Santander Review 10

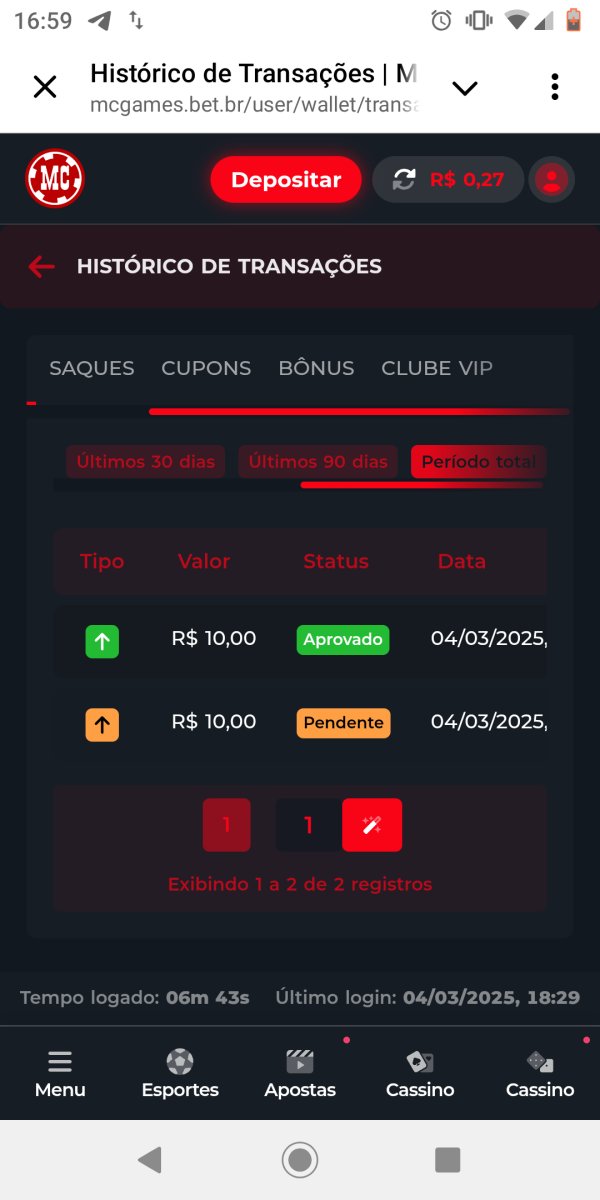

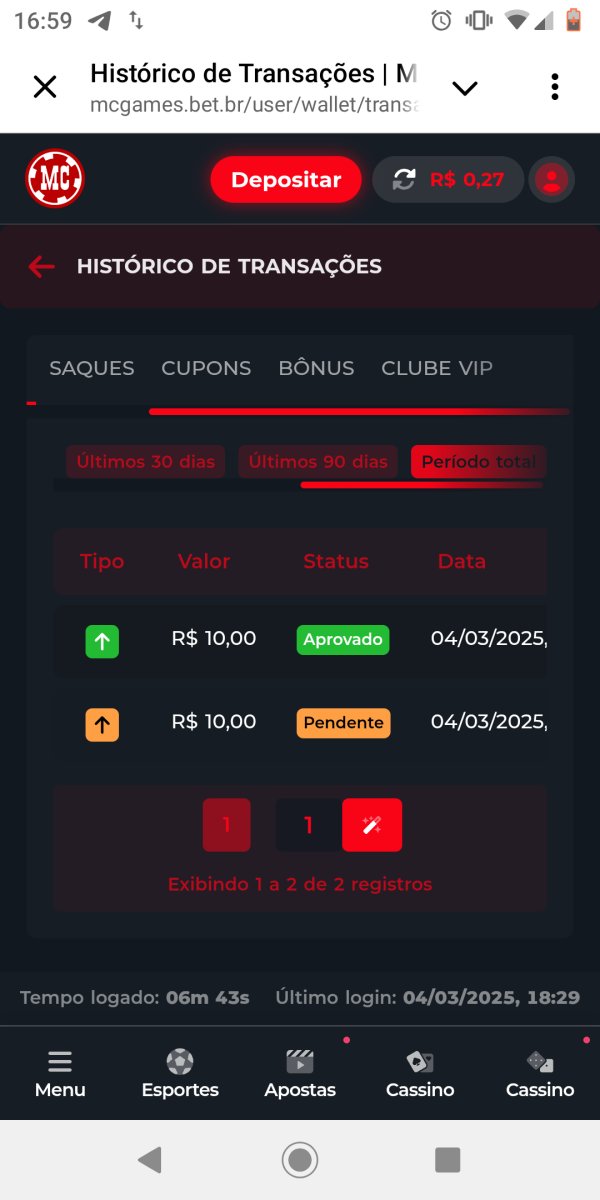

I deposited $146 on this platform and transferred $4030 from suouesta. But my account was blocked.

