Long Asia 2025 Review: Everything You Need to Know

Executive Summary

This long asia review aims to provide a complete assessment of Long Asia. Long Asia is a broker that operates under the NDD (No Dealing Desk) business model, which means they don't trade against their clients. Based on available information, Long Asia positions itself as a CFD trading provider offering access to foreign exchange, stocks, and indices markets. The broker operates under regulatory oversight from US FinCEN MSB and FSCA (South Africa). This provides some level of regulatory foundation for its operations.

Long Asia's key distinguishing feature appears to be its NDD business model. This model theoretically ensures that the broker clears client trades and forwards quotes from liquidity providers rather than acting as a counterparty, which can reduce conflicts of interest. This model typically appeals to traders seeking potentially lower spreads and reduced conflict of interest scenarios. The broker targets investors interested in forex and CFD trading across multiple asset classes.

However, our assessment reveals significant information gaps regarding critical trading conditions, account specifications, and user feedback. The lack of detailed information about minimum deposits, specific spreads, commission structures, and platform offerings makes it challenging to provide a definitive evaluation. We cannot determine the broker's competitive position in the current market landscape without this crucial information.

Important Disclaimer

This long asia review is based on publicly available information and regulatory data. Long Asia operates through different regulatory entities across regions, with US FinCEN MSB oversight in the United States and FSCA regulation in South Africa, which may affect your trading experience. These regional differences may impact trading conditions, available services, and regulatory protections for users in different jurisdictions.

Our evaluation methodology relies on accessible public information, regulatory filings, and industry databases. This review does not include direct user feedback collection or live trading account testing. This may limit the comprehensiveness of certain assessments, particularly regarding trading experience and customer service quality.

Rating Overview

Broker Overview

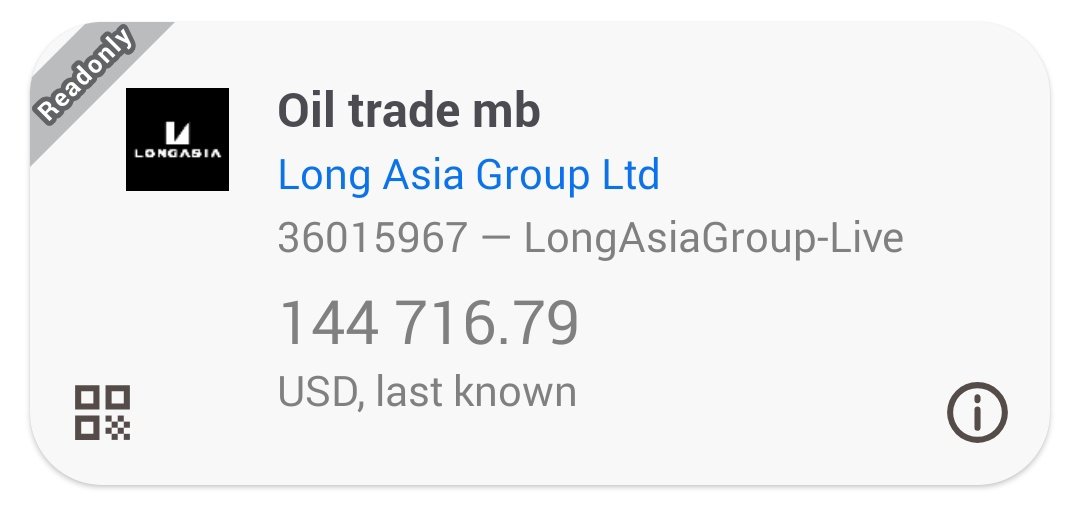

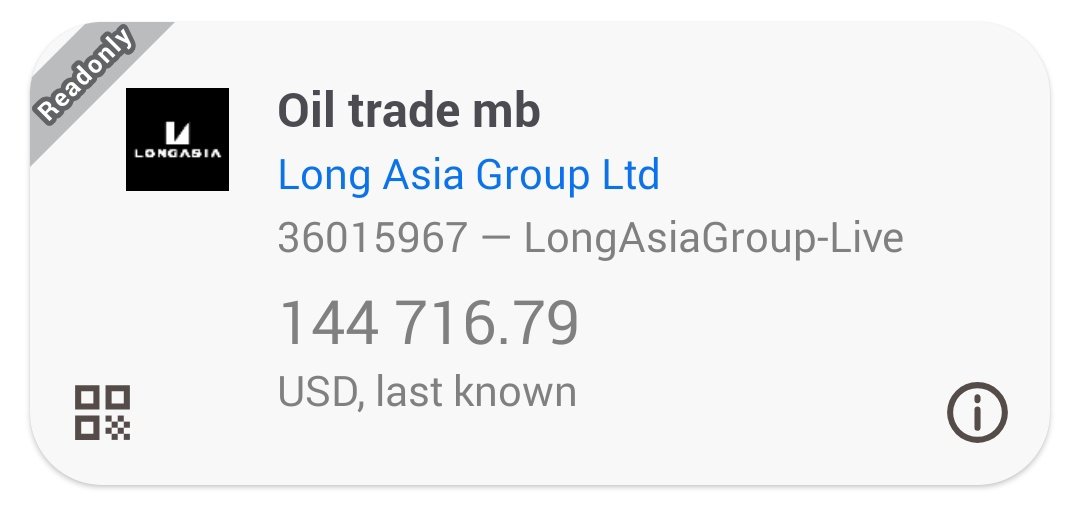

Long Asia operates as a regulated CFD broker under the Long Asia Group NZ structure. The company offers trading services across multiple financial markets, focusing on providing access to forex, stocks, and indices. The broker has established its business model around the NDD (No Dealing Desk) framework. This positions it as an intermediary that processes client orders and forwards pricing from institutional liquidity providers rather than taking opposite positions against clients.

