Eterwealth 2025 Review: Everything You Need to Know

Summary

This eterwealth review looks at a broker that has worked in the international CFD trading market since 2006. Eterwealth Limited says it is a regulated financial services provider under the MWALI International Services Authority (License No. T2023287). It offers good trading conditions across many asset types including forex, metals, energy, indices, and cryptocurrencies.

The broker has very high leverage up to 1:1000 and spreads starting from 1 pip. This makes it attractive for new traders who want low entry barriers and experienced traders looking for high-leverage opportunities. With a minimum deposit of just $20, Eterwealth makes itself accessible to traders with different amounts of money. The platform uses MT5, giving traders a familiar and strong trading environment.

However, consumer review data shows that Eterwealth currently has a user rating of 13.5 out of 31 total reviews. This shows mixed user experiences and highlights the need for careful research before using this broker. This eterwealth review aims to give a balanced look at the broker's offerings, regulatory status, and overall fit for different types of traders in today's market.

Important Notice

Regulatory Complexity: Eterwealth Limited claims registration across multiple jurisdictions, including references to the Financial Services Authority of Saint Vincent and the Grenadines alongside its MWALI authorization. This approach may result in different levels of regulatory oversight and client protection depending on the trader's location and the specific entity they work with.

Review Methodology: This evaluation uses publicly available information, regulatory filings, and user feedback from various review platforms. Given the limited data available about certain aspects of Eterwealth's operations, traders should verify all claims independently and seek additional information directly from the broker before making trading decisions.

Our Rating Framework

Broker Overview

Eterwealth Limited has worked in the international financial markets since 2006. It positions itself as a complete CFD trading broker specializing in multiple asset classes. The company operates with a business model focused on providing access to global financial markets through leveraged trading products. It serves both retail and potentially institutional clients seeking exposure to forex, commodities, indices, and cryptocurrency markets.

The broker's operational framework centers around offering high-leverage trading opportunities with competitive spread structures. It targets traders who prioritize capital efficiency and market access flexibility. According to available information, Eterwealth emphasizes rapid trade execution and market accessibility. However, specific performance metrics and execution statistics are not publicly detailed in the reviewed sources.

From a regulatory standpoint, Eterwealth operates under the authorization of the MWALI International Services Authority with license number T2023287. The company's trading infrastructure is built around the MetaTrader 5 platform. This provides clients with access to advanced charting tools, automated trading capabilities, and comprehensive market analysis features. The broker supports trading across five major asset categories: foreign exchange pairs, precious metals, energy commodities, global indices, and various cryptocurrency instruments. This offers traders diversified portfolio construction opportunities within a single platform environment.

Regulatory Jurisdiction: Eterwealth operates under MWALI International Services Authority oversight with license T2023287. Additional jurisdictional claims require verification.

Deposit and Withdrawal Methods: Specific payment processing methods and associated fees are not detailed in available public information. This represents a significant information gap for potential clients.

Minimum Deposit Requirements: The broker sets an accessible $20 minimum deposit threshold. This makes it suitable for traders with limited initial capital.

Bonus and Promotional Offers: Current promotional structures and bonus offerings are not specified in publicly available materials reviewed for this analysis.

Tradeable Assets: Comprehensive coverage includes forex pairs, precious metals (gold, silver), energy commodities (oil, gas), major global indices, and cryptocurrency instruments. This provides diverse trading opportunities.

Cost Structure: Spreads begin at 1 pip according to broker claims. However, commission structures, overnight fees, and other trading costs lack detailed public disclosure.

Leverage Ratios: Maximum leverage reaches 1:1000, representing one of the higher leverage offerings in the retail trading market. Regulatory restrictions may apply based on client jurisdiction.

Platform Options: Trading exclusively through MetaTrader 5, with no mention of proprietary platforms or alternative trading interfaces in reviewed materials.

Geographic Restrictions: Specific country limitations and service availability restrictions are not clearly outlined in accessible broker information.

Customer Support Languages: Support language options and communication channels are not specified in the reviewed documentation. This creates uncertainty about service accessibility.

This eterwealth review identifies several areas where additional transparency would benefit potential clients in making informed decisions about broker selection.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

Eterwealth's account structure presents both advantages and limitations for prospective traders. The broker's $20 minimum deposit requirement stands out as exceptionally accessible. This is particularly true when compared to industry standards that often require $100-$500 initial deposits. This low barrier to entry makes the platform suitable for beginning traders or those testing new strategies with limited capital exposure.

