Zenstox 2025 Review: Everything You Need to Know

Executive Summary

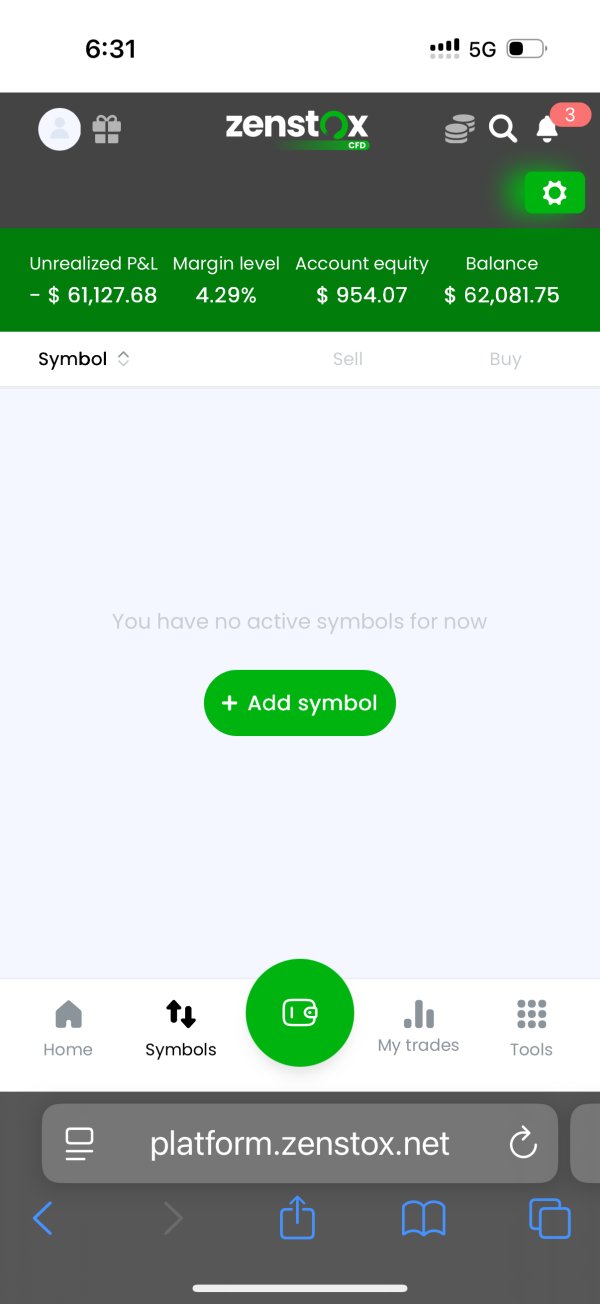

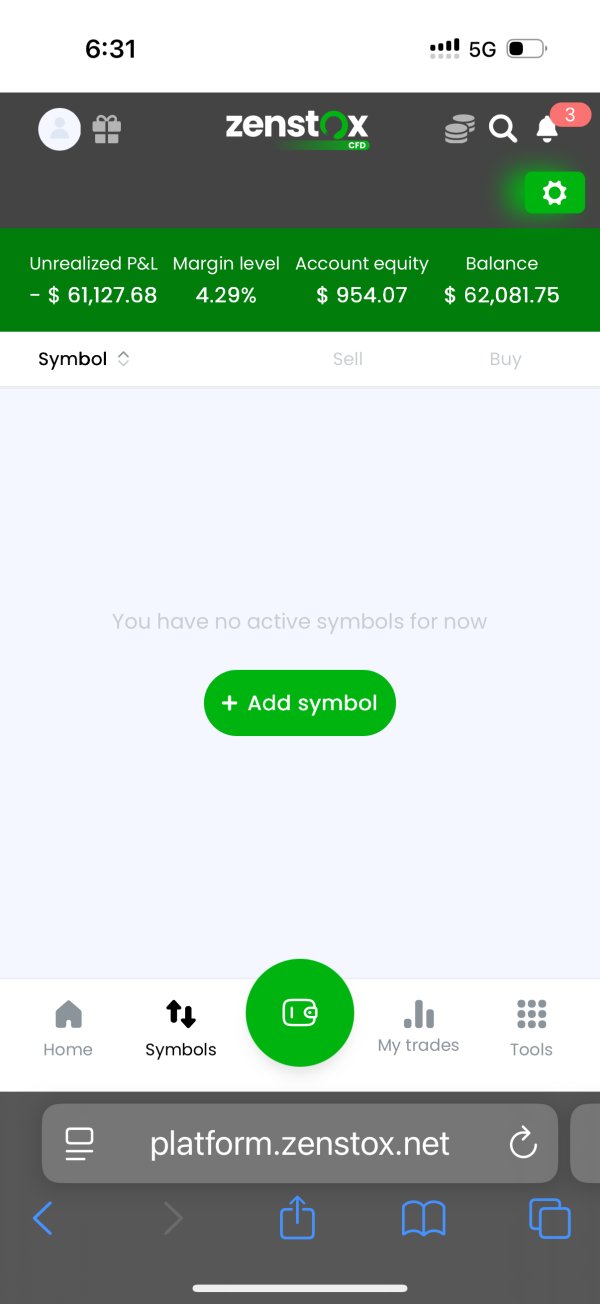

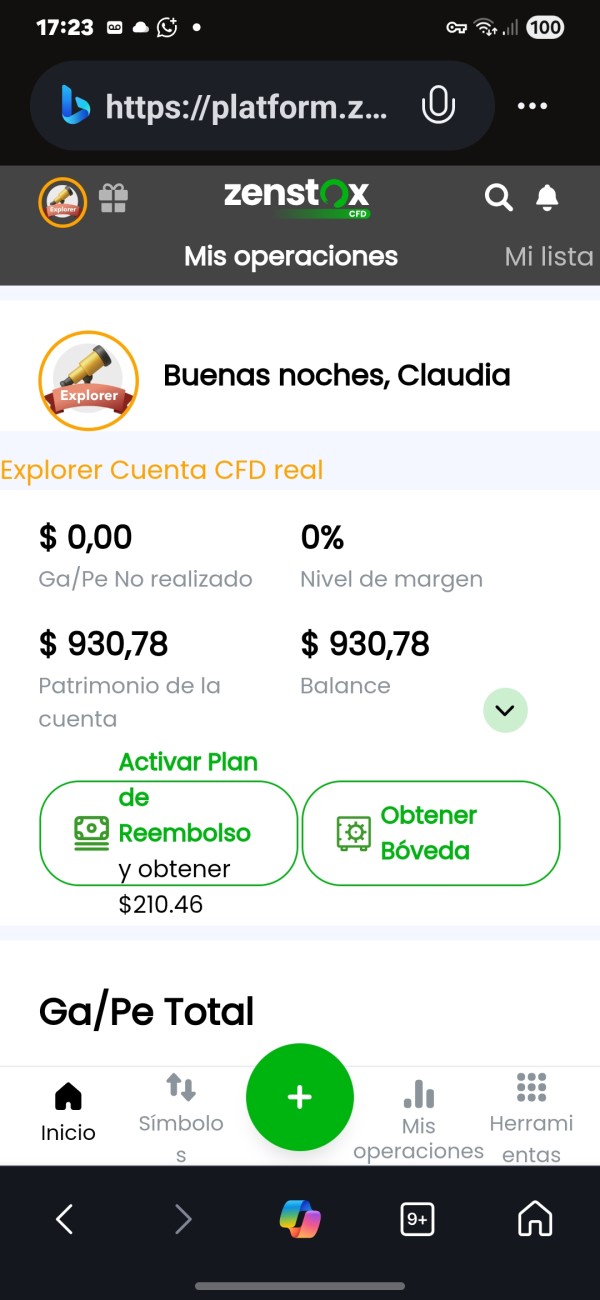

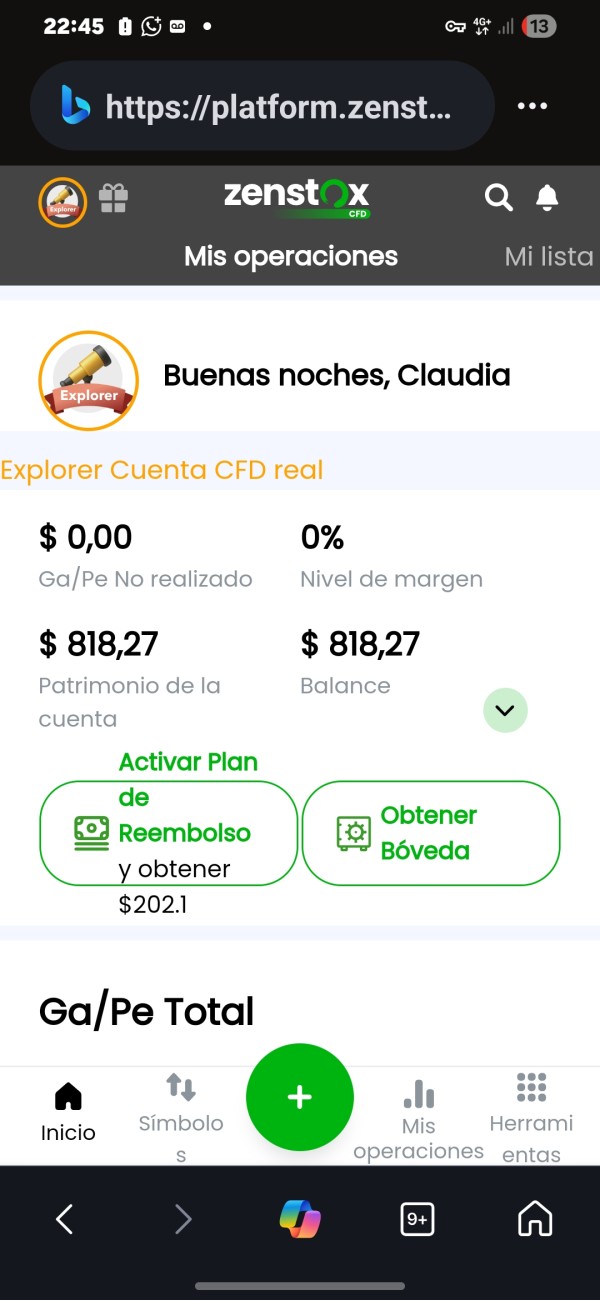

This comprehensive zenstox review examines a CFD trading platform that has gained significant market attention. However, the platform comes with controversy. Zenstox operates as a multi-asset CFD broker offering trading opportunities across various financial instruments including commodities, currencies, ETFs, indices, stocks, and cryptocurrencies. The platform attracts traders with competitive spreads starting from zero and leverage ratios up to 1:300.

