Regarding the legitimacy of ActivTrades forex brokers, it provides SCB, FCA and WikiBit, .

Is ActivTrades safe?

Pros

Cons

Is ActivTrades markets regulated?

The regulatory license is the strongest proof.

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

ActivTrades Corp

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

209/210 Church Street, Sandyport Plaza, Nassau, BahamasPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Activtrades Plc

Effective Date:

2005-10-27Email Address of Licensed Institution:

compliance@activtrades.comSharing Status:

No SharingWebsite of Licensed Institution:

www.activtrades.co.ukExpiration Time:

--Address of Licensed Institution:

ActivTrades Plc The Loom, Office 2.6 14 Gowers Walk London Tower Hamlets E1 8PY UNITED KINGDOMPhone Number of Licensed Institution:

+4402076500500Licensed Institution Certified Documents:

Is ActivTrades A Scam?

Introduction

ActivTrades is a well-known forex and CFD broker founded in 2001, headquartered in London, UK. It has established itself as a significant player in the online trading market, providing access to a wide range of financial instruments, including forex, commodities, indices, shares, and ETFs. Given the rapid growth of the online trading industry, it is essential for traders to carefully evaluate brokers to ensure they are engaging with a reputable and secure platform. This article aims to investigate whether ActivTrades is a safe and trustworthy broker or if there are any potential red flags that traders should be aware of. Our investigation is based on a comprehensive analysis of regulatory compliance, company background, trading conditions, client safety measures, customer feedback, and overall risk assessment.

Regulation and Legitimacy

One of the most critical factors in assessing whether a broker like ActivTrades is safe is its regulatory status. A well-regulated broker is more likely to adhere to strict financial standards, ensuring that client funds are protected. ActivTrades is regulated by several authorities, including the UK Financial Conduct Authority (FCA), the Securities Commission of the Bahamas (SCB), and the Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg. Below is a summary of ActivTrades' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 434413 | United Kingdom | Verified |

| SCB | 199667B | Bahamas | Verified |

| CSSF | B232167 | Luxembourg | Verified |

The FCA is known for its stringent regulations and oversight, offering a high level of protection for traders. For instance, in the event of broker insolvency, the FCA protects client deposits up to £85,000 through the Financial Services Compensation Scheme (FSCS). The SCB and CSSF also provide oversight, although the SCB is considered an offshore regulator, which may not provide the same level of investor protection as the FCA. Overall, the regulatory framework surrounding ActivTrades suggests that it operates within a safe and legitimate environment, reinforcing that ActivTrades is safe for trading.

Company Background Investigation

ActivTrades was established in Switzerland in 2001 and later moved its headquarters to London in 2005. The company has grown significantly over the years, expanding its services to clients in over 140 countries. The ownership structure of ActivTrades is private, which provides a level of transparency regarding its operations and financial stability. The management team includes experienced professionals with backgrounds in finance and trading, contributing to the broker's credibility. The firm has consistently focused on enhancing its trading platforms and customer service, which is evident in its multiple awards and recognitions over the years.

The broker's commitment to transparency is reflected in its policies and the information available on its website. ActivTrades publishes detailed information about its fees, trading conditions, and educational resources, allowing traders to make informed decisions. This level of transparency supports the notion that ActivTrades is safe for traders looking for a reliable broker.

Trading Conditions Analysis

ActivTrades offers competitive trading conditions, including low spreads and no commissions on most trades. The broker operates a spread-only pricing model, which is generally favorable for traders as it simplifies the cost structure. However, it is essential to examine the specific costs associated with trading on the platform. Below is a comparison of core trading costs:

| Cost Type | ActivTrades | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.0 pips |

| Commission Model | Spread-only | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads offered by ActivTrades for major currency pairs start as low as 0.5 pips, which is significantly lower than the industry average. However, traders should be aware that commissions may apply to specific instruments, such as shares and ETFs, where a fee of 0.05% may be charged. Additionally, overnight fees (swap rates) may apply, depending on the positions held. Overall, the trading conditions at ActivTrades are competitive, indicating that ActivTrades is safe for those looking for cost-effective trading solutions.

Client Fund Safety

Client fund safety is paramount when evaluating a broker's reliability. ActivTrades employs several measures to ensure the security of client funds. Client deposits are held in segregated accounts, separate from the broker's operational funds. This practice minimizes the risk of losing client funds in the event of financial difficulties faced by the broker. Furthermore, ActivTrades provides negative balance protection, ensuring that clients cannot lose more than their deposited amount.

