ActivTrades 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

ActivTrades, established in 2001 and headquartered in London, has emerged as a significant player in the competitive landscape of online trading. Regulated by reputable authorities such as the Financial Conduct Authority (FCA) in the UK and the Securities Commission of the Bahamas (SCB), ActivTrades offers a robust trading environment characterized by a diverse range of financial instruments, competitive trading conditions, and a strong emphasis on customer support.

While the broker appeals to retail and experienced traders alike with its wide array of trading platforms (including MT4, MT5, and its proprietary ActivTrader) and educational resources, potential clients should also consider the challenges associated with higher minimum deposit requirements, fees, and mixed user feedback about withdrawal processes. Novice traders may find the initial deposit of $500 a considerable barrier, making ActivTrades less attractive for those just starting their trading journey.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement: Trading on margin can be a double-edged sword, amplifying both potential gains and losses. The inherent volatility of the markets and regulatory constraints complicate trading further.

Potential Harms:

- High Risk of Loss: 74-89% of retail trader accounts lose money trading CFDs with this provider.

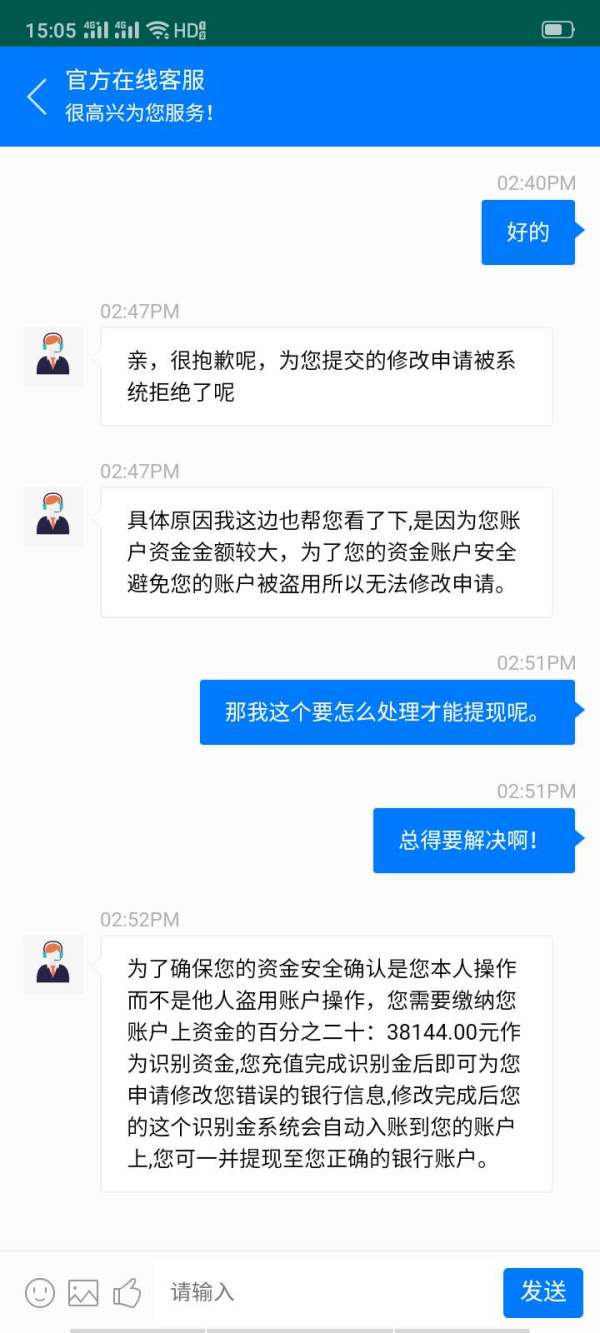

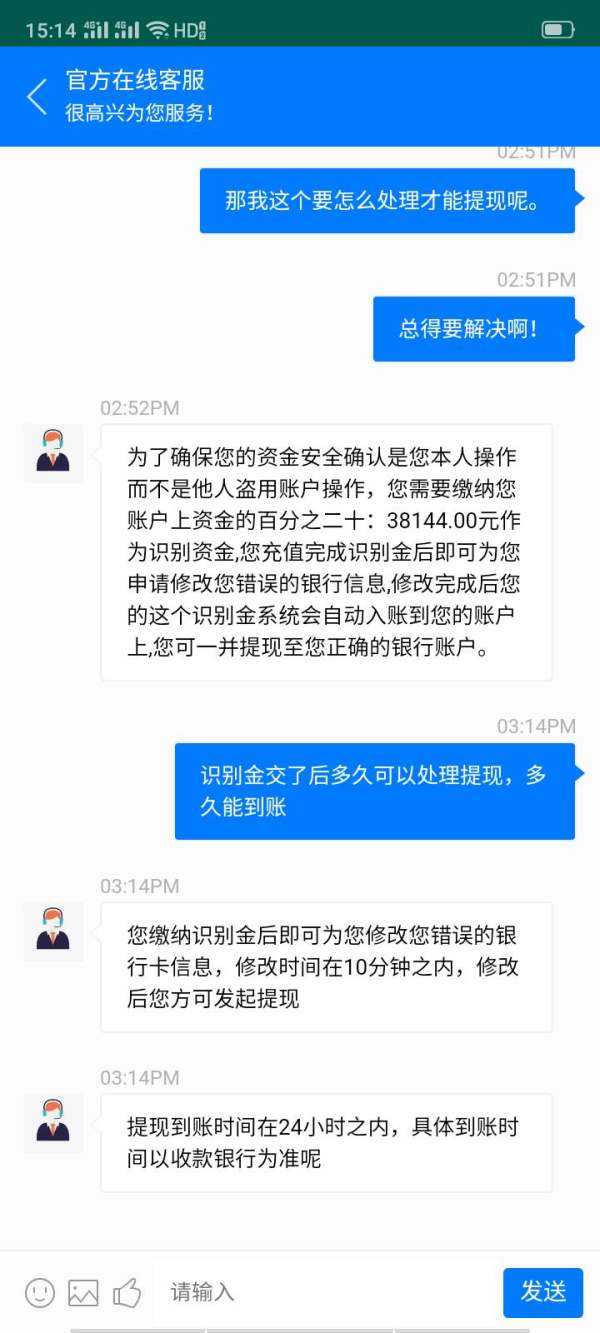

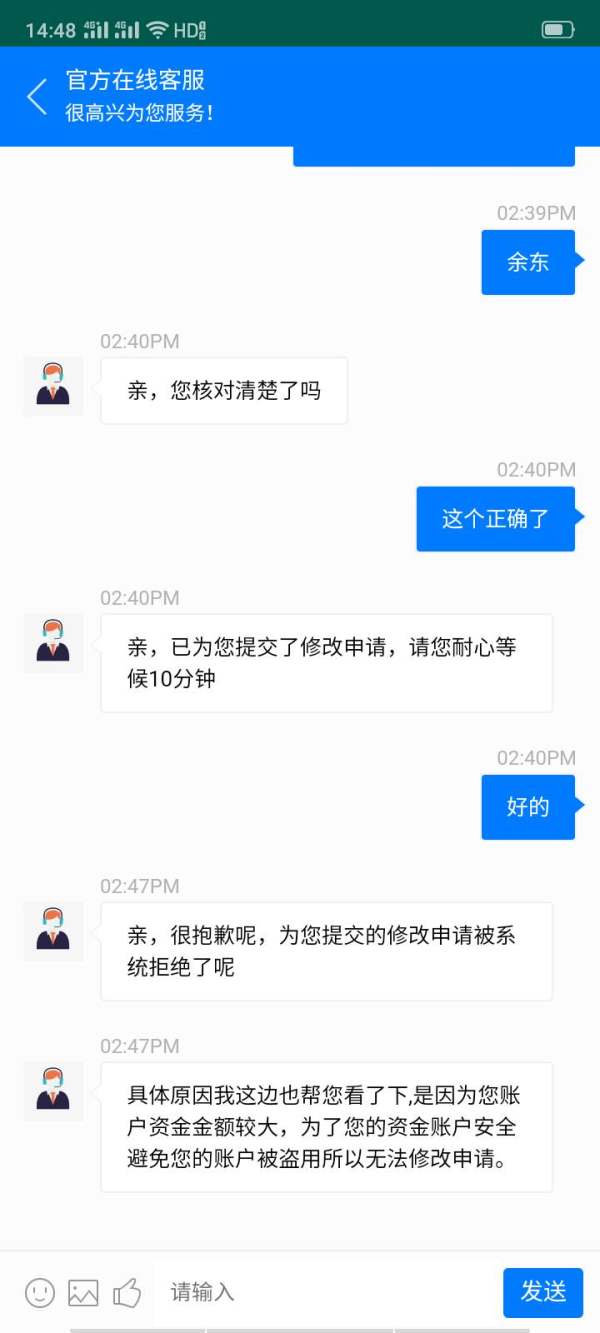

- Withdrawal Limitations: Mixed reviews on withdrawal processes may lead to complications in accessing funds.

