Traze 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive traze review examines a CFD broker headquartered in the Seychelles. The broker has gained attention in the trading community. Based on available information from multiple review platforms and user feedback, Traze operates as a Contract for Difference broker targeting investors seeking exposure to various financial instruments through derivative trading.

Our analysis reveals a mixed picture for this broker. While Traze maintains operations from the Seychelles and offers CFD trading services, several critical aspects of their service offering remain unclear or poorly documented across review platforms. The lack of comprehensive regulatory information and limited transparency regarding trading conditions presents challenges for potential clients. These issues make detailed broker evaluation difficult.

This review is primarily intended for investors considering CFD trading opportunities and those evaluating offshore brokers. However, the limited availability of detailed operational information suggests that traders should exercise heightened due diligence when considering this platform. Our assessment is based on publicly available information and user feedback collected from various review platforms and industry sources.

Important Notice

Regional Regulatory Differences: Trading regulations vary significantly across jurisdictions. Offshore brokers like Traze may operate under different regulatory frameworks than those familiar to traders in major financial centers. Investors should independently verify the regulatory status and compliance requirements applicable to their jurisdiction before engaging with any offshore broker.

Review Methodology: This evaluation is based on publicly available information, user feedback from review platforms, and industry reports. Due to limited detailed information available about Traze's operations, some aspects of this review reflect the absence of comprehensive data rather than negative findings.

Rating Framework

Broker Overview

Company Background and Operations

Traze operates as a CFD broker with its headquarters located in the Seychelles. This offshore jurisdiction is popular among financial services providers. The company focuses on providing Contract for Difference trading services, which allow clients to speculate on price movements of various financial instruments without owning the underlying assets. According to available sources, the broker targets individual investors seeking exposure to CFD markets.

The Seychelles location suggests Traze operates under the regulatory framework of this jurisdiction. However, specific licensing details and regulatory compliance information remain unclear from available sources. This offshore positioning is common among CFD brokers seeking to serve international clients while operating under specific regulatory environments that may offer different compliance requirements compared to major financial centers.

Trading Focus and Market Positioning

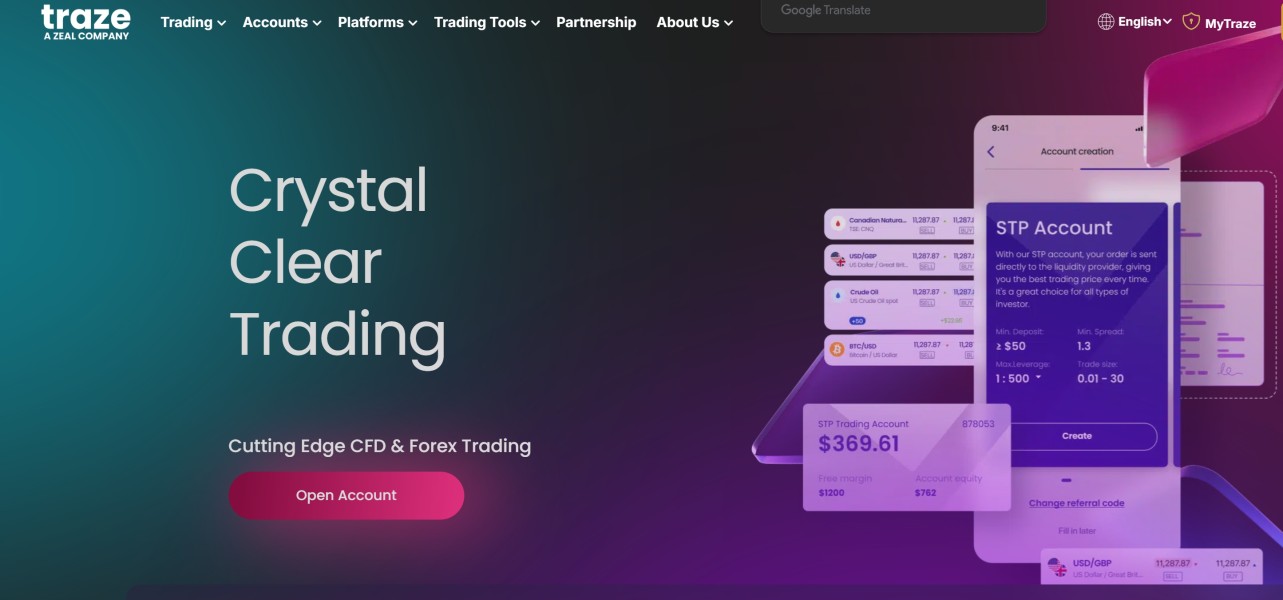

As a CFD-focused broker, Traze positions itself within the derivatives trading sector. The company offers clients the ability to trade contracts that derive their value from underlying financial instruments. This business model typically involves providing leveraged trading opportunities across various asset classes, though specific details about the range of available instruments and trading conditions are not comprehensively documented in available sources.