In terms of investor protection, clients in the UK benefit from the FSCS, which compensates eligible clients up to £85,000 in case of broker insolvency. The broker also offers additional insurance coverage for qualifying clients, providing further peace of mind. Historical data indicates no significant issues related to fund security or disputes, reinforcing the idea that ActivTrades is safe for traders concerned about the safety of their investments.

Customer Experience and Complaints

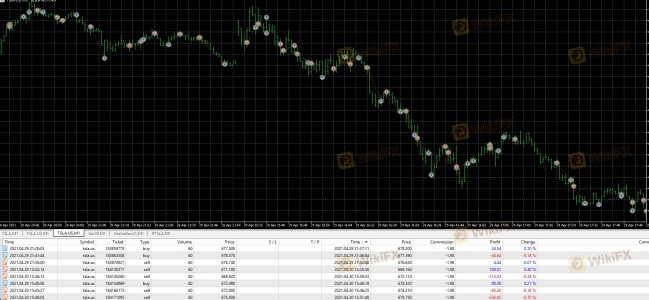

Customer feedback plays a crucial role in assessing a broker's reliability. ActivTrades has received a mix of reviews from clients, with many praising its trading conditions and customer support. However, some users have reported issues related to platform stability and withdrawal processes. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Platform Stability Issues | Moderate | Timely |

| Withdrawal Delays | High | Moderate |

| Customer Support Responsiveness | Low | Excellent |

Typical cases include clients experiencing delays in withdrawals, which can be concerning for traders who prioritize quick access to their funds. However, ActivTrades has generally responded to complaints in a timely manner, indicating a commitment to resolving issues. Despite some negative feedback, the overall customer satisfaction rating remains high, suggesting that ActivTrades is safe for traders who value responsive customer service.

Platform and Trade Execution

ActivTrades provides access to multiple trading platforms, including its proprietary ActivTrader platform and the widely-used MetaTrader 4 and 5 (MT4 and MT5). The platforms are designed to offer a user-friendly experience while ensuring robust performance and stability. Users have reported positive experiences with trade execution, citing low slippage and effective order fulfillment.

The broker claims an average execution speed of less than 0.004 seconds, which is impressive and indicates a high level of efficiency in trade execution. There have been no significant reports of platform manipulation, which further supports the conclusion that ActivTrades is safe for trading activities.

Risk Assessment

While ActivTrades presents a generally favorable environment for traders, it is essential to consider the inherent risks involved in trading. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by reputable bodies |

| Financial Risk | Medium | Trading involves leverage and market volatility |

| Operational Risk | Medium | Platform stability can vary |

| Customer Service Risk | Low | Generally responsive support |

To mitigate these risks, it is advisable for traders to engage in thorough research, utilize demo accounts for practice, and implement effective risk management strategies, such as setting stop-loss orders and avoiding excessive leverage.

Conclusion and Recommendations

In conclusion, the evidence suggests that ActivTrades is a reputable and reliable broker for forex and CFD trading. The broker is well-regulated by top-tier authorities, employs robust client fund protection measures, and offers competitive trading conditions. While there are some areas for improvement, particularly regarding platform stability and withdrawal processes, the overall assessment indicates that ActivTrades is safe for traders.

Traders, whether beginners or experienced, can consider ActivTrades as a viable option. However, it is essential to remain vigilant and conduct personal research before engaging in trading activities. For those seeking alternatives, brokers such as IG Group, OANDA, and Saxo Bank may also provide secure trading environments and robust trading features.

Is ActivTrades a scam, or is it legit?

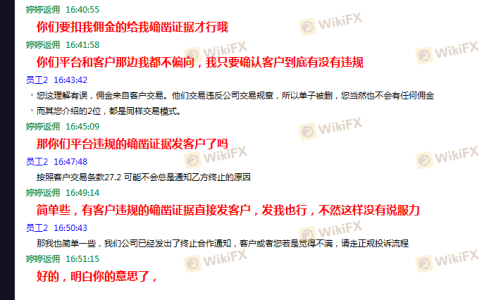

The latest exposure and evaluation content of ActivTrades brokers.

ActivTrades Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ActivTrades latest industry rating score is 2.67, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.67 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.