Tjv 2025 Review: Everything You Need to Know

Executive Summary

This Tjv review gives you a complete analysis of a company that has worked since 1995. The specific forex trading services remain unclear from the information we can find. TJ Telemarketing started in 1995 and focuses on high-quality lead generation mainly for insurance agents. They claim an impressive contact rate of over 95%. The company works with TJ Data Services, which has more than 25 years of experience in database application development and management.

This company seems to focus on lead generation and data services rather than traditional forex brokerage services. The company says it provides the best business solutions, with special focus on open-source technologies and database management systems. However, the lack of specific trading conditions, regulatory information, and user feedback about forex services makes it hard to give a clear assessment of how good it is as a forex broker.

The target customers appear to be businesses and individuals who need high-quality lead generation services, especially in the insurance sector. How it might help forex traders who need lead generation remains unclear.

Important Notice

This evaluation uses limited available information from external sources and company materials. The assessment method relies on publicly available data, though complete details about specific forex trading services, regulatory compliance, and user experiences are not easy to find in current documentation.

You should know that information about cross-regional entity differences has not been found in available sources. Readers should do additional research before engaging with any financial services.

Rating Framework

Broker Overview

TJ Telemarketing started in 1995 and has built its reputation around providing high-quality lead generation services. They mainly target insurance agents and related professionals. The company works with a focus on delivering what they call the best solutions for their clients' business needs. According to available information, TJ Telemarketing keeps an impressive contact rate of over 95%, which suggests a smart approach to lead qualification and management.

The organization works with TJ Data Services, which brings over 25 years of specialized experience in database application development and management of world-class relational database management systems. This technical expertise seems to form the backbone of their service offerings, with special focus on open-source solutions made for specific business requirements.

However, this Tjv review must note that specific information about forex trading platforms, asset classes, and regulatory oversight is not detailed in available source materials. The company's main business model seems centered on lead generation and data services rather than direct financial trading services. Without clear information about trading platform types, regulatory authorities, or specific forex-related services, it remains unclear how this entity works within the forex trading ecosystem.

Regulatory Regions: Specific regulatory information is not detailed in available source materials. This makes it difficult to determine which financial authorities oversee any potential trading services.