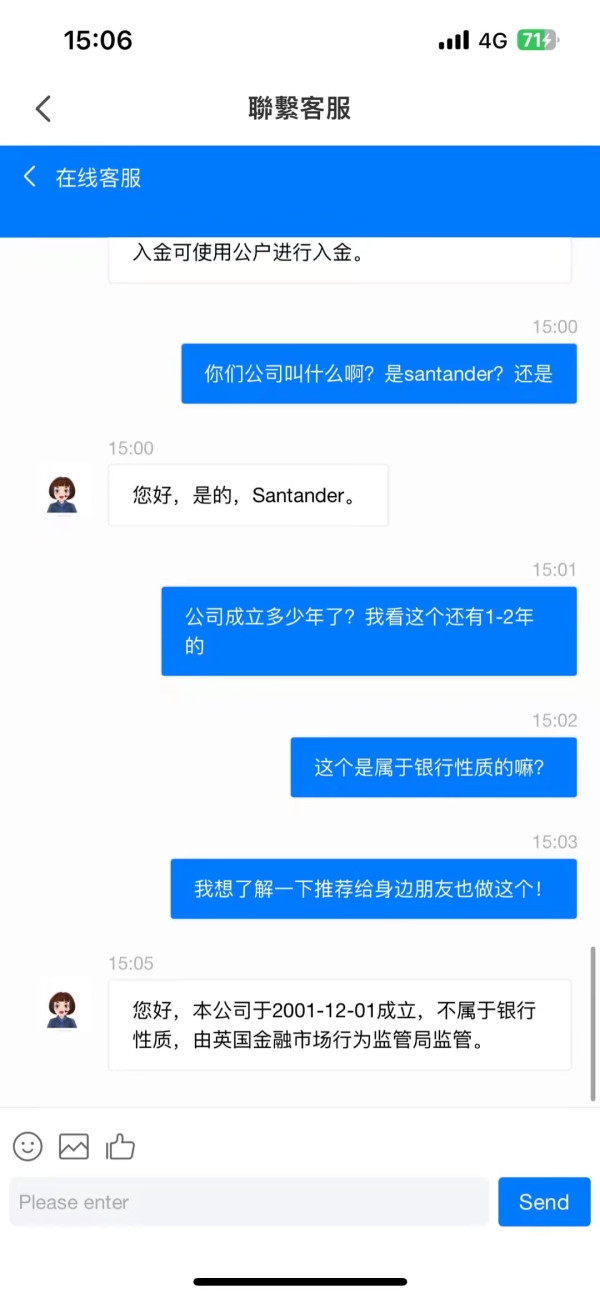

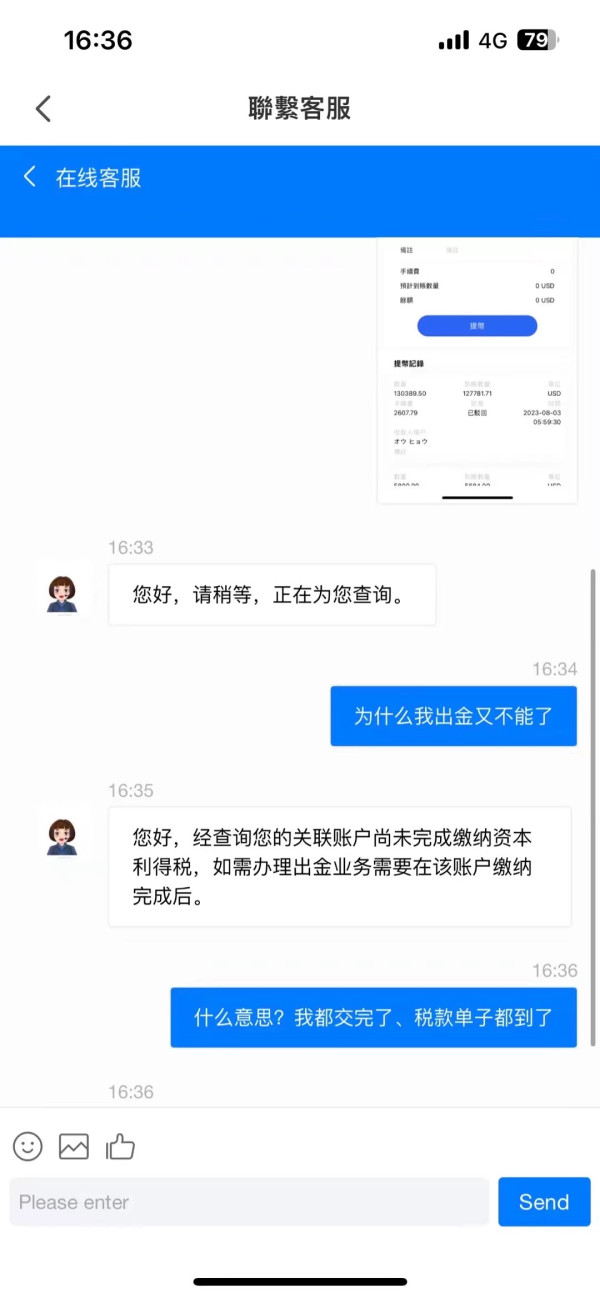

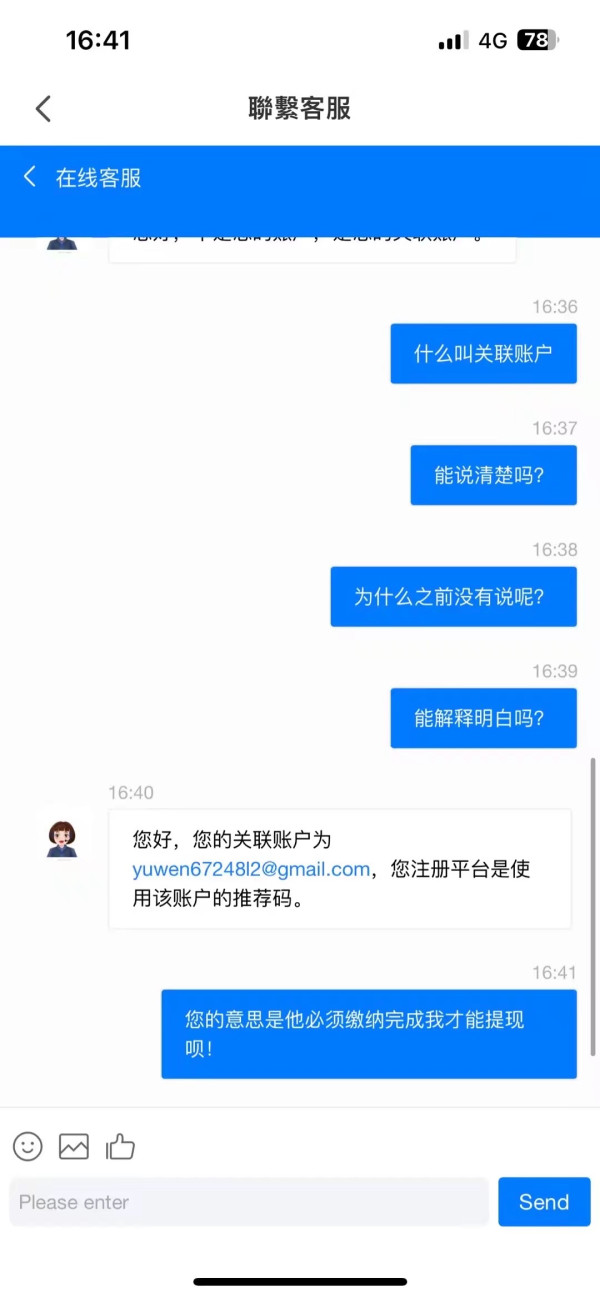

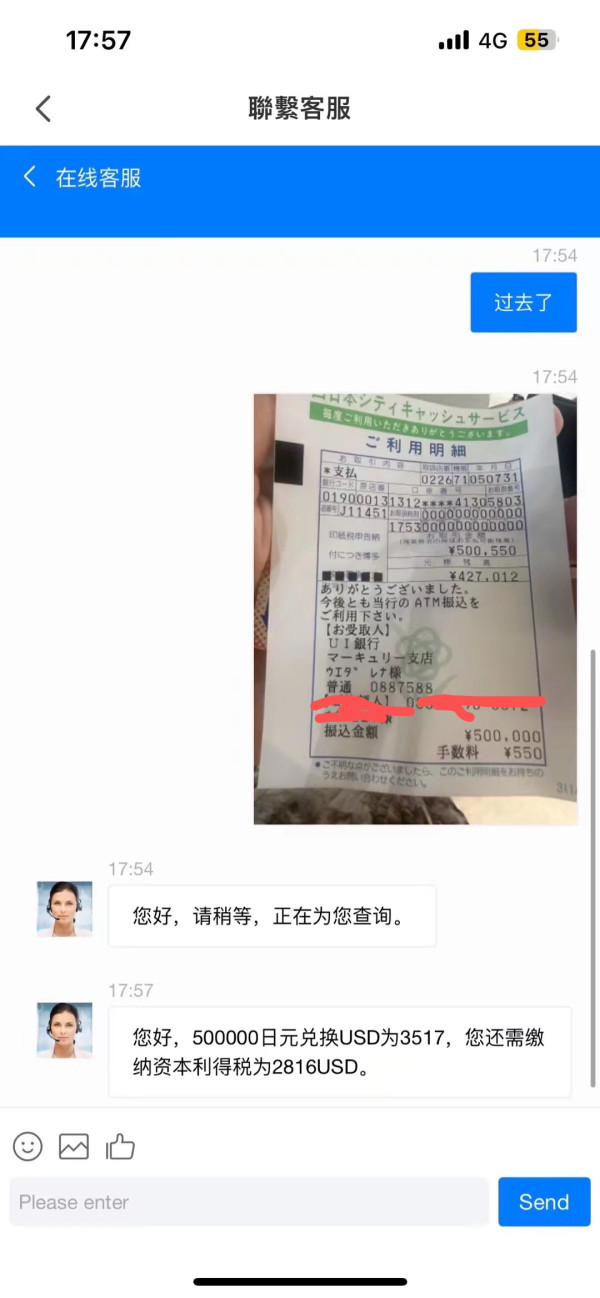

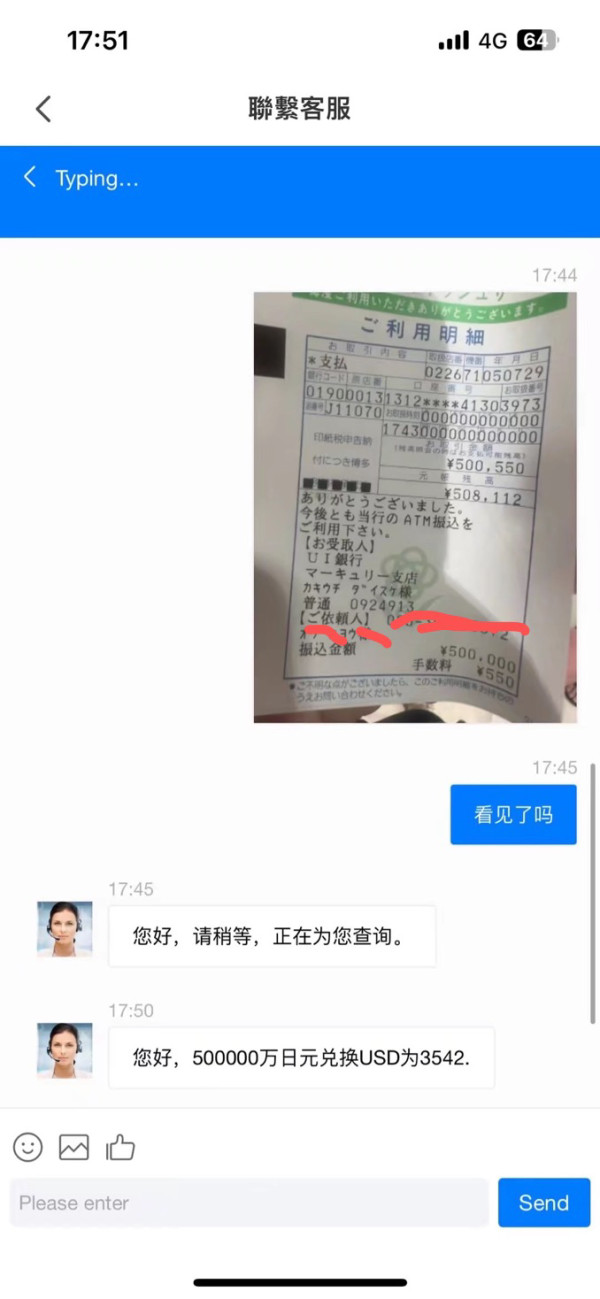

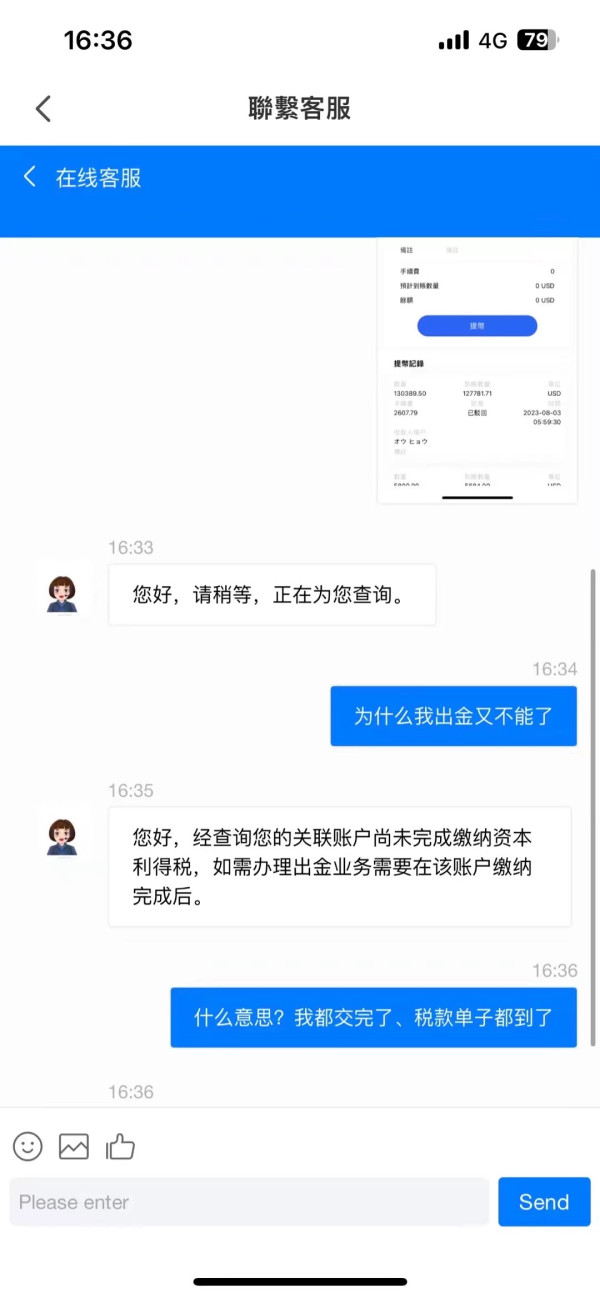

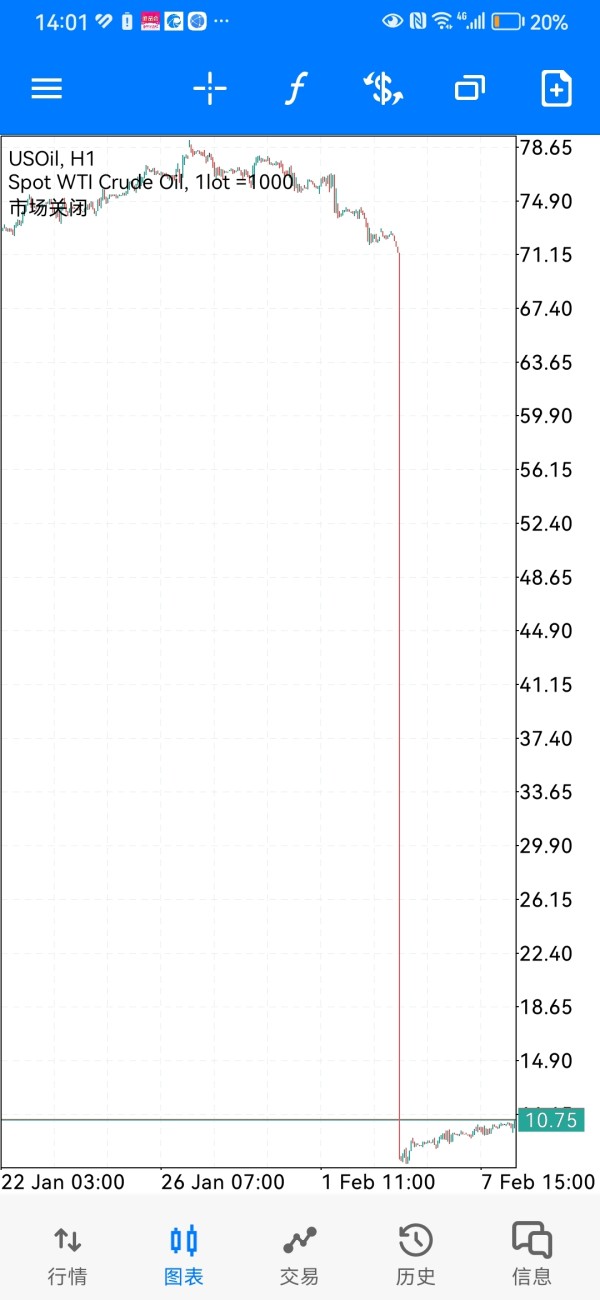

I registered this account using the code given to me by the recommender. Now I don't know if it's the platform policy or what. Originally, the reason why I couldn't withdraw money was because I hadn't paid taxes on my profits. I need to pay 20% of the profit to withdraw money. But I still can't withdraw money after paying the taxes. The platform also said that the money associated with the account was not paid. What kind of policy is this? My own taxes and my account have been paid, but I cannot withdraw funds yet. I can't understand. The person who recommended me now is always saying that he has no money to pay and has been out of contact. I couldn't withdraw my principal, and I paid another 20563 usd in taxes!

