Regarding the legitimacy of Allianz forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is Allianz safe?

Risk Control

Software Index

Is Allianz markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Allianz Global Investors Asia Pacific Limited

Effective Date:

2015-06-01Email Address of Licensed Institution:

APCSHK.Biz-Compliance@allianzgi.comSharing Status:

No SharingWebsite of Licensed Institution:

https://hk.allianzgi.comExpiration Time:

--Address of Licensed Institution:

32/F, Two Pacific Place, 88 Queensway, Admiralty, Hong KongPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Allianz Safe or Scam?

Introduction

Allianz, officially known as Allianz Global Investors Asia Pacific Limited, is a financial investment service company based in Hong Kong. The firm operates within the foreign exchange (Forex) market, providing a variety of financial instruments and services to its clients. With the rise of online trading, many investors are drawn to the potential for profit but must navigate a landscape rife with risks and potential scams. Therefore, it is essential for traders to carefully evaluate the legitimacy and safety of their chosen broker. This article investigates the safety of Allianz by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk factors, aiming to provide a comprehensive assessment of whether Allianz is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a Forex broker is a critical factor in assessing its safety and legitimacy. Allianz is regulated by the Securities and Futures Commission (SFC) in Hong Kong, which is known for its stringent regulatory framework. Below is a summary of the core regulatory information for Allianz:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | 230/14 | Hong Kong | Verified |

The SFC's oversight is significant as it ensures that Allianz adheres to industry standards, promoting transparency and accountability. However, while regulation provides a level of trust, it is also essential to consider the broker's historical compliance record. Reports indicate that Allianz has faced some negative feedback regarding customer withdrawals and alleged fraud, raising concerns about its operational reliability. Therefore, while Allianz is regulated, potential clients should remain vigilant and conduct thorough research to ascertain if Allianz is safe for their trading activities.

Company Background Investigation

Allianz was founded in 1998 and has since established itself as a notable player in the financial services sector in Asia. The company is owned by Allianz Global Investors, a part of the broader Allianz Group, which is a well-known global insurance and asset management firm. The management team at Allianz comprises experienced professionals with backgrounds in finance and investment, contributing to the company's credibility.

However, the level of transparency in Allianz's operations has been questioned. While the company provides basic information about its services, detailed disclosures about its financial health, ownership structure, and management profiles are limited. This lack of comprehensive information can be a red flag for potential investors, leading to doubts about whether Allianz is safe or if it operates with a degree of opacity that could indicate underlying issues.

Trading Conditions Analysis

Allianz offers a variety of trading conditions, including access to major currency pairs, commodities, and CFDs. Understanding the cost structure is vital for traders to evaluate the broker's competitiveness. Below is a comparison of the core trading costs associated with Allianz:

| Cost Type | Allianz | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Variable, starting at 1.5 pips | 1.0 - 2.0 pips |

| Commission Model | No commissions on standard accounts | Varies (0 - 10 USD per lot) |

| Overnight Interest Range | Varies by pair | 2 - 5% |

The spreads offered by Allianz are slightly higher than the industry average, which could affect profitability for traders, especially those engaging in high-frequency trading. Additionally, the absence of a clear commission structure may lead to hidden fees that could impact overall trading costs. Therefore, potential clients should scrutinize these conditions to determine if Allianz is safe for their trading strategies.

