T4Trade 2025 Review: Everything You Need to Know

Executive Summary

This detailed t4trade review looks at one of the new players in online trading. T4Trade says it's a reliable trading platform that gives you access to different financial tools like forex, commodities, indices, shares, and futures. User feedback shows that the broker has gotten attention for its competitive trading conditions, with spreads starting as low as 0.0 pips and zero commission structure.

The platform mainly serves traders who want cost-effective trading solutions with flexible leverage options. User reviews show mostly positive experiences, with traders liking the platform's focus on delivering reliable and straightforward trading services rather than flashy features that might hide potential problems. T4Trade uses the popular MT4 platform, giving fast execution and what users call reliable trading conditions.

But our analysis shows some gaps in transparency, especially about regulatory oversight and detailed operational information. While the broker offers competitive pricing and user-friendly services, potential clients should know about these information limits when making their decision.

Important Notice

Regional Entity Differences: Our research shows limited public information about T4Trade's regulatory status across different areas. This lack of complete regulatory transparency may hurt user confidence and should be thought about when judging the broker's trustworthiness.

Review Methodology: This evaluation uses publicly available information, user feedback from various review platforms, and market analysis data. No direct testing or on-site checking has been done for this assessment.

Rating Overview

Broker Overview

T4Trade works as an online trading platform designed to give access to global financial markets. TechBullion reports say the company calls itself "one of the leaders" in offering global market access with reliable security and new trading solutions. The broker's mission focuses on giving users cutting-edge technology, fast execution speeds, and smooth trading experiences across multiple asset classes.

The platform specializes in forex trading, offering access to major, minor, and exotic currency pairs with flexible leverage options. Beyond forex, T4Trade extends its services to include commodities, indices, shares, and futures trading. Available information shows the broker focuses on delivering straightforward, reliable trading services rather than complex features that might hide important trading conditions.

T4Trade uses the MetaTrader 4 (MT4) platform as its main trading interface, giving traders a familiar and strong trading environment. The broker's approach emphasizes competitive pricing with spreads starting as low as 0.0 pips and a zero-commission structure, making it especially attractive to cost-conscious traders. However, specific information about the company's establishment date, headquarters location, and detailed corporate background stays limited in publicly available sources.

Regulatory Status: Current publicly available information does not give complete details about T4Trade's regulatory oversight. Some sources show a connection to Seychelles jurisdiction, but specific regulatory body information and license numbers are not clearly documented in available materials.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in current public sources, showing a gap in transparency that potential clients should investigate directly with the broker.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in available public documentation, requiring direct inquiry with the broker for accurate information.

Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in publicly available sources, though this is common for brokers focusing on transparent pricing rather than promotional incentives.

Tradeable Assets: T4Trade offers access to multiple asset classes including forex pairs (major, minor, and exotic), commodities, stock indices, individual shares, and futures contracts, giving diversified trading opportunities.

Cost Structure: The broker features competitive pricing with spreads beginning at 0.0 pips and implements a zero-commission model. Available information shows the platform offers both live floating and fixed spread options across four distinct account types, allowing traders to select pricing models that match their trading preferences.

Leverage Options: T4Trade gives flexible leverage arrangements, though specific maximum leverage ratios for different instruments and account types are not detailed in current public sources.

Platform Selection: The broker mainly uses the MetaTrader 4 (MT4) platform, offering traders access to this industry-standard trading environment with its complete charting tools and automated trading capabilities.

Geographic Restrictions: Specific information about geographic restrictions and service availability by region is not completely detailed in current public documentation.

Customer Support Languages: Available customer support languages and communication channels are not specifically outlined in publicly accessible sources.

This t4trade review highlights both the broker's competitive advantages and areas where additional transparency would benefit potential clients.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