The leverage offering of up to 1:1000 represents a significant competitive advantage for traders seeking maximum capital efficiency. However, such high leverage also substantially increases risk exposure. This requires careful consideration of risk management protocols. The availability of this leverage level suggests the broker operates under jurisdictions with more permissive regulatory frameworks. This compares to major financial centers like the EU or UK, where leverage is typically capped at 1:30 for retail clients.

Unfortunately, specific account type variations, Islamic account availability, and account tier benefits are not detailed in available public information. This lack of transparency regarding account structures makes it difficult for traders to understand what additional features or benefits might be available at different deposit levels. The absence of detailed account opening procedures and verification requirements also creates uncertainty about the onboarding experience.

The broker's spread structure starting from 1 pip appears competitive for major currency pairs. However, without specific details on average spreads across different market conditions or asset classes, it's challenging to assess the true cost competitiveness. This eterwealth review notes that the combination of low minimum deposits and high leverage could appeal to specific trader demographics. But the lack of comprehensive account information limits the ability to make fully informed comparisons.

The trading infrastructure at Eterwealth centers around the MetaTrader 5 platform. This provides a solid foundation for technical analysis and automated trading strategies. MT5 offers advanced charting capabilities, multiple timeframes, a comprehensive indicator library, and Expert Advisor support. These features meet the basic requirements for serious trading activities.

However, the broker's offering appears limited when evaluated against comprehensive trading resource expectations. There is no mention of proprietary analytical tools, market research provision, economic calendar integration, or trading signal services. Many contemporary brokers provide these as value-added services. The absence of educational resources, webinar programs, or trading tutorials represents a significant gap. This is particularly true for the beginner trader demographic that the low minimum deposit might attract.

Market research and analysis support appear to be lacking based on available information. Modern traders typically expect access to daily market commentary, technical analysis reports, fundamental analysis, and economic event coverage. The absence of these resources suggests traders would need to source market intelligence independently. This potentially increases their research burden and operational costs.

Automated trading support through MT5's Expert Advisor functionality is presumably available. However, there's no indication of broker-provided trading algorithms, copy trading services, or social trading features. These have become increasingly popular in the retail trading space. The limited information about additional trading tools and resources suggests a relatively basic service offering. This may not meet the expectations of traders seeking comprehensive trading support environments.

Customer Service and Support Analysis (Not Rated)

The evaluation of Eterwealth's customer service capabilities is significantly hampered by the absence of detailed information. This includes support channels, availability, and service quality metrics. This represents a critical information gap that potential clients should address through direct inquiry before account opening.

Standard industry expectations include multiple communication channels such as live chat, email support, telephone assistance, and potentially callback services. Response time commitments, support availability hours, and escalation procedures for complex issues are typically important factors in broker selection. Yet none of these details are publicly available for Eterwealth.

Multi-language support capabilities remain unclear. This could be particularly important given the broker's international positioning and diverse potential client base. The absence of information about dedicated account management, technical support specialization, or complaint resolution procedures creates uncertainty. This affects the overall service experience clients might expect.

Without access to user testimonials specifically addressing customer service experiences, response quality, or problem resolution effectiveness, it's impossible to assess this crucial aspect of the broker's operations. The lack of publicly available customer service information suggests either limited service offerings or insufficient transparency about support capabilities. Both represent potential concerns for prospective clients requiring reliable assistance.

Trading Experience Analysis (6/10)

Eterwealth claims to provide fast and efficient trade execution. This is fundamental to successful trading outcomes, particularly for scalping strategies or during high-volatility market conditions. However, the absence of specific execution statistics, latency measurements, or independent verification of these claims limits the ability to assess actual execution quality objectively.

The MT5 platform foundation provides a robust trading environment with advanced order types, one-click trading capabilities, and comprehensive market depth information. The platform's stability and feature set are well-established in the industry. However, the specific server infrastructure and execution technology employed by Eterwealth are not detailed in available materials.

Spread stability claims appear in broker marketing materials. But without real-time spread monitoring data or user feedback specifically addressing spread behavior during news events or market volatility, it's difficult to validate these assertions. The starting spread of 1 pip could be competitive depending on the specific currency pairs and market conditions. However, average spread data would provide more meaningful performance indicators.