- Inactivity and Other Fees: Trading inactivity fees and possible hidden costs can impact net trading returns.

How to Self-Verify:

- Check Regulatory Compliance: Visit the FCA and SCB websites to confirm ActivTrades's licensing and regulatory status.

- Review User Feedback: Explore trader reviews on reputable forums and financial advisory websites for insights into user experiences.

- Confirm Fund Safety: Verify that your funds are held in segregated accounts with higher deposit protection facilitated by the FCA.

Rating Framework

Broker Overview

Company Background and Positioning

ActivTrades was founded in 2001 and initially operated from Switzerland before moving its headquarters to London in 2005. Over the years, the broker has expanded its operations to service clients globally, particularly in Europe, Asia, and the Middle East, while maintaining stringent compliance standards under various regulatory authorities. It now offers trading services across a wide array of financial instruments including Forex, CFDs, and commodities, capitalizing on its reputation for transparency and client security.

Core Business Overview

ActivTrades primarily functions as a CFD and Forex broker, allowing trading in over 1,000 financial instruments. The firm emphasizes a customer-centric approach, providing various trading platforms like the widely used MetaTrader 4 and 5, alongside its proprietary ActivTrader platform. Plus, it offers additional features such as balance protection and risk management tools which are beneficial for both retail and institutional traders.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching users to manage uncertainty.