According to available data, Zenstox maintains a 90% user recommendation rate. This suggests general satisfaction among its client base. However, this positive metric is balanced by concerning trust indicators, including a trust score of 49 (categorized as low-to-medium) and five red flag warnings that potential users should carefully consider. The broker operates under FSA (Seychelles) regulation. While legitimate, this may not provide the same level of investor protection as top-tier regulatory jurisdictions.

Zenstox primarily targets intermediate to advanced traders seeking diversified investment opportunities across multiple asset classes. The platform's minimum deposit requirement of $200 makes it accessible to entry-level traders. However, the mixed reviews regarding customer service and trust factors suggest that potential clients should approach with appropriate due diligence.

Important Notice

Regional Regulatory Differences: Zenstox operates under the regulatory oversight of the Financial Services Authority (FSA) of Seychelles. Traders should be aware that Seychelles-based regulation may differ significantly from regulatory standards in other jurisdictions. This particularly affects investor protection measures, compensation schemes, and dispute resolution procedures. The regulatory environment in Seychelles is generally considered less strict than those of major financial centers.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback, publicly available market data, regulatory filings, and third-party review platforms. Information has been gathered from multiple sources including customer review websites, broker comparison platforms, and regulatory databases. This provides a balanced assessment of Zenstox's services and reputation.

Rating Framework

Broker Overview

Zenstox positions itself as a modern CFD trading platform designed to serve the evolving needs of contemporary traders. The company focuses on providing access to over 300 premium trading symbols across multiple asset categories. It emphasizes technological innovation and user-friendly trading environments. While specific founding details are not extensively documented in available materials, Zenstox has established itself as a recognizable name in the online trading sector. The platform particularly appeals to traders seeking exposure to diverse financial markets through CFD instruments.

The broker's business model centers on Contract for Difference (CFD) trading. This allows clients to speculate on price movements without owning underlying assets. This approach enables Zenstox to offer trading opportunities across traditional markets like stocks and forex, as well as emerging sectors including cryptocurrency CFDs. The platform markets itself as offering "countless investment opportunities" with elaborate helping tools. These tools are designed to support trading decisions across its extensive symbol range.

Zenstox operates under the regulatory framework established by the Financial Services Authority of Seychelles. This provides legal structure for its operations while serving international clients. The broker offers trading across six primary asset categories: commodities, currencies, ETFs, indices, stocks, and cryptocurrencies. This diversification allows traders to build comprehensive portfolios or focus on specific market sectors according to their investment strategies and risk tolerance levels.

Regulatory Jurisdiction: Zenstox operates under FSA (Seychelles) regulation. This provides basic regulatory oversight but may not offer the same level of investor protection as major financial centers like the UK's FCA or Australia's ASIC. Traders should carefully consider the implications of this regulatory choice.

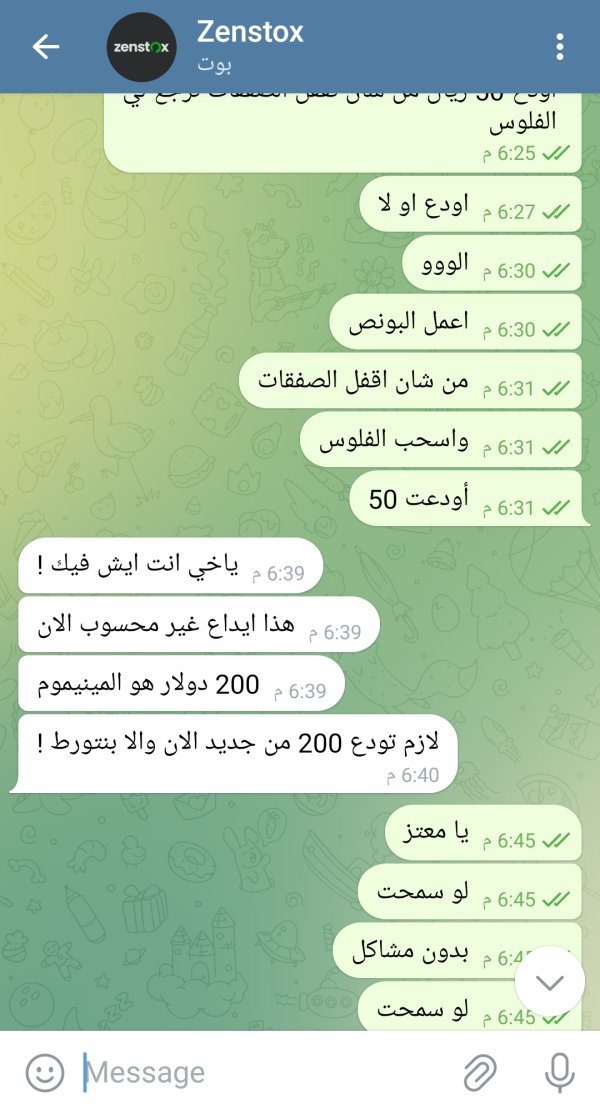

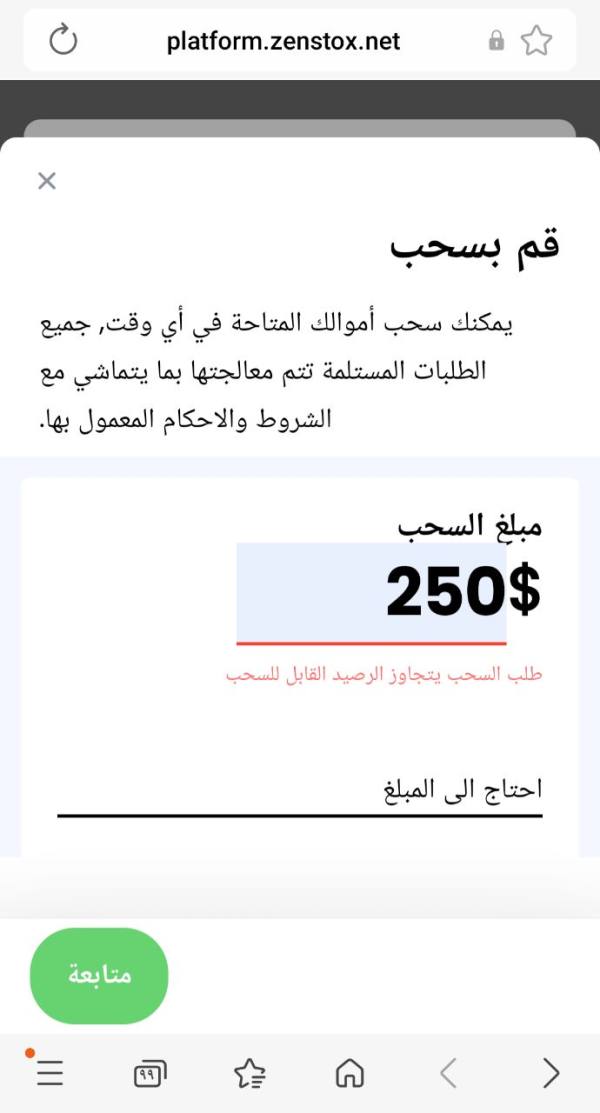

Minimum Deposit Requirements: The platform requires a minimum deposit of $200. This positions it as accessible to entry-level traders while remaining reasonable for more experienced investors seeking to test the platform's capabilities.

Available Trading Assets: Zenstox provides access to six major asset categories. These include commodities ranging from precious metals to energy products, major and minor currency pairs, Exchange Traded Funds (ETFs), global stock indices, individual company stocks, and cryptocurrency CFDs covering popular digital assets.