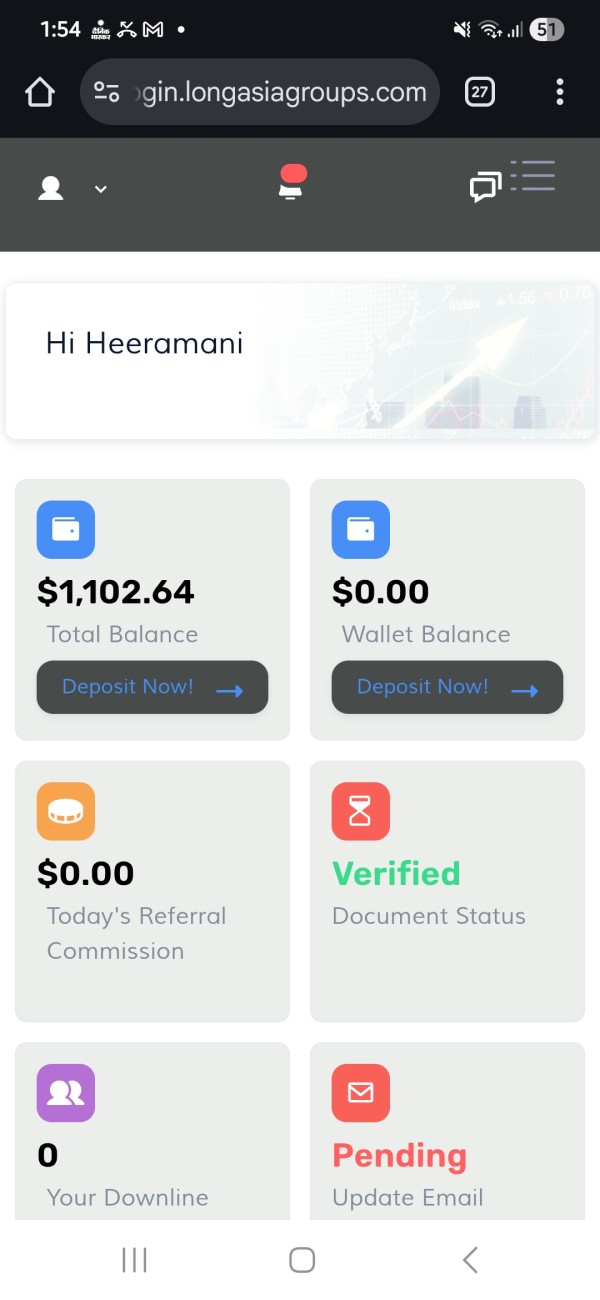

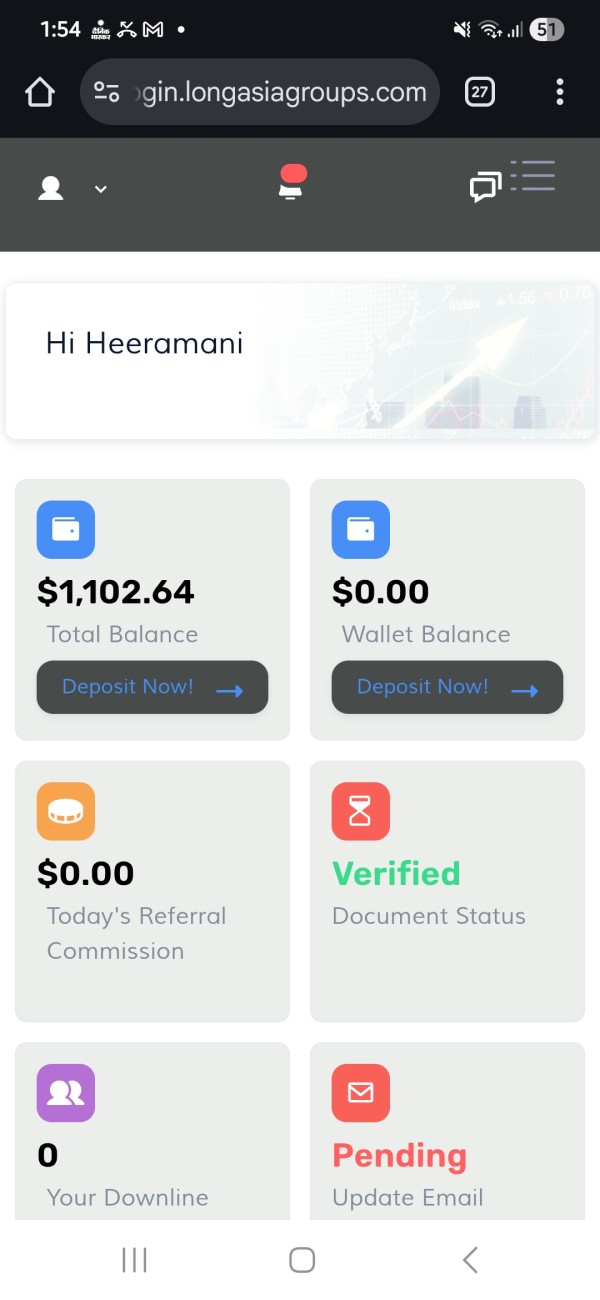

The company's regulatory foundation includes authorization from US FinCEN as a Money Services Business and oversight from South Africa's Financial Sector Conduct Authority (FSCA). This dual regulatory approach suggests the broker aims to serve clients across different geographical regions while maintaining compliance with local financial regulations, though the effectiveness of this approach remains to be seen. According to available information, Long Asia Group NZ serves as the primary operational entity. Specific details about the company's founding date and operational history remain unclear from current sources.

The broker's service offering encompasses foreign exchange trading, stock CFDs, and index trading. This positions it within the competitive retail CFD market where many established players already compete for market share. The NDD business model typically appeals to traders seeking direct market access and potentially tighter spreads, as it theoretically eliminates the broker's incentive to trade against client positions. However, this long asia review notes that specific details about execution quality, average spreads, and trading conditions require further investigation for a complete assessment.

Regulatory Jurisdictions: Long Asia operates under dual regulatory oversight. The company holds US FinCEN MSB registration (License #20248117108) and FSCA authorization in South Africa (License #53197), providing coverage for operations in North American and African markets.