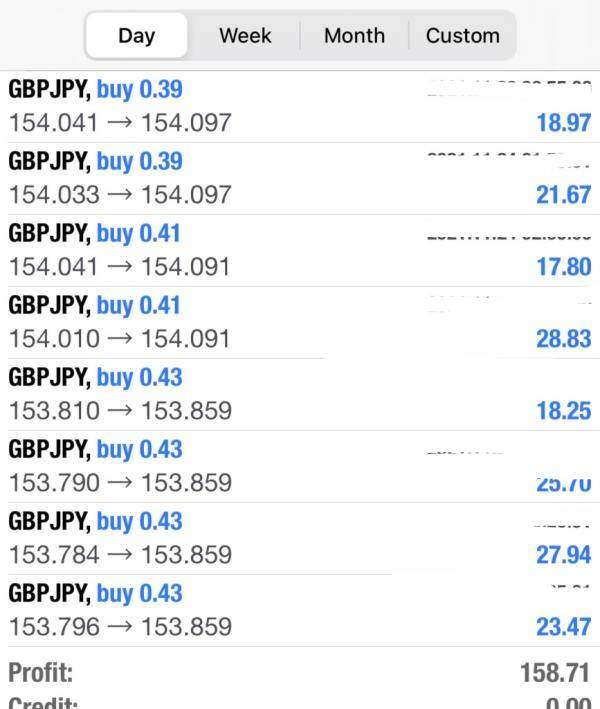

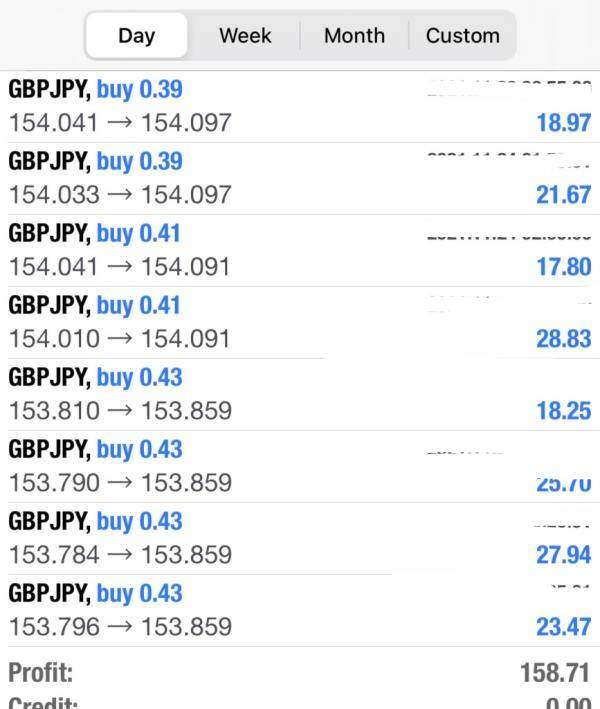

T4Trade's account structure shows several competitive advantages, especially in its pricing model. The broker offers four distinct account types, each featuring both live floating and fixed spread options, giving traders flexibility in choosing their preferred pricing structure. The standout feature is the zero-commission approach combined with spreads starting as low as 0.0 pips, which puts T4Trade favorably against many competitors in the retail trading space.

However, this t4trade review must note significant gaps in publicly available information about account specifics. The minimum deposit requirements for each account tier are not clearly documented, making it difficult for potential clients to understand the entry barriers. Also, specific details about account features, such as the availability of Islamic accounts for Muslim traders or demo account provisions, are not completely outlined in current public sources.

User feedback suggests that traders appreciate the straightforward approach to account conditions, with many noting the absence of hidden fees as a positive aspect. The competitive spread structure, especially the 0.0 pip starting point, appears to be a significant draw for cost-conscious traders. However, the lack of detailed account comparison information may require potential clients to contact the broker directly for complete account specifications.

T4Trade's platform offering centers around the MetaTrader 4 (MT4) environment, which receives positive marks for reliability and functionality. User feedback shows the platform gives fast execution speeds and stable trading conditions, with one reviewer noting their positive first experience with MT4 through T4Trade's implementation. The broker appears to have optimized the MT4 setup for efficient order processing and reliable connectivity.

The platform's strength lies in its focus on core trading functionality rather than overwhelming users with excessive features. Users report that T4Trade emphasizes delivering "more reliable and simple to use trading service" rather than hiding potential drawbacks behind flashy features. This approach appears to work well with traders who prioritize execution quality over extensive analytical tools.

However, this t4trade review identifies limited information about additional trading tools, research resources, or educational materials. While the MT4 platform gives basic charting and analysis capabilities, the availability of proprietary research, market analysis, economic calendars, or educational content is not clearly documented. The absence of detailed information about automated trading support, expert advisors, or advanced trading tools represents a gap in the publicly available resource assessment.

Customer Service and Support Analysis (6/10)

Customer service evaluation for T4Trade faces significant limitations due to insufficient publicly available information about support structures. Current documentation does not give clear details about available customer service channels, operating hours, response times, or multilingual support capabilities. This lack of transparency about support services represents a notable concern for potential clients who prioritize accessible customer assistance.