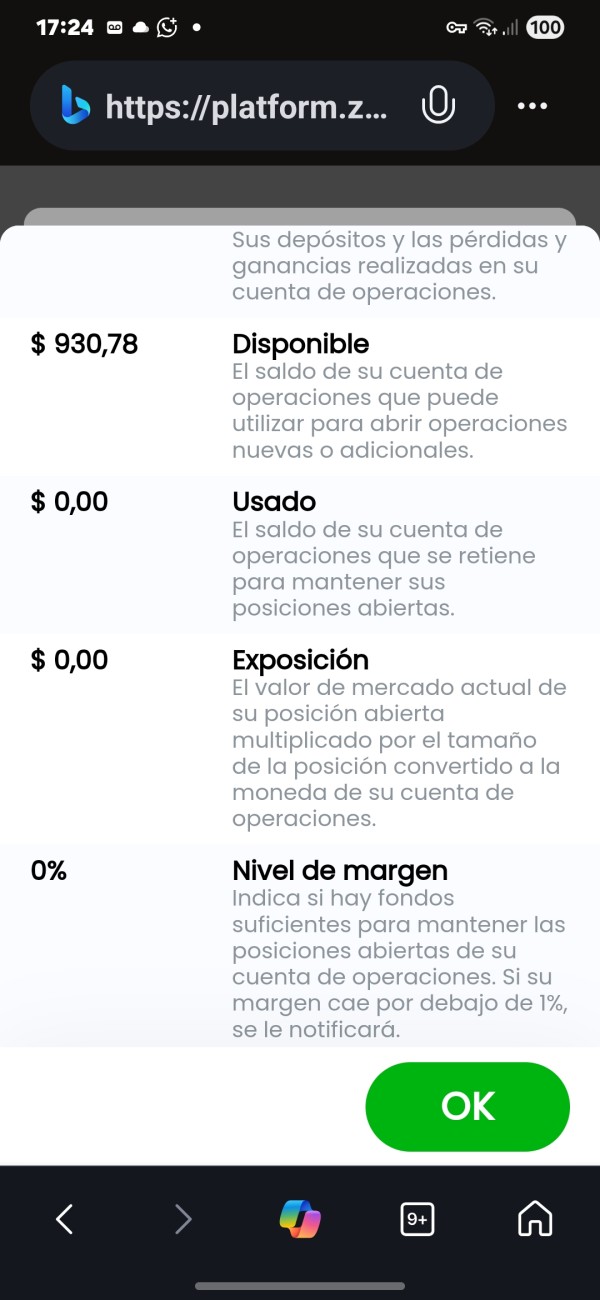

Cost Structure and Spreads: The broker advertises spreads starting from zero. This can be attractive for high-frequency traders and scalpers. However, specific commission structures and additional fees are not clearly detailed in available materials, requiring potential clients to inquire directly for comprehensive cost breakdowns.

Leverage Ratios: Maximum leverage reaches 1:300. This is relatively high and can significantly amplify both profits and losses. This level of leverage requires careful risk management and may not be suitable for inexperienced traders.

Promotional Offers: Specific information regarding welcome bonuses, deposit bonuses, or other promotional incentives is not detailed in available documentation. This suggests potential clients should contact the broker directly for current promotional terms.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

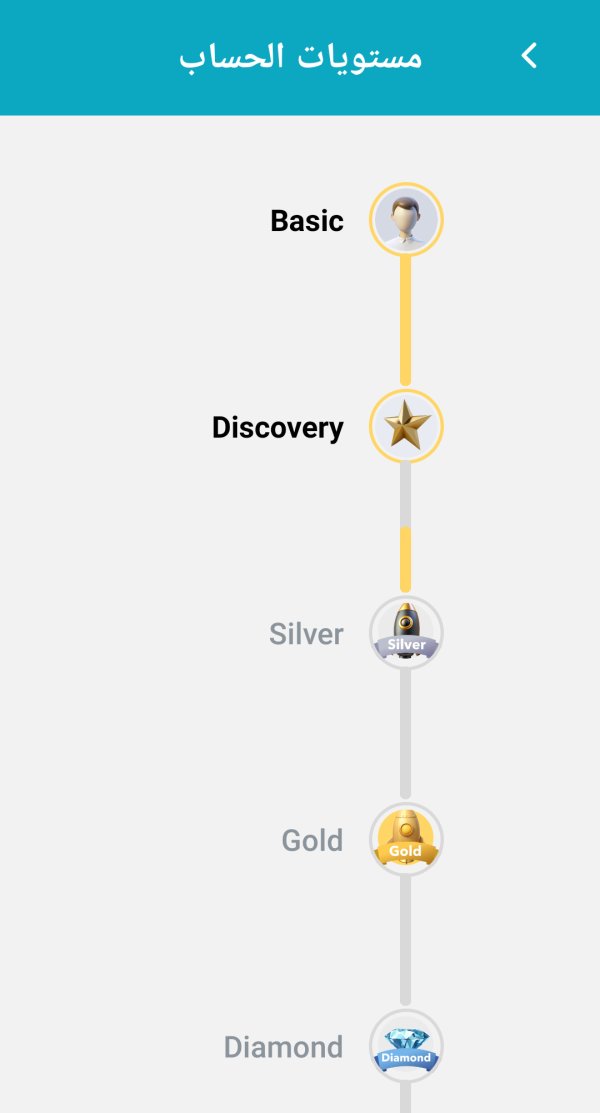

Zenstox's account conditions present a mixed picture that reflects both accessibility and limitations. The $200 minimum deposit requirement positions the broker competitively within the industry standard range. This makes it accessible to traders who may not have substantial initial capital. This threshold is reasonable compared to premium brokers that often require $500-$1,000 minimum deposits, while remaining above ultra-low-barrier brokers that accept deposits as low as $10-$50.

The leverage offering of up to 1:300 represents one of the more aggressive ratios available in the market. This can appeal to experienced traders seeking maximum capital efficiency. However, this high leverage also presents significant risk, particularly for newer traders who may not fully understand the implications of amplified exposure. According to user feedback, 90% of reviewers recommend the platform. This suggests that account holders generally find the basic conditions acceptable for their trading needs.

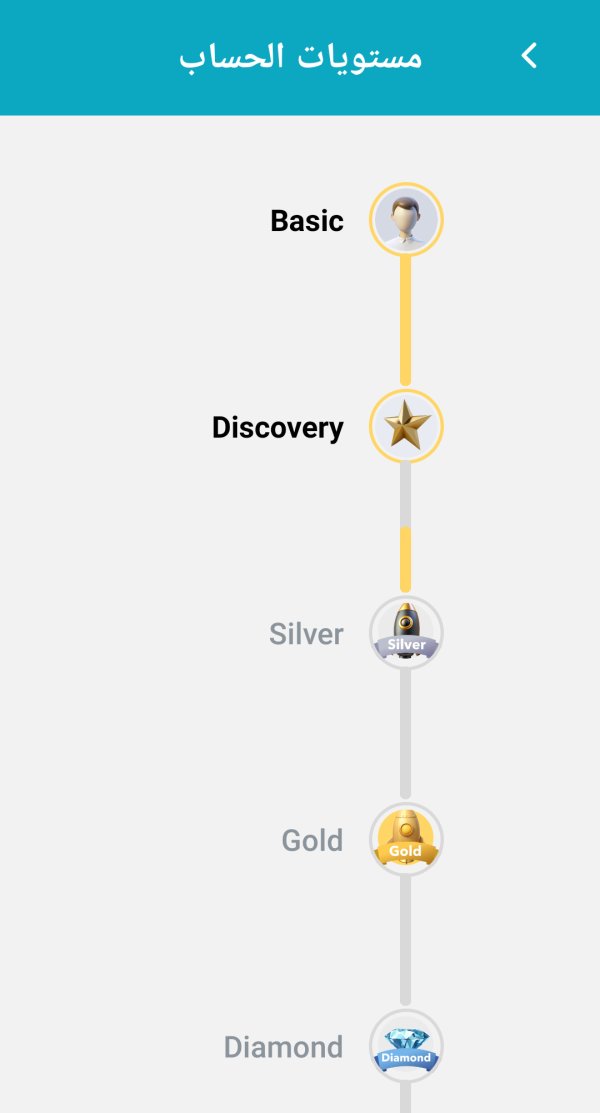

However, the evaluation is limited by the lack of detailed information about different account tiers, special features, or Islamic account options. This transparency gap makes it difficult for potential clients to fully understand what account progression opportunities exist. It also raises questions about whether the broker accommodates diverse religious or trading style requirements. The absence of clearly defined account types also suggests a potentially simplified but possibly limited account structure.

The zenstox review data indicates that while basic account conditions are competitive, the broker may benefit from providing more comprehensive information about account features, upgrade paths, and specialized account options. This would better serve diverse client needs and improve overall transparency.

