Is ETER WEALTH safe?

Pros

Cons

Is EterWealth A Scam?

Introduction

EterWealth is a forex broker that emerged in the trading landscape in 2021, positioning itself as a provider of various financial instruments, including forex, metals, cryptocurrencies, and indices. Given the increasing number of online trading platforms, traders must exercise caution when selecting a broker. The forex market is known for its volatility and potential for fraud, making it essential for traders to conduct thorough due diligence before investing their hard-earned money. This article aims to objectively assess the legitimacy of EterWealth by examining its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and overall risk. The investigation is based on a review of multiple sources, including user feedback and regulatory databases, to provide a comprehensive overview of EterWealth's operations.

Regulation and Legitimacy

The regulatory framework surrounding a broker is a critical factor in determining its legitimacy. Regulatory bodies are intended to protect traders by enforcing compliance with financial laws and standards. EterWealth claims to operate under the jurisdiction of Saint Vincent and the Grenadines; however, this region is notorious for having minimal regulatory oversight for forex brokers. Notably, EterWealth's license from the National Futures Association (NFA) in the United States is marked as unauthorized, raising significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Unauthorized | USA | Not Verified |

| SVG FSA | 26560 | Saint Vincent | Not Regulated |

The absence of valid regulatory oversight means that EterWealth does not offer the investor protections typically associated with licensed brokers, such as segregated accounts and negative balance protection. This lack of regulatory compliance is a major red flag, suggesting that traders may be at risk of losing their funds without recourse in the event of a dispute or fraud.

Company Background Investigation

EterWealth Limited's history is relatively short, having been founded in 2021. The company claims to be registered in the United States, but the lack of transparency surrounding its ownership structure and management team raises concerns. There is limited information available about the key individuals leading EterWealth, which is often indicative of a lack of accountability.

The company has been criticized for its unclear corporate governance and inadequate information disclosure. In reputable firms, potential clients can easily find details about the management team, including their professional backgrounds and qualifications. However, EterWealth does not provide such information, which diminishes trust and raises questions about its operational integrity.

Overall, the lack of transparency regarding its ownership and management structure further casts doubt on EterWealth's legitimacy and reliability as a trading platform.

Trading Conditions Analysis

EterWealth advertises a variety of trading instruments and account types, but the details regarding its fee structure remain vague. The absence of clear information about spreads, commissions, and other trading costs is concerning. A transparent broker typically provides detailed information on these aspects to help traders make informed decisions.

| Cost Type | EterWealth | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 1.0-1.2 pips |

| Commission Model | Not specified | Varies |

| Overnight Interest Range | Not specified | Varies |

EterWealth claims to offer competitive spreads, but without specific figures, it is difficult to assess the true cost of trading with this broker. Additionally, the lack of clarity around commission fees and overnight interest rates may lead to unexpected costs for traders. Such opacity is often a tactic used by less reputable brokers to attract clients while hiding unfavorable trading conditions.

Client Fund Security

The safety of client funds is paramount when choosing a broker. EterWealth's claims regarding fund security are questionable, as it does not provide adequate information about its fund protection measures. A reputable broker typically offers segregated accounts to ensure that clients' funds are kept separate from the company's operational funds, thereby providing a layer of protection in case of insolvency.

Furthermore, EterWealth does not appear to offer negative balance protection, which is crucial for safeguarding traders from losing more than their initial investment. The absence of these essential security features indicates a potential risk for clients, as they may not have recourse if the broker encounters financial difficulties or engages in fraudulent activities.