The trustworthiness of a broker is crucial for maintaining client confidence. ActivTrades is regulated by several high-profile authorities; however, some user reviews have raised concerns about overarching regulatory compliance, particularly with offshore regulators.

Analysis of Regulatory Information Conflicts: Quite notably, while ActivTrades boasts strong regulatory backing, concerns have been voiced regarding the withdrawal processes, signaling potential conflicts in customer trust.

User Self-Verification Guide:

Visit the FCA‘s Financial Services Register to confirm any broker’s licensing details.

Check the SCBs official site to assess compliance and secure trading options.

Utilize websites like Trustpilot to review actual user experiences on fund safety and customer service.

Industry Reputation and Summary: Overall, user feedback varies widely. Many commend the fast trading execution while cautioning about withdrawal delays.

"I have withdrawn money many times before and it always arrives without delay," said a long-time user.

Trading Costs Analysis

The double-edged sword effect.

ActivTrades offers competitive trading costs but these come with caveats.

Advantages in Commissions: Spreads for major currency pairs start as low as 0.5 pips. Many traders appreciate the absence of commissions on most trades, which enhances profit potentials.

The "Traps" of Non-Trading Fees: Users have voiced grievances regarding deposit and withdrawal fees, particularly for bank transfers.

"A $12 fee for bank withdrawals is frustrating, especially when other methods are free," reported one user from a trading forum.