Mobile trading capabilities through MT5 mobile applications are presumably available. However, broker-specific mobile features or optimizations are not mentioned. The overall trading environment appears functional based on platform capabilities. But the lack of detailed performance metrics, user experience feedback, or independent execution quality assessments prevents a more comprehensive evaluation.

This eterwealth review notes that while the basic trading infrastructure appears adequate, the absence of detailed performance validation and user experience data limits confidence in execution quality claims.

Trust and Reliability Analysis (5/10)

Eterwealth's regulatory status under the MWALI International Services Authority provides some level of oversight. However, this jurisdiction may not offer the same level of client protection as major financial centers. These include the UK's FCA, Cyprus's CySEC, or Australia's ASIC. The license number T2023287 can be verified through the appropriate regulatory channels. This provides some legitimacy to the broker's operations.

The absence of information regarding client fund segregation, deposit insurance coverage, or negative balance protection policies creates uncertainty about fundamental client protection measures. Major regulatory jurisdictions typically require these protections. However, the specific safeguards available to Eterwealth clients are not clearly outlined in publicly available materials.

Company transparency appears limited based on the available information. There are minimal details about company leadership, financial statements, or operational history beyond the claimed 2006 establishment date. The lack of industry awards, recognition, or third-party certifications suggests either limited industry engagement or insufficient marketing of such achievements.

No information is available regarding significant negative events, regulatory actions, or client disputes. However, this could indicate either a clean operational record or limited public disclosure of such matters. The relatively low user rating of 13.5 suggests some level of client dissatisfaction. However, specific concerns are not detailed in the reviewed materials.

The multi-jurisdictional registration claims require careful verification. Different entities may operate under varying regulatory standards and client protection levels. This complexity could potentially create confusion about which regulatory protections apply to specific clients. This depends on their location and the entity they engage with.

User Experience Analysis (4/10)

The user rating of 13.5 based on available review data indicates significant challenges in client satisfaction. This represents a concerning metric that potential traders should carefully consider. This low rating suggests that user experiences may not consistently meet expectations across various aspects of the service offering.

Without access to detailed user feedback, it's challenging to identify specific pain points or areas of dissatisfaction that contribute to the low rating. Common issues that affect user experience in the brokerage industry include withdrawal processing delays, execution quality problems, customer service responsiveness, platform stability, or unexpected fees. However, the specific concerns affecting Eterwealth clients are not detailed in available materials.

The registration and account verification process details are not publicly available. This creates uncertainty about the onboarding experience and time requirements for new clients. Smooth account opening procedures and efficient verification processes are crucial for positive initial user experiences. Yet these aspects remain unclear.