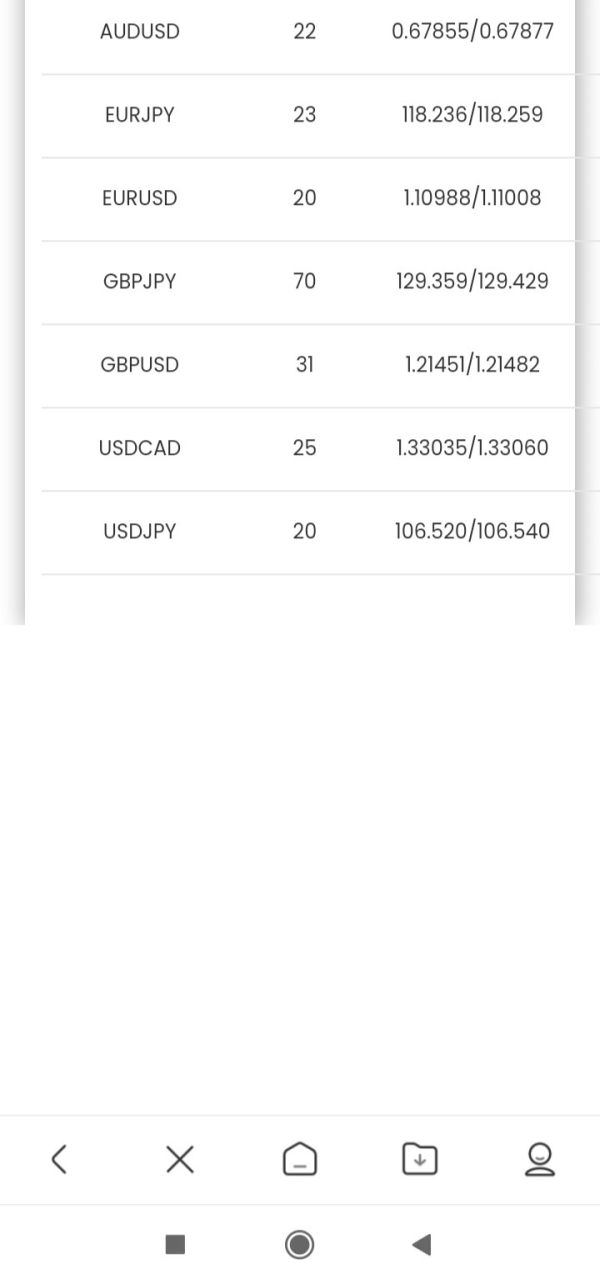

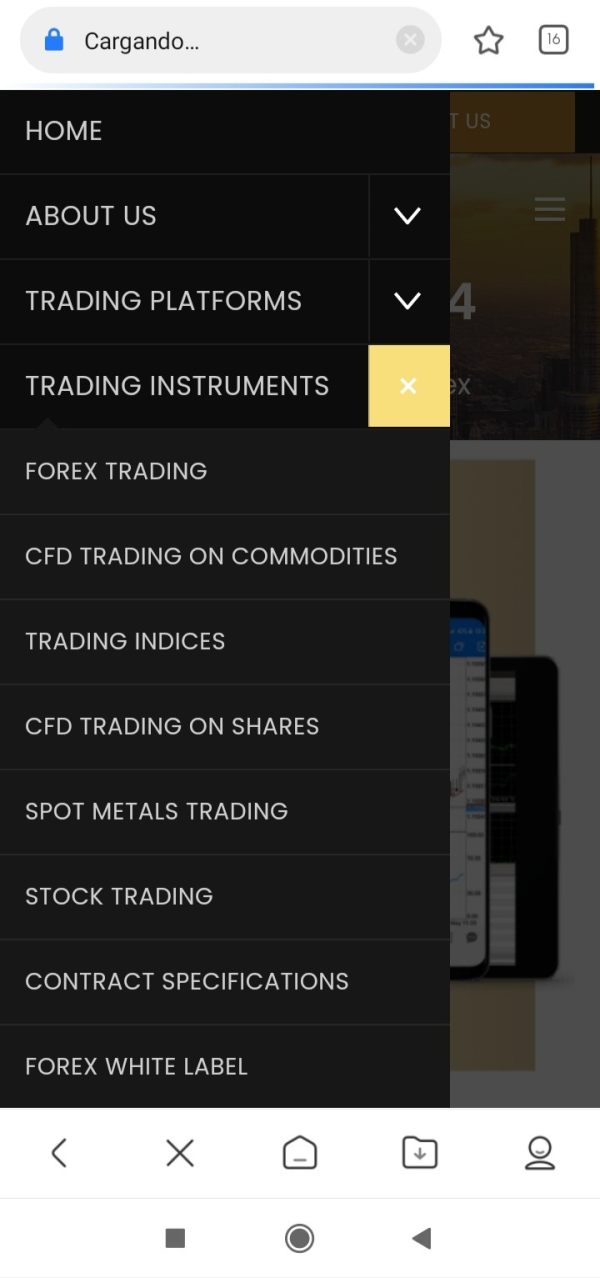

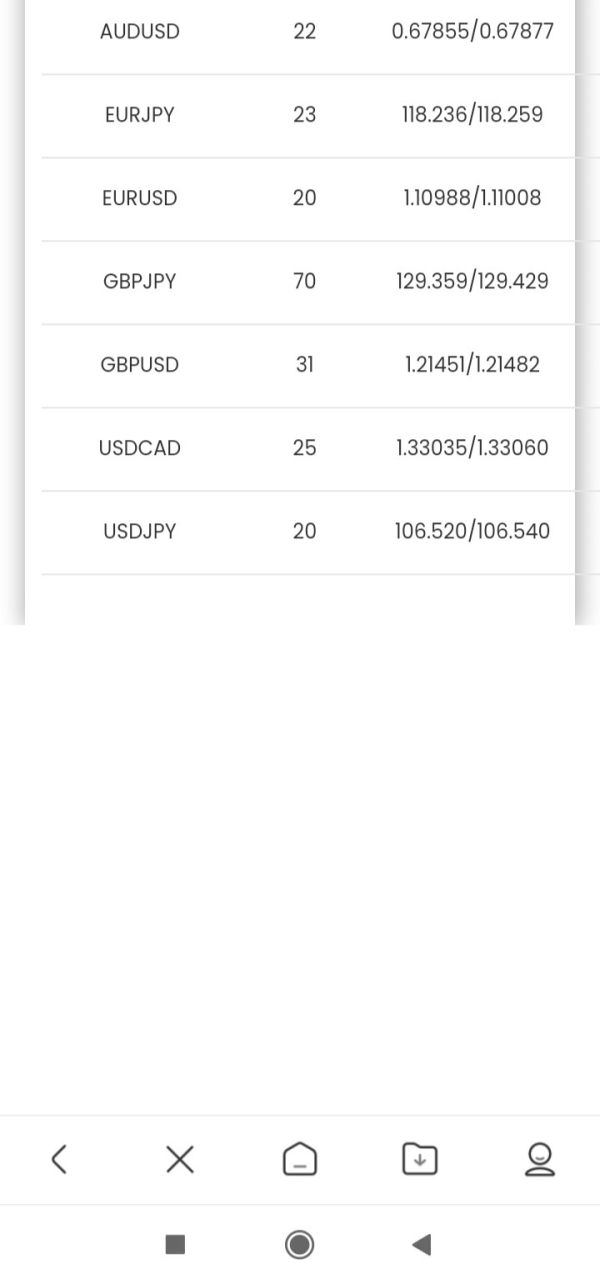

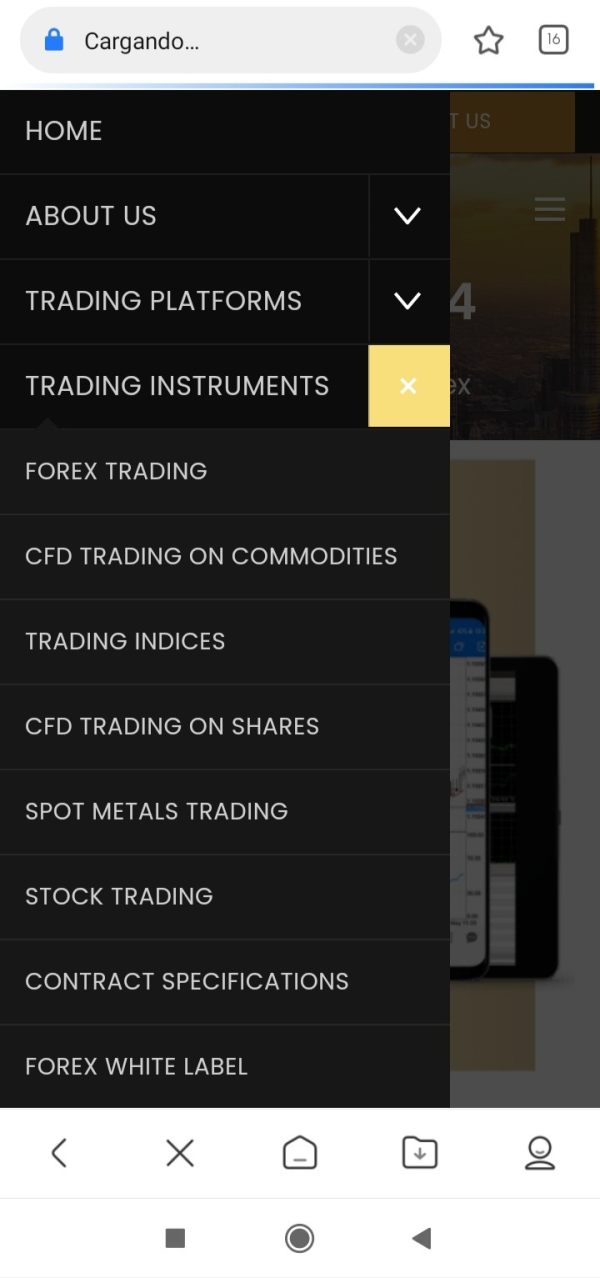

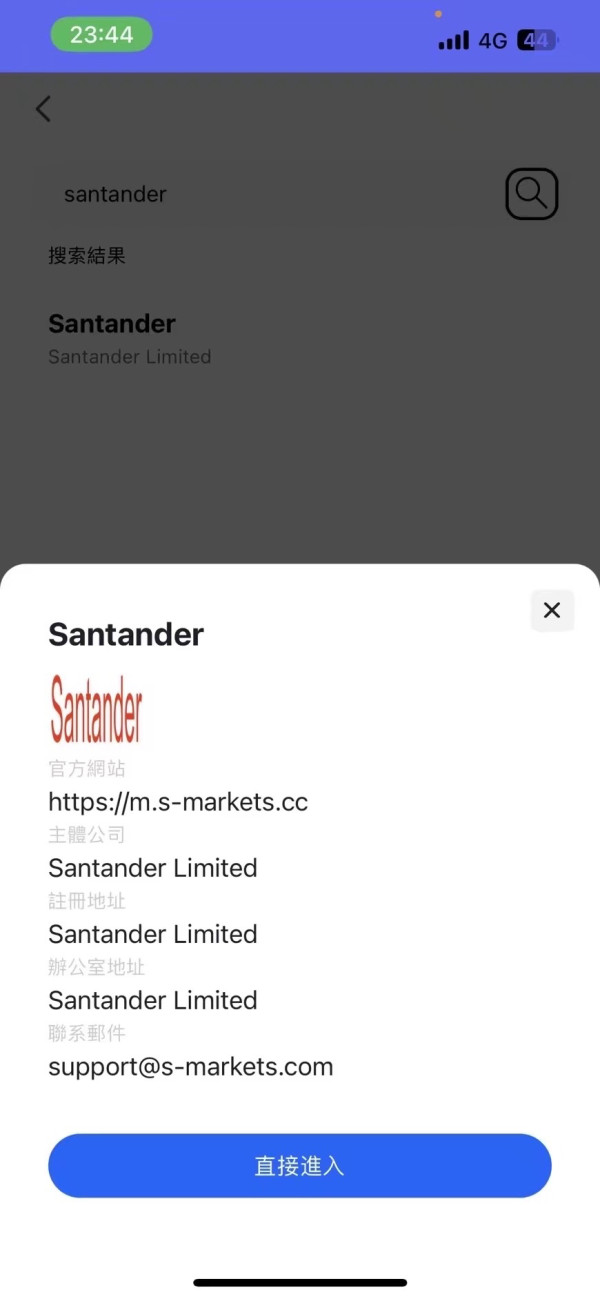

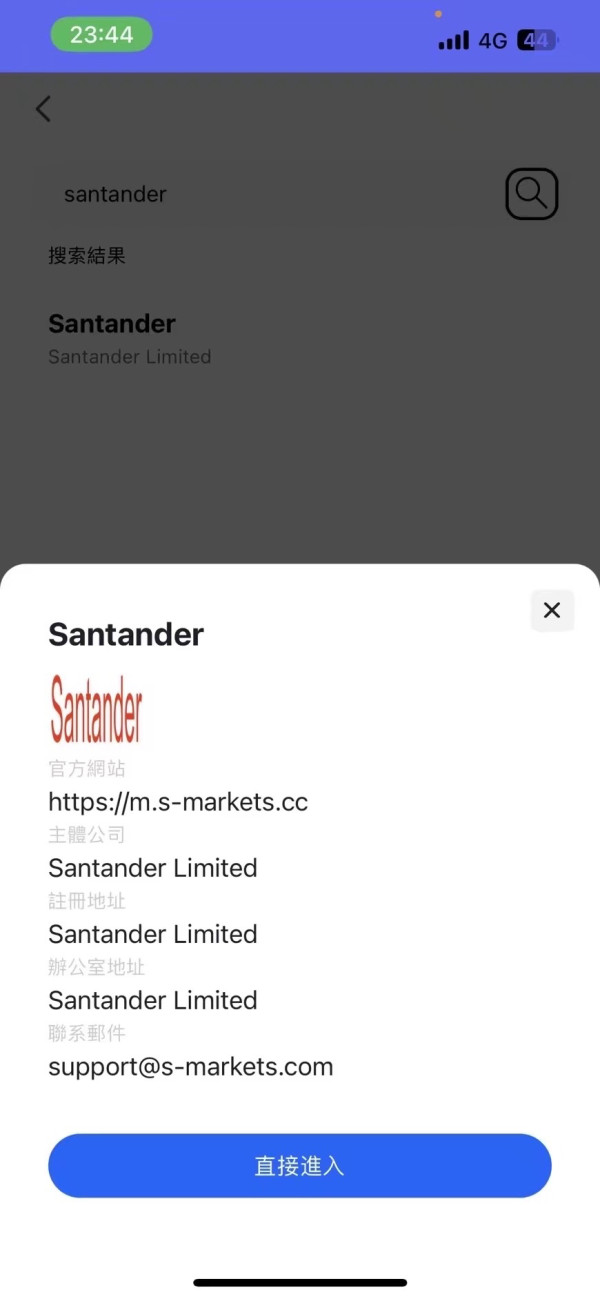

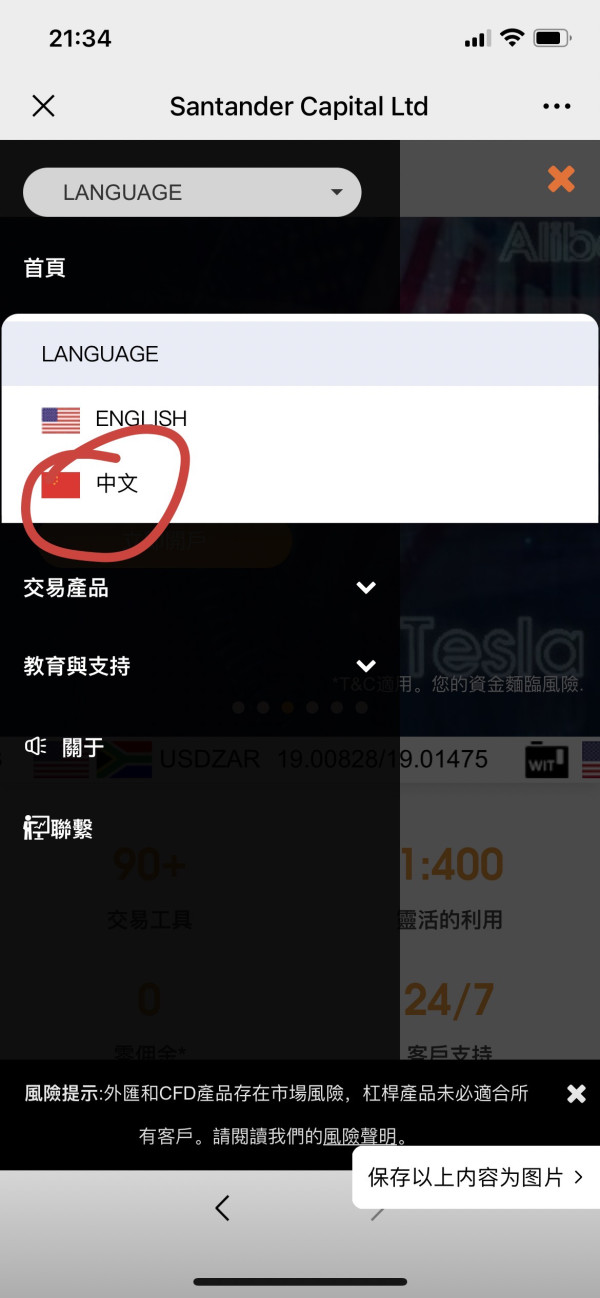

I can only post the exposure information under the official ones. The ones marked below are official. The platform I deposited is fake. The address of the fraudulent and fake platform: is https://www.santanderfx.com It has been liquidated to obtain the user's assets. I am now unable to withdraw funds.