- Cost Structure Summary: The trading costs present a trade-off where novice traders might find it challenging to commit to higher minimum deposits amidst potential pitfalls of non-trading fees.

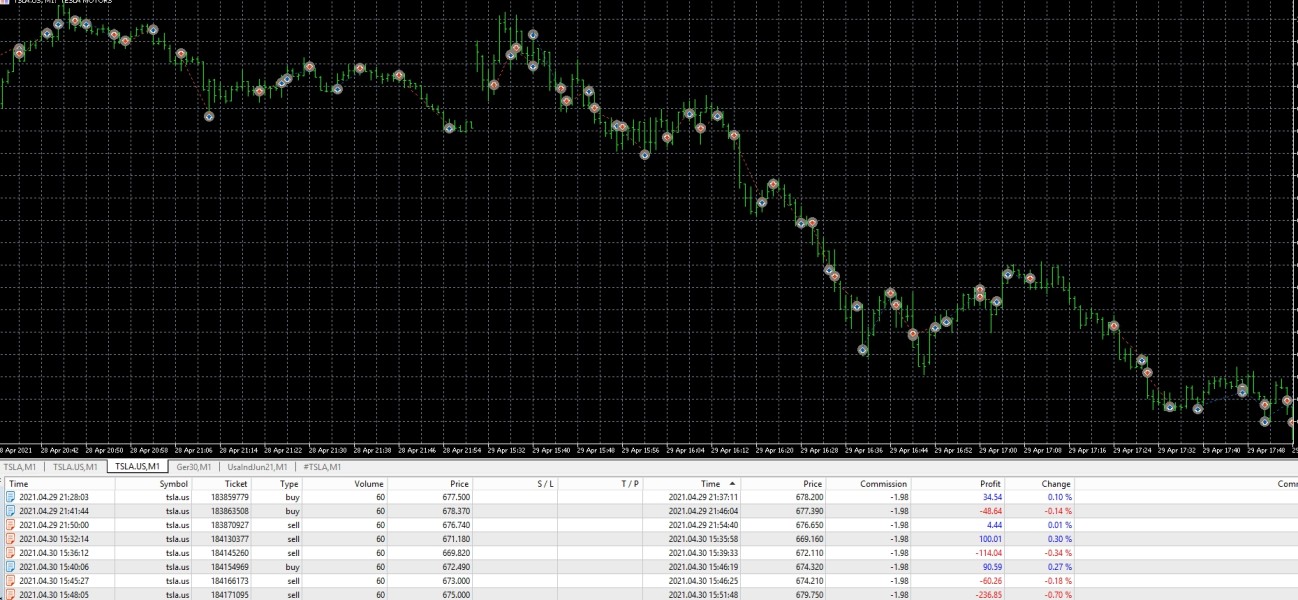

Professional depth vs. beginner-friendliness.