Customer Experience and Complaints

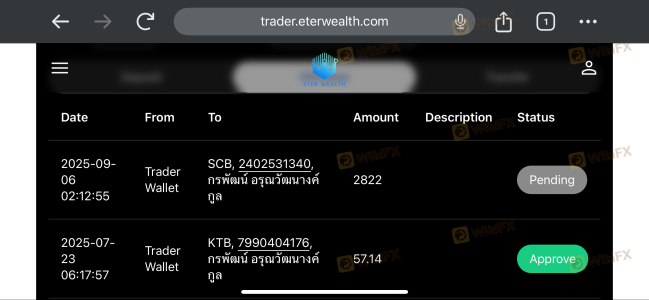

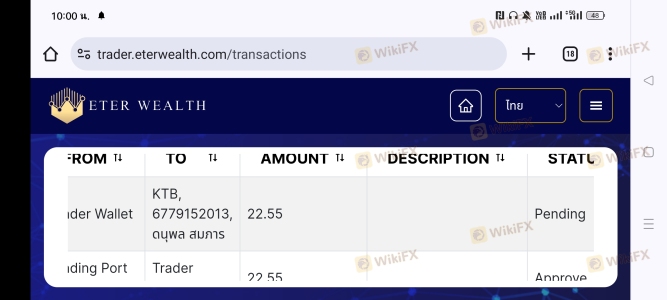

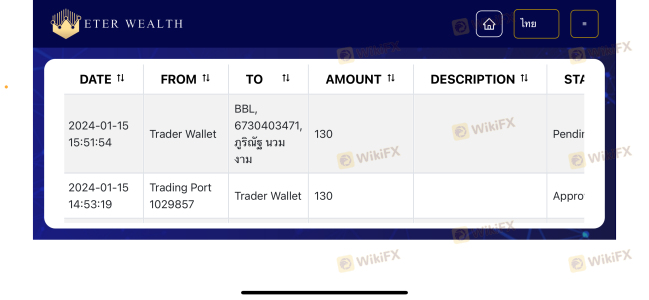

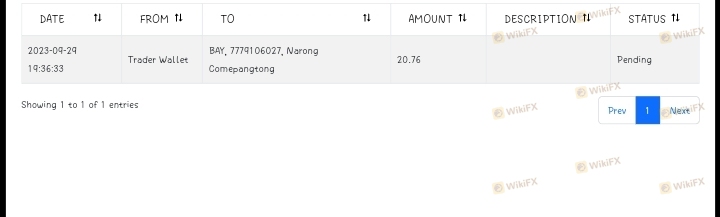

Customer feedback is a valuable indicator of a broker's reliability and service quality. EterWealth has received mixed reviews from clients, with several users expressing frustration over the lack of transparency and responsiveness from the company. Common complaints include difficulty in withdrawing funds, delays in customer support responses, and issues with the trading platform's performance.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Delays | Medium | Inconsistent |

| Platform Performance | High | Unresolved |

For instance, some users reported that their withdrawal requests were met with excessive delays, and in some cases, they were unable to retrieve their funds at all. This lack of responsiveness raises concerns about EterWealth's commitment to customer service and its overall reliability.

Platform and Trade Execution

EterWealth utilizes the popular MetaTrader 5 (MT5) platform, which is known for its advanced trading features and user-friendly interface. However, there are concerns regarding the platform's performance, including issues with order execution quality, slippage, and potential re-quotes. Traders have reported instances of slippage during volatile market conditions, which can significantly impact trading outcomes.

The execution quality is crucial for traders, as it directly affects their ability to capitalize on market movements. If a broker's platform frequently experiences delays or fails to execute trades at the desired price, it can lead to substantial losses.

Risk Assessment

Engaging with EterWealth presents several risks that traders should consider before investing. The lack of regulatory oversight, coupled with insufficient transparency regarding trading conditions and fund security, elevates the risk level for potential clients.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Security Risk | High | Lack of segregated accounts and protections |

| Customer Service Risk | Medium | Slow response times and unresolved issues |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers with established regulatory frameworks and transparent operations.

Conclusion and Recommendations

In conclusion, EterWealth raises several red flags that warrant caution. The lack of legitimate regulatory oversight, transparency regarding its operations, and customer complaints about fund withdrawals and service quality indicate that it may not be a safe choice for traders. While the platform offers a variety of trading instruments and utilizes a reputable trading software, the overall risks associated with this broker outweigh the potential benefits.

Traders should be particularly wary of investing with EterWealth and consider seeking alternatives that are fully regulated and have a proven track record of reliability. Brokers such as TD Ameritrade, City Index, and JFD offer more secure trading environments and better protections for clients. Always prioritize safety and transparency when choosing a trading platform to minimize the risk of fraud and financial loss.

Is ETER WEALTH a scam, or is it legit?

The latest exposure and evaluation content of ETER WEALTH brokers.

ETER WEALTH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ETER WEALTH latest industry rating score is 2.08, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.08 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.