Too good

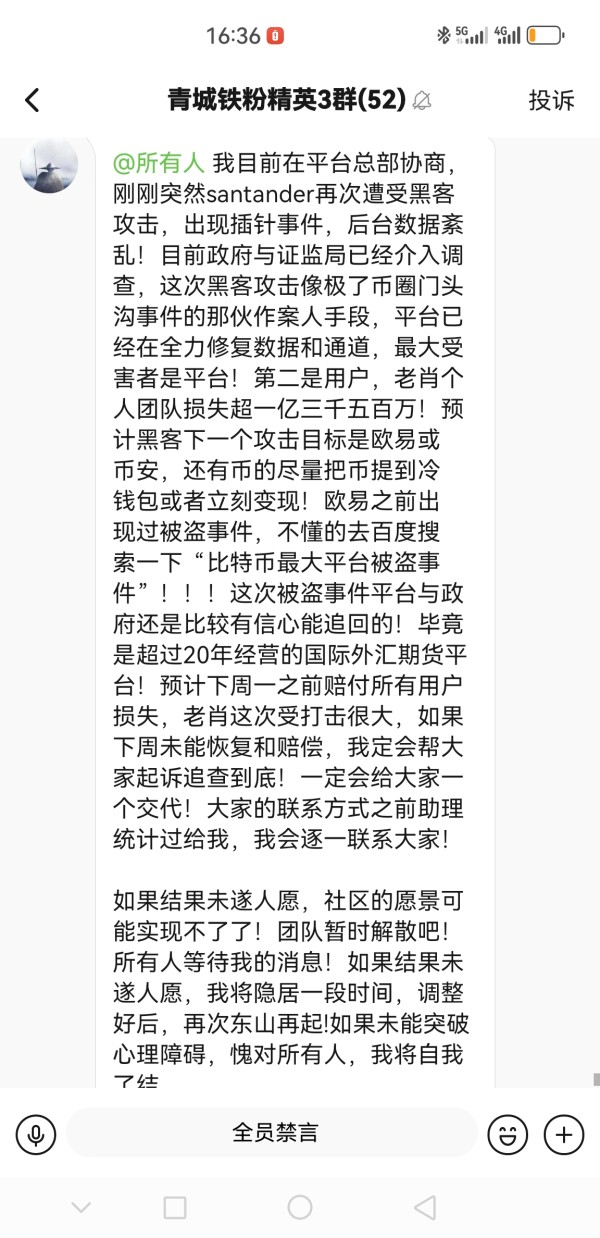

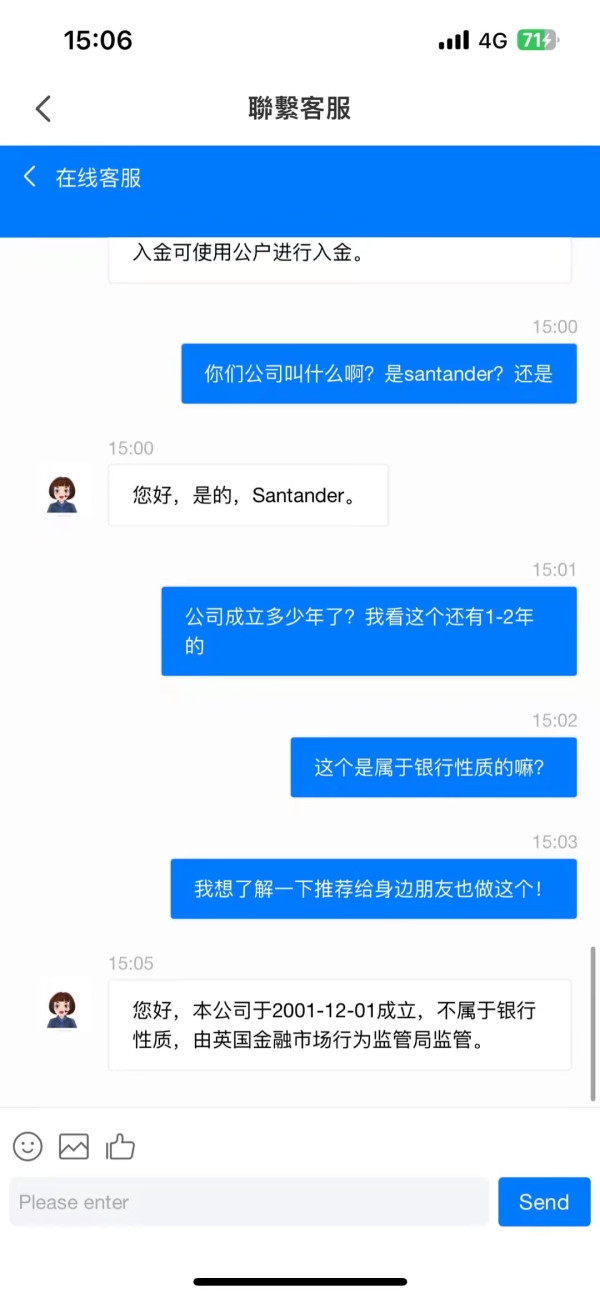

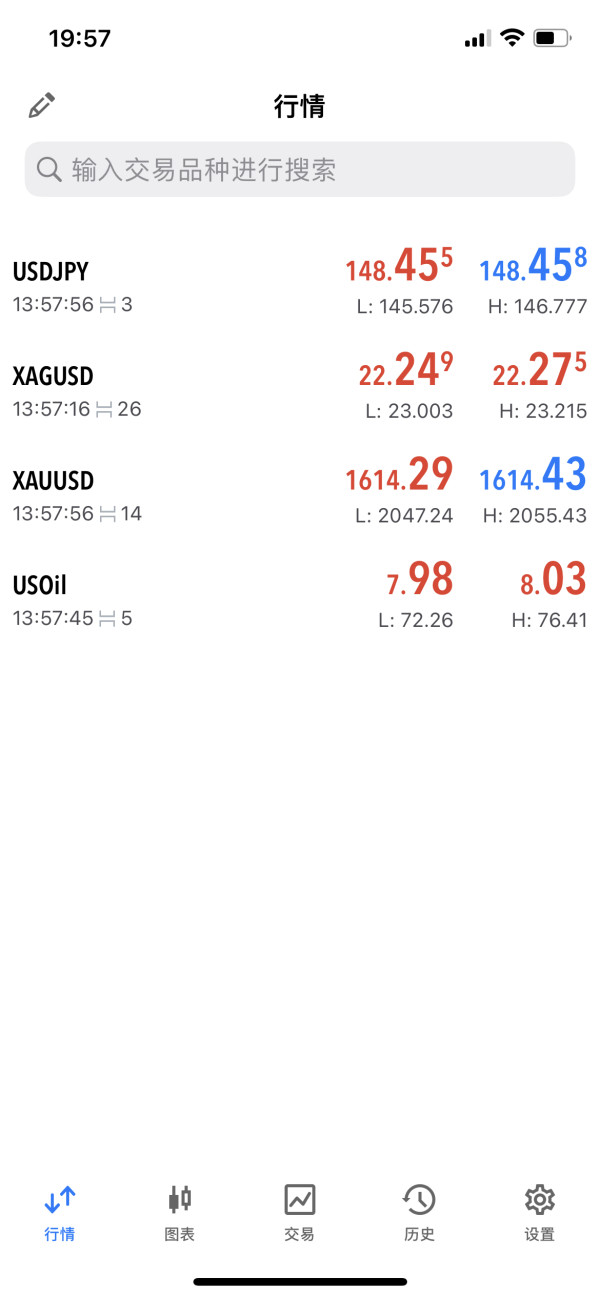

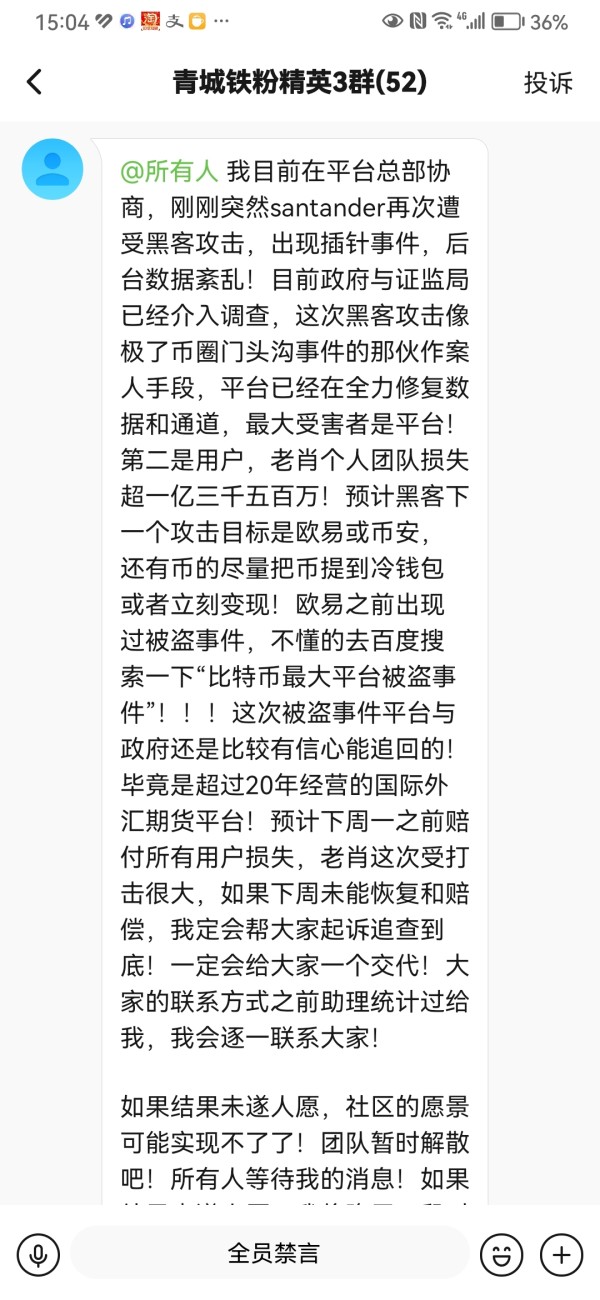

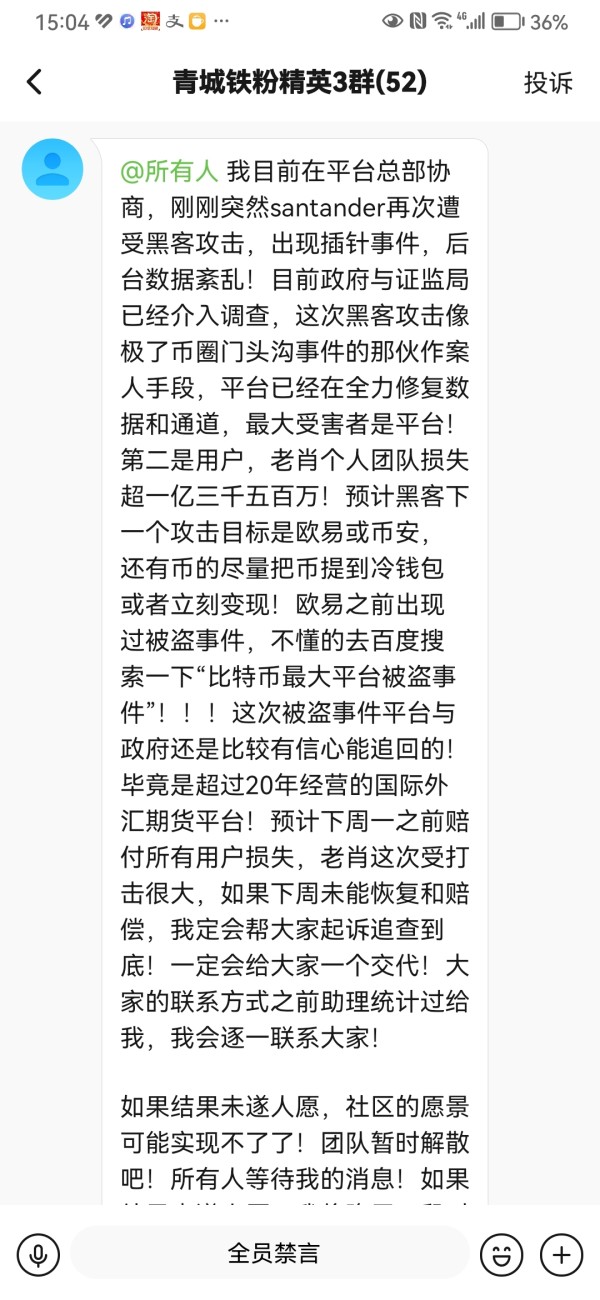

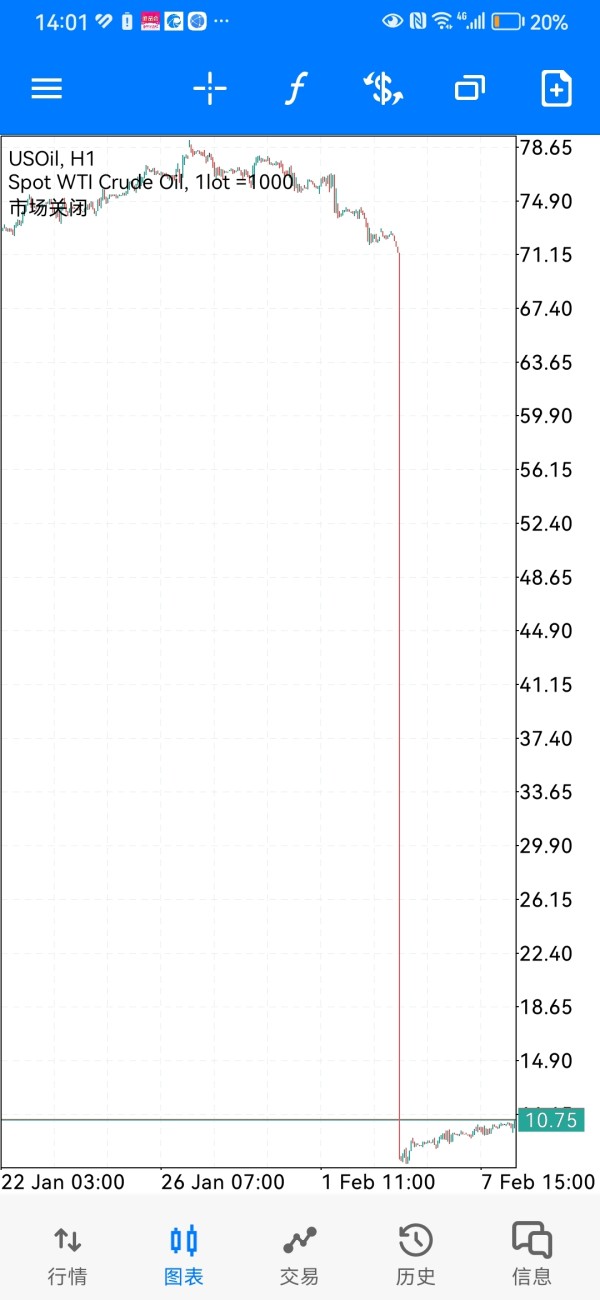

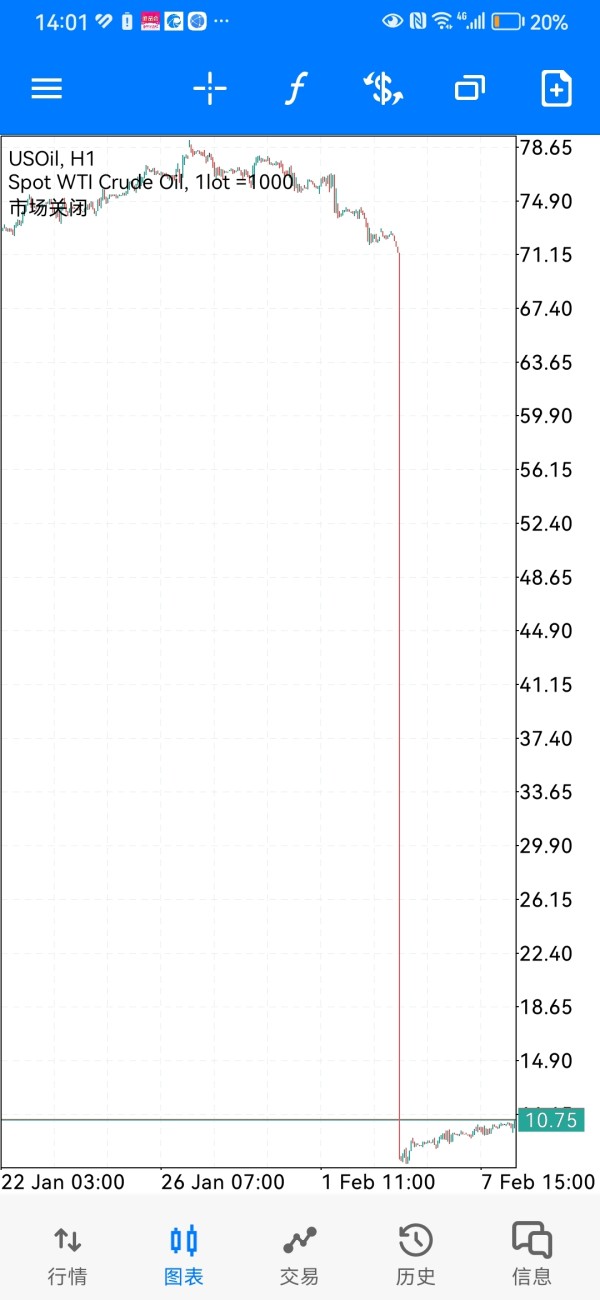

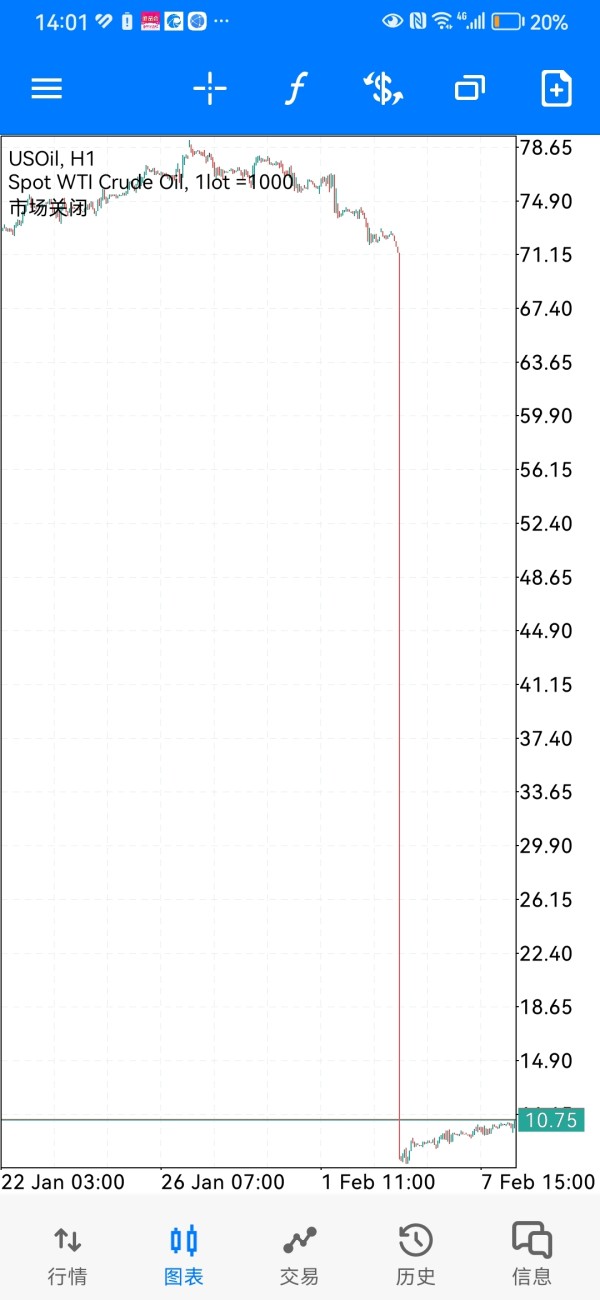

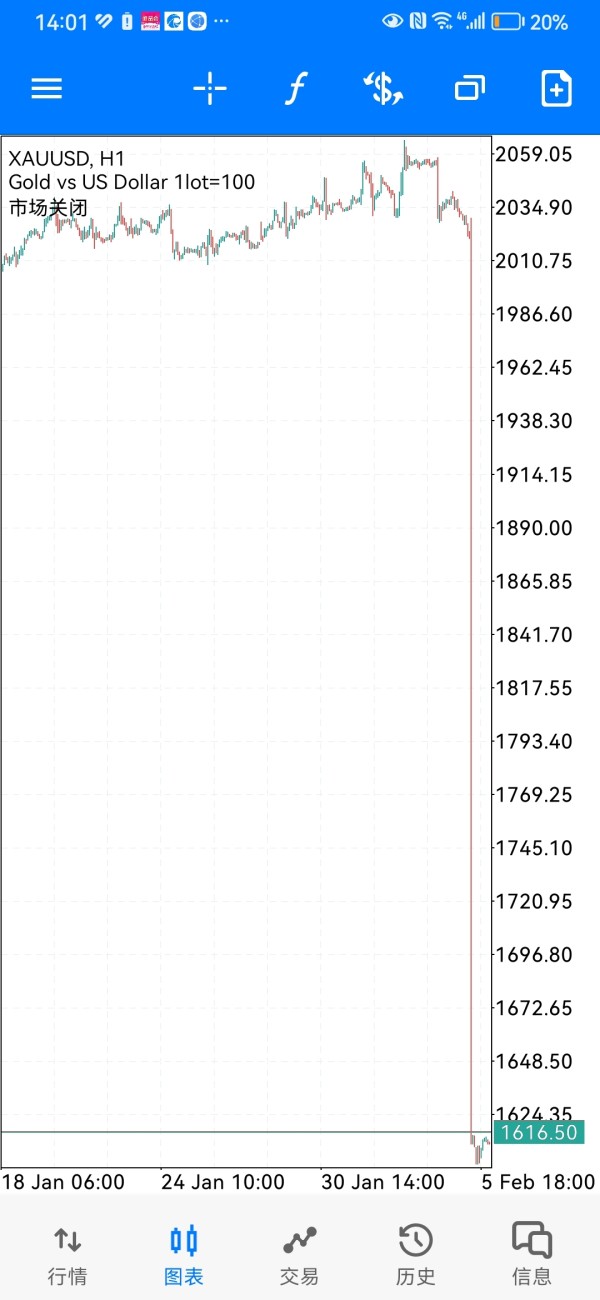

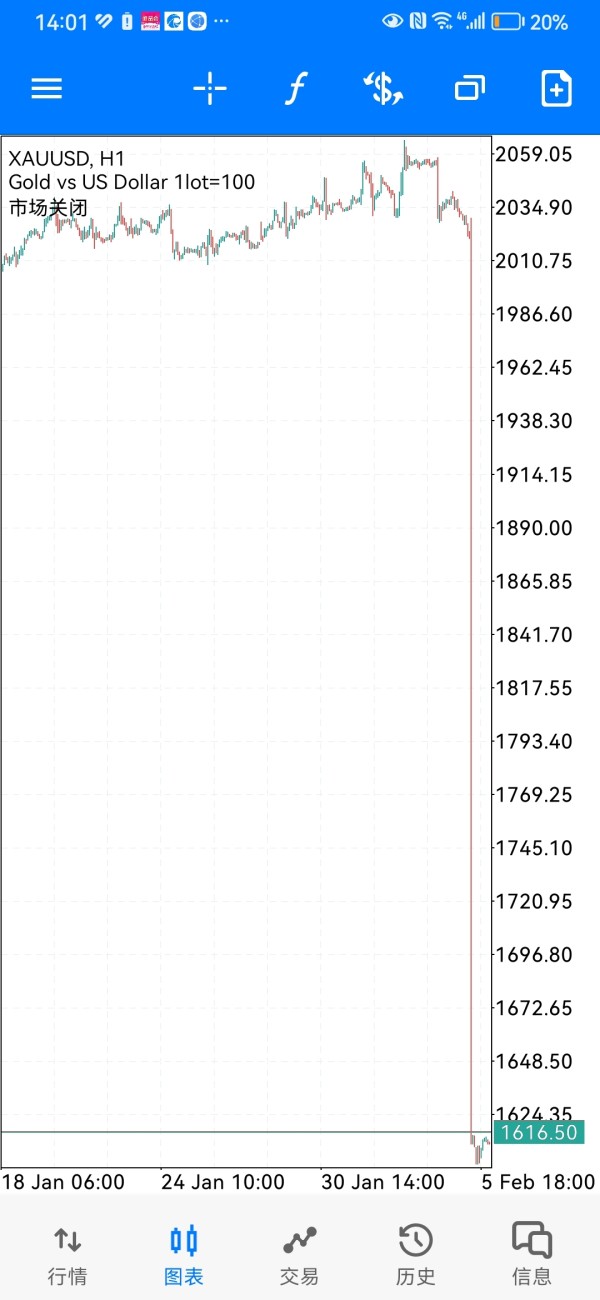

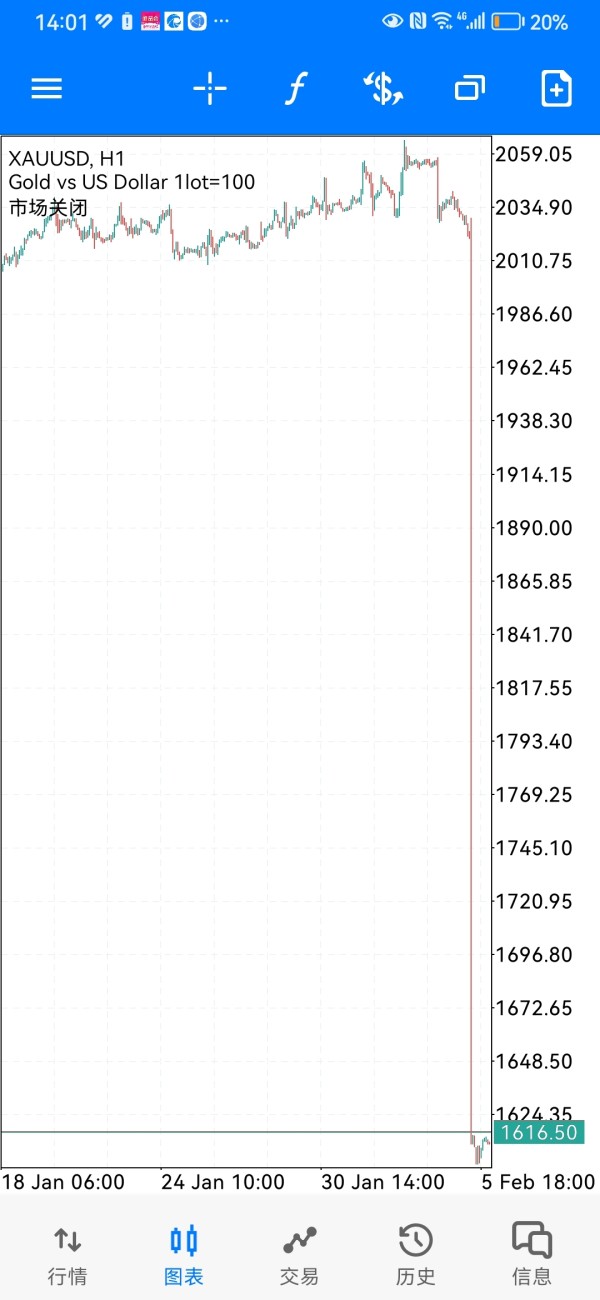

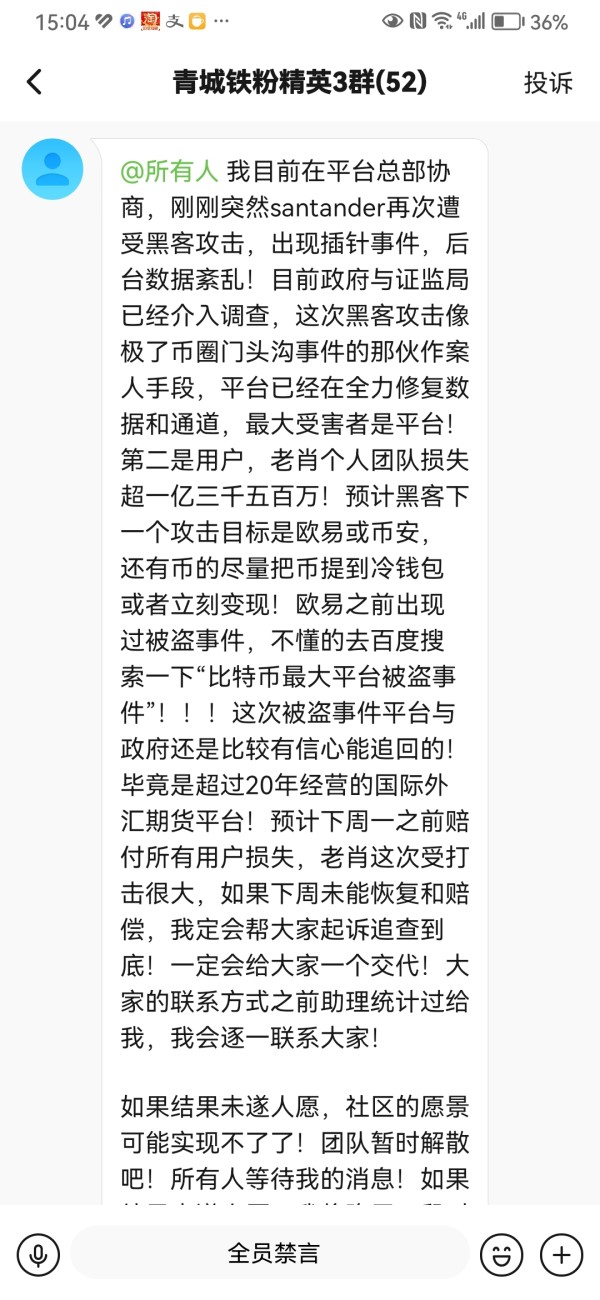

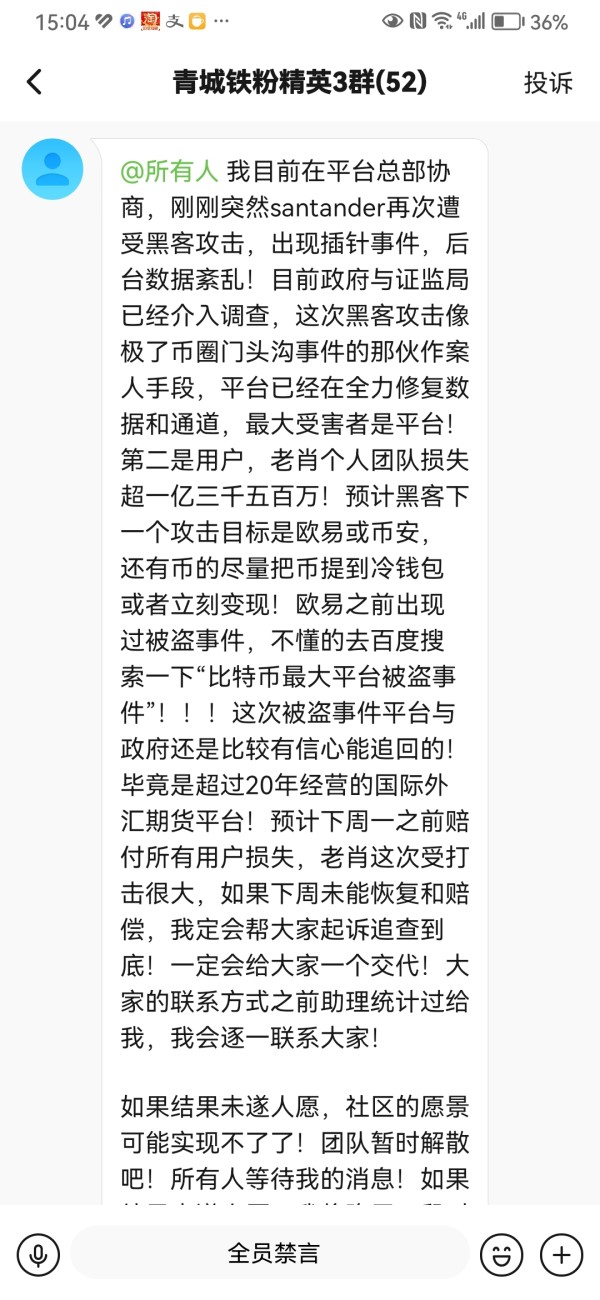

