This enables traders to execute transactions across multiple asset classes with professional-grade tools and analytical capabilities.

Geographic Restrictions

The broker primarily serves the Indonesian market. Traders from other regions should verify local regulatory compliance and service availability.

Customer Service Languages

Primary customer support is provided in Indonesian. However, specific information about additional language support was not detailed in available sources. This didimax review recommends verifying language support options during the account opening process.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

The account conditions at didimax present a mixed picture that reflects both strengths and limitations. The minimum deposit requirement of $10,000 positions the broker firmly in the premium segment. This may limit accessibility for retail traders but ensures a client base with serious trading intentions and adequate capital reserves. This relatively high entry threshold suggests that didimax focuses on attracting experienced traders rather than beginners exploring the forex market.

While specific information about account types and their distinctive features was not available in the source materials, the standardized approach appears to simplify the selection process for potential clients. The absence of detailed information about Islamic accounts or other specialized account variants may limit appeal for traders with specific religious or trading requirements.

The account opening process details were not comprehensively covered in available sources. This suggests that prospective clients should engage directly with customer service to understand verification requirements, documentation needs, and activation timelines. User feedback indicates varying experiences with the minimum deposit requirement, with some traders expressing concerns about the accessibility barrier this creates.

Compared to industry standards, the $10,000 minimum deposit significantly exceeds most retail-focused brokers, which typically require between $100-$500 for initial accounts. This positioning strategy clearly indicates didimax's focus on the institutional and high-net-worth individual segments rather than mass-market retail trading. This didimax review notes that while this approach may limit the client base, it potentially contributes to a more stable and committed trader community.

The tools and resources offered by didimax center around the MetaTrader 5 platform. This provides a solid foundation for professional trading activities. However, the specific range of trading tools, indicators, and analytical resources available through the platform was not comprehensively detailed in the available source materials. This makes it difficult to assess the full scope of analytical capabilities provided to traders.

Educational resources represent a significant strength for didimax. The broker earned recognition as "Indonesia's Best Forex Education Broker" in 2018. This accolade suggests a substantial commitment to trader development and knowledge enhancement, though specific details about educational content, webinar schedules, tutorials, or market analysis publications were not available in the reviewed materials.

The absence of detailed information about research and analysis resources, market commentary, or economic calendar integration limits the ability to fully evaluate the broker's analytical support offerings. Additionally, information about automated trading support, including Expert Advisors (EAs) or algorithmic trading capabilities, was not specified in available sources.

User feedback regarding educational resources appears generally positive. Traders acknowledge the value of the educational support provided. However, the lack of specific details about the content quality, frequency of updates, or comprehensiveness of educational materials prevents a more detailed assessment. Expert opinions in the industry consistently emphasize the importance of educational resources for trader development, particularly for intermediate traders seeking to advance their skills.

Customer Service and Support Analysis (Score: 8/10)

Customer service represents one of didimax's strongest performance areas. The provision of 24-hour customer support is a significant advantage for traders operating across different time zones or engaging in round-the-clock trading activities. This comprehensive availability demonstrates the broker's commitment to client service and support accessibility.

Multiple communication channels appear to be available, including telephone, email, and online chat options. This provides traders with flexibility in choosing their preferred contact method. User feedback indicates relatively quick response times, which is crucial for addressing urgent trading-related issues or technical problems that may arise during active market hours.

The quality of customer service receives positive recognition from users. Feedback suggests that support staff demonstrate professional competence and helpful attitudes when addressing client inquiries. However, the primary language support appears to be Indonesian, which may create communication barriers for international traders or those not fluent in the local language.

The round-the-clock support schedule aligns well with the global nature of forex markets. This ensures that traders can access assistance regardless of their trading schedule or geographic location. This service level exceeds many regional brokers who may offer limited support hours or language options.

While specific case studies or problem resolution examples were not available in the source materials, the overall user sentiment regarding customer service quality appears positive. This contributes significantly to the broker's reputation in this critical service area.

Trading Experience Analysis (Score: 7/10)

The trading experience at didimax is built around the MetaTrader 5 platform. This provides a stable and feature-rich environment for forex and commodity trading. User feedback suggests that platform stability is generally satisfactory, with traders reporting reliable performance during normal market conditions. However, specific technical performance data regarding server uptime, connection stability, or latency measurements were not available in the reviewed materials.

Order execution quality information was limited in available sources. No specific details about slippage rates, requote frequencies, or execution speed measurements were provided. The spread structure starting from 1 pip appears competitive for the asset classes offered, though comprehensive spread comparisons across different market conditions and trading sessions were not provided.

The platform's functionality appears comprehensive for standard trading activities. However, specific details about advanced order types, one-click trading capabilities, or customizable interface options were not detailed in available sources. The absence of specific information about mobile application performance or cross-device synchronization capabilities represents a gap in the available assessment data.

