Colmex Pro 2025 Review: Everything You Need to Know

Executive Summary

This Colmex Pro review looks at a Cyprus-based forex and CFD broker that has served traders since 2010. Colmex Pro presents itself as a medium-risk brokerage that works well for both new and professional traders, offering many different trading tools and platforms. The broker follows rules set by the Cyprus Securities and Exchange Commission (CySEC) under license number 123/10. This gives a solid base of oversight for how it operates.

Key highlights of Colmex Pro include its multi-platform trading setup with MT4, Colmex Pro MultiTrader, and Colmex Pro 2.0. It also offers a wide range of assets including forex pairs, CFDs, indices, and stocks. The broker mainly targets retail and professional traders who want advanced trading tools and custom platform solutions.

However, potential clients should know about the high minimum deposit requirements that range from $500 to $3,000 based on account type. User feedback shows the platform gets mixed reviews with a 3/5 rating. This shows moderate satisfaction levels among its clients.

Important Notice

Colmex Pro works across different regions, and services may change based on local rules. Traders should carefully read the specific terms that apply to their area before opening an account.

The broker's CySEC regulation provides European Union regulatory framework compliance, but services and products may differ for clients outside the EU. This review uses publicly available information and user feedback collected from various sources as of 2025.

The analysis aims to give potential investors complete insights while noting that trading involves significant risk. Past performance does not guarantee future results.

Rating Framework

Broker Overview

Company Background and Foundation

Colmex Pro started in 2010 and has its main office in Limassol, Cyprus. The company has positioned itself as a specialized financial services provider that focuses on forex, stocks, commodities, and contracts for difference (CFDs) for both retail and professional trading communities.

With thousands of registered clients according to company reports, Colmex Pro has built its reputation as a professional trading broker that helps traders across different experience levels. The broker's business model centers on providing complete trading solutions through multiple platform options while maintaining regulatory compliance under European Union frameworks.

According to available information, the company focuses on advanced trading tools and tailored platform experiences designed to meet diverse trading needs and preferences.

Trading Infrastructure and Asset Coverage

Colmex Pro offers three main trading platforms: MetaTrader 4 (MT4), Colmex Pro MultiTrader, and Colmex Pro 2.0. This gives clients flexibility in choosing their preferred trading environment.

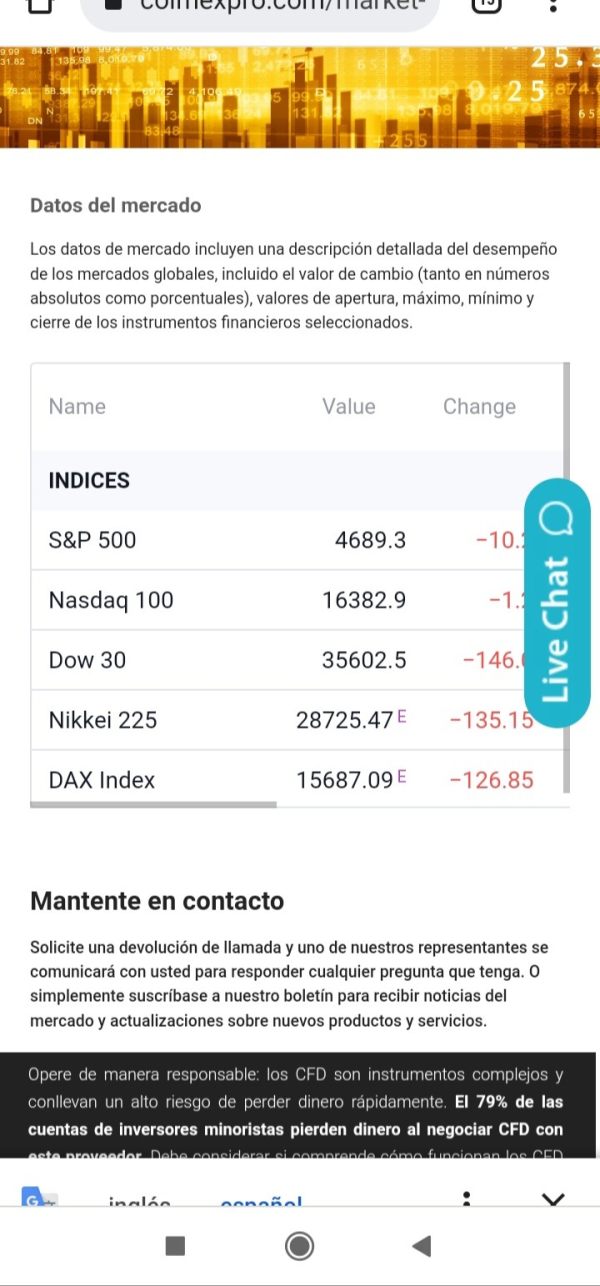

The broker's asset portfolio includes currency pairs for forex trading, various CFD instruments, major global indices, and individual stock trading options. The company operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC), which provides European regulatory framework compliance and investor protection measures.