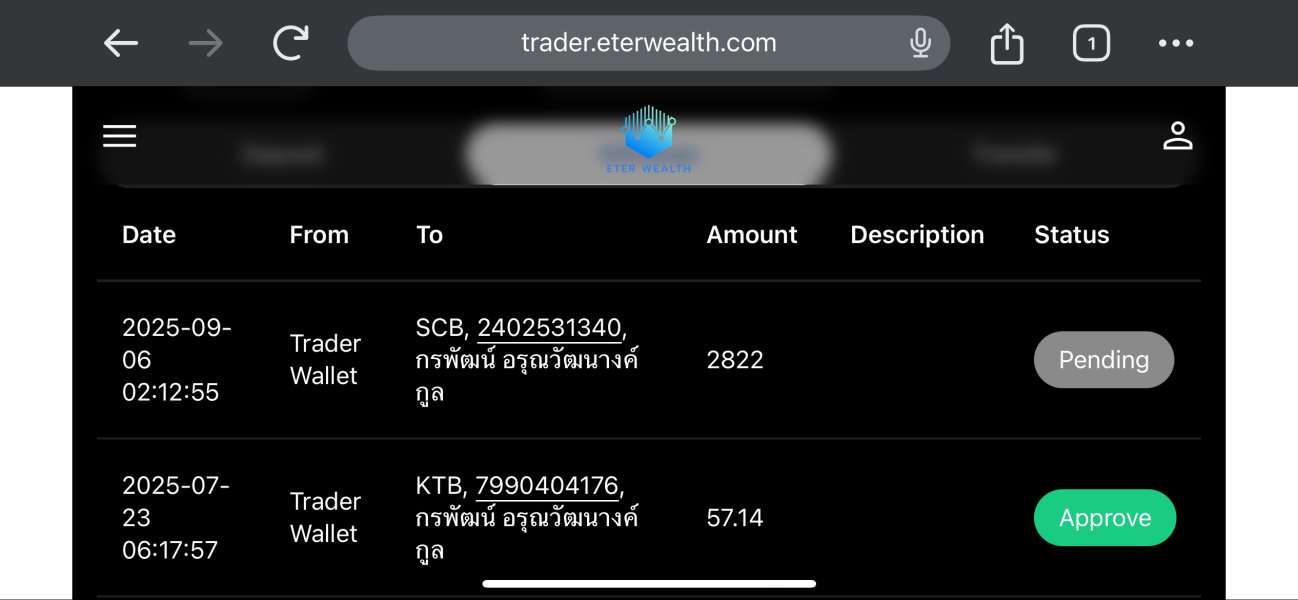

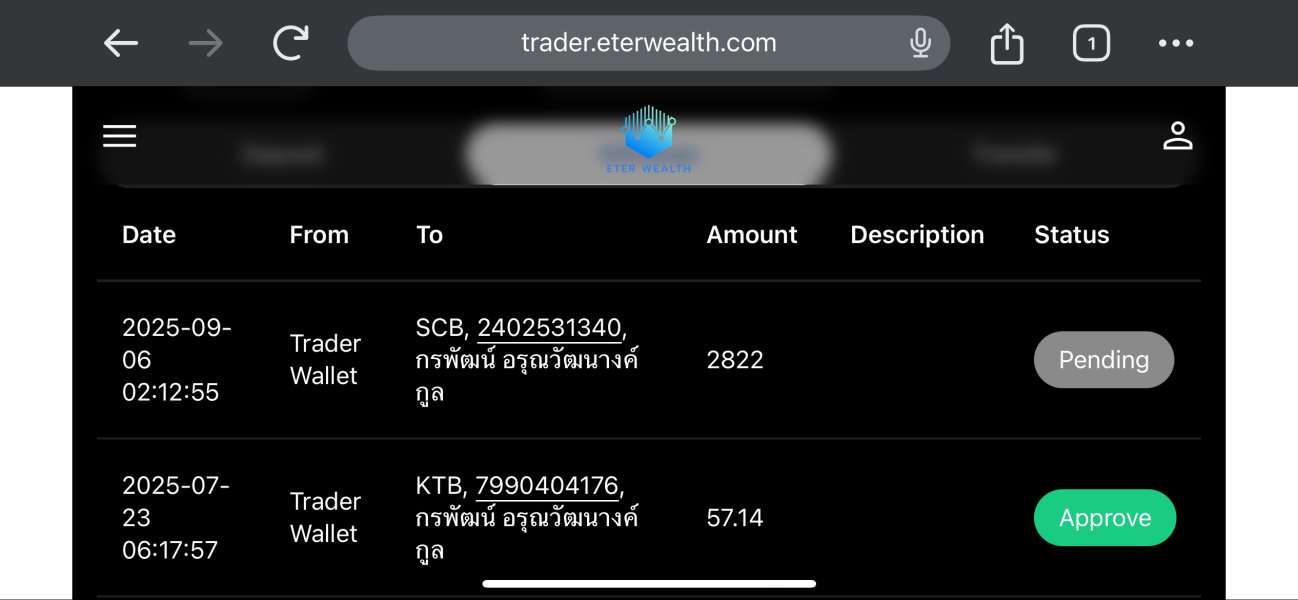

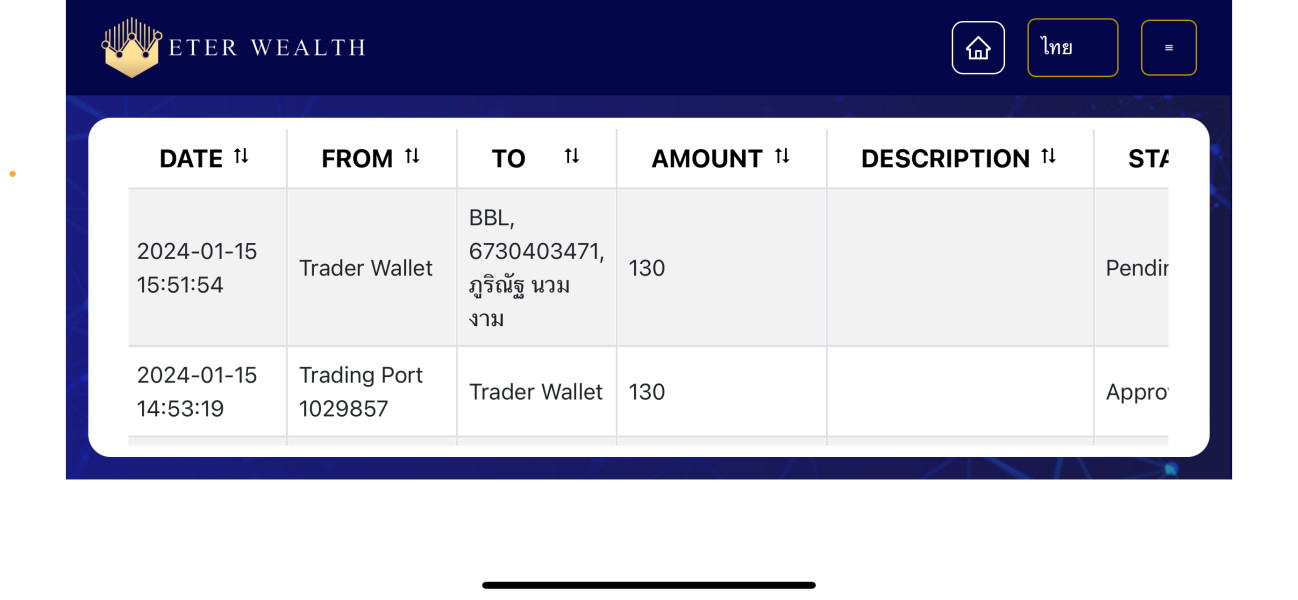

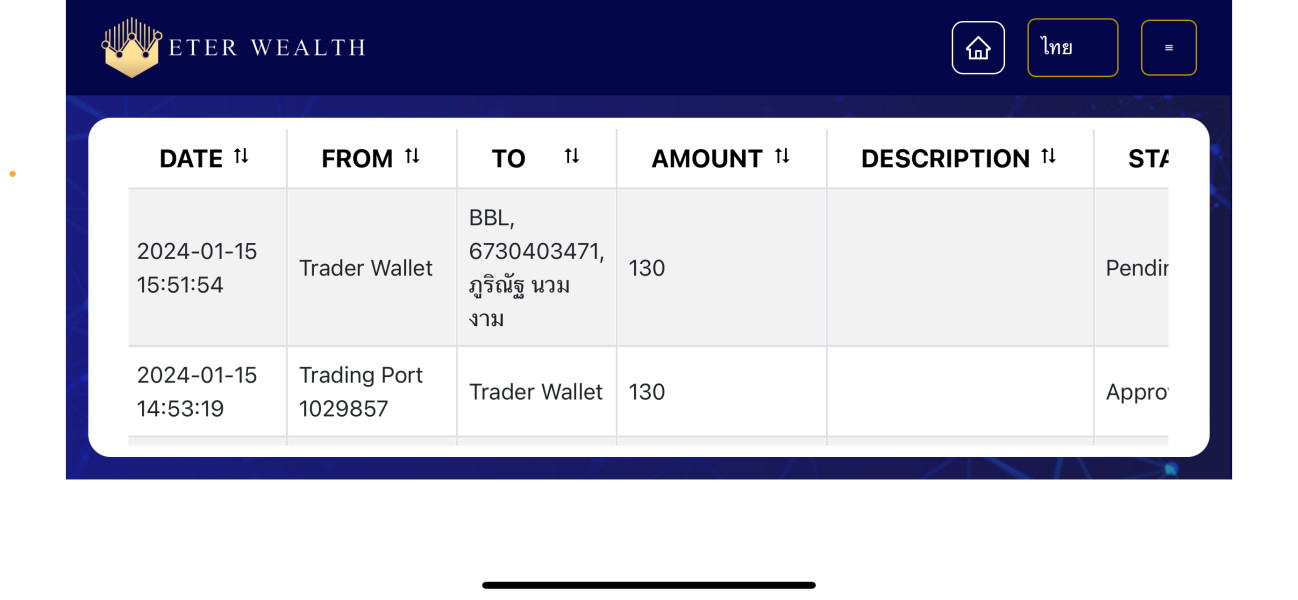

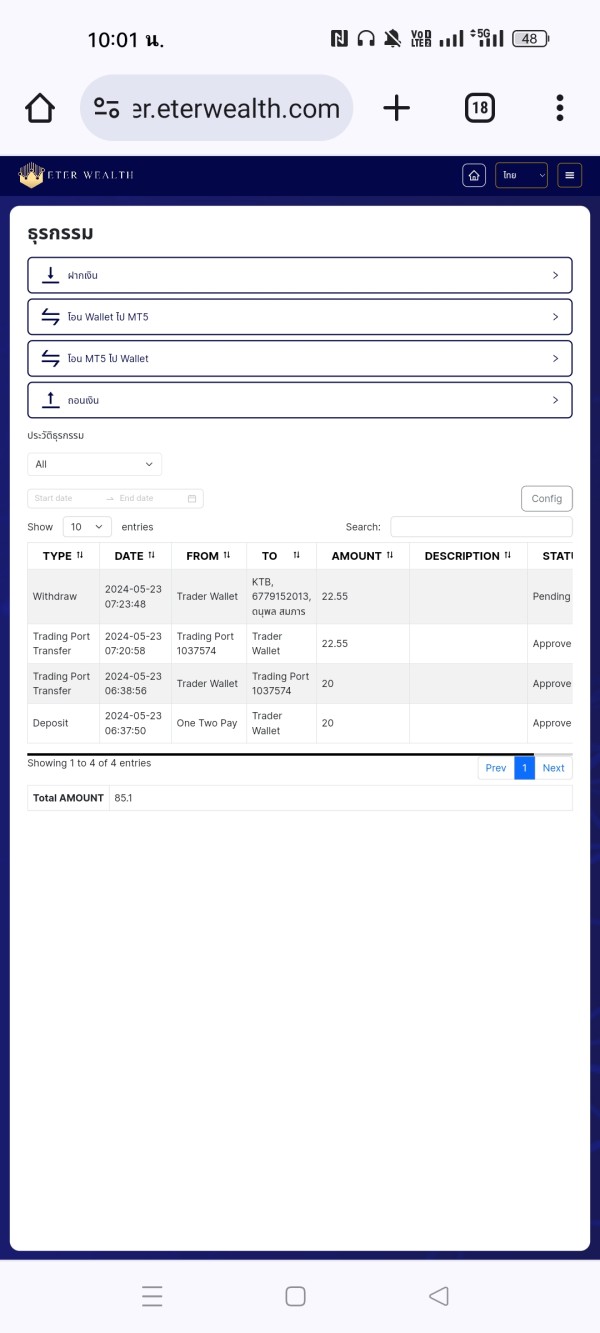

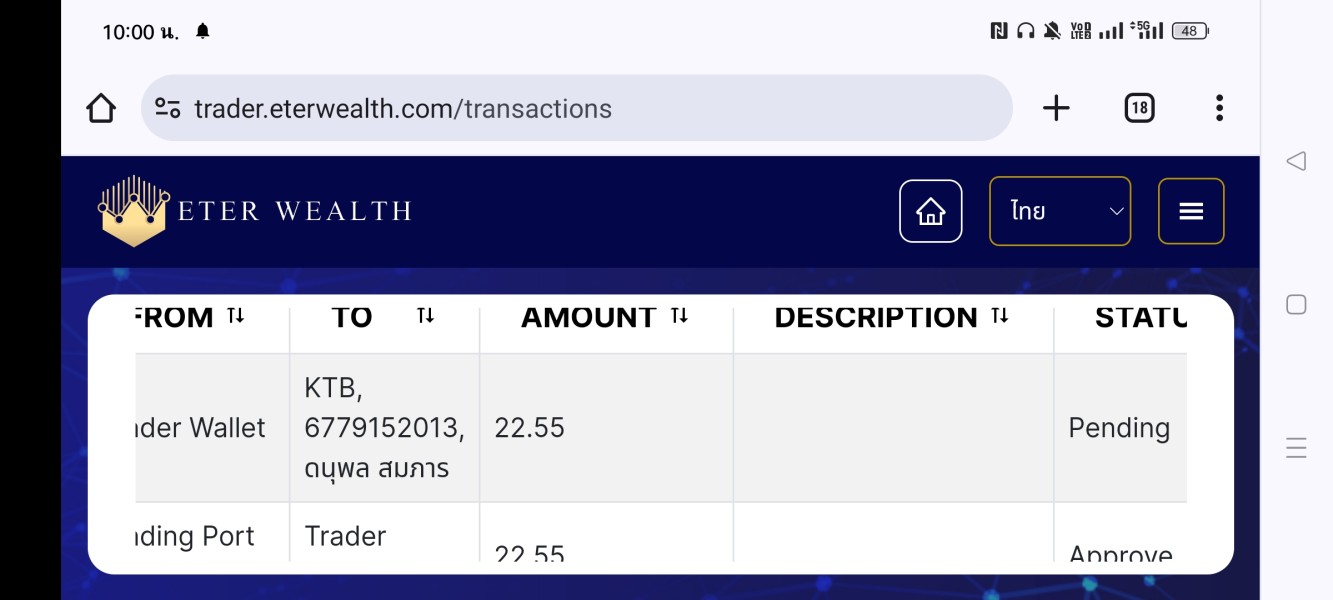

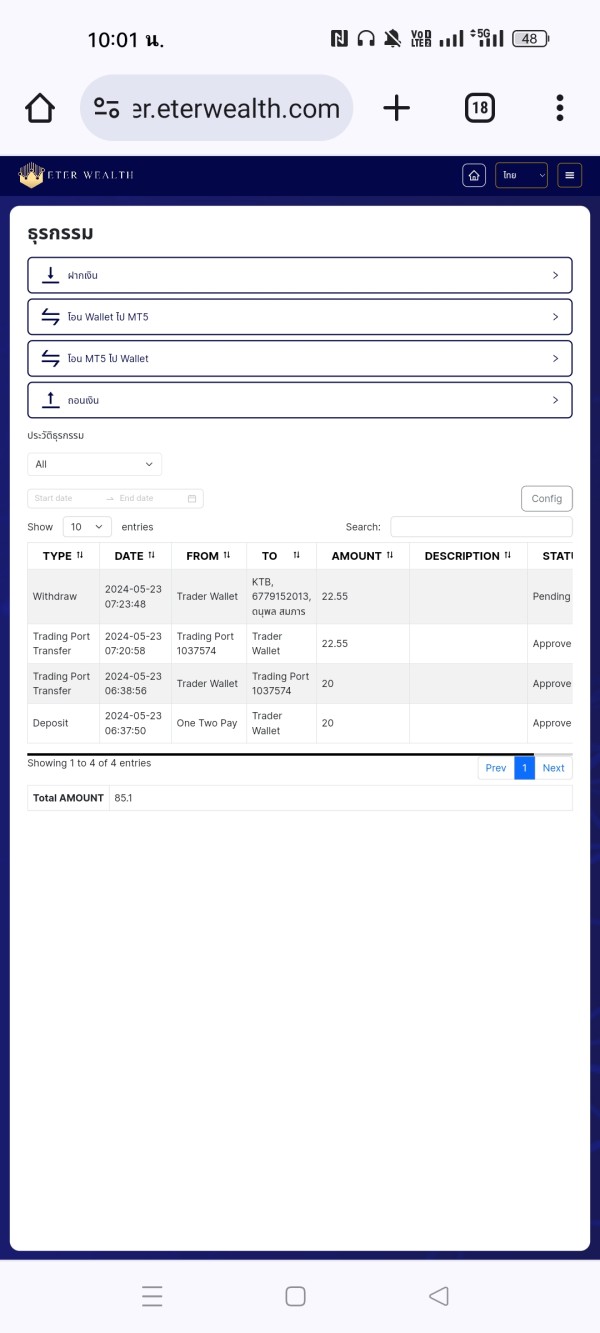

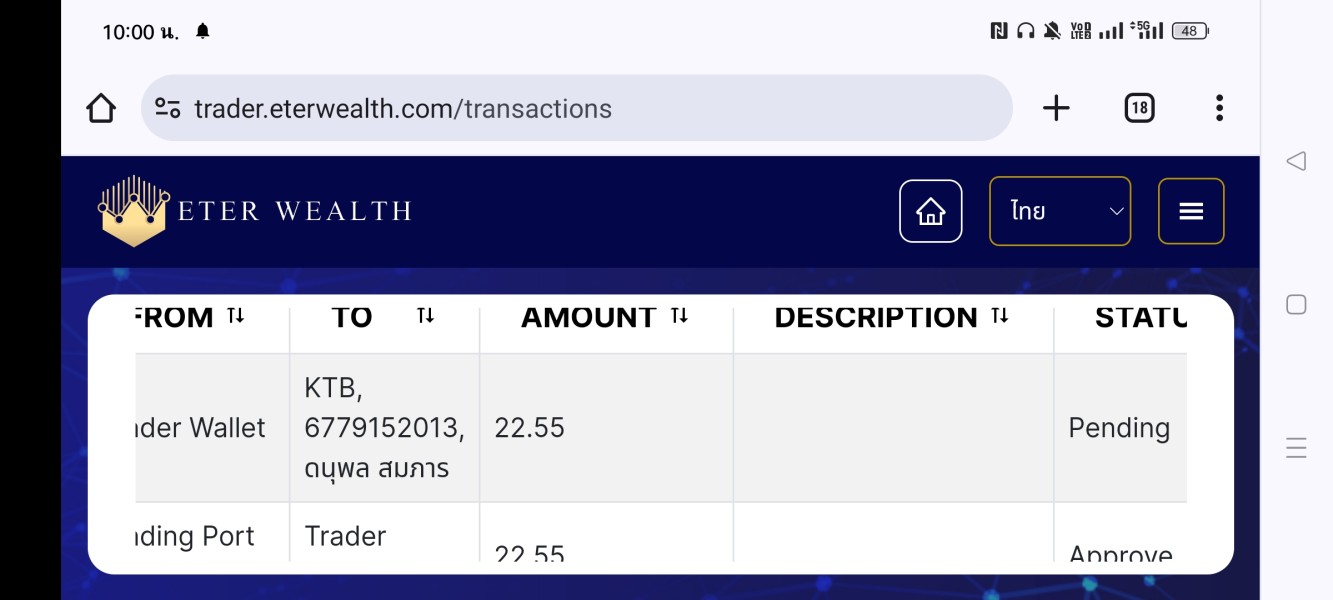

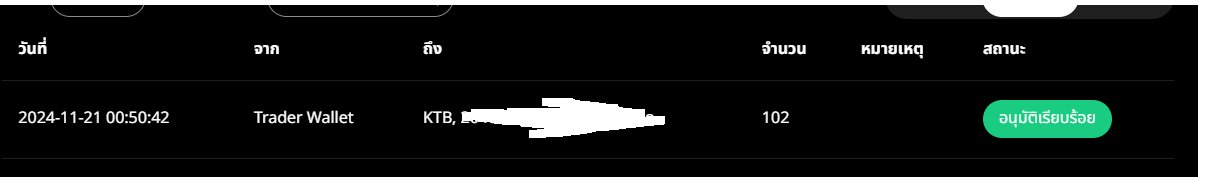

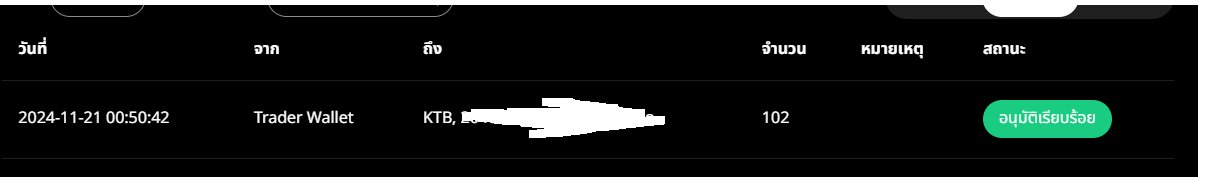

