XNT 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive xnt review provides an in-depth analysis of XNT LTD. XNT is a financial services company that was established in 2011 and is regulated by the Malta Financial Services Authority. Based on available market data and user feedback, XNT receives a neutral overall assessment, reflecting both its strengths and limitations in the competitive forex brokerage landscape.

XNT's most notable feature is its extensive offering of over one million financial instruments. This provides traders with exceptional market access across the US, European Union, and Asia-Pacific regions through more than 50 markets. However, the broker's significantly high minimum deposit requirement of €50,000 positions it as a service primarily suited for well-capitalized traders rather than retail investors or beginners.

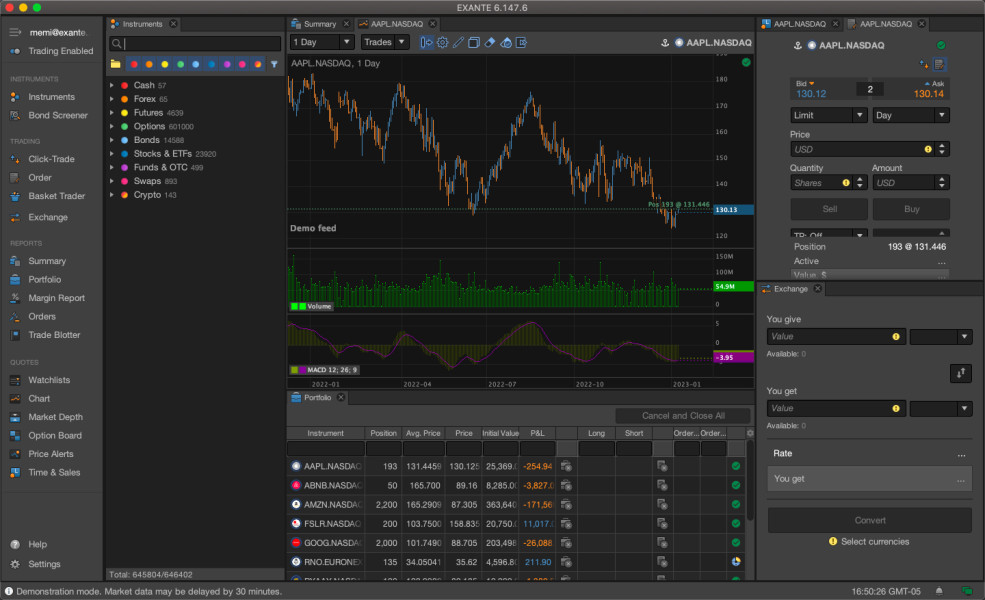

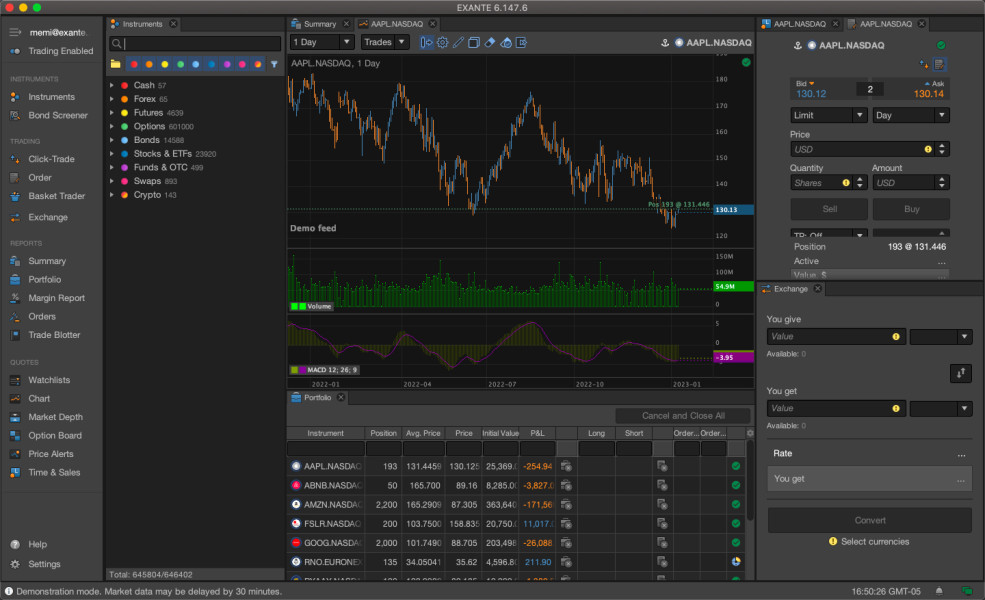

According to Forexbrokerz ratings, XNT maintains a user score of 3/5. This indicates mixed user experiences and highlights areas for potential improvement. The company operates through the EXANTE trading platform, offering direct market access to a diverse range of financial instruments including forex and CFDs. While the broker's regulatory status under MFSA provides a foundation of legitimacy, the limited transparency regarding trading conditions, customer service capabilities, and fee structures presents challenges for potential clients seeking comprehensive information before making investment decisions.

Important Notice

Traders should be aware that regulatory frameworks and available services may vary significantly across different jurisdictions where XNT operates. Due to the company's international presence spanning multiple regions including the US, European Union, and Asia-Pacific markets, users must carefully review the specific legal and regulatory requirements applicable to their location before engaging with the platform.

This xnt review is based on publicly available information, regulatory filings, and market feedback compiled from various sources. The analysis represents a comprehensive evaluation based on current data, though individual trading experiences may vary. Potential clients are advised to conduct their own due diligence and consider their specific trading requirements and risk tolerance before selecting any brokerage service.

Rating Framework

Broker Overview

XNT LTD was established in 2011 as a financial and technology company specializing in direct market access services. The company has built its reputation over more than a decade of operation, focusing on providing institutional-grade trading infrastructure to qualified investors. With its headquarters operating under Malta Financial Services Authority regulation, XNT positions itself as a bridge between sophisticated trading technology and global market access.

The broker's business model centers on offering comprehensive market connectivity rather than traditional retail forex services. This approach distinguishes XNT from conventional retail brokers by emphasizing direct market access and institutional-quality execution. The company's longevity in the industry, spanning over 11 years, demonstrates its ability to maintain operations through various market cycles and regulatory changes.