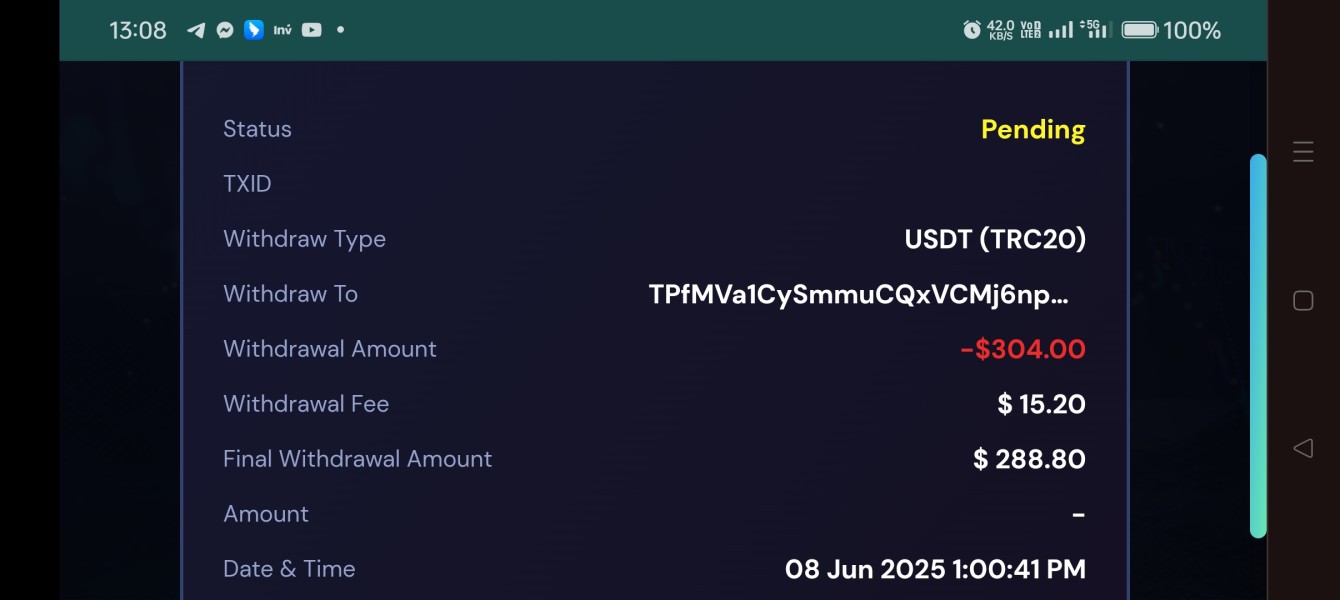

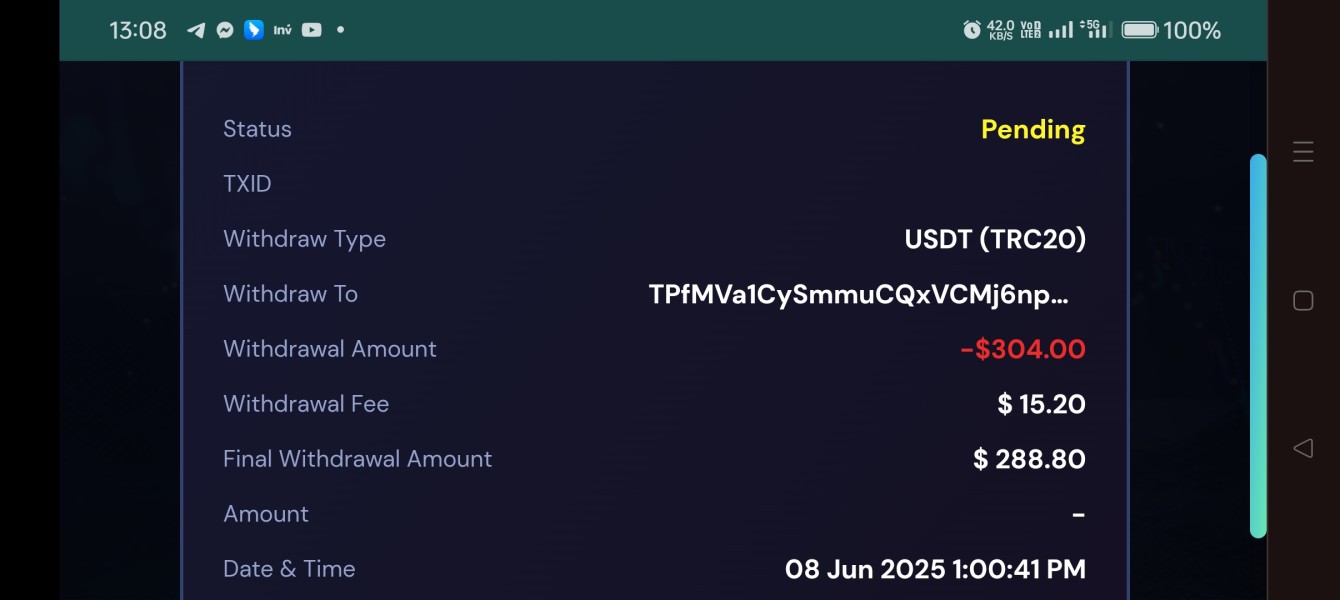

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available sources. This represents a significant information gap for potential clients who need to understand how they can fund their accounts.

Minimum Deposit Requirements: Current sources do not specify minimum deposit amounts for different account types. This makes it difficult for traders to assess accessibility and entry requirements before committing to the platform.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not available in current information sources. Many brokers use promotional offers to attract new clients, but Long Asia's approach to this remains unclear.

Tradeable Assets: The broker provides access to foreign exchange pairs, stock CFDs, and index trading instruments. However, the specific number of available instruments and market coverage details require clarification from the broker directly.

Cost Structure: While the NDD model suggests competitive pricing potential, specific spread ranges, commission rates, and overnight financing charges are not detailed in available materials. This information is crucial for traders to calculate their potential trading costs accurately.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in current sources. This is crucial information for risk assessment and trading strategy planning.

Platform Selection: Trading platform options and technological infrastructure details are not comprehensively covered in available information. Traders need to know which platforms they can use to execute their trading strategies effectively.