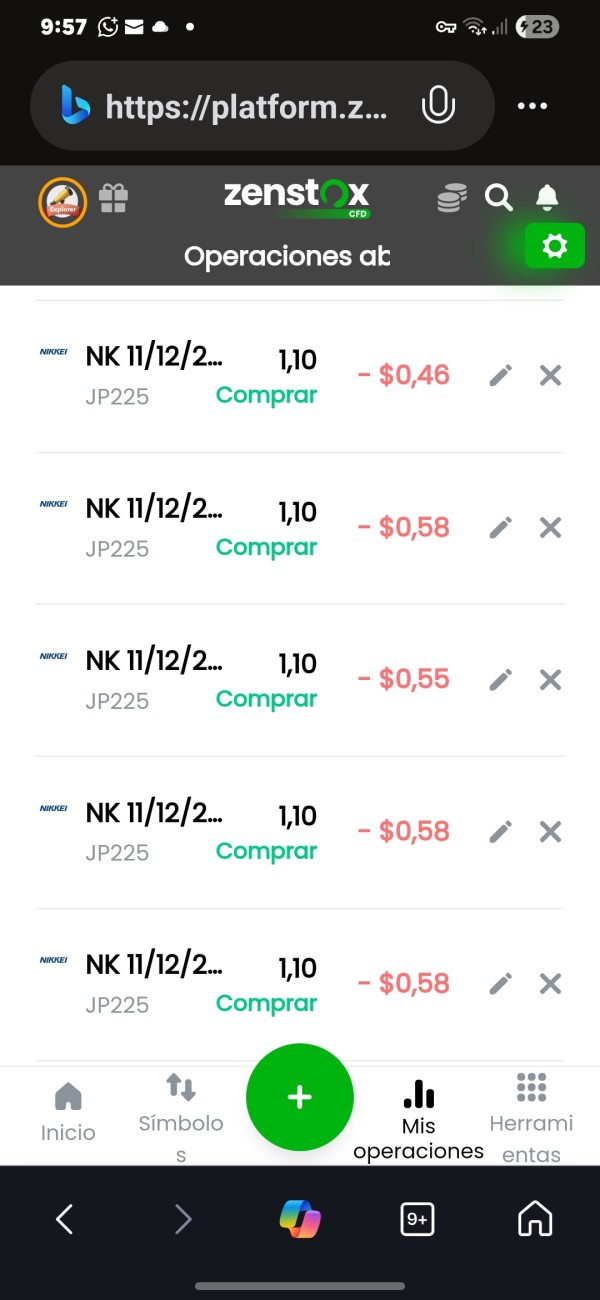

Zenstox demonstrates strength in its tools and resources offering, particularly in the breadth of tradeable instruments available to clients. The platform provides access to over 300 premium symbols across six major asset categories. This creates substantial opportunities for portfolio diversification and strategic trading approaches. The range spans traditional markets including commodities and currencies, extends to modern ETF and index trading, and embraces contemporary cryptocurrency CFDs.

The CFD trading infrastructure appears robust, with users reporting generally positive experiences with the available trading tools. The 90% user recommendation rate suggests that the majority of traders find the platform's resources adequate for their trading activities. The breadth of asset coverage allows traders to implement various strategies, from traditional forex trading to more contemporary cryptocurrency speculation, all within a single platform environment.

However, the evaluation is constrained by limited specific information about research tools, market analysis resources, educational materials, or automated trading capabilities. Professional traders often require comprehensive charting packages, economic calendars, market news feeds, and analytical tools to make informed decisions. The absence of detailed information about these critical resources represents a significant gap in understanding the platform's full capabilities.

Additionally, there is no clear information about educational resources for developing traders. This could limit the platform's appeal to those seeking to improve their trading skills while actively participating in markets.

Customer Service and Support Analysis (Score: 5/10)