This Colmex Pro review notes that the regulatory status offers clients certain safeguards typical of EU-regulated financial service providers.

Regulatory Jurisdiction and Oversight

Colmex Pro operates under CySEC regulation with license number 123/10. This provides regulatory compliance within the European Union framework and offers clients investor protection measures and operational transparency requirements.

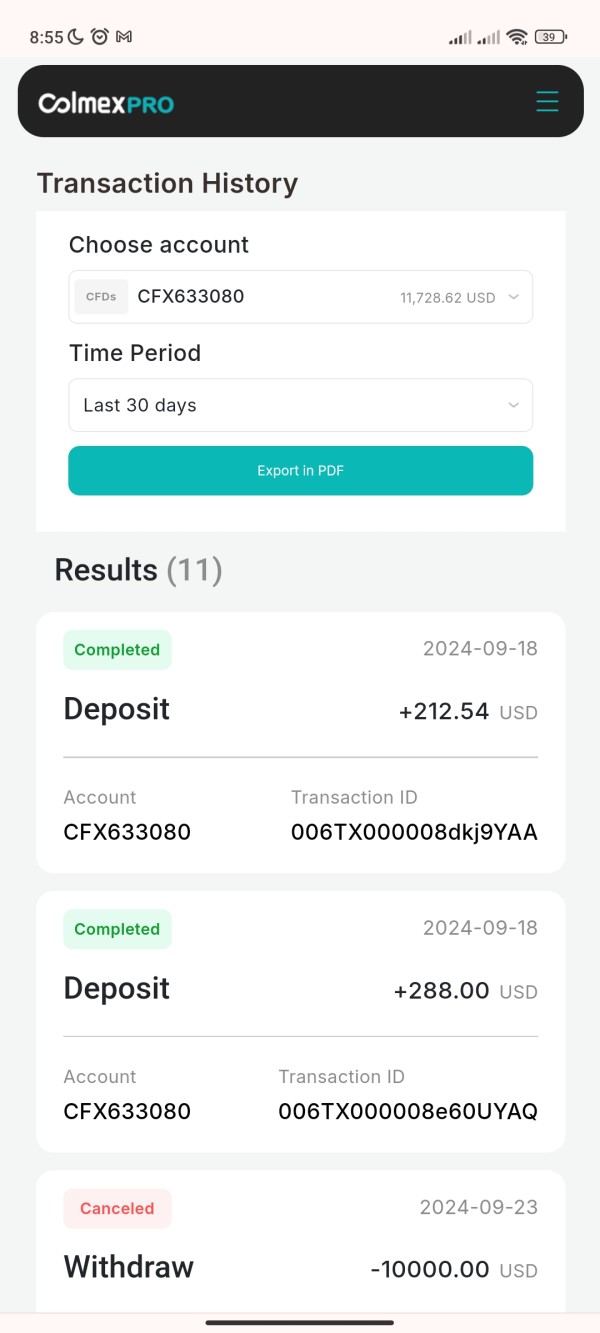

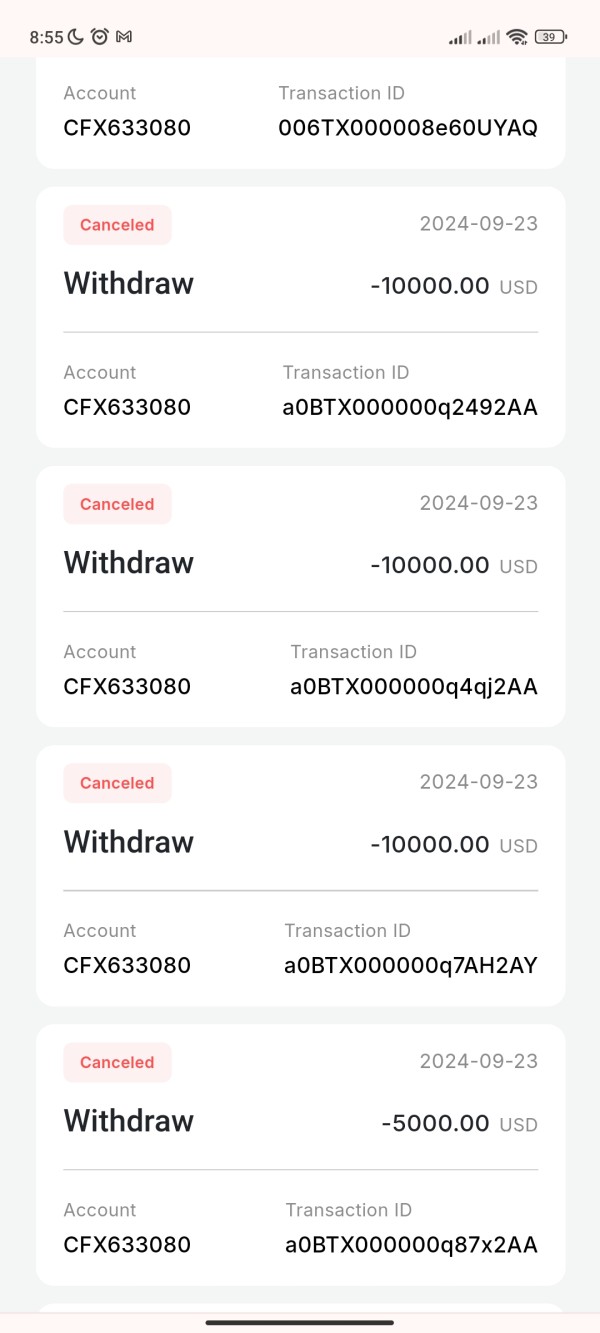

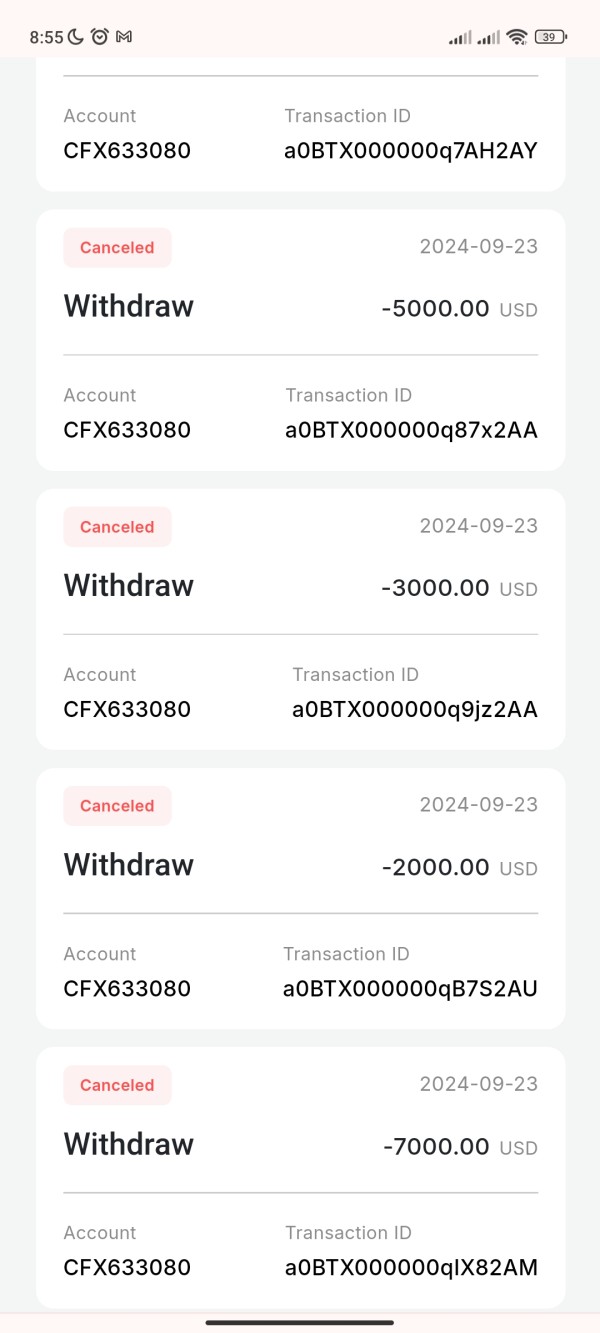

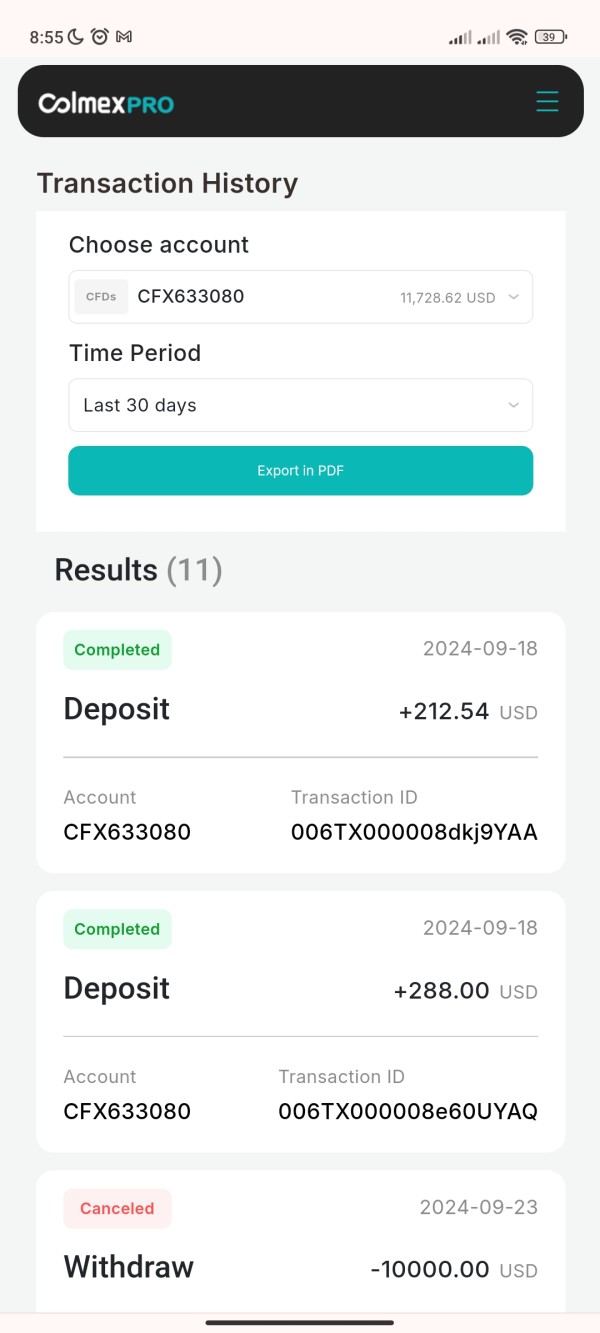

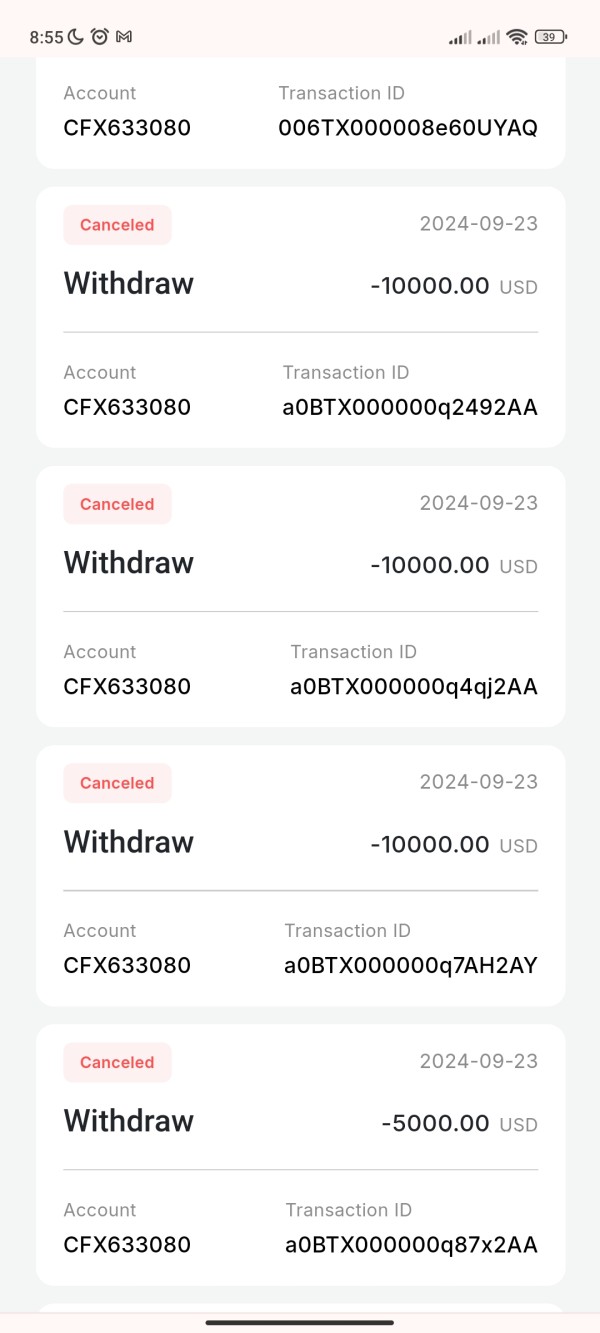

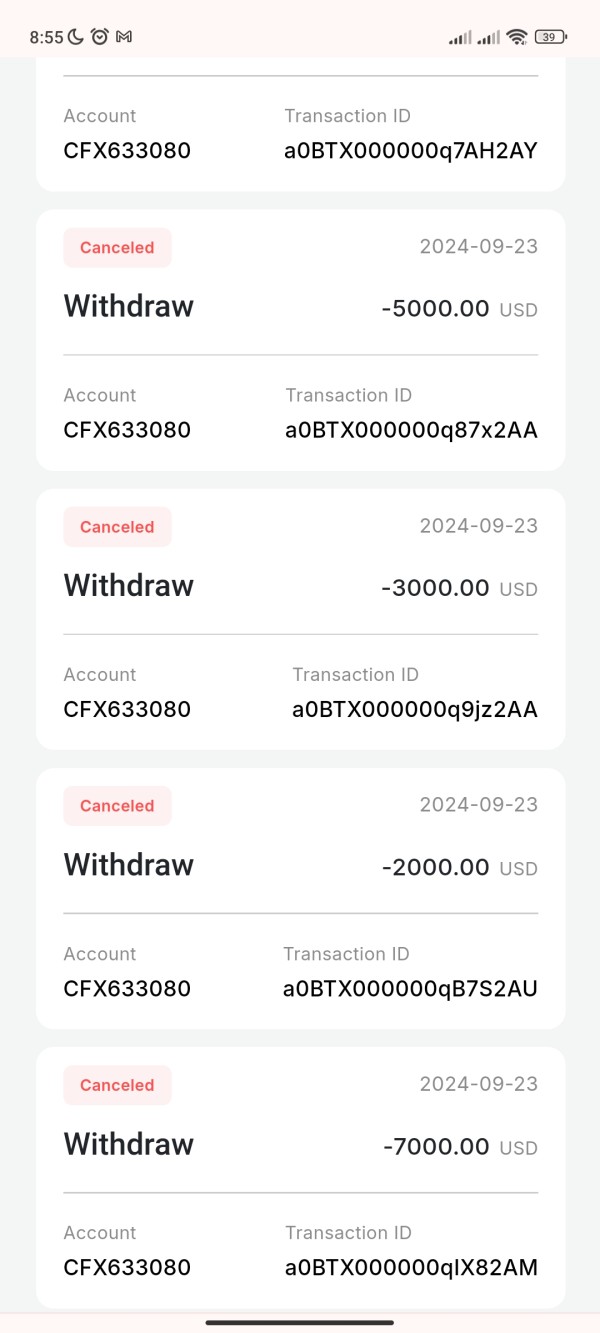

Deposit and Withdrawal Methods

Specific information regarding deposit and withdrawal methods was not detailed in available sources. This requires direct consultation with the broker for complete payment processing information.

Minimum Deposit Requirements

The broker uses tiered minimum deposit structures: $500 for Stock CFD accounts, $3,000 for direct stock trading accounts, and $2,000 for forex trading accounts. These requirements position Colmex Pro in the higher-tier category regarding initial investment expectations.

Promotional Offers and Bonuses

Specific bonus and promotional information was not detailed in available sources at the time of this review.