The absence of detailed customer service information makes it difficult to assess the broker's commitment to client support. While some user reviews suggest generally positive experiences with the broker's services, specific feedback about customer support interactions, problem resolution efficiency, or support quality is not prominently featured in available sources.

For a complete evaluation, potential clients would need to directly test the broker's support responsiveness and quality. The limited public information about support structures suggests that T4Trade may need to improve transparency about their customer service capabilities and accessibility. This represents an area where the broker could enhance client confidence through more detailed public documentation of support services.

Trading Experience Analysis (7/10)

User feedback shows generally positive trading experiences with T4Trade, especially about execution speed and platform stability. Traders report fast order execution and reliable trading conditions, with spread stability receiving favorable mentions. The MT4 implementation appears well-optimized, giving smooth trading operations without significant technical disruptions.

The broker's focus on simplicity and reliability rather than complex features seems to create a positive trading environment for users seeking straightforward market access. User reviews suggest that the platform performs well during normal market conditions, with traders appreciating the absence of unnecessary complications that might interfere with trading activities.

However, specific technical performance data, such as average execution speeds, slippage statistics, or requote frequencies, are not publicly documented. The lack of detailed performance metrics makes it challenging to give a complete technical assessment. Also, information about mobile trading capabilities, advanced order types, or trading during high-volatility periods is not well-documented in current public sources.

