CICC 2025 Review: Everything You Need to Know

Executive Summary

China International Capital Corporation stands as China's first Sino-foreign joint venture investment bank. The company was established in 1995 with nearly three decades of experience in the Chinese financial market. However, this cicc review reveals a concerning picture regarding overall user satisfaction, with the company receiving a notably low rating of 2.0 out of 5 from user feedback. Despite its historical significance and comprehensive financial services portfolio, CICC faces substantial challenges in employee satisfaction and workplace conditions.

The company has built its reputation through participation in numerous groundbreaking transactions throughout China's economic reform and development. CICC offers a full-service business model encompassing investment banking, capital markets, brokerage services, fixed income, asset management, private equity, wealth management, and research capabilities. This comprehensive approach positions the firm as a significant player in China's financial landscape.

CICC primarily targets institutional investors and high-net-worth individuals seeking exposure to Chinese markets. The company's extensive experience in local regulations and market dynamics makes it particularly relevant for clients looking to navigate China's complex financial environment. However, potential clients should carefully consider the mixed feedback regarding service quality and operational efficiency before making investment decisions.

Important Disclaimers

This cicc review is based on available public information, user feedback, and company-provided data as of June 2025. CICC operates under the regulatory oversight of the China Securities Regulatory Commission, and regulatory requirements may vary across different jurisdictions where the company provides services. Potential clients should be aware that trading conditions, service offerings, and regulatory compliance may differ depending on their location and the specific CICC entity they engage with.

The evaluation methodology employed in this review incorporates user testimonials, regulatory information, and publicly available company data. Readers should conduct their own due diligence and consider consulting with financial advisors before making any investment decisions based on this review.

Rating Framework

Broker Overview

China International Capital Corporation Limited emerged in 1995 as a pioneering force in China's financial sector. The company marked its establishment as the country's first Sino-foreign joint venture investment bank. CICC has played an instrumental role in China's economic transformation, participating in numerous precedent-setting transactions that have shaped the nation's financial landscape. The company's commitment to providing high-quality, value-added financial services has earned recognition through various national and international awards, including Best Asian Bank of the Year, Best Investment Bank in China, and Most Influential Research Institution.

The company operates under a comprehensive business model that spans multiple financial service sectors. CICC's service portfolio includes investment banking, capital markets operations, brokerage services, fixed income products, asset management, private equity, wealth management, and research services. This diversified approach allows the firm to serve a broad range of client needs within the Chinese market context. The company trades on the Shanghai Stock Exchange under the symbol 601995 and maintains its headquarters at China World Office 2, located at 1 Jianguomenwai Avenue in Beijing's Chaoyang District. CICC operates under the regulatory supervision of the China Securities Regulatory Commission, ensuring compliance with Chinese financial regulations and standards.

Regulatory Oversight: CICC operates under the regulatory authority of the China Securities Regulatory Commission. This regulatory framework ensures compliance with Chinese financial laws and investor protection standards.