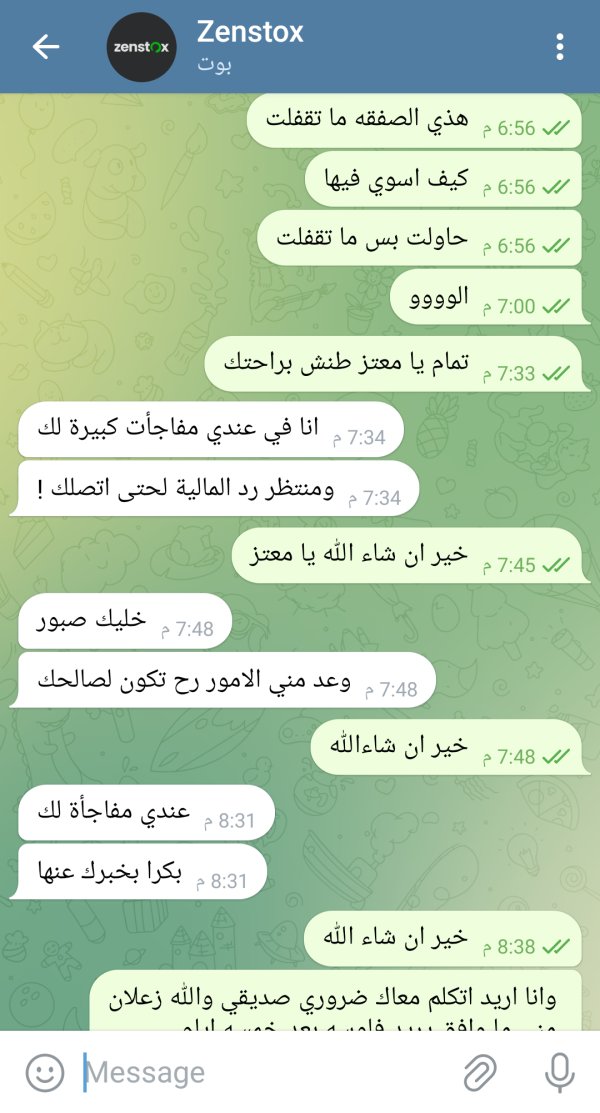

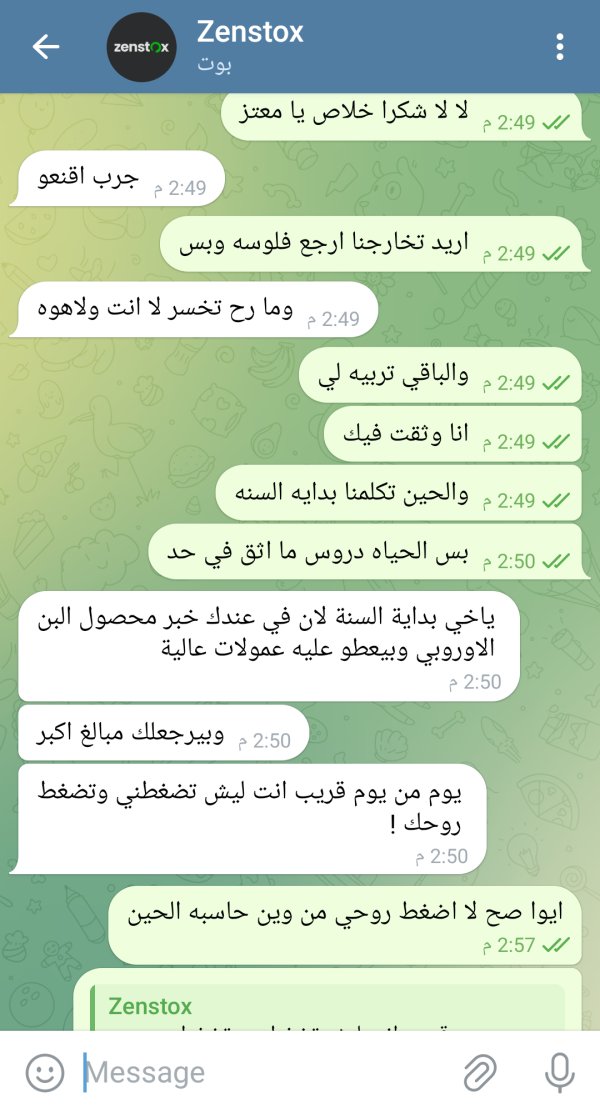

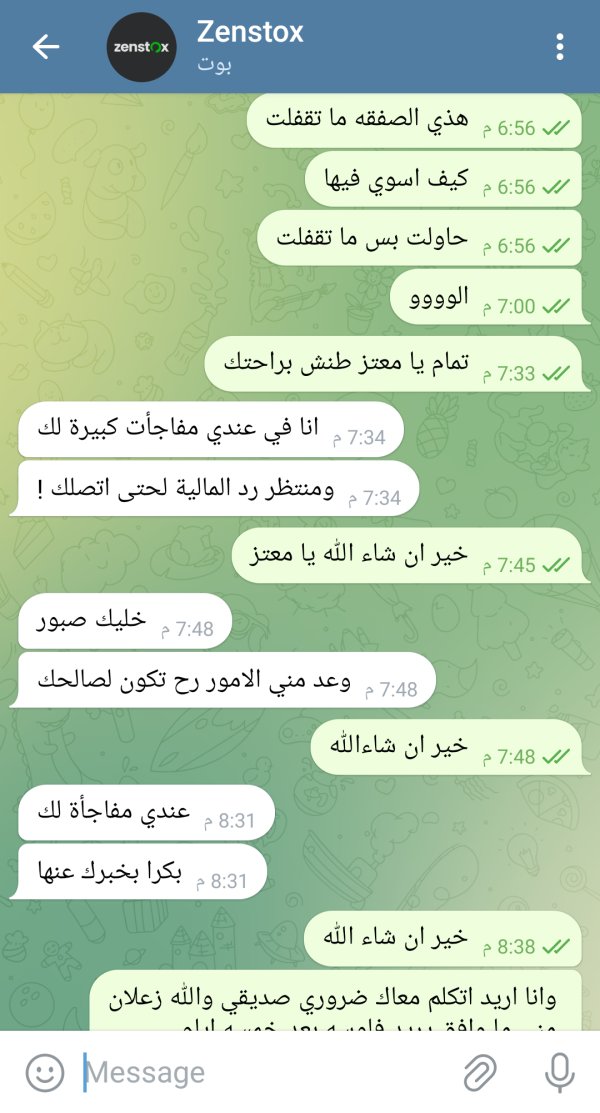

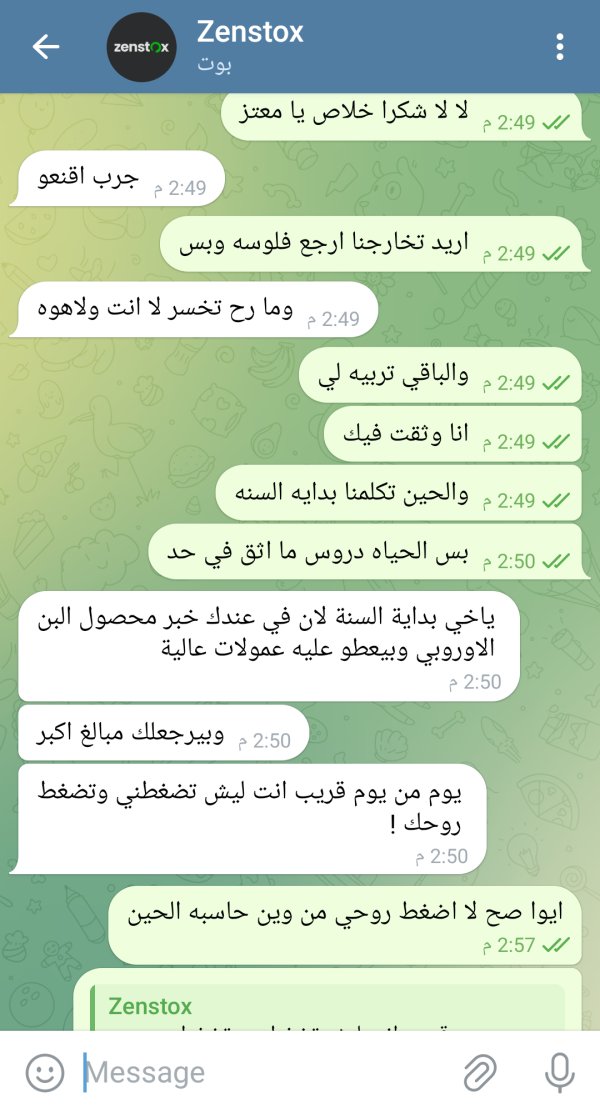

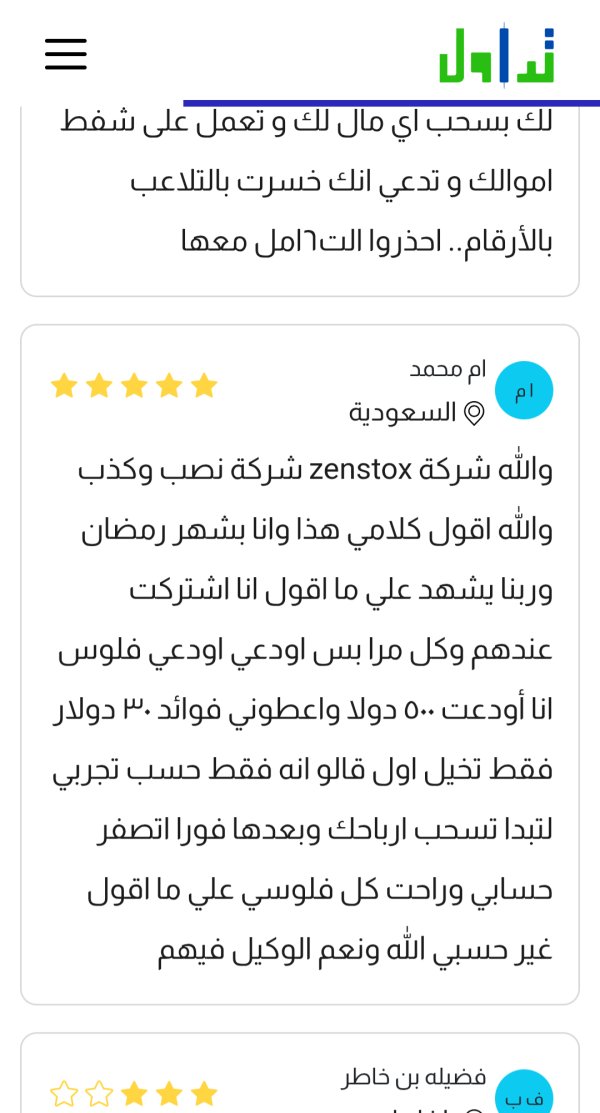

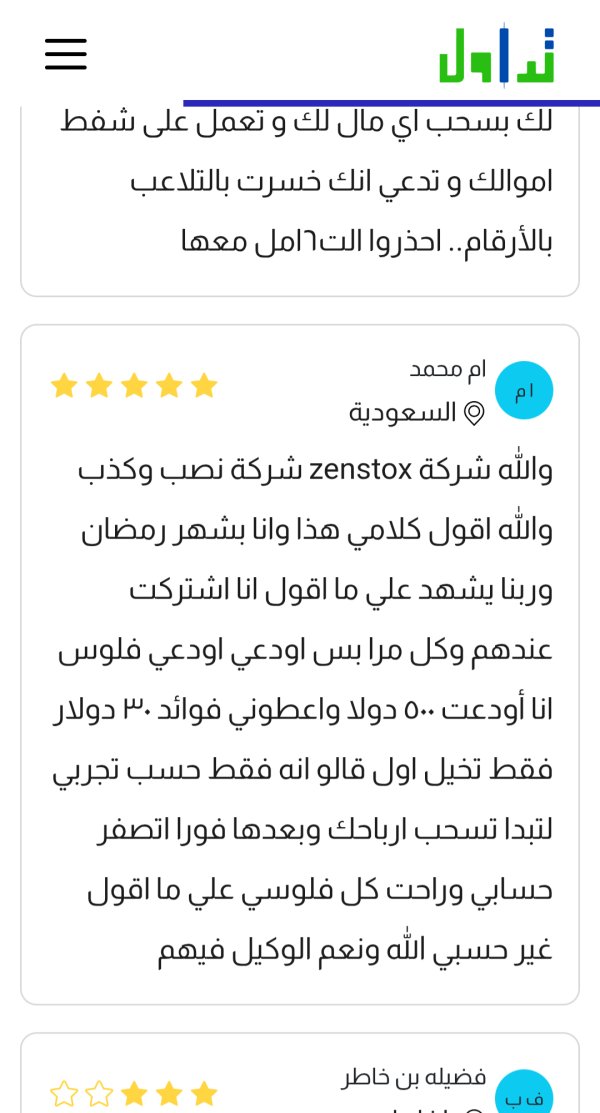

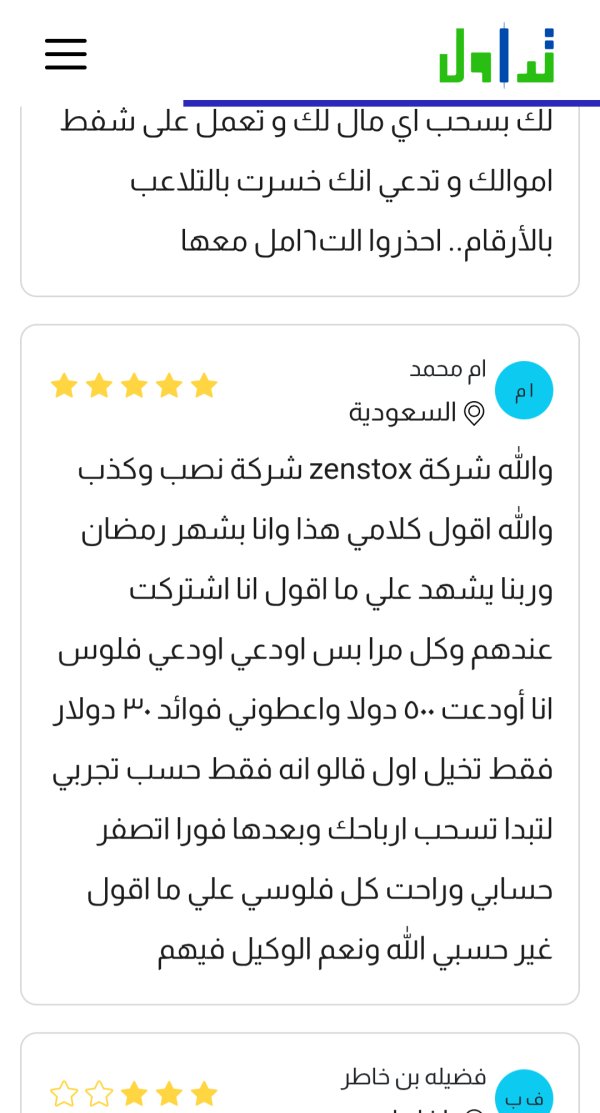

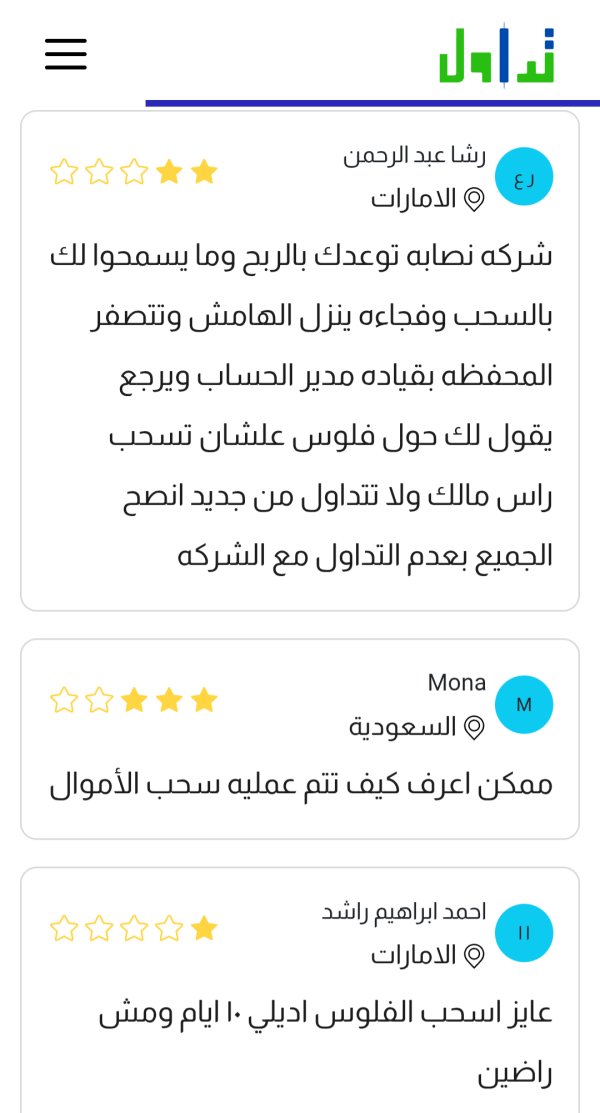

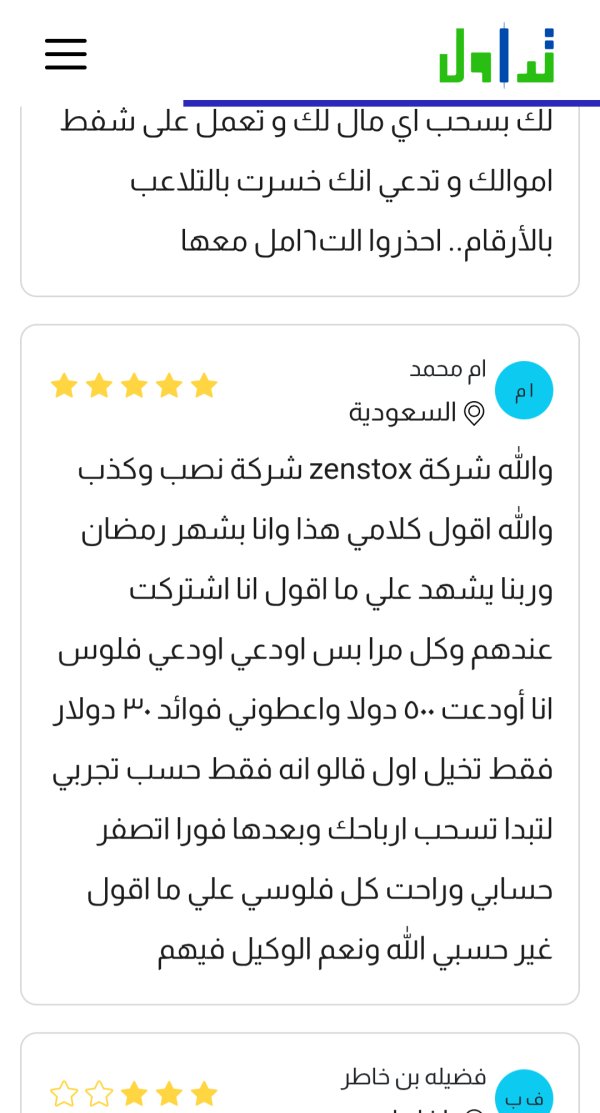

Customer service represents a notable weakness in Zenstox's offering, with user feedback revealing inconsistent support quality that impacts overall client satisfaction. While the platform maintains a 90% recommendation rate, negative reviews specifically highlight customer service issues. These include slow response times and concerns about support staff professionalism and knowledge levels.

User complaints suggest that when issues arise, clients may experience frustration with the resolution process. Some reviews indicate that customer service representatives may lack the technical knowledge necessary to address complex trading-related queries