Geographic Restrictions: Specific country restrictions and availability limitations are not clearly outlined in current sources. This could affect whether traders in certain regions can access the broker's services.

Customer Support Languages: Multi-language support capabilities and communication channels require further clarification. International brokers typically need to support multiple languages to serve their global client base effectively.

This long asia review identifies these information gaps as areas requiring additional research for traders considering this broker.

Account Conditions Analysis (Score: 5/10)

The assessment of Long Asia's account conditions faces significant limitations due to insufficient publicly available information about key trading parameters. While the broker operates under regulatory oversight and employs an NDD business model, critical details about account structures remain unclear, which makes it difficult to evaluate their offerings properly.

Account type variety and specifications are not detailed in current sources. This makes it impossible to evaluate whether the broker offers different account tiers for various trader segments, which is a standard practice in the industry. Standard industry practice typically includes basic, premium, and professional account categories with varying minimum deposits, spreads, and service levels. Without this information, potential clients cannot assess which account type might suit their trading capital and experience level.

Minimum deposit requirements represent another significant information gap that affects broker accessibility. This parameter directly affects broker accessibility and target market positioning, as it determines who can afford to start trading with the platform. Industry standards vary widely, from $10 for entry-level brokers to $10,000 or more for institutional-focused services. The absence of this information in Long Asia's publicly available materials creates uncertainty for prospective clients planning their trading capital allocation.

The account opening process, verification requirements, and timeline are not specified in available sources. Modern regulatory requirements typically mandate Know Your Customer (KYC) procedures, but the specific documentation requirements and processing timeframes remain unclear, which could frustrate potential clients. Additionally, specialized account features such as Islamic (swap-free) accounts for Muslim traders are not mentioned in current materials.

This long asia review notes that the limited information about account conditions significantly impacts the broker's transparency. The lack of clear information makes it difficult for potential clients to make informed decisions about account selection and setup requirements.

Long Asia's trading tools and resources assessment is severely limited by the lack of detailed information about the broker's technological offerings and educational support. The absence of comprehensive data about trading platforms, analytical tools, and client resources represents a significant transparency concern that could deter potential clients.

Trading platform specifications are not detailed in available sources. This leaves questions about whether the broker offers MetaTrader 4, MetaTrader 5, proprietary platforms, or web-based solutions, which are fundamental considerations for any trader. Platform choice significantly impacts trading experience, available analytical tools, automated trading capabilities, and mobile access. Without this fundamental information, traders cannot assess whether the technological infrastructure meets their trading requirements.

Research and market analysis resources are not described in current materials. Professional traders typically rely on economic calendars, market news feeds, technical analysis tools, and fundamental research reports to make informed trading decisions. The absence of information about these resources suggests either limited offerings or poor communication of available services.

Educational resources and training materials are not mentioned in available sources. Quality brokers typically provide trading guides, webinars, video tutorials, and market education content to support client development, especially for beginners. The lack of educational resource information may indicate limited support for beginner traders or inadequate marketing of existing materials.

Automated trading support, including Expert Advisor compatibility, algorithmic trading tools, and API access, remains unspecified. These features are increasingly important for sophisticated traders seeking to implement systematic trading strategies or connect third-party analytical tools to enhance their trading performance.

The limited information about tools and resources significantly impacts this broker's competitive positioning. This makes it difficult for traders to assess the overall value proposition of Long Asia's service offering compared to more transparent competitors.

Customer Service and Support Analysis (Score: 5/10)

The evaluation of Long Asia's customer service capabilities is constrained by the absence of detailed information about support channels, response times, and service quality metrics. This lack of transparency makes it challenging to assess the broker's commitment to client support and problem resolution, which are crucial factors for trader satisfaction.

Available communication channels are not specified in current sources. This leaves uncertainty about whether clients can access support through phone, email, live chat, or social media platforms, which are standard options in the industry. Modern brokers typically offer multiple contact methods with varying response time commitments, but Long Asia's specific support infrastructure remains unclear.

Response time commitments and service availability hours are not detailed in available materials. International brokers serving global markets typically provide extended support hours or 24/5 coverage during market hours to accommodate traders across different time zones. Without this information, traders cannot assess whether support availability aligns with their trading schedules and time zones.

Service quality indicators, including staff expertise, problem resolution efficiency, and client satisfaction metrics, are not available in current sources. User feedback and testimonials about support experiences would typically provide insight into service effectiveness, but such information is not accessible for this assessment, making it impossible to gauge actual service quality.

Multi-language support capabilities are not specified, which is particularly relevant given the broker's international regulatory structure. Traders in different regions may require support in local languages, but the availability of such services remains unclear and could limit the broker's appeal to international clients.

The absence of detailed customer service information represents a significant transparency gap. This may concern potential clients who prioritize responsive and effective broker support for their trading activities.

Trading Experience Analysis (Score: 5/10)

Assessing Long Asia's trading experience quality is significantly hampered by the lack of user feedback, platform performance data, and detailed operational information. The trading experience encompasses platform stability, execution quality, and overall user satisfaction. These are areas where comprehensive information is currently unavailable, making evaluation extremely difficult.

Platform stability and performance metrics are not documented in available sources. Critical factors such as server uptime, connection reliability, and system response times during high volatility periods remain unspecified, which are essential for successful trading. These technical performance indicators directly impact trading success, particularly for strategies requiring precise timing or high-frequency execution.

Order execution quality represents another area with insufficient information that could significantly impact trading results. While the NDD business model suggests direct market access and potentially favorable execution conditions, specific data about execution speeds, slippage rates, and requote frequency are not available. These metrics are crucial for evaluating whether the broker can deliver competitive execution quality.

Platform functionality and feature completeness cannot be assessed without detailed information about available trading tools, charting capabilities, order types, and analytical functions. Modern trading platforms typically offer advanced charting, multiple order types, risk management tools, and customization options, but Long Asia's specific offerings remain unclear and unverified.

