Regarding the legitimacy of LONG ASIA forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is LONG ASIA safe?

Pros

Cons

Is LONG ASIA markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

SCAP BROKER (PTY) LTD

Effective Date: Change Record

2023-09-04Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

CALLE 148 # 7-05 APT 702BOGOTA., COLOMBIA0Phone Number of Licensed Institution:

+573 042469413Licensed Institution Certified Documents:

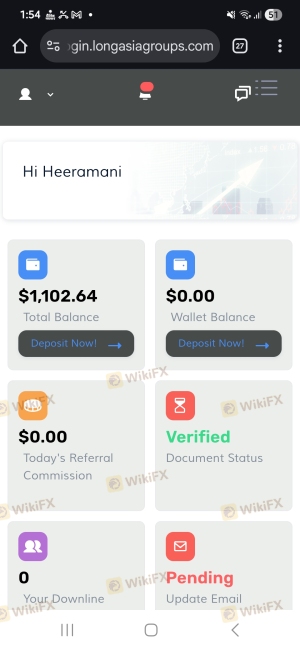

Is Long Asia A Scam?

Introduction

Long Asia, a brokerage firm established in 2012, positions itself as a player in the foreign exchange (Forex) market, offering a range of trading instruments including Forex, commodities, and cryptocurrencies. As the online trading landscape continues to expand, traders must exercise caution in selecting brokers, as the prevalence of scams and fraudulent activities can lead to significant financial losses. This article aims to provide a comprehensive analysis of Long Asia, evaluating its legitimacy through various lenses, including regulatory compliance, company background, trading conditions, and customer experiences. The assessment is based on extensive research from credible sources, user reviews, and regulatory databases.

Regulation and Legitimacy

The regulatory status of a brokerage is paramount in determining its credibility and safety for traders. Long Asia claims to be regulated by various authorities, including the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and the Financial Markets Authority (FMA) in New Zealand. However, the legitimacy of these claims is questionable, as several reports indicate that the broker may not hold valid licenses.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FINTRAC | 241165 | Canada | Revoked |

| FMA | N/A | New Zealand | N/A |

Despite the claims of regulatory oversight, investigations reveal that Long Asia's licenses have been revoked, raising serious concerns about its operational legitimacy. The lack of regulatory compliance not only exposes traders to potential fraud but also indicates a significant risk regarding the security of their funds. Regulatory bodies like the FCA (UK) and ASIC (Australia) enforce stringent rules to protect investors, and Long Asias absence from these reputable lists is a red flag.

Company Background Investigation

Long Asia's history, ownership structure, and management team play a crucial role in assessing its credibility. Founded in 2012, the company has undergone various transformations, claiming to operate under multiple subsidiaries across different regions, including New Zealand and Singapore. However, the transparency regarding its corporate structure is lacking, with little information available about its key stakeholders and management team.

The management teams qualifications and experience are vital in establishing trust. Still, there is insufficient publicly available information to evaluate the expertise and background of the individuals running Long Asia. The company's opacity in disclosing its ownership structure and management details raises concerns about its commitment to transparency and accountability. A brokerage that is unwilling to disclose relevant information may not prioritize its clients' interests, further emphasizing the need for caution when considering trading with Long Asia.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall cost-effectiveness and reliability. Long Asia claims to provide competitive trading conditions, including leverage up to 1:500 and various account types. However, the absence of transparency regarding fees and commissions can lead to unexpected costs for traders.

| Fee Type | Long Asia | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | $8 per lot (ECN) | $5 per lot |

| Overnight Interest Range | Varies | Varies |

The spread on major currency pairs is reported to be higher than the industry average, which could impact trading profitability. Furthermore, the commission structure, particularly for ECN accounts, may not be as competitive as other brokers in the market. Traders should be aware of the potential for hidden fees and the lack of clarity in fee structures, which can significantly affect their trading experience.

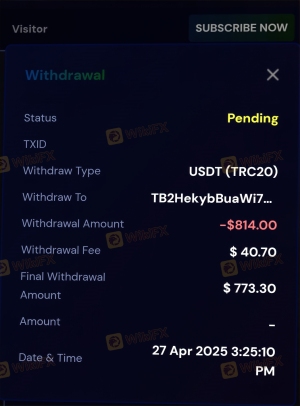

Customer Fund Security

The safety of customer funds is a critical consideration when evaluating a broker. Long Asia claims to implement various security measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable given the lack of regulatory oversight.

Traders should be particularly cautious about the security of their investments with Long Asia, as the absence of robust regulatory frameworks can lead to potential fund mismanagement or loss. Historical complaints and reports of withdrawal issues further exacerbate concerns regarding the safety of customer funds. In light of these factors, it is essential for traders to thoroughly assess the security measures in place before engaging with Long Asia.

Customer Experience and Complaints

Analyzing customer feedback is crucial in understanding the overall experience of traders with Long Asia. Numerous reviews highlight significant issues, particularly regarding withdrawal processes and customer service responsiveness. Common complaints include delays in processing withdrawals, lack of communication, and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| Account Blocking | High | Poor |

For instance, many users report being unable to withdraw their funds for extended periods, with some claiming that their accounts were blocked without explanation. These patterns indicate a troubling trend that potential clients must consider when evaluating the reliability of Long Asia. The company's inadequate response to customer complaints raises concerns about its commitment to client satisfaction and trust.

Platform and Trade Execution

The trading platform's performance and execution quality are vital for a successful trading experience. Long Asia offers the widely-used MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading features. However, reports of order execution issues, including slippage and rejections, have been noted by users.

The quality of trade execution is paramount, as delays or issues can lead to significant financial losses. Traders should be wary of any signs of platform manipulation or inconsistencies in order processing, which could further compromise their trading experience.

Risk Assessment

Using Long Asia as a trading platform presents various risks that traders must consider. The lack of regulation, coupled with numerous customer complaints, indicates a high-risk environment for potential investors.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid licenses; potential fraud risk |

| Customer Service Risk | Medium | Poor response to complaints |

| Fund Security Risk | High | Lack of transparency in fund management |

To mitigate these risks, traders should conduct thorough research, consider alternative brokers with better regulatory standing, and exercise caution when investing. Utilizing demo accounts and practicing risk management strategies can also help in minimizing potential losses.

Conclusion and Recommendations

In conclusion, Long Asia raises numerous red flags that suggest potential fraud and a lack of reliability. The absence of valid regulatory licenses, coupled with a history of customer complaints and withdrawal issues, indicates that traders should approach this broker with extreme caution.

For traders seeking a safer and more transparent trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Brokers such as FP Markets, eToro, and Plus500 are recommended for their regulatory compliance and positive user experiences. Ultimately, ensuring the safety of your funds and having a reliable trading partner is paramount in the volatile world of Forex trading.

Is LONG ASIA a scam, or is it legit?

The latest exposure and evaluation content of LONG ASIA brokers.

LONG ASIA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LONG ASIA latest industry rating score is 2.00, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.00 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.