Fund operation experiences, including deposit processing times, withdrawal procedures, and associated fees, are not documented in the reviewed materials. These operational aspects significantly impact user satisfaction and represent critical factors in overall broker evaluation.

The absence of detailed user testimonials, case studies, or specific feedback categories makes it difficult to understand what aspects of the service might be working well versus areas requiring improvement. The low user rating combined with limited feedback detail suggests potential clients should seek additional user experience information. This can be done through direct broker contact or alternative review sources before making account opening decisions.

Conclusion

This eterwealth review reveals a broker with both attractive features and significant information gaps that potential clients must carefully consider. Eterwealth offers competitive trading conditions including exceptionally low minimum deposits ($20) and high leverage (1:1000). This makes it potentially suitable for traders seeking accessible entry points and maximum capital efficiency.

The broker appears most appropriate for beginning traders attracted to low entry barriers and experienced traders comfortable with high-leverage trading in less regulated environments. However, the low user satisfaction rating of 13.5 and limited transparency regarding crucial operational details suggest considerable caution is warranted.

Key advantages include: low minimum deposits, high leverage availability, and MT5 platform access. Primary concerns encompass: limited transparency about customer service, unclear fund protection measures, insufficient user experience documentation, and below-average satisfaction ratings. Prospective clients should conduct thorough due diligence and consider requesting detailed information directly from the broker before proceeding with account opening.