BlackRock 2025 Review: Everything You Need to Know

Executive Summary

BlackRock is one of the world's biggest asset management companies. It commands strong respect in the global financial market and has built a solid reputation over many years. This blackrock review shows a company with huge market presence and high employee satisfaction scores. BlackRock was founded in 1988. The company has its main office in New York and has become a leader in investment management and technology services, helping both individual people and big institutions reach their financial goals.

According to AdvisorSearch, BlackRock manages $508 billion in assets under management. This shows the huge scale and trust that investors around the world place in the company. Employee satisfaction data from Glassdoor shows that 73% of BlackRock workers would tell their friends to work there too. This suggests the company has a good culture and work environment. The company focuses mainly on complete investment management services across many different types of assets. This makes BlackRock a full-service provider for clients who want professional investment help and technology solutions.

BlackRock's main customers are individual and institutional investors who want smart investment management and technology services. The company has been around since 1988 and manages a lot of money, which makes it very appealing to clients who care about financial health and professional investment help.

Important Notice

This review uses information that anyone can find about BlackRock's company structure, employee feedback, and business model. The information does not give specific regulatory details or complete trading platform information that you would normally find in traditional forex broker reviews.

Our review method includes looking at employee ratings, company history, and business model assessment. But readers should know that specific trading conditions, platform features, and detailed regulatory information are not covered in the sources we had available for this review.

Rating Framework

Company Overview

BlackRock started in 1988 and has grown to become a global leader in asset management. The company has its main headquarters in New York, which gives it a strategic location in the financial world. BlackRock was founded with a mission to help individuals and institutions achieve financial health through complete investment management and cutting-edge technology services. Over its 37-year history, the company has built a strong reputation for professional investment management across many different types of assets, making itself a trusted partner for clients who want smart financial solutions.

The company's business model focuses on giving complete investment management services that cover multiple asset classes and investment strategies. BlackRock combines traditional investment management with new technology services. This creates a platform that serves both individual investors and large institutional clients. According to available information, the company manages $508 billion in assets. This shows the huge trust and confidence that clients worldwide place in BlackRock's investment abilities. This large asset base proves the company can attract and keep client investments across different market conditions and economic cycles.

While specific details about trading platform types and particular asset categories are not explained in the available source materials, BlackRock stays focused on investment management and technology services. The blackrock review shows a company that has successfully positioned itself as a complete solution provider in the investment management space. However, specific regulatory oversight information is not specified in the current information summary.