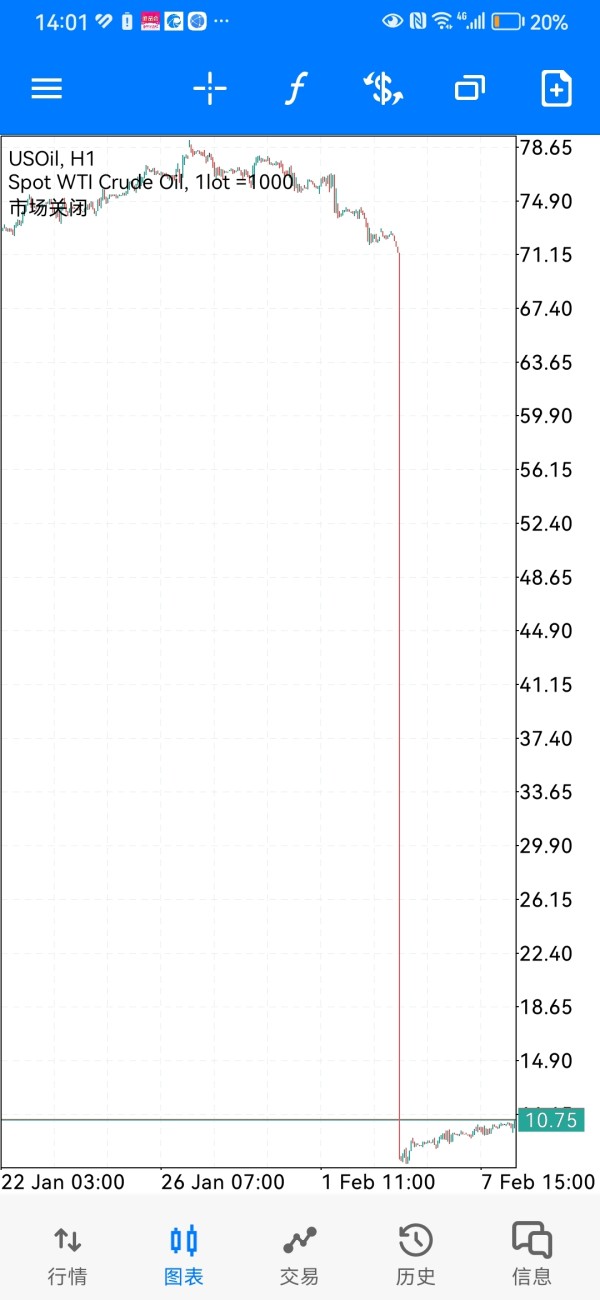

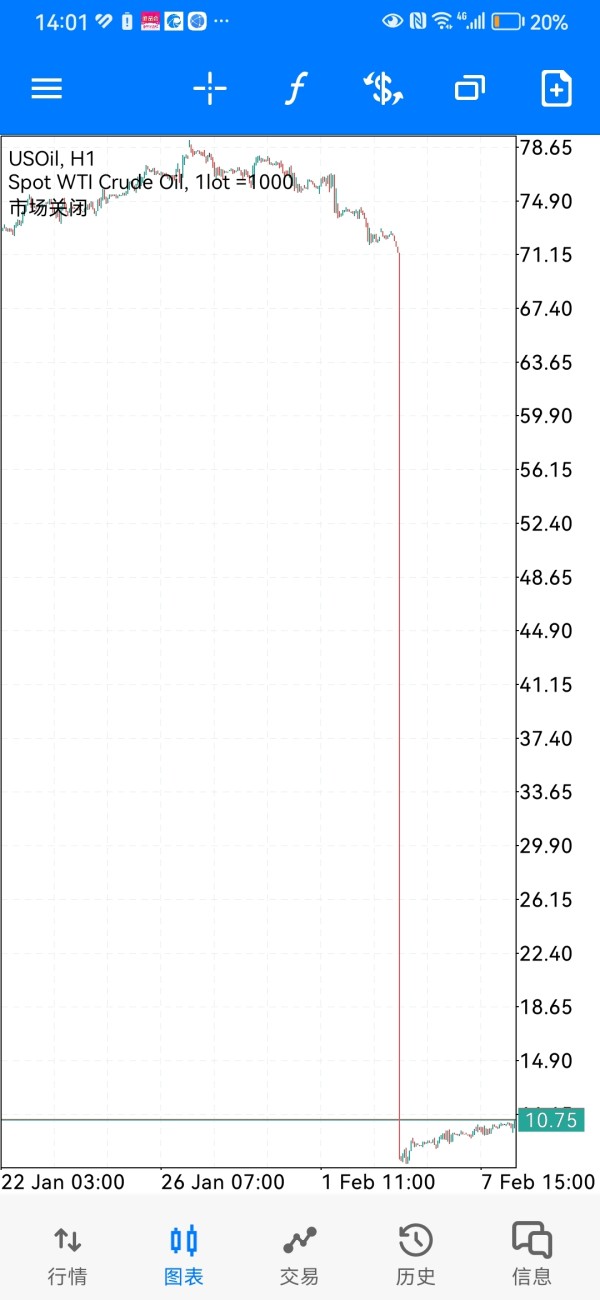

Xiao Peng began to gain the trust of members through lectures, and step by step induced everyone to register for the fake Santander website: https://www.santanderfx.com. Starting from depositing money, he induced everyone to buy gold and crude oil, and finally directly controlled the platform to liquidate their positions! They lied about a hacker attack and no one can withdraw money. The website is currently unavailable! This is pure fraud. Please be sure to unite and