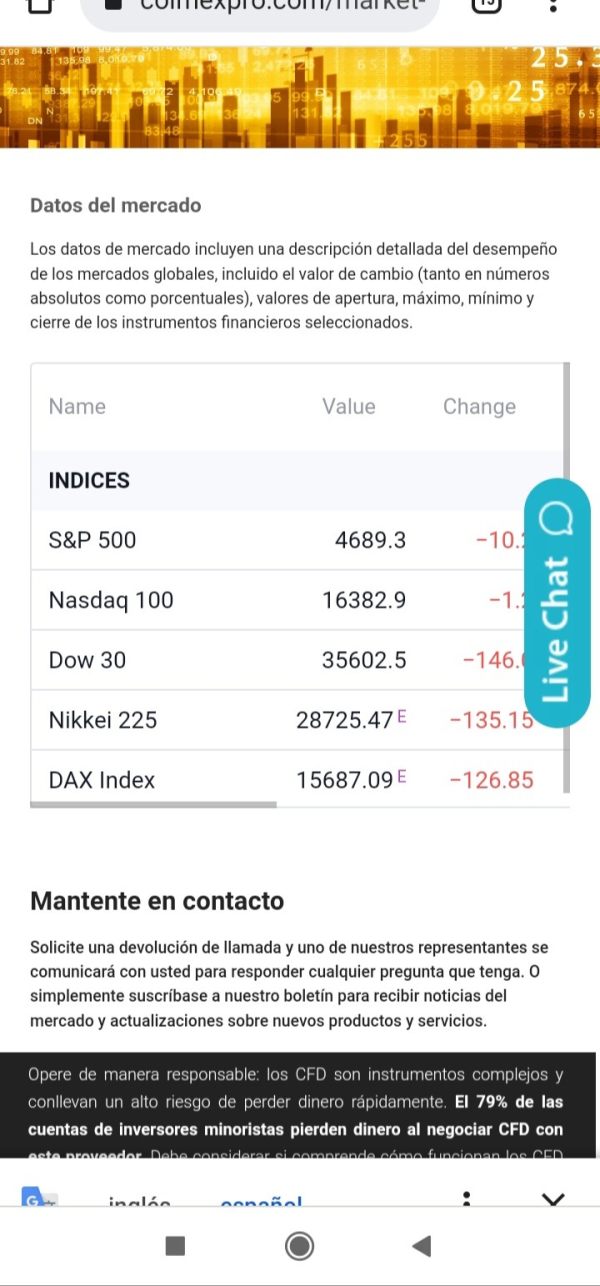

Available Trading Assets

Colmex Pro's trading portfolio includes forex currency pairs, contracts for difference (CFDs), major global indices, and individual stock instruments. This provides diversified trading opportunities across multiple asset classes.

Cost Structure and Fees

Detailed spread and commission information was not specified in available sources. This requires direct inquiry with the broker for complete pricing structures.

Leverage Ratios

The broker offers leverage ratios up to 1:30. This aligns with European regulatory requirements for retail client protection.

Platform Options

Traders can access MT4, Colmex Pro MultiTrader, and Colmex Pro 2.0 platforms. These offer various technological approaches to market access and trade execution.

Geographic Restrictions

Specific regional restrictions were not detailed in available sources.

Customer Support Languages

Information regarding supported languages for customer service was not specified in available materials.

This Colmex Pro review acknowledges that several operational details require direct verification with the broker due to limited public disclosure of specific service parameters.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Colmex Pro's account structure presents a mixed picture for potential traders. The broker offers different account types designed to accommodate various trading preferences, including specialized accounts for stock CFDs, direct stock trading, and forex instruments.

However, the minimum deposit requirements present a significant consideration for many traders, particularly those just beginning their trading journey. The $500 minimum for Stock CFD accounts represents the most accessible entry point, while forex accounts require $2,000 and direct stock trading demands $3,000.

These thresholds place Colmex Pro in the higher-tier category compared to many competitors who offer sub-$100 minimum deposits. User feedback indicates satisfaction with demo account functionality, suggesting the broker provides adequate testing environments for strategy development.

Account opening procedures and special features such as Islamic accounts were not detailed in available sources. This indicates potential areas where prospective clients should seek direct clarification.

The account structure appears designed for serious traders rather than casual market participants, which may limit accessibility for some user segments. Compared to industry standards, the minimum deposit requirements represent a barrier to entry that may discourage beginners, though they potentially attract more committed traders.

This Colmex Pro review notes that the account conditions favor traders with substantial initial capital rather than those seeking minimal investment thresholds.

Colmex Pro demonstrates strength in providing diverse trading tools across its platform offerings. The availability of three distinct platforms – MT4, MultiTrader, and Colmex Pro 2.0 – indicates a commitment to accommodating different trading styles and technological preferences.

MT4's inclusion ensures access to the industry's most widely adopted trading platform with its comprehensive charting tools and automated trading capabilities. The broker provides blog content and research resources, though the depth and frequency of analytical content were not extensively detailed in available sources.