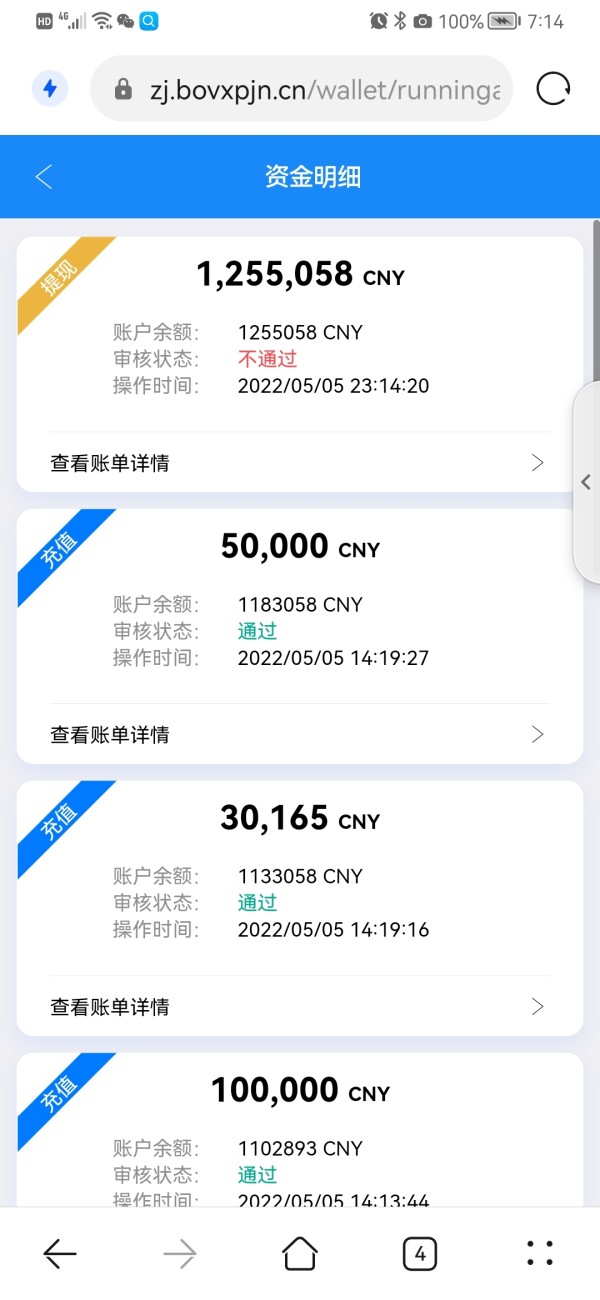

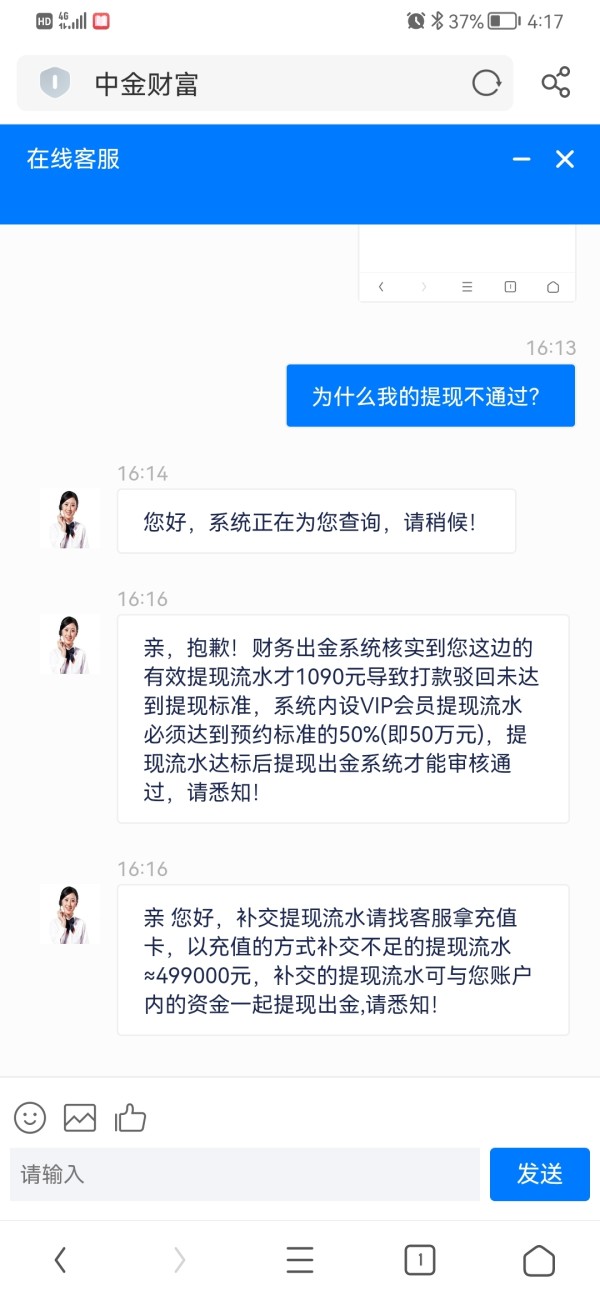

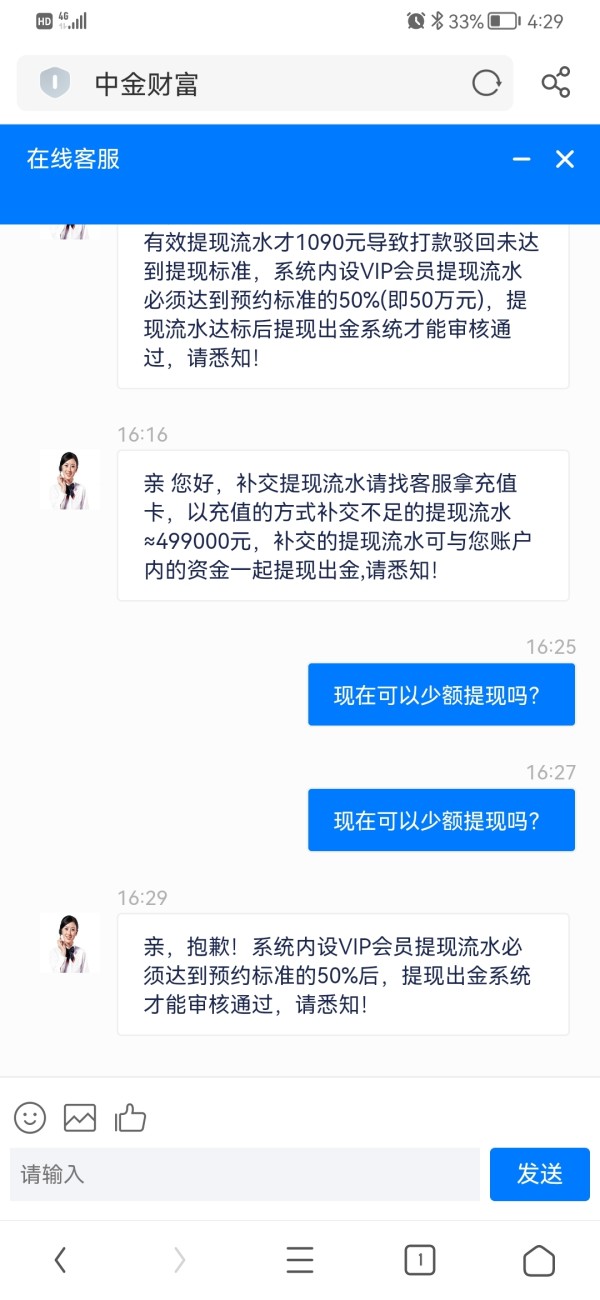

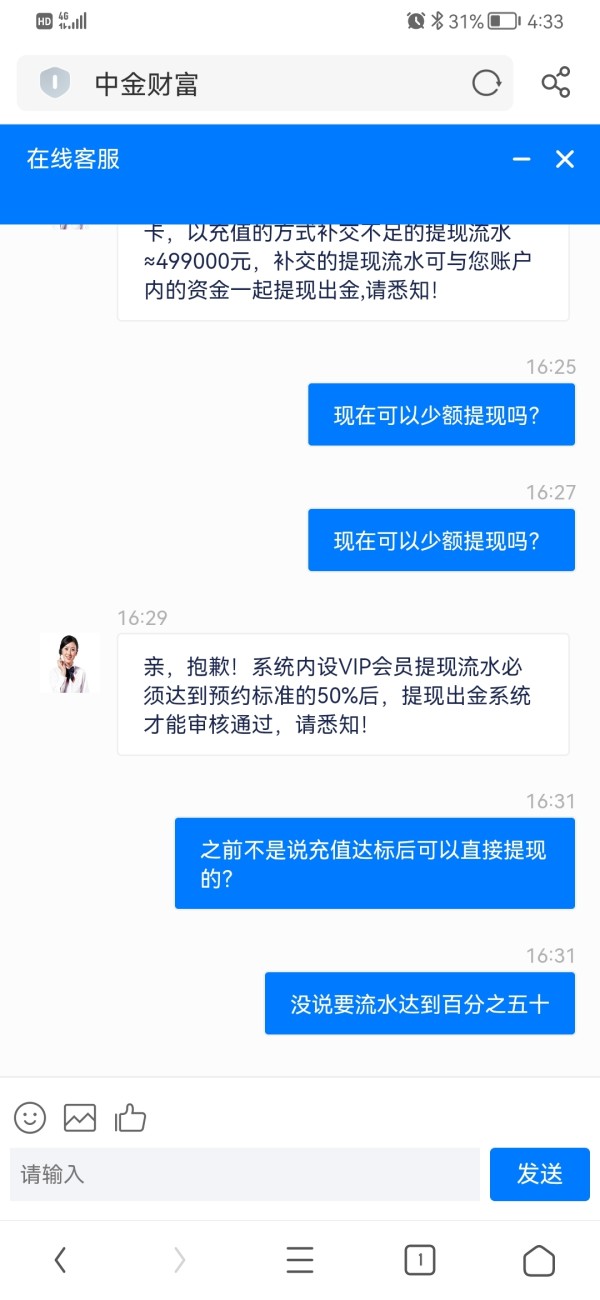

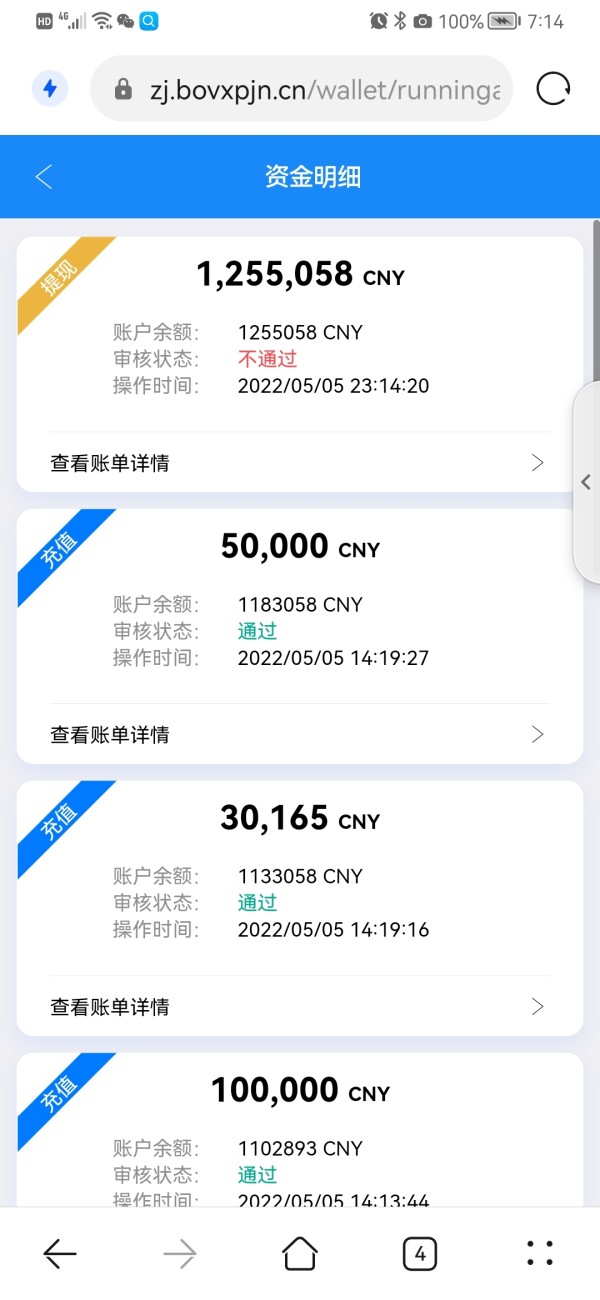

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available source materials. Clients should contact CICC directly for current payment processing options and procedures.

Minimum Deposit Requirements: Current minimum deposit requirements are not specified in available documentation. Prospective clients should inquire directly with CICC representatives for account opening requirements.

Bonus and Promotional Offers: Information regarding current promotional offers or bonus programs is not available in the source materials reviewed for this cicc review.

Available Trading Assets: CICC provides access to a comprehensive range of financial services including investment banking products, capital markets instruments, brokerage services, fixed income securities, asset management products, private equity opportunities, wealth management services, and research resources.

