Regarding the legitimacy of Santander forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is Santander safe?

License

Risk Control

Is Santander markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Santander UK plc

Effective Date:

2001-12-01Email Address of Licensed Institution:

santanderregulatoryliaison@santander.co.uk, consumerservice@santander.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.santander.co.ukExpiration Time:

--Address of Licensed Institution:

2 Triton Square Regent's Place London NW1 3AN UNITED KINGDOMPhone Number of Licensed Institution:

+44 03309123123Licensed Institution Certified Documents:

Is Santander Safe or a Scam?

Introduction

Santander, a prominent name in the financial sector, has established itself as a major player in the forex market. With a history dating back to 1857, Santander has evolved into a multinational banking giant, offering a wide array of financial services, including forex trading. However, with the proliferation of online trading platforms, traders must exercise caution when selecting a broker. The forex market is rife with scams and unreliable entities, making it imperative for traders to conduct thorough due diligence. This article aims to provide an objective analysis of Santander's credibility as a forex broker, utilizing a comprehensive evaluation framework that includes regulatory status, company background, trading conditions, client experiences, and risk assessment.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety and reliability of any forex broker. A well-regulated broker is typically subject to stringent oversight, which helps protect traders' interests. In the case of Santander, the broker operates under the supervision of reputable regulatory bodies, which lends credibility to its operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA (Financial Conduct Authority) | 106054 | United Kingdom | Verified |

The Financial Conduct Authority (FCA) is one of the most respected regulatory bodies globally, known for enforcing strict compliance standards. Santander is regulated by the FCA, which means it is required to adhere to rigorous operational guidelines, including maintaining sufficient capital reserves and ensuring transparency in its dealings. The FCA also mandates that client funds be kept in segregated accounts, providing an additional layer of security for traders.

Historically, Santander has maintained a positive compliance record with the FCA, which further solidifies its standing as a legitimate broker. However, it is essential for potential clients to remain vigilant and stay updated on any regulatory changes or warnings issued by the FCA or other authorities.

Company Background Investigation

Santander's history is characterized by growth and adaptation in an ever-evolving financial landscape. Founded in Spain, the bank has expanded its operations globally, including a significant presence in the U.S. market. As a wholly owned subsidiary of Banco Santander, the company benefits from a robust financial foundation and extensive resources.

The management team at Santander is composed of seasoned professionals with diverse backgrounds in finance and banking. This expertise is crucial in navigating the complexities of the forex market and ensuring that the broker remains competitive and compliant with industry standards. Transparency is a key focus for Santander, as evidenced by its comprehensive disclosures regarding financial performance, regulatory compliance, and operational practices.

Santander's commitment to transparency is reflected in its regular updates to clients regarding market conditions, trading practices, and any potential risks associated with forex trading. This level of openness is vital in fostering trust between the broker and its clients.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is paramount. Santander provides a competitive trading environment, but potential clients should carefully consider the associated costs and fees.

| Fee Type | Santander | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.2 pips |

| Commission Structure | $5 per trade | $4 per trade |

| Overnight Interest Range | 0.5% | 0.4% |

The overall fee structure at Santander is competitive, though slightly higher than the industry average in some areas. The spreads on major currency pairs average around 1.5 pips, which is within a reasonable range but can be improved. The commission fee of $5 per trade is also slightly above average, which may impact profitability, especially for high-frequency traders.

It is essential to note that Santander has been transparent about its fee structure, allowing clients to assess the cost of trading before opening an account. However, any unusual or hidden fees should be scrutinized closely to avoid unexpected costs.

Client Funds Safety

The safety of client funds is a paramount concern for any forex trader. Santander implements several measures to ensure the security of client deposits. One of the key practices is the segregation of client funds from the broker's operational funds. This means that even in the event of financial difficulties, clients' funds are protected and can be returned.

Additionally, Santander participates in investor protection schemes, which provide further assurance to clients. In the U.K., the Financial Services Compensation Scheme (FSCS) protects eligible clients up to a certain amount in the event of broker insolvency. This adds an extra layer of security for traders using Santander as their forex broker.

Despite these safety measures, it is crucial for traders to remain aware of potential risks. Historical issues related to fund security, such as unauthorized transactions or mismanagement, can occur in any financial institution. Therefore, clients should remain vigilant and report any suspicious activity immediately.