Trading environment stability receives positive feedback from users. This suggests that the technical infrastructure supports reliable trading operations. However, the lack of detailed information about trading conditions during high-volatility periods or major market events limits the ability to assess performance under stressed market conditions.

The overall trading experience appears suitable for intermediate to advanced traders, particularly those comfortable with the MetaTrader 5 environment and seeking access to educational support alongside their trading activities. This didimax review notes that while the basic trading infrastructure appears solid, more detailed technical specifications would enhance trader confidence.

Trust and Reliability Analysis (Score: 8/10)

Trust and reliability represent strong points for didimax. They are primarily anchored by regulatory oversight from BAPPEBTI and JFX. These Indonesian regulatory bodies provide supervision and compliance monitoring, ensuring that the broker operates within established legal frameworks and maintains required operational standards. This regulatory foundation offers important protections for traders operating within the Indonesian jurisdiction.

The industry recognition as "Indonesia's Best Forex Education Broker" in 2018 demonstrates professional acknowledgment of the company's capabilities and service quality. This contributes positively to its reputation within the regional market. This award suggests peer and industry validation of the broker's educational offerings and overall service standards.

However, specific information about fund safety measures, such as segregated account policies, insurance coverage, or compensation schemes, was not detailed in available sources. The absence of published financial reports or detailed management team information limits transparency assessment, though this is not uncommon among regional brokers.

Company longevity since 1999 provides evidence of operational stability and market survival through various economic cycles and market conditions. This extended operational history suggests established business practices and accumulated experience in serving trader needs.

User trust feedback appears mixed. Some traders express confidence in the regulatory framework while others seek additional transparency regarding fund protection measures. The absence of reported major negative events or regulatory actions in available sources suggests a clean operational record, though comprehensive verification would require direct regulatory database checks.

User Experience Analysis (Score: 6/10)

User experience at didimax presents a balanced picture with both positive elements and areas for improvement. Overall user satisfaction appears to span a range from positive to neutral. This suggests that while many traders find the service adequate, there may be room for enhancement in several areas.

The MetaTrader 5 interface is generally recognized as user-friendly and intuitive, particularly for traders familiar with the MetaTrader ecosystem. The platform's established design and functionality provide a familiar environment for experienced traders, though newcomers may require time to master its comprehensive feature set.

Registration and verification processes were not detailed in available sources. This prevents assessment of account opening efficiency or documentation requirements. Similarly, specific information about fund transfer experiences, including deposit and withdrawal processing times or user satisfaction with payment procedures, was not available for evaluation.

