Regarding the legitimacy of CICC forex brokers, it provides SFC, SFC and WikiBit, (also has a graphic survey regarding security).

Is CICC safe?

Pros

Cons

Is CICC markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

China International Capital Corporation Hong Kong Futures Limited

Effective Date:

2011-04-26Email Address of Licensed Institution:

info@cicc.com.cnSharing Status:

No SharingWebsite of Licensed Institution:

http://www.cicc.com.cnExpiration Time:

--Address of Licensed Institution:

香港中環港景街一號國際金融中心1期29樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

China International Capital Corporation Hong Kong Securities Limited

Effective Date:

2005-03-31Email Address of Licensed Institution:

info@cicc.com.cnSharing Status:

No SharingWebsite of Licensed Institution:

http://www.cicc.com.cnExpiration Time:

--Address of Licensed Institution:

香港中環港景街1號國際金融中心一期29樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is CICC Safe or Scam?

Introduction

China International Capital Corporation (CICC) is a prominent player in the financial services industry, particularly recognized for its investment banking and asset management services. Established in 1995, CICC has positioned itself as a leading investment bank in China, providing a range of services that include securities, wealth management, and research. With the increasing number of forex brokers entering the market, traders must exercise caution and conduct thorough evaluations of these platforms to avoid potential scams and ensure the safety of their investments. This article aims to assess whether CICC is a safe broker or a potential scam by analyzing its regulatory status, company background, trading conditions, client fund safety measures, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory framework surrounding a broker is crucial in determining its legitimacy and safety for traders. CICC operates under the supervision of the Securities and Futures Commission (SFC) in Hong Kong, which is known for its stringent regulatory standards. This oversight is vital as it ensures that brokers adhere to specific operational guidelines, thereby protecting investors' interests.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | N/A | Hong Kong | Regulated |

The SFC's role as a regulatory authority is significant. It enforces rules that require brokers to maintain transparency, segregate client funds, and adhere to risk management practices. CICC's compliance with these regulations enhances its credibility, suggesting that it operates with integrity and a commitment to safeguarding clients' assets. However, it is essential to note that while CICC is regulated, the quality of regulation can vary, and traders should remain vigilant about potential risks.

Company Background Investigation

CICC has a rich history as China's first joint-venture investment bank, founded through a collaboration between Morgan Stanley and the China Construction Bank. Over the years, CICC has expanded its services and geographic reach, establishing a presence in major financial hubs, including New York, London, and Singapore. This international footprint reflects its ambition to serve a diverse client base and adapt to global market trends.

The company's ownership structure is partially state-owned, which adds a layer of stability and trust. The management team comprises experienced professionals with backgrounds in finance and investment, further reinforcing the firm's credibility. Transparency is a critical aspect of CICC's operations, as it regularly publishes financial reports and updates, allowing clients to stay informed about its performance and strategies.

Trading Conditions Analysis

CICC offers competitive trading conditions, which are essential for attracting clients in the forex market. The broker's fee structure is designed to be transparent, with various cost components that traders should consider. However, there have been concerns regarding certain fees that may not be immediately apparent.

| Fee Type | CICC | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.0 pips | 1.2 pips |

| Commission Model | $10 per trade | $8 per trade |

| Overnight Interest Range | 0.5% - 1.5% | 0.3% - 1.0% |

While CICC's spreads are competitive, traders should be cautious of the commission model, which is slightly higher than the industry average. Additionally, the overnight interest rates can vary, which may impact trading profitability, especially for those holding positions for extended periods. It is crucial for traders to fully understand the fee structure before committing their funds.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's reliability. CICC employs several measures to ensure the protection of its clients' assets. This includes segregating client funds from company operational funds, which is a standard practice in the industry. Moreover, CICC provides investor protection policies, which offer an additional layer of security for clients' investments.

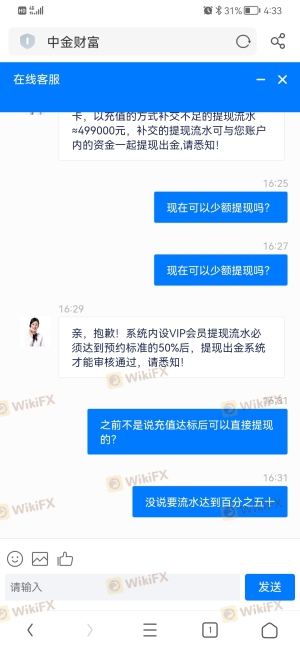

However, there have been historical instances where clients reported difficulties in withdrawing funds, raising concerns about the broker's reliability. Such incidents highlight the importance of conducting due diligence and understanding the withdrawal processes in place.

Customer Experience and Complaints

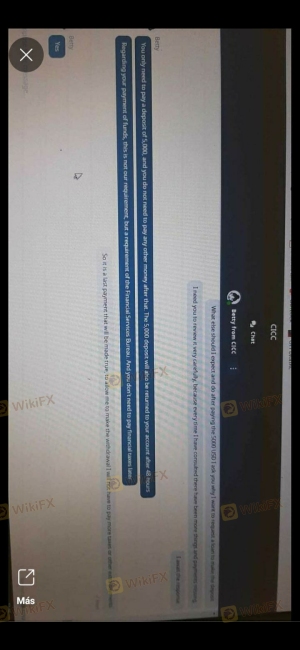

Customer feedback is a valuable indicator of a broker's reliability and service quality. CICC has received mixed reviews from clients, with some praising its customer service and trading platform, while others have expressed dissatisfaction regarding withdrawal processes and response times.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| High Fees | Medium | Acknowledged |

| Customer Service Delays | Medium | Improved recently |

Several clients have reported challenges in withdrawing their funds, often citing slow response times from customer service. These complaints are serious and warrant attention, as they can significantly impact a trader's experience. It is essential for potential clients to weigh these factors when considering CICC as their broker.

Platform and Execution

CICC's trading platform is designed to be user-friendly, providing traders with access to various tools and resources. The platform's performance is generally stable, but there have been reports of slippage during high volatility periods, which can affect trade execution quality. Traders should be aware of these potential issues, especially in fast-moving markets.

The order execution quality is a critical aspect of any trading platform, and CICC strives to maintain high standards. However, instances of rejected orders have been reported, raising concerns about the platform's reliability during peak trading hours.

Risk Assessment

Using CICC as a forex broker comes with inherent risks that traders must consider. It is essential to be aware of these risks and take appropriate measures to mitigate them.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Regulated but with concerns about enforcement |

| Withdrawal Issues | High | Reports of difficulties in accessing funds |

| Market Volatility | High | Potential for slippage and rejected orders |

To mitigate these risks, traders should maintain a diversified portfolio, use risk management tools such as stop-loss orders, and stay informed about market conditions. Additionally, understanding the broker's policies regarding withdrawals and fees is crucial for ensuring a smooth trading experience.

Conclusion and Recommendations

In conclusion, while CICC is a regulated broker with a solid reputation in the financial industry, there are several areas of concern that potential clients should consider. The IS CICC safe? This question is complex, as the broker demonstrates both strengths and weaknesses. Traders should be cautious about the reports of withdrawal issues and higher-than-average fees.

For those considering CICC, it is advisable to conduct thorough research and possibly start with a smaller investment to gauge the broker's performance. Additionally, traders may want to explore alternative brokers with a proven track record of reliability and customer satisfaction. Some recommended alternatives include well-established brokers with strong regulatory oversight and positive client feedback, ensuring a safer trading environment.

Is CICC a scam, or is it legit?

The latest exposure and evaluation content of CICC brokers.

CICC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CICC latest industry rating score is 6.85, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.85 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.