Regarding the legitimacy of SBI forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is SBI safe?

Pros

Cons

Is SBI markets regulated?

The regulatory license is the strongest proof.

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

株式会社SBIネオトレード証券

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都港区六本木1-6-1Phone Number of Licensed Institution:

03-6635-2860Licensed Institution Certified Documents:

Is SBI Securities A Scam?

Introduction

SBI Securities, a subsidiary of the State Bank of India (SBI), has established itself as a key player in the Indian financial markets, providing a wide range of investment services including equity trading, mutual funds, and derivatives. Given the complexity and risks associated with forex trading, it is crucial for traders to thoroughly evaluate the credibility and reliability of any broker they choose to work with. This article aims to assess whether SBI Securities is a trustworthy broker or if it raises any red flags that potential clients should be aware of. Our investigation is based on a comprehensive analysis of regulatory compliance, company background, trading conditions, client feedback, and overall market reputation.

Regulation and Legitimacy

Regulation is a fundamental aspect of any brokerage's credibility. SBI Securities operates under the supervision of the Securities and Exchange Board of India (SEBI), which is responsible for regulating the securities market in India. The presence of a regulatory body ensures that brokers adhere to strict guidelines designed to protect investors. Below is a summary of the regulatory details for SBI Securities:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SEBI | INZ000200032 | India | Verified |

The importance of regulation cannot be overstated. A well-regulated broker like SBI Securities is subject to regular audits and compliance checks, which helps to mitigate risks associated with fraud and mismanagement. Historically, SBI Securities has maintained a clean record, with no significant violations reported by SEBI. This regulatory oversight adds a layer of security for traders, making it less likely for SBI Securities to engage in fraudulent activities.

Company Background Investigation

Founded in 2006, SBI Securities is part of the SBI Group, which is the largest banking conglomerate in India, boasting a vast client base of over a million customers. The company has built its reputation on the solid foundation of its parent bank, leveraging its financial strength and market expertise. The management team at SBI Securities comprises seasoned professionals with extensive experience in finance and investment, contributing to the company's credibility and operational efficiency.

In terms of transparency, SBI Securities provides a wealth of information on its services, fees, and trading conditions, which is crucial for building trust with clients. The company regularly publishes reports and updates on market trends and investment opportunities, ensuring that clients are well-informed.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and commissions, is vital. SBI Securities has a tiered fee structure that varies based on the type of trading activity. Below is a comparison of core trading costs:

| Fee Type | SBI Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.50% | 0.30% |

| Commission Model | Variable | Flat Rate |

| Overnight Interest Range | 0.045% per day | 0.03% per day |

SBI Securities charges a commission of 0.50% for equity delivery and 0.075% for intraday trades, which is higher than many discount brokers in the market. This pricing structure may deter cost-sensitive traders, particularly those engaged in frequent trading. Additionally, the overnight interest rates can add to the overall cost of trading, making it essential for traders to factor these expenses into their strategies.

Client Funds Safety

The safety of client funds is paramount when choosing a broker. SBI Securities employs several measures to ensure the security of client assets, including segregating client funds from company operating funds. This segregation is a critical aspect of safeguarding investors' capital. Furthermore, SBI Securities follows strict guidelines for investor protection, including negative balance protection policies, which prevent clients from losing more than their initial investment.

Despite these measures, it is essential to consider any historical issues related to fund safety. As of now, there have been no significant incidents reported that would raise concerns about the safety of funds held with SBI Securities. This history of reliability contributes to the broker's reputation as a safe option for traders.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience with a broker. Many users report positive experiences with SBI Securities, particularly praising its robust research capabilities and customer support. However, some common complaints have also surfaced, primarily concerning high fees and slow account opening processes.

Below is a summary of the main complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| High Fees | Moderate | Addressed |

| Slow Account Opening | High | Under Review |

| Customer Support Delays | Moderate | Improved |

For instance, some clients have expressed frustration over the time taken to open accounts, which can be a barrier for new traders eager to start trading. On the other hand, the company has made efforts to improve its customer service response times, indicating a commitment to addressing client concerns.

Platform and Trade Execution

The performance of a trading platform is a critical factor for traders. SBI Securities offers several platforms, including a web-based platform and a mobile app, both of which are designed to provide a user-friendly experience. However, some users have reported issues with order execution, including slippage and occasional order rejections.

While these issues are not uncommon in the industry, they can significantly impact a trader's experience. The company has not been reported to engage in any manipulative practices; however, consistent performance issues could affect user trust and satisfaction.

Risk Assessment

Using SBI Securities does carry certain risks, as is the case with any brokerage. A comprehensive risk assessment reveals the following key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by SEBI |

| Financial Risk | Medium | Higher fees compared to discount brokers |

| Operational Risk | Medium | Occasional execution issues |

Traders should be aware of these risks and consider implementing risk management strategies, such as setting stop-loss orders and diversifying their investments.

Conclusion and Recommendations

In conclusion, SBI Securities is not a scam, but it does have characteristics that potential clients should carefully consider. The broker is well-regulated, has a strong company background, and provides a range of investment options. However, the higher fees and occasional execution issues may not suit every trader's needs.

For those who prioritize regulatory safety and are willing to pay a premium for comprehensive services, SBI Securities can be a reliable choice. Conversely, cost-sensitive traders or those seeking more competitive pricing may want to explore alternative options, such as discount brokers like Zerodha or Upstox, which offer lower fees and more flexible trading conditions.

Overall, while SBI Securities is a legitimate broker, traders should conduct thorough research and carefully assess their trading needs before making a decision.

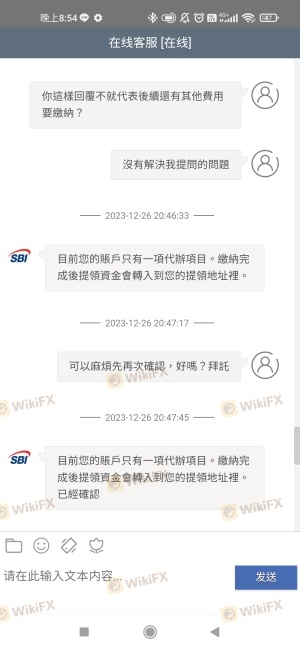

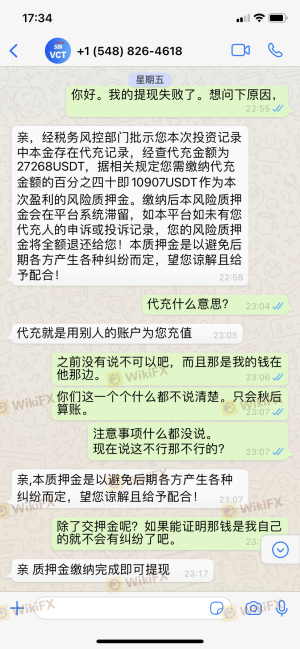

Is SBI a scam, or is it legit?

The latest exposure and evaluation content of SBI brokers.

SBI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SBI latest industry rating score is 7.98, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.98 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.