Regarding the legitimacy of ColmexPRO forex brokers, it provides CYSEC, FSCA and WikiBit, (also has a graphic survey regarding security).

Is ColmexPRO safe?

Risk Control

License

Is ColmexPRO markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 20

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Colmex Pro Ltd

Effective Date:

2010-10-19Email Address of Licensed Institution:

info@colmexpro.comSharing Status:

No SharingWebsite of Licensed Institution:

www.colmexpro.com, www.colmex.comExpiration Time:

--Address of Licensed Institution:

117 Makariou III Avenue & Sissifou Street, Quarter of Apostoloi Petrou & Pavlou, 3021 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 030 036Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

COLMEX PRO LIMITED

Effective Date: Change Record

2016-10-11Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

117 MAKARIOU III AVENUE & SISSIFOU STREE QUARTER OF APOSTOLOI PETROU & PAVLOU 3021 LIMASSOL CYPRUS 3021Phone Number of Licensed Institution:

+357 250 30036Licensed Institution Certified Documents:

Is Colmex Pro A Scam?

Introduction

Colmex Pro is a forex and CFD broker based in Cyprus, established in 2010. It positions itself as a professional trading platform catering to both retail and institutional traders, offering a range of trading instruments including forex, stocks, commodities, and indices. Given the complexity and risks associated with trading in the forex market, it is crucial for traders to perform thorough due diligence when selecting a broker. This article aims to provide a comprehensive analysis of Colmex Pro, evaluating its regulatory status, company background, trading conditions, and customer experiences to determine its legitimacy and safety for traders. The investigation draws upon multiple sources, including regulatory filings, user reviews, and expert analyses, ensuring a balanced and objective assessment.

Regulation and Legitimacy

Regulation is a key factor in assessing the credibility of a forex broker. Colmex Pro is regulated by the Cyprus Securities and Exchange Commission (CySEC) and is also registered with the Financial Sector Conduct Authority (FSCA) in South Africa. This dual regulation is significant, as it indicates that the broker is subject to the stringent compliance standards set by these authorities, aimed at protecting investors and ensuring fair trading practices.

| Regulator | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| CySEC | 123/10 | Cyprus | Verified |

| FSCA | 46990 | South Africa | Verified |

The presence of a regulatory body like CySEC, which mandates strict operational guidelines, enhances the broker's credibility. Furthermore, Colmex Pro is a member of the Investor Compensation Fund, which provides additional protection for clients in case of insolvency, covering claims up to €20,000. However, it is essential to note that while regulation adds a layer of security, it does not guarantee the quality of service or the absence of issues, as evidenced by mixed reviews from users.

Company Background Investigation

Colmex Pro Ltd. has been operational since 2010, with its headquarters in Limassol, Cyprus. The company has developed a reputation for providing a range of trading services, including access to various financial markets and advanced trading platforms. The ownership structure of Colmex Pro is not extensively detailed in public sources, which may raise questions about transparency. However, the management team comprises experienced professionals from the finance and technology sectors, contributing to the broker's operational integrity.

In terms of transparency, Colmex Pro publishes relevant information about its services, trading conditions, and regulatory compliance on its website. However, the lack of detailed information regarding its ownership and management structure may be a concern for some traders. Overall, while Colmex Pro appears to be a legitimate broker, the level of transparency could be improved to foster greater trust among potential clients.

Trading Conditions Analysis

Colmex Pro offers a variety of trading accounts, each with different minimum deposit requirements and fee structures. The broker's fee structure is generally competitive, but it is essential for traders to understand the associated costs before committing funds.

| Fee Type | Colmex Pro | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.8 - 1.4 pips | 0.5 - 1.0 pips |

| Commission Model | $1.50 - $15 per lot | $5 - $10 per lot |

| Overnight Interest Range | 0.026% per day | 0.02% - 0.05% per day |

The spreads offered by Colmex Pro can be higher than the industry average, which might impact trading profitability, especially for those engaging in high-frequency trading. Additionally, the commission structure varies depending on the account type, which can lead to confusion for new traders. The broker does not charge deposit fees, but withdrawal fees can be as high as $40 after the first free transaction of the month, which could be considered excessive compared to competitors.