User feedback suggests satisfaction with the platform's trading tools, particularly among beginners who appreciate the customization options and advanced features available through the proprietary platforms. Research and analysis resources appear to be supplementary rather than comprehensive, with the primary focus on platform functionality rather than extensive market research.

Educational resources were not specifically highlighted in available information, suggesting this may be an area for potential improvement or requiring direct inquiry for comprehensive details. The multi-platform approach demonstrates technical sophistication and user choice prioritization.

However, the absence of detailed information about automated trading support, signal services, and advanced analytical tools limits the complete assessment of the broker's resource offering. Users seeking extensive educational content and research depth may need to supplement Colmex Pro's offerings with external resources.

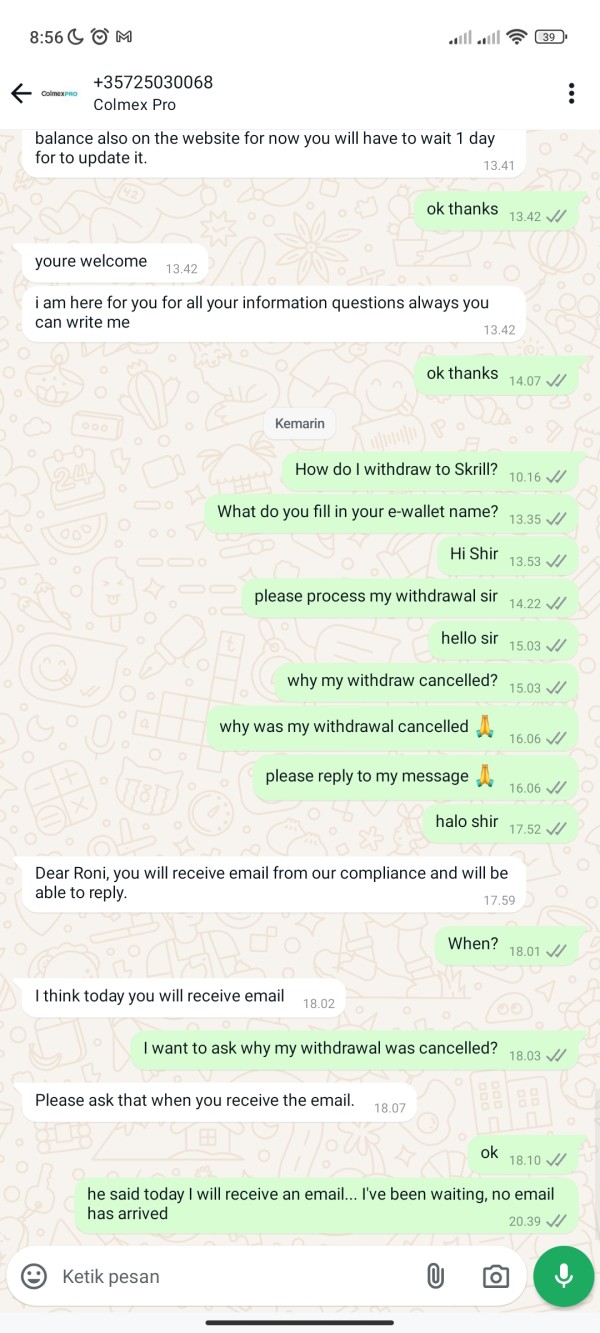

Customer Service and Support Analysis (Score: 5/10)

Customer service represents a challenging area for Colmex Pro based on available user feedback. Multiple sources indicate user dissatisfaction with service quality, suggesting inconsistent support experiences across the client base.

The specific channels available for customer support were not detailed in available information, making it difficult to assess accessibility and availability comprehensively. Response time concerns appear in user feedback, indicating potential delays in addressing client inquiries and issues.

Some users report negative experiences with company service quality, though specific incidents and resolution approaches were not detailed in available sources. The lack of detailed information about multilingual support capabilities may present challenges for international clients.

Support availability hours and specialized support for different account types were not specified in available materials. This information gap suggests potential clients should directly verify support structures before committing to the platform.

The customer service challenges appear to impact overall user satisfaction and may influence retention rates. Problem resolution case studies were not available in source materials, limiting insight into the broker's approach to handling complex client issues.

The customer service rating reflects documented user concerns while acknowledging that individual experiences may vary significantly based on specific circumstances and inquiry types.