The broker appears to target retail investors interested in CFD trading. However, the specific market segments and client demographics served by Traze require further clarification. This traze review finds that while the basic business model is clear, many operational details that would typically inform trader decision-making remain undocumented in publicly available sources.

Regulatory Framework: Available information does not provide clear details about Traze's specific regulatory status, licensing numbers, or compliance frameworks. While the Seychelles headquarters suggests operation under local financial services regulations, specific regulatory documentation is not readily available in reviewed sources.

Deposit and Withdrawal Methods: Banking and payment processing information for Traze is not detailed in available sources. This includes supported payment methods, processing times, or associated fees for financial transactions.

Minimum Deposit Requirements: Specific minimum deposit amounts and account funding requirements are not clearly documented in the available information about Traze's services.

Promotional Offers: Information regarding welcome bonuses, promotional campaigns, or incentive programs offered by Traze is not available in the reviewed sources.

Tradeable Assets: While Traze is identified as a CFD broker, specific details about the range of underlying assets, markets covered, or instrument categories available for trading are not comprehensively documented.

Cost Structure: Trading costs, spreads, commission structures, and fee schedules are not detailed in available sources. This makes cost comparison with other brokers challenging.

Leverage Options: Specific leverage ratios, margin requirements, and risk management parameters offered by Traze are not clearly documented in reviewed materials.

Platform Technology: Information about trading platforms, software options, mobile applications, and technological infrastructure is not detailed in available sources.

Geographic Restrictions: Specific countries or regions where Traze services are restricted or unavailable are not clearly documented in reviewed sources.

Customer Support Languages: Available languages for customer support and service availability are not specified in the information reviewed for this traze review.

Account Conditions Analysis

The evaluation of Traze's account conditions faces significant limitations due to insufficient publicly available information. Traditional broker reviews typically examine account types, minimum deposit requirements, account features, and opening procedures. However, comprehensive details in these areas are not readily accessible for Traze.

Without clear documentation of account tiers, minimum funding requirements, or specific account features, potential clients cannot easily compare Traze's offerings with industry standards. This information gap represents a significant consideration for traders who rely on transparent account condition comparisons when selecting brokers.

The absence of detailed account information also extends to verification procedures, documentation requirements, and account activation timelines. Industry best practices typically involve clear communication of these processes. The lack of readily available information in this area may concern potential clients seeking straightforward account opening procedures.

This traze review finds that the limited transparency regarding account conditions makes it difficult for potential clients to make informed decisions. Traders cannot easily determine whether Traze's account structure aligns with their trading needs and expectations.

Evaluation of Traze's trading tools and educational resources is constrained by the limited information available in public sources. Modern CFD brokers typically provide comprehensive trading platforms, analytical tools, and educational materials to support client trading activities. However, specific details about Traze's offerings in these areas are not well-documented.

Trading tools typically include charting software, technical analysis indicators, risk management features, and automated trading capabilities. However, the specific trading tools and analytical resources available through Traze are not detailed in available sources. This makes it difficult to assess the broker's technological capabilities.

Educational resources represent another important evaluation criterion. Quality brokers often provide market analysis, trading guides, webinars, and research materials. The availability and quality of such resources from Traze cannot be adequately assessed based on currently available information.

Research and analysis capabilities, including market commentary, economic calendars, and trading signals, are standard offerings among established CFD brokers. However, Traze's specific capabilities in these areas require further investigation beyond what is available in current sources.

Customer Service and Support Analysis

Assessment of Traze's customer service quality faces limitations due to insufficient detailed information about support channels, response times, and service quality metrics. Effective customer support is crucial for CFD trading, where clients may require assistance with platform issues, account questions, or trading-related concerns.

Standard customer service evaluation criteria include available contact methods, support hours, response times, and multi-language capabilities. However, specific details about Traze's customer support infrastructure are not comprehensively documented in available sources.

User feedback regarding customer service experiences with Traze is limited in the reviewed sources. This makes it difficult to assess actual service quality based on client experiences. Industry-standard customer service typically involves prompt response times, knowledgeable support staff, and multiple contact channels.

The absence of detailed customer service information may concern potential clients who prioritize responsive support. This is particularly important in the fast-paced CFD trading environment where timely assistance can be crucial for addressing urgent trading or technical issues.

Trading Experience Analysis

Evaluating Traze's trading experience requires examination of platform stability, execution quality, and overall trading environment. However, comprehensive information in these areas is not readily available from reviewed sources. Trading experience typically encompasses platform reliability, order execution speed, slippage rates, and overall system performance.