Client Fund Safety

Client fund safety is paramount when selecting a broker. Colmex Pro employs several measures to ensure the security of client funds, including segregated accounts that keep traders' funds separate from the broker's operating capital. This practice is essential for protecting client assets in the event of financial difficulties faced by the broker.

Colmex Pro also participates in the Investor Compensation Fund, which provides additional security for traders' funds. The broker's commitment to using reputable banks for fund storage further enhances the safety of client deposits. However, there have been reports of withdrawal issues and delays experienced by some clients, raising concerns about the broker's operational efficiency in handling funds.

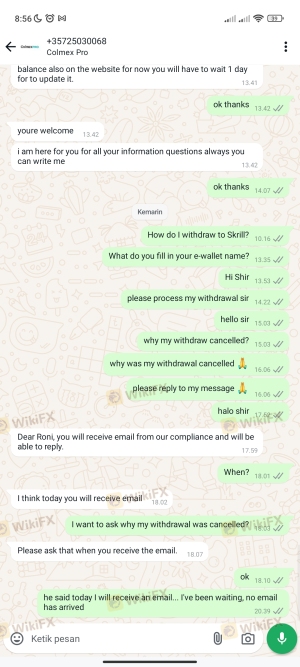

Customer Experience and Complaints

Customer feedback is a critical aspect of evaluating a broker's reliability. Colmex Pro has received mixed reviews from users, with some praising its trading platform and execution speed, while others have reported issues with customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow, often unresponsive |

| Customer Service Issues | Medium | Mixed responses, lack of live chat |

| Account Management Problems | High | Unresolved for extended periods |

Typical complaints include withdrawal delays, where clients have reported waiting weeks for their funds to be processed. In some cases, users have claimed that their accounts were frozen or that they faced unexplained charges when attempting to withdraw profits. These issues highlight the importance of assessing a broker's customer support quality and responsiveness, which appears to be a significant concern for many users.

Platform and Execution

Colmex Pro offers several trading platforms, including its proprietary Colmex Pro 2.0 and the widely used MetaTrader 4 (MT4). Users generally report a positive experience with the trading platforms, noting their stability and user-friendly interfaces. However, concerns have been raised regarding order execution quality, particularly during volatile market conditions, where slippage and order rejections can occur.

The average execution time is reported to be around 31 milliseconds, which is competitive; however, some users have reported instances of slippage that could affect trading outcomes. Overall, while the platform is robust, traders should remain vigilant during high volatility periods.

Risk Assessment

Trading with Colmex Pro involves several risks, which need to be carefully considered by potential clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | While regulated, there are concerns about transparency and withdrawal issues. |

| Financial Risk | High | Leverage can amplify both profits and losses; traders should be cautious. |

| Operational Risk | Medium | Reports of withdrawal delays and customer service issues may impact user experience. |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform and trading conditions. Additionally, it is advisable to trade only with funds that one can afford to lose, given the inherent volatility in forex trading.

Conclusion and Recommendations

In conclusion, while Colmex Pro is a regulated broker with a broad range of trading instruments and competitive platforms, there are notable concerns regarding its customer service and withdrawal processes. The regulatory oversight by CySEC and the membership in the Investor Compensation Fund provide a level of security for traders. However, the mixed reviews and reports of withdrawal issues warrant caution.

For traders considering Colmex Pro, it is essential to assess their individual trading needs and risk tolerance. Those who prioritize strong customer support and quick withdrawal processes may want to explore alternative brokers with better reputations in these areas. Recommended alternatives include brokers with a solid track record in customer service and transparent fee structures, such as IG Markets or OANDA, which may offer more reliable trading experiences.

Is ColmexPRO a scam, or is it legit?

The latest exposure and evaluation content of ColmexPRO brokers.

ColmexPRO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ColmexPRO latest industry rating score is 7.79, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.79 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.