Mobile trading experience details are not available in current sources. Given the increasing importance of mobile trading, information about app functionality, feature parity with desktop platforms, and mobile-specific tools would be valuable for assessment but is currently missing.

This long asia review concludes that the limited information about actual trading experience significantly impacts the ability to evaluate Long Asia's competitive position. The lack of detailed information makes it difficult for potential clients to assess platform suitability for their trading needs.

Trust and Safety Analysis (Score: 6/10)

Long Asia's trust and safety assessment benefits from verifiable regulatory oversight while facing limitations due to insufficient information about specific safety measures and operational transparency. The broker's regulatory foundation provides some confidence, but additional safety details would strengthen the overall trust profile significantly.

Regulatory credentials include US FinCEN MSB registration (License #20248117108) and FSCA authorization in South Africa (License #53197). These regulatory relationships indicate compliance with anti-money laundering requirements and basic operational standards in respective jurisdictions, which provides a foundation for trust. US FinCEN registration requires compliance with Bank Secrecy Act provisions, while FSCA oversight provides consumer protection frameworks under South African financial regulations.

Client fund protection measures are not detailed in available sources, representing a significant information gap that could concern security-minded traders. Industry best practices typically include segregated client accounts, deposit insurance coverage, or compensation scheme participation to protect client funds. The absence of specific information about fund protection mechanisms may concern security-conscious traders.

Operational transparency regarding company ownership, financial statements, and business operations is limited in current sources. While regulatory oversight provides basic legitimacy verification, additional transparency about company structure, financial stability, and operational history would enhance trust assessment for potential clients.

Negative incident history and regulatory actions are not evident in available information, which is positive for the broker's reputation. However, the absence of detailed operational history makes it difficult to assess long-term reliability and crisis management capabilities during market stress.

The regulatory foundation provides a baseline level of trust, but additional transparency about safety measures and operational details would strengthen Long Asia's overall trustworthiness profile. This would be particularly important for potential clients prioritizing security and regulatory protection.

User Experience Analysis (Score: 5/10)

The user experience evaluation for Long Asia is significantly limited by the absence of client feedback, satisfaction surveys, and detailed usability information. Without direct user input, assessing the overall client experience requires reliance on available operational information and industry standard comparisons, which provides an incomplete picture.

Overall user satisfaction metrics are not available in current sources. This makes it impossible to gauge client retention rates, satisfaction scores, or recommendation likelihood, which are key indicators of service quality. These indicators typically provide valuable insight into the broker's ability to meet client expectations and deliver satisfactory service quality.

Interface design and usability details are not specified for Long Asia's trading platforms or client portal systems. Modern broker platforms typically emphasize intuitive navigation, responsive design, and customizable interfaces, but specific information about Long Asia's user interface quality remains unavailable for evaluation.

Registration and account verification processes are not detailed in available materials. The efficiency and user-friendliness of onboarding procedures significantly impact initial client experience, but specific information about documentation requirements, verification timeframes, and process complexity is not accessible to potential clients.