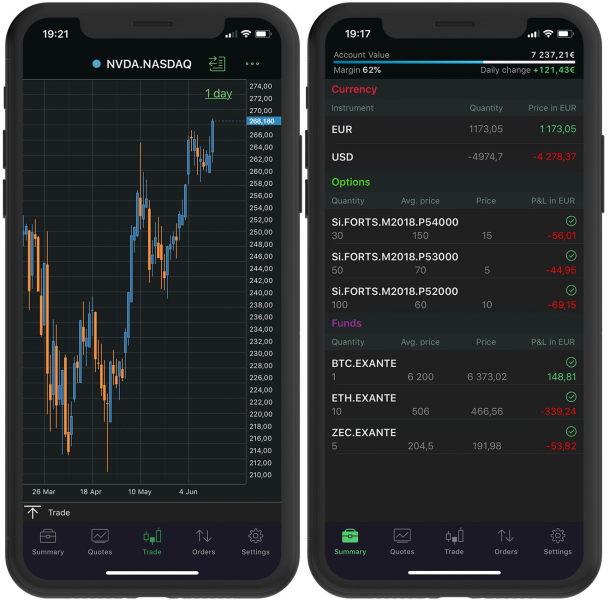

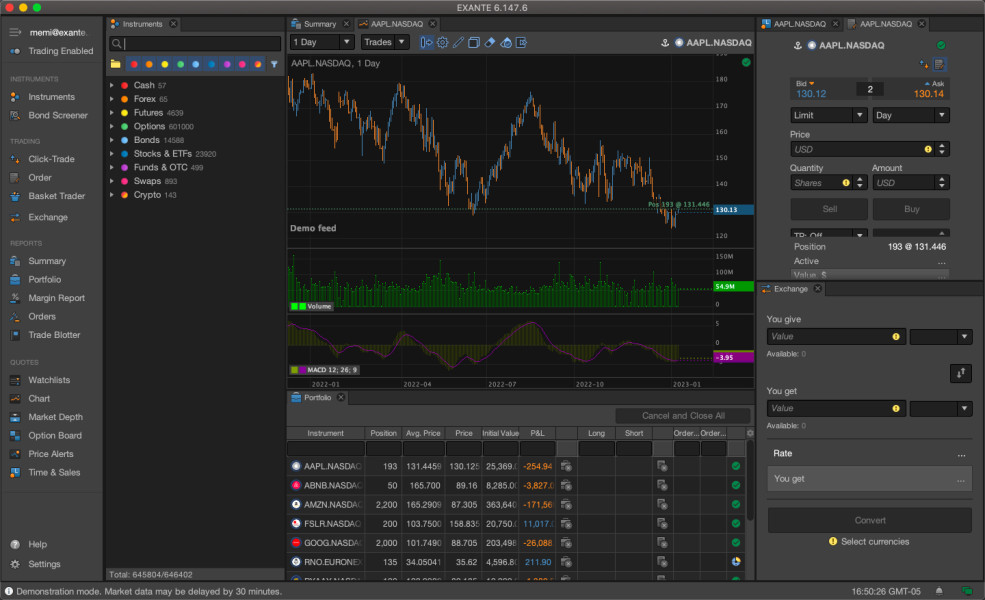

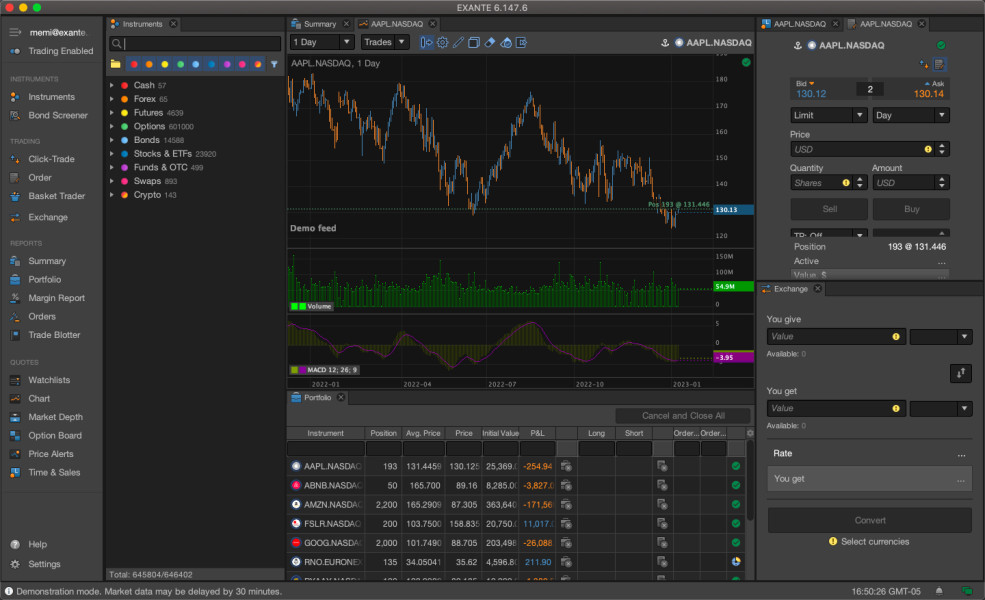

XNT operates primarily through the EXANTE trading platform. This platform serves as the technological backbone for accessing its extensive range of financial instruments. The platform provides connectivity to over 50 markets globally, encompassing major financial centers in the United States, European Union, and Asia-Pacific regions. This broad market access, combined with the availability of over one million financial instruments, positions XNT as a comprehensive solution for traders seeking diversified investment opportunities across multiple asset classes including forex, CFDs, and other financial derivatives.