effectively. This creates particular challenges for traders who encounter platform issues during active trading sessions or need urgent assistance with account-related matters.

The lack of detailed information about available support channels, operating hours, or multilingual capabilities further compounds these concerns. Professional trading environments require reliable, knowledgeable support available during market hours across different time zones. Without clear information about support infrastructure, potential clients cannot adequately assess whether the broker can meet their service expectations.

The customer service challenges appear to be one of the primary factors contributing to the broker's trust issues and the presence of red flag warnings. Effective customer service is crucial for building and maintaining trader confidence. This is particularly important in an industry where trust and reliability are paramount.

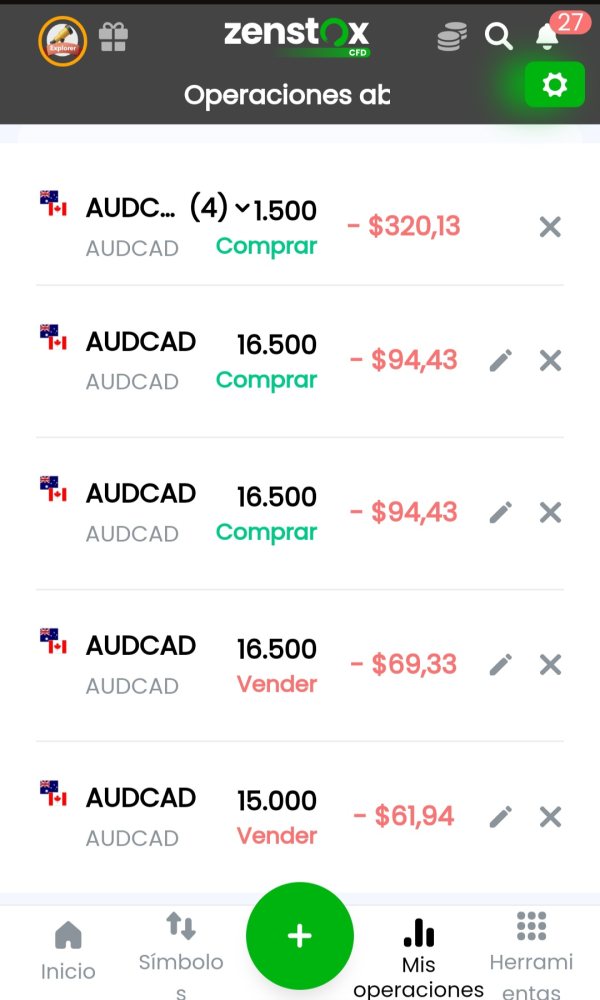

Trading Experience Analysis (Score: 6/10)