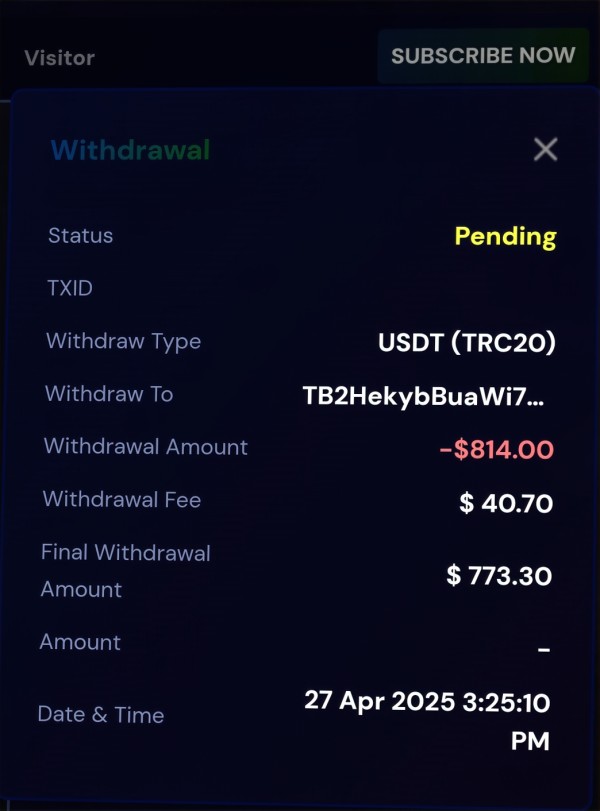

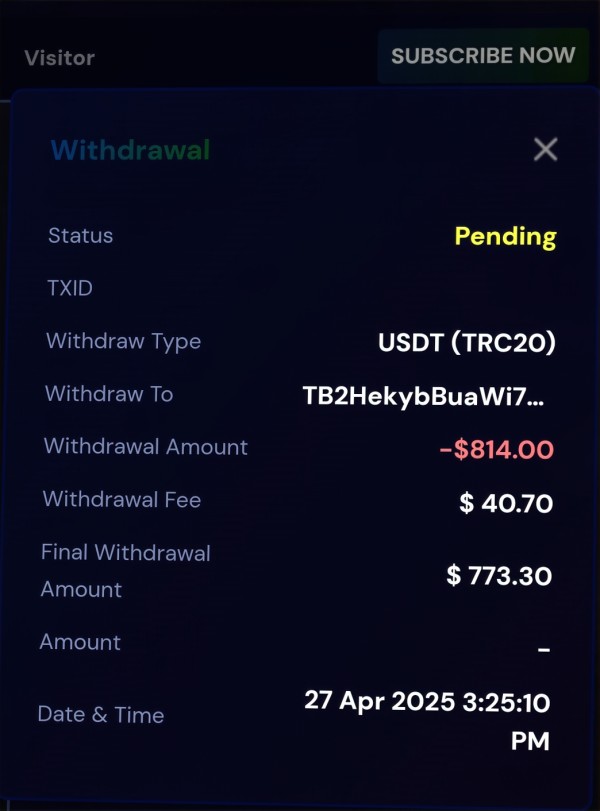

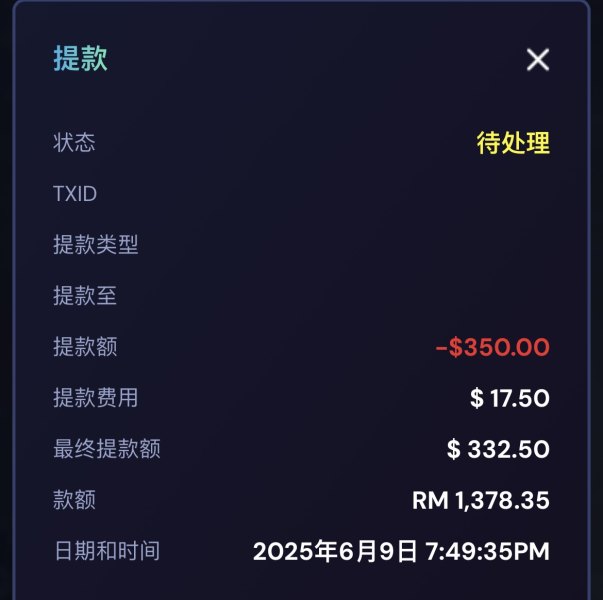

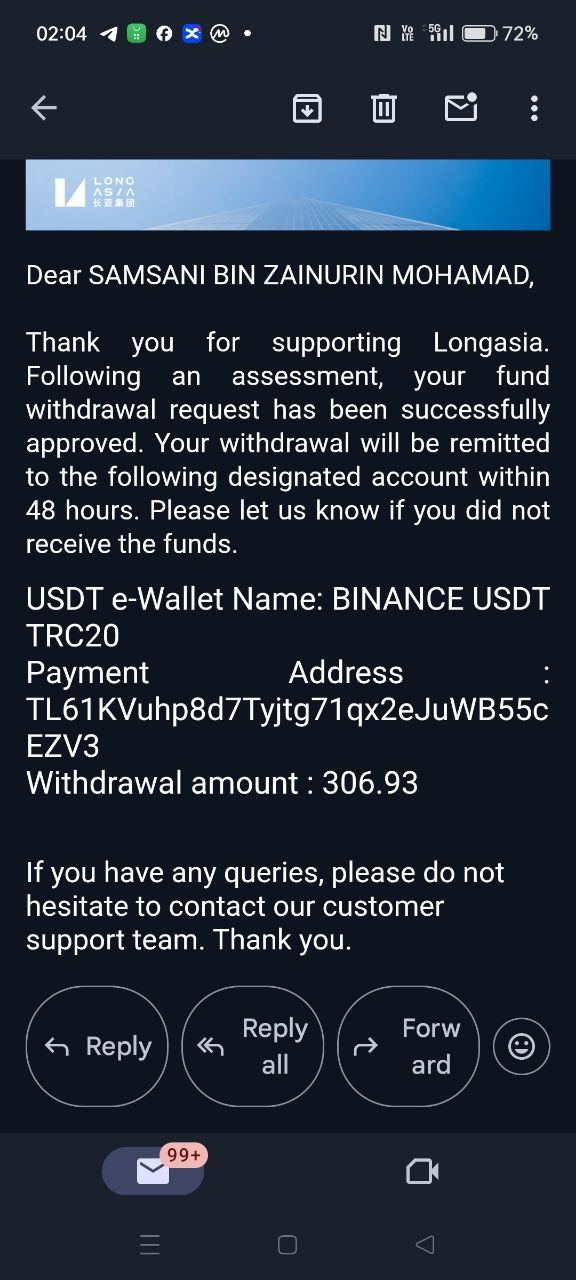

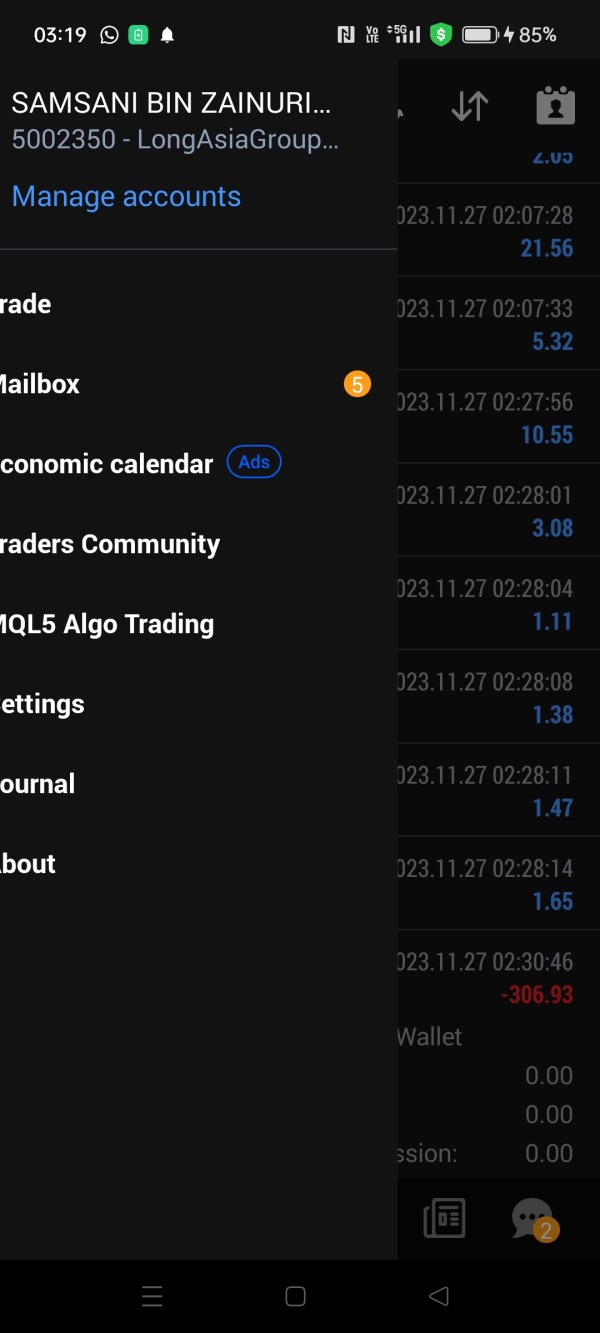

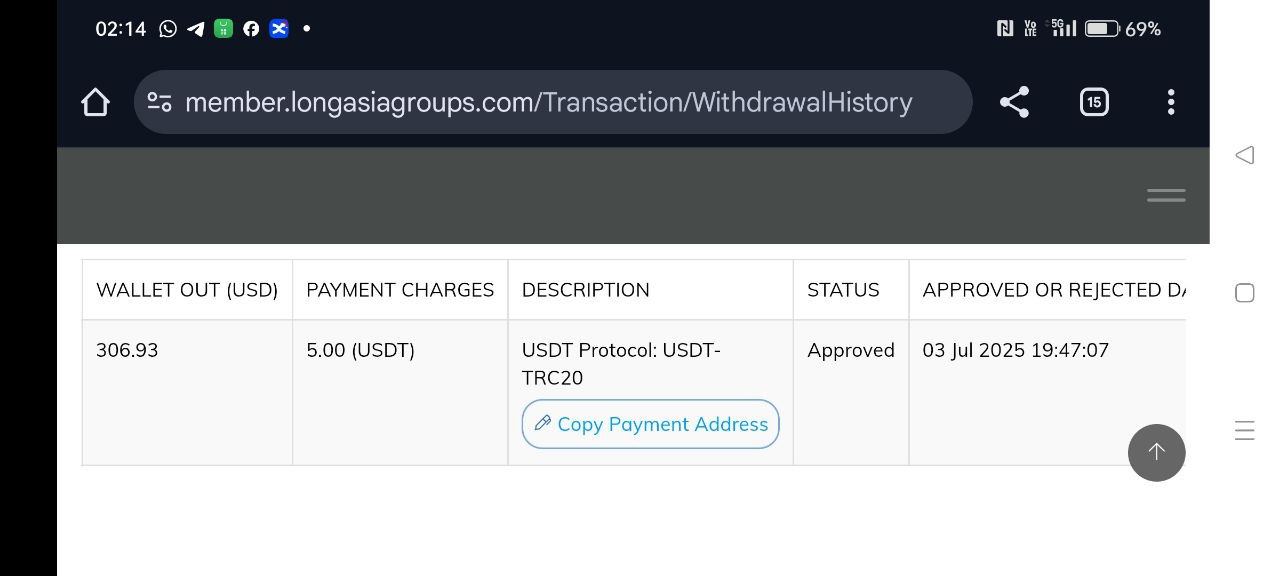

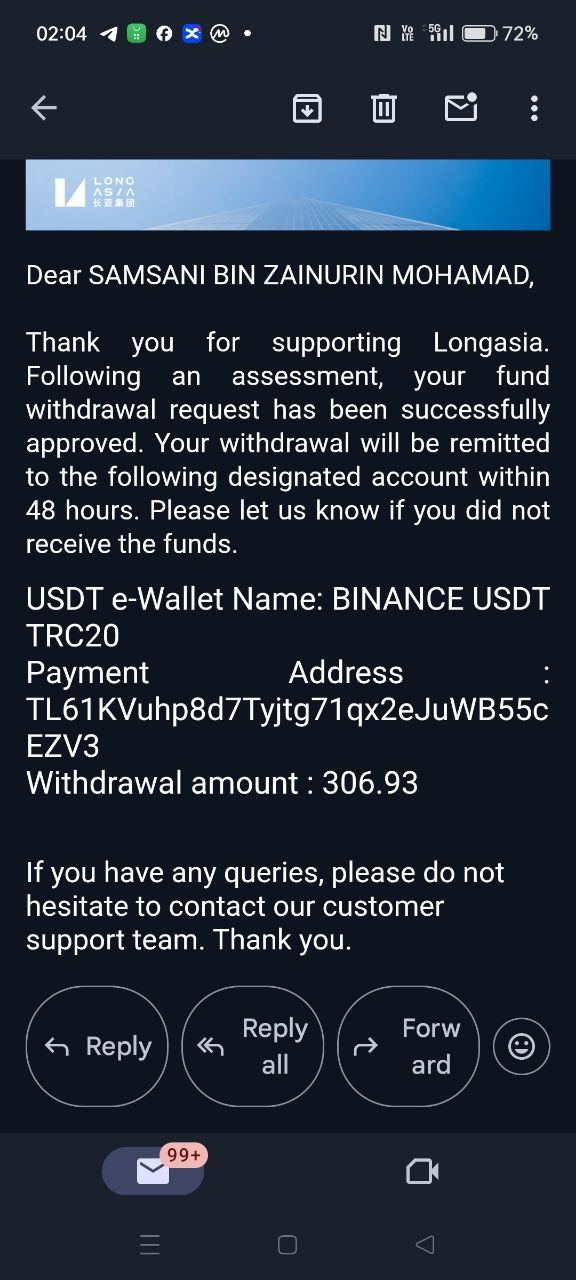

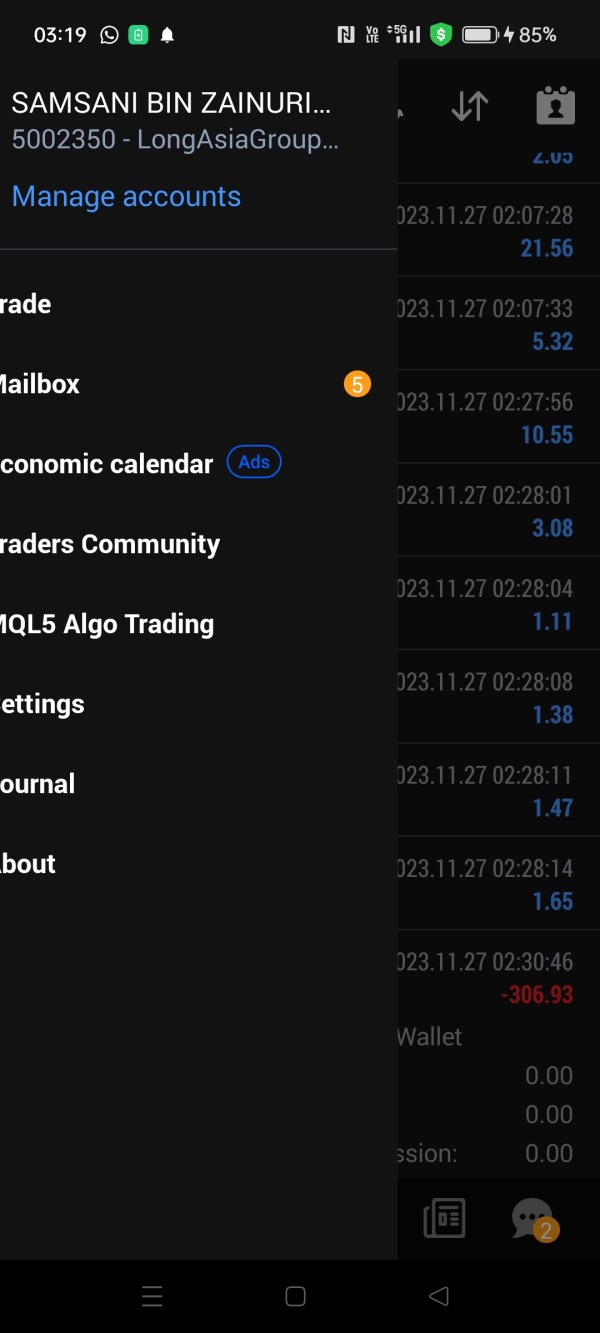

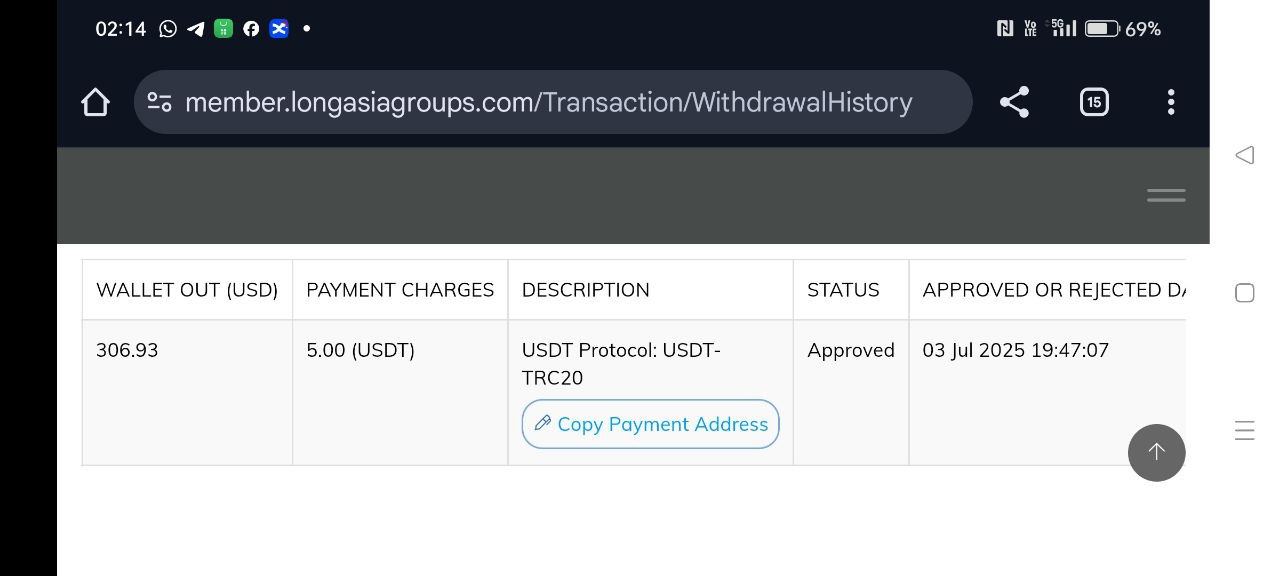

Fund management experience, including deposit and withdrawal procedures, processing times, and fee structures, lacks detailed documentation. These operational aspects directly affect client satisfaction and ongoing relationship quality, but current information sources do not provide comprehensive details about these crucial processes.

Common user complaints and satisfaction drivers cannot be assessed without access to client feedback or review platforms. This information gap prevents identification of potential experience issues or service strengths that might influence prospective client decisions about choosing this broker.