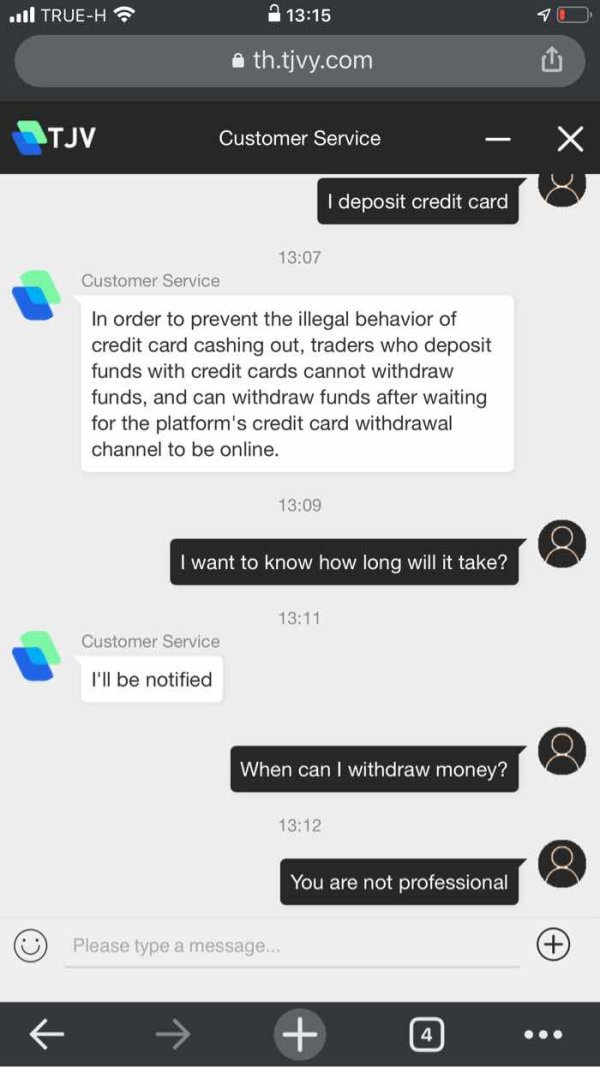

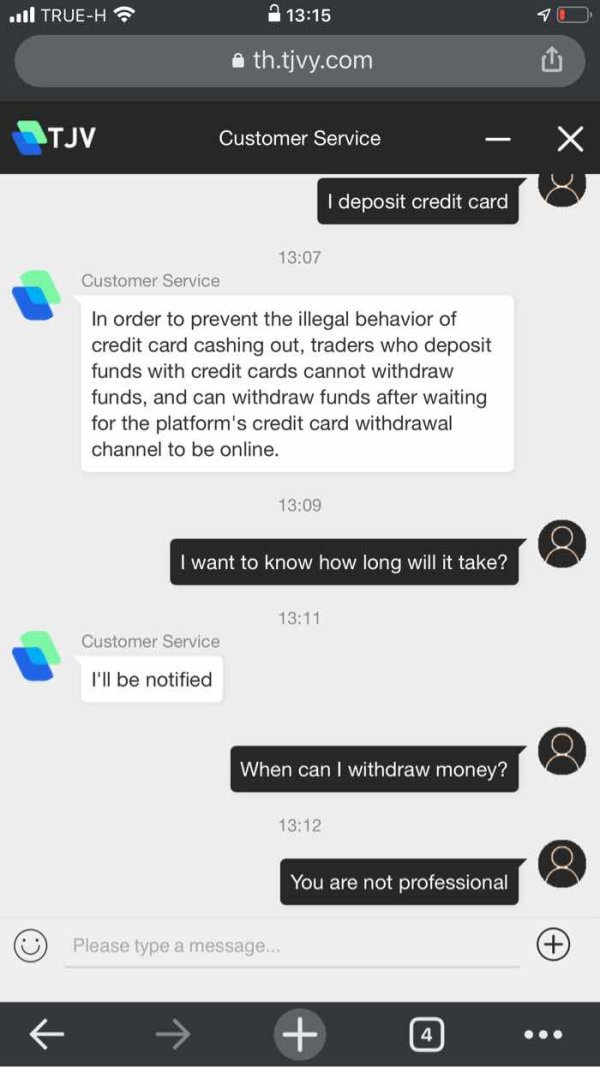

Deposit and Withdrawal Methods: Information about deposit and withdrawal options is not mentioned in accessible documentation.

Minimum Deposit Requirements: Specific minimum deposit requirements are not specified in available sources.

Bonuses and Promotions: Details about promotional offers or bonus structures are not included in current documentation.

Tradeable Assets: Information about specific tradeable assets or financial instruments is not mentioned in available materials.

Cost Structure: Detailed pricing information and fee structures are not specified in accessible sources. The focus appears to be on lead generation services rather than traditional trading costs.

Leverage Ratios: Leverage information is not provided in available documentation.

Platform Options: Specific trading platform details are not mentioned in source materials.

Regional Restrictions: Geographic limitations or restrictions are not detailed in available information.

Customer Service Languages: Supported languages for customer service are not specified in accessible documentation.

This Tjv review highlights the significant information gaps about traditional forex brokerage services. Interested parties should seek additional clarification directly from the company.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of account conditions proves challenging in this Tjv review due to the absence of specific information about account types, structures, or features in available source materials. Traditional forex broker account categories such as standard, premium, or professional accounts are not detailed in accessible documentation.

Minimum deposit requirements are not specified in current sources. These typically serve as a key difference among forex brokers. Similarly, information about account opening procedures, required documentation, or verification processes remains unavailable in the materials reviewed.

Special account features commonly offered by forex brokers are not mentioned in available documentation. These include Islamic accounts compliant with Sharia law, cent accounts for beginners, or institutional accounts for high-volume traders. The lack of this basic information makes it impossible to evaluate how competitive or suitable the potential account offerings are.

Without access to user feedback about account setup experiences, funding processes, or account management features, this analysis cannot provide meaningful insights into the practical aspects of account conditions. Potential users would need to contact the company directly to get specific details about available account types and their features.

The evaluation of trading tools and resources presents significant challenges due to limited information in available sources. Traditional forex trading tools such as technical analysis indicators, charting packages, or automated trading support are not specifically mentioned in accessible documentation.

Research and analysis resources are not detailed in current source materials. These typically include market commentary, economic calendars, or fundamental analysis reports. The absence of information about educational resources such as webinars, tutorials, or trading guides further complicates the assessment of the company's commitment to trader development.

However, the company's background in database application development and management suggests potential technical capabilities that could translate into sophisticated analytical tools. TJ Data Services' 25+ years of experience with relational database management systems indicates strong technical infrastructure that could support advanced trading platforms. Specific applications to forex trading are not confirmed though.

The emphasis on open-source solutions mentioned in company materials could potentially indicate flexibility in tool customization. Without specific examples or user testimonials, the practical benefits for forex traders remain unclear. Additional research would be necessary to determine what specific tools and resources are actually available to users.