Client Experience and Complaints

Client feedback is a vital indicator of a broker's reliability and service quality. Reviews of Santander reveal a mixed bag of experiences, with some clients praising the broker's services while others have reported significant issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response time |

| Customer Service | Medium | Inconsistent quality |

| Fee Transparency | Medium | Clarifications provided |

Common complaints include difficulties with fund withdrawals, inconsistent customer service, and concerns about fee transparency. Many clients have reported delays in processing withdrawals, which can be frustrating for traders needing quick access to their funds. Additionally, while some clients have had positive interactions with customer service, others have experienced long wait times and unhelpful responses.

Two notable cases highlight these issues. One client reported being unable to withdraw funds for several weeks, leading to frustration and dissatisfaction with the broker's communication. Another client faced unexpected fees that were not clearly communicated at the outset, resulting in confusion and distrust.

Platform and Execution Quality

The quality of the trading platform and order execution is critical for a successful trading experience. Santander's trading platform is generally regarded as user-friendly, offering a range of tools and features to assist traders. However, the execution quality has drawn mixed reviews.

Traders have reported varying experiences with order execution, including instances of slippage and delays during high volatility periods. While some users have praised the platform's stability, others have expressed concerns about the speed of order processing and the frequency of rejected orders.

Overall, while Santander provides a solid trading platform, potential clients should be aware of the execution quality and ensure that it meets their trading needs.

Risk Assessment

Engaging with any forex broker carries inherent risks, and Santander is no exception. A comprehensive risk assessment reveals several key areas of concern.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Low | Well-regulated by FCA |

| Fund Safety | Medium | Segregated accounts, but historical issues exist |

| Customer Service | High | Mixed reviews and slow response times |

The regulatory compliance risk is relatively low due to Santander's oversight by the FCA. However, there are medium risks associated with fund safety, as historical disputes and issues can arise. Customer service is a significant area of concern, with high risks stemming from negative feedback regarding responsiveness and effectiveness.

To mitigate these risks, traders should conduct thorough research before engaging with Santander, maintain clear communication with the broker, and stay informed about any regulatory changes or updates.

Conclusion and Recommendations

In conclusion, while Santander is a well-established broker with regulatory backing, potential clients should remain cautious. The analysis reveals that while there are no significant signs of outright fraud, there are areas of concern, particularly regarding customer service and withdrawal issues.

Traders looking for a reliable forex broker should consider their specific needs and trading style. For those who prioritize strong regulatory oversight and are comfortable navigating potential customer service challenges, Santander may be a suitable choice. However, for traders seeking a more seamless experience, exploring alternatives with a strong reputation for customer service and transparent trading conditions is advisable.

Some recommended alternatives include brokers regulated by top-tier authorities, known for their excellent customer service and transparent fee structures. Always ensure to conduct due diligence before committing to any broker, as the forex market can be unpredictable.

Is Santander a scam, or is it legit?

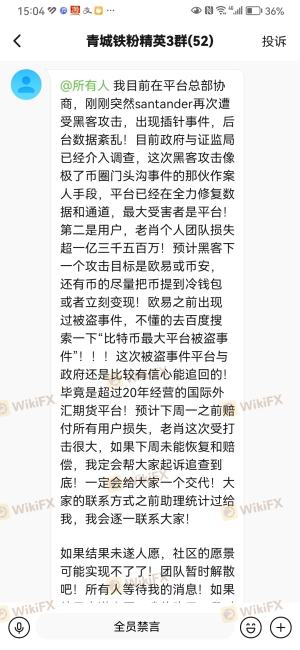

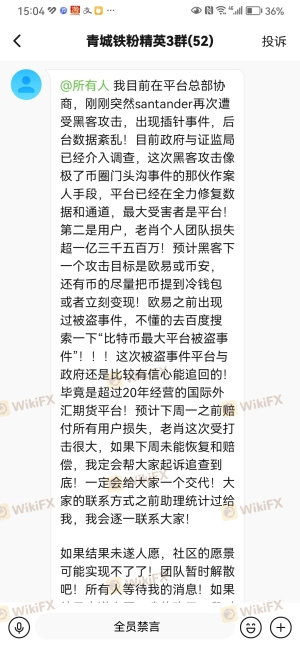

The latest exposure and evaluation content of Santander brokers.

Santander Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Santander latest industry rating score is 6.91, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.91 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.