The limited user experience information represents a significant assessment challenge and suggests the need for additional research. Potential clients may need to contact the broker directly to obtain comprehensive service quality details.

Conclusion

This long asia review reveals a broker with regulatory foundation and an NDD business model that theoretically offers advantages for CFD and forex trading. Long Asia operates under dual regulatory oversight from US FinCEN and South Africa's FSCA. This provides basic legitimacy and compliance frameworks for its operations across different geographical markets.

The broker's NDD business model represents a potential advantage for traders seeking direct market access and reduced conflict of interest scenarios. This operational approach, combined with regulatory oversight, suggests Long Asia aims to position itself as a legitimate service provider in the competitive retail trading market where many established players compete. The availability of forex, stock, and index CFD trading provides reasonable asset diversity for most retail trading strategies.

However, significant information gaps limit the ability to provide a comprehensive recommendation that traders can rely on. Critical details about trading conditions, account specifications, platform capabilities, and user satisfaction remain unclear. This makes it difficult for potential clients to assess whether Long Asia meets their specific trading requirements.

The absence of user feedback and detailed service information represents a transparency concern that may impact trader confidence. Long Asia may be suitable for traders specifically seeking NDD execution and basic regulatory oversight, but this comes with significant unknowns about service quality. Prospective clients should conduct additional due diligence to obtain detailed information about trading conditions, costs, and service quality before making account opening decisions.

The broker's competitive position relative to more transparent alternatives requires careful consideration given the current information limitations. Long asia traders should weigh the potential benefits of the NDD model against the risks of choosing a broker with limited publicly available information about its services and performance.