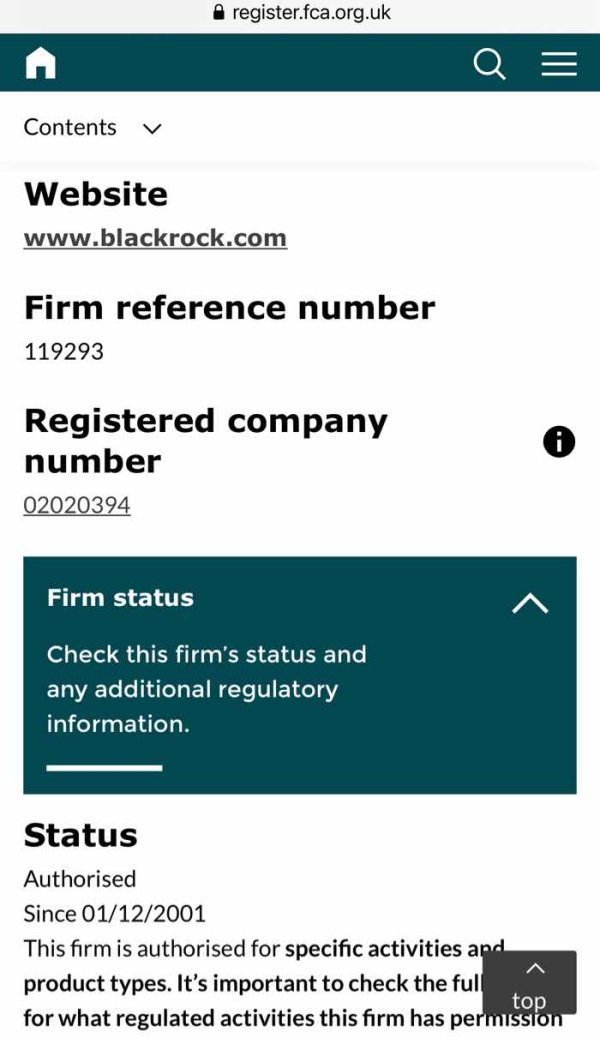

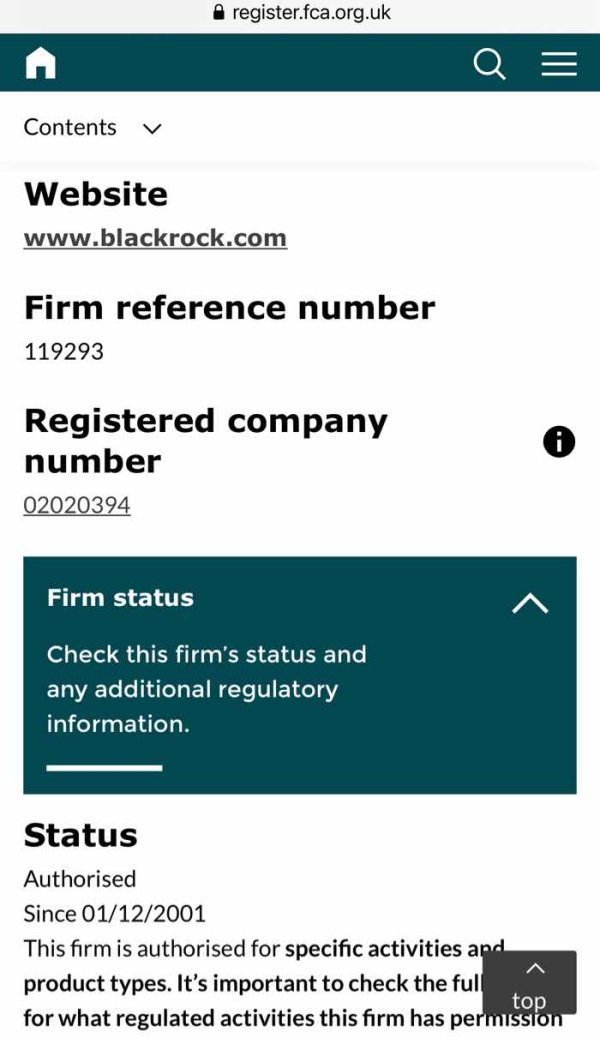

Regulatory Oversight

The available information does not specify particular regulatory agencies or areas where BlackRock operates. As a major asset management firm, it likely operates under multiple regulatory frameworks around the world.

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods for BlackRock's services is not detailed in the available source materials.

Minimum Investment Requirements

The information does not provide details about minimum investment amounts or account opening requirements.

Current promotional offers or bonus programs are not specified in the available source materials for this blackrock review.

Available Assets

While BlackRock focuses on investment management across multiple asset classes, specific tradeable assets and investment options are not detailed in the current information.

Cost Structure

Information about fees, expense ratios, management costs, or other pricing structures is not provided in the available source materials.

Leverage Options

Leverage ratios and margin requirements are not specified in the current information.

Specific trading platforms or technology interfaces offered by BlackRock are not detailed in the available source materials.

Geographic Restrictions

Regional limitations or availability restrictions are not mentioned in the current information.

Customer Service Languages

Available customer service languages are not specified in the source materials.

Detailed Rating Analysis

Account Conditions Analysis

The available information for this blackrock review does not give specific details about account types, structures, or conditions that BlackRock offers. Traditional account opening processes, minimum deposit requirements, and special account features such as Islamic accounts are not detailed in the current source materials. Without specific information about account tiers, benefits, or requirements, it becomes hard to judge how competitive and accessible BlackRock's account offerings are.

The lack of detailed account condition information in the available sources suggests that potential clients would need to contact BlackRock directly or look at other resources to understand specific account requirements and benefits. This information gap makes it hard to assess how BlackRock's account conditions compare to other investment management firms. It also makes it difficult to determine if the accounts would work well for different types of investors.

For a complete review of account conditions, investors would benefit from talking directly with BlackRock representatives. These representatives can give detailed information about account structures, minimum investment requirements, fee schedules, and any special account features that may be available.

The current information does not give specific details about trading tools, research resources, or analytical capabilities that BlackRock offers. While the company says it provides investment management and technology services, the particular tools, research platforms, market analysis resources, and educational materials are not detailed in the available source materials.

Given BlackRock's substantial $508 billion in assets under management, it's reasonable to expect sophisticated tools and resources. But the specific nature, quality, and accessibility of these resources cannot be judged based on the current information summary. Research capabilities, market analysis tools, educational resources such as webinars or tutorials, and automated trading support features are not specified in the available materials.