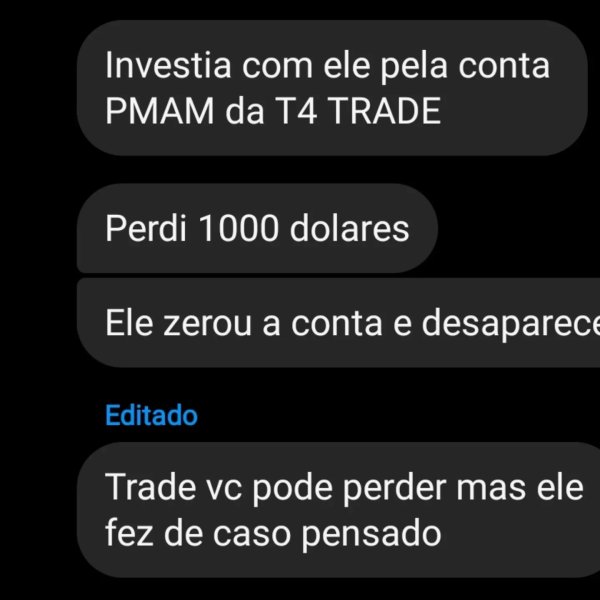

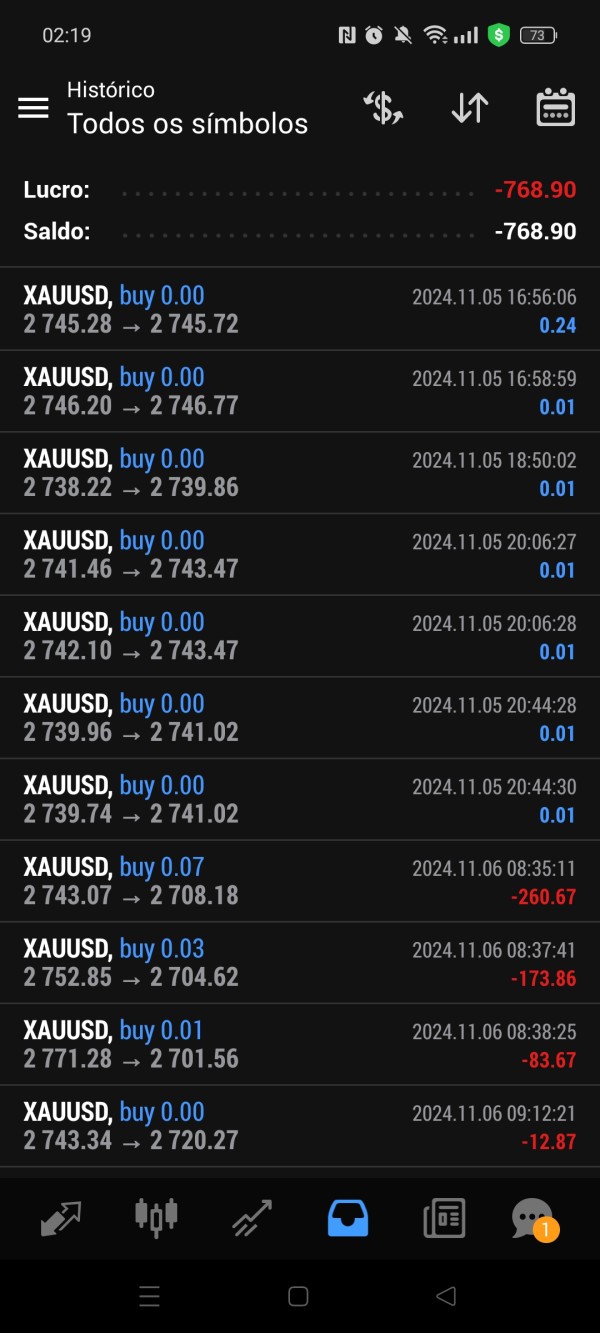

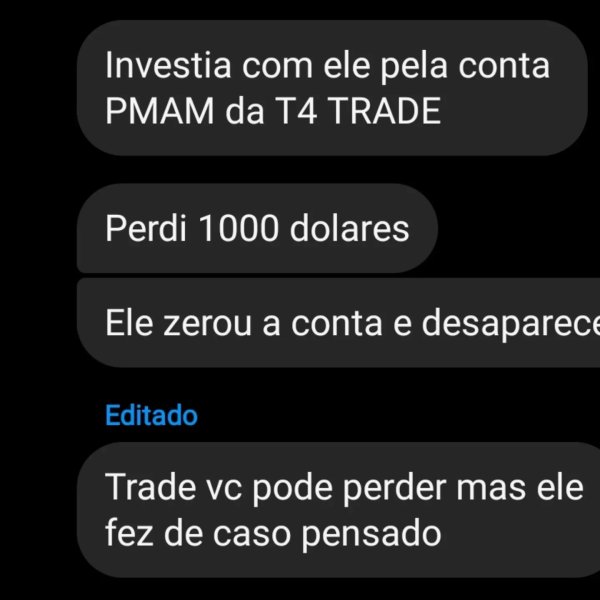

Trust Factor Analysis (4/10)

The trust factor assessment reveals significant concerns about transparency and regulatory clarity. The most notable issue is the limited information available about T4Trade's regulatory status and oversight. While some sources suggest connections to Seychelles jurisdiction, complete regulatory details, license numbers, and supervisory authority information are not clearly documented in publicly accessible sources.

This regulatory transparency gap represents a significant concern for traders who prioritize regulatory oversight and client protection measures. The absence of clear information about client fund segregation, investor compensation schemes, or regulatory compliance measures makes it difficult to assess the broker's commitment to client protection standards.

Also, limited information about the company's corporate structure, management team, financial backing, or operational history further impacts the trust assessment. For a broker operating in the competitive forex market, enhanced transparency about regulatory status and corporate governance would significantly improve client confidence and trust ratings.

User Experience Analysis (8/10)

Available user feedback suggests generally positive experiences with T4Trade's services, with users appreciating the broker's straightforward approach to trading services. The platform appears to attract traders who value simplicity and reliability over complex features, with users noting the broker's focus on essential trading functionality rather than potentially distracting add-ons.

The user base appears to consist mainly of traders seeking cost-effective trading solutions, drawn by the competitive spread structure and zero-commission model. Feedback shows satisfaction with the platform's performance during regular trading activities, with users reporting stable spread conditions and reliable execution.

However, complete user demographic analysis and detailed satisfaction surveys are not publicly available, limiting the depth of user experience assessment. The absence of detailed user feedback about specific platform features, customer service interactions, or long-term satisfaction rates represents a gap in the overall user experience evaluation.

Conclusion

This t4trade review reveals a broker with several competitive advantages, especially in pricing structure and platform reliability, but also significant transparency limitations. T4Trade appears well-suited for cost-conscious traders seeking straightforward market access through the reliable MT4 platform, with competitive spreads starting at 0.0 pips and zero commission structure representing clear advantages.

However, the limited regulatory transparency and insufficient public information about key operational aspects represent notable concerns that potential clients should carefully consider. The broker would benefit from enhanced disclosure about regulatory status, customer service capabilities, and detailed account specifications to improve overall client confidence and market positioning.