contact me on WeChat to wipe out the Xiao Peng gang together to prevent more people from being deceived!

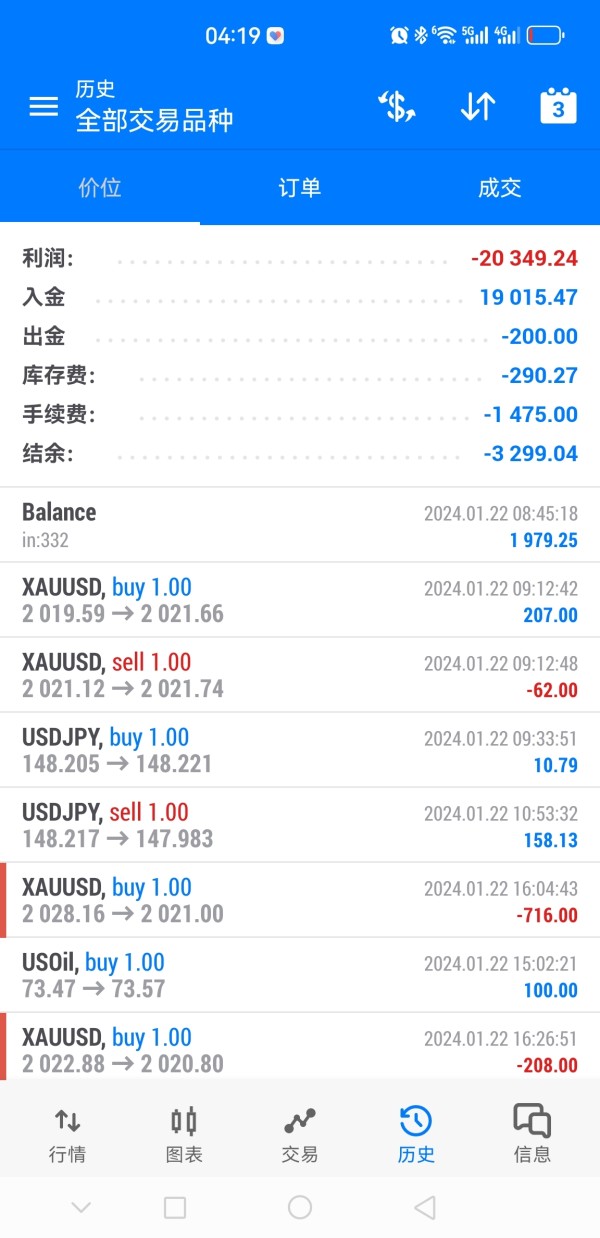

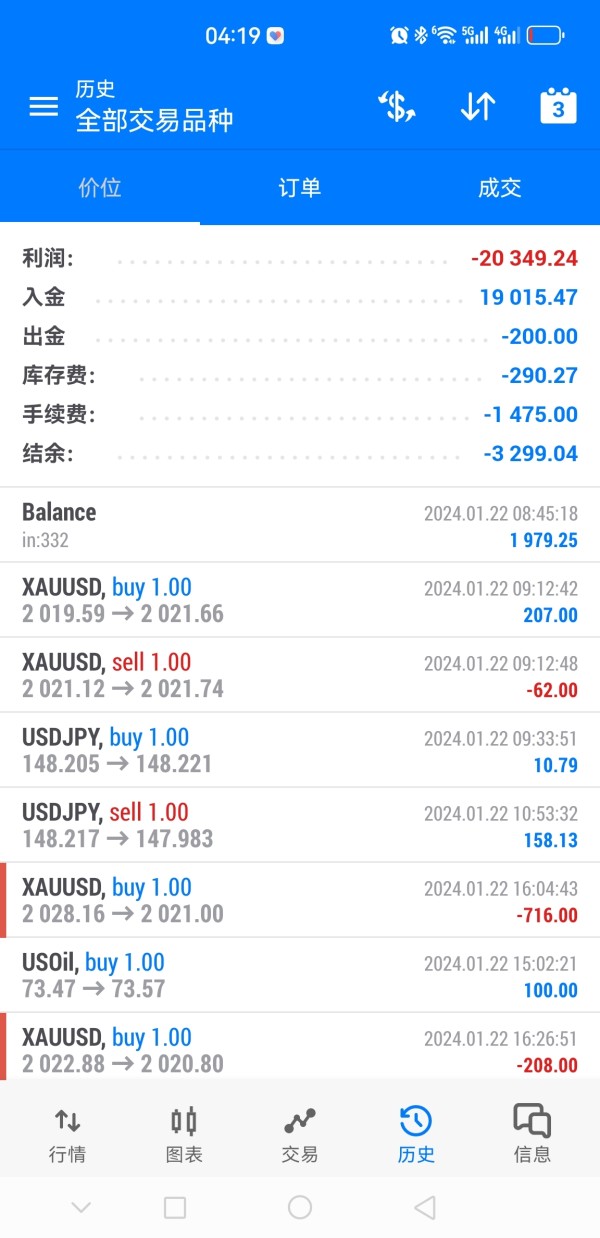

Xiao Peng's fraud team uses lectures to deceive our trust and induces us to download the mt5 platform. He persuades us to choose the Santander trader and conduct copy trading! The malicious marking caused us to liquidate our positions. The trading platform was hacked last Thursday and we were unable to withdraw cash. Furthermore, the chat group was suddenly disbanded and blacklisted! Withdrawal is currently unavailable! I have called the police. The police has accepted the case and has been sorting out relevant information.

I was defrauded by Xiao Peng's team. The telecom network used the fake meta5 platform. It is the trader Santander. My position is currently liquidated and I am unable to withdraw money. I have reported the case! The police are sorting it out!

I was also deceived by Xiao Peng, fake Santander, now has a burst position, has been unable to withdraw funds, Santander has been unable to log in.