The absence of detailed information about tools and resources represents a big information gap for potential clients. These clients need to understand what analytical and educational support they would receive as BlackRock clients. This limitation makes it hard to compare BlackRock's offerings with other investment management firms or to assess whether the available tools would meet specific investor needs.

Customer Service and Support Analysis

Specific information about customer service channels, availability, response times, and service quality is not provided in the available source materials for this review. While the employee satisfaction data showing 73% of staff would recommend BlackRock to friends suggests a positive internal culture, this doesn't directly translate to customer service quality metrics.

The information lacks details about customer service channels such as phone support, email assistance, live chat options, or in-person consultation availability. Response time expectations, service hours, time zone coverage, and multilingual support capabilities are not specified in the current materials. Without this information, it's hard to judge how effectively BlackRock serves its client base. It's also difficult to know how accessible support services are for different types of investors.

Professional service quality, problem resolution capabilities, and customer satisfaction metrics are not detailed in the available sources. The absence of specific customer service information makes it difficult for potential clients to understand what level of support they can expect. It also makes it hard to know how BlackRock's service compares to other investment management firms in the industry.

Trading Experience Analysis

The available information does not give specific details about platform stability, execution quality, or user interface characteristics that would typically define the trading experience. While BlackRock offers investment management and technology services, the particular aspects of platform performance, order execution quality, charting tools, technical indicators, and mobile application functionality are not detailed in the current source materials.

Platform reliability, speed of execution, slippage rates, and requote situations are not addressed in the available information. The stability of spreads, liquidity conditions, and overall trading environment characteristics cannot be judged based on the current blackrock review source materials. Mobile trading capabilities and app performance metrics are similarly not specified.

Without specific information about the trading experience, it becomes hard for potential clients to understand what to expect from BlackRock's technology platforms. It also makes it difficult to know how the user experience compares to other investment management firms. This information gap is particularly significant for clients who prioritize platform functionality and trading experience in their investment management decisions.

Trust and Reliability Analysis

While BlackRock's substantial $508 billion in assets under management suggests significant client trust, the available information does not give specific details about regulatory licenses, oversight agencies, or compliance frameworks. Fund segregation policies, insurance coverage, and other client protection measures are not detailed in the current source materials.

Company transparency regarding financial reporting, management structure, and operational procedures is not specifically addressed in the available information. Industry recognition, awards, or third-party ratings that would typically support trust and reliability assessments are not mentioned in the current summary. The handling of any negative events or regulatory issues is not covered in the available materials.

The absence of specific regulatory and compliance information makes it hard to fully judge BlackRock's trustworthiness and reliability compared to industry standards. While the company's longevity since 1988 and substantial asset base suggest stability, detailed regulatory oversight and client protection information would be necessary for a complete trust assessment.

User Experience Analysis

Overall user satisfaction metrics, interface design quality, and ease of use characteristics are not specifically detailed in the available source materials. While the positive employee satisfaction data (73% would recommend to friends) suggests a well-managed organization, this doesn't directly correlate to client user experience metrics.

Registration processes, account verification procedures, and onboarding experiences are not described in the current information. Fund deposit and withdrawal experiences, processing times, and convenience factors are not specified. Common user complaints or frequently mentioned issues are not detailed in the available materials.

The lack of specific user experience information makes it difficult to determine what type of investors would be best suited for BlackRock's services. It also makes it hard to identify potential areas where the user experience might need improvement. Without direct user feedback or experience metrics, potential clients cannot easily assess whether BlackRock's platform and services would meet their specific usability and convenience requirements.

Conclusion

This blackrock review reveals a company with strong market presence and positive internal culture. This is shown by its $508 billion in assets under management and 73% employee recommendation rate. However, the available information lacks complete details about specific trading conditions, platform features, and user experience metrics that would typically be essential for a complete evaluation.

BlackRock appears most suitable for institutional and individual investors seeking professional investment management services from an established firm with substantial market credibility. The company's 37-year history and significant asset base suggest stability and client trust. This makes it potentially attractive for investors who prioritize established track records and professional management.

The main advantages include BlackRock's strong market position, substantial assets under management, and positive employee culture indicators. However, the significant limitation lies in the lack of transparent information about specific service conditions, platform capabilities, and detailed client experience metrics. This makes comprehensive comparison with other investment management firms challenging for potential clients.