Regarding the legitimacy of HEADWAY forex brokers, it provides FSCA and WikiBit, .

Is HEADWAY safe?

Pros

Cons

Is HEADWAY markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

JAROCEL (PTY) LTD

Effective Date:

2022-04-08Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

FLAMINGO CRES 3BEACON BAYEAST LONDON , EASTERN CAPE5200Phone Number of Licensed Institution:

0626964732Licensed Institution Certified Documents:

Is Headway A Scam?

Introduction

Headway, a relatively new entrant in the forex market, was established in 2022 and is based in South Africa. The broker aims to provide a comprehensive trading experience for both novice and experienced traders by offering a wide range of financial instruments, competitive trading conditions, and user-friendly platforms like MetaTrader 4 and 5. As the forex market continues to grow, traders must exercise caution and conduct thorough evaluations of brokers before committing their capital. This article aims to provide an objective analysis of Headway, focusing on its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk assessment. The evaluation is based on a combination of qualitative and quantitative data gathered from multiple reputable sources.

Regulation and Legitimacy

Regulation is a critical factor for any forex broker as it ensures a level of oversight and protection for traders. Headway is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, which is considered a tier-2 regulatory body. While FSCA regulation offers some level of security, it does not carry the same weight as top-tier regulators like the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US.

Core Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 52108 | South Africa | Verified |

The FSCA requires brokers to adhere to strict compliance measures, including the segregation of client funds from company assets, which adds a layer of security. However, it is essential to note that the FSCA does not have the same stringent requirements as some higher-tier regulators, which can lead to concerns about the broker's overall reliability. Although there have been no significant compliance issues reported against Headway since its inception, the broker's short operational history makes it challenging to evaluate its long-term reliability.

Company Background Investigation

Headway operates under Jarocel Pty Ltd and has its headquarters in East London, South Africa. The broker's management team comprises experienced professionals with a background in finance and trading, which is a positive indicator for potential clients. However, detailed information about the ownership structure and transparency of the company is somewhat limited, raising questions about its overall accountability.

The broker claims to prioritize transparency and customer satisfaction, but the lack of extensive information about its management team and operational history might deter some potential traders. In the rapidly evolving forex landscape, established companies with a proven track record often instill greater confidence in traders.

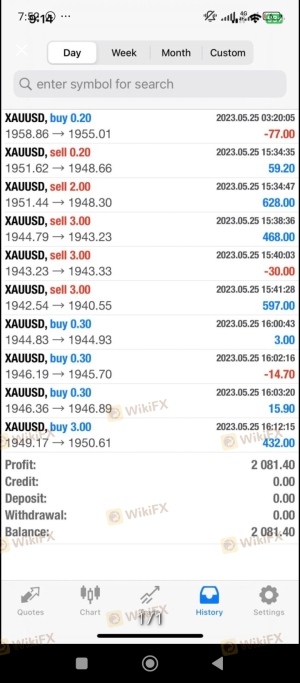

Trading Conditions Analysis

Headway offers a competitive trading environment with low minimum deposit requirements and various account types, including Cent, Standard, and Pro accounts. The broker's fee structure is designed to attract a wide range of traders, but it is crucial to scrutinize the costs involved carefully.

Core Trading Costs Comparison

| Fee Type | Headway | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.3 pips | From 1.0 pips |

| Commission Model | $3 per lot (Pro account) | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While Headway claims to have zero commissions on Cent and Standard accounts, it charges a commission of $3 per round lot traded on Pro accounts. This fee structure is relatively competitive, especially for high-volume traders. However, the spread on major currency pairs can vary significantly depending on market conditions, which traders should consider when assessing potential trading costs.

Customer Fund Safety

The safety of customer funds is paramount in the forex trading industry. Headway implements several safety measures, including the segregation of client funds from operational funds, which is a standard practice among regulated brokers. This segregation ensures that client funds are protected in the event of the broker facing financial difficulties.