Cost Structure: Detailed fee schedules and cost structures are not specified in the available information sources. Clients should request current pricing information directly from CICC for accurate cost assessments.

Leverage Ratios: Specific leverage ratios and margin requirements are not detailed in the current information sources.

Platform Options: Information regarding specific trading platforms and technology offerings is not available in the reviewed materials.

Geographic Restrictions: Details about geographic limitations or regional restrictions are not specified in available sources.

Customer Service Languages: Information about available customer service languages is not detailed in current source materials.

Detailed Rating Analysis

Account Conditions Analysis

The available information sources do not provide comprehensive details about CICC's account conditions. This makes it challenging to conduct a thorough evaluation of this aspect. Without specific information about account types, minimum balance requirements, account opening procedures, or special account features, potential clients cannot make informed decisions about account suitability.

The lack of detailed account information represents a significant gap in transparency that could impact client decision-making processes. Professional investment firms typically provide clear documentation about account structures, eligibility requirements, and associated benefits or limitations. This cicc review cannot provide a comprehensive assessment of account conditions due to insufficient available data.

Prospective clients should directly contact CICC representatives to obtain detailed information about available account types, opening procedures, minimum deposit requirements, and any special features or restrictions that may apply to different account categories. The absence of readily available account information may indicate a need for improved transparency in client communication.

Current information sources do not provide detailed specifications about CICC's trading tools, research resources, educational materials, or technological capabilities. This lack of detailed information makes it difficult to assess the quality and comprehensiveness of tools available to clients.

Modern investment firms typically offer sophisticated trading platforms, comprehensive research capabilities, market analysis tools, and educational resources to support client decision-making. The absence of detailed information about these critical components in available sources suggests either limited tool offerings or inadequate communication about available resources.

Without specific information about research quality, platform functionality, automated trading support, or educational programs, potential clients cannot adequately evaluate whether CICC's technological infrastructure meets their trading and investment needs. This represents a significant information gap that should be addressed through direct inquiry with company representatives.