Regulatory Framework: XNT LTD operates under the authorization and regulation of the Malta Financial Services Authority. This provides clients with regulatory protection under European Union financial services directives. The MFSA oversight ensures compliance with established financial standards and client protection measures.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in available sources. Potential clients need to contact the broker directly for comprehensive payment processing information.

Minimum Deposit Requirements: The broker maintains a substantial minimum deposit requirement of €50,000. This positions its services toward high-net-worth individuals and institutional clients rather than retail traders. This threshold significantly exceeds industry standards for retail forex brokers.

Promotional Offerings: Current promotional campaigns, welcome bonuses, or trading incentives are not specified in available documentation. This suggests the broker may focus on service quality rather than promotional marketing strategies.

Available Trading Assets: XNT provides access to an extensive range of financial instruments, with over one million options available across forex, CFD, and other derivative markets. The platform covers major global markets including US, European, and Asia-Pacific exchanges.

Cost Structure: Detailed information regarding spreads, commissions, and other trading costs is not readily available in public sources. This requires direct inquiry with the broker for comprehensive fee disclosure.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available materials. This necessitates direct contact with XNT for complete trading condition information.

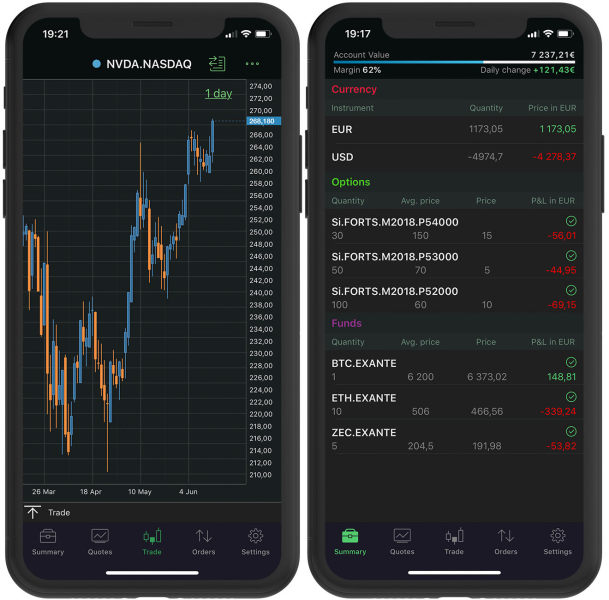

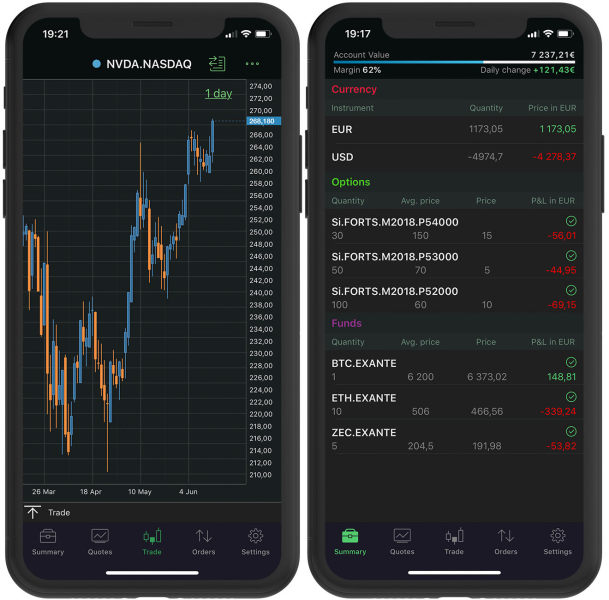

Platform Selection: The primary trading platform is EXANTE. This provides the technological infrastructure for accessing the broker's extensive market connectivity and instrument offerings.

Geographic Restrictions: Specific regional limitations or restricted territories are not clearly outlined in available information sources.

