Regarding the legitimacy of Morgan Stanley forex brokers, it provides CIRO and WikiBit, (also has a graphic survey regarding security).

Is Morgan Stanley safe?

Business

Risk Control

Is Morgan Stanley markets regulated?

The regulatory license is the strongest proof.

CIRO Derivatives Trading License (EP)

Canadian Investment Regulatory Organization

Canadian Investment Regulatory Organization

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Morgan Stanley Canada Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

www.morganstanley.comExpiration Time:

--Address of Licensed Institution:

181 Bay Street Suite 3700, P.O. Box 776 Toronto ON M5J 2T3Phone Number of Licensed Institution:

416-943-8400Licensed Institution Certified Documents:

Is Morgan Stanley Safe or a Scam?

Introduction

Morgan Stanley is a prominent global financial services firm with a significant presence in the forex market. Established in 1935, it has evolved into a major player in investment banking, wealth management, and investment management. Given its stature, traders and investors often seek to understand whether Morgan Stanley is a safe choice for their financial dealings or if there are underlying issues that could indicate a scam. In the volatile world of forex trading, where the stakes are high, it is crucial for traders to exercise caution and conduct thorough evaluations of their brokers. This article aims to provide a comprehensive assessment of Morgan Stanley's credibility, safety, and any potential red flags that may arise.

To gather insights, this evaluation draws upon various sources, including regulatory filings, customer reviews, and expert analyses. The assessment framework focuses on several key areas: regulatory compliance, company background, trading conditions, client fund safety, customer experience, platform performance, and overall risk assessment.

Regulation and Legitimacy

One of the cornerstones of any brokerage's credibility is its regulatory status. Morgan Stanley is regulated by multiple authorities, including the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) in the United States, as well as the Canadian Investment Regulatory Organization (CIRO) in Canada. The firm holds various licenses that allow it to operate within these jurisdictions, ensuring that it adheres to strict regulatory standards designed to protect investors.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| SEC | 801-70103 | USA | Verified |

| FINRA | 149777 | USA | Verified |

| CIRO | N/A | Canada | Verified |

The quality of regulation is paramount, as it directly impacts the broker's accountability and operational integrity. Morgan Stanley's long history of compliance with regulatory standards enhances its legitimacy. However, there have been instances where the firm faced scrutiny over the actions of individual brokers, such as the case involving a former advisor who was implicated in a Ponzi scheme. While these incidents raise concerns, they do not inherently indicate that Morgan Stanley as a whole is a scam. Instead, they highlight the importance of oversight and the need for investors to remain vigilant.

Company Background Investigation

Morgan Stanley's history is rich and complex, reflecting its growth and adaptation in the financial sector. Founded during the Great Depression, the firm was established to provide investment banking services separate from commercial banking, in line with the Glass-Steagall Act. Over the decades, Morgan Stanley has expanded its services and footprint, acquiring various firms and enhancing its capabilities in wealth management and investment banking.

The ownership structure of Morgan Stanley is publicly traded, with shares listed on the New York Stock Exchange (NYSE). This transparency is a positive indicator of the company's reliability, as public companies are subject to rigorous reporting requirements. The management team comprises seasoned professionals with extensive experience in finance, which further supports the firm's credibility.

In terms of transparency, Morgan Stanley provides comprehensive disclosures about its financial performance and operational practices. The firm is required to file regular reports with the SEC, allowing investors to access vital information about its financial health and business activities. This level of transparency is essential for assessing whether Morgan Stanley is safe for traders and investors.

Trading Conditions Analysis

When evaluating whether Morgan Stanley is safe, it's crucial to consider its trading conditions, including fees and spreads. The firm's fee structure is competitive, offering various account types that cater to different trader needs. However, some users have reported unexpected fees, such as low balance charges and account maintenance fees, which can be a concern for smaller investors.

| Fee Type | Morgan Stanley | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 1.2 pips |

| Commission Model | Variable | Variable |

| Overnight Interest Range | 2.5% | 3.0% |

The overall cost of trading with Morgan Stanley is generally in line with industry averages, but potential clients should be aware of the specific terms associated with their accounts. While the firm does offer commission-free trading on certain platforms, additional fees may apply, and traders should carefully read the terms and conditions before opening an account. Understanding these costs is vital for assessing the overall value and safety of trading with Morgan Stanley.

Client Funds Safety

The safety of client funds is a critical aspect of evaluating whether Morgan Stanley is safe. The firm employs various measures to protect client assets, including segregating client funds from its operational capital. This practice ensures that client funds are not used for the firm's business operations, providing a layer of security in the event of financial difficulties.

Moreover, Morgan Stanley is a member of the Securities Investor Protection Corporation (SIPC), which protects customers in the event of a brokerage failure. SIPC coverage provides up to $500,000 in protection for cash and securities held in customer accounts, which adds an additional layer of safety for investors.