Customer Service and Support Analysis

Customer service evaluation proves difficult due to the absence of specific information about support channels, availability, or service quality metrics in available source materials. Traditional customer service indicators such as response times, support ticket resolution rates, or customer satisfaction scores are not provided in accessible documentation.

The availability of multiple communication channels is not detailed in current sources. These include live chat, email support, phone assistance, or social media engagement. Similarly, information about customer service hours, timezone coverage, or multilingual support capabilities remains unspecified.

One positive indicator mentioned in available materials suggests that the company has built lasting relationships with clients. There are references to connections that "felt right" and an ability to make clients feel important when seeking advice or support. This anecdotal evidence suggests a personalized approach to client relationships, though specific metrics or systematic feedback are not available.

The lack of detailed customer service information makes it impossible to assess response quality, problem resolution effectiveness, or overall support satisfaction. Potential users would need to engage directly with the company to evaluate their customer service standards and determine whether the support level meets their specific requirements.

Trading Experience Analysis

The assessment of trading experience faces significant limitations due to the absence of specific platform performance data or user experience feedback in available source materials. Critical factors such as platform stability, execution speed, and order processing quality are not detailed in accessible documentation.

Traditional trading experience metrics are not specified in current sources. These include slippage rates, execution times, platform uptime statistics, or mobile application performance. The lack of information about trading environment features such as one-click trading, advanced order types, or risk management tools further complicates this Tjv review.

Without access to user testimonials about platform reliability, interface design, or overall trading satisfaction, it becomes impossible to provide meaningful insights into the practical trading experience. Technical performance data that would typically inform decisions about platform suitability is not available in reviewed materials.

The company's technical background in database management suggests potential capabilities for robust platform infrastructure. Specific applications to trading technology remain unconfirmed though. Prospective users would need to request demonstration access or trial periods to properly evaluate the trading experience quality.

Trust and Reliability Analysis

Trust assessment proves challenging due to limited information about regulatory compliance, financial oversight, or industry standing in available source materials. Traditional trust indicators such as regulatory licenses, financial authority registration, or compliance certifications are not detailed in accessible documentation.

Fund security measures are not specified in current sources. These include segregated accounts, insurance coverage, or third-party auditing. The absence of information about company transparency measures such as published financial statements, regulatory filings, or independent verification makes comprehensive trust evaluation difficult.

The company's longevity since 1995 provides some indication of operational stability and market persistence. This suggests an ability to maintain business operations over nearly three decades. However, without specific information about regulatory oversight or financial safeguards, the assessment of trustworthiness remains incomplete.

Industry reputation indicators such as awards, certifications, or recognition from financial authorities are not mentioned in available materials. The lack of information about negative incident handling or dispute resolution processes further limits the ability to assess reliability standards comprehensively.

User Experience Analysis

User experience evaluation encounters significant obstacles due to the absence of systematic user feedback or satisfaction surveys in available source materials. Traditional user experience metrics such as interface usability, navigation efficiency, or overall satisfaction ratings are not provided in accessible documentation.

Registration and verification process experiences are not detailed in current sources. These often significantly impact user impressions. Similarly, information about fund management experiences remains unavailable, including deposit and withdrawal satisfaction, processing times, or user interface quality.

The limited anecdotal evidence suggests positive relationship-building capabilities. There are mentions of connections that felt natural and ongoing support that makes clients feel valued. However, this isolated feedback cannot substitute for comprehensive user experience analysis across diverse user types and usage scenarios.

Without access to systematic user feedback addressing common pain points, feature requests, or improvement suggestions, this analysis cannot provide meaningful insights into the overall user experience quality. Potential users would need to seek current user testimonials or trial access to properly evaluate the user experience standards.

Conclusion

This Tjv review reveals a company with substantial operational history dating back to 1995. It primarily focuses on lead generation and data services rather than traditional forex brokerage. While TJ Telemarketing demonstrates expertise in client relationship management and TJ Data Services brings significant technical capabilities in database management, the lack of specific information about forex trading services, regulatory compliance, and user experiences makes comprehensive evaluation challenging.

The company appears most suitable for businesses or individuals seeking high-quality lead generation services, particularly in the insurance sector. This is given their claimed 95%+ contact rate and decades of specialized experience. However, for traditional forex trading needs, prospective users would require additional information about trading conditions, platforms, and regulatory oversight that is not available in current documentation.

The primary advantage lies in the organization's extensive industry experience and technical infrastructure capabilities. The main limitation is the absence of transparent information about specific forex trading services and conditions.