Customer Support Languages: Available customer service languages and communication options are not specified in current documentation.

Account Conditions Analysis

The account conditions offered by XNT present a mixed picture that reflects the broker's institutional focus rather than retail market orientation. The most significant barrier for potential clients is the substantial minimum deposit requirement of €50,000, which immediately excludes a large portion of retail traders from accessing the platform. This threshold suggests that xnt review considerations must account for the broker's clear targeting of high-net-worth individuals and professional trading entities.

The lack of detailed information regarding different account types creates uncertainty for potential clients attempting to evaluate the broker's offerings. Unlike many retail-focused brokers that provide tiered account structures with varying features and deposit requirements, XNT appears to maintain a more streamlined approach that may not accommodate diverse trader preferences and capital levels.

User feedback reflected in the 3/5 rating from Forexbrokerz indicates mixed experiences with account conditions. Specific complaints or praise regarding account features are not detailed in available sources. The absence of information about special account features such as Islamic accounts, demo accounts, or educational account benefits further limits the assessment of XNT's accommodation of diverse trader needs.

The account opening process, verification requirements, and ongoing account maintenance procedures are not clearly documented in public sources. This creates additional uncertainty for prospective clients. This lack of transparency in account condition details may reflect the broker's institutional focus, where individual client relationships are managed through direct communication rather than standardized public information.

XNT demonstrates exceptional strength in its tools and resources offering. It earns recognition for providing access to over one million financial instruments across more than 50 global markets. This extensive range significantly exceeds what most retail brokers offer, positioning XNT as a comprehensive solution for traders seeking diversified market exposure across US, European Union, and Asia-Pacific regions.

The EXANTE platform serves as the primary technological foundation. Specific details about its analytical capabilities, charting tools, and research resources are not extensively documented in available sources. The platform's ability to provide direct market access to such a vast array of instruments suggests sophisticated underlying technology, though user interface quality and ease of use remain unclear without detailed user testimonials.

The absence of information regarding educational resources indicates that XNT may not prioritize educational content in the same manner as retail-focused brokers. This includes market analysis, research reports, and trading guides. This approach aligns with the broker's apparent institutional focus, where clients are expected to possess existing trading knowledge and analytical capabilities.

Automated trading support, API access, and algorithmic trading capabilities are not specifically detailed in available documentation. The institutional nature of the platform suggests such features may be available upon request. The lack of publicly available information about these advanced trading tools may reflect the broker's preference for direct client consultation rather than standardized service offerings.

Customer Service and Support Analysis

The evaluation of XNT's customer service and support capabilities is significantly hampered by the limited availability of specific information. This includes support channels, response times, and service quality metrics. This information gap presents challenges for potential clients seeking to understand the level of support they can expect when trading with the broker.

Available sources do not detail the specific communication channels offered by XNT. These would include live chat, telephone support, email assistance, or dedicated account management services. The absence of published customer service hours, response time commitments, or service level agreements makes it difficult to assess the broker's commitment to client support quality.

The lack of user testimonials specifically addressing customer service experiences means that the 3/5 overall rating from Forexbrokerz cannot be attributed to any particular aspect of customer support quality. Without detailed feedback regarding problem resolution effectiveness, staff knowledge levels, or communication efficiency, potential clients cannot make informed decisions about expected support quality.

Multi-language support availability is crucial for an international broker serving diverse markets across the US, EU, and Asia-Pacific regions. However, this is not specified in available documentation. This omission is particularly notable given the broker's global market focus and the diverse linguistic needs of international trading clients.

Trading Experience Analysis

The trading experience evaluation for XNT centers primarily around the EXANTE platform. Comprehensive user feedback regarding platform performance, execution quality, and overall trading environment remains limited in available sources. The platform's capability to provide access to over one million financial instruments across 50+ markets suggests robust technological infrastructure, though specific performance metrics are not publicly documented.