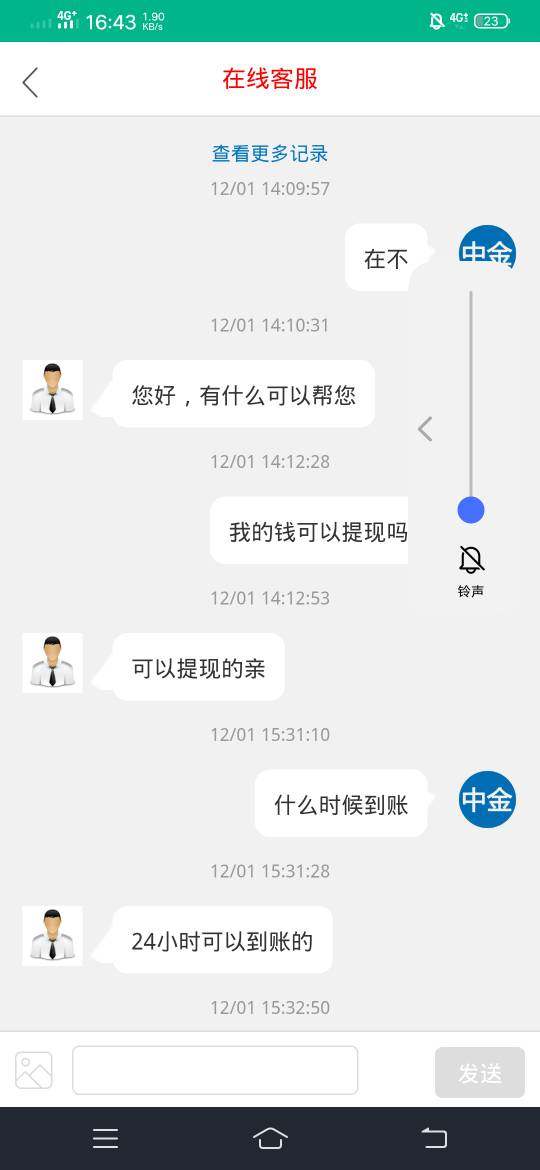

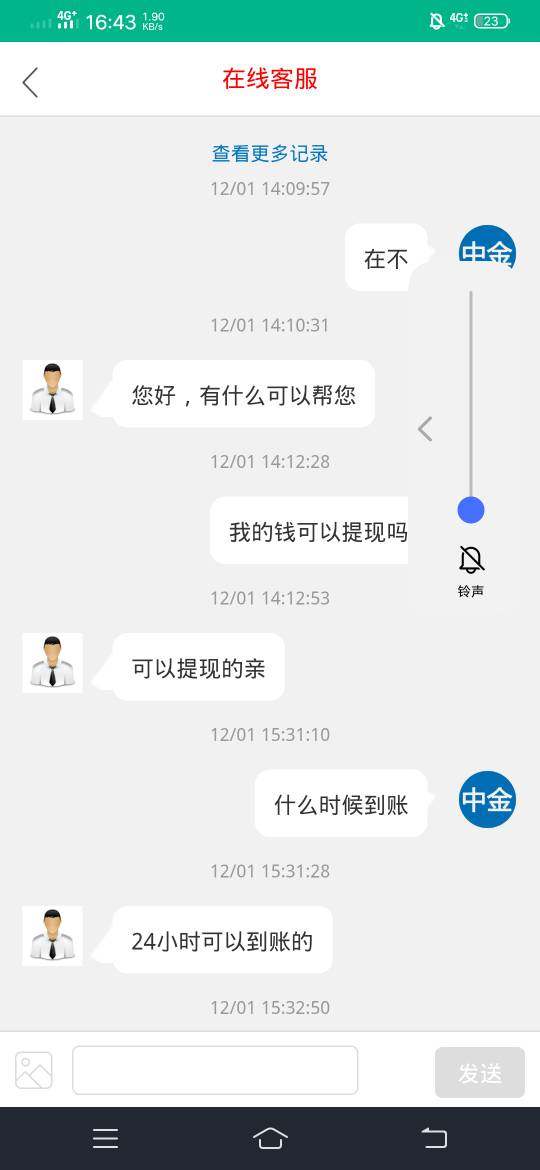

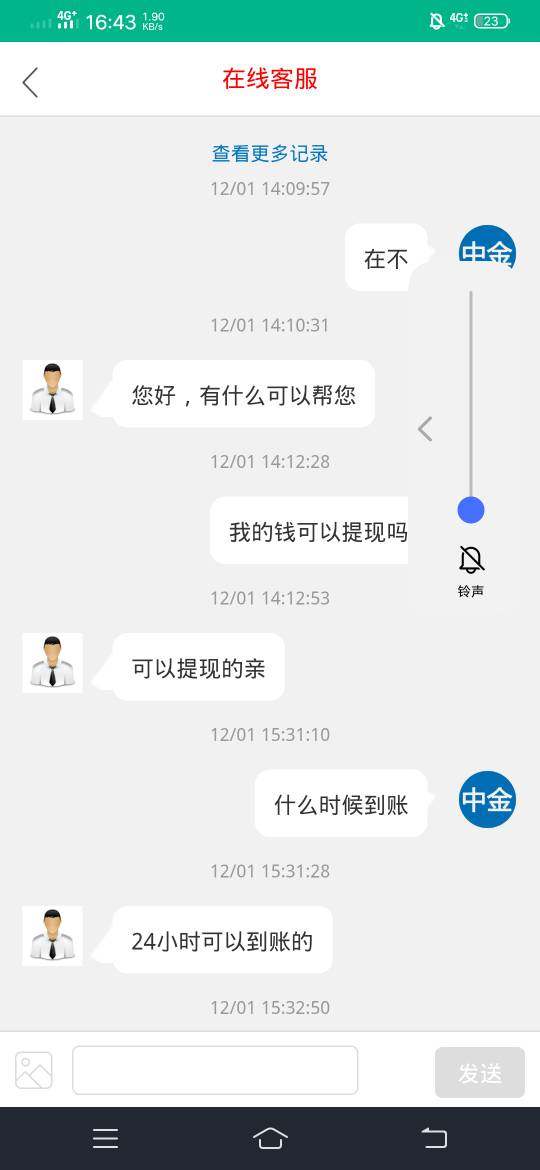

Customer Service and Support Analysis

Available source materials do not include specific information about CICC's customer service channels, response times, service quality metrics, multilingual support capabilities, or operating hours. This absence of customer service information makes it impossible to evaluate support quality based on available data.