Platform stability and uptime are critical factors for CFD trading, where market movements can be rapid and timing is essential. However, specific performance metrics, uptime statistics, or user reports about platform reliability are not detailed in available sources about Traze.

Order execution quality, including execution speed and price accuracy, represents another crucial aspect of trading experience. Without detailed information about Traze's execution practices, technology infrastructure, or performance statistics, this traze review cannot provide comprehensive assessment of these critical trading factors.

Mobile trading capabilities and cross-device functionality are increasingly important for modern traders. However, specific information about Traze's mobile offerings, app functionality, or multi-device support is not detailed in currently available sources.

Trust and Security Analysis

Trust and security assessment for Traze is significantly hampered by limited transparency regarding regulatory compliance, fund protection measures, and company background information. Trust factors typically include regulatory licensing, segregated client funds, insurance protection, and transparent business practices.

Regulatory compliance represents the foundation of broker trustworthiness. However, specific regulatory licenses, compliance certifications, or oversight mechanisms for Traze are not clearly documented in available sources. This regulatory uncertainty may concern potential clients seeking brokers with clear regulatory oversight.

Fund security measures, including client fund segregation, bank partnerships, and insurance coverage, are standard safety features among established brokers. However, specific information about Traze's fund protection practices and client money handling procedures is not detailed in reviewed sources.

Company transparency, including ownership information, financial statements, and business history, contributes to overall trustworthiness assessment. The limited availability of such information about Traze may influence potential clients' confidence in the broker's reliability and long-term stability.

User Experience Analysis

User experience evaluation for Traze faces constraints due to limited user feedback and detailed interface information available in public sources. User experience typically encompasses platform usability, registration processes, account management features, and overall client satisfaction levels.

Interface design and platform usability are important factors for trader satisfaction. However, specific information about Traze's platform design, navigation structure, or user interface features is not comprehensively detailed in available sources.

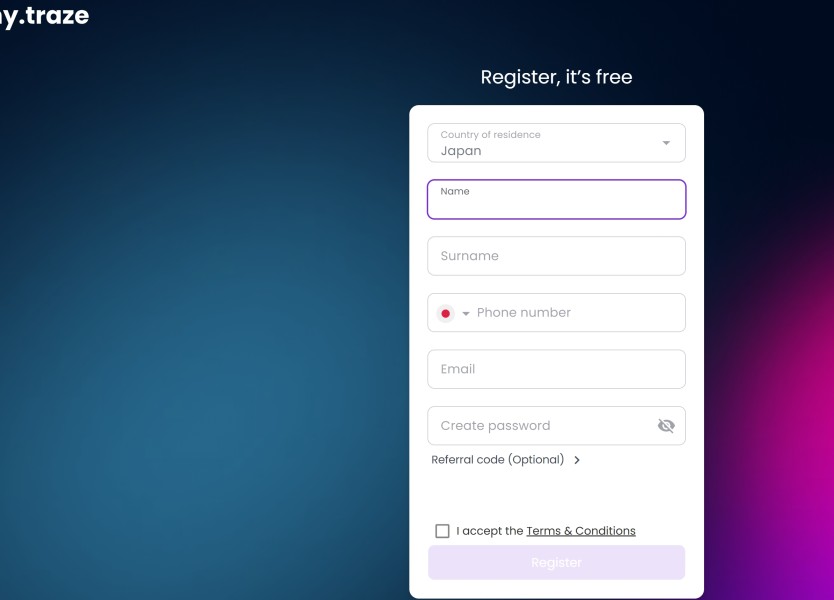

Registration and account verification processes significantly impact initial user experience. However, detailed information about Traze's onboarding procedures, documentation requirements, or account activation timelines is not readily available for assessment.

User satisfaction feedback from actual clients would provide valuable insights into real-world experience with Traze's services. However, comprehensive user reviews and satisfaction surveys are limited in the sources reviewed for this analysis.

The absence of detailed user experience information makes it challenging for potential clients to assess whether Traze's platform and services align with their usability preferences. Traders cannot easily determine if the broker meets their trading workflow requirements.

Conclusion

This traze review reveals a CFD broker operating from the Seychelles with limited publicly available information about its services, trading conditions, and operational practices. While Traze positions itself as a CFD trading provider, the lack of comprehensive details about regulatory compliance, trading conditions, platform features, and customer support presents significant information gaps.

The limited transparency regarding key operational aspects suggests that potential clients should exercise considerable caution and conduct thorough due diligence before engaging with this broker. Traders typically benefit from brokers that provide clear, detailed information about their services, regulatory status, and trading conditions.

Based on available information, Traze may be suitable for experienced traders comfortable with offshore brokers and willing to accept the uncertainties associated with limited transparency. However, traders seeking comprehensive information and clear regulatory oversight may prefer brokers with more detailed public disclosure and established regulatory frameworks.