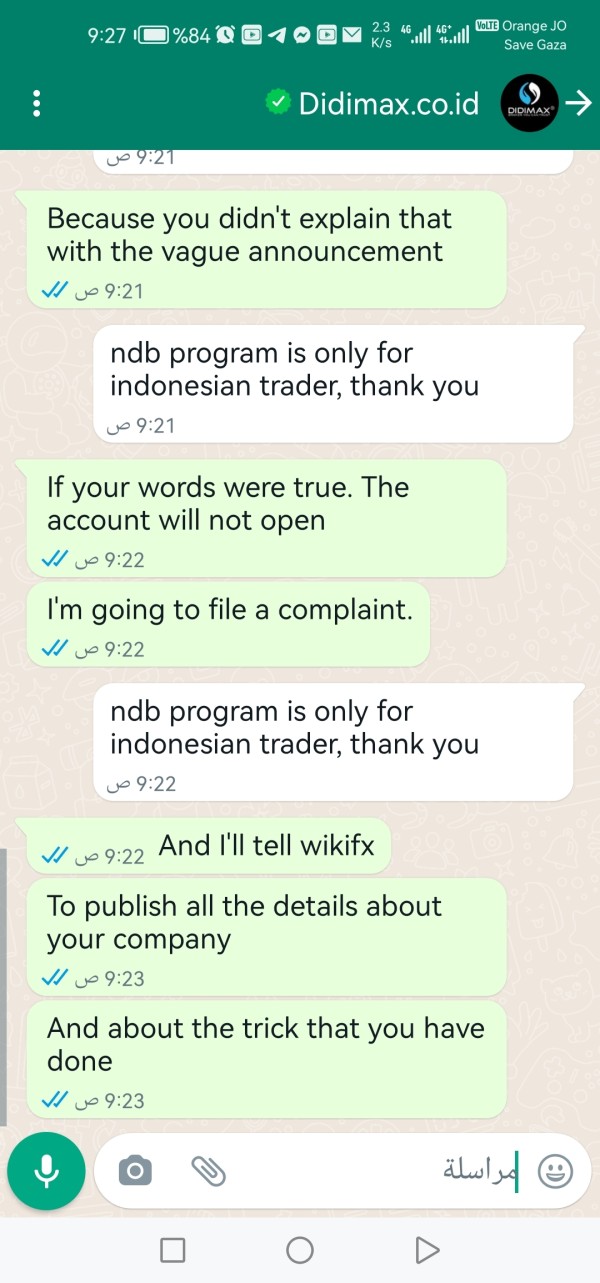

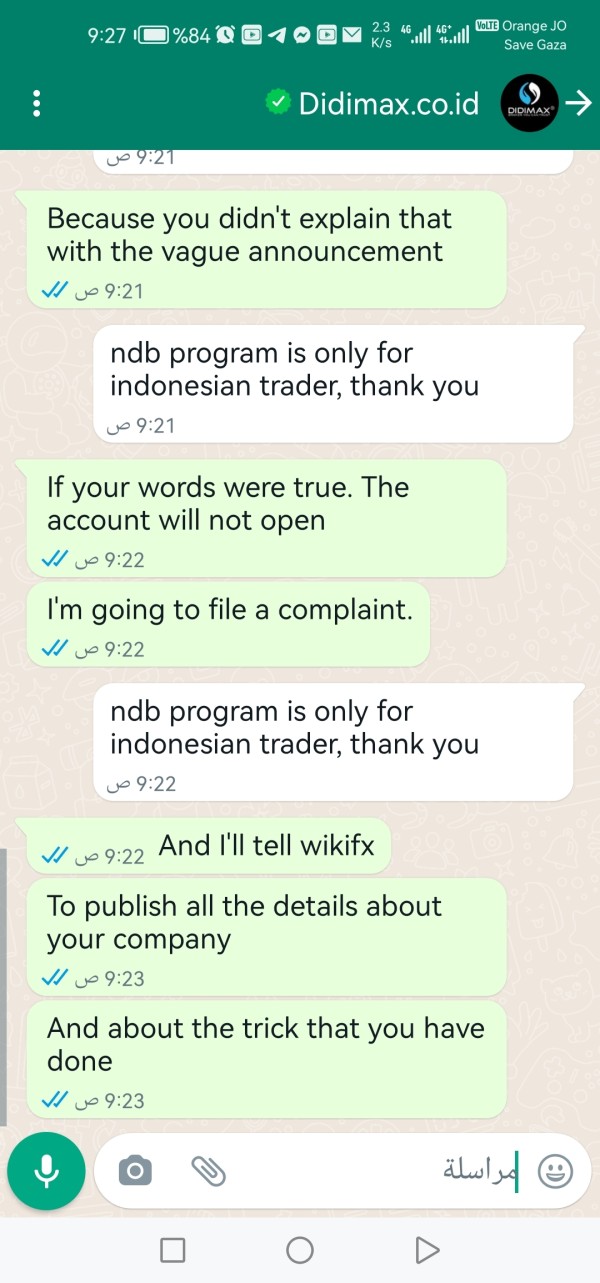

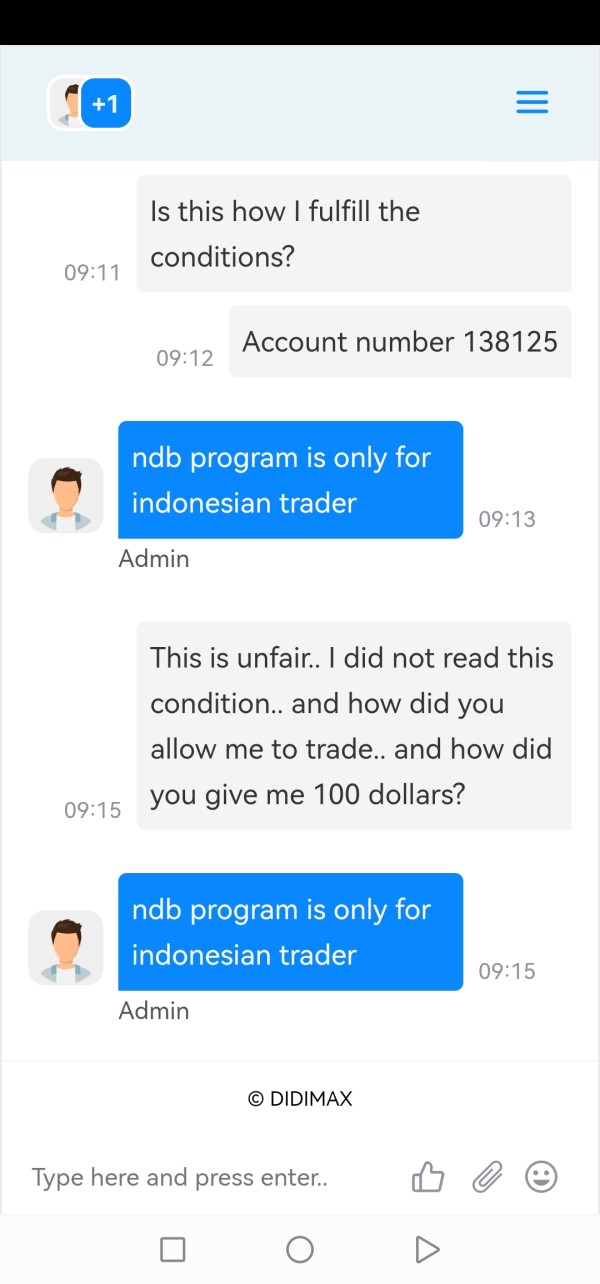

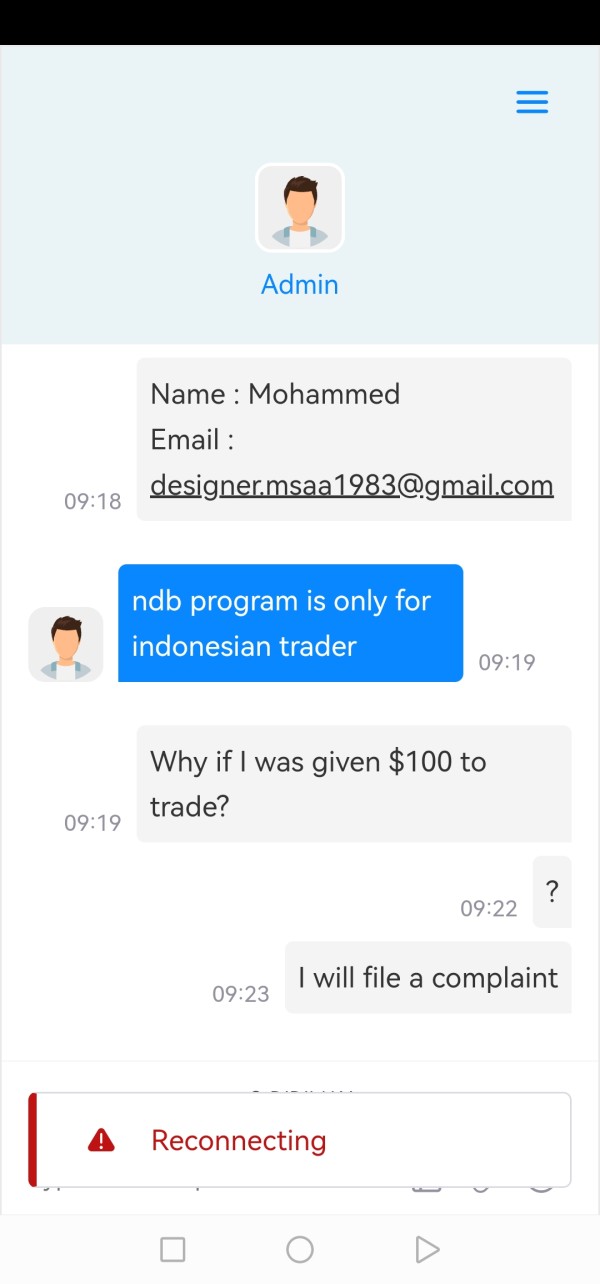

Common user complaints appear to focus on service quality variations and the high minimum deposit requirement, which some traders find restrictive. The mixed feedback suggests that while core services function adequately, consistency in service delivery may require attention.

User demographic analysis suggests that the broker's target market of intermediate to advanced traders aligns well with those seeking educational support and professional trading environments. However, the high entry barrier may limit market reach and exclude potentially valuable client segments.

Areas for improvement based on available feedback include enhancing service consistency, expanding payment method options, and potentially reconsidering entry-level account options to broaden market accessibility. The current user experience appears functional but may benefit from modernization and expanded service options.

Conclusion

didimax emerges as a regulated forex broker with notable strengths in educational resources and customer support. However, certain limitations may restrict its appeal to specific trader segments. The broker's regulatory compliance under BAPPEBTI and JFX oversight provides a foundation of legitimacy and operational standards within the Indonesian market.

Recommended for intermediate to advanced traders who prioritize educational support and professional customer service, particularly those operating with substantial trading capital and seeking a regulated environment for their trading activities. The broker's educational focus and industry recognition make it particularly suitable for traders looking to enhance their knowledge while engaging in active trading.

Key advantages include comprehensive regulatory compliance, extensive educational resources, 24-hour customer support, and established market presence since 1999. However, notable limitations encompass the high minimum deposit requirement of $10,000, limited information about advanced trading tools, and primarily Indonesian-focused service delivery that may not suit international traders' needs.

The mixed user satisfaction ratings suggest that while didimax provides functional services, there may be opportunities for improvement in service consistency and market accessibility. These improvements could enhance its competitive position in the evolving forex brokerage landscape.