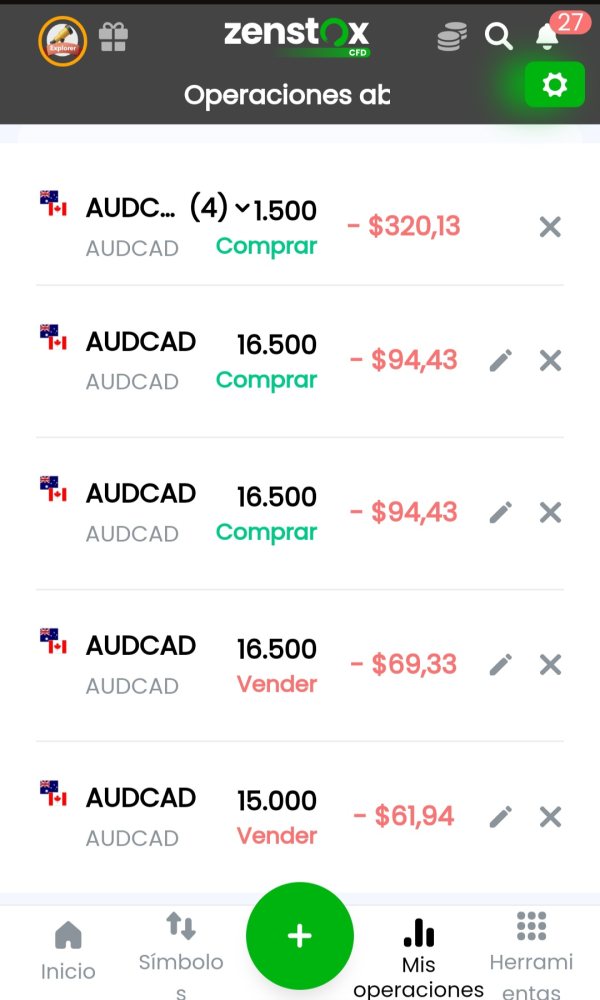

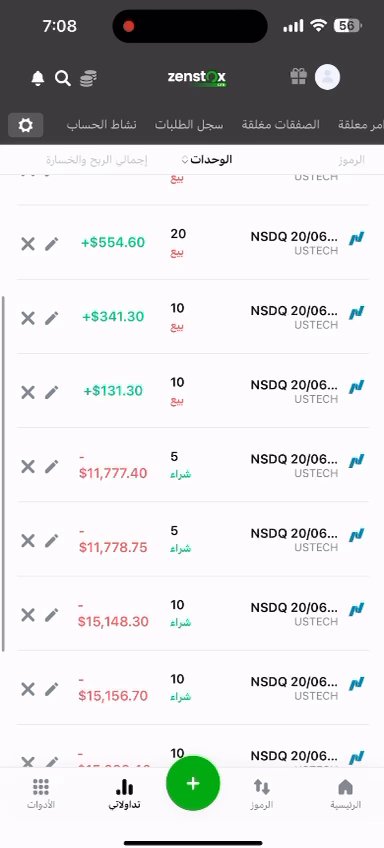

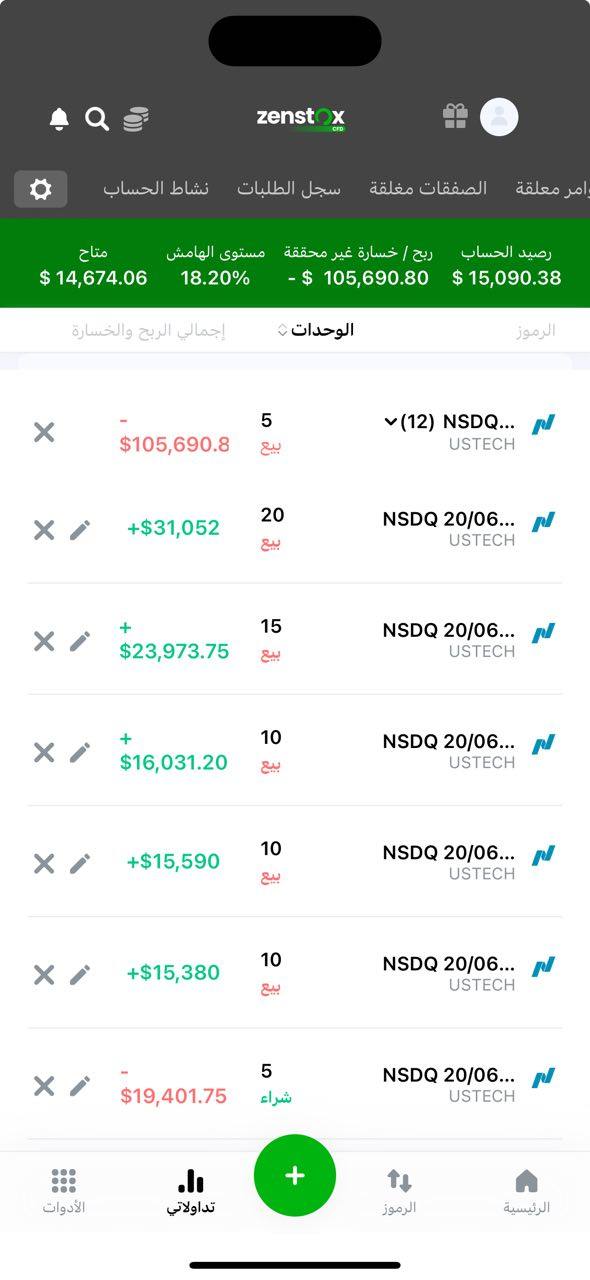

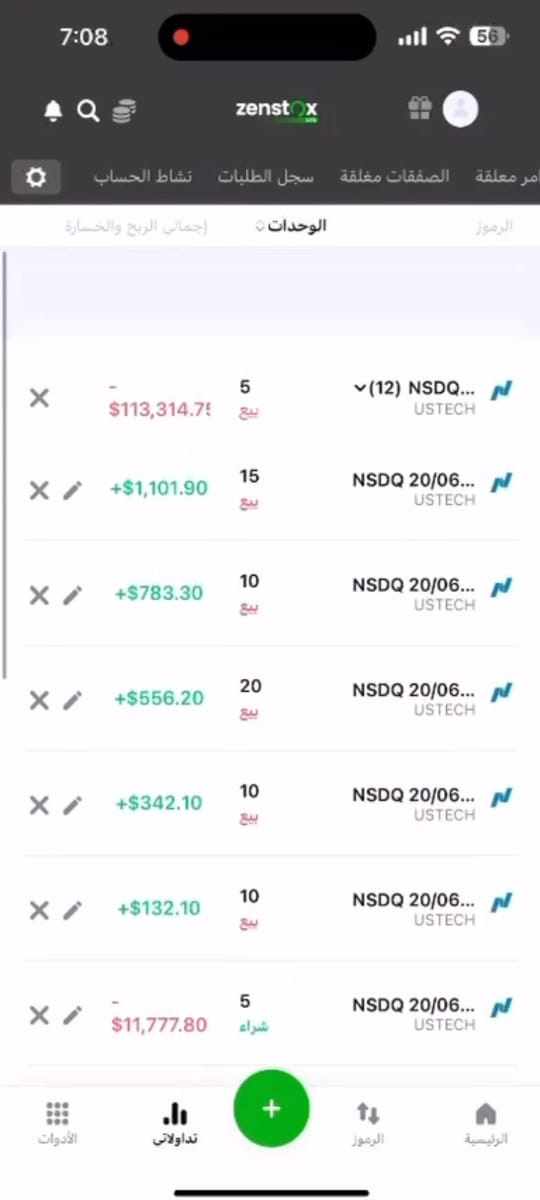

The trading experience on Zenstox presents a generally acceptable but not exceptional environment for CFD trading. Users report overall platform stability with competitive spreads starting from zero. This can be particularly attractive for active traders seeking to minimize transaction costs. The broad asset coverage allows for diverse trading strategies and portfolio approaches within a single platform environment.

However, user feedback reveals some concerning technical issues that impact the trading experience. Reports of occasional requotes and slippage suggest that execution quality may not consistently meet professional standards, particularly during volatile market conditions. These issues can be particularly problematic for scalpers and high-frequency traders who depend on precise, rapid execution for their strategies to remain profitable.

The platform's performance appears adequate for most standard trading activities, with the majority of users finding the experience satisfactory enough to recommend the broker. However, the presence of negative reviews mentioning "suspicious practices" raises questions about execution transparency. This creates concerns about whether all trades are handled fairly and professionally.

This zenstox review indicates that while the basic trading infrastructure functions acceptably, the broker may need to address execution consistency and transparency concerns. This would improve overall trading experience quality and build stronger trader confidence in platform reliability.