Trading Experience Analysis (Score: 7/10)

The trading experience at Colmex Pro receives positive recognition for platform sophistication and tool availability. Users acknowledge the advanced trading tools provided across the platform options, suggesting robust technical capabilities for market analysis and trade execution.

The multi-platform environment allows traders to select interfaces that best match their experience levels and trading approaches. Platform stability receives moderate user ratings, indicating generally reliable performance with occasional concerns.

Specific information about slippage rates, requote frequency, and execution speeds was not detailed in available sources, representing important factors that require direct testing or broker consultation. The availability of multiple chart types and technical indicators suggests comprehensive analytical capabilities.

Mobile trading applications are available, though specific user feedback about mobile platform performance was not extensively documented. The trading environment appears designed to accommodate both manual and systematic trading approaches, though specific automated trading capabilities require verification.

Order execution quality and spread consistency information was not detailed in available sources. The broker's technological infrastructure supports professional-level trading requirements while remaining accessible to less experienced users.

User feedback suggests satisfaction with tool sophistication, though platform stability concerns indicate room for improvement. This Colmex Pro review notes that the trading experience appears strongest for users who prioritize tool variety and platform options over ultra-low costs or extensive educational support.

Trustworthiness Analysis (Score: 8/10)

Colmex Pro's regulatory status under CySEC provides a solid foundation for trustworthiness assessment. The Cyprus Securities and Exchange Commission regulation ensures compliance with European Union financial service standards and offers investor protection measures standard within the EU regulatory framework.

License number 123/10 can be independently verified through CySEC's official database. Specific fund safety measures beyond regulatory requirements were not detailed in available sources, though CySEC regulation typically includes client fund segregation requirements.

Company transparency regarding financial reporting and management structure was not extensively covered in available information, representing areas where additional disclosure could strengthen trust perceptions. Industry reputation and award recognition were not specifically mentioned in available sources, though the broker's establishment in 2010 indicates operational longevity within the competitive forex industry.

Negative incident handling and dispute resolution processes were not detailed, though CySEC regulation provides framework for complaint procedures. The regulatory foundation provides significant trustworthiness advantages compared to unregulated alternatives.

However, the absence of additional trust-building measures such as insurance coverage details, third-party auditing information, or industry recognition limits the complete trustworthiness picture. Users seeking maximum security should verify specific client protection measures directly with the broker while recognizing that CySEC regulation provides substantial baseline protections.

User Experience Analysis (Score: 6/10)

Overall user satisfaction with Colmex Pro presents a mixed picture, with the platform receiving a 3/5 rating based on available feedback. This moderate rating suggests adequate performance in some areas while highlighting opportunities for improvement in others.

User feedback indicates particular satisfaction with demo account functionality, suggesting effective onboarding and testing capabilities. Interface design and usability feedback was not extensively detailed in available sources, though the availability of multiple platform options suggests accommodation of different user preferences.

Registration and account verification processes were not specifically described, representing important factors for assessing initial user experience quality. Fund operation experiences, including deposit and withdrawal convenience and processing speeds, were not detailed in available user feedback.

Common user complaints appear to center on customer service quality and platform stability concerns, indicating areas where the broker could focus improvement efforts. The user experience appears strongest for traders prioritizing tool variety and platform options.

User demographic analysis suggests suitability for both beginners and experienced traders, though the higher minimum deposit requirements may limit accessibility for some segments. Improvement recommendations based on user feedback would include enhanced customer service quality and platform stability optimization.

The moderate user satisfaction rating reflects the broker's adequate performance across multiple areas while highlighting the need for consistency improvements in service delivery and platform reliability.

Conclusion

This Colmex Pro review reveals a regulated forex and CFD broker that offers solid platform options and regulatory oversight while facing challenges in customer service delivery and accessibility. The broker's CySEC regulation provides important trustworthiness foundations, and the multi-platform trading environment accommodates diverse trading preferences effectively.

Colmex Pro appears most suitable for traders who prioritize platform variety and advanced trading tools, particularly those with sufficient capital to meet the higher minimum deposit requirements. The broker serves both beginner and professional traders, though beginners should be prepared for limited educational resources and potentially inconsistent customer support experiences.

The main advantages include regulatory protection, diverse platform options, and sophisticated trading tools, while key disadvantages encompass higher minimum deposits, customer service concerns, and limited transparency in operational details. Potential clients should carefully evaluate their priorities regarding cost, support quality, and platform features when considering Colmex Pro among available alternatives.