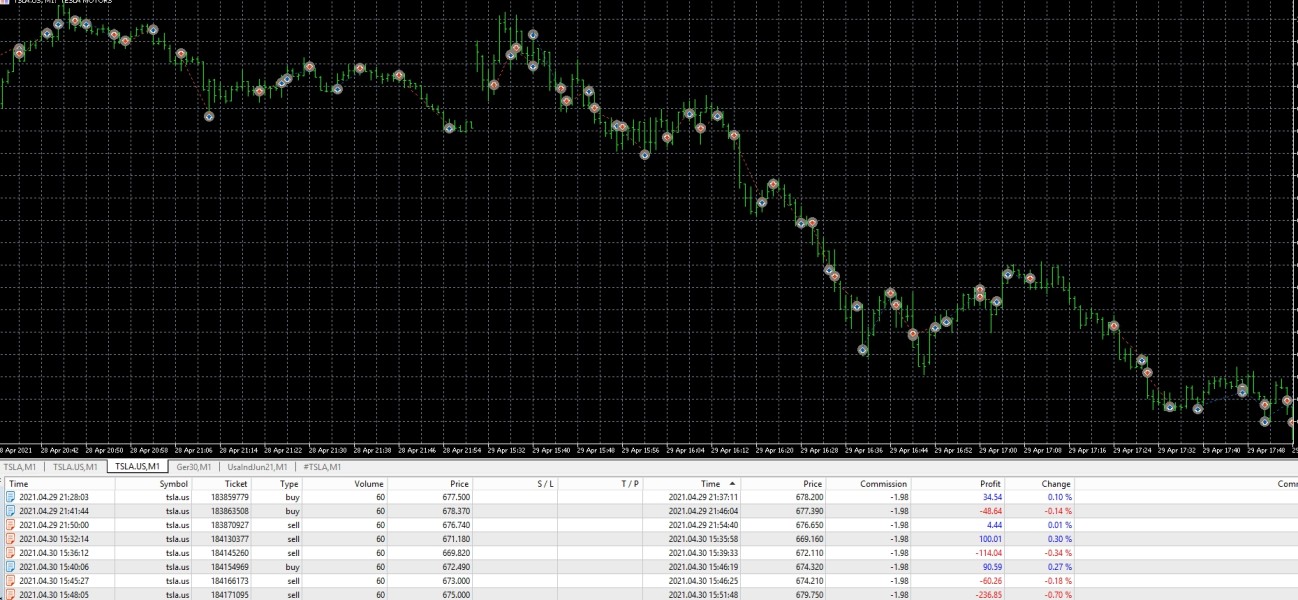

Platform Diversity: ActivTrades provides access to several platforms including MT4, MT5, and its proprietary ActivTrader, catering to a variety of trader needs.

Quality of Tools and Resources: The tools available for analysis and charting are robust but might be overwhelming for novice traders. The proprietary features like progressive trailing stops differ from traditional functionalities.

Platform Experience Summary: Mixed reviews have surfaced regarding the usability of ActivTrader.

"The interface feels outdated compared to the swift analysis tools offered," stated an experienced trader in a recent review.

User Experience Analysis

-

Valued Client Features: The overall experience is generally positive, boasting fast execution times and a user-friendly interface.

Negative User Reviews: Nonetheless, some have reported issues with the platforms stability during peak usage times.

"During crucial trading moments, I experienced lags which hampered execution," remarked a critical reviewer.

- User Feedback Summation: ActivTrades maintains a commitment to improving the user interface but there's room for enhancements particularly in server stability.

Customer Support Analysis

-

Evaluation of Support Availability: ActivTrades provides support through multiple channels but some users have noted delays in resolution times.

Customer Feedback Insights: Positive experiences largely outweigh negatives; users appreciate the multilingual support offered.

"Responses are often quick and helpful but can vary during high traffic times," another trader detailed.

- Support Mechanism Overview: While the support system is robust, enhancements in response times can further improve user experience.

Account Conditions Analysis

-

Initial Investment Requirements: The required minimum deposit of $500 is seen as a significant barrier for novice traders.

Account Flexibility Observations: The availability of multiple account types does cater to a range of trader profiles but might feel limiting to those looking for advanced features without hefty initial capital.

Account Conditions Summary: These conditions can deter less experienced traders from seizing opportunities available through more permissive platforms.

Conclusion

ActivTrades presents a viable trading option for retail and experienced traders alike, reinforced by robust regulatory standards and a wide selection of tradeable instruments. However, the initial deposit barriers and withdrawal concerns could be significant drawbacks for potential clients considering entering the market. With an emphasis on client funds' safety and positive user experiences, it remains a competitive option in the evolving world of online trading. Traders are advised to weigh the broker's strengths against potential risks before committing.

In light of the extensive features, educational resources, and multidimensional support, ActivTrades may well serve as a strong ally for those ready to embrace the complexities of forex and CFD trading.

This comprehensive review ensures prospective users have the necessary insights to make informed decisions while highlighting areas where improvements could be made. ActivTrades stands as a solid choice in many regards but due diligence is always advised.