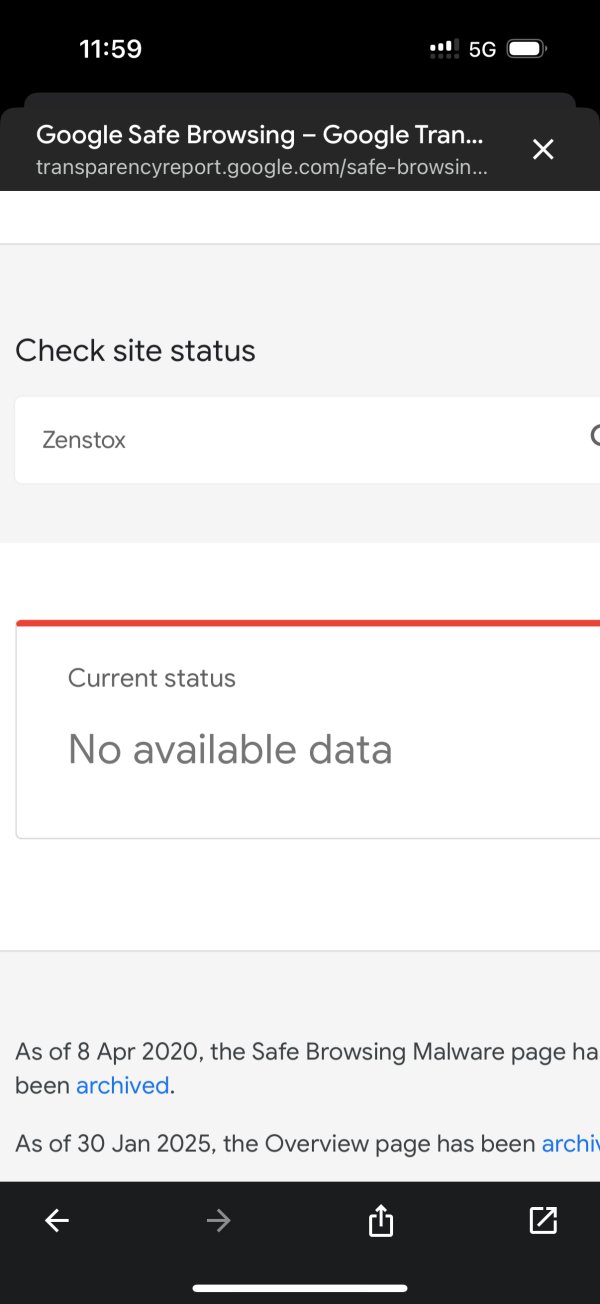

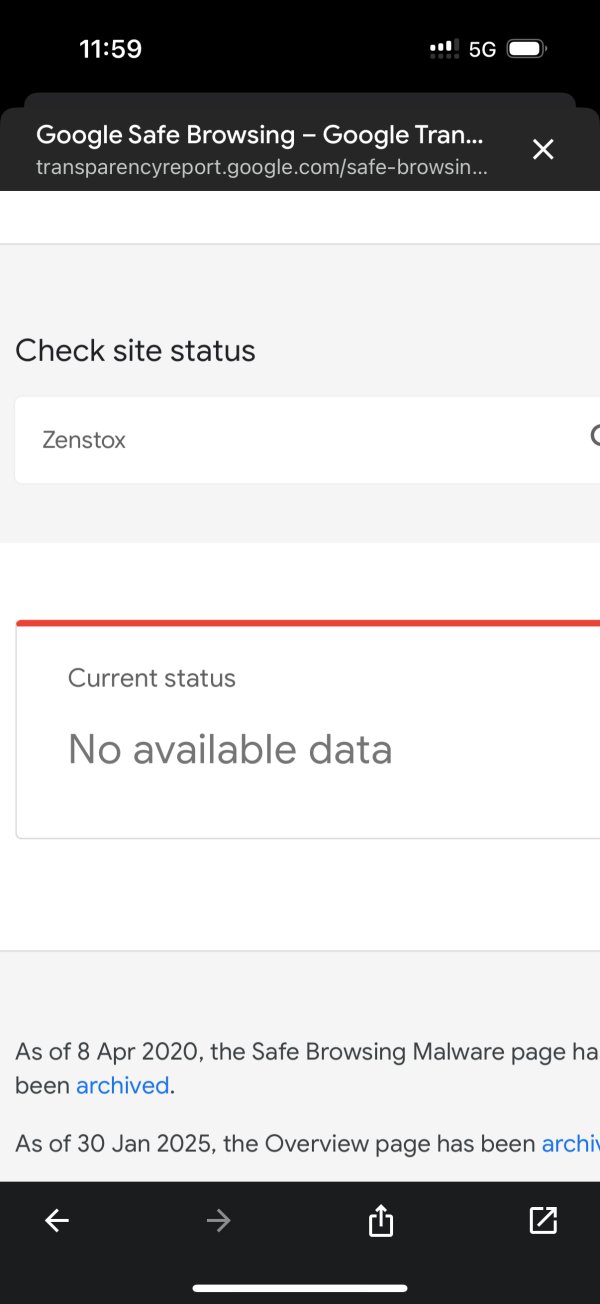

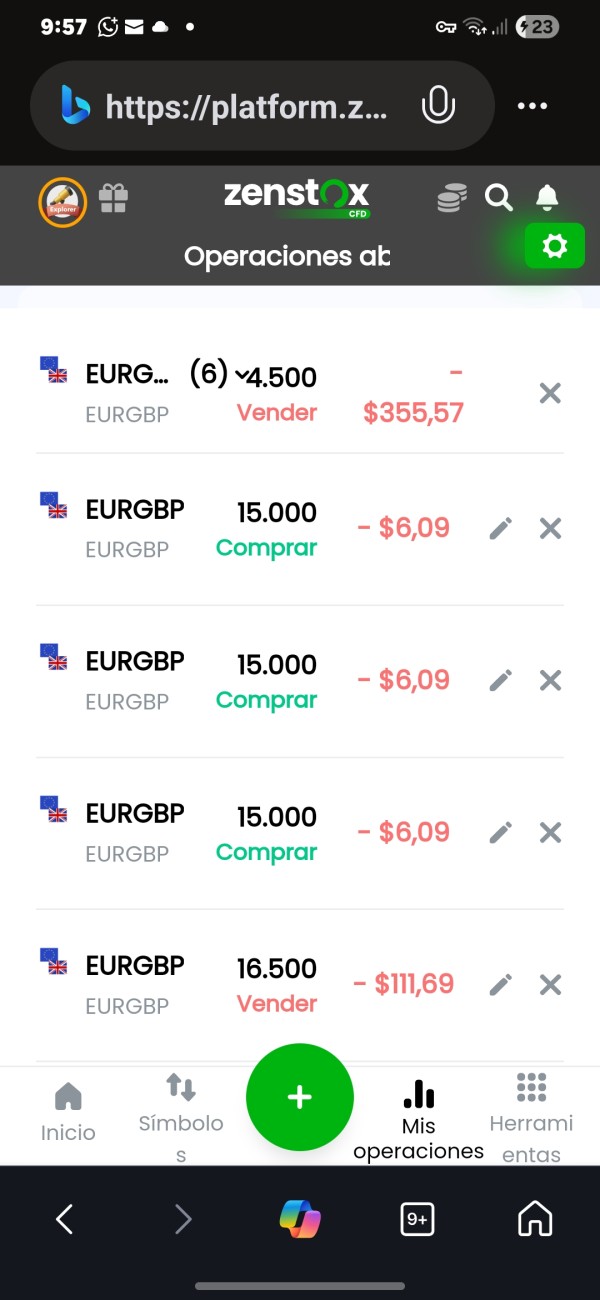

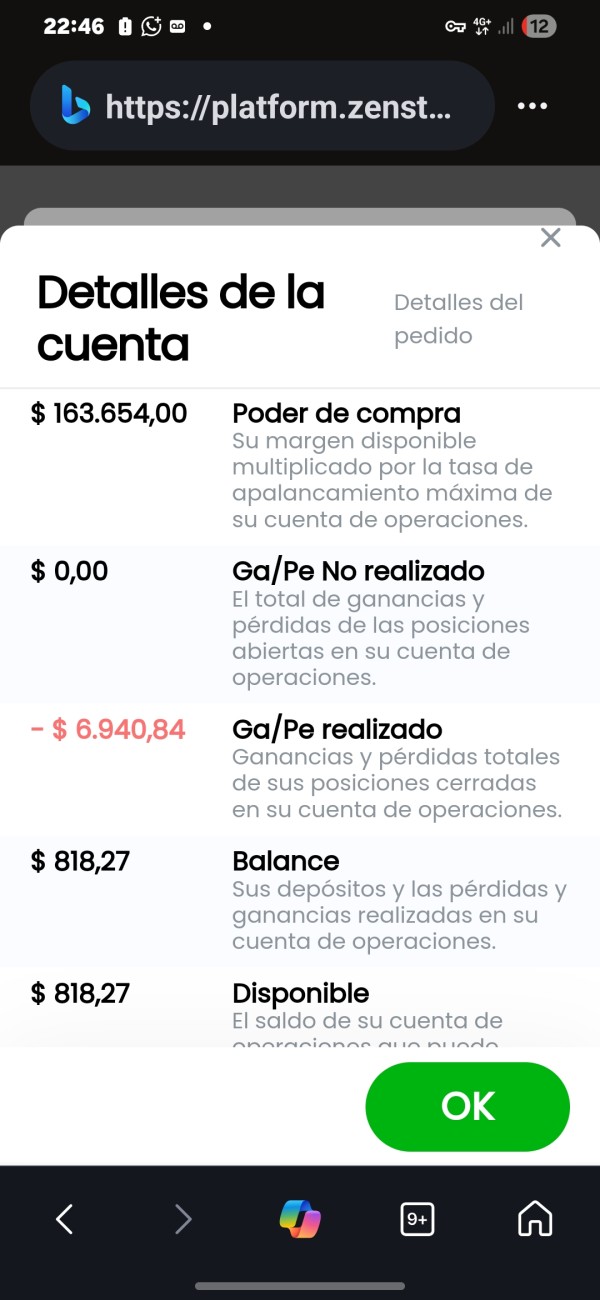

Trust and Safety Analysis (Score: 4/10)

Trust and safety represent Zenstox's most significant challenges, with multiple indicators suggesting heightened caution is warranted. The trust score of 49, categorized as low-to-medium, combined with five identified red flag warnings, creates substantial concerns about the broker's overall reliability and safety for client funds and data.

The FSA (Seychelles) regulatory framework, while legally valid, provides limited investor protection compared to major regulatory jurisdictions. Seychelles regulation typically offers minimal compensation schemes, limited dispute resolution mechanisms, and less stringent operational oversight. This regulatory choice may reflect business considerations rather than a commitment to maximum client protection.

User reports of "suspicious practices" in negative reviews further compound trust concerns. While specific details of these practices are not elaborated in available materials, such reports typically relate to issues with withdrawals, execution practices, or account management that clients perceive as unfair or non-transparent.

The lack of detailed information about fund segregation, insurance coverage, or third-party auditing creates additional uncertainty about client protection measures. Professional traders typically require clear understanding of how their funds are protected and what recourse exists if problems arise.

These trust factors significantly impact the broker's suitability for traders who prioritize security and regulatory protection. This is particularly relevant for those trading with substantial capital amounts.

User Experience Analysis (Score: 6/10)

User experience at Zenstox reflects the mixed nature of the broker's overall offering, with positive elements balanced by notable concerns. The 90% user recommendation rate indicates that the majority of clients find the platform sufficiently satisfactory to endorse it to others. This suggests that basic functionality and service delivery meet most users' fundamental requirements.

The platform's design appears to accommodate traders seeking diversified CFD trading opportunities, with the extensive asset range providing flexibility for various trading approaches and investment strategies. The relatively low minimum deposit requirement makes the platform accessible to a broad range of traders. This includes beginners testing the waters and experienced traders exploring a new broker.

However, the presence of negative reviews citing "suspicious practices" and service quality issues indicates that user experience can vary significantly. Some clients clearly encounter problems that substantially impact their satisfaction and trust in the platform. The customer service issues previously discussed also contribute to inconsistent user experiences, particularly when problems arise that require support intervention.

The lack of detailed information about platform features, user interface design, mobile accessibility, and account management tools makes it difficult to fully assess the user experience quality. Modern traders expect intuitive interfaces, comprehensive mobile access, and efficient account management capabilities that support their trading activities effectively.

Conclusion

This comprehensive zenstox review reveals a broker that occupies a middle position in the competitive CFD trading market. It offers both attractive features and notable concerns that potential clients must carefully weigh. Zenstox demonstrates competitiveness through its extensive asset coverage, competitive spreads starting from zero, and accessible minimum deposit requirements. This makes it potentially suitable for intermediate to advanced traders seeking diversified investment opportunities across multiple asset classes.

However, significant trust and safety concerns, evidenced by the low-to-medium trust score and multiple red flag warnings, require serious consideration. The FSA (Seychelles) regulatory framework, while legally valid, may not provide the level of investor protection that many traders prefer. This is particularly relevant for those handling substantial capital amounts.

The broker appears most suitable for experienced traders who can navigate potential service inconsistencies and who prioritize asset diversity and competitive pricing over premium customer service and maximum regulatory protection. New traders or those prioritizing safety and support quality may find better alternatives in the market until Zenstox addresses its trust and service quality challenges.