Additionally, Headway offers negative balance protection, which prevents clients from losing more than their deposited amount. This feature is particularly important for traders using high leverage, as it mitigates the risk of catastrophic losses. However, there have been no significant historical incidents or controversies surrounding Headway regarding fund safety, which is a positive indicator for potential clients.

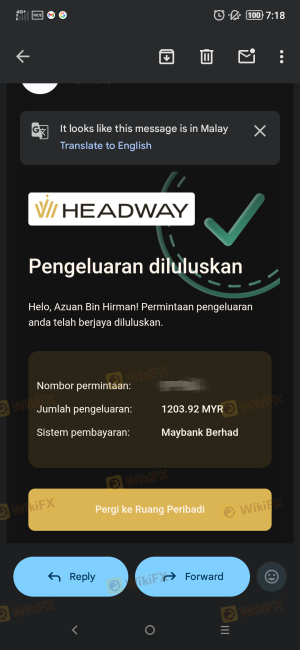

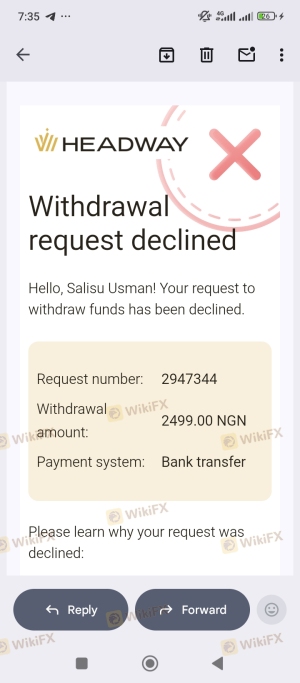

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. Headway has garnered mixed reviews from users, with some praising its competitive trading conditions and responsive customer service, while others have raised concerns about withdrawal issues and the overall customer support experience.

Major Complaint Types and Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Addressed |

| Customer Support Issues | High | Under Review |

Common complaints include delays in the withdrawal process and difficulties in reaching customer support. While Headway has made efforts to address these concerns, the recurring nature of these issues suggests that the broker may need to enhance its customer service infrastructure.

Platform and Trade Execution

Headway provides access to the popular MetaTrader 4 and 5 platforms, known for their reliability and extensive features. Traders can expect a user-friendly interface, advanced charting tools, and the ability to implement automated trading strategies using Expert Advisors (EAs).

The execution quality appears to be satisfactory, with reports of minimal slippage and a low rate of rejected orders. However, as with any broker, traders should remain vigilant for any signs of platform manipulation, particularly during high volatility periods.

Risk Assessment

Using Headway as a trading platform comes with inherent risks, as is the case with any forex broker. Traders should be aware of the potential pitfalls associated with high leverage and the broker's regulatory status.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Tier-2 regulation only |

| Leverage Risk | High | Unlimited leverage |

| Customer Support Risk | Medium | Mixed user feedback |

To mitigate these risks, traders should employ sound risk management practices, including setting appropriate stop-loss orders and avoiding excessive leverage.

Conclusion and Recommendations

In conclusion, Headway is not a scam; it is a regulated broker offering competitive trading conditions and a user-friendly experience. However, the broker's tier-2 regulation and mixed customer feedback warrant caution. Traders should carefully consider their risk tolerance and trading objectives before engaging with Headway.

For beginner traders, it may be wise to start with a demo account to familiarize themselves with the platform and trading conditions. Experienced traders seeking a broader range of regulatory protection might want to explore alternatives like Avatrade or FXTM, which offer multi-tier regulatory oversight and extensive educational resources.

Overall, while Headway presents a viable trading option, potential clients should conduct thorough research and consider their specific needs before making a decision.

Is HEADWAY a scam, or is it legit?

The latest exposure and evaluation content of HEADWAY brokers.

HEADWAY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HEADWAY latest industry rating score is 4.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.