However, there have been historical instances where clients raised concerns about the handling of their funds, particularly in cases involving individual brokers. These incidents underscore the importance of due diligence and monitoring account activity to ensure that client funds are managed appropriately. Overall, while Morgan Stanley implements robust safety measures, clients should remain proactive in safeguarding their investments.

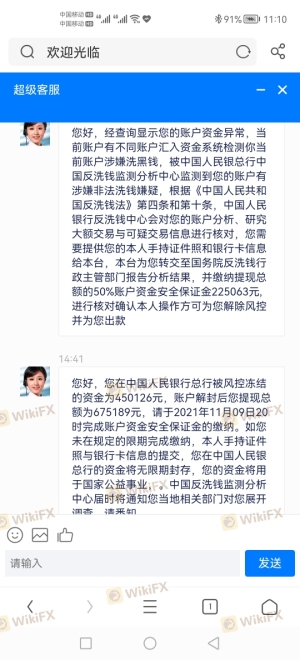

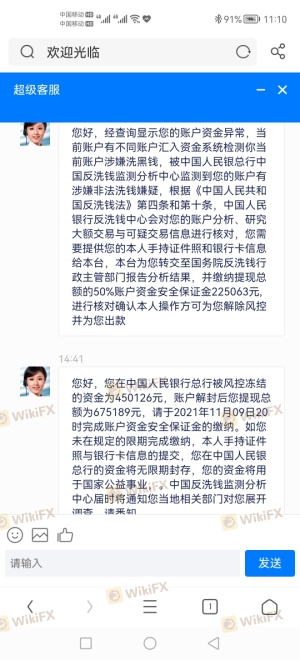

Customer Experience and Complaints

Analyzing customer feedback is essential in determining whether Morgan Stanley is safe. Reviews from clients reveal a mixed bag of experiences, with some praising the firm's advisory services and others expressing frustration over customer service and account management issues. Common complaints include slow response times, difficulty in accessing funds, and lack of communication from advisors.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Account Access Issues | High | Slow |

| Poor Customer Service | Medium | Inconsistent |

| Unexpected Fees | Low | Minimal |

Two notable case studies highlight the challenges faced by some clients. One client reported losing a significant amount due to a lack of timely advice during a market downturn, leading to substantial financial losses. Another client experienced difficulties in transferring funds out of their account, resulting in frustration and delays in accessing their money. These cases illustrate the importance of effective communication and timely support in ensuring a positive client experience.

Platform and Trade Execution

The performance of Morgan Stanley's trading platform is another critical factor in assessing whether it is safe. The firm offers a range of platforms tailored to different trading styles, including both web-based and mobile applications. Users generally report that the platforms are user-friendly and provide access to essential trading tools and resources.

However, there have been reports of execution delays and slippage during high volatility periods, which can impact trading outcomes. Traders should be aware of these potential issues and consider them when evaluating their trading strategies. Additionally, there have been no significant indications of platform manipulation, which is a positive sign for the integrity of the trading environment.

Risk Assessment

Using Morgan Stanley as a forex broker comes with inherent risks, as is the case with any financial institution. Understanding these risks is crucial for traders looking to protect their investments. Below is a summary of key risk categories associated with trading through Morgan Stanley:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Market Risk | High | Exposure to market fluctuations |

| Operational Risk | Medium | Potential for execution delays |

| Regulatory Risk | Low | Generally compliant with regulations |

To mitigate these risks, traders should employ sound risk management practices, such as setting stop-loss orders and diversifying their investment portfolios. Additionally, maintaining open communication with their advisors can help address any concerns that may arise.

Conclusion and Recommendations

In conclusion, the evidence suggests that Morgan Stanley is a legitimate financial services firm with a long-standing history and regulatory oversight. While there are occasional complaints and concerns raised by clients, these do not necessarily indicate that Morgan Stanley is a scam. Instead, they highlight areas where the firm can improve its customer service and communication.

For traders considering whether Morgan Stanley is safe, it is essential to weigh the pros and cons based on their individual needs and trading strategies. Those seeking a reputable broker with a solid regulatory foundation may find Morgan Stanley to be a suitable choice. However, it is advisable to remain vigilant and proactive in managing accounts and understanding the associated costs.

For those who may have reservations or have experienced issues with Morgan Stanley, alternative options such as Charles Schwab or Fidelity Investments may provide a more user-friendly experience with competitive trading conditions. Ultimately, conducting thorough research and due diligence is vital for ensuring a safe and successful trading experience.

Is Morgan Stanley a scam, or is it legit?

The latest exposure and evaluation content of Morgan Stanley brokers.

Morgan Stanley Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Morgan Stanley latest industry rating score is 5.11, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.11 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.