Platform stability and execution speed are critical factors for successful trading. These are not detailed in available user reviews or performance reports. The absence of specific data regarding order execution times, slippage rates, or platform downtime incidents makes it challenging to assess the technical reliability that traders can expect when using XNT's services.

The trading environment's competitiveness in terms of spreads, liquidity provision, and market depth is not clearly documented. This leaves potential clients without crucial information needed to evaluate trading costs and execution quality. This information gap is particularly significant given the broker's institutional positioning and the expectations of sophisticated traders regarding execution performance.

Mobile trading capabilities and cross-device synchronization features are not specifically addressed in available documentation. Modern institutional platforms typically include such functionality. The xnt review must note that without detailed platform specifications or user interface demonstrations, the complete trading experience remains largely unverified through independent sources.

Trust and Reliability Analysis

XNT's trust and reliability assessment benefits significantly from its regulation by the Malta Financial Services Authority. This provides a foundation of regulatory oversight and client protection under European Union financial services frameworks. The MFSA regulation ensures compliance with established financial standards, capital adequacy requirements, and client fund protection measures that are essential for broker credibility.

The company's operational longevity spans over 11 years since its 2011 establishment. This demonstrates its ability to maintain business continuity through various market conditions and regulatory changes. This extended operational history contributes positively to trust assessment, though specific information about the company's handling of market stress periods or client disputes is not available in public sources.

Client fund safety measures, segregated account policies, and investor compensation scheme participation are not detailed in available documentation. This creates gaps in the complete trust evaluation. These elements are crucial for potential clients seeking assurance about their capital protection, particularly given the high minimum deposit requirements that represent significant financial commitments.

The company's transparency regarding ownership structure, management team, and corporate governance practices is limited in publicly available sources. While regulatory compliance provides a baseline of credibility, the lack of detailed corporate information may concern potential clients seeking comprehensive due diligence information before committing substantial capital to the platform.

User Experience Analysis

User experience evaluation for XNT is challenged by limited detailed feedback from actual platform users. The available 3/5 rating from Forexbrokerz suggests mixed client experiences that warrant careful consideration. This moderate rating indicates that while some users find acceptable value in the platform, others may have encountered limitations or disappointments in their trading experience.

The overall user satisfaction appears to be influenced by the broker's institutional focus and high minimum deposit requirements. These naturally limit the user base to well-capitalized traders with specific expectations for professional-grade services. The user profile alignment becomes crucial, as traders seeking retail-oriented features and support may find the platform less accommodating than those requiring institutional-level market access.

Interface design and platform usability assessments are not detailed in available user feedback. This makes it difficult to evaluate the learning curve and operational efficiency that new users can expect. The EXANTE platform's complexity and feature set may require significant familiarization time, particularly for users transitioning from more simplified retail trading platforms.

Account registration, verification processes, and initial platform setup experiences are not documented in available user reviews. This creates uncertainty about the onboarding process efficiency. Given the high minimum deposit requirements and institutional focus, the account opening process likely involves enhanced due diligence procedures that may extend setup timeframes compared to retail brokers.

Conclusion

This comprehensive xnt review reveals a broker that occupies a unique position in the financial services landscape. It offers institutional-grade market access through extensive instrument availability while maintaining regulatory compliance under MFSA oversight. XNT's strength lies primarily in its exceptional range of over one million financial instruments and access to 50+ global markets, making it a potentially valuable resource for well-capitalized traders seeking comprehensive market exposure.

However, the broker's €50,000 minimum deposit requirement and limited transparency regarding trading conditions create significant barriers for many potential clients. This includes customer service capabilities and platform features. The mixed user rating of 3/5 suggests that while some traders find value in XNT's services, others may encounter limitations that impact their overall satisfaction.

XNT appears most suitable for high-net-worth individuals, professional traders, and institutional clients who prioritize market access breadth over retail-oriented features and support. The broker's institutional focus, while limiting its appeal to general retail traders, may provide advantages for qualified clients seeking sophisticated trading infrastructure and direct market connectivity.