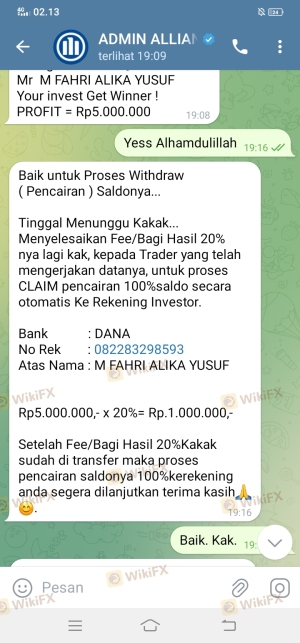

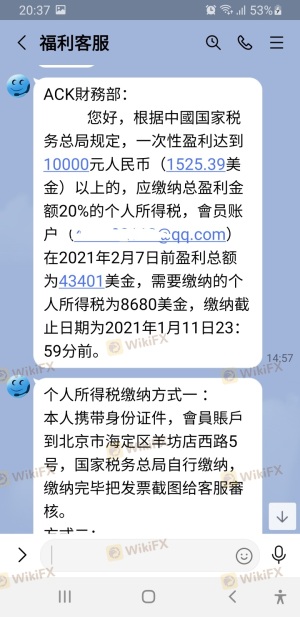

Customer Fund Safety

The safety of customer funds is paramount in the Forex trading environment. Allianz claims to implement robust security measures, including fund segregation and data protection policies. Segregating client funds from the companys operational funds is a regulatory requirement that helps protect clients in the event of insolvency. However, it is crucial to evaluate how effectively these measures are enforced.

Furthermore, Allianz has not publicly detailed any investor protection schemes, such as compensation funds that would safeguard clients' investments in case of broker failure. Historical complaints regarding withdrawal issues and allegations of fraud raise concerns about the actual implementation of these safety measures. Therefore, while Allianz appears to have some protective measures in place, the lack of transparency and historical complaints necessitate caution when assessing if Allianz is safe for trading.

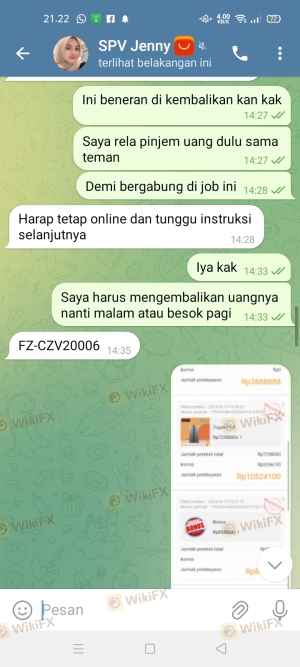

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of Allianz reveal a mixed bag of experiences, with some clients praising the broker's platform and services, while others report significant issues, particularly regarding withdrawals. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or no response |

| Account Blocking | Medium | Inconsistent communication |

| Misleading Promotions | High | Limited accountability |

Several users have reported being unable to withdraw their funds after making deposits, which is a significant concern that could indicate potential fraud. The responsiveness of the company to these complaints has also been criticized, with many users feeling neglected. Such patterns of negative feedback raise questions about whether Allianz is safe for potential investors.

Platform and Trade Execution

The trading platform offered by Allianz is a critical aspect of the trading experience. Users have reported that the platform is generally stable and user-friendly, but there are concerns regarding order execution quality. Instances of slippage and rejections have been noted, which can adversely affect trading outcomes. Additionally, there are no indications of platform manipulation; however, the lack of transparency regarding execution policies leaves room for doubt.

Traders should consider the reliability of the platform, as any issues with execution can lead to significant financial losses. Therefore, potential clients must assess the platform's performance and reliability to determine if Allianz is safe for their trading endeavors.

Risk Assessment

Using Allianz as a trading platform comes with inherent risks. Below is a summary of key risk categories associated with trading through Allianz:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Regulated but with negative reviews |

| Financial Risk | High | Complaints about withdrawal issues |

| Operational Risk | Medium | Platform stability concerns |

To mitigate these risks, potential traders are advised to start with small amounts, utilize risk management strategies, and remain informed about the broker's operational practices. Conducting thorough due diligence before engaging with Allianz is crucial to understanding whether Allianz is safe for trading.

Conclusion and Recommendations

In summary, while Allianz is regulated by the SFC in Hong Kong, various factors raise concerns about its overall safety and reliability. The presence of negative customer feedback, particularly regarding withdrawal issues, combined with a lack of transparency in operations, suggests that potential clients should approach with caution.

For traders looking for a reliable Forex broker, it may be prudent to consider alternatives that have a stronger track record of customer satisfaction and transparency. Brokers with solid regulatory frameworks, positive user feedback, and clear fee structures are recommended for those seeking a safer trading environment. Ultimately, careful evaluation and due diligence are essential in determining if Allianz is safe for your trading needs.

Is Allianz a scam, or is it legit?

The latest exposure and evaluation content of Allianz brokers.

Allianz Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Allianz latest industry rating score is 6.95, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.95 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.