Effective customer service represents a critical component of financial services, particularly for institutional investors and high-net-worth individuals who require responsive support for complex transactions and inquiries. The lack of detailed customer service information in available sources may indicate insufficient emphasis on support quality communication.

User feedback suggests potential issues with overall satisfaction, which could extend to customer service experiences. However, without specific customer service metrics or detailed user testimonials about support interactions, this review cannot provide a comprehensive assessment of service quality.

Trading Experience Analysis

The available information does not include specific details about platform stability, execution speed, order processing quality, mobile trading capabilities, or overall trading environment characteristics. This absence of trading experience data prevents a comprehensive evaluation of CICC's trading infrastructure.

Professional trading environments require reliable platforms, efficient order execution, comprehensive functionality, and stable performance across different market conditions. The lack of specific trading experience information in available sources makes it difficult for potential clients to assess whether CICC's trading infrastructure meets professional standards.

This cicc review cannot provide detailed insights into trading experience quality due to insufficient available data. Prospective clients should request demonstration access or detailed information about trading capabilities directly from CICC representatives to evaluate platform suitability for their trading requirements.

Trust and Reliability Analysis

CICC demonstrates strong regulatory credentials through its oversight by the China Securities Regulatory Commission. This provides a solid foundation for trust and reliability. The company's 30-year operational history since 1995 establishes a track record of sustained business operations within China's evolving financial regulatory environment.

The firm's status as China's first Sino-foreign joint venture investment bank provides historical significance and suggests regulatory approval for international collaboration in Chinese financial markets. CICC's participation in numerous precedent-setting transactions throughout China's economic development demonstrates deep integration with the country's financial infrastructure.

However, available information does not provide specific details about fund safety measures, company transparency initiatives, third-party audits, or negative event handling procedures. While regulatory oversight provides baseline protection, the absence of detailed safety and transparency information represents a gap in available trust-related data.

The company's recognition through various national and international awards, including Best Asian Bank of the Year and Best Investment Bank in China, suggests industry acknowledgment of professional capabilities. However, specific criteria for these awards are not detailed in available sources.

User Experience Analysis

User experience evaluation reveals significant concerns based on available feedback. The overall rating of 2.0 out of 5 indicates substantial dissatisfaction among users. The negative feedback encompasses multiple areas including compensation concerns, limited skill development opportunities, poor job security, inadequate advancement prospects, low work satisfaction, and problematic company culture.

These user experience issues, while primarily focused on employment conditions, may reflect broader organizational challenges that could impact client service quality. The consistent pattern of negative feedback across multiple workplace dimensions suggests systemic issues that may extend beyond internal operations to client-facing services.

The target user base of institutional investors and high-net-worth individuals seeking Chinese market exposure requires high-quality service delivery and professional interaction. The documented user experience challenges raise questions about the company's ability to meet the sophisticated service expectations of this client demographic.

Interface design, registration processes, fund operation procedures, and other client-facing experience elements are not detailed in available sources. This prevents comprehensive user experience assessment beyond the documented negative feedback patterns.

Conclusion

This cicc review reveals a complex picture of China's first Sino-foreign joint venture investment bank. While CICC possesses strong regulatory credentials through CSRC oversight and maintains a significant 30-year operational history, substantial concerns emerge regarding user satisfaction and service quality. The company's comprehensive financial services portfolio and historical significance in China's economic development represent notable strengths, but these advantages are overshadowed by consistently negative user feedback.

CICC appears most suitable for institutional investors and high-net-worth individuals specifically seeking exposure to Chinese markets through an established local presence. However, potential clients should carefully evaluate service quality expectations against documented user experience challenges. The main advantages include regulatory compliance, comprehensive service offerings, and deep Chinese market expertise, while significant disadvantages encompass poor user satisfaction ratings, workplace culture issues, and limited transparency in operational details.

Prospective clients should conduct thorough due diligence and consider alternative options while weighing CICC's unique market position against documented service quality concerns.